How beneficial is declaring insolvency?

Before going to court, a citizen needs to understand that the insolvency procedure is far from getting rid of debt obligations. First of all, everything is aimed at resolving the issue, the claims of creditors, and helping to solve the current financial problem. Recognition of physical persons insolvent, does not bring benefits. The procedure can help reduce payments on credit and other financial obligations if you have a regular income.

If a person is unable to fully service the debt or the amount of the debt is too high, valuable property is sold to satisfy the demands of the creditors. After which the balance of the debt is written off.

Also, do not forget that the procedure is not free, and to start it, the debtor will need at least 25,300 rubles. 25 thousand is deposited into the deposit account of the court, 300 rubles is the state tax sanction for filing an application. Payment for the work of the arbitration manager is also required. The procedure is legally not simple, so it is best to seek help from qualified specialists - and this also means additional financial costs.

From all of the above, we can draw the following conclusions - before resorting to the procedure, it is worth weighing the pros and cons.

Briefly about the stages of the bankruptcy procedure

Let's look at how the insolvency issue proceeds.

REGISTERING AND SUBMITTING AN APPLICATION TO THE COURT FOR RECOGNIZING A CITIZEN BANKRUPTCY

CONSIDERATION OF THE APPLICATION BY THE COURT

| Positive decision | Negative decision (the application is returned to the debtor) |

|

|

| Introduction of debt restructuring. | Sale of property | Settlement agreement |

|

|

|

If no one buys the property at auction

The time frame for the sale of property in the procedure is usually 6 months, the exact dates are determined by the court depending on the situation. If the property was not sold at the first auction, the manager carries out the following procedures under Art. 139 of Law No. 127-FZ “On Insolvency”:

- repeated auctions are organized, following which a purchase and sale agreement can be concluded with the winner or the only participant;

- if repeated auctions do not bring results, the manager can sell the debtor’s property through public offers (in the media, on the Internet);

- if the manager cannot sell the property, or the creditors refuse to receive it to pay off the debt, things and objects will be transferred back to the debtor (Article 213.26, 127-FZ).

Section 213.26. Features of the sale of a citizen’s property

(introduced by Federal Law dated June 29, 2015 N 154-FZ)

- If the financial manager is unable to sell the citizen’s property and (or) claims against third parties in the prescribed manner and the creditors refuse to accept said property and (or) claims to pay off their claims, after the completion of the sale of the citizen’s property, his right to dispose of the said property is restored. property and (or) claims.

In this case, the property that constitutes the bankruptcy estate and has not been sold by the financial manager is transferred to the citizen under an act of acceptance and transfer. In this case, paragraph 1 of Article 148 of this Federal Law does not apply.

Federal Law of October 26, 2002 N 127-FZ (as amended on December 30, 2020) “On Insolvency (Bankruptcy)” (as amended and supplemented, entered into force on January 2, 2021)

Read completely

Source

If you are interested in bankruptcy, but do not know how to go through the procedure of selling the debtor’s property with minimal risks, contact professional lawyers for help and support. We will help you admit your insolvency, develop an action plan, provide qualified support at all stages of the process, and achieve debt write-off without loss of property!

Get a consultation right now - by phone or online chat.

Consequences of bankruptcy of an individual during the procedure

The first unpleasant consequences will be felt already at the stage of the procedure. A citizen, independently or through a representative, sends an application to arbitration with a request to declare him insolvent. The request is accepted, considered and a decision is made.

The procedure then proceeds in one of three directions:

- Peaceful settlement of the issue between the debtor and collectors;

- Restructuring of financial responsibilities;

- Sale of valuable property.

Each of the presented options has its own positive and negative consequences for the physicist. However, there are common negative aspects that arise in two of the three cases presented. The exception is a settlement agreement.

Consequences of bankruptcy of an individual:

- Payment for the work of the financial manager. Cost from 50 to 70 thousand rubles.

- From the moment of implementation or restructuring, the entire financial situation of the citizen comes under the supervision of the manager.

- A person hands over credit cards and account information to the financial institution. Receives part of the salary established by the court. Usually this part is equal to the subsistence level; if there is a minor child to support, the payment is also assigned to him.

- All activities related to the property also come under the control of the manager. A citizen does not have the right to independently buy and sell valuables.

- You cannot act as a guarantor.

- You cannot purchase securities.

- You cannot open and close accounts in financial institutions on your own.

- Imposition of a court ban on leaving the territory of Russia. This measure is applied in exceptional cases, at the discretion of the judge.

Negative consequences of bankruptcy of an individual during debt restructuring

What is restructuring? It is the gradual repayment of debt obligations to creditors. The procedure has undoubted positive aspects, but also no less unpleasant results for the physicist.

- Formally, it is considered that the deadline for fulfilling financial obligations has arrived. The totality of all debt settlements is fixed and no longer grows, no fines, penalties, etc. are imposed.

- Previously submitted applications from creditors regarding financial obligations remain without consideration.

- Restrictive measures imposed by the bailiff are lifted. In particular: seizures imposed on bank accounts, movable or immovable property.

- Initiated enforcement proceedings are terminated. The exception is cases of collection of alimony for damage caused to health.

- Prohibition on transactions with gratuitous valuables.

Consequences of introducing the sale of property

Sales – sale of valuables to individuals. persons at open auctions. The funds received are transferred to the bankruptcy estate, which is intended to satisfy the requirements. The main advantage of the implementation is that after its completion, the remaining debts of the physicist will be written off. The negative ones include the following:

- Sale of valuable property owned by the debtor.

- Selling collateral, even if it is the only home.

- If one of the spouses becomes bankrupt, then all jointly acquired valuable property is sold. Half of the money received from the sale goes to the bankruptcy estate, the other is transferred to the spouse.

- Not all debts can be written off after completion of the sale procedure.

Settlement agreement

This option for developing bankruptcy means finding a mutually beneficial solution between the debtor and creditors. This could be a reduction in interest, an increase in the debt repayment period, write-off of penalties, and penalties.

The positive point is that upon conclusion of the agreement, the bankruptcy procedure is terminated. Interim measures are removed from the debtor, and the ability to manage accounts and valuables is restored. The services of a manager are no longer required.

The negative consequences of bankruptcy of an individual at this stage are as follows:

- Financial obligations are not written off. The citizen will be obliged to pay debts according to the new established procedure. In case of non-fulfillment of obligations, creditors send an application for forced collection.

- After the conclusion of the agreement, the individual a person cannot re-submit a request for the introduction of an insolvency procedure for 5 years.

List of property to be sold

Almost everything the debtor owns can be taken to pay off debts:

- Apartment;

- Apartments;

- House;

- Land;

- Dachas;

- Garages;

- Commercial real estate objects;

- Cars;

- Motorcycles;

- ATVs;

- Boats;

- Boats;

- Yachts;

- Snowmobiles;

- Household appliances;

- Luxuries;

- Shares, shares in companies;

- Bank accounts.

Even if the debtor hides any property, it is unlikely that he will ultimately be able to do it his way. This practice is quite common among bankrupts, so bailiffs have already developed quite effective tactics and strategies for identifying hidden property, which ultimately make it possible to find and seize (if possible due to the physical characteristics of the object) what the debtor carefully tried to hide.

Residential real estate: apartment, house, mortgage property

From the moment the debtor is declared bankrupt, all rights regarding real estate (including the right to dispose of it) are transferred to the financial manager. The sale of property occurs by selling an apartment or house at auction.

Debtors do not have the right to sell an apartment/house on their own after a court decision has been made! Organizing trading is the responsibility of the financial manager.

However, if the specified real estate is the only one suitable for residence of the debtor and members of his family, the bailiff has no right to “take” it to pay off the debt.

But this ban does not apply to mortgage housing. Even if it is also the only one the debtor has, he will still be foreclosed on (if, of course, the amount of the debt is commensurate with the market value of the property).

Cars

Repayment of debt using a vehicle occurs as follows:

- To find out which vehicles are registered to the debtor, bailiffs send a request to the traffic police.

- Next, the car is subject to seizure (restriction on performing registration actions) - from that moment on, the owner will not be able to sell it, donate it, exchange it, or otherwise get rid of it.

- If the amount of debt is commensurate with the estimated value of the car, and no other sources of repayment of debt obligations have been identified (the citizen does not work, he does not have a bank account), the bailiffs go to court to obtain permission to seize the car.

- Having received such permission, the bailiff begins searching for the car. To do this, he can appear at the citizen’s place of registration and residence, or at his place of work. If the search remains unsuccessful, the FSPP officer proceeds to the following measures.

- The FSPP, together with the leadership of the local traffic police, create a joint group of employees of both services, which conducts raids to identify debtors. The traffic police officer stops the driver and while he is having a conversation, the bailiff “pushes” the data of the car owner into his database. If enforcement proceedings are opened against him, the car is immediately taken with the help of a tow truck to the impound lot.

- Even if the car is identified in another way, its movement to the impound lot is also carried out using a tow truck.

- After this, an auction is organized and the car goes under the hammer. The proceeds go to pay off the debt.

Even if the car was bought on credit, and at the time of the opening of enforcement proceedings it has not yet been paid, the bailiffs still have the right to seize and sell the vehicle at auction.

In some cases, the car may be put on the wanted list for debts.

| Bailiffs have the right to put a car on the wanted list if: 1) the interests of the Russian Federation, constituent entities of the Russian Federation, municipalities require protection, and the amount of claims exceeds 10,000 rubles; |

| 2) it is necessary to collect alimony from the debtor; |

| 3) the proceedings concern compensation for damage caused to health or in connection with the death of the breadwinner; |

| 4) the debtor did not compensate for the damage caused by the crime; |

| 5) the bankrupt has not paid the fine imposed as punishment for the crime; |

| 6) the owner has not completed the assigned compulsory work. |

After the search warrant is issued, a copy of it is sent to the traffic police. Then the traffic police officer can stop the car with the numbers specified in the decree, even if the driver behind the wheel did not commit any violations. After stopping and informing the driver that his car is wanted, a report is drawn up, and the vehicle is transported to the parking lot with the help of a tow truck.

Equipment (ATVs, boats, boats, snowmobiles)

Information about who is the owner of boats, boats, yachts, jet skis is contained in the databases of the State Inspectorate for Small Vessels of the Ministry of Emergency Situations of Russia.

Since it is problematic for bailiffs to identify such equipment on their own (you are unlikely to find it at your place of residence/registration), the FSPP organizes raids jointly with the State Inspectorate of the Inspectorate (GIMS) (similar to joint raids with the State Traffic Safety Inspectorate), during which swimming equipment is checked in local bodies of water.

Information about registered snowmobiles, tractors, and all-terrain vehicles is stored in Gostekhnadzor databases. It is in this structure that the bailiffs find out whether any of the above belongs to the debtor. In regions where snowmobiles are the main means of transportation, joint raids by the FSSP and Gostekhnadzor can also be organized.

Motorcycles and ATVs are registered with the traffic police. The interaction of FSPP employees with this structure is described above.

Cottages, garages, land

In addition to apartments and cars, the following may also be confiscated from the debtor:

- Plots of land on which a garden or vegetable garden is located;

- Dachas (meaning buildings);

- Garages.

How do bailiffs find out about the existence of this property? They send a request to Rosreestr and BTI, from where they receive an answer which objects are owned by a particular person.

Next, the bailiffs will come to the actual address of the found property, include it in the inventory and make an assessment.

However, bailiffs do not have the right to seize and sell a plot of land on which the only suitable housing is located.

Luxuries

Luxury items include:

- Precious stones and jewelry;

- Antiques;

- Things of artistic, historical or other cultural value (paintings, statues, busts, exhibits, collections, etc.).

The term “luxury” is not defined by law. You cannot find any listings of items that fall into this category in current laws and other regulations. Therefore, this concept is quite relative. The right to evaluate an item according to the criterion of “luxury” is given to the bailiff. If you do not agree with his actions, you can challenge them in court and exclude certain items from the inventory of property.

Bailiffs describe those luxury items that are located in an apartment/house or other real estate owned by the debtor or in which he is registered. Moreover, those that are in the field of view. Bailiffs do not have the right to conduct a search.

What are the consequences after bankruptcy of an individual?

If the decision is positive, the citizen will receive the result he expected. Major debts will be written off or payments will become noticeably easier. It doesn’t matter what the amount of the debt was, whether the creditor presented his rights, whether he received compensation, the debt is written off to zero and the citizen is clean. However, negative consequences for the physicist still remain.

- Submitting a repeated application to declare a citizen insolvent is possible no earlier than five years after the procedure has been completed. Why was such a restriction introduced: so that physical individuals did not feel the desire to re-accrue loans and write them off again.

- If a restructuring procedure was introduced, it can be introduced again after eight years. In other words, if there is a second insolvency petition earlier than eight years, for example after six, introducing a restructuring will not be possible.

- For at least five years, an individual recognized as bankrupt is obliged to inform credit organizations about the past legal proceedings.

- A person cannot hold a leadership position for at least three years.

- The individual entrepreneur loses the status of a private entrepreneur and is prohibited from opening a new business for five years.

- Information about insolvency is entered into the credit history bureau.

- Some employers do not allow employees who have gone through bankruptcy proceedings to work. For the most part, this applies to the profession of civil servant.

Can a spouse's property be taken away?

Yes they can. But since the property belongs to the spouses under the right of common joint ownership, the share of the second must be allocated in kind. This is indicated by Art. 255 Civil Code of the Russian Federation, part 4. Article 213.25 of the Federal Law “On Insolvency (Bankruptcy)”, paragraph 63 of the Resolution of the Plenum of the Armed Forces of the Russian Federation dated November 17, 2015 N 50.

Both the bailiff and the creditor can apply to the court with a request to allocate a share in kind. If it is impossible to allocate the share or the second spouse objects to this, the creditor may demand that this share be sold to the second owner at a price commensurate with the market price.

If the second spouse does not want to buy a share, a public auction is organized at which it is sold to strangers, and the spouse’s debt is repaid with the proceeds.

Debt that is not written off after insolvency proceedings

The legislation establishes a number of financial obligations that cannot be written off, even in the event of bankruptcy proceedings. It is worth remembering this when submitting an application to arbitration or planning to resort to the procedure.

- Payments for alimony payments to minor children or disabled parents;

- Payments ordered by the court for causing harm to life, health or property;

- Payments related to labor legislation;

- Payment when causing moral damage;

- Current debt obligation – debts that arose during the insolvency procedure.

It happens that after completing the procedure, the debt on tax payments, loans, and housing and communal services payments is not removed. The reason may be the discovery of falsification of the submitted data identified during the procedure.

Negative consequences of insolvency proceedings for relatives

It would seem what the consequences after the bankruptcy of an individual may be for immediate relatives or spouses. However, they exist.

Negative consequences for the husband or wife of a bankrupt

Let us examine in more detail the consequences for the spouse during the restructuring and sale of property.

- Debt restructuring. In this case, the family budget suffers, since for a long time the bankrupt spouse will be obliged to pay the debt according to the established schedule.

- Sale of property. Here the question will directly affect not only physical. a person who is declared bankrupt, but also his wife or husband, even if they are divorced. These points are established by the Federal Law “On Bankruptcy”. What can happen:

- Jointly acquired property is seized and sold at auction. For example, spouses (even ex-spouses) purchased a vehicle during their marriage. It can be written to one or both, in this case it does not matter. The property will be put up for sale, but half of the due share will be returned to the bankrupt's wife or husband in cash.

- Challenging transactions that took place in the previous three years, before sending an application to declare an individual insolvent. In other words, when a financial manager begins his work, he first of all checks all transactions that were carried out by the bankrupt or both spouses over the previous three years. If it is discovered to be suspicious (sale or gift of valuable property to relatives, a transaction with a greatly reduced value), it can be contested, the property returned to the ownership of the bankrupt and put up for auction.

Unfortunately, the rights of a spouse of an individual bankrupt are very modest. And if the husband or wife acted as guarantors for the bankrupt, the situation becomes even less pleasant.

Consequences for other relatives in the event of bankruptcy of an individual

The negative consequences of bankruptcy of an individual can affect not only spouses, but other close relatives.

- Shared ownership of a relative and a bankrupt. As in the case of a spouse, if a bankrupt individual has a share in the common property of relatives, it will be forcibly sold. The funds received in a share ratio are sent to the bankruptcy estate, the remainder is returned to the relative.

- Challenging transactions between relatives.

How does the situation affect relatives?

Despite the fact that the procedure concerns one citizen personally, it may indirectly affect his loved ones. First of all - husband/wife and children, second - the rest of the relatives.

What to do next if a person is declared bankrupt, and he is your spouse

A common situation is when a married couple jointly takes out a mortgage or other loan secured by a common home. Then the wife/husband can act as a co-borrower or guarantor. We will have to accept that the property will be sold. But even if there was no such fact, the apartment will go under the hammer, and the other half will receive only monetary compensation for their share. The situation is similar with household appliances and cars. However, division is only in case of divorce; if the couple remains married, then everything goes to auction.

Minor children/dependents

This category is the most protected. When analyzing the minimum that an insolvent citizen needs, the number of people who remain in his care is taken into account. Often having a family allows you to keep a fairly large house. If there is a disabled person who needs to be transported by car, motor transport may also be considered necessary.

Other relatives and guarantors have problems

Parents, sisters and other relatives will not be harmed. But if the debtor has had transactions with them (sale, gift, inheritance of property) over the past three years, then they will be checked and may be declared invalid, especially if figures (price) appear that do not correspond to the real market value.

Read the bankruptcy trustee: who is he, his rights, obligations and requirements under the Federal Law

A guarantee implies a full or partial division of responsibilities and agreement to repay the debt in the event of the insolvency of the main borrower. if What should the guarantor do next if the person who took the loan is declared bankrupt:

- Litigation to exonerate oneself from liability. It can be proven that these obligations have lost their legitimacy due to a number of factors.

- Payment of debts. Typically, a guarantee is issued for one loan, and not for all at once, so the amount may be feasible.

- Beginning of bankruptcy proceedings.

Upon death of the debtor

If at the time of the start of the procedure the plaintiff died, but an insurance contract for this case was not concluded, then the one who enters into the inheritance receives all the debts. However, a common practice is to renounce property, and at the same time, all obligations. Everything that belonged to the deceased borrower is auctioned off in honor of the payment.

Negative consequences of insolvency proceedings for creditors

Not only physicists facing insolvency, or their relatives, face troubles during and after the end of legal proceedings. What consequences of bankruptcy of an individual affect creditors:

- Fraud. It is not uncommon for a citizen to deliberately stop paying a loan in order to be able to file a petition to have it declared insolvent. Even if a settlement is reached, the claimant loses funds because the debtor does not pay most of the interest or penalties.

- Refund of only part of the money. When the property is sold, money is returned to creditors. However, the bankruptcy estate, even after the sale of all property assets, is rarely enough to fully satisfy the claims of creditors.

- Loss of benefit. Creditors cannot charge fines, penalties and penalties on debt.

As you can see, claimants lose a significant part of the money they are entitled to when selling property. However, an undoubted advantage is that they return at least part of the due funds. Collection of funds through the courts and the bailiff service may not always be successful; in this case, credit institutions simply write off the debt.

How to preserve collateral during bankruptcy

What will happen to housing if it is not just the only one, but is the subject of a mortgage

? But here the law takes the side of the bank, not the borrower. A collateralized apartment (like any other collateral) will certainly be sold if the mortgagor bank has declared its claims and they have been included in the register. They can also sell the plot on which the mortgaged property is located for debts.

It is interesting that in judicial practice there are cases when an apartment with a mortgage was not taken away during bankruptcy. The reason was that the bank did not have time to declare its claims within the time limits established by law.

Note!

A striking example of such a precedent is case No. A41-25058/16, where Sberbank missed all the deadlines, and as a result, the mortgage issued by this bank remained with the borrowers. Accordingly, the sale of collateral property in the event of bankruptcy of an individual could not fully take place. But let us remind you that such situations are extremely rare. Usually it is in the interests of the bank to return their funds to the maximum.

You can avoid selling your mortgaged apartment if you repay the loan in full before filing for bankruptcy. In this case, the pledge is removed from the property while the debtor retains ownership rights. Naturally, the apartment with the mortgage removed must be the only one owned by the debtor and his family members, otherwise it will be able to be sold on a general basis.

Consequences for guarantors in insolvency proceedings

If, when registering loan obligations, a guarantor was involved and a bankruptcy procedure was organized. A citizen who is a guarantor also bears responsibility on an equal basis with the main borrower.

What troubles await a person:

- An individual, instead of a guarantor, becomes the same debtor;

- The law obliges the guarantor to pay the debt incurred. However, it is worth noting that in addition to the responsibilities, a physicist also has rights. If accounts are seized or banned, he has the right to go to court to have them removed.

- When purchasing a car or apartment on credit, along with the bankruptcy procedure, the property is alienated in favor of the guarantor.

If a citizen-guarantor does not have the ability to pay off the debt, he has the right to apply for an insolvency procedure.

Can they take things from the apartment if I don’t live there, but am registered?

Yes they can. If the bailiffs do not have information about your real place of residence, then they will come to the place of registration and begin an inventory of the property. They will describe all visible items that can be sold to pay off the debt, and will not look for evidence indicating who exactly owns the items. The burden of proof lies with the owner of this property or with you. You can confirm the fact of ownership of property:

- purchase and sale agreement;

- sales receipts;

- invoices, etc.

After the property is described, you or the injured owner can file a lawsuit to exclude the property from the inventory. If it can be proven otherwise, the error will be eliminated and the arrest will be lifted.

Hidden negative consequences

In addition to the above negative aspects of the insolvency procedure, there are also hidden negative consequences for the debtor. Some are worth knowing about before going to court.

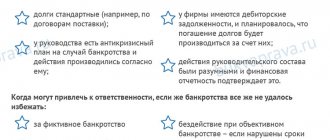

- Intentional bankruptcy is a situation in which the debtor could avoid going to court for recognition of bankruptcy. For example, there are financial obligations in favor of the debtor (owing money). Article 196 of the Criminal Code of the Russian Federation.

MORE ABOUT FICTIONAL BANKRUPTCY IS SET FORTH IN THE ARTICLE >>>

Intentional bankruptcy: features, signs and responsibility

- Fictitious insolvency. The citizen creates the appearance of insolvency, usually by falsifying financial documentation. After which it sends an application to the court. Thus, a person hopes for a deferment in payments or complete debt write-off. Article 197 of the Criminal Code of the Russian Federation.

- Wrongful bankruptcy. Hiding valuable property, illegal transactions, resale to relatives, settlements with some creditors, ignoring the demands of others, misleading the financial manager.

How to avoid the negative consequences of bankruptcy

Of course, the debtor should understand that he cannot avoid the consequences that are directly provided for by law. Upon completion of the procedure, restrictive measures will be fully applied to the individual. Therefore, if a citizen decides to file a petition, he should be fully aware of the further consequences.

When going through insolvency, what you should never do:

- You should not engage in illegal manipulation of property or forgery of documents. The debtor needs to understand that any fraud with property, accounts or papers will be disclosed in the first stages of the procedure. The process is monitored not only by the financial manager, the court, but also by creditors. Everyone has their own personal interests, which do not always coincide with the interests of the debtor. If illegal activity is discovered, the debtor will face negative consequences, not to mention the fact that bankruptcy will be denied.

- As soon as the procedure starts, the debtor cannot give preference to any of the creditors. Making a payment to one may lead to the initiation of a criminal case at the initiative of others.

- Do not collude with the financial manager. As a rule, financial institutions perform their duties conscientiously, but an adventurer may also be caught, so you should be careful.

- A reasonable decision would be not to let the procedure take its course, but to delve into the situation, learn about the progress of the case, and ideally attend court hearings. In this way, negative consequences can be avoided.

As you can understand, the procedure for declaring insolvency for an individual and his relatives has a number of unpleasant consequences, financial restrictions and simply tense situations. However, we should not forget about the positive sides. If the documents were submitted correctly, the citizen did not commit illegal actions or fraud, and voluntarily and honestly cooperated with the financial manager, his debts will be written off and he will be able to live in peace. Well, the restrictions imposed by law can be easily survived after the procedure is completed.

Restrictions after recognition of financial insolvency

There are rules that begin to apply already in the process of office work, others - only from the moment a person is declared insolvent.

Regarding property

There is an opinion that the court will put all housing under the hammer. In fact, this is not true; the defaulter will be able to keep the housing, provided that it is the only one and does not exceed the minimum number of square meters for each registered family member. The exception applies only to mortgaged apartments or building plots. When the mortgage is paid off, it is written off as debt.

Regarding the rest, a person will only have the minimum that he needs for life, namely personal belongings. Valuables, jewelry, furs, household appliances (not all) will be sold.

Bankruptcy of individuals

from 5000 rub/month

Read more

Services of a credit lawyer

from 3000 rubles

Read more

Legal assistance to debtors

from 3000 rubles

more

Write-off of loan debts

from 5,000 rubles/month

More details

One of the consequences of declaring a citizen-debtor (individual) bankrupt to the bank is the verification of all financial transactions over the last three years. If fraud is detected, the purchase and sale will be declared invalid, and a case may be initiated with administrative or criminal penalties. Therefore, it will not be possible to transfer an apartment or car to relatives on the eve of the trial. If the property is jointly owned, then you cannot use your share.

Other personal rights

It is prohibited to be the general director or founder of a legal entity; you can open an individual entrepreneur, however, this restriction is valid for 3-5 years. After this, according to Russian and European practice, the debtor can reach any career heights.

Regarding debts

One of the positive consequences of declaring oneself bankrupt is that all debts of an individual that were not covered after the sale of property are considered cancelled. Collectors or bank employees no longer have the right to call demanding a refund.

Is it possible to travel abroad?

At the time of paperwork, a ban on leaving the country may be imposed, but in practice such a restriction is imposed extremely rarely. At the end of the process, the person has the same rights to obtain a visa and cross the border as other citizens.

Is it possible to take out loans?

Repeated lending is permitted, but when submitting an application, the debtor is obliged to inform that there is a restriction on it for bankrupt individuals. The bank will make its own decision, and it is possible that it will be positive. The second negative factor is an entry in your credit history; it will take time to correct it.

Read Imaginary and feigned transaction, what is it in simple words, consequences and differences