Let's analyze the situation

Russia is one of the few countries where registration is mandatory for everyone. The receipt of all social benefits is “tied” to registration: medical care, enrollment in a school or kindergarten, etc. Financial structures do not want to cooperate with persons who do not have registration and do not accept applications for consideration, even if we are talking about standard consumer loan

Many people mistakenly believe that the owner of the mortgaged apartment is the bank, and that the buyer lives there on a commercial lease. Some people think that they shouldn’t even think about registering until the debt is settled. It must be emphasized that lenders actively support this misconception by stipulating any restrictions on registration in the loan agreement. This primarily concerns minors.

Important! Such actions of banks violate a number of regulations. If the property right is registered, you can prepare for a meeting with the passport officer.

The bank does not become the owner of the apartment by providing money for its purchase. Only the encumbrance is registered in his favor. Debt not repaid? You should not dream of selling, donating, exchanging or bequeathing, or carrying out redevelopment. All other operations are permitted and absolutely legal.

How many days does it take to register ownership of an apartment under a mortgage in 2021?

The Federal Law “On State Registration of Real Estate” dated July 13, 2015 No. 218-FZ establishes the following deadlines for registering ownership of an apartment from the date of filing the application and the full package of documents:

- when submitting documents to Rosreestr – 7 working days;

- when registering ownership of an apartment in the MFC – 9 working days;

- when registering property rights based on a court decision (through Rosreestr) – 5 working days;

- when submitting notarized documents through Rosreestr – 3 working days; if through the MFC – 5 working days.

When does an apartment with a mortgage become a property?

If the borrower (buyer of the apartment) has entered into a transaction for the purchase and sale of housing, then he becomes the owner of the apartment even if there is an outstanding mortgage.

However, such housing will be collateral, which means that the rights of the apartment owner are limited. So, he will not be able to sell or exchange such an apartment until he pays off the entire debt.

Who is the mortgage owner of the apartment issued to?

The purchased mortgaged apartment is registered as the property of the borrower. If he wants to re-register the home in the name of one of his relatives, he will not be able to do this until the loan is fully repaid.

It will be possible to re-register the apartment as the property of another person only after the borrower has fully repaid the loan taken from the bank.

Is the mortgaged apartment the property of the bank until the loan is fully repaid?

Some borrowers mistakenly believe that an apartment taken on a mortgage is the property of the bank until the loan debt is fully repaid.

In fact, housing purchased with the help of bank mortgage funds and registered as collateral immediately becomes the property of the borrower in accordance with the purchase and sale agreement concluded with the seller.

But there is one thing: in the certificate of ownership of the apartment, the registrar puts a note about the presence of an encumbrance . This means that the apartment is pledged to the bank. This mark is canceled after the borrower fully repays the debt.

And this erroneous opinion of people can be explained simply: if the apartment is under encumbrance, then the borrower will not be able to sell, exchange it or remodel it until he has fully paid off the bank.

A mortgage is subject to mandatory state registration with Rosreestr or MFC . Registration is carried out only for the person who acts as the borrower under the mortgage agreement.

After registering ownership of the apartment, it is important to remove the encumbrance so that the bank no longer has claims against the borrower, and the apartment is “clean” - it can be sold, exchanged, etc.

The procedure for registering housing with Rosreestr is not complicated or time-consuming . All that is required from interested parties is to submit all the necessary and correctly completed package of documents to Rosreestr, and then receive ready-made documents with stamps and seals of the regulatory authority.

Is it possible to register in a mortgaged apartment?

Russian legislation does not have time to change following the trends of the times. You can buy living space with credit money, but registration issues have not yet been properly considered.

How to register for an apartment purchased with a mortgage? Everything is left “at the mercy” of creditors and officials from the Federal Migration Service, who actively take advantage of it. Borrowers are often faced with completely unreasonable demands on their part.

For example, in the capital there is Resolution No. 859-PP On approval of the Rules for registration and deregistration of citizens of the Russian Federation at the place of stay and place of residence in the city of Moscow. Regional legislators decided that registration on collateralized housing is possible after permission is received from the lender in the format of a letter or notification.

But passport officers in their work must be guided by the Administrative Regulations of the Federal Migration Service of the Russian Federation. There is not a single line in it that the mortgagee has the right to regulate registration issues.

Accordingly, any additional requirements put forward by both the passport office employees and the bank can be considered illegal. They can be appealed in court. At the same time, experts advise not to quarrel with the creditor, so as not to give a reason in the future to demand early termination of the contract.

How can a non-owner register in a mortgaged apartment?

If a person who does not own the property wants to register in the apartment with a mortgage, first of all they will need to obtain consent from the owner. If the owner of the premises is not against performing the action, it is important to pay attention to the category of the applicant for registration and the provisions of the loan agreement. If the person is not a close relative or spouse of the borrower, it may be necessary to obtain permission from the company to perform the procedure. You need to contact the bank before submitting documents for registration. You will have to act according to the following scheme:

- Visit the bank and obtain permission to register.

- Collect a package of documents and contact the Main Department of Migration Affairs of the Ministry of Internal Affairs.

- Hand over the papers and fill out a tear-off coupon, if there is a need for its execution.

- Wait for registration and receive supporting documents.

Registration in apartments with a mortgage

Is it possible to register in the apartment? For Russia, this type of premises is quite new and unusual. In European countries, apartments are understood as high-comfort living space. In Russia their status is not defined by law at all. If we refer to Art. 16 of the Housing Code of the Russian Federation, you can see that residential premises include:

- apartments and their parts;

- residential buildings and their parts;

- isolated rooms.

Registration in apartments is impossible by definition. If absolutely necessary, you can register for up to 1 year, with further extensions as needed.

The most important thing to know about apartments is that they are not residential premises. This is commercial real estate. Its owners have to pay increased tariffs for utilities and taxes.

If we talk about temporary registration of apartments with a mortgage, it is necessary to highlight several points:

- registration in such premises is possible only for a strictly defined number of days, weeks, months or years;

- If a production facility, workshop, or office building has been converted into apartments, you will not be able to register at all.

Important! The procedure has not been formally worked out and fixed. But, if you want to live in this particular premises, you can try to convert the non-residential premises into residential ones.

If the apartments were purchased with credit money, any operations to change the status can only be carried out with the consent of the bank. And here everything remains at the discretion of the lender, since there is not a single regulatory act prohibiting or permitting such transfers.

How to register for a mortgaged apartment through State Services?

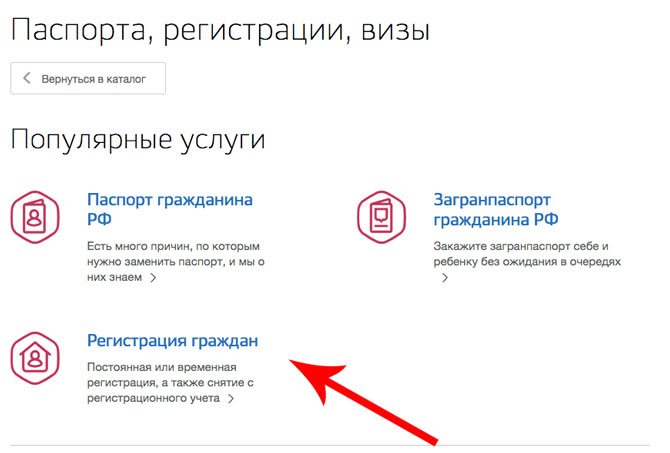

You can register in a mortgaged apartment through State Services. The website simplifies the procedure for contacting an authorized body. A citizen will not have to visit the Main Migration Department of the Ministry of Internal Affairs twice. To register for a mortgage apartment through the State Service, you must:

- Create an account and verify it. Then you need to log in and go to the Catalog section class=”aligncenter” width=”694″ height=”450″[/img]

- In the window that opens, click on the item Passports, registration, visas.

- Go to the Citizen Registration section. The system will prompt you to choose what kind of registration the person wants to receive - permanent or temporary.

- Read the detailed information and click on Get service.

- Carefully fill out the application for registration, indicating all the data.

- Clarify whether the deregistration was carried out at the previous place of registration. Then you have to reflect who owns the living space and indicate the owner’s details. Additionally, information about title documents is required.

- Select the department that is most convenient for the citizen to contact and record consent to the processing of personal data. After this, all you have to do is click on the Send button.

The application for registration will be reviewed within 3 days. If the application is approved, the citizen will be sent an invitation to visit the selected unit of the Main Department of Migration Affairs of the Ministry of Internal Affairs. The authorized body will issue a registration stamp to the person.

The procedure for registering in a mortgaged apartment

How to register if the apartment has a mortgage? If the new housing is the only one, the problem with registration must be resolved at the stage of concluding the contract. If it contains clauses stating that you can register only after 10 years, children cannot be registered at all, etc., it may be worth contacting another organization.

The bank is breaking the law. But, if the borrower decides to act without paying attention to dubious provisions, the lender will have an extra opportunity to demand early termination of the contract at the first opportunity.

You can try to defend your rights in court, but the process will drag on for months. You will have to spend money on hiring a lawyer and paying state fees. The result will be the same. The bank will try to get rid of a problem client under any pretext. If the agreement is signed, it is better to comply with it.

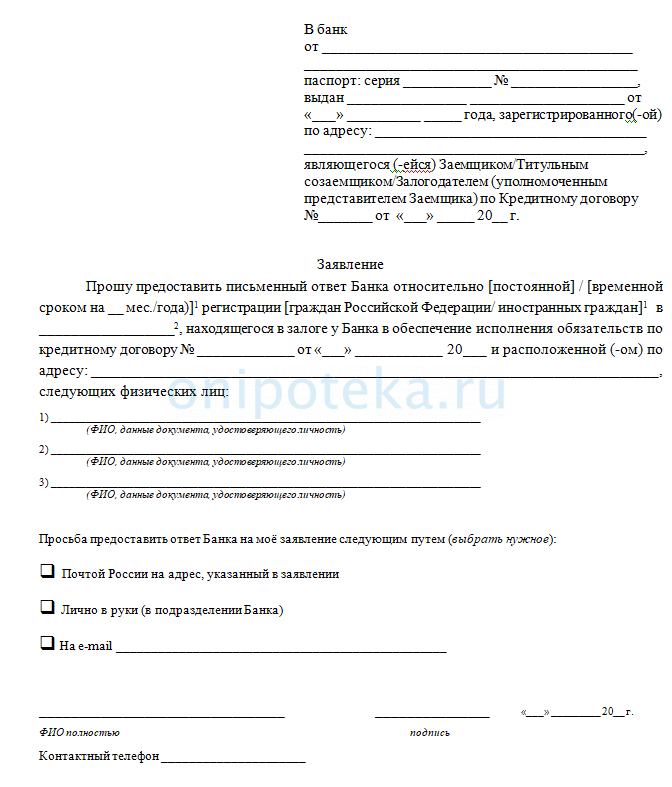

You can register for a mortgage in an apartment in accordance with the following algorithm:

- The borrower writes a notice to the bank by hand. It indicates who needs to be registered, their details and degree of relationship. Some banks provide the ability to fill out such documents in your personal account on the official website;

- approximately a week later a response is received from the bank;

- If the decision is positive, you can collect a package of documents and go to the passport office.

Application for registration in an apartment with a tenants' mortgage

Important! If we are talking about the registration of third parties in the apartment, the owner must be present in person when submitting documents. If there are several owners, everyone will have to gather at the passport office. The same applies to minors who have already received a passport.

Documentation

In accordance with the FMS Regulations, the following documents are required for registration:

- application on form No. 6 (All citizens over 14 years of age fill it out in their own hand. The signature is placed in the presence of a passport office employee;

- passports of the owner and registered person;

- military ID if available;

- certificate of departure from the previous place of registration. This item is not considered mandatory. If the citizen has not yet been discharged, it is enough to fill out a tear-off coupon for the application. The operation of deregistration from the previous place of residence will take place automatically;

- marriage certificate for registration of the spouse;

- birth certificate of children, if it is necessary to register minors;

- extract from the Unified State Register of Real Estate. This document is issued only in electronic format (according to Federal Law dated July 13, 2015 N 218-FZ On State Registration of Real Estate). Paper copies, along with certificates of ownership, are no longer relevant.

If you have the documents listed above, you can register in an apartment taken on a mortgage. So that the passport officer does not ask many questions and does not have the right to refuse on formal grounds, it is better to take with you a copy of the mortgage agreement (you are interested in the sections regarding registration) and permission from the lender to carry out registration actions.

How can the owner register in a mortgaged apartment?

To register in a mortgaged apartment, you must follow the following procedure:

- Prepare a package of documents and contact the Main Department of Migration Affairs of the Ministry of Internal Affairs.

- Hand over the papers to a specialist. An employee of the authorized body will check the documentation for errors. If they are not identified, the person will be asked to fill out a tear-off slip. There is a need to enter data if simultaneous discharge and registration are carried out. When deregistration was completed earlier, the list of documents must include a departure slip.

- Enter the information on the tear-off slip, if necessary.

- Wait until registration is completed. The procedure takes 3 working days.

- Receive a document confirming registration. In the Russian Federation, a registration stamp is placed in the passport.

Other people's children and their registration in collateral housing

The Housing Code of the Russian Federation, the Investigative Committee of the Russian Federation and the Civil Code of the Russian Federation say that a child under 14 years of age is required to register at the place of residence of his legal representatives (parents, guardians).

But when buying a home on credit, do not forget about several important and difficult points:

- if the owner of a mortgaged apartment has a child, there will be no problems with registration;

- If you already have children at the time of signing the contract, the situation becomes somewhat more complicated. You will have to ask the bank for permission to register. At best, the creditor is simply notified.

Some banks (Sberbank is no exception) require the borrower to sign an undertaking to discharge children if there are problems repaying the debt. The document is certified by a notary.

Important! Lenders are reluctant to allow children to register; if the borrower violates the payment schedule, he is regularly charged penalties and fines. A ban on registration can also be imposed by guardianship and trusteeship authorities, but for a different reason.

If the child was previously registered in an apartment of 100 square meters. meters, it will not be allowed to be re-registered in a house of 50 square meters. meters. It is believed that the minor's living conditions are deteriorating. Where the child actually lived before moving is not verified.

Is it possible to register someone else’s child in a mortgaged apartment?

Formally, the law does not prohibit such operations if the owner and parents of the minor agree. But with a high degree of probability the bank will be against it.

The reason is that it is impossible to discharge a child without the consent of his parents. Guardianship will not allow this to be done unless other, equivalent housing is provided. If there is a controversial situation, the apartment cannot be sold at auction. Lenders take this into account and prohibit registering nephews, children of co-workers, etc. on the mortgage area. If the borrower violates the loan agreement, the bank may accuse him of violating his obligations and demand repayment of the entire amount ahead of schedule.

If registration is required to get a place in kindergarten or while studying, you can limit yourself to temporary registration for a maximum of 5 years. If necessary, temporary registration in a mortgaged apartment is extended.

But here, too, limitations are possible. In 2013, 376-FZ was adopted (Federal Law dated December 21, 2013 N 376-FZ (as amended on December 31, 2014) On amendments to certain legislative acts of the Russian Federation), regulating the concept of “fictitious registration.” At the same time, articles were introduced into the Criminal Code of the Russian Federation providing for punishment for the creation of “rubber” apartments. Accordingly, the bank may prohibit even temporary registration of strangers.

How to register a child in a mortgaged apartment?

You can register a child in a mortgaged apartment if at least one of the parents is also registered in the property. To complete the procedure, you must:

- Collect a package of documents and contact the Main Department of Migration Affairs of the Ministry of Internal Affairs. An alternative is to transfer papers to the MFC. The organization's employees will forward the documents to their destination. Registration of a minor under the age of 18 must be carried out by his legal representatives together with the owner of the apartment.

- Provide documents and fill out a tear-off coupon, if the child has not previously been deregistered at the previous place of registration.

- Wait for the decision to be made. Document verification takes up to 3 business days. After this, employees of the authorized body are required to affix a registration stamp or refuse to carry out the action.

- Notify the lender about the child's registration. Additionally, it may be necessary to provide certified consent to remove the minor from the premises.

IMPORTANT

In practice, employees of the Main Department of Migration Affairs of the Ministry of Internal Affairs may require the written consent of the bank to carry out the registration procedure. In this case, it is necessary to refer to Article 20 of the Civil Code of the Russian Federation. It states that the place of residence of the child is the place of registration of his parents. Additionally, you can recall the provisions of the Government of the Russian Federation Decree No. 713 of July 17, 1995 on the registration of Russians at their place of residence.

Is registration required for a mortgaged apartment?

In accordance with the Civil Code of the Russian Federation, the Housing Code of the Russian Federation, Law of the Russian Federation dated June 25, 1993 N 5242-1 (as amended on April 1, 2019) “On the right of citizens of the Russian Federation to freedom of movement, choice of place of stay and residence within the Russian Federation”, Government Decree RF dated July 17, 1995 N 713 “On approval of the Rules for registration and deregistration of citizens of the Russian Federation at the place of stay and place of residence within the Russian Federation and the list of persons responsible for receiving and transferring to the registration authorities documents for registration and deregistration registration of citizens of the Russian Federation at the place of stay and place of residence within the Russian Federation”, a citizen of Russia must have permanent or temporary registration. But you can only permanently register at one address.

For some borrowers, a mortgaged apartment is their only place of residence. But there are also people who purchase real estate for investment purposes, for example, for children or renting out in the future.

Do I need to register for an apartment with a mortgage? It all depends on the circumstances of the buyer himself. The law does not oblige the borrower to register for the purchased living space. For a bank, the absence of registered ones is an ideal option. In case of problems with payment, the procedure for seizing square meters and selling at auction is simplified.

Can a bank prohibit registration in a mortgaged apartment?

When starting to cooperate with a borrower, the bank strives to protect itself as much as possible and reduce all possible risks. Therefore, the agreement indicates a restriction on registration. So, if a person registers a minor child in an apartment as a mortgage, they must give a written undertaking that the children will be released if the terms of debt repayment are violated and the property is seized. Sometimes companies refuse to register third parties or citizens who are distantly related to the borrower.

IMPORTANT

Organizations dictate their own rules due to the fact that the current legislation of the Russian Federation does not directly regulate the issue of registration in mortgage real estate. Banks take advantage of the imperfections of existing regulations. However, the refusal to register a third party can be challenged in court. The owner of a mortgaged apartment has the right to dispose of his property at his personal discretion, if the above actions do not contradict the law. However, legal disputes with a financial organization often result in the company terminating the contract and demanding that the mortgage money be returned ahead of schedule. Therefore, it is better to follow the established instructions.

What does the borrower face when registering third parties?

Registration at the place of residence in the mortgaged apartment, if this applies to third parties, must be carried out with the knowledge of the bank. If there is a direct indication of this in the contract. One can argue for a long time about the legality of such statements and challenge them in courts of various instances.

Lawyers agree that it is necessary to prove the illegitimacy of the ban before signing an agreement with the bank. If the signatures have been delivered, the transaction has taken place, all that remains is to fulfill the proposed conditions.

If the borrower ignores the provisions of the contract or systematically violates them, the bank may declare early termination of the contract. And then you will have to register not only to third parties, but also directly to the former owner.

If there are too many people registered, you can become involved in a criminal case and pay a large fine. The maximum penalty is 3 years in prison.

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Publication dateJune 9, 201July 4, 2019

Registration of property after payment of the mortgage

After paying off the mortgage, the owner of the apartment has the right to register ownership of the apartment in full. After all, while the apartment is pledged as a guarantor of repayment of the loan, the owner has no right to perform practically any legal actions with it. The following types of encumbrance are imposed on the apartment: prohibition of sale, exchange, donation. Sometimes financial institutions prohibit even registration until the loan is fully repaid.

An application must be submitted to the local representative office of Rosreestr along with documents on the termination of the pledge agreement. Registration of lifting the ban takes three days.