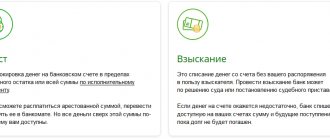

Bailiffs' rights

According to the law, the FSSP has the opportunity to describe property at the place of registration. It does not matter who owns the house (apartment), where the borrower is registered, and who else lives there.

But at the same time, employees have the right to describe only that part of the property that belongs specifically to the client.

As evidence, you can attach sales and purchase agreements, various checks, registration documents, etc. Property that is located at the borrower’s place of residence and does not belong to him, but which does not have evidence confirming this fact, is subject to seizure.

If other people claim their rights to these things, the court employee must make a note in the protocol, nothing more.

ATTENTION! Seizure of property may imply the imposition of a ban on the right to dispose of it (sell, give away free of charge, exchange, etc.), as well as, in some cases, the right to use it.

In determining these features, the employee must consider the options of the property being described and its importance to the borrower. For example, all household appliances that are in the apartment are subject to description, but no one will take them away, and they can be used.

The procedure for seizing the debtor's property by a bailiff

Seizure of the debtor's property by bailiffs Question Answer What are the grounds for seizure? If enforcement proceedings have been opened against the debtor. How much time is given for voluntary repayment of debt? 5 days. Does the bailiff have the right to seize property in the first 5 days? Yes, it has. In what case is arrest not applied?

If the defaulter's debt does not exceed 3,000 rubles. What things does the bailiff seize? Only those items that belong to the debtor. Where is property seized? The seizure of the debtor's property by bailiffs takes place at the place of registration, registration or where his property is actually located.

What time does the arrest take place? On weekdays from 6 to 22 o'clock. Who should be present during the inventory? The debtor or his representative, a bailiff and 2 witnesses. Can seized property be sold immediately? No, it can't. Another important rule follows from this - relatives and third parties are not liable for the debts of the borrower, even if he is registered in their living space.

What to do if the bailiffs described the property of the debtor’s parents at their place of registration? Cases where bailiffs come to the debtor’s place of residence, but instead of the borrower, his parents or distant relatives live there deserve more detailed mention. Do bailiffs have the right to make an inventory of the property in the apartment? Of course, but with some caveats:

- When the debtor is registered at his place of registration, but lives at a different address, the bailiffs have the right to describe the property recognized as the property of the payer.

- If the property located in the debtor's living space belongs to his parents or third parties, the bailiffs cannot make an arrest.

At the same time, it is not always completely clear who is the real owner of the objects that are included in the inventory (inspection report). Among the problematic issues, it should be added that the time for the final assessment of objects of property rights is two months. Typically, citizens use this period to challenge their rights through the courts. Quite often, after filing a claim, the bailiff himself offers to resolve the issue pre-trial.

As a result, one of the relatives or proxies of the debtor simply buys the seized property. What the Constitution says Article 25 of the highest normative document states that housing is inviolable property.

We invite you to familiarize yourself with: Seizure of collateral property

The Criminal Code is also on the side of the owner of the premises - if he does not give consent for unauthorized persons to enter the premises, they cannot enter, much less break the door.

- If there is valuable property, but there are no supporting documents, then you can draw up such documents with relatives (for example, donating gold jewelry, a computer, etc.).

- Allocate a room to the debtor-son, install a lock and hang a sign. Thus, you will demonstrate to the bailiff the real living space and property of the debtor in the case.

- These simple rules will help relatives who have become victims of accidental circumstances to protect their property from encroachment by a creditor. Seizure of the property of other persons at the place of residence of the debtor becomes possible only if these persons acted as guarantors under loan agreements. Remember, no matter who you are - a debtor, relatives, friends or third parties - you have the right not to open the door to the executor from the court who appears in front of her.

Bailiffs can begin enforcement proceedings only by a court decision on the basis of a writ of execution. They apply enforcement measures at the place of registration of the debtor or at his last place of residence, as well as at the location of the property belonging to him.

In accordance with paragraph 4 of Article 69 of the Civil Code of the Russian Federation, if no bank deposits, plastic cards issued in the name of the debtor were found, or there is not enough money on them to pay off the debts, the bailiffs turn their attention to his property.

First of all, the bailiffs go to the address where the debtor, son or daughter, is registered.

Here they have the legal right to describe all property that may be subject to foreclosure by law.

Bailiffs seize the property of children at the place of their actual residence if they receive strong evidence of this residence. Someone must tell them the address of the house or apartment - the parents or the debtor himself.

When does inventory take place?

According to the law, the FSSP is responsible for the inventory of property. There are collection authorities in every city in Russia, and their work is controlled by the Federal Law “On Individual Entrepreneurs”. According to the law, the nature of the current situation dictates the need to make an inventory of the house of the negligent debtor:

- the property is in an area of conflict between the borrower and the lender (for example, a mortgage on a car);

- the property belongs to the debtor;

- the amount of debt is commensurate with the property being described (if the debt has crossed the border of one million rubles, then collection may affect the client’s real estate).

It is also necessary to remember that bailiffs are just executors of court decisions. The basis for an inventory of things can only be the opening of an individual entrepreneur, which gains momentum after analyzing the application of the victim (creditor).

ATTENTION! Court employees have the right to seize only that property whose value is commensurate with the debt.

For example, if the debt is 20 thousand rubles, the bailiffs will not be able to display the car or diamonds. Most likely, the recovery will affect the borrower’s salary, and in its absence, cash deposits or inexpensive equipment.

What documents must the bailiff present?

Do bailiffs have the right to describe the property of relatives? The writ of execution indicates a specific debtor. Only his property can be taken to pay off his debt. And debtors who live in the same living quarters with other people take advantage of this. For example, bailiffs came to the debtor for a consumer loan. There is a TV worth 50 thousand rubles hanging on the wall. But the bailiffs will not be able to take it away, because the debtor’s mother will show the receipt for the purchase: her TV, even from her son’s room, cannot be taken away.

How the described property is taken away

They do not take away things necessary to meet minimal household needs. That is, the bailiffs will not take away the bed, table, chairs, refrigerator, stove. But they can take away a washing machine, a sofa on which no one sleeps, armchairs, a microwave oven and a carpet.

The credit debtor must remember that if he has doubts regarding the correctness of the execution of acts of inventory of property and its arrest, then he has every right not to sign any documents that are offered to him by bailiffs. They, in turn, will break the law if they force a citizen to sign documents. You also need to take into account that bailiffs can transfer rights to seized property directly to the borrower or his closest relative (relatives also have something to beware of).

Property at the place of registration

Before examining this issue, you need to look at the documentary type status of the place of registration. Following the Code of Civil Procedure, the place of registration is considered to be the registration of an individual. persons receiving documents and a stamp in their passport. It turns out that if the borrower has written down his place of registration, then court workers can describe the property in the house. It’s another matter if the client does not live at his place of registration and his things are not there.

All bailiffs operate within the framework of Article 33 of the Federal Law “On Enforcement Proceedings,” which states that collection is carried out at the place of registration, residence address or location of the borrower’s property (even if the things are in the possession of other people).

Thus, it can be understood that employees can come to the place of registration and describe the things in the house for debts.

Do not forget that bailiffs can describe property in order to guarantee payment of debts. For example, the debtor’s bank accounts are being seized and verified, or the client has asked for a deferment to repay the debt. In each specific option, the issue of foreclosure of property is resolved jointly with the borrower and the bailiffs.

Inventory procedure

In everyday life, there are often cases when a person is registered at one address, but lives in a completely different place, maybe even in another city. Sometimes it happens that his relatives - parents, brothers and sisters - do not maintain any contact with him. But if their loved one takes out a loan from a bank and stops paying it off, then, by court decision, FSPP officers will come to exactly the address indicated in the debtor’s passport as the main place of residence. Can bailiffs describe and seize property if the debtor is registered but does not live in this apartment?

You might be interested ==> Certificate of fund MN fund

What to do if the debtor does not live at the place of registration?

Article 69 of the Federal Law “On Enforcement Proceedings” of the Russian Federation states that the seizure of the debtor’s property located at the place of permanent registration is carried out if the borrower does not have enough cash or non-cash funds to pay the debt. In this case, bailiffs are sent to his home.

The method of selling the property depends on its value. The bailiff can organize an auction if the debtor's property is worth more than 500 thousand rubles. The same applies to real estate, securities or things that have historical or artistic value.

Procedure

The commencement of the enforcement process occurs after fourteen days from the date of the court decision. Having visited the borrower’s house, the employee reports the beginning of an inventory of property for debts:

- , the borrower himself and two witnesses must be in the house . In some situations, a bank employee is also present when things are seized.

- The procedure for completing the inventory involves the creation of an official protocol of actions - an act of acceptance of property. The bailiff is responsible for drawing up this document. The act includes information about those present during the inventory, information about the seized property, the rights of participants and deadlines for execution.

- The seized property is stored in the borrower's home or in the possession of a third party until it is sold at auction. The deadline for selling seized property is five days from the date of seizure.

- Items are sold at auction at a low price, and the proceeds from the sale are used to reduce debt. The law does not prohibit people from independently selling some of their things and taking a deferment to repay the loan.

Rights and responsibilities of the bailiff and their action plans

Emphasizing their authority, they invade the apartment, describe the property (which can be recovered) and then transfer rights to it to one of the residents present. And they are not at all interested in who actually has a direct connection to this or that thing. Bailiffs believe that they are doing the right thing, and if the debtor is not satisfied with their work, they suggest that he apply to the court. Ignorance of one's rights often leads the debtor to disastrous consequences.

Can bailiffs describe property? Do they have the right to do this?

By creating obstacles for the bailiff on the way to your apartment, the credit debtor creates the opportunity for employees of this authority to commit a number of legal errors. This will be an excellent weapon against bailiffs during court hearings, when filing a complaint with the prosecutor's office and other governing bodies that have more rights compared to the bailiff.

Unlike the same collectors and banks, bailiffs are interested in advancing the case at least a few steps - for example, the debtor will begin to repay part of the debt, thereby protecting his home from arrest or seizure.

To avoid a situation where bailiffs can open the apartment, it is advisable to take care of repaying too much debt. As practice shows, even reducing debt from 70% to 50% of the cost of an apartment helps to avoid confiscation of property.

What rights do bailiffs have?

- Before visiting the debtor's apartment, bailiffs must obtain an official court document or, in other words, a court decision to collect the debt.

- Having received the writ of execution, the responsible bailiff sends a copy of it to the debtor. The papers are sent by Russian Post, but in addition to this, the bailiff calls the borrower and notifies him about the opening of paperwork.

- Having informed the payer about the enforcement process, the bailiff informs about the start date of debt repayment - according to the law, 5 days are given from the moment the debtor learned about the opening of the case. If the deadlines are violated, the borrower faces a fine.

- The lack of real benefit in notifying the debtor smoothly flows into active actions on the part of the bailiffs. Here it should be noted a personal visit to the debtor’s apartment in order to analyze the current situation, and, if necessary, to seize property to pay off debts.

You may be interested ==> At the birth of 3 children in 2021, it is planned in the Kaluga region

Question: can a bailiff seize a car that is pledged to a bank? Answer: yes, it can be repossessed, but only if the car is foreclosed on in favor of the mortgagee's bank (creditor). If it is pledged to the bank, then no one except the pledgor will be able to seize the pledged vehicle until the obligations under the loan agreement are fully fulfilled and the pledge agreement is closed.

As for real estate, everything is much simpler here - you don’t need to look for it, the responsible person must seize it and collect a package of sales documents. The arrest is often imposed without leaving the office. If a foreclosure is made on real estate, it is unlikely that you will be able to evade liability.

Case studies

Question: I cannot pay off the entire debt amount at once, what should I do? Answer: try to establish interaction with the official, do not provoke him into conflict situations. Perhaps such actions will help avoid seizure of property. Show up for your appointment and don’t ignore notices. If this does not help, then write to the court an application to defer the execution of the court decision.

Hello Galina. In accordance with the Federal Law “On Enforcement Proceedings”, enforcement actions are carried out at the place of residence, location of the debtor. The place of residence is the place of permanent residence of a citizen (registration). Thus, if the debtor is registered in an apartment, then at the place of his registration the bailiffs have the right to make an inventory of the property and seize it. Another thing is that if the case concerns the apartment itself, then the bailiff does not have the right to foreclose on the apartment, since it is not the property of the debtor. The owner of the apartment has the right to present evidence that the property does not belong to the debtor in order to exclude this property from the inventory

There is a simple way to secure property in an apartment for which there are no documents. Let one of your friends or close relatives draw up a deed of gift (you can even have a notarized one - it’s inexpensive) in the name of the real owner.

We have selected similar situations for you:

If a person is registered in an apartment, this means legally that he lives there. Bailiffs will act on this basis, so they can seize any property whose owner has not been identified.

Legal illiteracy of the population often results in unpleasant consequences for them. Bailiffs strive to carry out the instructions received by any means. Carelessly opening the door to uninvited guests is fraught with inventory and confiscation of property, which, by the way, may belong not only to debtors. You can get your material assets back, but through a series of bureaucratic procedures.

Proof

If court employees seized property removed by law from the inventory, then their manipulations are considered invalid. It is impossible to describe the property recorded in Art. 446 Code of Civil Procedure of Russia (single apartment, land, personal belongings, food, etc.)

In all other options, the property is subject to an inventory. But the main point is that the property belongs to the debtor.

IMPORTANT! A striking example is the following case: another person owns the property, but it is located in the borrower’s apartment. By law, employees do not have the right to inventory such property.

But how to calculate ownership of property? Providing evidence falls on the shoulders of the borrower and the owner of the items. In the absence of evidence, the property is confiscated. Evidence may include:

- commodity type checks, invoices, receipts, special coupons with a guarantee;

- title documentation: copy of deed of gift, purchase and sale agreement, certificate of inheritance, marriage agreement.

Testimony of witnesses does not serve as a basis for excluding property from the inventory. The fact of ownership is documented.

Is it possible not to allow bailiffs into the apartment?

And yet, it should be remembered that strangers, including FSSP employees, are authorized to enter the apartment without the knowledge of the owners only on the basis of an appropriate court decision. Other demands will be regarded as unlawful.

Should bailiffs be allowed in if the debtor does not live at his place of registration?

If the goal of the bailiffs is to confiscate property, they will need to prove that not all material assets belong to the debtor. The owners may be relatives and neighbors of the defaulter. It would be a good idea to prepare documents for expensive property. In some cases, witness testimony in this matter is also taken into account.

According to paragraph 1 of Art. 446 of the Code of Civil Procedure of the Russian Federation, foreclosure cannot be made on residential premises if it is the only residential premises suitable for living for the debtor and his family members. Therefore, let them arrest if they suddenly want to. If this is the only room you can live in, then it will not be taken away from you.

Not only banks resort to this when working with their debt assets, but also tax authorities and even individuals. Lawyer Oleg Sukhov compiled the top 5 most popular legal incidents relating to the seizure of real estate. Judicial authorities can seize an apartment and other property if its owner has come under criminal prosecution - for example, for fraud, official misconduct or a serious economic crime that provides for punishment fines or confiscation of property.

A person is registered in the apartment but is not the owner. Do the bailiffs have the right to seize the property?

Good afternoon. Enforcement proceedings have been initiated against my close relative. Naturally, bailiffs must come to answer his debt. But he is not registered in the living space in which I live. In this case, can they describe the property located in this apartment?

07 Apr 2021 semeiadvo 325

Share this post

- Related Posts

- Food rations for Chernobyl victims in monetary terms in 2021

- Living wage in St. Petersburg for pensioners in 2021

- How much money does a caregiver receive for a child in the Moscow region?

- Certificate stating that the bank is ready to provide you with a mortgage

How to Avoid Responsibility

The first and main way to avoid more serious penalties in the form of seizure of all accounts, all things, etc. - to pay. If it is possible to transfer small amounts, then you need to notify the court staff, who will be content with what you can give.

Exception from the inventory. The next way to avoid arrest is considered exclusion from the inventory. This power is granted by Part 1 of Article 119 of Federal Law No. 229; it belongs only to the owner of a specific thing and is established in court. To do this, the property owner will need to write a petition to the court.

ATTENTION! Collect documents, witness statements and other evidence that helps to quickly establish that the items belong to him and not the borrower.

Often the situation arises due to the fact that it is impossible to allocate shares in the common property of the husband and wife, so everything that belongs to them is seized. But this is wrong, since in accordance with Art. 256 Civil Code and Art. 45 IC debts can be collected only from that part of the property that belongs to the client.

And if the partners only have joint property, then the employee must first declare to the court about the allocation of his share and only after that be seized. In this option, the second spouse will have to challenge the bailiff’s verdict and demand that their part of the property be excluded from the inventory.

On what basis can bailiffs describe property?

The process of inventorying property is aimed at preventing unlawful actions of the debtor associated with the deliberate concealment of their assets and non-existent debts. The inventory process also has a number of requirements that must be fully observed by bailiffs.

During the execution of the actions, the bailiff established that the debtor's property was in the sister's apartment, which the sister confirmed by telephone to the bailiff; on the same day, the bailiff went to the sister's address and seized the debtor's property. Assess the legality of the bailiff's action.

Appeal

If there are grounds to believe that a court employee violated your rights while performing his duties, carried out an incorrect inventory, did not give you the right to sell things yourself, etc., then his manipulations can be appealed. First you should contact his superiors.

It is better to do this immediately - only within 10 days from the moment the offense occurred or became known about it. Within the next ten days, an investigation into this fact must be carried out, and you must be provided with information about its results.

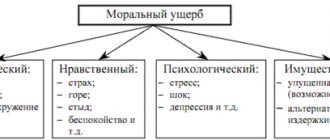

If the FSSP’s appeal does not help solve the problem, you can go straight to court. Such applications are exempt from paying state fees. In addition to the cancellation of the verdict itself, the inventory or act, you can demand the punishment of the culprit, bringing him to justice and compensation for losses.

Can a bailiff describe property belonging to relatives?

For example, if all the property is described in the amount of 5 thousand rubles, the debtor, having found this amount, without selling the property, can transfer it to the bailiffs, but they will already have an indication that this property does not exist, and accordingly, they will not come to describe anything else.

The arrest procedure is as follows. The bailiff requests information from banking institutions about the presence or absence of an account agreement, deposit, etc., and if discovered, a seizure is imposed. Bailiffs cannot seize accounts belonging to relatives.

Application to lift the arrest

In the application for the release of property from seizure, the plaintiff indicates:

- The name of the court in which it is filed;

- Data (full name, address) of the plaintiff, defendants, third party (this is the bailiff who imposed the arrest);

- The essence of the claim is stated, the name of the property is given and on the basis of what documents the plaintiff’s ownership of it is confirmed, a request is formulated to exclude the plaintiff’s property from the inventory (indicate the number of the decree under which it was seized);

- List of attached documents, dated, signature of the plaintiff.

The application is written in as many copies as there are persons (organizations) indicated at the top in the header (according to the number of participants in the process and one more for the court). Accordingly, the same number of copies of the attached documents must be prepared.

The following documents are attached to the application:

- Plaintiff's passport (you must have it with you);

- A document confirming the transfer of state duty (its amount depends on the amount of the claim);

- A copy of the bailiff's arrest order;

- Documents confirming the plaintiff’s ownership (these may be certificates of ownership, sales contracts, cash receipts, receipts, warranty cards, if they indicate the buyer, written transactions, etc.);

- Documents confirming the grounds for the claims of the interested party (for example, collateral receipts, collateral agreement).

In cases where the transfer of ownership of property, according to the law, is registered by state bodies (real estate), the right to file an application arises for the plaintiff not on the basis of a concluded transaction (purchase agreement, transfer and acceptance certificate), but only on the condition that the state registration of the right at the time when the bailiffs described the property had already been completed.

If the plaintiff did not indicate all co-defendants in the application, the court may, on its own initiative, involve the rest.

Can bailiffs describe a wife's property?

13. I have this situation. I have two months of overdue debt from Tinkoff Bank in the amount of 7,600 rubles. At the moment, I can’t pay the full amount, but I pay 50 rubles a month, because I lost my job, bank employees are calling and saying that bailiffs will come soon and seize my property. I have two children and a non-working wife. Tell me, can they come to me without a trial and describe the property? But I don’t refuse to pay, I pay as much as I can.

4.1. Hello. This Federal Law determines the conditions and procedure for the forced execution of judicial acts, acts of other bodies and officials who, in the exercise of powers established by federal law, are given the right to impose on foreign states, individuals (hereinafter also referred to as citizens), legal entities, the Russian Federation, subjects of the Russian Federation Federations, municipalities (hereinafter also referred to as organizations) have obligations to transfer funds and other property to other citizens, organizations or the relevant budgets, or to perform certain actions in their favor or to refrain from performing certain actions.

We recommend reading: Privatization of the local area in an apartment building

If you don’t have a residence permit, where will the bailiffs come?

If the bailiff knocks on the defendant’s house, then most likely he will begin to inventory the available property. Many people are interested in: if there is no registration, where will the bailiff come? It’s worth saying right away that the bailiff visits the debtor at his actual residential address, that is, registration does not matter.

The husband is registered with his ex-wife. They haven't lived together for a long time, but they've been officially divorced for a year, my husband took out a loan and can't pay it off. There is an agreement on the division of property, but it is not notarized. Can bailiffs describe property at its place of registration if the agreement says that there is no property there, and does it need to be notarized now if it was drawn up more than a year ago?

We recommend reading: How to form a land plot and register it with the cadastral register

Where will bailiffs come to describe property?

If a citizen does not have funds and has not repaid the debt in this way, the procedure for forced seizure of property will begin.

By this time, the bailiffs will already have data from the traffic police and Rosreestr at their disposal. But the first place where the bailiffs come with the appropriate order is at the place of registration. However, household members must be prepared to prove that the property located here is definitely not the debtor’s. The bailiffs have the right not to look into it too much and, if there is no compelling evidence to the contrary, to consider that all discovered items belong only to the debtor. The property will have to be retrieved through the courts, and this will take quite a long time.

List of property that bailiffs can seize

simple home environment. The refrigerator and stove in the kitchen will not be touched. They will leave the washing machine if there are small children in the family. Only a professional programmer, designer, or accountant can defend a computer. The bailiffs have the right to take away all the furniture. The old one is usually left. The FSSP has the right to take away all small household appliances and dishes, except for the bare minimum; personal items.

livestock (breeding, dairy and working); deer; birds; bees; rabbits; feed and pasture required to maintain the above objects; structures and buildings intended to contain the above-mentioned living creatures; seeds for the next sowing season.

What laws govern property inventory?

The main legislative acts that guide bailiffs are:

- Federal Law No. 229 “On Enforcement Proceedings” - in Art. 80 sets out the rules according to which property can be seized, as well as the requirements for property.

- Federal Law No. 118 “On Bailiffs” - this describes the duties that a bailiff must perform.

The documents on the basis of which the seizure of property is permitted are:

- court order;

- court order.

The countdown of enforcement proceedings begins from the moment the debtor receives notification of this. He is given two weeks to resolve the issue of paying the debt on his own. If this does not happen, the bailiff has the right to enforce collection.

In case of refusal to receive a notice, the debtor will not be subject to the deadline for voluntary repayment.