The state strives to provide assistance and support to certain segments of the population through the payment of one-time benefits, subsidies and the implementation of federal and regional programs.

One of these is the “Young Family” program. The name itself speaks for itself, because a prerequisite for participation in the project is young age and a state in official relations with your spouse.

Decree of the Government of the Russian Federation dated December 17, 2010 No. 1050, in its latest edition, regulates the rules of participation and the essence of the federal target program “Housing”. It was within the framework of this project that a program appeared with the help of which young families can solve the issue of purchasing living space.

Decree of the Government of the Russian Federation dated December 17, 2010 No. 1050 “On the implementation of certain measures of the state program of the Russian Federation “Providing affordable and comfortable housing and utilities to citizens of the Russian Federation”

Up to what age is a family considered young, its privileges

- The federal program assumes that real estate can be purchased on both the secondary and primary markets.

- The subsidy can also be allocated to pay for materials or construction work when building your own home.

- Regions have their own programs to support young families; they may differ from the federal program. For example, in Moscow, young families who registered their housing before March 1, 2005, can only count on a social mortgage - purchasing housing on credit, but at a reduced cost.

- In this case, housing is purchased not from private individuals or developers, but directly from city authorities.

- The essence of the program is that the state contributes part of the cost of the apartment for the family.

- This is not a loan, not a preferential mortgage, but a subsidy - you won’t have to repay the money. And those who participate sometimes wait for years and end up left without government support.

- And yet, hundreds of families receive money from the budget for housing every year. There are specific conditions that must be met at the same time. A man and a woman who live together, but without a stamp in their passport, cannot participate in the program. At the same time, spouses may not have children; this will not prevent participation in the program, but it will affect the amount of the subsidy.

- Here are the nuances in issuing subsidies to improve housing conditions for young families in Russia. If you meet the requirements, you can submit an application and wait your turn. The family may be incomplete, for example one parent and child.

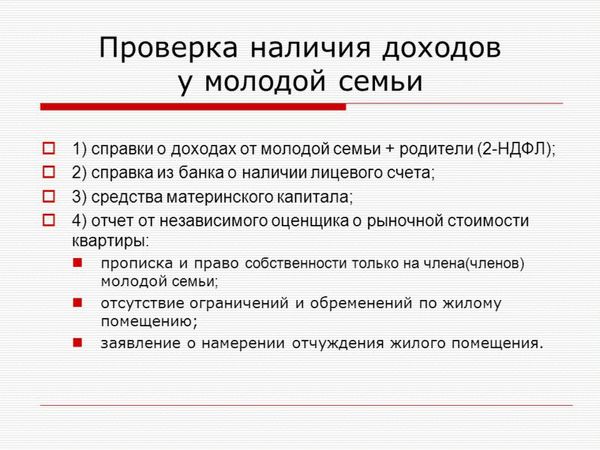

- The idea is this: the family receives 30 or 35% of the cost of the apartment from the state, and pays the rest itself - immediately or with a mortgage.

- To receive a subsidy, you need to confirm that you have money to pay the balance or repay the loan.

The local administration must officially confirm that this family needs improved living conditions.

For example, spouses do not have an apartment at all, they live in a dilapidated house, or with three children they huddle in a room with an area of 18 m².

They are not automatically registered - you need to submit an application and collect documents.

Or apply for a certificate that will confirm your right to a subsidy.

Each region has its own rules for determining the need to improve housing conditions - the local administration, social security or MFC will help you figure it out. It is set by the municipality, and it can vary even in neighboring cities of the same region.

For example, in Volgograd the accounting norm is 11 m² per person, in Khabarovsk - 12 m², in Moscow - 10 m², and in Krasnoznamensk - only 8.

In addition to the accounting norm, there is also a provision norm - this is not the same thing.

There are benefits where the provision rate is used for calculation, but for a young family an accounting rate is needed.

If you mix it up, you may lose the right to a subsidy, although there was a real chance for it. It is issued when the administration confirms that the family will receive money for housing.

The money from the program is used to buy an apartment or house.

The subsidy will be allocated only if the contract requirements are met.

The scheme is this: a family buys an apartment and is ready to pay the seller or developer.

First, she goes to the bank and submits a document from the administration, which confirms her right to the money.

Then the bank submits an application to the administration, receives confirmation and makes the payment.

Video on the topic:

Requirements for borrowers

Almost all banks have a set of basic requirements that their mortgage clients must meet:

- Russian citizenship;

- Age. The minimum age for concluding a mortgage agreement is 18-21;

- Work experience in the specialty for at least a certain period of time, confirmation of work activity with a certificate of income.

Read also: List of free medicines for 2021

The income that affects the approval of the application includes wages both for the main place of work and for part-time work.

Supporting citizens and caring for them is one of the current areas of state policy. By helping its citizens improve their living conditions, it equalizes the demographic situation, improves people's living standards and makes them strive to achieve new heights.

The State Duma told how to get rid of problems with queues.

- The only exceptions are women who care for small children.

- As for the number of people in a low-income family and their age, in this case there can be many options.

- First of all, the following families will be recognized as low-income: Recognition of families as low-income is carried out by regional local governments, rural and urban settlements.

- Control over the activities of all these bodies is carried out by the regional executive authorities.

- After accepting all documents for consideration, the applicant receives a receipt indicating this procedure.

- If necessary, local government employees may also require a list of other documents.

- Review of documents and verification of the accuracy of all specified data within thirty days.

- Next, the commission decides whether or not to recognize the family as low-income.

- The decision is issued to the applicant in the form of a specific conclusion.

- Citizens receive a refusal to establish their status in the following cases: In addition to all of the above benefits, there are also other types of assistance for special categories of low-income citizens. Such people are provided with compensation for travel and transportation of personal luggage.

How to get a mortgage for a young family

The “Providing Housing for Young Families” program operating throughout the country is recognized as the most beneficial measure of financial assistance for Russian citizens.

It allows the state to solve one of the most pressing social problems, which has been and remains relevant at all times.

The necessary conditions

Spouses must officially register their marriage. If citizens are in a civil marriage, then, in accordance with the standards of legislative acts, they are not issued a mortgage loan.

As a rule, individual banks, depending on the terms of a mortgage loan, ask to present additional business papers, certificates, and identification.

Preferential lending

Some citizens are interested in what is needed to obtain a preferential mortgage. It is one of the types of mortgage lending programs, similar to the state program focused on financial support.

The preferential mortgage program is designed for families with low income.

The bank is increasing the duration of use of loan funds to 35 years, while reducing the interest rate to 12-14.5%.

Families are entitled to receive a mortgage loan to purchase housing under the above program.

In this case, the family is allowed to purchase housing with the benefits established for a mortgage loan, arrange it with a subsidized interest rate, and receive some funds to pay part of the cost of the purchased housing.

How to obtain a mortgage for the construction of a private house can be found in the article: mortgage for the construction of a house

If you are interested in whether a co-borrower can take out a mortgage, read here.

Subsidization

The amount of subsidies provided by the state is determined by the market value of living space.

State social assistance to a young family is provided in the form of payments:

| Indicators | Description |

| Available for families who have no children | in the amount of 35% of the cost |

| For the birth of a child in the family and subsequent children | 5% is added to 35% |

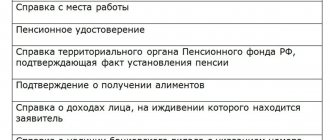

Required documents

To receive a mortgage loan, a young family must submit a list of required documents to the bank along with the application.

The required documents include:

| Indicators | Description |

| Spouses' passports | proving their identity |

| Evidence |

|

| Income certificates | both spouses |

| Certificates from both spouses | Form 2-NDFL |

| SNILS certificate | TIN information |

| Employment history | duly executed |

| Conclusion of the commission for examining housing conditions | confirming the family’s need for improvement |

| Extract from the house register | by place of residence |

| Certificate | granting the right to improve living conditions |

USEFUL INFORMATION: How to break up with your wife painlessly

Registration procedure

A young family must stand in line at the municipality so that it has the opportunity to receive funds from the state to improve their living conditions.

He reviews the submitted business papers for 10 days, after which he makes his decision. It can be both positive and negative.

The executive authority verifies the information contained in the documents. He notifies the young family in writing by sending a notice by mail.

It is issued on the basis of a decision of the local government. The certificate gives the right to receive social benefits from the regional budget in the year of its issue.

Start of the program

The purpose of creating housing programs was the difficult demographic situation in Russia.

Therefore, the “Young Family” program has its own history, which began in 2002. At the beginning of the twenty-first century, a project was launched to provide housing for young families. The subprogram lasted until 2010; during its operation, a large number of families improved their living conditions. Until 2006, a prerequisite for receiving a subsidy from the state was the presence of one or more children with young parents. After 2006, deputies revised the terms of the project, according to which families who did not have children received the right to receive benefits. The presence of a child added to the amount of final payments to the family. The age limit for spouses was set at 30 years.

In 2008, the terms of the program changed significantly, raising the age of either spouse to 35 years. To date, the “Young Family” program applies to families in which at least one of the spouses is under thirty-five years of age. In 2010, the program ceased to operate and was replaced by a new project that currently exists.

Terms of service

Initially, this social mortgage program was approved for the period 2011-2015. However, the Government of the Russian Federation decided to extend it until 2021.

This is primarily due to the fact that in previous years it has proven itself to be the best. Moreover, it is worth noting the fact that, according to research, it influenced the demographic situation in the country. It is extremely popular among the population of the Russian Federation.

In order to freely use this program, you must meet certain requirements.

In particular, we are talking about the following conditions:

- a young family should be no more than 35 years old;

- the spouse or his wife must be a citizen of the Russian Federation;

- the overall income level of a young family should be average or above average;

- the young family was recognized as those who are in dire need of a change of housing due to the disrepair of the existing one, or it does not exist at all.

In addition, you need to know that:

this program can be used even if there is only one parent (in this case) the mother

It doesn’t matter how many children she has; in a situation where a young family applies for a mortgage loan under the program in order to purchase real estate in the capital or in St. Petersburg, a prerequisite is to live in these cities for at least 10 years; The area of the purchased property is determined from the standards that apply directly in a particular region. It is worth noting that each region has its own standards; for a young family that does not have children, real estate can be purchased under this program with an area of no more than 43 square meters

If the family is defective, or there is more than one child, 18 square meters are due. meters for each family member.

If a young family applies for a large area of real estate, then under the terms of mortgage lending for a young family they may be refused.

If we talk about the real estate cost assessment itself, this process is carried out depending on the standards for each specific region separately. In a word, the standards are different everywhere and you need to remember this.

The Government of the Russian Federation provides the following conditions for participation in the state program from Sberbank:

- a young family that does not yet have children is provided with a subsidy of no more than 30% of the cost of the purchased living space; if there is 1 child, the subsidy does not exceed 35%;

- in the event that the subsidy is issued specifically to pay the remaining amount of the debt, which is significantly lower than the fixed percentage for a certain category of citizens, then the final amount will be determined precisely by the balance;

- The purchased apartment or house must be purchased directly on the primary market. Purchasing on a secondary level is strictly prohibited, since this housing area is directly related to the economy class.

It is worth noting that you can more accurately determine the amount of the subsidy using the online calculator, which is located on the official website of Sberbank. This is not difficult to do and will take no more than a minute.

Providing land plots to large families: law and practice

According to the Decree of the Government of the Khabarovsk Territory dated September 24, 2014 No. 337-PR “On establishing payment rates under a contract for the sale and purchase of forest plantations for the own needs of citizens in the Khabarovsk Territory,” each forest species has its own prices.

In accordance with the Law of the Khabarovsk Territory dated June 29, 2011 No. 100 “On the free provision of land plots in the territory of the Khabarovsk Territory to citizens with three or more children”, citizens with three or more children have the right to acquire land plots free of charge, located in state or municipal ownership, including land plots for which state ownership is not demarcated (hereinafter referred to as land plots), in the following cases:

03 Mar 2021 etolaw 866

Share this post

- Related Posts

- When registering a deed of gift for a person, can the bailiffs then take away the car for debts?

- Calculation of penalties, rent, refinancing rate

- Announcement from Konycheva for land surveying

- Rented Apartment Bailiffs Came

Receiving assistance from the state step-by-step instructions

It is possible to complete all the documents and submit an application within 1-2 months, but you may have to wait quite a long time for your turn.

Step 1. Collection of necessary documents

First of all, the family must be recognized as needy, so the spouses must contact their Administration. Take with you a mandatory set of the following documents:

- original passports

- certificate confirming marriage registration;

- birth or adoption certificates of a child;

- certificate confirming family composition.

According to the standard, the area per person should be less than 12 m2, then he can be recognized as needy. In this case, it is necessary to provide information about living conditions for the last 5 years. If the address has changed, you need to make inquiries to the relevant passport offices. Based on the result of the review, after no more than 30 calendar days, the Administration must make a decision and provide the family with an appropriate certificate.

Step 2. Submitting an application, waiting

The same documents must be attached to this certificate. In addition, you need to bring the original certificate of income for each person (usually 2-NDFL). The application is submitted to the same Administration. After this you need to wait another 30 days. If a positive decision is made, the family is registered to receive government assistance (a queue is formed).

Step 3. Buying an apartment

When it is the applicant’s turn, the Administration additionally notifies him about this. To receive a subsidy, the applicant must provide the same documents, as well as all papers related to the transaction for the purchase of an apartment:

- mortgage agreement;

- apartment purchase agreement;

- certificate of ownership of the apartment (now this is an extract from the Unified State Register of Real Estate);

- details of the bank account where the funds should go.

After approval of the provision of assistance, the family is given a certificate confirming this fact. From this moment, the applicant has 9 months to decide how to use this subsidy (take out a mortgage for an apartment or build a house, pay for a share in a cooperative, buy housing in cash with the addition of their own savings, etc.).

Getting a mortgage

Many banks provide additional preferential lending programs for various categories of citizens. One of these categories is a young family, which can participate in a program specially developed individually by each bank.

In this case, the bank has the right to present its own requirements for the concept of “young family”, different from the state ones. Thus, banks may require the following:

- One or both spouses must be under 35 years of age at the time of applying for a mortgage.

- Registered marriage for more than a year or another period.

- Russian citizenship.

- Depending on the presence of children, the loan interest rate and down payment may vary.

- Official employment of one or necessarily both spouses.

- Down payment from 10%.

- Participation of co-borrowers and/or guarantors.

- Both spouses have no bad credit history.

- Financial ability to pay mortgage obligations.

Based on these criteria, the bank independently makes a decision on whether the applicant meets the established criteria. If a married couple meets these criteria, they are provided with a mortgage loan on more favorable terms. These may include:

- Reduced interest rates.

- Extended loan term.

- Possibility of deferring the final payment amount under certain conditions.

- Reduced down payment.

- Unofficial family income is taken into account.

USEFUL INFORMATION: Formula for indexing alimony in different cases

These preferential banking programs can be used together with the state or independently of it.

Documents for the bank

To draw up a mortgage agreement, a married couple needs to prepare the following documents with which they need to come to the bank:

- passports and birth certificates of all family members;

- documents proving financial income (2-NDFL certificate, bank account statement and other evidence of additional income);

- Marriage certificate;

- passports of co-borrowers and guarantors.

Based on the documents provided, the bank makes a decision and transfers funds to the specified current account.

When concluding a shared construction agreement, you must pay attention to the list of developers accredited by the bank with whom it cooperates. If you choose another developer, the bank may refuse payment

Young Family Program

The Young Family program subsidizes the improvement of family living conditions. Payments are made in the manner approved by the Rules. Subsidies are aimed at solving the following problems:

- buying an apartment or house;

- share contribution to a housing construction cooperative;

- payment of a contract for the construction of a house;

- making a payment on a loan to purchase a home or paying off the mortgage and accrued interest.

The minimum payment is 30% of the cost of housing for a childless family and 35% for a family with children. Assistance for improving living conditions is provided only once. The participant must meet the following requirements:

- compliance with age criteria;

- lack of housing or the need to improve living conditions;

- availability of permanent work and solvency.

The standard total living area for two people is 42 sq.m., for three or more family members - 18 sq.m. for everyone. The need to improve living conditions must be officially confirmed. The main factors for recognizing the fact of improvement of living conditions:

- the housing area is less than the standard in the region;

- non-compliance with sanitary standards and requirements established for residential premises;

- several families living in the same living space, including a patient with a severe chronic illness.

Conditions for obtaining a mortgage

Most young people purchase housing using borrowed funds. A mortgage is issued in banks or in JSC DOM.RF, which specializes in mortgage lending to citizens.

Young families may be provided with preferential terms for loan products. It could be:

- reduced rate;

- reduced percentage of initial contribution;

- other benefits.

Each organization sets its own mortgage regulations and requirements for clients. These conditions are:

- age limit;

- payment of the down payment;

- determination of solvency;

- certain work experience.

A certificate of entitlement to a subsidy must be provided to the credit institution. Once all terms and conditions for the loan are agreed upon, an agreement is concluded. A large selection of regional preferential loans is provided by JSC DOM.RF.

Registration procedure

The certificate is issued by the local administration body based on the decision made to include a young family in the list of program participants. The application and documentation are verified within ten days.

Based on the results of the inspection, a decision is made to include the family in the list of program participants or to reject the application. The family is notified of the decision within five days. Refusal may be received in the following cases:

- participants do not meet established requirements;

- an incomplete package of documents has been collected;

- Inaccurate information is provided;

- government support has already been used previously.

The family's right to receive payments is confirmed by an appropriate certificate. This document is provided to the servicing credit institution within a month from the date of its receipt. Based on the agreement concluded with the bank, an account is opened for non-cash transfer of funds.

Required documents

To participate in the program, an application filled out according to the approved form is submitted. It should be accompanied by a package of supporting documentation:

- passports of adult family members and birth certificates of minor children;

- marriage document;

- conclusion on the need to improve living conditions;

- certificate of solvency.

If subsidies are requested for loan repayment, additional documents are provided. These include:

- documentation on registration of housing purchased on credit;

- agreement with the bank;

- information about the loan debt and accrued interest.

Sberbank Young Family Program

- The size of the payment varies depending on the presence of children in the family, as well as the average cost per square meter in the region.

- If there are two or more children in the family, another part of the cost of housing will be covered by maternity capital, which can be sold together with a housing certificate.

- A prerequisite is that the family must be registered as in need of improved housing conditions, as well as the availability of a sufficient amount of funds to pay the remaining part (65-70%) of the cost of housing.

- If the area of an apartment or house is larger than what a family is entitled to, the subsidy still only covers a percentage of the standard area.

- In addition, you can only buy economy (comfort) class housing with the help of a subsidy; luxury real estate is not eligible for a subsidy.

- Considering the difficult financial situation of young families and the high cost of housing in Russia, assistance in purchasing real estate for young families is also possible in the form of a social mortgage.

- The only exception is that the money is not used to pay off the purchase and sale agreement or to build a house, but to pay off the mortgage loan.

- Preferential terms for mortgage loans for young families are offered by commercial banks as part of government programs. RF (former Agency for Housing Mortgage Lending), Sberbank, VTB, Rosselkhozbank and other credit organizations also have programs.

- For example, Rosselkhozbank offers various social mortgage options for young families, the interest rate is 9.75-10.25%, which is lower than other programs.

- Starting in 2021, another, larger-scale program to help young families is being implemented.

Therefore, when applying for, for example, a mortgage loan, a family with 2 children can take advantage of several benefits at once: Since the status of a young family depends only on the age of the spouses, it does not need to be confirmed separately - it will be enough to present an identification document when submitting applications.

In order to receive a housing subsidy under the Young Family program, you must go through several stages: After receiving the Certificate, the family can submit it to the bank, which will open the appropriate account.

When a family decides to purchase real estate, it will notify the bank, which will request the appropriate amount from the local administration.

When completing a transaction, funds are transferred either to repay the mortgage loan or under the purchase and sale agreement.

The list of documents required to receive a subsidy is as follows: This list is not exhaustive; you should check the package of documents with the local administration, since some forms of documents are approved at the local level.

If a family wants to receive a free plot of land, the procedure is slightly different: Thus, to participate in the program, you need to collect a fairly large package of documents, and then submit it along with an application to the local administration.

In recent years, the program to provide housing for young families has undergone some changes.

In particular, according to Decree of the Government of the Russian Federation No. 609 “On Amendments to Certain Acts of the Government of the Russian Federation,” state subsidies cannot be used when purchasing housing from close relatives.

USEFUL INFORMATION: How to limit a father's communication with a child

Also, starting this year, the implementation of the federal target program “Housing” is terminated ahead of schedule, but this is a technical issue; instead of this program, the program “Providing affordable and comfortable housing and utility services to citizens of the Russian Federation” begins to operate.

It is in the new program that the opportunity to obtain a social mortgage at 6% per annum has been added.

For recipients of this mortgage there are no age requirements for the applicant (can also be obtained by those over 35 years old). In 2021, a change was made according to which the subsidy cannot be used for the purchase of housing on the secondary market.

These changes are part of government policy aimed at enhancing new construction and developing mortgage lending in Russia.

Funding for the program to help young families comes from the regional budget, but initially the money is allocated by the federal center.

Therefore, before applying for a subsidy, you need to make sure that a financing agreement has been concluded between the constituent entity of the Russian Federation and the customer of the state program.

Video on the topic:

Subsidy calculation rules

Calculation of the amount of state support is calculated using the following formula:

RS = 30% * SSKM * P, where

- RS - subsidy amount,

- SSKM - average cost per square meter in the region;

- P is the taxable area of the property.

In each region, one person or family is entitled to a certain number of meters. However, if the area of the purchased housing is much larger than the minimum required, only the necessary assistance is taken into account.

Package of documents for candidates for participation in the state support program Young family

Before contacting government agencies, applicants will have to prepare a package of documents according to the established checklist.

Checklist of documents for participation in the state program:

- An application that must be signed by both spouses (if the family is complete) or only the parent of a single-parent family with a child. The document is drawn up in 2 copies, one of which remains in the hands of the applicants.

- A certificate from the Housing Inspectorate stating that the living conditions of the applicants’ family are officially recognized as in need of improvement.

- Photocopies of the applicants' civil passports.

- Birth certificates for each child (if there are no children, then only a marriage certificate is provided).

- Documents confirming the applicants’ income and availability of their own funds (bank account statements, 2-NDFL certificates, certificates of accrued benefits, etc.).

Having collected the documents, they must be submitted to the administration. Verification of documents usually takes at least two weeks. Only after making sure that all the conditions for participation in the federal-level program are met will administration officials put the young family on the waiting list.

Practice shows that queues of program participants move quite slowly. The administration of a large region is able to provide subsidies to about 200 young families per year. There are many more people who want to receive financial assistance from the state. That is why experts recommend getting on the waiting list in advance, without waiting until one of the spouses turns 35 years old. If your family’s turn does not reach within a year, then you will be removed from the lists, since the family will no longer be considered “young” by law.

A young family is: definition in law 2021

After this period, the applicant will receive a detailed answer about a positive or negative decision;

- Approving lists and waiting for your turn. To participate in the housing program in 2021, you need to submit the entire package of documents before the beginning of September 2021 and, after approval, wait your turn;

- Prompt subsidy processing. After receiving a response from the local government about a positive decision (later replaced by a certificate), you must transfer this confirmation to the bank as quickly as possible within 30 days after receipt. In turn, the bank opens a bank account in the name indicated in the certificate and sends the documents within 6 days to local authorities. After receiving a request from the bank, government officials transfer funds as a subsidy within 5 days.

The decision is made according to the circumstances and depending on individual criteria.

- Newlyweds, provided that they are both citizens of the Russian Federation. In a family with a child or several children, only one parent with a Russian passport is sufficient to receive benefits. In an incomplete family, a Russian citizen must be the parent in whose care the child is.

- Applicants over 35 years of age, even if they just got married, are not considered in the “Young Family” program, since they no longer meet the age criteria.

- Families that cannot be considered in need of housing due to their financial situation cannot participate in the program.

An important requirement for obtaining a certificate is having at least two years of work experience in your current place.

- A document certifying the family’s need for improved housing conditions. Most often we are talking about an extract and the Unified State Register, but sometimes other certificates may be required (for example, if a change of place of residence is required due to the presence of a sick relative).

- Marriage certificate.

- A document confirming registration at the place of residence.

Thus, some categories of citizens can receive a certificate under the “Young Family” program.

In practice, this is not as simple as it might seem at first glance.

This jump is due to the fact that prices for building materials have increased and the cost of land has increased.

The main and only condition of the “Young Family” program is that the location of the future home is determined by representatives of local authorities. They also approve the developer’s company, all the necessary documents, and the plans according to which the house will be built.

By July 1, 2021, 25 million square meters of housing will be ready for delivery, located in 67 federal subjects.

In addition, each project must be located with a developed infrastructure, and if there is none, then by the time the project is commissioned, all necessary buildings (parks, hospitals, kindergartens, shopping centers) must be within walking distance

Another important condition concerns the cost of housing. It should not be higher than 80% of the cost of apartments in the city

At the same time, they will be able to purchase or build housing in the territory of the region where they have lived for at least five years.

Programs to improve housing conditions for young families, as well as to provide housing for veterans, will continue.

Determination of the Investigative Committee for civil cases of the Supreme Court of the Russian Federation dated January 16, 2008

When considering an application, the decisive factor will not even be the presence of a child in the family, but the average income sufficient to make mortgage payments.

Other features of regional programs should be clarified at your place of residence, since each region has its own changes in legislation. They are capable of significantly expanding the scope of federal law.

We are talking, in particular, about the state mortgage lending program, operating on special preferential terms.

Law on Young Family 2018

Conditions for participation in the Young Family program in Moscow and the Moscow region

In Moscow, the housing issue faces these segments of the population as acutely as it faces citizens of other regions. This is due, first of all, to the fact that prices for apartments in the capital and region are very high.

Important

In this regard, a large percentage of married couples under 35 years of age are registered as needing housing.

The “Young Family” project in the capital began its work in 2003. Its goals are determined by federal requirements to provide citizens under 35 years of age with housing.

Participation in the program

In order to take advantage of the right to preferential purchase of real estate, you can go in several ways.

A citizen can contact the local government authority directly, or the MFC with a package of documents, or fill out an application on the State Services website. Everyone chooses an option that is convenient for themselves. In any case, after a citizen applies for a service, he will have to wait for a decision from the authorities within 10 days, after which the applicant will be sent a detailed response about a positive or negative solution to the issue.

Read also: Benefits for military wives

When a citizen’s application is satisfied, he awaits approval of the lists and his turn.

The queue is formed on the dates of persons’ appeal to local government bodies. All applicants who submitted documents on the same day have privileges based on the number of children. If the number of children matches, the queue is formed in alphabetical order.

Attention! To become a participant in the program in 2021, a package of documents must be submitted before September 2021. This rule applies to all regions; the only deadline for submitting documents in the regions may vary within one or two months.

After the applicant gets his turn, he will need to contact the bank branch to open an account and transfer all information to the self-government body. After approval, local authorities transfer funds within 5 days.

Attention! Choosing an electronic application form has undeniable advantages. The absence of queues and the ability to track the status of an application make online applications a popular way to interact with the municipality.