Home /Articles on bankruptcy of individuals

Author of the article: Konstantin Milantiev

Last revised April 01, 2021

Reading time 9 minutes

Debt collection is legal if the collectors purchased the loan or microloan, have a work permit, and act within the law. In this article we will tell you whether to pay debt collectors before the trial or after a decision is made, how to check the legality of the collection and protect yourself from scammers.

Why debt collectors may demand a debt

Only a portion of collection firms engage in fraud and extortion and demand money illegally. Most organizations operate after receiving permission from the FSSP and inclusion in the register, on the basis of an assignment or agency agreement. That is, the claims against the debtor are legal, and the money paid will be used to pay off the debt.

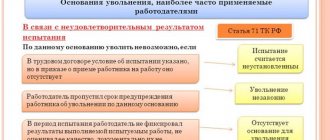

The collection company operates according to the law:

- if she has a FSSP certificate, is included in the register;

- if there is an assignment or agency agreement;

- When collecting, Law No. 230-FZ and other regulations are observed.

The borrower has the right to know that his debt has been sold to collectors or transferred for collection through an agency. In 2021, creditors (banks and microfinance organizations) are required to publish information about the sale of debt on Fedresurs. To check whether the bank sold the debt to collectors, log in using the Unified Identification and Automation System and look at the Collectors tab in your personal account. If there is no information about the sale, call the bank for clarification. In addition, you will be sent a written notification by Russian Post.

The debtor has the right to verify the legality of the collection when communicating with the collection company - you can request information and documents, check information about the organization through the FSSP online service.

Written request for documents on the sale of debt to collectors - 11.6 KB

Until the bank or debt collectors provide a copy of the debt sale agreement, you do not need to pay the debt collectors.

If collectors demand payment without documents signed by the bank and the collectors, call the bank and clarify the situation.

What to do if the collectors get it?

- There is a wonderful application called “Anti-collector”, you can install it on your phone for free, then you can simply not pick up the phone. It is worth remembering that debt collectors can write to you in any legal way: by mail, on social networks, and even by sending telegrams. Therefore, you should not ignore debt collectors.

- If you think that your rights have been violated, you should complain to the supervisory authority - the FSSP of the Russian Federation. In this case, you will have to provide evidence: recordings of threats, photographs of letters, screenshots of calls made at unauthorized times. If the collectors acted within the law, there is no point in complaining.

- If you see a violation of rights in the actions of collectors, in addition to bailiffs, you should send a copy of the complaint to the National Association of Professional Collection Agencies (NAPCA).

- Go through the bankruptcy procedure. This will save you from debt collectors once and for all: according to the law, all calls are stopped and debts are written off as soon as the collectors receive a copy of the court decision on the client’s insolvency. And this happens just two months after the start of the procedure.

Related materials:

Official website of the Federal Bailiff Service of Russia (FSSP) Official website of the National Association of Professional Collection Agencies (NAPKA)

When should you pay debt collectors?

You will have to pay if the collectors have confirmed the legality of the collection and you have the money.

If the obligation is assigned by assignment, the collection company becomes a creditor. You cannot pay the bank in arrears, since it is no longer a creditor. During agency, the collection agency is only a representative of the bank. In this case, you need to pay to the bank.

You can pay debts at the request of collectors under the following conditions:

- there is an assignment agreement;

- the collector provided information about his company and the amount of debt;

- the collection bureau is listed in the FSSP register;

- the money will be transferred to the current account.

Settlements with collectors are carried out only by non-cash method.

If a person asks you to hand over money to him, then you are faced with scammers. According to Law No. 230-FZ, each collection company is required to have a current account and indicate it in correspondence with debtors. Once you pay into your account, you will receive an official confirmation document.

Should I pay or wait for the court's decision?

The bank has the right to assign an overdue loan before judicial collection. Often debts for which the statute of limitations has expired are transferred to debt collectors; selling such debt is not prohibited, which is what banks take advantage of. If the bank did not go to court before assigning the debt, the collection company itself can file a claim and obtain a writ of execution.

Why is it better to wait for a court decision and not pay before filing a claim:

- at the time of the trial, the statute of limitations may have expired

- at the request of the defendant, the court will completely or partially reject the claim; - in court, you can reduce the interest if it is disproportionate to the loan

- for this, an application is also submitted to the judge; - If you are in a difficult financial situation, you can defer or spread out the payment of debt

- this will allow you to get a break, and then start paying off your debts.

Until there is a court decision, collectors will not involve bailiffs in the case. If the court has decided to collect the debt, collectors can work together with bailiffs - provide information about the defaulter, his property, work, location, etc.

Is it worth paying debt collectors after a court decision?

A bank or a collection company may sue after repurchasing the debt. This does not affect the debtor - he is the defendant. If collectors have a court decision, they can send documents for retention to the place of work, to the bank or to the bailiffs.

Even if there is a writ of execution or court order, the collector cannot

:

- seize property, take it as collateral;

- prohibit actions with vehicles and real estate;

- sell property.

Only bailiffs have these powers. Collectors can send documents to the FSSP, but usually use other collection methods.

Sample agreement with collectors on a discount - 10.8 KB

You can agree in writing to repay the debt before a certain date, asking for a discount - even if there is a court decision, collectors will discount the interest.

If there is no money, you can defer or install payments in court.

Bankruptcy allows you to completely get rid of debts. From the moment a bankruptcy case is opened, collectors have no right to make claims against the debtor. In 2021, bankruptcy will be recognized with debts of 300 thousand rubles. Find out more about the options and consequences of bankruptcy from our lawyers.

Should collectors be paid under an assignment agreement?

An assignment is a change of creditor of an obligation. If collectors have drawn up such an agreement, they have bought the debt and will collect money without a bank. We do not recommend immediately and categorically refusing to cooperate with a collection company. She can offer a convenient payment schedule, including deferment or installments, remove some interest, and provide benefits.

Before paying any assignment or signing any documents, be sure to consult with an attorney. It will help check the legality of the grounds for debt assignment and information about the collection agency.

Do debt collectors sue?

The threat to sue is one of the standard tools of psychological pressure that debt collectors use. At the same time, they can say that allegedly failure to fulfill obligations under a loan agreement is fraud, a criminal offense. If you are not familiar with the law, collectors may report that the court threatens the borrower with a suspended sentence or even a real sentence.

As a rule, on the part of collectors, such words are nothing more than a trick with which they try to get money out of you. The first thing to remember is that you will not face criminal prosecution for non-payment of a loan. Through the court, a collector or bank can achieve only one thing - oblige you to pay a certain amount. With competent defense (especially with the participation of a credit lawyer), the court often takes the side of the borrower and significantly reduces the initial demands of the lender.

Moreover, in some situations you can convince the court that you do not have to pay anything at all. Such cases arise, for example, if the statute of limitations on the loan or if, when transferring the debt from the bank to the collector, all the requirements of the “letter of the law” were not met. If the borrower engages an experienced credit lawyer for legal proceedings, he can find many similar violations, and collectors know this.

Thus, for a collector, going to court is a big risk, as well as additional expenses. Usually, collectors avoid this measure until the last moment, so loud words about the court most often remain only an empty threat. If the borrower understands the real situation, he can use this to his advantage and answer any question about the loan: “Everything is only through the court.” Most likely, after such answers, the collectors will not go to court, but the pressure on you will be eased.

Helpful information

- What to do if debt collectors sue

- How does the loan trial work?

But still, the possibility of ending up in court is not at all excluded, although legal proceedings are often initiated by the bank itself, and not by collectors. Practice shows that if your debt does not exceed 30-40 thousand rubles, the likelihood of litigation is very low. However, if your debt is 50-100 thousand rubles or more, then the case may still end in court (the larger the amount, the higher the chances). You do not need to be afraid of such an outcome, because... With adequate defense on your part, the court's decision will most likely be in your favor.

In any case, it is better not to rely on general recommendations, but to clarify the details with specialists. In each situation there are many nuances that can significantly affect the behavior of debt collectors and the court’s decision. The consultation will allow you to better understand the options for the development of events and communicate with debt collectors more confidently. In our office, an in-person consultation with a lawyer is provided for a fee; you can check the cost by phone.

Helpful information

- What benefits does consulting a lawyer over the phone provide?

- How to make an appointment with a lawyer?

Is it possible not to pay if the statute of limitations has expired?

Missing the statute of limitations will not allow debt collectors to collect the debt in court if the defendant declares this during the process.

Theoretically, the missed statute of limitations does not prevent, according to Law No. 230-FZ, from calling and sending SMS, or meeting the debtor in person. But you can send them a refusal to interact, prohibiting the collectors from any communication.

Declaration of refusal to interact with collectors - 32.4 KB

Collectors can receive a court order; in order to cancel it, they need to file an application for cancellation (objection). Read instructions on how to cancel a court order here.

Objection to a court order - 21.3 KB

The statute of limitations is reinstated if the defaulter acknowledges the debt in an agreement or other document.

In order not to reinstate the statute of limitations for collectors, we recommend that you read the documents carefully and do not sign without a lawyer. Important points are written in small print or disguised as harmless terms.

How to pay debt collectors correctly

If you want to get rid of debts, you will have to cooperate with a bank or collection company. If the overdue payment has not yet been assigned to the collection agency, it is better to try to negotiate with the bank. By confirming your readiness and ability to pay, you will receive a restructuring or credit holiday.

If a collection organization has become a creditor, to protect rights when paying off a debt:

- always check the correctness of debt and interest calculations;

- pay attention to the terms of collection, since collectors cannot change the provisions of the original loan agreement;

- at the first conversation with the collector, clarify the name and address of his organization, check the certificate number, INN and OGRN according to the register of bailiffs;

- Request written documents from the collection agency, including bank account details for transfers.

Payment documents for each transfer must be kept. If after 1-2 weeks there are no changes in the amount of debt in your credit history, contact the head of the collection company for clarification.

In 2021, you can correct your credit history through the court if you provide evidence of timely payment.

Rights of debtors and powers of collectors

Collectors are limited in their powers. The main collection methods are calls and personal meetings. Also, demands for debt repayment may be contained in written claims, SMS and voice messages. For all these methods of collection, 230-FZ has restrictions on quantity and time.

If collectors violate them, immediately file a complaint with the FSSP, the prosecutor's office, and the police.

The debtor has the following rights:

- request information and documents about the debt and its assignment to collectors;

- refuse to interact, after which collectors are obliged to stop calls, meetings and other methods of collection;

- file complaints about illegal actions of debt collectors.

The debtor also has the right to act through a representative - a lawyer or lawyer. For legal support, it is advisable to issue a notarized power of attorney. Using it, a lawyer will be able to request and submit documents, participate in negotiations with debt collectors and in court hearings.

How do scammers work?

Where to complain about debt collectors? Related article

The adoption of Law No. 230-FZ has reduced the number of fraudsters in the collection market. But there is a risk. Signs of fraud to watch out for:

- the collectors introduced themselves as employees of the FSSP or the court, showed strange fake IDs and did not allow them to be photographed;

- they do not have an assignment agreement with the seal and signature of the bank;

- scammers demand money in cash or property to pay off a debt (this is expressly prohibited by law);

- illegal structures resort to threats, do not comply with restrictions on the time and number of calls, meetings, SMS;

- fines and commissions are charged in excess of the loan agreement.

Black and gray collectors work illegally - they will not provide information about their company, the grounds for collection and the amount of debt. There is no point in continuing communication or paying - scammers will demand more and more money.

If it is clear that the debt is being extorted illegally, file a complaint with the FSSP and the prosecutor’s office. If you are threatened, contact the police.

Complaint to the prosecutor's office - 12.7 KB

Complaint to the FSSP - 12.4 KB

Complaint to the police - 23.5 KB

Assistance from a debtor's lawyer

If a collection company offers unfavorable conditions for the client, then it is better not to sign such an agreement. Alternatively, you can contact our lawyer.

A debt lawyer from our law firm will provide qualified assistance and act on your behalf in negotiations with the debt collector on the terms of an agreement favorable for signing, or will find another way to solve your problem to get out of the “debt hole”: professionally and on time. What to do? Just call us and we’ll start solving the issue together today!!!

Consequences

Collectors will not give up if you simply refuse to pay. To do this, you need to have nerves of steel: endure calls and SMS for years, and not get stressed after meetings.

The result of collection by collectors can be:

- full payment of all debts and changes to the credit history, if the collection company strictly complies with the law and the rights of the debtor;

- debt write-off through judicial or extrajudicial bankruptcy;

- sending documents to the bailiffs if the collectors have a writ of execution.

If the debt is not paid, the collection company can continue collection without any time limit. For example, the debtor’s property and financial situation may improve several years after the last calls from collectors. If the debt has not been discharged through bankruptcy at this point, calls, text messages and personal meetings can resume.

If you have questions about all options for interacting with debt collectors and repaying debts, please contact our lawyers. We will help even in the most difficult situation!

Collectors

Author of the article Konstantin Milantiev

Publications 151

More information →

about the author

Expert in the field of bankruptcy of individuals. He has been an active arbitration manager since 2015. Konstantin’s publications are published in various expert publications and media. Active participant in conferences, seminars and discussions on amendments to the current legislation of the Russian Federation on bankruptcy.

Rate this article

38 likes

Share with friends:

How debt ends up in the hands of collectors

Both banks and microfinance organizations are prohibited from holding so-called “bad” or bad debts in their portfolios. These are loans and credits that are overdue for more than three months. The more such loans a bank or microfinance organization has, the worse the organization’s credit rating, the more claims against them from regulatory authorities. Therefore, there is only one way out - you need to get rid of such debts. If you go to court, there is a chance that you will spend more on lawsuits and lawyers than you will eventually be able to get back. But if you sell the debt to collectors, the bank will be able to not only improve its loan portfolio, but gain at least some funds.

Of course, credit institutions have their own collection departments. But they act exclusively within the framework of the law and do not put any pressure on the debtor. Firstly, it is impossible to hold a bad debt for a long time, and secondly, it carries reputational risks. Who would want to get involved with this bank if it becomes known that it has its own debt collectors?

_

More videos on our channel, subscribe!

How does a bank transfer debt to collectors?

A credit institution has two ways to transfer “bad” debts to collectors:

- Through an agency agreement.

In this case, the debt still belongs to the bank, and the collectors act as contractors. - Under an assignment agreement

, when the right to claim the debt is completely transferred to the collection agency, this is called the “sale” of the debt. If the bank chooses the first method, it is obliged to notify the debtor about the transfer of the debt to collectors within 30 business days. But you can sell a debt without the knowledge of the debtor. Therefore, in the latter case, a call from collectors may come as an unpleasant surprise for the debtor.