Who is the survivor benefit for a child intended for?

A survivor's pension is paid if other family members are unable to work for various reasons. The following individuals fall into this category.

- Disabled, officially registered disabled people;

- Pensioners (even if they have lost a younger family member who supported them);

- Minors (survivor's benefit for a child is provided to the eldest child under 18 years of age);

- Adults (persons from 18 to 23 years old, full-time students in higher and secondary educational institutions until graduation);

- Other relatives of the deceased (who took custody of a child under 8 years of age).

If family members meet the requirements stated above, they can count on receiving benefits. It will stop being paid until someone in the family becomes able to work.

Survivor's pension – is it possible to work?

Federal Law No. 400 fully discloses the entire scheme for calculating pension payments for the loss of a breadwinner. Article 10 clearly prescribes the receipt of benefits only for those categories of citizens who cannot provide for themselves. Thus, survivor's pension and work are completely incompatible concepts.

The Pension Fund will not understand for what reasons the pension recipient got a job and how much he receives for it. It also does not matter the work schedule and the number of working hours per week. Even if the salary received does not reach the pension payment, the very fact of employment is grounds for refusal to accrue a survivor's pension.

The same applies to those who got a job after the pension payment was assigned. As soon as information about employment becomes known to the Pension Fund, the payment of benefits immediately stops.

The survivor's pension is paid only to that category of persons who are disabled. When a person gets a job, he loses this status.

Important: only family members of military personnel who served in military service during their lifetime can combine work and receive a survivor’s pension.

Another exception is the parent or guardian of a child under fourteen years of age. In this case, he can simultaneously receive a survivor’s pension for the child and work.

Once the Pension Fund receives information about employment, it stops accruing payments. The pension will stop being paid starting next month, after receiving employment data.

Having started working, the recipient of the benefit must immediately inform the Pension Fund about this so that it stops accruing the pension.

If the fact of employment becomes known much later, the entire amount of payments will have to be returned. Article 25 of Federal Law No. 173 prescribes financial liability for giving false information. Overspending of public funds entails full compensation for the damage caused.

Resumption of benefits after dismissal from work

Pension payments for the loss of a breadwinner are resumed when a citizen is dismissed from work. This can be done as soon as the applicant receives a work book with a record of dismissal. In this case, an application for renewal of benefits is submitted to the Pension Fund.

An application for the renewal of a pension, as well as for its accrual, is submitted on a special form, which is filled out at the local branch of the Pension Fund.

The application is reviewed in approximately ten days. If the decision is positive, pension payment begins the next month after submitting the application.

Survivor's pension and work - a combination option

In most cases, the survivor's pension does not completely cover all the costs of ensuring a normal standard of living. This is the main reason that many benefit recipients still try to combine work and pension accruals.

Attention: as mentioned above, the Law prohibits receiving a survivor's pension and wages at the same time, with some exceptions. This applies only to those cases when you work officially.

There is only one opportunity to combine receiving benefits and wages - when applying for a job, do not enter into a formal employment agreement with the employer.

When calculating wages, deductions to the Pension Fund will not be made, which means that government agencies will not know about the employment of the pension recipient.

When does child survivor's benefit stop being paid?

Child support for the breadwinner may cease to be paid as a result of:

- the child comes of age;

- after the student graduates from university or upon expulsion;

- a relative of the deceased who had a dependent child under 18 years of age upon reaching that age.

Interestingly, the breadwinner does not necessarily have to live with the person who is under his guardianship. It is also not necessary to be related to a dependent. It is enough to regularly make money transfers to him at least to a bank account (bank card).

In some cases, the law allows for the payment of benefits to widows, those who remarried after the loss of the main breadwinner, as well as persons who have received the ability to work, but have not reached the age of majority.

If the breadwinner died while already a pensioner, then dependents, in accordance with Article 28 of the Law of the Russian Federation No. 4468-1 On Pension Security, can also apply for a survivor's pension, but they must apply for it no later than 5 years after the death of the breadwinner and, as a result, termination of payment his pension.

Debit card All inclusive from Fora-Bank

Apply now

Questions and answers

In addition to the information in the article, we will provide answers to the most pressing questions on the topic.

Assignment to the families of those who died while eliminating disasters

Separately, mention should be made of the survivor's benefit paid to family members of a deceased participant in the liquidation of the consequences of the Chernobyl nuclear power plant accident.

In accordance with the current legislation (Article 29 of the Law of the Russian Federation No. 1244-1), a survivor's pension is assigned to the following relatives of a participant in the liquidation of the Chernobyl disaster:

- spouses (when caring for a child under 14 years of age or upon reaching the ages of 50 and 55 years (wife or husband, respectively));

- disabled parents;

- children under 18 years of age.

The size of the pension in this case is similar to that assigned for a military injury.

Is it paid after 18 years?

In some cases, the children of the liquidator can count on receiving a pension even after reaching adulthood. So, if a child is a full-time student at an institution of higher or secondary vocational education, then funds will be paid until graduation, but no longer than until he turns 25 years old.

Is the subsidy still available if the mother gets married?

It has been established that a pension for the loss of a breadwinner - a participant in the liquidation of the consequences of the Chernobyl accident - is paid regardless of the availability of other income. Thus, if the child’s mother remarried, then the funds will continue to be paid to him.

Will there be a payment if the parents are divorced?

The fact of divorce does not detract from the range of mutual rights and responsibilities in the relationship between parent and child. Thus, even after the divorce, both parents are obliged to provide him with financial support. Accordingly, the fact of parents' divorce does not affect the possibility of receiving a survivor's pension.

For two children

In accordance with the law, every child can qualify for payment, regardless of the number of children in the family and the total number of dependents.

What is the survivor benefit amount in 2021?

The size of the survivor benefit in 2021 is one of the most discussed issues. The size of the social pension for the loss of a breadwinner per child in 2021, taking into account indexation on April 1, is:

- 5,796 rubles 78 kopecks in case of loss of one parent;

- 11,593 rubles 58 kopecks in case of loss of both parents.

Payments begin from the time the relevant application is submitted to the authorized bodies, as well as receiving its approval. The money arrives at the end of each month to the account of the family representative.

The amount of payments may be a much smaller equivalent, for example, if the deceased breadwinner had only one relative in need of support. In this case, it will be 50% of the above amounts. If there are two or more people left who are unable to feed themselves, the pension is paid in full.

The pension itself consists of two parts:

- Basic - fixed;

- Insurance - depends on the number of dependent persons, as well as the insurance savings of the breadwinner himself.

When calculating payments, the main rule must be taken into account - they should not be less than a certain subsistence level in the region of residence of the dependents.

Classic debit card from SberBank

Apply now

Decor

The survivor's pension is not established automatically only upon the fact of his death. To apply for benefits, a citizen who has the right to do so should contact the appropriate institution with an application.

Thus, for recipients of an insurance or social pension, such an institution is the state pension fund, since it is from its funds that it will be paid.

There is a separate treatment procedure for dependents of a deceased serviceman. They must submit an application to the department in which the deceased carried out official activities. For example, if the deceased was a police officer, then you should apply for the appointment of security to the Ministry of Internal Affairs. The pension for this category of persons will be paid from the federal budget.

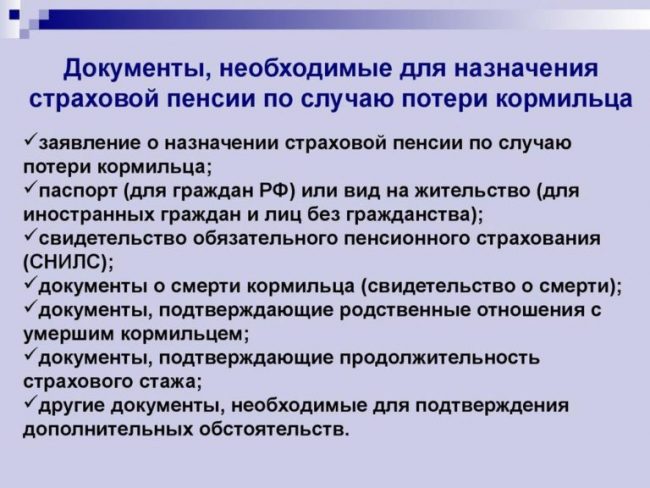

Citizens must attach the following documents and their copies to the corresponding application in the established form:

- identification document;

- death certificate of a citizen;

- documents confirming relationship;

- work book of the deceased;

- documents confirming the fact of being a dependent (for example, a certificate of family composition).

This list is basic; employees of the Pension Fund or other government agency may request other documents if necessary.

You can apply for payments at any time, starting from the date of death of the breadwinner.

Reference! If citizens apply for a pension after a certain time, then they have the right to receive money for the period that preceded the application, but it is limited only to the last 12 months.

You can apply for benefits either personally or through a representative. In the latter case, the authorized person must have a duly executed written power of attorney. In addition, it is possible to apply for a pension through multifunctional centers, as well as submit documents online through the State Services portal.

Receipt for a child

Due to obvious features, a young child cannot independently apply for survivor benefits. In this case, all the necessary procedures are carried out for him by his legal representative. This can be either the child's parent or his guardian .

In this case, an appeal to government authorities occurs on the same grounds and in the same manner as when an application is submitted by an adult citizen.

Separately, mention should be made of the peculiarities of receiving funds by an adult citizen who is a student of an educational institution. In this case, he independently provides a certificate issued at the place of study. If a student is expelled before he reaches the age of 23 or switches to distance learning, the payment of the pension is terminated.

In what case is re-registration necessary?

Current legislation establishes that payments for the loss of a breadwinner to children are made until they reach adulthood. However, there is an exception to this rule related to the establishment of support for persons studying full-time in certain educational institutions.

However, this fact needs confirmation, after which the pension will be reissued. In order to re-register, the student must provide the pension fund with a certificate from the educational institution and submit a corresponding application .

Restoration of payments

The law establishes situations when the payments in question may be suspended. In relation to provision for the loss of a breadwinner, the most common of them are the pensioner’s failure to receive money within six months, as well as the failure to submit to the pension fund information about full-time education of a person who has reached the age of 18 (remember that such information is submitted once a year).

Restoration occurs when the circumstances that led to the suspension of the transfer of money are eliminated and the Pension Fund is contacted on this issue. That is, for example, if a recipient of payments from among the students did not provide information about his studies, then he should contact the Pension Fund of the Russian Federation with the corresponding certificate from the educational institution, submitting an application for reinstatement.

How do I apply for survivor benefits?

To receive the presented survivor benefit, you will need to collect a package of the following documents:

- Documents proving the identity of each member of the family who has lost their breadwinner;

- Official certificate of loss of the deceased;

- Work record book of the breadwinner;

- Certificate from the place of employment about the income of the breadwinner for the last 2 months.

These documents are submitted to the branch of the Pension Fund of the Russian Federation together as an appendix to the corresponding application.

Thus, the state continues to support citizens in need of social security after the loss of a breadwinner by providing benefits. It is different in each region, but not less than the subsistence level determined for its residents.