If you have decided to go bankrupt because you can no longer pay your debts, you need to clearly understand how to file a personal bankruptcy claim. It is necessary to take into account several important nuances. We will tell you in detail what and how to write so that the court accepts your application for bankruptcy of an individual for consideration and confirms the fact of insolvency.

Before filing a claim for bankruptcy of an individual, you must complete several tasks

:

- Collect a set of documents attached to your personal bankruptcy application;

- Compose the application itself correctly;

- Take and file a bankruptcy claim for an individual in court. Or submit it through online services without errors.

Let's look at each point in more detail.

How to file a bankruptcy petition for an individual

When and who should prepare such a statement? Applicants in a bankruptcy case of an individual may be the citizen himself, his creditors, or authorized bodies for the collection of mandatory payments (for example, the tax service). The law establishes the obligation of an individual to file a bankruptcy petition within 30 working days from the date of discovery of the relevant circumstance if the amount of his obligations to creditors is more than 500,000 rubles, and satisfying the creditor’s demands will make it impossible to fulfill his monetary obligation to other creditors.

A citizen can file an application with the court to declare him bankrupt when he meets the criteria of insolvency and is unable to fulfill monetary obligations within the established time frame, i.e. he foresees himself going bankrupt.

In this case, the application will be accepted by the court if payments are overdue for more than 3 months.

In other words: a citizen’s available funds, property, and assets do not cover the amount of his debts to other individuals and organizations.

The grounds on which creditors and authorized bodies apply to the court for bankruptcy of an individual are established by Art. 213.5.

The list of information that is indicated in the application and its annexes are strictly regulated by law. The sample posted on the website will help you prepare such an application yourself.

How to prepare a bankruptcy application yourself?

The contents of the bankruptcy application are based on the documents attached to it. Therefore, it makes sense to proceed to writing the application itself when a complete package of documents necessary for the bankruptcy of an individual has been collected. We recommend that you check the documents you have collected with our checklist (individual list of documents). Send the checklist by E-mail.

Donskov Dmitry Igorevich

- Project Manager “Debt.NET”;

- Practicing lawyer, arbitration manager

Take your time, read the article to the end! Find out what pitfalls you may encounter when preparing your application, and only then proceed to prepare your personal bankruptcy application using our free online service. An illiterate application will most likely be left by the court without action, which can significantly delay the overall time frame for bankruptcy.

Contents of an application for bankruptcy of an individual

Typically, a bankruptcy petition consists of four parts:

- Statement header

- Main part

- Petition part

- List of attachments to the application

1. Bankruptcy application header

The header of an application to declare a citizen bankrupt must contain:

- the name and address of the arbitration court at the place of permanent registration of the debtor to which you are applying;

- Your full name, INN, SNILS, registration address, telephone and E-mail (if available);

- Names and addresses of all creditors.

2. The main part of the bankruptcy application

The main part of the bankruptcy application for an individual must contain the following information:

- on the existence and amount of debt to creditors;

- about the availability and approximate value of property (if the value of the property that can be foreclosed on exceeds the amount of debts, then the court may come to the conclusion that you are not bankrupt);

- about the availability and amount of income if there is income sufficient to pay off debts for 3 years, then the court will introduce a debt restructuring procedure;

- if there is no income, the court may require evidence of attempts to find employment;

If you have any objective reasons why you stopped paying your bills (you were laid off from work, were injured or disabled, were disabled for a long time, etc.), then we recommend that you reflect this in the text of your bankruptcy petition and attach to it, copies of documents confirming the existence of these circumstances (copies of the order on layoffs, sick leaves, certificates of disability).

Based on this data, the court will determine whether your bankruptcy application is justified and what bankruptcy procedure should be introduced.

Less “water” and more legal grounds

When drawing up an application for bankruptcy, do not get too carried away with describing your life situation.

Usually this can be realistically fit into 1-2 paragraphs. It is much more important to provide the legal grounds according to which one or another bankruptcy procedure should be introduced against you. The bankruptcy application generated by our free online service meets all the requirements of Federal Law No. 127-FZ and the Arbitration Procedural Code. If you need help drawing up an application, or you need a trusted financial manager who will bring your case to write off debts in the shortest possible time, call the toll-free number 8-800-333-89-13. 3. The pleading part of the bankruptcy application

The petition part of the bankruptcy application for an individual must clearly formulate what you are asking the court to do:

I ASK THE COURT:

- Recognize the application for insolvency (bankruptcy) of Ivan Ivanovich Ivanov as justified and introduce in relation to Ivanov I.I. procedure for the sale of property (debt restructuring).

- Approve to the financial manager from among the SRO members: ...

It is advisable to indicate which specific bankruptcy procedure for an individual you are asking to introduce. If your income significantly exceeds the subsistence level for you and your children, then it is reasonable to request a debt restructuring procedure. Otherwise, the procedure for the sale of property (it is this procedure that, if successful, ends with the writing off of debts).

Donskov Dmitry Igorevich current financial manager. “An application for bankruptcy of an individual must necessarily indicate the name and address of the self-regulatory organization (SRO), from among whose members a financial manager must be approved. The financial manager is an obligatory figure in the bankruptcy case of an individual. I do not recommend indicating the first SRO you come across from the list, since there is a risk that in this SRO there are no financial managers in your region, or they are present and are heavily loaded, or they will simply refuse to work on your case. And without approval of his candidacy, the bankruptcy case will be terminated, so you need to make sure that the SRO you specified can provide you with a financial manager at your request.”

You can file an application for declaring yourself bankrupt absolutely free on our website using the link (for this you will need to register). Our service au.dolgam.net will help you find a financial manager. Using this service you can find all managers practicing in your region; and also compare their performance indicators (number of successful and unsuccessful cases).

4. List of applications

What documents must be attached to the bankruptcy application?

In your bankruptcy application, you must list the names of all documents, copies of which you provide along with your application to the court. Be careful, when submitting documents through the “My Arbitrator” Internet service, you may be denied acceptance of your bankruptcy application if it is discovered that the list of attachments in the application does not correspond to the list of submitted documents.

The list of documents submitted along with an application for bankruptcy of an individual to the court is quite impressive, which can cause serious problems in collecting them for many “potential bankrupts”. For example, having learned about your planned bankruptcy, banks will most likely delay the deadline, and sometimes ignore requests to provide a certificate calculating the current debt on the loan, statements of personal accounts for the last 3 years. People are generally afraid to go to microfinance organizations (MFOs) for certificates.

Don't want to collect documents? Contact us and order a turnkey service for comprehensive support of the bankruptcy procedure for an individual. Immediately after concluding the contract, we will create for you in a matter of minutes:

- official requests to creditors requiring them to provide documents necessary for bankruptcy;

- requests for bank statements for the last 3 years;

- written refusals from direct interaction with creditors (personal meetings, telephone calls) in a special form. Having received this document, the lender is obliged to stop calling you if the loan is overdue for more than 4 months;

- etc.

We will order a number of documents for you via the Internet.

Filing a bankruptcy petition for an individual

The application is submitted to the arbitration court at the debtor’s place of residence. The state duty will be 6,000 rubles. Along with the prepared application, the documents established by Art. 213.4 of the Law. Unlike the rules for filing a claim in civil proceedings, where the court itself sends copies of the claim to the defendant, the debtor in bankruptcy cases must send its creditors a copy of the statement and materials thereto by registered mail with a notice better than the declared value. A notice of referral is attached to the application.

How to prepare applications for your application yourself

When talking about how to start bankruptcy proceedings for an individual on your own, you cannot ignore the list of documents that the legislator requires to be attached to the application. After all, to successfully apply to the arbitration court, just filing for bankruptcy of an individual in 2021 is not enough - the debtor will need to collect a package of documents confirming the fact of his inability to pay his existing obligations and allowing him to determine the period of time during which he did not pay his bills.

This is also important to know:

Bankruptcy of an individual entrepreneur with debts: conditions and timing of the procedure

The list of documents that must be attached to the application (if any) is established by the provisions of paragraph 3 of Art. 213.4 Federal Law No. 127. These include, in particular:

- an inventory of the applicant's assets and copies of certificates confirming the fact that he has ownership rights to such assets;

- list of creditors;

- documents confirming the existence of debt;

- extracts confirming the presence/absence of the applicant’s entrepreneur status;

- other documents, the list of which varies depending on the circumstances of a particular situation.

Debts to each creditor or lender

List what you owe and to whom. Debts can be of any kind; the main thing is to have a document supporting the information. Moreover, you also need to indicate such debts that will not be written off from you, but the court must know about their existence.

For example, if you pay alimony, indicate this fact and the amount of alimony. If you have caused damage to the health of a citizen and are paying him money for treatment, also indicate this fact, etc.

To simplify your task, you can find a sample bankruptcy petition for an individual online and look at examples of creditors in it.

Justification for bankruptcy

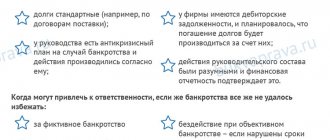

Declaring bankruptcy of individuals always has good grounds.

Therefore, you need to briefly but specifically outline the circumstances that led you to make this decision.

The court must be convinced that you have not been able to pay your debts for three months. Another condition is that you yourself tried to establish contact with the banks and convince them to reconsider your payment schedule.

If the banks did not cooperate, and your income fell so much that it became impossible to pay, you must explain why this happened and provide evidence.

For example, you received an injury that caused you to lose your ability to work. In this case, attach documents from the doctor and tell about this episode in the application.

If you had a high salary level, but there were layoffs at work that you fell under, explain that you were unable to find a new job with such a salary, although you joined the labor exchange, trying to somehow improve your situation. There may be other reasons, the main thing is to be able to prove them.

Current litigation and decisions

If there are any legal proceedings against you, or you are complying with any court decisions, list them. After the bankruptcy decision is made and during the restructuring, all of them will be suspended. The exception is alimony payments, compensation for harm to life and health, etc.

Bank accounts and deposits

If you have money in banks, provide a list of the accounts in which they are stored and add copies of agreements to the appendices.

This is also important to know:

Bankruptcy of legal entities in 2021

An application for bankruptcy of individuals must necessarily contain this information, since concealing it may end disastrously for you, because the financial manager will still discover this fact.

Of course, one of the disadvantages of bankruptcy is that if you have these financial “excesses,” the court will oblige you to cover your debts or part of them with them, but hiding the existence of accounts is jeopardizing the possibility of filing bankruptcy and getting rid of debts that you will not be able to do anyway pay.

Property

As with bank accounts, do not try to hide assets.

Concealing property can be regarded as an attempt to carry out a fictitious bankruptcy, and this is already a criminal liability.

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Make a detailed inventory and enter there not only the property that you have in Russia, but also that which is located outside its borders (if any).

Property can be movable and immovable. As a rule, the fact of the existence of property is confirmed by certificates of state registration of property.

Total debt

A bankruptcy claim for an individual must contain information about the total amount of debt as a justification for your bankruptcy.

SRO of arbitration managers

According to the Law on Bankruptcy of Individuals (2015), the application must contain the name of one of the organizations of arbitration managers. The court will select from it a financial manager for your trial.

Applications

The list of applications that must be present in the general package of documents is reflected in the law on bankruptcy of individuals. The sample statement of claim presented on our website will help you understand the variety of applications.

The main sections of the applications include the following:

- Documents of the borrower about his personality, marital status, children and status as an individual entrepreneur;

- Information about the borrower’s debts and about the creditors who provided funds: private individuals can also be indicated here, and not just credit organizations;

- Information about the borrower’s income and finances for three years;

- Inventory of property with the attachment of relevant papers;

- Medical certificates, documents recognizing the borrower as unemployed or disabled, documents on guardianship, documents on transactions in amounts exceeding 300 thousand over the last three years;

- Receipts for payment of state fees and labor of the financial manager.

Date, signature

Place a date and signature at the end of the application.

After completing the collection of papers and writing the application, you need to file a bankruptcy petition for an individual in court.

Since the process of writing an application and collecting papers is quite labor-intensive and requires attention, we offer you applications to the court.

Bankruptcy of individuals is not just a formal procedure, therefore the absence of certain applications or positions in the application may lead to the fact that the case simply will not be considered.

Where should the application be submitted?

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

An application for bankruptcy of an individual must be submitted to the arbitration court at the citizen’s place of residence. Along with the application, you must submit a package of documents (the full list can be found in paragraph.

3 tbsp. 213.4 of Law No. 127-FZ).

In this case, you must pay a state fee of 300 rubles. and deposit 25 thousand with the court.

rub. – remuneration to the financial manager.

Time limits for consideration of an individual's bankruptcy application

Within 5 working days, the Arbitration Court must “determine the fate” of the bankruptcy application (sometimes, due to the workload of the courts, this period is not observed):

- Accept the application for proceedings, set a date for the first court hearing

After accepting a bankruptcy petition for proceedings, the court must consider it within 15 days to 3 months. If a citizen’s bankruptcy application is recognized as justified, a debt restructuring procedure is introduced by default. If, at the time of consideration of the question of the validity of the application, the citizen has no income or it is minimal, the Arbitration Court, on the basis of the corresponding petition of the citizen, has the right not to begin the debt restructuring procedure, but to immediately declare the citizen bankrupt and begin the procedure for the sale of property.

- Leave the bankruptcy application without progress until the deficiencies are eliminated

This is also important to know:

How does a bank bankruptcy proceed and what are the features of the insolvency stage?

Most often, courts leave an individual’s bankruptcy petition without progress if:

- An incomplete set of documents required by the bankruptcy law was provided;

- The state duty in the amount of 300 rubles has not been paid;

- No funds have been deposited with the Court in the amount of 25,000 rubles.

Unfortunately, often, bankruptcy applications for individuals are left without legal action. According to Resolution of the Plenum of the Supreme Court No. 45 dated October 13, 2015, if the amount of debt exceeds 500 thousand rubles, the court does not have the right to leave an individual’s bankruptcy application without progress, citing the lack of a number of necessary documents. In this case, the court must accept the application for proceedings and request the missing documents by the date of the court hearing.

- Refuse to accept an individual's bankruptcy petition for processing

- Due to the lack of jurisdiction of the case in this court. Jurisdiction is determined according to the place of your permanent registration (registration). Bankruptcy at a temporary registered address can cause difficulties. For example, in the Moscow Arbitration Court, some judges categorically refuse to accept a bankruptcy petition if a person does not have permanent registration in Moscow. At the same time, among our clients there are many people who are going bankrupt in the Moscow Arbitration Court due to temporary registration.

- If the amount of debt is less than 500 thousand rubles. Unfortunately, the myth about the impossibility of bankruptcy with a debt amount of less than 500 thousand rubles also exists among some judges who refuse to accept applications with a debt amount of less than 500 thousand rubles and a delay of less than 3 months. In this case, you will have to prove your case in higher courts.

How to write a bankruptcy application (instructions for filling out)

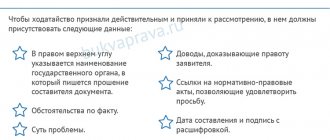

Filling out official papers requires compliance with clearly established rules. In this case, an application for recognition of bankruptcy of an individual is drawn up as follows:

- The head of the document indicates the name of the judicial authority, then the details of the applicant (the person representing his interests) and information about the creditors. Even if the creditor is an individual, he is also indicated in the application.

- Then we move on to the very essence of the document. The body of the paper indicates: the number of debts of the bankrupt and their amounts;

- the reasons that prompted the debtor to file an application with the arbitration court;

- information about the debtor's bank accounts;

- list of property;

- total amount of debt;

- the selected SRO from which the financial manager will be appointed;

- attachments to the document (list of papers confirming the bankruptcy of the bankrupt).

- 300 rubles is the cost of the state duty;

- 25 thousand rubles is the payment for the services of a financial manager (the amount is deposited with the court and a specialist is provided only upon completion of the case).

Get help filing a bankruptcy petition