When are payments due from the tax service?

Every adult citizen who receives a certain income () must pay personal income tax. It is written off in favor of the state from wages or other income. The return of such funds occurs when a person applies for a deduction. However, pensions are not subject to this tax (). Therefore, pensioners without additional income are not entitled to a tax deduction for the purchase of an apartment. Citizens of retirement age have the right to count on such benefits if:

- In addition to payments from the state, they receive wages from some enterprise, from which personal income tax is deducted.

- Before retirement, you worked for 3 years (during this period, documents are submitted when making payments).

- They have another source of income, and they regularly pay personal income tax from it (renting an apartment, providing professional services, self-employment, etc.).

The main condition for obtaining a tax deduction for the purchase of an apartment for a pensioner is the availability of regular personal income tax payments. And it doesn’t matter whether this tax is paid from the main activity, from business or other income.

Can a pensioner receive a tax deduction when buying an apartment with a mortgage?

In 2012, further adjustments to the legislative framework affected pensioners. Legislators decided that the older generation was undeservedly deprived of the right to benefits. He was given the opportunity to get back part of the money invested in real estate.

WE RECOMMEND: Loan to a pensioner under 80 years old

Previously, a person who had crossed the pension threshold and did not want to continue working was automatically deprived of the right to a subsidy from the budget. If there was a salary or other income, applications were submitted on a general basis. The condition is payment of personal income tax for early reporting periods.

For what period can you receive money?

It is stated that for persons of retirement age, payments can be transferred to earlier periods. Although the maximum period for which a transfer is allowed is three years. And this is if the citizen has already retired and quit his main job. During the periods for which payments are assigned, he must have sufficient income and also regularly pay personal income tax.

Recommended article: All about the down payment on a mortgage

In practice, the tax deduction for an apartment is paid to a working pensioner for the last 4 years. But you need to submit documents on time. For example, if in 2019 you received a pension certificate and quit your job, then payments are made for the period 2015-18. But next year this period will be shortened, and it will be possible to count on payments only from 2016. Don’t forget about ways to receive funds.

How can I get compensation?

The procedure for making such payments is regulated by tax legislation. It states here that there are two main ways to receive funds:

- through the employer;

- by contacting the Federal Tax Service.

To apply for a tax deduction for an apartment for non-working pensioners, you should use the second option. In this case it is necessary:

- collect a package of papers;

- contact the Federal Tax Service with an application;

- wait for an answer.

A decision on the appeal is made within three months. Another month is given to transfer funds. You can receive money in a lump sum. It is transferred to the applicant’s account.

The first option for returning part of the taxes paid is suitable only for working citizens. If you apply through an employer, the procedure becomes somewhat more complicated:

- You must receive a notification from the tax service indicating that you have the right to a deduction;

- You should contact your employer with this certificate (to the accounting department or directly to your boss - it depends on the specific company).

A month is given to prepare the notification. It will be issued if the citizen collects a package of documents by sending an application to the inspectorate. When the procedure is completed, a payment limit will be set, dividing it into a certain period. During this period, wages will increase by 13%. Now you know how to get a tax deduction for an apartment for a pensioner. But we still need to figure out the list of documents that will have to be collected.

Recommended article: Instructions for returning 13 percent of the purchase of an apartment with a mortgage

Recommended articles: Tax deduction when buying a second apartment

Tax deduction for mortgage life insurance

Tax deduction for undervalued purchases

How to get a tax deduction for renovating an apartment or house

How to get a deduction

There are 2 ways. Both require contacting the tax office at your place of permanent residence (registration). The address where the purchased apartment is located does not matter.

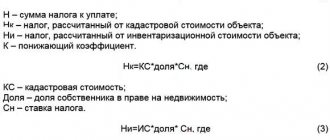

The first is based on the income tax return (form 3-NDFL). This method is used if tax was withheld from you during the year, and you want to return it with “real” money. In this case, you submit to the tax office a declaration of income and copies of documents that confirm your right to the benefit (purchase agreement, seller’s receipt, etc.). Read on for more details about these documents. The declaration must indicate the amount:

- income received during the year;

- tax withheld for the year;

- tax deduction;

- tax that must be returned from the budget.

Along with the declaration, submit an application for a tax refund from the budget. For a sample return application with a detailed procedure for filling it out, see the link. Follow this link to see how to submit documents for deduction to the inspectorate.

Within 3 months, the tax office will check the declaration and documents. Another 1 month for a refund. That is, the tax refund will occur within 4 months from the date of submission of the package of documents.

Secondly, you submit to the tax office only copies of documents for the purchase and payment of the apartment. Tax authorities issue a special Notice of your right to benefits and reduction of income. You give this notice to the accounting department at your place of work. Income taxes are no longer withheld from you. Tax authorities are required to issue a notification no later than 1 month from the date of receipt of the package of documents from you.

What documents are needed

It doesn’t matter which method of receiving such payments you choose, you will need to prepare a package of documentation. It includes:

- application and pension certificate of a citizen;

- title papers for housing;

- completed declaration and confirmation of expenses;

- certificate of income for a certain period;

- marriage certificate.

The certificate is required to receive a tax deduction for an apartment for pensioners if they (husband and wife) plan to distribute it among themselves. The payment is confirmed by a certificate. An agreement on the purchase of real estate, an extract from the register, etc. are considered as title documents.

Bank statements, proof of payment receipts, receipts, checks, and other documents may be used to substantiate expenses incurred by the applicant. When a tax deduction for an apartment is issued for military pensioners, you may need a military ID or other papers confirming the receipt of housing under a military mortgage.

It is also worth adding an ID card to the list. All these papers are sent to the Federal Tax Service, from where they send a response within three months. In order for the decision to be positive, you need to pay special attention to filling out declarations.

How to take advantage of the benefit if you have additional income

It says that benefits paid to a private individual from budgets of all levels are not subject to income tax. Accordingly, not only pensions, but also unemployment benefits, other required payments (compensations for harm to health, etc.) are not taken into account when it comes to obtaining a tax deduction.

RECOMMENDED: What is a credit institution for pension delivery

At the same time, no additional requirements for types of income are set. The buyer of an apartment can not only have a salary, but also rent out a garage, sell products from a household plot, and work under GPC contracts. The main requirement is to pay income tax on these amounts.

How many declarations will be required?

Even if there is a clear understanding of how to issue a tax deduction for a pensioner for an apartment, difficulties arise in filling out this document. As a general rule, you need to provide one return for each of the last three years. But if the applicant worked during the period of purchasing housing, then the declaration must be filled out four years in advance. And in the process of submitting this document, you must remember the rules for filling it out.

Recommended article: How to properly file a tax deduction after refinancing a mortgage

Usually the declaration is submitted. But the law states that it must be drawn up in the format that was in effect during the period to which the remaining amount is transferred (for example, compensation is received for 2015, 2021 and 2017 - the document forms of these years are used). During this period, there were other requirements for the form; you will have to be guided by them.

Do not forget also that a refund of the tax deduction for an apartment to pensioners is possible only if the housing was purchased in 2014 or later. From now on, citizens of retirement age have the opportunity to transfer the balance of payments. Take into account the forms of declarations that were in force in different years. They can be requested from the Federal Tax Service or downloaded on the Internet. If these rules are followed, there will be no difficulties in obtaining compensation for the purchase of real estate.

Rate the author

(

2 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Date of publication November 21, 2019 November 22, 2019

Procedure for applying to the tax office. Mandatory documents

All deductions are of a declarative nature. Inspectors do not monitor transactions. No one will call the buyer and invite him for a deduction. To register you need:

- Purchase residential real estate, register the transaction in the Unified State Register of Real Estate. The latter is a prerequisite. The tax authorities will not accept those who only have DDU;

- Request from the accountant a certificate for the previous year, drawn up in accordance with all the rules;

- Submit your calculations to the Federal Tax Service in advance. Only the required section is filled in;

- Submit an application with attachments to the Federal Tax Service inspector for verification (in person, through a representative by proxy, by registered mail with an inventory). The answer is within 3 months. Only after this can you expect the money to be credited to your current account.

WE RECOMMEND: What documents are needed for the pension fund to pay off a mortgage with maternity capital?

Additionally, the Federal Tax Service inspector will request the following documents:

- the applicant's general passport;

- application - it is better to obtain a sample in advance from the Federal Tax Service or download it from the official website;

- pension certificate or certificate from the Pension Fund of the Russian Federation confirming the assignment of a pension;

- marriage certificate;

- extract from the Unified State Register of Real Estate.

If money was borrowed from a bank, you will need:

- contract;

- certificate of actual payment indicating the principal and interest;

- receipts, payment orders;

- payment schedule.

Important! If an apartment is purchased without finishing, the corresponding entry must be in the contract. If it is available, you can add to the cost of housing the costs of laying communications, pouring screed, installing door blocks, etc.