Which accounts cannot be seized?

Many people believe that the law does not allow the seizure of a salary card. But the bailiffs may well do this if you have not repaid your bank loan or have not paid utility bills for a long time. The seizure of a salary card does not violate current legislation.

In accordance with the Civil Code, only social cards cannot be seized. That is, those for which the debtor receives funds from the state - pensions for disability or a disabled child, child care funds, military pensions. These accounts are not subject to taxes; bailiffs do not have the right not only to withdraw part of the debt from them, but also to seize such cards.

Having a problem with bailiffs?

We will consult on this issue for free!

+7

Advantages of electronic wallets

Electronic wallets are a reliable way to store assets and not show them to third parties. Some of them can be registered even without passport data - just an email. If the account is “discovered, its identification must be proven in court. This is a long process: the owner will have time to withdraw money from the payment system.

To start using the Yoomoney wallet (Yandex. Money), you need to go through a simple registration. However, if you need to make a financial transaction for more than 15,000 rubles, you will still have to send your passport information. The advantage is that electronic wallet data is almost never transferred to the tax office and bailiffs.

Debit cards linked to an electronic wallet

Today, many payment systems offer debit cards with favorable rates.

For example, Qiwi makes it possible to issue a debit card from the bank of the same name using a link. Validity period: 2 years. The card will be delivered by Russian Post or via courier. To complete an application, registration in the payment system of the same name is required. The daily limit depends on the user status. If the client has passed the identification procedure, 60 thousand are available to him, if he has not passed, 50 thousand. The Yoomoney system (Yandex. Money) offers a gold card for a period of 3 years (link). It is possible to pay for purchases with one touch - without entering a code. The cost of delivering the card within Russia is 149 rubles. For all completed transactions, free SMS information is provided: they are available in the “Personal Account” or on the payment system website itself.

The limits depend on the status of the personal wallet in the system. “Anonymous” users can spend no more than 15 thousand per day, identified users - one hundred thousand.

What to do if bailiffs seize a salary card

The procedure for freezing a salary account is as follows:

- Once the court decides that the defendant must pay the debts, he is given the opportunity to do so on his own.

- The writ of execution is sent to the bailiff service.

- The bailiffs hand over this document to the client's bank and demand that the account be closed.

- The bank blocks the salary card and account.

The direct responsibility of the bank is to urgently comply with the bailiffs' orders. According to current legislation, bailiffs do not have the right to write off more than 50% of a salary, advance payment or bonus from a card to account for existing debts. But this rule applies only to funds that the debtor receives after the issuance of a writ of execution. Funds that were in the account before the court order can be written off in full as a debt.

How an account and card are blocked

In its work, the FSSP is guided by the norms of legislation, as well as a clearly defined algorithm of actions that ensures the legality of their actions. The blocking procedure takes place in several stages. The first of these is a court hearing, at which the debtor is given the opportunity to independently pay off the current debt.

If this has not been done, the judicial authorities will initiate a forced collection procedure:

- The writ of execution, which is the basis for the actions of the bailiffs, is sent by the court to the FSSP.

- Bailiffs search for the debtor's assets, after which they send requests for blocking to the financial organizations where they are located.

- Banks fulfill the request and their client is deprived of the opportunity to use the account as usual.

When figuring out which banks are blocked by bailiffs, it should be noted that all operating financial organizations in the Russian Federation are required to comply with requests from the FSSP. At the same time, the bailiffs independently search for the client’s assets, which is why there is a small chance of avoiding blocking.

However, it is worth considering that representatives of this department have every right to write off all charges that were found on the debtor’s accounts if they were credited before the writ of execution was issued.

Among the organizations from whose accounts bailiffs quite rarely write off funds, it is advisable to note:

- Online payment systems. Due to the high level of anonymity, accounts in electronic money systems do not always come to the attention of the FSSP, which allows some users to protect their accounts from blocking.

- Cryptocurrency. Perhaps the most reliable option to avoid blocking funds by judicial authorities is to store them in cryptocurrency wallets. Many of them guarantee complete anonymity to the owner, and transactions made by users of such systems cannot be tracked.

- Small and regional financial institutions. Since bailiffs, on the basis of a writ of execution, are forced to independently carry out search activities and send requests to banks, the client can avoid blocking the account if he places it in a little-known institution.

However, none of these options gives a 100% guarantee that the user will be able to avoid legal debiting of his funds and blocking of his account.

When the debt is fully repaid, the arrest from the accounts is removed

What are your options when your salary card is seized?

If your bank account is blocked, you need to act immediately. The debtor has several options for solving this problem. Initially, you should go to the bank and find out the reason for the blocking, get a certificate of seizure of the card or account.

You can go to the bailiffs and write an application to return the card. If everyone has loans or debts, then half of the salary, bonuses and advances will be written off monthly until the debt is paid off. If the arrest was due to unpaid child support, you will be required to pay it in full.

The simplest and most effective method is to pay off all debts and start using your salary account again. But such an opportunity is not always available. You can also go to the creditor and ask him to withdraw the claim from the court, but this will most likely require partial repayment of the loan.

Another option is to file a counterclaim in court to appeal the decision of the bailiffs or the monthly amount. This option is suitable only for those debtors for whom salary is not the main source of income.

The seizure can be removed from the account only in one case - the bailiffs have approached the bank with this request. If you have paid off your debts or reached an agreement with the bailiffs and the card is still not unblocked, you have the right to make a formal complaint. The application is submitted to the bailiff body, the prosecutor's office, or directly to the court. It can be sent by registered mail, or taken to the office in person.

To remove the arrest from the card, you need to submit a corresponding application to the bailiff service. The application must include the details of the debtor, the address and full name of the bailiff service, the details of the executor responsible for the case, the registration address and place of work of the debtor. It is also required to indicate the date of opening of enforcement proceedings, its number, address and name of the court that made the decision. You must also provide bank details – bank name and blocked account number. All data must be indicated in full, without abbreviations, since otherwise the bailiff simply will not accept it.

The service of bailiffs for judicial proceedings will consider this application within 30 days, after which the debtor will be informed of the decision of the authority. After considering the application, the executors are required to submit a request to the bank to remove the seizure from the account.

Credit cards as a way of protection

Credit cards are not subject to seizure by law, and the bank itself is not interested in disseminating information about them. To attract new clients, some organizations allowed them to store their personal funds on credit cards with interest payments.

In fact, the money on the card does not belong to the borrower, but to the financial institution. If the funds are nevertheless written off, proceed as follows.

- You need to contact the bank for a certificate indicating the bank account details and the terms of the loan agreement.

- The card owner writes an application to remove the arrest from the account and submits a set of documents to the FSSP reception.

- The bailiff will make a decision on cancellation within ten days.

The bailiffs have already figured out this loophole: a proposal has been made to introduce appropriate amendments to the legislative framework. However, the Supreme Court has not yet addressed this issue.

Top 3: Credit card from MTS Bank

A credit card from MTS is considered universal. Main characteristics:

- it has a grace period, cashback and the ability to accrue income through interest on the balance;

- the card, as well as the account linked to it, is serviced free of charge during the entire validity period of the product, which is 3 years;

- when withdrawing money from cash desks and ATMs owned by MTS, no commission is charged;

- The client is provided with Mobile Banking and Internet banking free of charge.

Design

Top 3: Virtual credit card “Kwiku”

It is not plastic that is issued, but an account with a cash limit, number, and information about the holder and expiration date.

This data is enough to arrange profitable shopping online.

- The credit card is linked to the Visa payment system.

- The decision about the possibility of issuing money comes in a couple of minutes.

- You can get a card even with a bad credit history.

- Payments are made twice a month.

- The preferential rate and interest period are calculated individually.

Design

Top 3: Tinkoff Platinum Credit Card

The Platinum card confidently occupies one of the leading places in popularity among users.

- Using borrowed funds from the card, you can pay for purchases and utility bills, or even rent a car and book a hotel room.

- For goods purchased in installments, the client does not pay interest for a year.

- When repaying loans from third-party banks, the borrower is provided with an extended interest-free period (120 days).

- You will not have to pay for the release, reissue, use of the mobile application and consultations with specialists (in chat or by phone).

Design

How long can bailiffs hold?

According to the law, bailiffs cannot withdraw more than half of the credits. If the debtor is a single parent with minor children to support, the amount is reduced to 25-30%.

That is, after the card is seized, the bailiffs can write off only half of the charges every month. But they also have the right to write off all previous charges that were received on the card earlier.

Cases when bailiffs write off all funds from a card at one time occur quite often. The reason for this is the fact that the performers simply do not know that the salary card has been seized.

If the debtor discovers that all the money has been written off from his bank account and the account itself has been seized, he must take the following steps:

- Contact your bank for clarification.

- Meet with the executors in person, study the writ of execution and all the case materials.

- Obtain from the accounting department a certificate of income for the previous few months.

- Obtain official confirmation from the accounting department at work that the debtor receives a salary from this organization.

Author of the article

Which card should I get so that bailiffs don’t withdraw money?

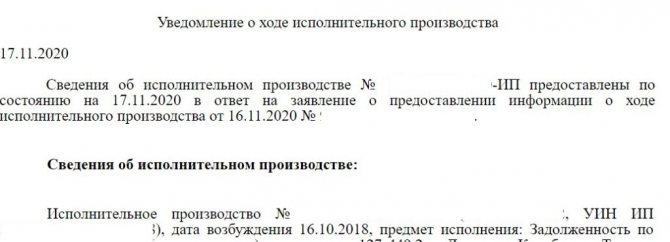

To answer the question of which card to get so that bailiffs do not withdraw money, let’s look at an example of the bailiff’s actions after initiating enforcement proceedings.

The information is taken from a file with information on the progress of enforcement proceedings, obtained through the State Services website:

What cards do bailiffs not see?

How to find out about the progress of enforcement proceedings, the measures taken by the bailiff and the restrictions imposed; and also about which banks the bailiff made requests to, we wrote in this article>>.

So, the first to be arrested, 9 days after the initiation of enforcement proceedings, were the accounts at Vostochny .

Then, 4 days later, a Sberbank , which was issued in the region that coincided with the registration.

A week later, accounts at ROSBANK .

Only after 1 year and 5 months they found an Alfa Bank , and a week later they seized Sberbank cards issued in another region (not matching the registration).

For 2 years of work, the bailiff did not find only bank card .

But the situation is very individual and depends on the bailiff.

For example, in the summer of 2021, one of the housing and communal services organizations mistakenly filed a lawsuit for a long-paid debt. The amount was small, only 6,000 rubles. There the bailiff acted differently: she immediately made a request to a large number of banks, which answered her about the amount of funds in the accounts, incl. and Tinkoff. But Tinkoff indicated the amount not at the current moment, but at the beginning of the month, when there was a minimum amount (still covering the debt). Then the arrest appeared on all Sberbank cards and savings accounts; the Tinkoff card was never arrested.

But, fortunately, the issue was resolved within a week and after providing the bailiff with a certificate from the housing and communal services, the arrests were lifted. And the amount that was written off went towards payment for the next months for housing and communal services.

All cards given in this article as examples were debit .

As you can see, bailiffs now quite easily find all the cards and deposits of the person against whom enforcement proceedings have been initiated.

Therefore, the only 100% way to hide money from the bailiffs is to get a card for a relative and use it until the debt is paid in full.

Or continue to use the seized card, quickly withdrawing or transferring all the money from the card immediately after receipt. And do not store them in accounts until the enforcement proceedings are terminated.

We wrote about how to manage to withdraw money from a seized card in this article >>.

And if you still decide to get a card, the risk of seizure of which is lower than that of Sberbank cards, we advise you to take a closer look at the debit card from Tinkoff Bank. For example, Tinkoff Black.

A huge advantage of Tinkoff debit cards is that you can withdraw money from a seized card to them even before the received funds appear on the card. Those. After funds are received on a seized card, for example, Sberbank, for some time they are not displayed on the card’s balance, and, accordingly, they cannot be transferred anywhere. But using the Tinkoff Bank application, money can be transferred without waiting for it to appear on the card.

Transfers to the Tinkoff card are completed in a matter of seconds, and you can easily manage to transfer money from it even from a seized card, for example, Sberbank.

You can read more about the Tinkoff card and leave a request using the link>>

For those who have pending enforcement proceedings, we recommend the Tinkoff Black card, including because it is very easy to use it to pay debts to bailiffs through State Services (for payments you will receive a 1% cashback, which fully covers the State Services commission for paying debts with cards).

And in the application you will see all new invoices for payment: you will learn about new FSSP debts, taxes or fines in time.

Payment for all housing and communal services is carried out without commission. For all purchases you will receive a good cashback (from 1% for each purchase will be returned to your card). And, although card maintenance costs 99 rubles per month, this amount can easily be covered by cashback.

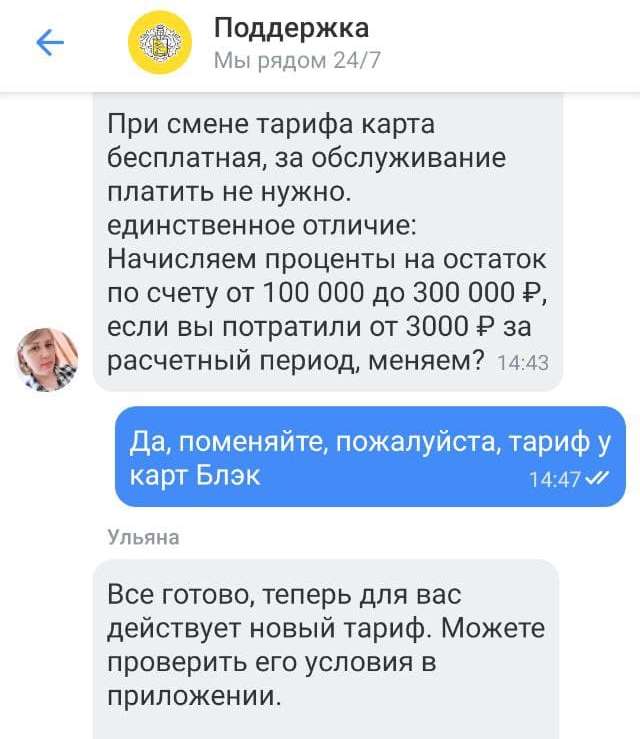

In addition, you can easily make your card free: just write to the technical support chat in the bank’s application and ask to “transfer to tariff 6.2” (the salary tariff to which all clients with a Tinkoff Black :

Cashback will continue to be accrued when changing the tariff, but servicing the card will be absolutely free .

Another important criterion when choosing a card for those who have debts from bailiffs is that the Tinkoff card is replenished instantly without commission through the application from any other card of any bank. Those. you can transfer money from a seized card to Tinkoff in a few seconds before the money is written off. The card will be delivered directly to your home or work.

You can read more about the Tinkoff card and leave a request using the link>>

Conclusion:

There is no clear answer to the question of which bank cards the bailiffs do not withdraw money from. Since bailiffs easily make requests to all banks that they consider necessary.

But you can get a card for a relative, or get a commercial bank card and transfer money to it, and then withdraw it.

In any case, if you have debts, do not keep all your money in banks , keep some of your money in cash.