Ways to re-register an apartment as the property of another person

Under a concluded rental agreement, funds are usually not paid for the property; property is transferred free of charge, and rental payments are paid in equal parts, and this is beneficial to both parties to the agreement.

An annuity agreement has been very popular lately, but it must clearly state all the obligations and rights of the parties, as well as the terms of the transaction, in order to avoid various misunderstandings. Such agreements are usually concluded by single elderly people. The apartment left by the testator passes to the heirs by law in equal shares or according to the will. All controversial issues regarding the determination of shares are resolved only in court. The notary will issue a certificate of inheritance only when all the heirs come to a voluntary agreement on the division of shares.

Who is it issued to?

A certificate can be issued to all those inheriting an inheritance under a will. The paper can be issued for part of the inherited property, for example: an apartment, a car, or another object.

Each heir has the opportunity to receive a document only for his/her allotted share.

The heirs who have actually accepted the certificate may apply for the right to receive the certificate.

We recommend reading: Claim for actual acceptance of inheritance and recognition of property rights

The procedure for receiving an inheritance can be determined by law or by will. The will provides for the possibility of appointing any citizen as a legal successor, if this does not contradict the provisions of the law.

The state provides for the possibility of allocating a mandatory share for socially vulnerable citizens. The norm must be observed by the will. Failure to comply with the requirements allows the document to be declared invalid.

Heirs by law, will, and official representatives have grounds for receiving a certificate.

The possibility of receiving for an incapacitated, minor citizen is provided to the guardian.

The presence of such a document is a mandatory condition for confirming ownership of property. During a judicial review of shares, previously issued securities are declared invalid.

An applicant who fails to register a share in a timely manner has the opportunity to appeal to the court with a request to revise the deadlines. If the request is granted, the property is redistributed taking into account new circumstances. The judicial authority may recognize the claim as justified if there are good reasons and documentary evidence of the fact.

How to register an inheritance after the death of a mother

- Passport;

- Certificate of death of the mother or a court decision declaring the mother dead;

- A document confirming the mother’s last place of residence (certificate from the housing office, extract from the migration authority);

- Birth/adoption certificate (other documents that confirm the relationship between the deceased and the heirs);

- Certificate of change of name/surname;

- Will;

- Documents for inherited property (title documents, extracts from the Unified State Register of Real Estate, technical and cadastral documents, certificate of assessment of inherited property).

Each subsequent queue inherits if there is no representative of the previous queue. For example, a mother's brothers and sisters will be able to accept an inheritance only if neither her husband, nor her children, nor her parents accept the inheritance. The reasons for this may be different - death, refusal, recognition as an unworthy heir. You can read more about the order of heirs in the article “The order of inheritance by law.”

Kinds

- According to the law (in order of priority according to degree of relationship in accordance with Articles 1057-1063 of the Civil Code of the Republic of Belarus)

- According to the will.

To receive an inheritance, it is necessary to enter into or refuse it within 6 months after the death of the parent/testator or from the date of entry into force of the court decision on death.

If the deadline for entering into an inheritance is missed due to valid reasons or ignorance, the court may accept the heir as accepting it.

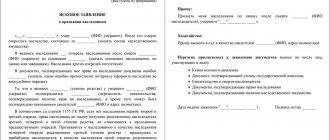

This can be done in the notary office at the place where the inheritance was opened, where you will need to write an application or send it, notarized.

Inheritance | Consultation with a lawyer ☎ +375 (29) 653–94–22

Re-registration of the apartment

- The deed of gift is drawn up in favor of the incompetent owner with a deferment until the age of majority. A person under the age of 18 (14) is represented by his legal representatives.

- A will allows for the execution of a testamentary refusal when a person who does not have the right to dispose of the housing remains in the apartment transferred to the heir. In his favor, guarantees are provided for the use of the premises throughout his life. Such settlement is considered to be a burden on the owner.

If only the right to an apartment is alienated, and the balance of the debt remains with the payer, the contract must be re-signed with the bank employees. In any case, the owner's ownership will come into force only after the loan obligations have been repaid.

Re-registration of an apartment after the death of parents

Is not it? Thank you For six months after my mother’s death, I had to submit an application to a notary to enter into an inheritance, after which, if all the documents for the apartment were in order, the notary would issue a certificate of ownership of inheritance by law. Since you did not submit an application, you missed the deadline for entering into inheritance. The heirs will be. children of the deceased, spouse, parents.

We recommend reading: State duty for divorce sample

A power of attorney is not required to accept an inheritance by a legal representative. 2. It is recognized, until proven otherwise, that the heir has accepted the inheritance if he has performed actions indicating the actual acceptance of the inheritance, in particular if the heir: has taken possession or management of the inherited property; took measures to preserve the inherited property, protect it from encroachments or claims of third parties; made at his own expense expenses for the maintenance of the inherited property; paid at his own expense the debts of the testator or received funds due to the testator from third parties. Article 1154.

Registration of property after inheritance

Once you have received a certificate of inheritance of property, you need to register your rights to the property of the deceased. You can do this in two ways:

- Through a notary office.

- Through “My Documents” (formerly MFC).

The first method is faster, in a maximum of 5 working days you will solve the problem, but you will have to pay for the services of a notary. If you are not in a hurry, you can submit the necessary documents (passport and certificate of inheritance) through the “My Documents” service, which is available in every city and town of the Russian Federation. But here the application for registration of rights will be confirmed with all changes in ownership rights made to the new owner - up to 21 days. In addition to the documents, you will need to attach a receipt for payment of the state duty. Its size is 2,000 rubles.

The result of a successful resolution of this issue will be the receipt of an extract from the Unified State Register of Real Estate (USRN). This stage is the final inheritance of the apartment. But in order to close all the “gaps”, go to the Management Company with an extract from the Unified State Register and passport and re-register personal accounts for the apartment. Remember that no matter when the property was re-registered to you, utility bills still do not stop accruing, and even if there are debts, the heir who has acquired ownership rights pays them.

Re-register the apartment in your name after the death of your mother

Placing a question above the rest within 48 hours Increase views by 4-20 times The fastest way to increase response More about the service To assign status to a question, send an SMS with the text 91505+311 to number 3161 - cost 12.5 UAH including VAT.

After the death of a person, when registering an inheritance, it is important to determine the inheritance mass. What inheritance is left after death? There are two categories of inheritance: In the first option, entering into an inheritance after death is not difficult (unless, of course, there are disputes of a different nature). In the second case, the process of registering an inheritance after the death of a citizen turns out to be long and very difficult. Sometimes registration of inheritance can only take place in court. To avoid missing the deadline, you can submit documents in person to a notary or to the court.

How to re-register an apartment after the death of your husband

1. Acceptance of an inheritance is carried out by filing it with a notary at the place of opening of the inheritance

or authorized in accordance with the law to issue certificates of the right to inheritance to the official of the heir’s application for acceptance of the inheritance or the heir’s application for the issuance of a certificate of the right to inheritance.

If the apartment is in your shared ownership with your spouse and child. That is, if you are not using it for social or other purposes, you should contact a notary within six months from the date of death of the spouse (testator). The notary will issue a certificate of right of inheritance to the heirs. The first priority heirs are the spouse, parents and children of the deceased. After this, on the basis of this certificate, Rosreestr will issue certificates of the right to shares in the specified property.

Registration of property objects

Registration of ownership occurs after receipt of the certificate. Registration of property is a mandatory stage, without which any actions with the object are impossible. Having registered the rights, the heir has the right to proceed with the re-registration of the object with the State authorities.

After receiving a certificate of inheritance, the registration procedure will depend on the object that was received.

Real estate registration occurs through the State Register.

You will need certain documents:

- Evidence;

- Passports;

- Copies of payment of fees;

- Papers for the object.

The period for registering property is seventy-five years. If the registration procedure is not completed, the heir has the right of residence. It is impossible to sell, donate, exchange, or perform any actions with the property.

Re-registration of a car is possible if you have an MTPL policy and undergo diagnostics. You must go to the traffic police with a package of documents and a copy of the payment of the duty.

Required documents

Standard documents for re-registration of property include:

- passport,

- death certificate of the testator,

- paper for inheritance share,

- copy of the fee payment.

As stated above, the list depends on the type of property.

We recommend reading: Division of inheritance: by will and by law

The amount of the fee depends on the estimated value of the property.

The vehicle must be re-registered within ten days after receiving the certificate. Re-registration of a vehicle not completed within ten days may be punishable by a fine.

Real estate can be re-registered within seventy-five years from the date of receipt of the document.

You can re-register a bank deposit knowing exactly where it is located. It is necessary to provide a package of required papers:

- Passport;

- Papers confirming the death of the testator;

- Documents confirming the contribution;

- Agreement with organizations.

After completion of the registration procedure, the successor receives the right to dispose of the property at his own discretion. The sale of real estate after inheritance, before the five-year period, is subject to tax in the amount of thirteen percent of the transaction.

Re-register the apartment in your name after the death of your mother

That is why the first priority heirs are children, spouse, and parents. Today there are eight lines of succession by law. If there are heirs of a higher order, then lower heirs do not participate in the inheritance. Particularly noted as possible heirs by law are persons who, although not related to the deceased, were members of the same family with him - dependents of the testator.

We recommend reading: Who sets the cadastral value of an apartment

Thank you for your answer, but the extract from the registry was also received immediately. The question concerned only the subsequent re-registration - when and why might this be needed or was the notary right, and there is no point in doing this at all? If you ask about personal accounts, then the supplier does not care who pays - records are kept not by last name, but by address. Changing the surname of the payer (owner) is free of charge, only in the gas industry you are required to undergo “training in the use of gas appliances” - this is paid.

Decorating an apartment after the death of a mother

- The first category includes immediate family members and relatives, such as children, surviving husband/wife, parents.

- The participants in the second are siblings and step-brothers, along with surviving grandparents.

- The third group includes relatives and uncles.

- According to the fourth, great-grandfathers and great-grandmothers belong to it.

- The legislator classified relatives of the fourth degree of kinship as the fifth stage.

- Great-great-grandchildren, nephews, uncles and aunts were legally assigned to the sixth stage.

- The last line, established by law, includes the stepsons, stepdaughters, stepfather and stepmother of the deceased person.

The opening of an inheritance is carried out either at the place where the person died, or at the location of a larger volume of property. Registration of the main inheritance document (certificate of the right to inheritance) is carried out by a notary of the corresponding notarial district. Further, if the inherited property is real estate, it must be re-registered with Rosreestr.

How to register an apartment after the death of a mother: features of inheritance, procedure, order and timing

- the person is the owner of part of the living space;

- the testator moved into the home after the death of its owner and legally uses things belonging to their former owner;

- the inherited person has paid off the apartment debts accumulated by the previous owner and regularly pays for current utilities;

- measures have been taken to strengthen the protection of the apartment by replacing doors, locks, installing alarm systems, etc.

- mother's death certificate (original) or an extract from the court decision declaring her dead;

- heir's passport;

- certificate from the deceased’s last place of residence;

- a document evidencing the relationship between the heir and the testator;

- documents for the apartment (certificate of mother’s ownership of the apartment; technical passport, etc.);

- will (if any) and other documents.

This is interesting: Assignment of a Pension for Work in an Area Equated to the Far North

How to re-register a privatized apartment in the name of a son after the death of his mother

If, on the basis of a previously issued certificate, state registration of rights to real estate was carried out, the notary's decision to cancel the previously issued certificate and the new certificate are the basis for making appropriate changes to the state registration record.

2. If the right of inheritance arises for other persons as a result of the heir’s refusal of the inheritance or the removal of the heir on the grounds established by Article 1117 of this Code, such persons may accept the inheritance within six months from the date on which their right of inheritance arises.

Re-register an apartment after death

1 answer. Moscow Viewed 1290 times. Asked 2012-08-16 11:05:00 +0400 in the topic “Civil Law” The apartment is registered in the name of the husband, a former military man, how can I now re-register it in the name of a husband and wife. — The apartment is registered in the name of the husband, a former military man, how can I re-register it now as a husband and wife?

A privatized apartment is the property of those citizens who are indicated in the privatization agreement and/or certificate of ownership. These specified owners have the right to dispose of their property at their own discretion, but taking into account the interests of others. Let's look at different options.