The concepts of “dependents” and “dependency”

Dependents are persons who are on long-term or permanent material or monetary support from other persons.

Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B. “Modern economic dictionary. — 6th ed., revised. and additional - M." (INFRA-M, 2011)

Dependency is a disabled person being fully supported by one of the family members or receiving assistance from one of the family members, which was a permanent and main source of livelihood for the disabled person.

Explanations of the Constitutional Court of the Russian Federation on dependency in the form of full or main content

The concept of “dependency” implies both the full maintenance of a person by the deceased breadwinner, and the receipt from him of maintenance, which was for this person the main, but not the only source of livelihood, i.e. does not exclude the possibility that the person (family member) of the deceased breadwinner may have any own income.

Thus, disabled family members of a deceased breadwinner who may be assigned a survivor's pension include, among others, his spouse who has reached the age of 60 and 55 years (for men and women, respectively) or who is disabled (paragraph 2 Article 9 of the Law “On Labor Pensions in the Russian Federation”), i.e. recipient of an old-age or disability pension.

..At the same time, the fact of being dependent or receiving significant assistance from the deceased can be established both extrajudicially and in court by determining the ratio between the amount of assistance provided to the deceased and his own income, and such assistance can be recognized as permanent and basic the source of his livelihood (Determination of the Constitutional Court of the Russian Federation dated September 30, 2010 N 1260-О-О).

Thus, the mere fact that a person has, for example, an old-age pension does not exclude the possibility of recognizing this person as a dependent of the deceased.

The concept of the main source of livelihood implies that the support of the breadwinner should constitute the bulk of the funds on which family members lived. It must be of such size that without it the family members who received it would not be able to provide themselves with the necessary means of life.

What documents can confirm the fact of being a dependent?

Documents confirming the fact of being dependent, that is, being fully supported by the deceased breadwinner or receiving assistance from him, which was a constant and main source of livelihood, are:

- certificates issued by housing authorities or local governments,

- certificates of income of all family members and other documents containing the required information,

- if necessary, a court decision establishing this legal fact.

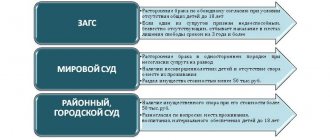

Recognition as a dependent in court

A person who was dependent on the testator must confirm in court that he was supported financially or otherwise for at least a year before his death. For such a person, this assistance from the testator should have been the main source of livelihood. Citizens who are not included in the circle of heirs, but who were dependent on him for at least a year before the death of the testator, who lived together with him and who were disabled, are also recognized as dependents.

Establishing the fact of being a dependent

To receive compensation for the loss of a breadwinner, you do not have to be disabled; it is enough to be dependent on the deceased to qualify for payment.

For children under 18 years of age, the law provides for automatic recognition of the fact of being a dependent. For other age categories, it may be quite sufficient to provide government or social security authorities with documents confirming the circumstances by which dependent status can be established. For example, to establish the fact of being a dependent of a student, that is, a child over 18 years of age who is a full-time student and has not reached 23 years of age, in 2021 it will be enough to provide the following documents:

Explanations of the Supreme Court of the Russian Federation on establishing the fact of dependency

Courts must keep in mind that establishing the fact that a person is dependent on the deceased is important for obtaining an inheritance, assigning a pension or compensation for damage if the assistance provided was a permanent and main source of livelihood for the applicant. In cases where the applicant had earnings, received a pension, scholarship, etc., it is necessary to find out whether assistance from the person providing the maintenance was a permanent and main source of livelihood for the applicant (clause 4 of the Resolution of the Plenum of the Supreme Court of the USSR dated 06.21.1985 N 9 “On judicial practice in cases of establishing facts of legal significance”).

The presence of an independent source of income for members of the family of the deceased does not, by force of law, prevent persons from being classified as dependents of the deceased (breadwinner), if assistance in the form of earnings (income) of the latter was a constant and main source of livelihood for the persons who were dependent on him (Definition of the Supreme Court RF dated November 12, 2010 N 4-B10-35).

Procedural features

Establishing the fact of being a dependent for inheritance is within the competence of a court of general jurisdiction (clause 4, part 2, article 264 of the Code of Civil Procedure of the Russian Federation). The fact of being dependent will have to be confirmed if it cannot be substantiated with existing documents or when such information is lost and cannot be restored. The application should be made to the district court where the applicant lives. The application can be written in free form. The main thing is to indicate information about the applicant, information about the testator, and also prove the impossibility of confirming dependency in other ways. The applicant may also refer to the inability to restore lost medical documentation.

The court considers the case taking into account the provisions of Art. 268 Code of Civil Procedure of the Russian Federation. The review is carried out as a special procedure. The disputing parties are not present at the meeting. The competence of the court includes the decision to confirm the fact of dependency or to refute it due to insufficient evidence.

Article 268 of the Code of Civil Procedure of the Russian Federation - Court decision regarding an application to establish a fact of legal significance

A court decision on an application to establish a fact of legal significance is a document confirming a fact of legal significance, and in relation to a fact subject to registration, serves as the basis for such registration, but does not replace documents issued by the bodies carrying out registration.

When studying the case, the court can obtain testimony from witnesses who directly lived in the testator’s house - relatives, acquaintances of the dependent, domestic servants. The court decision on the application does not replace the act of the registration authority. The competence of the court in such cases does not include establishing incapacity and incapacity.

Expert commentary

Leonov Victor

Lawyer

If the fact of dependency is confirmed by a court decision, then the applicant can provide it to a notary and prepare documents for inheritance by law, or as an applicant for an obligatory share, but only in the absence of a legal dispute. The presence of a dispute may become a basis for suspending the inheritance case until a final court decision is made.

Recognition as a dependent for the purposes of receiving a survivor's pension

If the right of disabled dependents to compensation for damage in the event of the loss of a breadwinner is not made dependent on whether they are in any degree related or related to the deceased breadwinner (see below), then the law “On Insurance Pensions” defines the circle of persons who are recognized as disabled members of the family of the deceased breadwinner and the list of these persons is exhaustive.

Thus, according to Article 10 of the Law of December 28, 2013 N 400-FZ “On Insurance Pensions”, disabled members of the family of the deceased breadwinner who were dependent on him have the right to an insurance pension in the event of the loss of a breadwinner...

For example, in the ruling of the Supreme Court of the Russian Federation dated July 25, 2016 N 18-KG16-53, the following was stated:

On January 1, 2015, Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions” came into force.

According to Part 1 of Article 10 of the Federal Law “On Insurance Pensions”, the right to an insurance pension in the event of the loss of a breadwinner is granted to disabled family members of the deceased breadwinner who were his dependents (with the exception of persons who have committed a criminal act that resulted in the death of the breadwinner and was established in pre-trial okay).

Part 2 of Article 10 of the Federal Law “On Insurance Pensions” defines the circle of persons who are recognized as disabled members of the family of the deceased breadwinner, including the parents and spouse of the deceased breadwinner, if they have reached the age of 60 and 55 years (men and women, respectively) or are disabled (clause 3 of part 2 of article 10 of the Federal Law “On Insurance Pensions”).

Family members of a deceased breadwinner are considered dependent on him if they were fully supported by him or received assistance from him, which was their constant and main source of livelihood (Part 3 of Article 10 of the Federal Law “On Insurance Pensions”).

Thus, the legislator has established a circle of persons who are subject to compulsory pension insurance in connection with the loss of a breadwinner, the list of which is exhaustive, not subject to broad interpretation and includes persons whose personal and property relations are inextricably linked with their status in marriage or kinship.

Recognition as a dependent for the purposes of compensation for harm in case of loss of a breadwinner

Who has the right to compensation for damages in the event of the loss of a breadwinner?

The circle of persons entitled to compensation for harm in the event of the loss of a breadwinner (victim) is established in paragraph 1 of Article 1088 of the Civil Code of the Russian Federation.

Please note that in the event of the death of the victim (breadwinner), first of all, disabled persons who were dependent on the deceased or who had the right to receive maintenance from him on the day of his death have the right to compensation for harm.

That is, the right to compensation for harm in the event of the loss of a breadwinner arises not only from the spouse of the breadwinner or his relatives, but also from any other persons dependent on the deceased. The Supreme Court of the Russian Federation also drew attention to this in Resolution 33 of the Plenum of the Supreme Court of the Russian Federation dated January 26, 2010 No. 1:

“..the right of disabled dependents to compensation for damages in the event of the loss of a breadwinner does not depend on whether they are in any degree related or related to the deceased breadwinner. The fundamental legal facts in this case are the fact of dependent status and the fact of incapacity for work.”

Who are considered disabled dependents for the purposes of survivor compensation?

Dependency of children under 18 years of age is assumed and does not require proof. The right to compensation for damage caused in connection with the death of the breadwinner is also enjoyed by adult children of the deceased who were dependent on him until they reached the age of 23, if they are studying full-time in educational institutions;

Dependency of persons of retirement age . Achieving the generally established retirement age in itself is an unconditional basis for recognizing such a person as disabled, regardless of the actual state of his ability to work (women over 55 years of age and men over 60 years of age are recognized as disabled with respect to the right to receive compensation for harm in the event of the death of a breadwinner).

people are also recognized as incapable of work with respect to the right to receive compensation for harm in the event of the death of the breadwinner, regardless of what disability group they are assigned to - I, II or III.

At the same time, the right of disabled dependents to compensation for damage in the event of the loss of a breadwinner does not depend on whether they are in any degree related or related to the deceased breadwinner. The fundamental legal facts in this case are the fact of being dependent and the fact of incapacity for work (clause 33 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated January 26, 2010 N 1 “On the application by courts of civil legislation regulating relations under obligations resulting from harm to the life or health of a citizen”)

Recommended publications:

- Compensation for damage caused by the death of the breadwinner. Who is a dependent and how to calculate the amount of damage?

- Compensation for harm to an employee’s health in the event of an industrial accident, recovery of insurance payment from the Social Insurance Fund

- Statements to establish facts of legal significance

- Samples of claims for compensation for damages in connection with the death of a breadwinner

- Claims for compensation for damage to health caused as a result of an accident at work (occupational disease)

In accordance with the Law of the Russian Federation

In accordance with the Law of the Russian Federation dated 02.12.1993 No. 4468-1 “On pension provision for persons who served in military service, service in internal affairs bodies, the State Fire Service, authorities for control of the circulation of narcotic drugs and psychotropic substances, institutions and bodies of the criminal executive system, the Federal Service of the National Guard Troops of the Russian Federation, and their families" (hereinafter referred to as the Law) NON-WORKING PENSIONERS receiving a pension for long service (Article 17 "b" of the Law) or for disability of group I or II (Article 24 of the Law) and having disabled family members dependent on them, a pension supplement for dependents may be established.

Disabled family members are considered to be children under 18 years of age or older than this age if they became disabled before reaching 18 years of age, and undergoing full-time training in educational organizations (with the exception of educational organizations in which training is associated with enlistment in military service or in the internal affairs bodies) - until the end of training, but no longer than until they reach the age of 23.

The remaining disabled family members are listed in paragraphs “a”, “b” and “d” of part three of Article 29, Articles 31, 33 and 34 of the Law.

This supplement is accrued only to those family members who do not receive a labor or social pension.

It is possible to assign a bonus for the past (no more than a year ago), subject to documentary confirmation of the right to it in a given period.

To assign a pension supplement to a dependent (when applying for the first time or after a break in receiving this supplement), you must provide the following documents to the Pension Service Department of the Central Federal District of the Ministry of Internal Affairs of Russia for the Kirov Region:

- a personally written application addressed to the head of the public education institution of the Central Federal District (for the allowance for dependent(s) under 18 years old - sample in Appendix 1; if there are dependents from 18 to 23 years old - sample in Appendix 2);

- birth certificates of children, or their certified copies;

- dependent's passport (if available), or a certified copy thereof;

- the pensioner’s work book or a certified copy thereof;

- certificate from the Office of the Pension Fund of the Russian Federation at the place of residence stating that neither the pensioner, nor the spouse, nor the children are recipients of a social or labor pension (when applying for an allowance for the past, neither the pensioner, nor the spouse, nor children were not recipients of social or labor pensions in the period from the date the bonus was assigned to the date the certificates were issued);

- a certificate from the tax service at the place of residence about the absence of information about the registration of the pensioner as an individual entrepreneur;

- certificate of registration with the tax authority of an individual at the place of residence on the territory of the Russian Federation (TIN certificate), or a copy thereof;

- a certificate from the dependent’s place of study indicating the date of enrollment, form of study and expected date of graduation from the educational institution (when applying for an allowance for adult dependents (from 18 to 23 years of age) studying full-time at the educational institution);

- information about the status of the individual personal account of the insured person from the Office of the Pension Fund of the Russian Federation at the place of residence (provided when applying for an allowance for the past);

- documents confirming being a dependent.

Documents confirming the dependency of minor children (under 18 years of age) are:

- a certificate from the place of residence about family composition (provided that the pensioner and dependent are registered at the same address);

- certificates from the place of residence of the dependent and pensioner about family composition and a statement from the second parent that the child is dependent on the pensioner (provided that the pensioner and dependent are registered at different addresses);

- certificates from the place of residence of the dependent and pensioner on family composition and a copy of the court order (resolution) to withhold alimony from the pensioner in favor of the dependent (provided that the pensioner and dependent are registered at different addresses).

Documents confirming the dependency of adult children (over 18 years of age) are:

- a certificate from the authorized body on the composition of the family indicating that the child is dependent on the pensioner, certified by two signatures and a seal;

- certificates from the place of residence of the dependent and pensioner on the composition of the family and a court decision recognizing a fact that has legal force - the child is dependent on the pensioner;

- certificates from the place of residence of the dependent and pensioner on family composition and the conclusion of the Commission of the Ministry of Internal Affairs of Russia for the Kirov Region on resolving issues related to the provision of pensions for pensioners of the Ministry of Internal Affairs and citizens of the Russian Federation on recognizing the child as a dependent of the pensioner (for the Commission to consider the issue of dependency, it is necessary to provide: an additional certificate from the dependent’s place of study about receiving (not receiving) a scholarship; a statement from the second parent that the child is dependent on the pensioner).

To extend an already assigned dependent allowance, you must submit:

- pensioner’s work book, or its certified copy (annually);

- certificate(s) from the place of residence of the dependent and pensioner on family composition (annually);

- certificates from the place of study of children indicating: start and end of education (day, month, year), form of education - full-time (2 times annually - in March and September).

- information on the status of the individual personal account of the insured person from the Office of the Pension Fund of the Russian Federation at the place of residence (annually).

All certificates submitted when assigning an allowance, or to confirm it, must be dated no earlier than one month before submission.

Copies of documents can be certified by a notary, either by employees of departments for working with personnel of internal affairs bodies at the place of residence, or at a personal reception at the Pension Services Department of the Central Federal District.

On the occurrence of circumstances for the early termination of the payment of the allowance for dependents (employment, or acquisition of individual entrepreneur status by a pensioner; expulsion of an adult dependent from an educational institution; enlistment of a dependent in the army (“on conscription”); admission of a dependent to a military educational institution; marriage of a dependent ; transition of a dependent from full-time to part-time study; assignment of a pension to a dependent; documentary evidence of the dependent’s care for a disabled 80-year-old citizen or a disabled person of group 1; death of a dependent) must be reported to the OPO of the Central Federal District as soon as possible. Payment of the allowance for dependents ceases from the month following the month in which the specified circumstance occurred (Article 55 of the Law).

Compensation to the state for damage caused

We draw special attention to the fact that for providing knowingly false and (or) unreliable information, or keeping silent about facts that entail the termination of payment of a pension, pension supplements, allowances, compensation, other social payments (for example, a pensioner entering the service; change of place of residence, subject to receiving a pension with a regional coefficient; concealment of the fact of employment, or expulsion of a dependent before the end of training, subject to receiving a dependent supplement to the pension; etc.) criminal liability is provided (Article 159.2 of the Criminal Code of the Russian Federation).

If the submission of false information or untimely submission of information has resulted in overspending on the payment of pensions, the guilty persons shall compensate the state for the damage caused in the manner established by the legislation of the Russian Federation (Part 10 of Article 56 of the Law).