All of us are familiar with purchase and sale transactions. Every Citizen of the Russian Federation has the right to sell and buy property. Usually, both the buyer and the seller are personally present during the transaction.

In this article, we will analyze the process of selling an apartment, in which the seller cannot be present at the place of the transaction (perhaps he is not in the city/country or due to health reasons is not able to come in person). In this case, the law provides for a solution in the form of signing powers of attorney for a certain third party.

What is a power of attorney?

A power of attorney is a special document in which you attribute certain powers and their scope to certain third parties. In accordance with Russian legislation, a power of attorney can be certified by a notary or simply registered.

What types of powers of attorney are there?

This document comes in three types:

- One-time

As the name implies, this type of power of attorney gives authority to perform any action only once. For example, such documents can be used to obtain funds one-time.

- Special

In such a power of attorney, the powers of the trustee are strictly prescribed. A person can perform several legal procedures of the same nature within a prescribed period of time. For example, issuing certificates, receiving goods.

- General (general)

In this document, you assign all powers to a third party, and this person has full control over all rights. Such powers of attorney must be signed if any transactions cover a wide legal area and many areas. The authorized person manages the property and can make purchase and sale transactions.

If you sell an apartment, you will need a general power of attorney.

How to obtain a power of attorney?

Photo Pexels

A general power of attorney is a document that has great notarial and legal force. To obtain such a power of attorney, you need to go to a notary’s office, where a notary will draw up this document especially for you.

To transfer all rights to a trusted person, the agent of the notary office will need:

- Full details of the principal (that is, yours). These are documents such as passport details.

- Certificate of ownership of property (in this case, an apartment).

- A document confirming the transfer of property to you (deed of gift, purchase and sale agreement, certificate of inheritance).

- Certificate of absence of debts for utility services.

- Apartment address

- If you are married, a written agreement from your partner.

- You will definitely need the passport (or a copy thereof) of the authorized person.

- If the home is owned by a person under 18 years of age, the person can sign a power of attorney only after the written consent of the guardian.

The process of certification of a power of attorney by a notary

To certify a document transferring part of the powers from one person to another at a notary, you need to take a number of actions:

- independently determine the terms of reference that the principal wishes to transfer to the attorney;

- choose a notary office - you can draw up and certify a document anywhere;

- the principal and the authorized representative visit the notary together;

- the employee of the notary office needs to clearly describe what powers need to be transferred - if there are difficulties, it is recommended to describe the situation, the notary will tell you what kind of power of attorney needs to be drawn up;

- the notary draws up a trust document based on the passports of the parties;

- you need to carefully re-read the document, check the correctness of the specified data, and only then sign;

- Now the notary certifies the trust document with his signature and seal, registers it in a unified register - the power of attorney is assigned a unique number by which you can check the eligibility on the official website of the FNP.

A notary has certain duties that must be fulfilled before proceeding with the execution of a power of attorney. According to Art. 16 of the Law “On Notaries” you need:

- carefully explain to both parties to the transaction the legal consequences of issuing a power of attorney;

- verify the identities of both parties;

- check the legal capacity of both parties - check the legal capacity of the legal entity (it arises from the moment the data is entered into the Unified State Register of Legal Entities).

Required documents

There are mandatory and additional documents for issuing a power of attorney. Mandatory ones include those that will be required from the parties, regardless of what powers will be transferred. These include the passports of both parties.

Depending on what powers will be transferred, you additionally need to prepare:

- PTS, STS – transfer of authority to perform actions with the car;

- extract from the Unified State Register of Real Estate – if there is a transfer of authority to carry out actions with real estate;

- details of the bank branch in which the account is opened, account details for receiving a pension through the bank;

- data of the testator, the original certificate confirming the death of the owner of the property, an extract from the house register indicating the address where the deceased lived before death - transfer of authority to formalize the entry into inheritance rights;

- birth certificate of a minor (if not yet 14 years old) or passport (if already 14 years old) - registration of a power of attorney for the child to travel outside the country;

- details of a legal entity (TIN, KPP, OGRN), charter - if the authority to purchase/sell a company or a share in it is transferred.

This is how a document of trust is issued from one person to another. If the principal is a legal entity, then you must present to the notary:

- constituent documents of the enterprise;

- charter;

- registration certificate;

- extract from the Unified State Register of Legal Entities;

- minutes of the meeting of participants/founders/shareholders on the appointment of a manager;

- order on the appointment of a manager;

- passport of the head of the enterprise.

If the principal is an individual entrepreneur, you must provide the notary with:

- entrepreneur's passport;

- certificate of assignment of a tax number to the entrepreneur;

- extract from the register of individual entrepreneur registration.

Authentication

Before acting on behalf of a person or business, it is necessary to verify the authenticity and legality of the power of attorney. When drawing up a trust document in a notary's office, the information is entered into a single register, and the document is assigned a unique number. Indicated on the reverse side near the notary's seal. Using this number, you can check the power of attorney for authenticity and competence.

There are 3 ways to verify the authenticity and validity of a trust document. This is done like this:

- send a written official request to the Federal Chamber of Notaries - executed by hand or on a computer;

- on the official website of the FNP;

- in the notary office where the document was drawn up - the data can be obtained by carefully examining the seal.

Regardless of the chosen method, verification of authenticity and validity is carried out using the details.

To check the power of attorney for authenticity and competence, you can send a request to the Federal Tax Service, 30 days are given for consideration and preparation of an official response, then the response is sent to the addressee.

There is no single legally established request form. This can be done in writing by hand or on a computer. To receive a correct answer, you should indicate in your request:

- details of the trust document;

- Full name of the notary who issued and certified.

It is recommended to attach a copy of the power of attorney. The request should be sent by registered mail with notification via Russian Post.

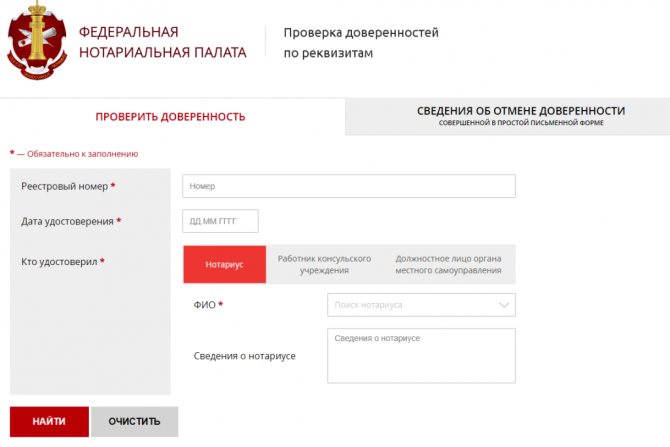

If you urgently need to check the trust document for competence and authenticity, you can use the official website of the FNP. To check, you need:

- go to the official website of the FNP at reestr-dover.ru;

- go to the “checking the power of attorney by details” tab;

- a search form will appear on the computer screen, which the user must fill out independently;

- It is required to write down the following information line by line - unique number, date of registration in the Unified Register, who issued it - a notary, consul or other responsible person vested with the appropriate powers; information about the person who issued the power of attorney must be indicated;

- After filling out the form correctly, click “find” and processing of the request will begin.

The system will take a few seconds to provide the user with the latest information. If some data is not specified by the user, the system will not be able to operate correctly. If the power of attorney is invalid or canceled by the principal, information about this will appear on the screen.

If it is not possible to conduct an online check, and it is too long to wait for an official response, you can visit the notary office that issued the power of attorney. Information about the notary is written on the seal with which the paper for the transfer of authority is certified. To check the authenticity and eligibility, just visit this notary office. The service is paid, you will need to pay at the office. The notary has no right to refuse to conduct an inspection.

Cost and validity period

The duration of the power of attorney is determined independently by the principal or in agreement with the attorney. Certification of a power of attorney by a notary will occur without indicating the validity period of the trust document. The main condition is to indicate the date of registration. Without it, the document will be considered invalid.

A power of attorney can be issued for any period – from 1 day to 50 years. The main thing is the transfer of powers of good will for a specified period. If the time period of validity is not specified, the trust document will be considered valid within one calendar year from the date of execution.

The cost of the service for drawing up a trust document for the transfer of powers consists of 3 indicators - the tariff, the price for registration and the state duty. The tariff is determined on the basis of Art. 22.1 of the Law “Fundamentals of Notaries”. The amount of the fee is determined on the basis of the delegated powers.

The cost of registration or legal support is determined by the notary himself. Prices are written down in official documents and certified by a notary in person.

Before proceeding with the execution of a notarized power of attorney, the notary is obliged to notify the client about the cost of the service provided.

Registration of a power of attorney

To issue a power of attorney, you do not need to look for any sample documents yourself. A power of attorney is a document that has no legal force unless certified by a notary. In other words, you cannot write a power of attorney by hand; you must contact a specialist.

The notary reviews all documents and verifies your identity. Afterwards, following a special template, he fills out all the necessary papers, taking into account the number of delegated powers and the specifics of the transaction. Afterwards, if the terms of the contract suit you, you sign this document. After signing the document, the notary enters it into the register.

If the property has multiple owners, all owners must sign a power of attorney. If the owner is divorced, the former spouse must sign the agreement to complete the transaction. This is done because an apartment purchased during marriage is considered joint property and the ex-spouse has the right to housing.

If the owner is incapacitated at the time of execution of the power of attorney, the document is signed by the guardian (in fact, protecting the interests of the incapacitated person is his direct responsibility).

The register is a single resource where the facts of the use of invalid documents are checked.

The participation of a third (trusted) person in the registration process is optional.

Following the legislation of the Russian Federation, powers of attorney do not have a specific validity period. You can choose the period of validity of the documents yourself. Often a general power of attorney is issued to conduct purchase and sale transactions, so you can indicate that the document will become invalid immediately after the end of the process. But if you did not write the validity period, then the power of attorney will remain valid for a year.

But under certain conditions, the power of attorney may expire earlier. For example, if you change your mind about selling your home or one of the parties is declared incompetent by the court.

When a power of attorney does not require notarization

The power of attorney does not require notarization at a notary's office in other cases not prescribed in Art. 185.1 of the Civil Code of the Russian Federation or other regulations. The parties can independently, in order to avoid misunderstandings, certify the trust document for the transfer of any powers.

Any power of attorney can be certified. The main condition is that the parties come to an agreement on this issue. But the “body” is made up of an employee of a notary office. There is no need to draw up a power of attorney yourself and then submit it for certification. Such a document will not be accepted.

You need to describe the situation to the notary, and he will draw up a power of attorney himself. The principal and the attorney need to familiarize themselves with the “body” of the trust document; if there are questions, they need to be asked. Only after this do you submit the power of attorney for certification. An employee of a notary office signs and seals, registers the paper in a unified register.

The power of attorney does not need to be certified by a notary if it is executed:

- not for representation of interests in court, tax inspectorate, regulatory and supervisory authorities;

- not for registration of real estate transactions;

- not for making transactions that must be certified by a notary office on the basis of legislative norms;

- not for reassurance;

- in other cases.

How to revoke a power of attorney?

Photo by Pexels

The principal must contact the notary who drew up the power of attorney with a statement. If you need to revoke a power of attorney urgently, and it is not possible to meet with a notary, you are allowed to use the services of another specialist. The application must indicate the intention to cancel this document. The notary must announce to all participants in the transaction who signed the power of attorney about the owner’s intentions. Also, the notary must note in a special register (see above) the cancellation of the power of attorney, so that in the event of a subsequent sale of the property, the owner will not have any problems.

You can also inform about the cancellation of a document yourself orally or in writing.

Cost of power of attorney

Everything here is quite individual and depends on the specific region, but on average, prices for this type of power of attorney (general) start from 2,000 rubles and above.

The cost of a power of attorney consists of:

- state fees for the service.

Depends on the relationship between the owner and the trustee. If a relative (son, father, nephew) becomes the third party, the cost of the fee is 100 rubles. If a friend, colleague (or other acquaintances) becomes the third party, the cost will be increased to 500 rubles.

- fees for performing technical and legal services.

It is also worth remembering that the more powers you give to a third party, the more expensive the power of attorney will be.

To whom are powers of attorney issued?

You can issue a power of attorney to anyone. This could be your partner, relative, friend or colleague.

When signing a power of attorney, you must be completely confident in the honesty of your representative, since you are transferring a lot of rights to him. It is better to make relatives and close friends your confidante, that is, people you have known for a very long time.

It is worth considering that by giving a person, by proxy, the right to enter into all kinds of transactions with property on his own behalf and subsequently register the transfer of ownership, the principal, in fact, can no longer strictly control how the proxy will manage his real estate (sell it or even give it away for nothing) ), what amount he will value and what he will purchase from the buyer.

Power of attorney to represent interests

Basic rules for drawing up a power of attorney

The power of attorney in question is a document drawn up by one party, according to which it authorizes the other party to perform certain actions on its behalf and in its interests. In accordance with civil law, a power of attorney is issued in the form of a written document. A written power of attorney has two types: a simple written form and a notarized power of attorney. Moreover, if a power of attorney is issued to carry out a specific transaction, which in turn requires notarization, then this power of attorney must also have a notarized form. Some powers of attorney for representation of interests are equivalent to notarial ones. The maximum term of office under a power of attorney is three years. The date of execution of the power of attorney is important, since a power of attorney for representation of interests that does not indicate this date is void. An exception is a notarized power of attorney to represent interests abroad, which is valid until revoked by the principal.

Power of attorney with the right of substitution. Rules of subrogation

Unless otherwise indicated by the power of attorney, legislative acts or other documents, the powers under the power of attorney may be delegated to another person. Powers can be delegated either completely or in some specific part. The term of a power of attorney by way of subrogation cannot exceed the term of authority under the main power of attorney, and must also be notarized, except for cases expressly specified in the law. When transferring powers, the person who issued the main power of attorney must be notified of this. The person who issued the power of attorney to represent interests may at any time terminate these powers under the power of attorney.

Termination of power of attorney

Also, the power of attorney is terminated in the following cases: expiration of the power of attorney; refusal of the person to whom the power of attorney was issued; termination of the legal entity on whose behalf the power of attorney was issued; termination of the legal entity to which the power of attorney was issued; death of the citizen who issued the power of attorney, recognition of him as incompetent, partially capable or missing; death of a citizen to whom a power of attorney was issued, recognition of him as incompetent, partially capable or missing. A power of attorney for representation of interests issued by way of subassignment loses its powers with the termination of the main power of attorney. If the person to whom the power of attorney was issued does not know that the powers under this power of attorney have been terminated, then the rights and obligations that arose before this notification remain in force in relation to third parties.

Forms and types of power of attorney

A power of attorney issued by a legal entity must be in simple written form.

In some cases (registration of real estate, etc.), notarization of a power of attorney to represent the interests of a legal entity is required. If you have any questions about the preparation of such a document, you can ask them to the specialists of our company or order the preparation of a document for your specific situation, write, call and we will help you. Power of attorney to represent interests

of the city of Moscow “__” __________2021. This power of attorney was issued by gr. ________________________, ________________________residing at the address: ________________________, passport ________________________ issued ________________________, department code ________________________ in that he is authorized to represent the interests of ________________________________________________________________________________________________________________________________ in all government agencies, including the tax inspectorate, banks and other credit institutions, law enforcement agencies and other organizations, to conduct from on his behalf and in his interests all cases with his participation as a plaintiff, defendant, third party in arbitration courts and other judicial bodies, including when considering the case on the merits, as well as in the appellate, cassation and supervisory authorities.