What is mortgage refinancing?

From a formal point of view, this is a new loan with a lower rate that pays off an existing mortgage loan.

They take it to improve lending conditions - if they don’t like the rate, the size of the monthly payment, the quality of service at the bank, or if they need to take the apartment out of collateral for sale. The product is quite specific: during periods of stability in the refinancing rate, it is almost never used. The current situation in the Russian Federation, when over the course of two years loan rates first soared by 30-50% and then fell by more than half, is unique. Right now, mortgage refinancing is most profitable.

What is needed to refinance a mortgage at VTB

A mandatory requirement for the borrower is to work in Russia. The applicant must be employed permanently and the probationary period must have ended. Citizenship can be any. If it is Russian, then the applicant can work in a transnational organization abroad.

Recommended article: Why the mortgage amount at Sberbank online is increasing

Involving relatives and cohabitants as guarantors is welcome. Spouses are obligatory guarantors in the absence of a marriage contract prohibiting this.

The premises may be ready or under construction.

How to Apply Online for Mortgage Refinance

What documents are needed to refinance a mortgage at VTB

To consider the application, the bank requires documents for the borrower and the premises:

- an application that can be submitted through the bank’s website or in person at its office;

- passport;

- SNILS;

- 2-NDFL or other confirmation of regular income, it is not required for participants in salary projects;

- a copy of the employment record for applicants who do not receive salaries through VTB;

- military ID - men under 27 years old;

- an extract from the Internet bank or received at the lender’s office about the balance of the debt and the absence of overdue payments as of the current date;

- agreement-the basis for the acquisition of property rights;

- current loan insurance agreements.

If co-borrowers or guarantors are involved, a similar package of documents is required for them. The exception is spouses as obligatory guarantors. All they need is a passport and SNILS.

VTB does not state any other required documents to consider the possibility of refinancing, but warns that it may request any other information and certificates. Each applicant personally learns, when communicating with a mortgage employee, the exact list of documents needed to refinance a mortgage at VTB.

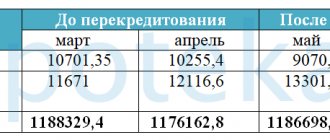

Let's look at an example

Let's assume that one of the clients of a large bank took out a mortgage loan in the amount of 2.5 million rubles for a period of 20 years. The rate at the time of the transaction was 15% per annum. But after 2 years, the economic situation in the country changed, and banks began to finance clients at 10.5%.

During this period, the amount of the principal debt on the loan decreased slightly, since the borrower paid mainly interest. The client considered that it would be advisable to reissue the loan at a lower rate. This will allow him to make his monthly payment more comfortable. The balance of debt at the time of the decision was 2,453,601.11 rubles.

An analysis of the situation on the financial market shows that refinancing a mortgage will not be profitable in all cases. You should contact the bank when:

- the difference in rates is at least 1-2% per annum;

- the client pays off two mortgages;

- at least half of the term has passed since the signing of the contract;

- the applicant has a foreign currency mortgage loan issued before 2015;

- the borrower feels that the debt burden is becoming unbearable for him;

- the user is not satisfied with the terms of cooperation with the credit institution (for example, the bank does not have enough ATMs or its offices are inconveniently located);

- the client wishes to change the currency of the mortgage loan.

- Important information: when re-issuing a loan, the borrower will face additional costs for assessing real estate, obtaining certificates and paying state fees, as well as insurance. This point should be taken into account immediately when making approximate calculations.

Refinancing will be successful if:

- a new bank and a lending program have been carefully selected (we will help you choose favorable refinancing conditions);

- the package of documents has been correctly collected and filled out (the slightest inaccuracy may cause a refusal from the bank);

- consent to the transaction is given by all three parties - the primary creditor bank, the client and the bank where it is planned to refinance the mortgage.

Restructuring as an alternative to refinancing

What is the difference? Refinancing is the repayment of an existing loan with funds from another. This involves concluding a new agreement, usually with a third-party bank.

Restructuring is the agreement of new terms for a loan through the conclusion of an additional agreement under the existing contract.

Recommended article: Refinancing a mortgage at the lowest interest rate - Top offers

The purpose of the procedures is similar - to reduce the financial burden of the borrower. However, contacting your lender has advantages:

- The bank already has information about the client’s income. The collection of documents on financial solvency will be formal.

- Often, the mortgage agreement provides for obtaining the lender's consent to refinance. In this case, if you conduct a transaction on the side, present the bank with a fact, this will be a formal violation of the current agreement. You may be charged penalties and fines. Their size can reach several thousand per day. Restructuring does not carry this risk.

Mortgage restructuring conditions

When is refinancing beneficial?

Before collecting information about what you need to refinance a mortgage loan or restructure it, evaluate your benefits. For this:

- You need a current payment schedule and a preliminary calculation of a new one. It’s better to ask for the second one at the bank branch you plan to contact. Calculators on websites often do not take into account all conditions.

- We find the overpayment according to the first and second options, calculate the difference, and subtract from it everything that we list below:

- cost of the appraisal report;

- state duty for registering an agreement in Rosreestr;

- notarized consent of the spouse, if you are married.

Study and compare insurance conditions; a reduced rate often entails commissions for insuring additional risks.

Mortgage refinancing is beneficial when:

- the rate under the new conditions is reduced by at least 1.5-2%;

- a small part of the debt has been paid, and you are not planning large early repayments, that is, a significant part of the upcoming payments falls on interest rather than principal;

- risk insurance under the new contract is comparable to the previous conditions or more profitable.

Reviews from mortgage providers

We took out a mortgage from Sberbank in 2014 for an apartment in a building under construction. At 14.25% while construction is underway and 13.25% after the house is commissioned. They paid for two years, glad that they managed to do it before the rates increased, and then they began to be sad.

By the end of 2021, our rate began to seem cosmic. We examined the mountain of bank offers and settled on Absolut Bank. Then he offered excellent conditions - 11.25% instead of our 13.25% per annum. The monthly payment was thereby reduced by 4,300 rubles, taking into account the preservation of the loan term. We grabbed a calculator and calculated that we would win more than 885 thousand over the remaining years.

But they soon realized that there would be additional expenses. With the new bank we had to insure not only the apartment, but also life and health. This is plus 10.3 thousand rubles per year. The only consolation was that Sber paid 7,600 a year for insurance, the difference is not too big. Additionally, we paid 2,500 rubles for the assessment, 300 rubles for an extract from the Unified State Register of Real Estate, and a state fee for re-registration of 668 rubles for two. But even after deducting expenses, they gained more than 830 thousand, and the monthly payment became, although not much, less stressful.

When is mortgage refinancing unprofitable?

In fact, not every borrower should get involved in refinancing transactions. There is a fairly extensive list of cases and circumstances when this should not be done:

1. A small amount of the remaining debt (up to 1 million rubles) and a short period until repayment (2–3 years or less).

The fact is that the borrower pays the bulk of the interest to the bank in the first half of the loan term; towards the end, most of his monthly payment goes directly to repaying the loan.

Let's look at an example:

- debt balance - 0.5 million rubles;

- maturity - 3 years;

- rate - 11%;

- the amount of interest payable is 89 thousand rubles. If the rate is reduced by 1 percentage point - to 10% - the amount of interest payable will decrease to 81 thousand rubles. It turns out that the total gain will be only 8 thousand rubles, which is comparable to the cost of appraising the apartment alone.

2. Small difference in rates (less than 0.5%).

Example:

- debt balance - 1 million rubles;

- maturity period - 5 years;

- initial rate - 10%;

- the amount of interest payable is 275 thousand rubles. When refinancing at 9.5%, the interest payable will be 260 thousand rubles. The difference will be 15 thousand. This is unlikely to cover refinancing costs.

3. There is no confirmed sufficient income.

Since you took out your mortgage, your official income may have decreased. The bank will refuse a loan if the payment is more than 40–50% of your salary.

4. The price of the apartment is equal to or lower than the amount of debt.

If the price of an apartment has decreased since the date of purchase (this is possible, for example, during a crisis), then it may not be enough to obtain a deposit, and then money and time will be wasted. Banks take the collateral value at a discount of 10–20% from the market price. So, if an apartment used to cost 3.5 million rubles, and now it’s 3 million, and you need 3.1 million rubles to repay the loan, then you will be refused. In this case, the maximum amount you can count on is 2.4–2.7 million rubles.

There are arrears on other loans over the past year or two.

What is needed to refinance a mortgage at Sberbank

Requirements for the borrower:

- minimum age 21 years;

- at the time of payment, maximum 75 years;

- Russian citizenship;

- for those who receive their salary through a third-party bank, the total work experience is at least 1 year, in the last place from six months;

- refinancing is provided to the person acting as a borrower or co-borrower on the primary loan;

- Spouses must act as co-borrowers unless they have a marriage contract that contradicts this requirement.

Debt requirements:

- no arrears over the last year;

- the loan was issued no later than 180 days ago;

- at least 90 days until the end of the loan agreement;

- the requested amount is from 300 thousand to 5 million rubles for all regions except Moscow, for the capital - up to 7 million;

- the debt has not previously been restructured.

Recommended article: Procedure and conditions for refinancing a mortgage at Rosselkhozbank

Sberbank does not have any special requirements for the premises. It must be residential. This may be part of the premises, for example a room.

How to refinance a mortgage, stages

What documents are needed to refinance a mortgage at Sberbank

Mandatory list at the first stage:

- application - a link to the form is on the bank’s website in the section describing refinancing, you can also contact the branch to fill it out;

- borrower's passport;

- if there are co-borrowers, their passports;

- if the borrower/co-borrower has temporary registration, a certificate;

- confirmation of permanent income and employment (2-NDFL, 3-NDFL, copy of work book, employment contract, account statements, etc.);

- consent to the bank receiving information about credit history and processing of personal data.

Sberbank does not require certificates of debt balance. In most cases, it obtains information from credit bureaus. If questions arise about the remaining debt, the client may be asked to provide an additional certificate from the original creditor.

How many times can you refinance your mortgage?

Having received initial approval for refinancing, the applicant must submit documents for the property within 90 days:

- basis of ownership (purchase and sale agreement, share participation in construction, etc.);

- an assessment report made no earlier than 6 months ago;

- floor plan and explication or technical plan - the document is not required for apartments in multi-storey buildings if there has been no redevelopment;

- notarized consent of the spouse or marriage contract;

- for unmarried persons, a statement about the absence of a spouse, drawn up at a bank or a notary;

- permission from the trustee authorities if a minor is involved in the transaction;

- certificate of persons registered in the premises or their absence.

An extract from the Unified State Register is not mandatory; the bank can order it independently.

The exact list of documents needed to refinance a mortgage with Sberbank depends on the specific situation. The bank reserves the right to request any additional certificate to assess the possibility of issuing a loan.

How to refinance a mortgage at Sberbank on Domklik

When can you apply for mortgage refinancing?

The decision to reissue a loan to purchase a home must be justified. Especially considering the fact that since March 2021, the rates for this banking program have increased against the backdrop of the economic crisis and the declared pandemic, not every transaction will be beneficial for the client.

You should only contact the bank for refinancing if the debt repayment period has not yet reached half of the total loan term. And if there is less than a year left before the end of the loan payment, and the borrower has repaid a significant part of the interest to the bank, there is no point in concluding a new agreement.

As for banks, they do not seek to issue loans to refinance loans issued recently. Every lender wants to make sure that the client is solvent and reliable. If the existing debt is less than six months old, then it will be difficult to renew the contract.

Which mortgage can be refinanced?

Not all mortgages can be refinanced. There are a number of requirements for such loans:

- The client must have no current overdue debt, and the monthly loan payment must be paid on time for at least the last 12 months. Banks monitor this very strictly, and the presence of even minor delays can affect the decision;

- Each financial institution has its own conditions for this program. Some banks set limits on the amount of refinancing. And other companies determine a period before which the contract cannot be renewed;

- It will not be possible to refinance a loan that has less than 3 months left to pay;

- The bank will refuse to renew the agreement on new terms for those clients who have already had debt restructuring.

By the way! In order not to forget about loan payments, you can use. We will not only notify you in case of a late payment, but we will also inform you if someone tries to apply for a loan on you, about an increase in the credit limit, if the interest-free credit limit on the card has been exceeded, and much more!

How to apply to VTB

Conditions at VTB will also depend on the location of the client’s application. You can consider the requirements and compare them with Sberbank using the example of Moscow and the Region. In 2021 they will be as follows:

- You can use the service even at the stage of housing construction - this is important for those who have signed an equity participation agreement even before the developer begins to provide the keys to the apartments.

- The service is also provided for those who have taken out a mortgage on existing or secondary housing.

- The minimum rate is 10.1%.

- The term is 30 years.

- The maximum amount is 30 million rubles.

Requirements:

- the apartment was purchased from a developer or in a new building accredited by VTB Bank;

- at least 2 documents - a Russian passport and a second one of your choice;

- certificate 2-personal income tax is required, or according to the bank’s form;

- registration and citizenship do not matter;

- life and health insurance of the borrower;

- if you need to increase the loan amount, then it is necessary to involve at least one co-borrower or guarantor - relatives or spouse;

- Minimum work experience - 1 year.

How does mortgage refinancing work at VTB, advantages:

- no commissions;

- Individual conditions are provided for the bank's salary earners - you can get a loan for up to 90% of the appraised value of the property;

- no need to collect a large number of documents;

- large selection of accredited developers;

- small bet;

- You can register as a business owner, individual entrepreneur;

- You can repay early - there are no penalties;

- You can make a preliminary calculation and fill out an application on the website.

Recommended article: Refinancing a Sberbank mortgage at Rosselkhozbank

In this case, it is possible to sum up other credit obligations that the client has. The processing time for an application, in practice, does not take more than 3 working days.

Additional information for clients:

- minimum age - 21 years, maximum - 65 years at the time of repayment;

- until the end of the mortgage agreement - more than 3 months;

- no current overdue debt.

Subtotal: VTB has the lowest rate and loyal conditions.

Conditions for refinancing a mortgage at VTB

Is it possible to refinance a mortgage with another bank?

Yes, you can. Banks are reluctant to restructure their own mortgages because they lose interest income due to lower rates. Therefore, registration with another bank may be easier than with the primary one.

Currently, the following conditions for processing refinancing transactions are popular:

- the interest rate must remain unchanged throughout the entire loan term;

- money is issued only in domestic currency;

- good credit history in BKI (check your credit history);

- term of use of borrowed funds – from 1 year to 30 years;

- repayment is made in equal parts;

- there are no commissions for reviewing the application and issuing cash;

- issuance limit – 80-85% of the value of the property;

- collateral is required;

- possibility of early repayment of debt;

- charging late fees;

- issuance of funds only by bank transfer;

- increase in interest rate if insurance is canceled.

Banks issue loans to individuals only if:

- solvent;

- not younger than 21 years old and at the time of expiration of the concluded contract their age will not exceed 65-70 years;

- have a total work experience of at least 1 year and at least 3 months in the last position.

Can a creditor bank prevent a borrower from refinancing with another bank?

It all depends on the initial mortgage agreement, which is concluded between the bank and the borrower. Some credit institutions indicate in the agreement a ban on subsequent mortgages of the same property. If there is no such prohibition in the contract, then you can safely contact the new bank for a more favorable offer.

But there are limitations here too. The previous bank often delays the process of considering the application, and the borrower cannot influence or speed it up.

IMPORTANT!

Since the refinancing process itself cannot be called quick, it should be taken into account that at the time of re-registration of the collateral, a higher rate applies to the borrower. At the same time, the requirements for solvency will be higher if the collateral is transferred with a deferment.

Analysts predict that 2021 will be a refinancing boom. People use this type of lending to improve the conditions of existing loans, including mortgages. In order for the refinancing process to truly become a change for the better, you should carefully select a bank and also calculate all the proposed conditions.

If the difference is less than 1.5%, then you should not refinance the loan and waste effort, money and time on it. Of course, the best option in case of difficulties is to restructure the mortgage at your bank. But credit institutions do not always agree to such conditions.

Step-by-step instruction

To conclude a new deal, the property owner must follow a step-by-step series of steps.

- Check with your “home” bank to see if they offer interest rate reduction services. This procedure allows you to reduce your debt burden without unnecessary formalities and expenses.

- Find an institution with a suitable program, clarify the terms of the loan and make calculations. To do this, you can use a special calculator.

- You need to find out in advance what additional costs are expected. Refinancing should be profitable only in this case it is worth resorting to this procedure.

- Advice to borrowers: when selecting a bank, it is recommended to use our mortgage selection service. With its help, you can refinance on the most favorable terms.

- Clarify the package of documents, collect them and submit them to the lending department of the selected bank.

- Fill out the personal information and submit an application. Many banks provide their clients with the ability to upload documents remotely. It is important to provide all data with maximum accuracy.

- Wait for the results of the consideration of the application (usually it takes no more than 2-3 days to review each application, but there are rare exceptions). If the bank responds remotely, this does not guarantee that the client will be issued a loan. A quick refusal may indicate that the applicant filled out the application form incorrectly.

- Contact your current lender with an application for early repayment of your mortgage.

- Take a certificate of the debt balance and personal details for transferring funds.

- Prepare a package of documents related to the property. If necessary, conduct a real estate assessment. This procedure usually takes 3-5 days.

- Sign an agreement with the new bank.

- Wait for the transfer of funds from the first creditor and pay off the old debt. Money is transferred by bank transfer.

- Take a certificate of full repayment of the debt to present it to the bank and a mortgage note with a note that the obligations have been fulfilled and the client does not owe anything to the financial company.

- Change the holders of the pledged property - contact the MFC and remove the encumbrance from the pledge under the first agreement.

- Provide the new lender with a certificate of ownership, not encumbered by collateral, and a recently received extract from the Unified State Register of Real Estate. This will serve as the basis for drawing up a new mortgage.

- Register collateral for a new transaction. When re-registration is carried out, the data of the second financial institution is entered into the register.

- Take out insurance for the collateral.

- Receive a modified payment schedule.

- Take the remaining money, if this is provided for in the loan agreement. However, in some cases this is not practical because additional money means additional debt.

Stages of receiving the service

Speaking about the advantages of refinancing, a completely logical question may arise as to what benefit banks are pursuing by providing such benefits to borrowers. The answer to this question is quite simple - competition. In this way, banks lure clients away from less profitable institutions, reducing interest rates and providing deferments; they receive a huge number of borrowers who, in 95% of cases, pay the full amount and continue to cooperate with the second bank.

Recommended article: Procedure, documents and conditions for refinancing a mortgage at Vozrozhdenie Bank

In 2021, the following stages of mortgage refinancing can be distinguished:

- The borrower must decide how much refinancing is necessary. Using refinancing is effective if, in addition to the mortgage, there are also loan obligations.

- After collecting the necessary documentation, filling out a questionnaire or application, the client must contact the institution with a request to change the terms of the current mortgage agreement in order to reduce monthly payments.

- The last stage is the bank checking all the documents provided and announcing the decision; by the way, it can be received in the form of an SMS or a call from an employee.

There is nothing complicated in the scheme. All paperwork lies entirely with the bank; the client only provides all the necessary certificates and chooses the amount of a new loan, which can not only cover old mortgage and loan debts, but also spend the remaining money on personal expenses. Relevant if you need to make repairs, buy equipment, pay for treatment. Stages of mortgage refinancing after approval of the application:

- Signing a new loan agreement and insurance;

- Application for early debt repayment;

- Transferring money to the previous bank to pay off the debt;

- Waiting for mortgage (may take 1 month)

- The borrower takes the mortgage with a note about cancellation, and goes to the MFC and submits it along with an application to remove the encumbrance (collateral by force of law). There is no state duty (period of 5 days);

- After the encumbrance is removed, a mortgage agreement is concluded with the bank and a new mortgage is issued.

- The mortgage agreement, mortgage note and loan agreement are transferred to the MFC for registration of a new encumbrance (collateral). State duty - 1000 rubles.

Additionally, you can find out information from the selected bank. Depending on the requirements, some steps may be modified.

How to submit an online application for mortgage refinancing is described in detail in another material.

Documents required to complete such transactions

Refinancing a mortgage typically requires the same documents as getting a regular mortgage. The potential borrower provides the bank with a package of documents with personal data, information on employment and income, as well as documents on collateral, which is currently encumbered and is awaiting re-registration. In some cases, the refinancing procedure may require the applicant’s TIN and SNILS.

You can confirm your income in various ways:

- a certificate from the accounting department in form 2-NDFL;

- statements from bank accounts where wages are credited, pensions or various benefits are received;

- certificate in the form of a credit institution.

If the applicant has a “salary” account with the creditor bank, and funds are credited there monthly, then there is no need to submit a 2-NDFL certificate to the bank.

Important: a distinctive feature of such transactions is that the client will also have to submit to the bank documents on a previously issued mortgage loan - a certificate of the balance of debt, a copy of the loan agreement, as well as full information about the refinanced mortgage (date of agreement, amount of monthly payment, interest rate and etc.).

The application on the basis of which the loan agreement is reissued must include the following points:

- information about the manager and the name of the financial institution;

- Full name, details of the document allowing identification of the applicant (passport);

- loan size;

- the purpose of the procedure;

- the period for which the agreement is concluded;

- interest rate (in numbers and in words);

- property provided as collateral.

When refinancing a mortgage, the homeowner incurs costs. Such costs include payment for certificates, extracts and state fees, as well as insurance and real estate valuation services. It is possible that the applicant will have to pay money for opening accounts. There is also a commission for transferring cash from the client’s current account at the bank with which a new agreement is concluded to his account at the first credit institution.

The cost of additional expenses can range from 15 to 50 thousand rubles, depending on the selected bank and the specific refinancing conditions. Please be aware that total costs may increase if lawyers are involved in the transaction.

Step-by-step instructions for refinancing a mortgage

To profitably refinance your mortgage, you will need to do the following:

- Find a suitable financial institution and submit an application. An initial decision will be made based on the questionnaire. For verification, you may need a passport, SNILS, work book, income certificate, loan agreement and certificate of debt balance. All information received is verified. Representatives of a financial institution can call the employer to verify that the potential borrower is officially employed.

- Prepare documents for real estate. You will need an appraiser's report, a purchase and sale agreement, a certificate of ownership, a cadastral passport, an insurance contract and a receipt confirming the fact of payment of the premium, a certificate of persons registered in the property, a document demonstrating the absence of arrears in payments. If the collateral apartment suits the company, the application will be approved.

- Enter into an agreement with a financial institution and wait until the old mortgage is paid off. It is mandatory to obtain confirmation of complete closure of obligations. To do this you need to get a certificate. Additionally, it is necessary to pick up the mortgage and register a new transaction with the Registration Chamber. The papers issued there will need to be transferred to the new creditor.

FAQ

Question: How to quickly calculate the benefits of refinancing?

Let's not forget that in addition to the difference in the interest rate, when calculating the effect of refinancing, additional processing costs should be taken into account. Not every borrower can quickly navigate the bank’s offers, so we offer you a formula from the BankInformService portal that can simplify the calculations.

Benefit from refinancing = (difference in monthly payment * number of months of loan) – funds already paid on the loan – cost of insurance – one-time costs for refinancing.

An example of using this formula:

In 2021, a married couple bought an apartment they really liked from the accredited developer VTB24 at 13.8% per annum.

A month later (one payment, 21,000 rubles) they began to arrange refinancing in their “salary” Raiffeisenbank at 10.9% per annum. The difference in monthly payment is 5800 rubles. The loan term is 10 years. The cost of insurance at VTB24 was 36,000 for the entire loan term (34,000 was returned), at Raiffeisen - 34,000 rubles. One-time expenses – 3500 rub. for assessment + 1200 rub. for inquiries.

We calculate: 696,000 (difference in monthly payments for 10 years) – 21,000 (amount paid to the original bank) – 2,000 (insurance cost in the original bank) – 34,000 (insurance cost in the new bank) – 3,500 (apartment appraisal cost) – 1,200 (cost of transaction certificates) = 634,300 rubles. (net benefit).

Question: What is the state support program for mortgage refinancing?

Officially, this product is called the “Program for Assistance to Mortgage Borrowers” (adopted by Decree of the Government of the Russian Federation of April 20, 2015 No. 373). This is rather not a refinancing, but a restructuring of the loan in the same bank where it was issued.

One way or another, as part of the program, since the beginning of 2021, over 22 thousand borrowers have been able to reduce their loan burden by up to 200 thousand rubles (mortgage holders whose income has fallen by 30% or more since taking out the loan were covered by state support). There were many more applicants, but banks, according to their own algorithm, delayed the consideration of applications for some and let others through.

Since August 2017, the emphasis in the program has shifted to holders of foreign currency mortgages, the cost of servicing which has increased by more than 30% due to the depreciation of the ruble. It is planned to restructure about 1,300 such loans.

Reviews from mortgage providers

Surprisingly, we got into this program! On May 25, I submitted the documents to VTB24, and since the end of June I have called several times to find out the status of the application.

On July 13, they called, informed about approval and invited me to fill out the form again. We approved a loan with an overpayment of 600 thousand less (due to a 200 thousand discount on the principal debt and 400 thousand interest savings over 25 years). Then I waited another 1.5 weeks, they called again and said that they needed to do all the preparation again - just like when refinancing. Appraisal, new insurance, new loan agreement. On August 9, the deal took place. The monthly payment was reduced by 5 thousand.

Question: Is there a tax deduction for a refinanced mortgage loan?

A property tax deduction is available to all home buyers with a mortgage, and it applies both to the cost of the apartment itself and to the interest paid on the loan. You can only receive a tax deduction once in your life.

Mortgage refinancing is the replacement of one home loan with another. Accordingly, if you have not previously issued a deduction, then you have every right to it after refinancing. You will have to provide the tax office with both the current loan agreement and the original one so that the tax authority can monitor the correctness of your indication of the loan balance.

Please note: the new agreement must indicate the purpose of the loan - mortgage refinancing. If you consolidate several products (mortgage, consumer, car loan, etc.), you can forget about the tax deduction - it does not apply to consumer loans secured by real estate.

If housing was purchased before 2014, the tax deduction calculation takes into account the interest actually paid in excess of the limit of 2 million rubles. Real estate purchased with a mortgage (including with subsequent refinancing) after January 1, 2014 allows you to receive a deduction of 2 million rubles on the principal cost of the premises, as well as in the amount of up to 3 million rubles on interest paid both before and after refinancing. That is, the maximum you can get in your hands is 5,000,000 * 0.13 = 650,000 rubles.

Under what conditions is refinancing possible?

To conclude a refinancing agreement, banks put forward certain requirements for the borrower, the original mortgage agreement and the collateral real estate.

Requirements for the borrower:

- Employment and solvency are confirmed by an extract from the work book and a certificate of income in form 2-NDFL;

- Compliance with the age limit (usually 21 years at the time of borrowing, no more than 65 years at the time of full repayment);

- Citizenship of the Russian Federation.

Requirements for a mortgage agreement at the first bank:

- Possibility of early full repayment of the loan;

- The bank's consent to carry out such repayment (it requires obtaining a calculation of the exact amount of the debt).

Requirements for collateral real estate:

- Absence of encumbrances (except for its being pledged to the first bank, which will be removed with the repayment of the debt);

- Liquidity - compliance with the size of the loan taken. Determined during an independent assessment of real estate by specialized appraisal companies.

The bank providing the refinancing service will also consider the size of the loan issued and relate it to the value of the collateral property. If the first loan was taken out without a down payment and the mortgage is at the stage of paying the very first monthly payments, then the bank may refuse to refinance or will set a down payment in a certain amount as a condition.