To whom can an individual entrepreneur issue such a document?

A power of attorney from an individual entrepreneur is needed in order to entrust his rights to third parties in situations where it is necessary:

- Submit documents to change details, close an individual entrepreneur, or obtain a patent.

- Represent the interests of the entrepreneur in the bank, withdraw funds from accounts.

- Hire a law firm that will accompany him in court.

- Prepare and submit a declaration to the tax office.

- Negotiate with the counterparty while the principal receives the cargo.

The law allows both legal entities and individuals to issue a power of attorney to represent the interests of an individual entrepreneur. It can be received by a relative of the entrepreneur, friend, subordinate, business partner (individual) or organization (legal entity).

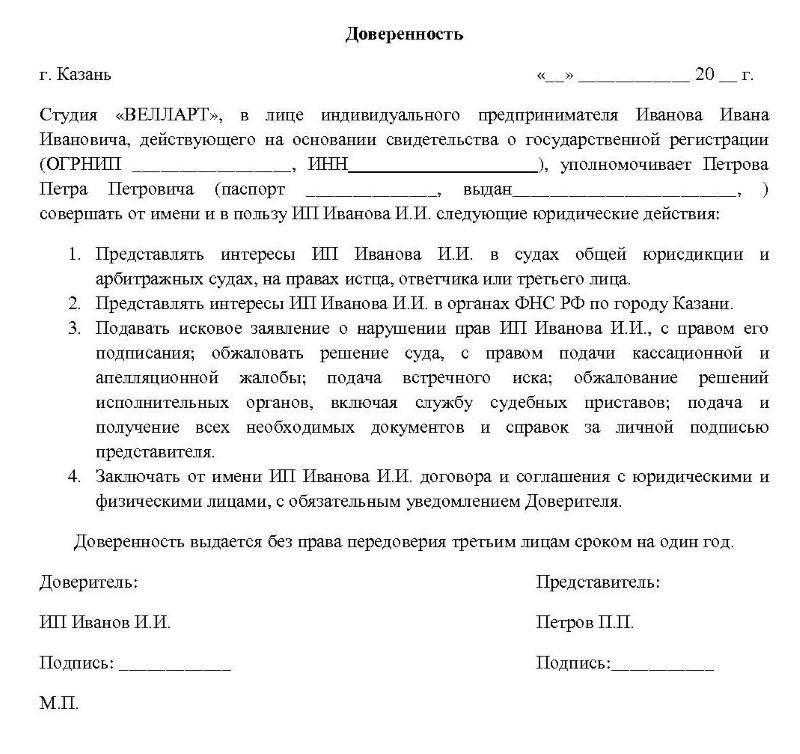

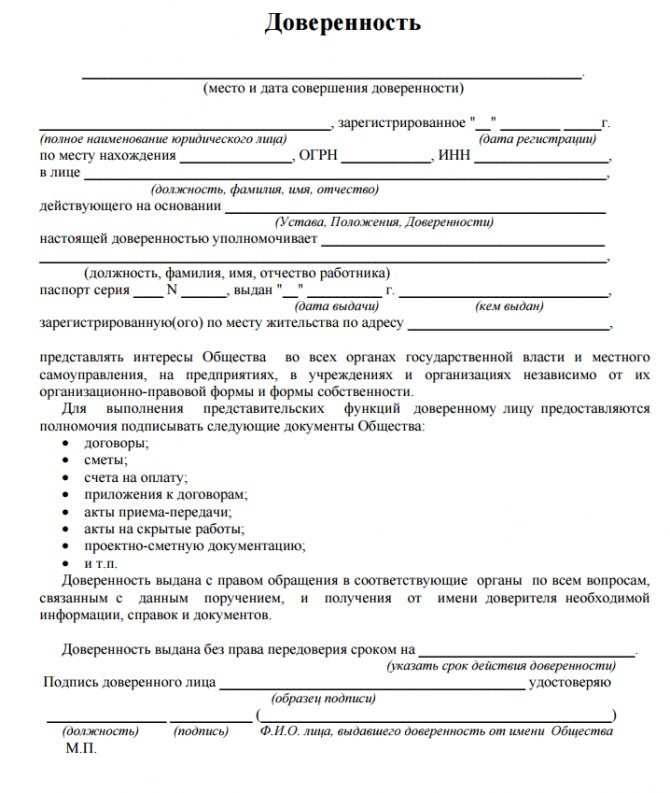

What form is provided for powers of attorney from individual entrepreneurs? Sample power of attorney from an individual entrepreneur to an individual

In accordance with current legislation, an individual entrepreneur is considered an individual carrying out business activities - therefore, the form of powers of attorney from an individual entrepreneur will be exactly the same as those issued by individuals. Most of these powers of attorney (except for those for which the law expressly provides otherwise) are drawn up in simple written form. A sample power of attorney can be found in the Forms section before the article.

If a power of attorney is drawn up to represent the interests of an individual entrepreneur in a bank (or other credit institutions) or post office, it can either be sent directly to the organization or given for presentation to an authorized person. At the same time, the bank (or other organization) retains the right to verify the identity of the individual entrepreneur.

It should be noted that an individual entrepreneur cannot certify the powers of attorney of his employees, since, in accordance with Article 185.1 of the Civil Code of the Russian Federation, this right is granted only to organizations.

When issuing powers of attorney on his own behalf, an individual entrepreneur certifies it only with his personal signature; if he has a seal, he can also use a seal (although from a legal point of view this is not essential). If an entrepreneur, at the same time as carrying out business activities, is officially employed or is studying at an educational institution, then a power of attorney from an individual entrepreneur to receive funds on his behalf (scholarships, wages, benefits, etc.) can be certified at the place of his work or study .

In what form is a power of attorney issued from an individual entrepreneur?

A document transferring part of the powers of an individual entrepreneur to an authorized person can be drawn up in ordinary written form with the signature and seal of the principal or executed by filling out a suitable power of attorney form downloaded from the Internet. In some cases, the preparation of such paper must be entrusted to a notary office.

It is undesirable to write in a document delegating the powers of an individual entrepreneur only general phrases “to represent interests”, “to conduct business”. A paper drawn up in this way may prevent the attorney from carrying out the necessary activities due to the lack of information in it about what specific actions are available to him.

Types of powers of attorney

Depending on the validity period and delegated responsibilities, the document transferring part of the rights of the individual entrepreneur to the representative can be one-time, special or general. A document designed for one-time use gives the attorney the right to perform one action, after which it becomes invalid.

An example of a one-time power of attorney from an individual entrepreneur to represent his interests to an individual or legal entity can be a document that allows you to ship or receive goods, deposit money at the cash register or withdraw it from there, submit a report to the tax office, register an individual entrepreneur, as well as a power of attorney to receive a registered letter. A special-purpose document for representing the interests of an individual entrepreneur is issued to a person so that the authorized person can regularly perform the actions specified in it.

As an example of a power of attorney from a special-purpose individual entrepreneur, you can provide a document transferring to the attorney the authority to send goods by courier, represent the interests of an individual entrepreneur in a bank or court. Such paper will also be required in case of regular cooperation with outsourcing companies that provide legal and accounting services to individual entrepreneurs. The validity period is specified in its text.

The transfer of authority to manage a business is carried out by issuing a general power of attorney from the individual entrepreneur. It will operate wherever an entrepreneur needs to be present in order to exist and conduct his business. The document gives the attorney the right to completely replace the principal in his business and allows him to dispose of his property.

As an example of such a paper, one can cite an option in which an individual entrepreneur, having registered several types of activities, entrusted one or two of them to his brother and, once every 3 years, re-issues the document transferring authority to him. Powers of attorney can also be classified according to their purpose, for example, to represent the interests of an individual entrepreneur in court, the tax office, or a bank.

The content of the document options will differ mainly only in the list of powers. In order for the attorney to be able to resolve all issues related to the Federal Tax Service for the principal, he must be given the opportunity to represent interests in the inspectorate itself, in the branch of the Pension Fund of the Russian Federation, in the State Statistics Committee, in health and social insurance funds, and in banks.

The authorized representative must also have the right to write statements, sign, receive and submit certificates and documents, including income statements. A power of attorney to represent the interests of an individual entrepreneur in banks should give the attorney, in addition to permission to be a representative in specific financial organizations and their structural divisions, the opportunity to sign papers, receive and present certificates, certificates, statements and certificates on behalf of the individual entrepreneur.

An authorized representative of an individual entrepreneur in banks usually also has the right to receive information on specific accounts and loans, negotiate with representatives of financial organizations and submit applications on issues of amending and terminating loan agreements, the emergence, restructuring, repayment, and novation of debt. To protect the interests of an individual entrepreneur in court, an attorney needs to be able to represent his interests as a plaintiff, defendant or third party in courts of higher jurisdiction and arbitration courts.

He must also obtain permission by power of attorney on behalf of the individual entrepreneur to enter into the necessary agreements and contracts with the legal entity. and physical persons (with notification of the principal), file a statement of claim on an issue of interest to the individual entrepreneur, appeal against decisions of the court and executive bodies, file an appeal and cassation complaint, submit and receive all documents and certificates necessary to complete the task.

What is a power of attorney and does an individual entrepreneur have the right to issue it?

A power of attorney is usually called an official document indicating the fact of delegation of certain powers to perform any legally significant actions. The power of attorney states who delegates what powers to whom and for how long. It can also be said that when one person delegates certain powers to another, the power of attorney serves as documentary evidence of this fact to any third party.

In some cases, a power of attorney from an individual entrepreneur requires mandatory notarization

Individuals and legal entities are authorized to issue powers of attorney in Russia. Individual entrepreneurs, who by law are considered individuals with a special status, do not belong to the exceptions. In practice, the difference between an individual entrepreneur and an ordinary citizen without the status of an entrepreneur is that for an individual entrepreneur, due to the specifics of his status and type of activity, the need to delegate powers to third parties usually arises more often.

The person issuing the power of attorney is usually called the principal, and the one to whom it is issued is called the attorney or trustee.

Particularly worth mentioning is the participation of a notary in the procedure. In any life situations when the law allows the use of a simple written form of power of attorney, an individual entrepreneur can do without it, but there are others. when the notarial form of a document is required. However, a notary only certifies the fact of delegation of authority by one individual or legal entity to another and guarantees that the document confirming this fact complies with the requirements of the law. The very procedure of delegation of powers has the right to be carried out only by their holder - including with the involvement of a notary.

To whom can an individual entrepreneur issue such a document?

The circle of persons to whom an entrepreneur has the right to issue a power of attorney with any range of powers is unlimited by law. However, no sane person would hand out such documents to the first person they come across. In practice, a power of attorney can be obtained by an individual entrepreneur’s employee to effectively perform his official duties or by a specialist who provides him with outsourced services, for example, a lawyer, an accountant, or in some cases a courier. An employee of a company specializing in providing certain services (usually legal, accounting, information, courier, etc.) to small businesses often needs a power of attorney from a client.

An individual entrepreneur also has the right to issue a power of attorney to perform certain actions, including within the framework of business activities, to a relative or friend. The only question is the degree of trust and competence of the supposed trusted person sufficient to perform these actions.

In some cases, the law allows employers to certify powers of attorney on behalf of their employees. But this does not apply to individual entrepreneurs. Only legal entities are granted this right. And an individual entrepreneur, even being an employer, still remains an individual.

Possible risks (video)

https://youtube.com/watch?v=Bh_YxUxsyhc

Main cases of using powers of attorney from individual entrepreneurs

We can identify the following life situations arising from business activities in which an individual entrepreneur may require the participation of third parties by proxy:

- interaction with tax authorities and extra-budgetary funds, including the submission of reports; it is also practiced to issue a power of attorney only for the submission of tax reports (download a sample power of attorney for representing interests at the tax office);

- obtaining material assets;

- receiving funds;

- representing the interests of individual entrepreneurs in the bank (download sample);

- concluding and signing contracts on behalf of individual entrepreneurs, participating in negotiations;

- representation in court (download sample);

- carrying out registration actions: submitting documents for state registration of individual entrepreneurs or termination of business activities, changing OKVED codes, etc.;

Sample power of attorney for opening an individual entrepreneur - representing the interests of individual entrepreneurs in one or more state, municipal, commercial and non-profit non-governmental structures, for example, the tax office, post office, etc.

The individual entrepreneur specializes in the production of printed products. He himself produces original layouts, and orders printing from a third-party private printing house. The delivery of original layouts, placing orders and receiving printed copies is carried out by his hired employee, whose relevant powers are confirmed by a power of attorney. Without this document, accepting orders and original layouts from him on behalf of an individual entrepreneur acting as a customer, and issuing a circulation would be impossible.

Powers of attorney are usually distinguished by the frequency of actions for which the principal grants the attorney the right to perform, and the range of powers delegated. Based on the above criteria, the following types of powers of attorney are distinguished:

- one-time;

- special;

- general (download sample).

Table: main types of powers of attorney

| Type of power of attorney | Peculiarities | Examples |

| One-time | Authority is delegated to perform one action, upon completion of which the document automatically becomes invalid. | One-time acceptance or shipment of goods, receiving cash from a bank or depositing money into a cash register, receiving and/or sending correspondence at the post office, submitting reports to the Federal Tax Service, state registration of an individual entrepreneur or termination of business activities, etc. |

| Special | Powers are delegated to regularly, repeatedly carry out a limited set of actions listed in the document during the entire period that the power of attorney is in force. Has an expiration date specified in the text. | Regular implementation of actions, including those for a one-time performance of which a one-time power of attorney is issued. Usually issued to an employee whose responsibilities include relevant actions (for example, receiving and sending correspondence by courier, submitting reports and/or other representation of interests to the Federal Tax Service, Pension Fund and Social Insurance Fund by an accountant, conducting negotiations and signing contracts by a manager, receiving and shipping goods, representing interests in a bank, etc. Often, a power of attorney is required for employees of outsourcing companies who interact with an individual entrepreneur - lawyers, accountants, consultants.A special power of attorney to conduct business or represent interests in court is usually required by lawyers who provide legal assistance to an individual entrepreneur. |

| General | During the period the document is in force, the authorized representative receives complete freedom of action in matters of conducting all the affairs of the individual entrepreneur, representing his interests, and disposing of his property. A general power of attorney has a limited validity period and requires mandatory notarization. | The need to issue a power of attorney of this type arises when an individual entrepreneur does not want or does not have the opportunity to handle his own affairs. The confidant, as a rule, becomes his relative, friend, business partner or hired top manager. |

Conducting business and representing interests

In relation to powers of attorney from individual entrepreneurs, the formulations “to conduct business” and “to represent interests” are often found. Indeed, they are actively used in everyday life, and sometimes appear directly in the names of powers of attorney. However, there are no sufficient grounds to talk about them as special varieties of this document. Moreover, in the power of attorney for the conduct of affairs, including in court, in the list of powers delegated by the principal to the attorney, “representation of interests” is often found, and in the power of attorney for the representation of interests – “conduct of affairs”.

We can say that both of these formulations are of a general nature, and specific actions, the right to which the principal gives the attorney, are of key importance. For example, to recognize or not to partially or fully recognize claims, enter into settlement agreements, act on behalf of the principal in various organizations, submit applications, sign for the principal, receive material assets and funds belonging to the principal, etc.

Combination of powers of attorney

Legally, an individual entrepreneur is not limited in terms of either the number of powers of attorney issued or the circle of proxies. This opens up the possibility for him to issue both a power of attorney for actions of a different nature to employees within the framework of their official duties, and for the same actions to different employees. For example, interaction with the tax office is the responsibility of an accountant, but he is a living person who may get sick or go on vacation. And no one will talk to another employee replacing him during his absence without a power of attorney. Unless the individual entrepreneur himself, who has the right to represent his own interests and conduct business without a power of attorney, will take over his functions for this period.

The situation when the registration of an individual entrepreneur is just being planned, and upon its completion, the future entrepreneur immediately intends to entrust all matters to a partner, a hired top manager or a loved one, deserves special mention. In such cases, the question arises whether it is possible for a third party, by power of attorney, to open an individual entrepreneur and conduct business on his behalf.

This option is possible, but there are some nuances. Before the state registration of an individual entrepreneur, the future businessman is an ordinary individual and does not have any authority to conduct business activities. This means that there is nothing to delegate to him yet.

Therefore, the process must be divided into two stages:

- Issue a one-time notarized power of attorney for state registration of individual entrepreneurs, on the basis of which the authorized person will be able to carry out all the necessary formalities.

- Immediately after completion of state registration and receipt of documents confirming it, issue a general power of attorney to the representative of the individual entrepreneur and repeat this procedure each time the document expires.

How to draw up a power of attorney to represent the interests of an individual entrepreneur?

A document transferring authority to represent the interests of an individual entrepreneur must include reliable information about the individual entrepreneur and his representative, contain a list of responsibilities that are delegated, the signatures of both parties and the date of preparation. If necessary, the paper is certified by a notary.

Contents of the power of attorney

In a power of attorney from an individual entrepreneur to represent interests, the person must indicate:

- The locality where the document was drawn up and the date when it was signed by the principal.

- Last name, first name, patronymic, passport details and details of an individual entrepreneur.

- Legal address. In this case, it is considered the place of registration of the individual entrepreneur.

- Last name, first name, patronymic, passport details of the authorized person, if he is an individual. Name and details of the organization, passport details and position of the person who will act on its behalf, if the authorized legal entity.

- A clear, detailed description of the delegated powers.

- The period of validity of a power of attorney to represent interests of an individual or legal entity.

- Possibility of transfer.

- Signatures of the attorney and principal with transcript.

Validity

If the power of attorney from an individual entrepreneur to represent a person’s interests does not indicate a period of validity, it can be used for a year.

For a document to have legal force, it must indicate the date of preparation. A power of attorney for representation of interests issued to a person will be valid without a date only if it is executed in a notary office for the work of an authorized person abroad. This document is valid until revoked.

The power of attorney automatically becomes invalid in the event of the attorney's refusal to relinquish the powers delegated to him, the death or incapacity of the principal or representative, or the bankruptcy of the entrepreneur who drew up the document or the attorney, if he is a legal entity. person, liquidation of legal entity. person of the principal or attorney, revocation of the document by the principal.

If a power of attorney from an individual entrepreneur is issued in a notary’s office, and it is intended to be used outside of Russia, and the period of its use is not limited, then in accordance with Part 2 of Art. 186 of the Civil Code of the Russian Federation, such a document will be valid until it is canceled by the principal. In this case, the individual entrepreneur will have to notify all third parties who have ever entered into a relationship with the individual entrepreneur about the change in the status of the representative.

Contents of the power of attorney

The Civil Code of the Russian Federation does not have many rules on the content of a power of attorney:

- It should be clear from the text who the represented and the representative are and what specific actions the latter is authorized to perform (clause 1 of Article 185).

- It is necessary to indicate the date of drawing up the power of attorney, otherwise it is void (clause 1 of Article 186).

The requirements for the content of notarized powers of attorney are established in clause 6.2 of the Methodological Recommendations of the FNP (letter dated July 22, 2016 No. 2668/03-16-3, hereinafter referred to as MR). It is recommended to follow them when drawing up simple powers of attorney. The full current text of these Methodological Recommendations can be found on the ConsultantPlus website. If you do not yet have access to the ConsultantPlus system, you can obtain it free of charge for 2 days.

Required details:

- document's name;

- place of compilation (locality and subject of the Russian Federation);

- date of composition (in words);

- information about the person being represented and the representative;

- powers of the representative;

- signature of the person represented.

It is possible to specify:

- validity period (otherwise it will be equal to a year - Article 186 of the Civil Code of the Russian Federation);

- the right of transfer of trust and further transfer of trust, prohibition of transfer of trust (see paragraph 1 of Article 187 of the Civil Code of the Russian Federation).

IMPORTANT! Information about the person being represented and the representative must be indicated as accurately as possible: passport details, place and date of birth, place of residence, TIN. In relation to the entrepreneur, his OGRNIP should be indicated.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

If the authority requires the right to sign for an individual entrepreneur, we recommend that you include a sample signature in the power of attorney.

Power of attorney for individual entrepreneur person for representation of interests

In many cases, such a document does not require notarization. But nevertheless, often the absence of a notary’s signature casts doubt on the integrity of the individual entrepreneur in the eyes of the counterparty.

If an individual entrepreneur wants to make another individual entrepreneur an authorized person, a regular power of attorney for an individual is drawn up as a document delegating his rights to this individual entrepreneur.

Mandatory and additional details of an individual entrepreneur

The power of attorney will be invalid if at least one of the individual entrepreneur’s details is not specified. There is no legislative norm defining what data must be present in the text of the document. Nevertheless, an entrepreneur usually indicates information about himself, through which the legality of his actions can be verified, in contracts, payments and places of business. According to the required data, information about the individual entrepreneur is clarified in the tax office:

- Last name, first name, patronymic of the individual entrepreneur.

- Place of residence. It is also the legal address of registration.

- TIN.

- OGRNIP, if it is registered as an individual entrepreneur before 01/01/2017, or USRIP, if later than this date.

If the powers delegated to the representative involve resolving financial issues, you should additionally indicate the account number and name of the bank where it is opened, the legal address of the financial organization, correspondent account number, BIC (bank identification code). If necessary, you can also leave a phone number, email, and website address.

Registration of a power of attorney from an individual entrepreneur to a legal entity. face

An individual entrepreneur has the right to delegate powers to a legal entity. Such a document may be required to represent the interests of an individual entrepreneur in court, in the traffic police, in an insurance company, in a bank, when receiving inventory or cargo. With its help, a representative of a legal entity will be able to formalize transactions and agreements, request certificates, and submit applications.

When issuing a power of attorney to represent interests from an individual entrepreneur to an organization, that is, to a legal entity, you need to take into account that the entrusted actions provided for in the document are the representative of the legal entity. persons will have the right to perform only when it is legal. the person will transfer them to him using a notarized document. There is no need to delegate the powers received from the individual entrepreneur if they will be exercised by the general director of the organization.

A power of attorney is issued to represent the interests of an individual entrepreneur by a legal entity in almost the same way as for an individual. The document must include the full name of the organization to which the principal transfers part of his powers, its registration data (OGRN, INN, KPP), and legal address. It is necessary to indicate the possibility of sub-authorization and have the paper certified by a notary.

What documents are needed

Documents for registration by proxy include:

- Application on form P21001.

The application is drawn up independently by the applicant or his representative in accordance with the approved rules. You must be careful when filling out this document, as errors may result in refusal of registration.

After filling out the application, you do not need to sign it, since this will need to be done in the presence of a notary.

- Passport of the future individual entrepreneur and a copy of all pages of the passport.

The applicant’s passport is required to draw up a power of attorney, and a copy will need to be certified by a notary and attached to the general package of documents for registration. If the package of papers submitted by the authorized representative to the Federal Tax Service does not contain a copy of the passport of the future individual entrepreneur, registration will be denied.

- Representative's passport.

The passport must be provided to the notary to prepare the power of attorney.

- Power of attorney + 2 copies.

A notarized power of attorney is the main document confirming the authority of the representative and without it it will not be possible to register an individual entrepreneur in the absence of the applicant.

Copies of the power of attorney are needed to give them to the inspector when submitting papers for registration and when receiving an extract from the Unified State Register of Individual Entrepreneurs after registration. If copies are not made, the inspector will take the original power of attorney when submitting the documents and to obtain an extract you will have to issue another power of attorney.

- Receipt for payment of state duty.

The state fee for registering an individual entrepreneur is 800 rubles and does not depend on who submits the documents: the applicant personally or his representative.

Please note that the starting individual entrepreneur pays the state fee personally. If the receipt contains information about the representative, the Federal Tax Service will refuse registration.

Do I need to notarize?

Like any other individual, an individual entrepreneur has the right to draw up a power of attorney in simple written form, confirming it with his signature and seal, or to execute such a document in a notary’s office. Do you need a notarized power of attorney? In accordance with Part 1 of Art. 185.1 of the Civil Code of the Russian Federation, a power of attorney from an individual entrepreneur to represent his interests must be certified by a notary in the following cases:

- The document is drawn up for the assignment of the right to claim under a transaction, execution of a mortgage agreement, that is, such actions that require the presence of a notary and are certified by him.

- The actions that the individual entrepreneur plans to perform are registered by government agencies or involve the transfer of property and rights, information about which is entered into state registers (for example, registration of a real estate property).

If an individual entrepreneur is studying or is officially employed, the power of attorney drawn up by him can be certified by the administration of the university or the employer. Also, if necessary, the document can be confirmed by credit or banking organizations that have the right to make financial transactions, the administration of correctional institutions, if the individual entrepreneur is serving a sentence, the head of a medical institution, while the individual entrepreneur is undergoing hospital treatment.

When you need notarization: 5 cases

The power of attorney does not have to be certified by a notary. An entrepreneur just needs to check the document data (his passport and the representative’s passport), sign and seal (if used in his work). However, the paper can be certified voluntarily at your own request. And in some cases this must be done without fail:

- If the representative will participate in a transaction that requires notarization. For example, assignment of the right of claim, rent agreement, mortgage, etc.

- If the representative performs actions that must undergo mandatory state registration. For example, any real estate transactions, registration of an individual entrepreneur or termination of its activities in this status, etc.

- If a general power of attorney is drawn up, certification is required when transferring all powers.

- If such a requirement is made by the organization itself, a partner or a client. For example, tax authorities often require a notary's signature on a document.

- A power of attorney may also be needed to open a bank account and manage the funds stored on it. In this case, it can be certified by the bank representative himself in the presence of the individual entrepreneur and his representative.

It is important to understand that if individuals decide to have the document certified by a notary, then they do not need to draw it up themselves. The notary will print out his own form, clarify the purpose of drawing up the document and draw it up in accordance with the requirements of the parties.

The document can also be certified in other ways. If an individual entrepreneur is studying or is officially employed, he can certify a power of attorney, respectively, at the place of study or work.

Thus, although in some cases certification is not a mandatory procedure, it is advisable that the power of attorney be signed by a notary. Then partners and potential clients will not have any doubts about the authenticity of the document.

Powers of attorney certified by the individual entrepreneur himself

When drawing up a power of attorney from an individual entrepreneur, an individual does not have to have it certified by a notary if it entrusts the authorized person with the right to represent the interests of the individual entrepreneur. As a sample document confirming the ability to represent the interests of an individual entrepreneur, you can provide a power of attorney to receive registered letters or parcels, goods to be sent by courier, securities, interaction with the tax office, banks or the court, and to carry out transactions.

To receive inventory or money, a one-time or special power of attorney is issued from the individual entrepreneur to represent the interests of an individual or legal entity. Without notarization, you can also transfer the right to receive money from a current account or postal correspondence to an authorized person. Such papers are certified by the signature and seal of an individual entrepreneur.

How to revoke a power of attorney?

An individual entrepreneur has the right to cancel such a document at any time, without waiting for the expiration of its validity. To do this, you need to draw up a review, similar in structure to the power of attorney, and hand it over to the attorney against receipt. A notarized power of attorney can only be revoked through a notary office.

A document transferring part of the rights of an individual entrepreneur to a representative cannot be canceled if its text contains an entry prohibiting this. In this case, it can be revoked only for the reason specified in it.

An incorrectly drawn up power of attorney from an individual entrepreneur to an individual or organization sometimes becomes the reason that an individual entrepreneur has to be held accountable for the unlawful actions of an authorized person who has exceeded his authority. A document containing only general phrases may provoke an unscrupulous subordinate to commit fraudulent actions against an individual entrepreneur.