7

There are several ways to accept an inheritance. One of them is factual. It is enough for the heir to live in the apartment that belonged to the testator, protect and maintain it. However, in order to begin to fully manage the property, it is necessary to register ownership of it. If the applicant does not submit documents to the notary in a timely manner or he refuses to issue him a certificate, then the citizen will have to go to court. The application form must comply with the requirements of procedural law.

Grounds for litigation

According to general rules, registration of inheritance takes place at a notary. The relative must submit an application to accept the property within 6 months. The countdown begins the day after the death of the individual.

If the applicant does not contact the notary, he loses his property rights. The exception is the actual acceptance of property. But such a person will need to visit a notary for proper paperwork.

You can submit an application after six months, but not later than the expiration of the limitation period - 3 years. But, if the applicant is unable to provide convincing evidence or a dispute is identified about the rights of several heirs, the notary may refuse to issue a certificate. Consequently, the claimant for the property of a deceased relative will have to go to court.

Example. After the death of the parent, the house remained. The testator bequeathed all his property to his two sons. There were no other claimants to the inheritance. But the sons did not contact the notary, thinking that the will automatically made them the owners of the property. As a result, the deadlines for entering into inheritance were missed. The children lived in the house with their father all their lives and continued to use it after the death of their parent. Other relatives did not claim the property of the deceased person. Later, the testator's sons wanted to sell the house, but, as it turned out, they could not dispose of their father's property. Having contacted the notary, the applicants submitted a request for the issuance of a certificate. The notary refused them because there were other relatives who could still apply. But the evidence provided of the actual acceptance of the inherited property is not enough. At the same time, the notary explained to the direct heirs that they could file a claim in court.

Why write a statement?

It is immediately necessary to clarify that writing an application is not a prerequisite for the actual acceptance of the inheritance. The document is necessary to certify the fact of entry into inheritance rights. An application is submitted to the court if the applicant has performed the actions required by law necessary for the actual acceptance of the inheritance, but has not contacted the notary’s office within the established time frame.

In addition, this practice is used in cases where the notary has doubts about compliance with the law. For example, the heir did not provide documents confirming the adoption of measures to preserve the property, make utility payments or repay the loan debt. Going to court may also be necessary in cases where the evidence presented raises doubts among the notary.

Important! If the applicant has not applied to the notary’s office within 6 months, he must write an application to restore the deadlines for entering into legal rights.

Application form to a notary for acceptance of inheritance

How to correctly draw up an application to establish the fact of acceptance of an inheritance

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

Making an application is not difficult when you have a legal education. If it is missing, then it is better to use ready-made samples or seek help from a specialized lawyer. Sometimes samples of documents are posted on information boards in the courthouse.

What does an applicant need to consider? The document must be drawn up in a form established by procedural law. The statement must state the essence of the matter. It is advisable to write briefly and to the point. Such documents should be concise.

Excessive detail and creativity is inappropriate when submitting official documents. The claim must also be accompanied by papers that substantiate and confirm the stated facts. When submitting documents to the court, you must pay a state fee. Its size is determined by the Tax Code.

If the applicant belongs to the preferential category of citizens, then he should attach written evidence. Otherwise, the court will not accept the application and leave it without movement. If the plaintiff does not eliminate the comments within the allotted time, that is, does not pay the tax, then the claim will be returned without consideration.

Form

The application is submitted taking into account the requirements of the Civil Procedure Law.

The document must contain the following information:

- the name of the district court that will hear the case;

- details of the applicant (full name, registration address, contact details);

- information about third parties;

- document's name;

- statement of the circumstances of the case;

- the purpose of establishing the fact;

- the plaintiff's final request;

- list of attached papers;

- date, signature of the applicant.

Content

This part of the application is no less important than its form. The plaintiff needs to clearly and consistently state the circumstances of the case. The court must see that the person concerned is the proper heir. The document must also justify the reason for going to court and confirm the position of the plaintiff. Lack of clear and convincing evidence may result in claims being rejected.

| No. | List of possible evidence |

| 1 | Certificate of registration of the applicant. The document confirms cohabitation with the deceased citizen. |

| 2 | A subpoena to begin a court hearing. Provided if the heir has initiated legal proceedings regarding the property of the testator, which is illegally retained by third parties. |

| 3 | Evidence that the home is equipped with a security alarm |

| 4 | Receipts for paying taxes to the local budget, membership fees to a cooperative or for the parking lot where the car is located |

| 5 | Certificate from the bank confirming full or partial repayment of the testator’s loan |

| 6 | Evidence of the purchase of feed for livestock of a deceased citizen |

| 7 | Letter from a notary explaining the reasons for the impossibility of issuing a certificate without a court decision |

The indicated actions must be completed within the time given to formalize the inheritance.

List of documents

The applicant needs to take care of preparing the following documents:

- death certificate of an individual;

- documents confirming the family relationship of the applicant and the testator;

- documents of title to the movable/immovable property of a deceased citizen;

- evidence of payment of utility bills or land taxes;

- contract agreement for construction and repair work;

- residential lease agreement;

- receipts for the purchase of building materials;

- statement to a notary;

- notary's decision to refuse to issue a certificate;

- proof of payment of state duty;

- copies of statements for participants in the trial;

- power of attorney for a representative.

If the plaintiff plans to call witnesses, then a corresponding petition can be prepared. If there is a benefit, the applicant must attach supporting documents to the claim.

What documents can confirm the actual entry into inheritance?

This includes the following documents:

- Certificates received at the passport office confirming the fact that the heir and testator live together in the same living space.

- A certificate issued by local authorities confirming the fact of use of the property: carrying out repair work, cultivating the land, etc.

- Receipts confirming mandatory payments in relation to inherited property: utilities, insurance premiums, taxes.

- Agreements with individuals and legal entities confirming the implementation of repair work, rental of real estate, installation of alarm systems, etc.

- Receipts and other payment documents certifying the making of obligatory loan payments or repayment of other debts of the testator.

- Photocopies of statements of claim against heirs who illegally entered into inheritance rights.

Read also: Taxes when selling an apartment received by inheritance

The given list of documents is not exhaustive. The applicant may submit for consideration to the court other documents confirming the actual acceptance of the inheritance.

All documents issued by government agencies and other authorities must be drawn up in accordance with the requirements of office work. For this purpose, unified forms and seals of these organizations are used. The issued certificates are certified by the signature of the manager or official, with a transcript.

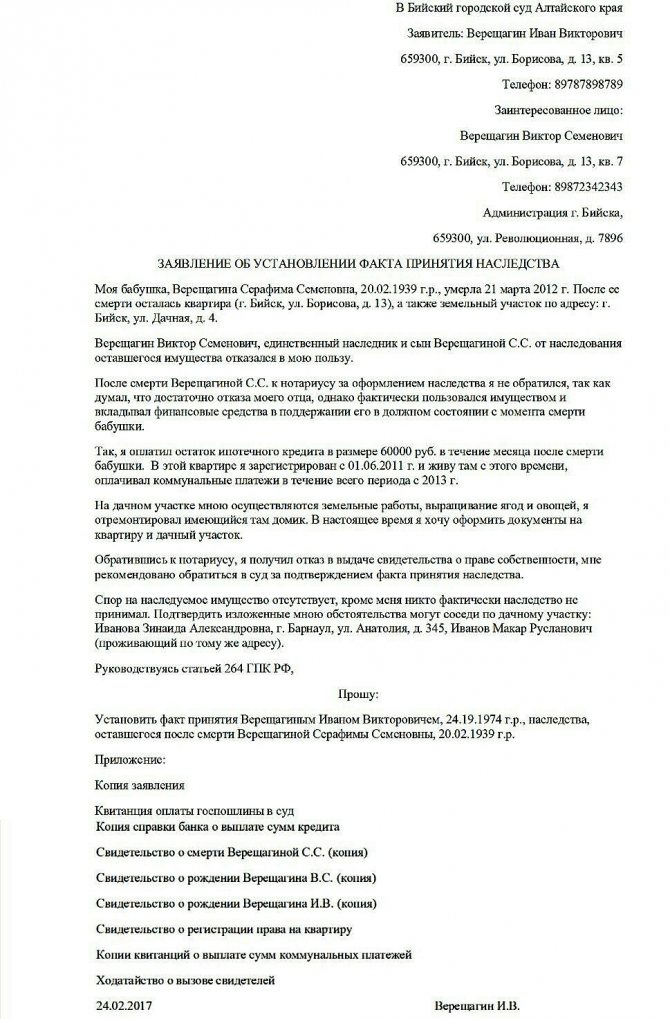

Sample statement of claim to establish the fact of acceptance of inheritance 2021

The application form has not changed this year.

The only thing that plaintiffs need to take into account is that the fact-finding hearing takes place within the framework of a special proceeding. But, if the applicant wishes to recognize the ownership of the property, then the case will be considered through a claim proceeding.

Form and content of the application to establish the fact of acceptance of inheritance

You can go to court by stating your demands in a statement of claim. This is a document that is drawn up in writing by the plaintiff.

The application form is not prescribed by law. However, it must comply with the provisions of Art. 131 Code of Civil Procedure of the Russian Federation.

Key points:

- the name of the judicial authority at the applicant’s place of residence;

- plaintiff's details;

- information about interested parties;

- name of the claim;

- information about the death of the owner;

- a list of property included in the inheritance;

- information about the presence/absence of other recipients;

- data confirming the fact of acceptance of the inheritance;

- reference to law;

- requirement to establish the fact of acceptance of inheritance;

- list of documents;

- signature and initials of the applicant, date.

Important! The document can be signed by the applicant personally or by his authorized representative.

Sample statement of claim

Sample application to establish the fact of acceptance of inheritance:

Consultation on document preparation

Statement of claim for inclusion of property in the inheritance

Sample statement of claim for restoration of the deadline for accepting an inheritance

Submission rules

An application to establish the fact is submitted to the district court at the place of registration of the plaintiff. If the court hearing will take place in relation to real estate, then the application must be submitted at the location of the property.

The plaintiff is any interested person who claims the property of a deceased citizen. The notary and the local administration act as a third party. The application must be accompanied by a list of documents that are relevant to the case and confirm the stated requirements.

State duty

For filing an application, a state fee of 300 rubles is withheld. Tax payment is made before filing an application with the court. The absence of a receipt in the case file will result in the court leaving the application without progress. If, based on the results of the court hearing, the court refuses to satisfy the requirements, then it will be possible to appeal its decision through the appeal procedure. To review the case, the applicant will need to pay the state fee again.

Its size is 50% of the original amount (Article 333.19 of the Tax Code of the Russian Federation). If the requirement is satisfied, the heir will need to contact a notary to draw up the papers. Persons who lived with the testator for more than a year are exempt from paying state duty upon entering into an inheritance.

If the court finds that there is a dispute in the light of the documents provided, it must make a decision to leave the application without consideration. At the same time, the judge explains to the applicant his rights regarding filing a claim. For this category of cases, the state duty is significantly higher.

The amount of the required fee depends on the cost of the claim. When calculating the state duty, a certain percentage and a fixed amount are used. For example, to file a claim costing more than 200 thousand, the heir needs to pay 5,200 rubles. + 1% of the amount exceeding 200,000.