The procedure for calculating property tax from 2021

Owners of residential buildings, cottages, townhouses, duplexes, as well as dachas, garages, and outbuildings must pay property taxes in full and on time.

The amount of tax depends on the price of the property, the tax rate and the number of full months of ownership of the asset in a year. In turn, the assessment of an object can be inventory and cadastral.

How is the value of a property determined?

Since 2015, our country has been experiencing a smooth transition from inventory valuation of real estate to cadastral valuation. Before this, all citizens' property was valued significantly lower than its real market value. This was due to the imperfection of the technical inventory system.

From this moment on, a phased transition to cadastral registration began in a number of pilot Russian regions, including the Moscow region. According to the state, the cadastral value more adequately reflects the valuation of assets based on the price prevailing on the market at the current moment. In turn, it is also revised over time (no more than once every 3 years, and in the Moscow region - once every 2 years).

Property tax calculated incorrectly - what to do

As already indicated, the property tax of an individual is calculated by the Federal Tax Service department, and its amount is reflected in the notification sent to the payer. If a citizen discovers an error (overestimation or underestimation, which is also bad), he is recommended to perform the following actions:

- Prepare a package of documents substantiating the inaccuracy. This includes: a) an application drawn up in the prescribed form or, if there is none, arbitrarily, indicating the full name of the payer, his tax identification number, notification number and inspection address; b) copies (scans, if the package is submitted electronically) of documents confirming the correct value of the tax amount.

- Send the specified packet to the service address. This can be done in several ways, including from your personal account after registering on the website of the Federal Tax Service of the Russian Federation. The most reliable way is a registered letter with a list of attached attachments and a delivery notification.

- Wait and receive a response, which is a new tax notice with the column “Calculated tax amount” (corrected value) and the canceled amount “previously calculated”. The standard response period is 30 days. In some cases, it can be extended for another 30 days.

- If the payment of the inflated amount has already been made, the citizen writes an application for the return of the excess or its offset for the next period in accordance with paragraph 1 of Article 78 of the Tax Code of the Russian Federation. The decision (usually positive) is made no later than 10 days after receiving the application. Another 5 working days are allocated by law for its registration and sending to the payer.

After a refund or offset of the overpayment of property taxes, the issue can be considered closed.

Property tax rates in 2021

The amount of taxes on a house or plot is determined by the category of the object and its value. The category of real estate is its purpose. Based on this parameter, tax authorities distinguish between:

- residential buildings;

- country and garden houses;

- garages;

- outbuildings;

- single real estate complexes with a residential building;

- objects of unfinished construction.

A garden house located on a gardening or summer cottage plot and not suitable for permanent residence may be referred to in registration documents as a non-residential house. According to the latest amendments to the Tax Code of the Russian Federation, they are equal to residential buildings in terms of calculating property taxes.

Important: There are no more discounts or tax breaks for owners of garden houses.

How to calculate an organization's property tax

The ownership of a company by a foreign resident does not in any way affect the taxation procedure. If an enterprise owns property on Russian territory, it has an obligation to pay a property tax for the year. You can learn more about how the property tax of legal entities is paid in 2021 by reading Article 401 of the Tax Code of the Russian Federation.

As is clear from the above material, the amount of the liability is affected by the tax rate and the value of the property. Knowing these values, you can easily calculate the tax for an LLC or other commercial organization.

How to calculate tax based on cadastral value and average annual value

The value of real estate is most often determined by the cadastral price. You can find it out on the Rosreestr website using the services “Obtaining information and the State Property Committee”, “Public cadastral map” or “Reference information”. This information is transparent and publicly available. To obtain them, you need a cadastral number and other data about the object provided by the search form, in particular, the address.

The lack of a cadastral price assigned to the entire property may prevent you from using this simple method. In this case, the average annual value of the property is determined. It is calculated according to the formula:

Where: SGDS – average annual value of property; i – serial number of the month; Сi – residual value of the property at the beginning of the month with number i (from 1 to 12); OS – residual value of property at the end of the reporting year.

Information on the cost of fixed assets is taken from the financial statements in 1C or from account 01 of the balance sheet.

It should be understood that the value of fixed assets related to movable or immovable property inevitably changes every month for various reasons: they can be sold, liquidated, acquired, etc. In addition, depreciation is charged on them.

Procedure for calculating property tax

Citizens are required to pay taxes only on those assets for which they have ownership rights, confirmed by the appropriate document - “Certificate”, or an extract from the cadastre (issued from 2021).

The algorithm for calculating payments to the budget is as follows:

H = (KS - HB) x C

, Where:

- N – payment amount for the current year;

- KS - cadastral value of real estate;

- NV – tax-free value of property;

- C is the tax rate.

The tax deduction is due to all owners and amounts to 50 sq. m for a residential building, or 1 million rubles. for a complex of buildings with residential premises. If a citizen owns two houses, he can apply the deduction to only one of them.

To show how taxes on houses with plots are calculated, here are a few examples:

Example 1:

The citizen is the owner of a single complex consisting of a cottage, a garage and a boiler room, the area of all buildings is 234 square meters. m. The cadastral valuation as of 01/01/2019 is determined at 8 million rubles. The tax amount will be:

(8 million - 1 million) * 0.1 / 100 = 7 thousand rubles.

Example 2:

The couple are the owners of a garden plot on which a house of 60 square meters is located. m. and a bathhouse of 30 sq. m. m. The property is registered in the name of the husband, so he is a tax payer. The cost of the house as of January 1, 2019 is 600 thousand rubles, the bathhouse is 100 thousand rubles.

To calculate the tax, you first need to determine the amount of the tax deduction. To do this, we calculate the taxable area of the building: 60 square meters. m. - 50 sq. m.=10 sq. m.

In this example, the tax base will be:

600 * 10 / 60 = 100 thousand rubles.

Tax payment for garden house:

100 * 0.1 / 100 = 100 rub.

Tax payment for a bathhouse:

100 * 0.1 / 100 = 100 rub.

How is property tax calculated in 2021?

Property tax is calculated by the Federal Tax Service, after which it sends a notification to the individual’s place of residence, which contains information about the amount of tax required to be paid.

On January 1, 2015, Chapter 32 of the Tax Code of the Russian Federation came into force, which provides for a new procedure for calculating property tax. According to the new rules, the tax is calculated not on the inventory value of the object, but on the basis of its cadastral value

(i.e. as close as possible to the market).

Note!

All subjects of Russia had to completely switch to calculating property taxes based on cadastral value by January 1, 2020.

The new calculation procedure is introduced separately by each subject of the Russian Federation. In 2021, the tax based on the cadastral value of real estate for individuals will be calculated in 74 regions (this is what will need to be paid in 2021). The tax for the period 2021 will be calculated based on cadastral value in all regions of the Russian Federation, except Sevastopol.

How is tax calculated from cadastral value?

Property tax for individuals based on the cadastral value of the property is calculated using the following formula:

Nk = (Cadastral value – Tax deduction) x Share size x Tax rate

Cadastral value

When calculating the tax, data on the cadastral value of an object is taken from the state real estate cadastre as of January 1 of each year (for new objects - at the time of their registration with the state). You can find out the cadastral value of an object at the territorial office of Rosreestr.

Tax deduction

When calculating tax, the cadastral value for the main types of objects can be reduced by a tax deduction:

| Object type | Tax deduction |

| Apartment | Reduced by the cost of 20 square meters of this apartment |

| Room | Reduced by the cost of 10 square meters of this room |

| House | Reduced by the cost of 50 square meters of this house |

| A single real estate complex that includes at least one residential premises (residential building) | Decreased by one million rubles |

The authorities of municipalities and cities of Moscow, St. Petersburg, and Sevastopol have the right to increase the amount of tax deductions described above. If the cadastral value turns out to be negative, then it is assumed to be zero.

Calculation example

Petrov I.A. owns an apartment with a total area of 50 sq. meters. Its cadastral value is 3,000,000 rubles. Cost of one sq. meter is equal to 60,000 rubles.

The tax deduction in this case will be: RUB 1,200,000.

(RUB 60,000 x 20 sq. meters).

When calculating the tax, it is necessary to take the reduced cadastral value: 1,800,000 rubles.

(RUB 3,000,000 – RUB 1,200,000).

Share size

If the object is in common shared ownership

, the tax is calculated for each participant in proportion to his share in the ownership of this object.

If the property is in common joint ownership

, the tax is calculated for each of the participants in joint ownership in equal shares.

Tax rate

Tax rates in each subject of Russia are different; you can find out their exact amount in force in 2021 on this page. Please note that tax rates should not exceed the following limits:

| Tax rate | Object type |

| 0,1% | Residential buildings (including unfinished ones) and residential premises (apartments, rooms) |

| Objects of unfinished construction if the designed purpose of such objects is a residential building | |

| Unified real estate complexes, which include at least one residential premises (residential building) | |

| Garages and parking spaces | |

| Commercial buildings or structures whose area does not exceed 50 square meters. meters and which are located on land plots provided for personal subsidiary farming, dacha farming, vegetable gardening, horticulture or individual housing construction | |

| 2% | Administrative, business and shopping centers |

| Non-residential premises that are used to accommodate offices, retail facilities, catering facilities and consumer services | |

| Objects whose cadastral value exceeds 300 million rubles | |

| 0,5% | Other objects |

The authorities of municipalities and cities of Moscow, St. Petersburg, Sevastopol have the right to reduce the tax rate 0,1%

to zero or increase it, but not more than three times. Also, depending on the cadastral value, type and location of the object, local authorities have the right to establish differentiated tax rates.

Calculation example

Object of taxation

Petrov I.A. belongs ½

apartments with a total area of 50 sq. meters. The cadastral value of the apartment is 3,000,000 rubles. The tax deduction will be equal to 1,200,000 rubles.

Tax calculation

To calculate the tax, we take the maximum possible tax rate 0,1%

.

Substituting all the available data we get the formula:

900 rub.

((RUB 3,000,000 - RUB 1,200,000) x ½ x 0.1%).

How is tax calculated on inventory value?

Property tax for individuals based on the inventory value of the property is calculated using the following formula:

Ni = Inventory value x Share size x Tax rate

Inventory value

When calculating the tax, data on the inventory value submitted to the tax authorities before March 1, 2013 is taken. You can find out this information at the BTI branch at the location of the property.

Share size

If the object is in common shared ownership

, the tax is calculated for each participant in proportion to his share in the ownership of this object.

If the property is in common joint ownership

, the tax is calculated for each of the participants in joint ownership in equal shares.

Tax rate

Tax rates in each subject of the Russian Federation are different; you can find out their exact amount on this page. Please note that tax rates should not exceed the following limits:

| Inventory value | Tax rate |

| Up to 300,000 rub. (inclusive) | Up to 0.1 percent (inclusive) |

| Over 300,000 rub. up to 500,000 rub. (inclusive) | Over 0.1 to 0.3 percent (inclusive) |

| Over 500,000 rub. | Over 0.3 to 2.0 percent (inclusive) |

Note

: depending on the amount of inventory value, type and location of the object, local authorities have the right to establish differentiated tax rates.

Calculation example

Object of taxation

Petrov I.A. belongs ½

apartments in Moscow.

The inventory cost of the apartment is 200,000 rubles.

.

Tax calculation

The tax rate for this apartment is provided in the amount

0,1%

.

Property tax in this case will be equal to: 100 rubles.

(RUB 200,000 x ½ x 0.1 / 100).

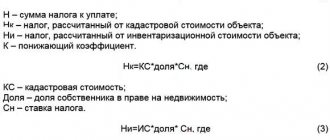

How is tax calculated under the new rules in the first 4 years?

When calculating the tax from the cadastral value, its amount is significantly larger than when calculating from the inventory value. In order to prevent a sharp increase in the tax burden, it was decided: in the first four years (after the introduction of new rules in the region), the tax should be calculated using the following formula:

H = (Hk – Ni) x K + Ni

Nk

– tax calculated from the cadastral value of the object (see above).

Neither

– tax calculated from the inventory value of the object (see above).

TO

– a reduction factor, thanks to which the tax burden will gradually increase by 20% each year.

Coefficient K is equal to:

- 0.2 – in the first year;

- 0.4 – in the second year;

- 0.6 – in the third year;

- 0.8 – in the fourth year.

Starting from the 5th year, property tax must be calculated based on the cadastral value of the property.

Note

: tax calculation according to the above formula is carried out only in cases where the tax from the cadastral value is obtained more than from the inventory value.

Property tax benefits

The main categories of citizens who are provided with benefits at the federal level are specified in paragraph 1 of Article 407 of the Tax Code of the Russian Federation. In particular, taxes are not paid:

- veterans and war heroes;

- disabled people of groups 1 and 2, incl. since childhood;

- military personnel and members of their families;

- liquidators of accidents at the Chernobyl Nuclear Power Plant and Mayak Production Association;

- pensioners.

Starting this year, benefits are also provided to pre-retirees. These are citizens who will retire according to the new legislation: women at 60 and men at 65, but they receive the benefit 5 years before the retirement age.

Land tax amount in 2021

The payers of this tax are the owners of land plots who have ownership rights to them, or the right of perpetual use, confirmed by the relevant legal document or an extract from the cadastre.

In the case of joint ownership of a plot by two or more persons, each of them pays tax in proportion to the value of their share.

The tax is calculated as follows:

ZN = KS x C

, Where

- ZN - land tax;

- KS – cadastral value of the site;

- C is the tax rate.

The cadastral value reflects the real market valuation of land plots made at the beginning of the current year. Data about it can be found on the Rosreestr website using the cadastral number of the plot. In addition, owners can make a request in writing and receive an official statement of the value of the site.

Land tax benefits

Some land owners can apply a benefit in the form of a tax deduction equal to 6 acres. Thus, land plots with an area of less than 6 acres are completely exempt from taxation. Owners of more land pay tax less that area.

Beneficiaries who own several plots of land can choose one of them to apply the deduction. To do this, you need to submit an application to the Federal Tax Service at the place of registration of the site.

Beneficiaries include:

- pensioners and pre-retirees (citizens who were supposed to retire by age in accordance with pension legislation in force until 2021);

- disabled people of groups 1 and 2, including from childhood;

- heroes and war veterans;

- liquidators of nuclear accidents.

Local authorities have the right to supplement the list of beneficiaries with other categories of the population. For example, some municipalities of the Moscow region include large and low-income families.

In addition, the administrations of the heads of municipalities and village councils can increase the tax deduction and apply a larger amount of non-taxable land area.

Tax benefits

In addition to tax deductions used in calculating tax, property tax provides for various benefits that partially or completely exempt a citizen from paying tax. All benefits can be divided into two groups: federal (valid throughout the Russian Federation) and local (valid on the territory of a specific municipality).

Federal benefits

The following are completely exempt from paying tax in respect of one object of each type of property:

- Heroes of the USSR and the Russian Federation, as well as bearers of the Order of Glory of three degrees;

- Disabled people of the first two disability groups, including those disabled since childhood;

- Participants of the Second World War;

- Victims of the Chernobyl accident and the accident at the Mayak production association;

- Military pensioners whose total duration of service is 20 years or more;

- Citizens participating in the testing of nuclear and thermonuclear weapons;

- Family members of military personnel who have lost their breadwinner;

- Pensioners who have reached retirement age;

- Other grounds provided for by federal legislation.

Local benefits

The list of benefits established in a particular region can be found in the legal act that approved the procedure for calculating property taxes in a given region. Additional local benefits may include, for example, tax exemptions for low-income citizens, orphans, etc.

It is worth noting that regional authorities in rare cases establish additional benefits for residents of their region.

Please note that property tax benefits do not depend on the procedure for its calculation and are provided both when calculating the payment based on the cadastral value and when calculating the inventory value.

Payment deadlines. Penalties and late fees

All types of property taxes are calculated by the Federal Tax Service based on data from Rosreestr. Each property owner will receive notifications this fall with the amount of payments to the budget. In case of non-payment of taxes by December 1, or late payment, additional fines and penalties will be assessed.

Did you find this article helpful? Please share it on social networks: Don't forget to bookmark the Nedvio website. We talk about construction, renovation, and country real estate in an interesting, useful and understandable way.

Property tax payment deadline

In 2021, a single deadline for payment of property taxes has been established for all regions of Russia - no later than December 1

next year. That is, before December 1, 2021, you need to pay tax for 2021.

note

that in case of violation of the deadlines for payment of property taxes, a penalty will be charged for the amount of arrears for each calendar day of delay in the amount of one three hundredth of the current refinancing rate of the Central Bank of the Russian Federation. In addition, the tax authority may send a notice to the debtor’s employer to collect the debt at the expense of wages, and also impose a restriction on leaving the Russian Federation. There is no fine imposed on individuals for non-payment of taxes.