In order to be able to collect old debts from an enterprise that is already at the stage of bankruptcy, it is important to follow the legal procedure for entering claims for unfulfilled obligations into the register of creditors' claims . If the situation is such that this is not done on time or the application is completed incorrectly or untimely, then there is a risk of not receiving the required amount of money. So, let’s look at what a register of claims is, what information is entered into it, who does it and how, the procedure for filing an application and collecting the debt itself. And what, in essence, does this register provide, does it help to recover the debt from a bankrupt counterparty.

What is the register of creditors, and why is it important for a creditor to get into it?

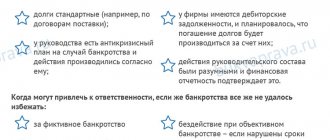

A register of claims that displays all the company's debts. It is a document that has legal force for the legal fulfillment of claims in favor of creditors by the debtor. The practice of maintaining a register of creditors is not new, and is successfully used in different countries. In its form and essence, this is a list of all debts that a bankrupt legal entity has, and which it could not independently fulfill within the time limits established in the contract. Because of this, bankruptcy proceedings were initiated. Satisfaction of creditors' claims is carried out according to the stipulated priority. Data such as the amount and priority of claims are also recorded in the register.

The registry document in the bankruptcy case displays information about the creditor himself and the presence of confirmed obligations on the part of the enterprise. If there is no recording of the debt in the debt register, then the possibility of repaying the overdue debt in the future is negligible for such a creditor. He cannot claim compensation for losses if this amount is not recorded in the register. That is why inclusion in the register of creditors’ claims is a mandatory procedure for a creditor to receive an outstanding financial obligation from a bankrupt legal entity.

Rules for submitting an application to the register of creditors

To record information about a debt in the registry, you must fulfill certain requirements related to the execution and submission of the application. These requirements are established by procedural legislation. An application for inclusion in the register of creditors' claims may be submitted by a representative authorized by the legal entity of the creditor. His credentials must be properly certified.

A package of documents - an application and attachments - must be sent to the arbitration court. There are basic requirements for the content of the creditor's application. Thus, the application must indicate the full name, address and details of the creditor’s enterprise. It is important not to forget to indicate the case number and name of the debtor.

There are clearly defined deadlines for the creditor, following which he can declare inclusion in the register of the creditor's claims against the debtor. This period is calculated from the date of publication in a specialized publication of information about the introduction of supervision in the bankruptcy procedure. This period is 30 calendar days (not business days). It is important for the lender to know this so as not to miss it, since it cannot be restored for any reason. Even if the reason for missing is very valid. Why is it so important to provide information within this deadline? After the applications are accepted, the first meeting of all creditors is scheduled and a committee is created. Those who managed to get there will be able to vote and thereby influence the course of the bankruptcy process.

If the creditor did not have time to file a claim against the debtor before this moment, then certain negative legal consequences arise for them. They will be able to receive their money only after a full settlement has been made with the bankruptcy creditors, information about which is available in the register. Accordingly, there is practically no chance that a hundred will remain after these mutual settlements.

It should be noted that you can get into the register later, only without the opportunity to take part in the bankruptcy case in the creditors’ committee. The registry is closed at the end of two calendar months, from the date of recognition as bankrupt, and the corresponding publication of this information. In relation to this enterprise, another procedure is already being applied, which is called bankruptcy proceedings . After this, applications for the introduction of requirements are not accepted, although they are considered in the general manner.

The creditor indicates the date the debt arose, the circumstances of the case, and what documents confirm the unfulfilled obligations. Inclusion in the register is carried out after the court makes a ruling. It is worth noting that, according to the practice of higher courts, debt collection by filing a claim against a legal entity is not allowed if it is at the stage of insolvency proceedings. Such a claim remains without consideration by the court.

What are they formed from?

When studying the accounting and procedure for collecting current payments in bankruptcy, the actions of banks in relation to debtors, it is worth first of all to understand the cost items. Of which, in fact, mandatory payments consist. These are the means:

- for employees of the organization who continue to work while the company is granted bankrupt status;

- employees who are involved in the bankruptcy process;

- amounts provided for the liquidation of the enterprise;

- penalties, penalties;

- tax fees even after the start of the procedure;

- payment for utilities and tenants;

- money for settlements with counterparties;

- interest allowances on loans;

- compensation for losses if they arose through the fault of the debtor.

In addition, the payer undertakes to cover all costs arising during the trial. This implies payment for the work of notaries and lawyers taking part in the case.

The order of repayment of claims

It is formed on the basis of applications submitted by credit companies that claim to repay borrowed funds. Applications from them are considered during the period when an individual or legal entity is declared insolvent. Thus, a specific queue is created. In accordance with the established procedure, the debtor pays the money. In practice it happens like this:

- First of all, the debtor pays alimony payments, court costs, and pays for the work of the financial manager. In addition, the priority includes: payment for the preparation of a package of papers (required for the trial), state fees, services of notaries and attorneys' offices.

- The second most important are the salaries of the company's employees. We are talking about those who were fired immediately after being assigned bankrupt status, and also continued to work after the start of the procedure.

- Lastly, the debtor will have to pay off utilities and tenants.

The remaining debts are paid only after the funds have been deposited on the above items. Again, in an approved manner, drawn up on the basis of statements from creditors.

Additionally, costs incurred due to the fault of a bankrupt individual or legal entity are subject to mandatory repayment. In the absence of timely payments, credit institutions have the right to send a complaint to the arbitration judicial body in order to reimburse the money lent.

Payment terms

Collection of current payments is carried out within the period established by the court. The procedure is described in detail in the previous paragraph. But let us remind you once again that, first of all, debts that arose after the legal entity or individual entrepreneur initiated an insolvency case are repaid.

Registered debts are paid immediately after the insolvency status is assigned. When a citizen or company is declared bankrupt, the property is sold under the direction of the financial manager. The proceeds from the auction partially cover the debt register. In this case, it is possible to change the timing and order of payments by prior agreement with a specialist appointed by the arbitration court.

Read Financial manager in bankruptcy of individuals: rights, obligations, when and by whom is appointed

Mechanism for repaying current debt in bankruptcy proceedings, associated costs

The current accounts of a bankrupt company or a bankrupt individual are closed. Only one remains active, through which the necessary payment manipulations in the process are performed. It is controlled exclusively by the financial manager. All powers of representatives of the organization’s management or proxies are revoked.

Replenishment of the only existing account is carried out with the help of funds received as a result of the sale of the debtor’s property. The same money is used to pay off obligatory debts.

In the event that a credit company mistakenly indicates the number of an inactive bank account in the application, the finances are transferred to the notary involved in the case. They are stored with him for 3 years and are subject to issue to the creditor organization at any time. If the money has not been claimed within a specified period, it is transferred to the state budget.

The procedure for collecting debt from a bankrupt

According to the rules specified in the Federal Law on Bankruptcy , there is a sequence of requirements for a bankrupt debtor. There are also current and registered payments by the debtor. Current are those claims for the obligations of a legal entity, the occurrence of which occurred after the opening of bankruptcy proceedings. Debt that arose as a result of unfulfilled obligations by the debtor before the onset of bankruptcy is called registry debt.

The Plenum of the Supreme Arbitration Court of the Russian Federation gave its explanation on how it is necessary to apply the rules on the distribution of current payments in bankruptcy cases.

You can read more about debt collection at the link: https://svbankrotstvo.ru/vzyskanie-dolga-cherez-bankrotstvo/

Priority of creditors' claims

So, the court classified the following as extraordinary, urgent current payments:

- payment for the services of establishing a bank or other financial institution, for conducting transactions on the current accounts of the debtor’s company, and servicing the account;

- legal costs;

- payment of fees and remuneration to the arbitration manager.

In the opinion of the Supreme Arbitration Court, the second stage of current payments includes debts to pay employees wages and benefits that the company incurred after the start of the insolvency process. In the event that the debt for unpaid wages and mandatory deductions from it towards enforcement proceedings is included in the register, such debt is considered a registered debt of the second priority.

The law establishes five priorities for current payments. The first includes the above-mentioned expenses for payment of fees, legal costs and payments for servicing the debtor by the bank. The second includes remuneration of individuals and the withholding of personal income tax from their salary income, payment of severance pay associated with dismissal. Further, the third in line are satisfied with current payments for the activities of specialists involved in the case to provide them with qualified assistance and assessment. The fourth is payment for utilities and operating payments. Fifthly, other current payments not specified in the clear list of Art. 134 of the Law.

It is noteworthy that a bankruptcy creditor who has registry claims against the debtor is not limited to the possibility of also having current claims against him for the debt. All claims have their own legally established order, the so-called order in which payment occurs.

Legislative aspects

All issues affecting the bankruptcy procedure, requirements for current payments, their repayment upon recognition of insolvency are considered by the arbitration judicial body. In making its decision, the court relies on Federal Law No. 127. It was this law that underwent radical changes in 2015, introduced with the aim of improvement. Which today has made it possible to apply for bankruptcy status not only to organizations, but also to individuals facing serious financial difficulties.

The legislative document establishes in detail the process of recognizing insolvency. In accordance with the standards prescribed in Chapter 10, every citizen who has an overdue loan of over 500,000 rubles can exercise their own right to write it off. At the same time, it is important to understand that it will not be possible to do without paying certain types of obligations. The initiator of the procedure will have to regularly repay current accruals.

To figure out who exactly will have to pay and in what amount, you should determine the moment the debt arose. For example, debts that arose before the start of the process of assigning insolvency status are classified as registered. Based on the results of a court decision, they are written off (in whole or in part). Here, much depends on the availability of assets of the bankrupt person. Some of them may be given as repayment to creditors.

Obligations that appeared after the start of the procedure are considered current. And they have to be paid in full.

Division into categories

According to the law, they are divided into two groups. The order of application is determined taking into account the classification. So, debts can be:

- Mandatory, assigned in the present tense - they are used primarily to calculate and pay current payments in bankruptcy proceedings.

- Registered - paid based on its results.

This procedure is approved by law. Applies to individuals and legal entities undergoing the procedure for assigning insolvency status.

To make the difference between the categories presented above more obvious, these two concepts should be examined in detail through comparison.

- When the process of declaring a citizen (company) bankrupt has already started, register payments are frozen. Credit organizations establish the amount of debt and record it in the database. So they “get” in line to receive payments.

- Without inclusion in the register, existing debts are automatically relegated to last place. In this case, creditors risk not getting their money back (after the sale of the property there may simply not be enough).

- The costs that accompany the trial are already considered current and are considered for repayment in the first place.

- All expenses arising during the procedure are paid by the debtor. These are services of notary and lawyer's offices, legal costs.

- For example, a company prepares documentation and submits a package for consideration to the court. Utility expenses accrued prior to the insolvency status must be paid in full. But a loan taken from a financial institution remains unpaid. The issue of reimbursement of this amount will be decided only after the company is declared bankrupt. One part of the debt will be written off, the other will be covered by the sold property.

Read Reviews of individuals who went through bankruptcy proceedings in 2021

What are the requirements for banks?

In the event of bankruptcy of a credit institution, clients and depositors also have the right to submit claims to the register. When a temporary administration is introduced into a bank, it may happen that the depositor is not included in the register of creditors. Therefore, bank clients are concerned with the question of how to include claims in the register of creditors’ claims , even at the stage of normal operation. After all, they are unlikely to know about the bankruptcy of the bank in advance. This can be done by submitting an application to the bankruptcy trustee. Information is entered into the form either on the basis of a court decision, or according to data on the availability of current and deposit accounts of a given client.

Thus, inclusion of confirmed claims in the register is necessary to increase the chance of returning your money to a depositor or creditor of a legal entity declared bankrupt. Refund of funds when a counterparty is at the stage of bankruptcy is an extremely important and complex procedure. Therefore, you can successfully complete it only with the support of professionals.