Who conducts it and how to conduct it correctly?

Any housing cooperative belongs to non-profit, non-governmental organizations , just like HOAs. They are created in order to jointly operate and manage the property in the condominium. Such organizations cannot pursue the goal of making a profit from their activities. This is stated in the Civil Code of the Russian Federation, paragraph 1 of Article 50.

If you trust the accounting of housing cooperatives to real professionals, this task becomes quite simple.

Determining the legal form is the first step towards resolving this issue. For example, a group of consumer cooperatives has developed its own rules.

The accounting policy is chosen by the housing cooperative accountant depending on how the organization pays taxes and what system it uses for this. Most often, the simplified version is preferred. Thanks to this special regime, insurance premium rates are reduced. For example, only the Pension Fund pays contributions for employees; according to the tariff, they are equal to 20 percent.

Calculations do not generate additional income if all owners have the status of members of the housing cooperative . With the exception of payment for individual services and ordinary work performed.

Simplified taxation system for HOAs 2021

Homeowners' associations (HOAs) are created not only to improve the quality of service in apartment buildings, but also to optimize the costs of residential property owners.

It is hardly possible to achieve this without careful accounting and a competent approach to choosing a taxation system.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

In accordance with the current legislation of the Russian Federation, HOAs are classified as non-profit organizations (Article 50, paragraph 3 of the Civil Code of the Russian Federation).

The decision to create a cooperative partnership is made by homeowners collectively, through voting.

At the same time, the number of votes that each homeowner can control depends on his share in a particular apartment building.

The activities of the HOA as a legal entity are regulated by the Housing Code of the Russian Federation and federal legislative acts. In matters of taxation, it is necessary to be guided by the Tax Code of the Russian Federation.

Despite the fact that the association of owners of residential premises is not a business entity, its managers are required to maintain standard accounting records and regularly make transfers to the state budget.

This is due both to the different nature of the financial resources coming to the accounts of the HOA, and to the fact that any organization of a similar profile always has hired employees on staff.

You will learn about HOA taxation from the video:

Among the main types of cash receipts to the HOA budget, in accordance with Art. 151 clause 2. Housing Code of the Russian Federation, we can highlight:

- entrance, mandatory and targeted fees, which are transferred by members of the association;

- payments from homeowners who are not members of the partnership;

- subsidies received from local governments and other organizations for repairs or ensuring proper quality of operation of certain economic facilities;

- income received during intermediation, provision of private utilities and other commercial activities of the HOA directly related to the tasks facing it;

- other financial receipts (charitable contributions, donations, etc.).

- the average headcount of the company is 100 people;

- the value of assets and fixed assets does not exceed 100 million rubles;

- The amount of revenue of the HOA for 9 months, taking into account the deflator coefficient, is no more than 45 million rubles.

In this case, funds that have the nature of targeted financing are not taxable (Article 251 of the Tax Code of the Russian Federation). These include, for example, utility bills, money for major or current repairs, budget injections, etc.

Now that you know that HOA taxes are a reality and not a myth, let's talk about what exactly you have to pay for.

The tax rate consists of two parts, regional and federal, and is calculated in each case individually. Value added tax.

If the HOA is actively involved in transactions for the sale of goods and services and at the same time uses the main taxation system, then it is obliged to timely report to the fiscal authorities and pay VAT in the general manner. Property tax.

An association of owners may own real estate and use it for commercial or economic purposes. The tax rate is determined, as a rule, by the cadastral or book value of the object. Land tax.

By analogy with the previous paragraph, it is paid only if the HOA owns a separate land plot.

It is transferred to the budget if the HOA has special equipment on its balance sheet, as well as cargo or passenger vehicles. Calculated based on engine power and rates adopted by regional authorities. Personal income tax (NDFL).

Its rate varies depending on the status of the employee. So, for a citizen of the Russian Federation you need to pay 13% to the budget. If the employee is not a tax resident of the Federation, the fee increases to 30%.

If the HOA attracts hired employees, then in relation to them it acts as an insurer for social, pension and health insurance, which obliges the association to provide quarterly reports to the Pension Fund and the Social Insurance Fund.

Homeowners' associations have the right to apply both basic (OSNO) and simplified (STS) taxation schemes.

Initially, all legal entities are in the general regime.

To switch to a preferential tax payment system, you must submit an application within the first 5 days after the association is registered for tax purposes.

Or in the period from October 1 to November 30 of the year that precedes the next reporting period from which the organization expects to switch to the simplified tax system.

As already stated, it applies by default to all legal entities. Provides for the transfer of VAT, as well as fees on profits and tangible assets of the HOA.

A partnership can use the simplified tax system if:

When switching to a simplified system, an association of homeowners can choose one of two tax objects:

- Total income (rate - 6%);

- Revenues to the budget minus expenses (rate - 15%, in case of a negative balance, a minimum fee of 1% is paid).

Under the simplified tax system, the taxpayer is exempt from paying VAT, as well as property and profit taxes. Transport and land duties are paid on a general basis.

It is mandatory for the HOA to submit reports to the tax authorities.

Regardless of the chosen taxation system, representatives of the HOA must promptly transfer to the employees of the local branch of the Federal Tax Service:

- An income tax return (OSNO) or a simplified tax return (USN).

- VAT return (OSNO).

- Information on the average staff composition and certificates in form 2-NDFL (once a year for each employee) and 6-NDFL (once a quarter for the entire organization).

Maintaining household reports. Watch the video of HOA activities:

However, before switching to the simplified tax system, it is necessary to draw up an estimate and calculate what cash receipts can be qualified as targeted, how many expenses there will be, how much can be earned for the provision of paid services, etc.

After all, it may well turn out that such an attractive at first glance rate of 6% is in your case less profitable than 15%.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now:

A real estate owners' association is a non-profit organization whose raison d'être is to perform the functions of independent maintenance, for example, of an apartment building. Subject to standard conditions, a TSN or HOA may apply a simplified taxation system. At the same time, like any legal entity, such a partnership must keep accounting records. What are the features of simplified accounting in TSN?

Registration of a non-profit organization in itself presupposes the conduct of activities not aimed at generating income. A partnership of real estate or housing owners, in particular, is organized for the purpose of managing the common property of an apartment building. However, the possibility of generating income from commercial activities for such companies is also not excluded. Therefore, the main issue in keeping records in the TSN becomes the attribution of certain revenues to the taxable income of the organization.

This is interesting: How to transfer electricity readings on a personal account 2021

Article 151 of the Housing Code implies that a homeowners’ association can receive four main types of income:

- mandatory payments, entrance and other contributions of members of the partnership;

- income from the economic activities of the partnership;

- subsidies for ensuring the operation of common property in an apartment building, carrying out current and major repairs, providing certain types of utilities and other subsidies;

- other supply.

Based on the provisions of paragraph 2 of Article 152 of the Housing Code of the Russian Federation, the operation, maintenance and repair of real estate in an apartment building are one of the types of statutory activities of the HOA. At the same time, the main source of funding for a non-profit organization, which includes a homeowners’ association, is precisely membership fees. Therefore, one could conclude that the funds coming from the members of the HOA, i.e. homeowners for the maintenance and repair of the house should be considered precisely as membership fees, which do not form the taxable profit of the HOA. And I must say that such logic was quite popular among the managers of partnerships.

Thus, it turns out that the use of the simplified tax system-6% is simply not profitable for HOAs, since a considerable share of income from homeowners comes from payment for the services of third-party organizations with which the HOA is forced to cooperate in order to maintain the house in proper condition from the point of view of its operation. However, there is still an option for using a “profitable” simplification in this case. Thus, the Tax Code provides that when determining the tax base, both for income tax and simplified tax, income in the form of property or funds received by a commission agent, agent or other intermediary in connection with the fulfillment of obligations under the relevant intermediary is not taken into account. agreement, as well as for reimbursement of its costs associated with the execution of such an agreement. Taxable income in such a situation will only be commission, agency or other similar remuneration.

Simply put, if the entrepreneurial activity of an HOA is based on such contractual obligations with home owners, within the framework of which the partnership acts as an intermediary, organizing the purchase of utilities in the interests of the owners, then the income of such an organization will not be the payment of these utilities by end consumers. In this regard, there is one rather fundamental point: an agency agreement should be concluded before signing contracts with resource supply organizations, otherwise the very fact of providing intermediary services may be called into question.

But in any case, there will be no problems with deductions for the formation of a reserve for repairs and major repairs of common property, which are made to the homeowners’ association by its members. Such revenues from HOAs do not count as income under the simplified tax system since they are targeted revenues for the maintenance of non-profit organizations and their conduct of statutory activities (clause 1, clause 2, article 251 of the Tax Code of the Russian Federation). Subsidies received from the budget for the same purpose of major repairs will not be considered income.

Since TSN revenues may include both taxable and non-taxable amounts, these organizations are one way or another faced with the need to keep separate records of income and expenses within the framework of their own activities. In the absence of clearly established principles for maintaining separate accounting, all income of the HOA will be treated as taxable.

TSN, as non-profit organizations, are required to provide financial statements in the following composition:

- balance sheet;

- income statement;

- report on the intended use of funds.

Such organizations do not prepare a statement of changes in capital, a statement of cash flows, or an appendix to the balance sheet, since they simply do not have the relevant data. But information on the use of targeted funds received from TSN participants is presented in a separate report as part of the accounting reports. It indicates data on funds received in the form of entrance, membership, voluntary contributions, in particular on their balances at the beginning and end of the reporting period, as well as on amounts received and spent during the year.

The accounting accounts used to reflect TSN receipts will also differ depending on the status of such receipts: target or commercial. Membership fees and revenues related to major repairs will go through account 86 “Targeted financing”.

Debit 51 “Current account” – Credit 76 “Settlements with various debtors and creditors” - money credited to the account;

Debit 76 – Credit 86 “Targeted financing” - the amount is recognized as target receipt.

The funds were spent on major repairs, including payment for work performed by a contractor and the purchase of materials necessary for major repairs. The calculation of costs for major repairs is reflected in the debit of account 20 “Main production” in correspondence with accounts 60 “Settlements with suppliers and contractors” and 10 “Materials”. Since costs are attributed to expenses within the framework of target revenues, at the end of the month the amount on the credit of account 20 is written off to the debit of account 86, thus the costs are closed at the expense of target funds.

Receipts recognized as income will be reflected through a regular “commercial” 90 account. The same account will be used to cover commercial expenses that TSN encounters in its activities while maintaining simplified accounting for the HOA. Postings in 2021 will look like this.

This will be reflected in accounting as follows:

Debit 76, subaccount “homeowners” - Credit 90.1 “Revenue” - for the amount of issued receipts.

Cost calculation for account 20:

Debit 20 – Credit 60 – accrual of the cost of utilities by supply companies;

Debit 20 – Credit 70 – salary of working personnel performing duties for servicing the common property of an apartment building;

Debit 20 – Credit 10 – the cost of materials written off for maintenance of the common property of an apartment building.

This list of costs relates to expenses within the framework of commercial activities, therefore, at the end of the month, the amount on the credit of account 20 for these items is written off to the debit of account 90.2 “Cost of sales,” thus forming the financial result of TSN’s commercial activities.

Many management companies and homeowners associations want to work under a simplified taxation system. But not everyone knows how to switch to it and how it can turn out. On May 16, we held an online seminar at which Yuriy Romanchenko, a tax lawyer, spoke about the risks, opportunities and rules for operating a management company and homeowners association under a simplified taxation system.

The simplified taxation system or simplified taxation system is one of five special tax regimes, according to paragraph 2 of Art. 18 Tax Code of the Russian Federation. This regime is aimed at small businesses, and its goal is to simplify the calculation and payment of taxes when conducting business activities. The procedure for applying the simplified taxation system is regulated by the norms of Chapter 26.2 of the Tax Code of the Russian Federation.

This is interesting: Water consumption log: form POD 11 2021

Tax expert, founder of an outsourcing company and tax assistant to the Ombudsman for Entrepreneurs of the Republic of Karelia, Yuri Romanchenko, at the online seminar “Simplified taxation system: risks, opportunities, rules for management entities and homeowners’ associations” noted that the simplified tax system is the optimal solution for maintaining tax accounting for managers companies and homeowners associations, residential complexes, housing cooperatives. After all, cooperatives and partnerships can hardly be classified as large businesses, and management companies do not always grow into medium-sized businesses.

Nevertheless, judicial practice has developed when courts recognize receipts of payments for utilities and housing services as income from management entities, homeowners' associations, and housing complexes. Therefore, there is no stable opinion about whether the simplified tax system makes their life easier.

We also note that under the simplified tax system, the taxpayer has the right to choose one of two objects of taxation specified in Art. 346.14 Tax Code of the Russian Federation:

- income;

- income reduced by expenses.

The transition to a simplified taxation system is voluntary. This can be done by organizations and individual entrepreneurs.

You can switch to the simplified tax system if, based on the results of 9 months of the year in which you submit an application to switch to the simplified tax system, the organization’s income did not exceed 45 million rubles excluding VAT, and from January 1, 2017 - 112.5 million (clause 2 of Art. 346.12 Tax Code of the Russian Federation).

In accordance with Art. 346.13 of the Tax Code of the Russian Federation, you can switch to the simplified tax system only from January 1 of the new year. To do this, an organization or individual entrepreneur must notify the tax authority about the change in taxation regime no later than December 31 of the year preceding the year of transition.

Newly created organizations and individual entrepreneurs can notify the tax authority about the application of the simplified tax system within thirty days from the date of registration of the person.

To switch to the simplified tax system, an application is submitted to the tax authority. The recommended forms for such applications are approved by order of the Federal Tax Service of Russia dated November 2, 2012 No. ММВ-7-3/ [email protected] If you do not want to use the order forms, write the application in any form. In this case, be sure to indicate in it:

- information about the organization,

- type of taxable object,

- average number of employees,

- cost of fixed assets.

For management companies, homeowners' associations and residential complexes there are no restrictions on the use of the simplified tax system, since they do not engage in banking, microfinance activities and do not work with securities.

However, they may not be allowed to switch to the simplified tax system if:

- the average number of employees for the tax period exceeds 100 people;

- the residual value of fixed assets according to accounting data exceeds 150 million rubles;

- the organization is registered outside the Russian Federation;

- the organization did not notify about the transition within the established time frame;

- the organization has branches.

You will find a complete list of conditions under which it is impossible to switch to the simplified tax system in clause 3 of Art. 346.12 Tax Code of the Russian Federation.

In accordance with paragraphs 2, 3 of Art. 346.11 of the Tax Code of the Russian Federation, the use of a simplified taxation system exempts from payment of certain types of taxes:

1. Value added tax.

The exception is the import of goods into Russia.

2. Tax on property of organizations.

An exception is the calculation of the tax base based on cadastral value.

3. Corporate income tax.

An exception is tax paid on income taxed at the tax rates provided for in clauses 1.6, 3 and 4 of Art. 284 of the Tax Code of the Russian Federation - when paying dividends and securities.

Other taxes under the simplified tax system are paid on a general basis.

From 2021, management companies, homeowners' associations and residential complexes that use a simplified taxation system will not be able to take into account as taxable income amounts received from owners to pay for utility services provided by third-party organizations (clause 4, clause 1.1, article 346.15 of the Tax Code of the Russian Federation) ). To do this, a resource supply agreement must be concluded between the management and resource supplying organizations.

This is good news for management companies, homeowners' associations and residential complexes, although it is not without difficulties. Thus, if the resource supply agreement is of an intermediary nature, the amount of the agency fee will have to be included in income. At an online seminar, Yuriy Romanchenko explained in detail how to correctly calculate tax expenses in such a relationship. You will find detailed recommendations in the recording of the online seminar.

When calculating income under the simplified tax system in the form of income reduced by the amount of expenses, receipts for utility services will not be taken into account in income and expenses.

At the same time, management companies, homeowners' associations and residential complexes still need to take other income into account as taxable income. Including:

- payment for the maintenance and repair of common property of the apartment building;

- payment for additional services.

Revenue still does not need to include:

- Budget funds allocated for shared financing of capital repairs of apartment buildings.

- Owner funds for targeted financing of capital repairs of the common property of the apartment building.

- Membership dues paid to a partnership or cooperative as a non-profit organization that are not associated with specific targeted programs.

- Contributions and donations from members of a partnership or cooperative for the formation of a tax reserve for current and major repairs of the common property of apartment buildings.

If there is non-taxable income of a management company, homeowners association, or residential complex, it is necessary to keep separate records, otherwise you will not be able to take advantage of the benefits and all income will have to be taken into account when calculating the simplified tax.

Yuri Mikhailovich noted that when using the simplified tax system, it is important not to miss a single nuance of such a system, otherwise the organization may lose the right to use it.

Management organizations, homeowners' associations and residential complexes do not have the right to change the taxation regime before the end of the tax period.

However, if certain conditions are not met, they may lose the right to use the simplified taxation system. We list the following conditions:

- Excess of taxpayer's income for the reporting period.

- Exceeding the established limit on the number of employees and the cost of fixed assets.

- Conducting activities in which the use of the simplified tax system is not allowed or the choice of object of taxation is limited (clause 3 of article 346.12 of the Tax Code of the Russian Federation, clause 3 of article 346.14 of the Tax Code of the Russian Federation).

From the moment the right to apply the simplified tax system is lost, the taxpayer must calculate and pay taxes according to the general taxation regime, which is provided for newly created organizations or individual entrepreneurs. Penalties and fines for late payment of monthly payments during the quarter in which the taxpayer switched to the general tax regime are not charged (clause 4 of Article 346.13 of the Tax Code of the Russian Federation).

You can return to using the simplified tax system no earlier than one year after losing your right to it.

Loss of the right to use the simplified tax system is not the only negative consequence that may arise for a management company, HOA, or residential complex if tax contributions are paid incorrectly. Yuriy Romanchenko also spoke about what legal entities and officials can receive fines for, and gave recommendations on how organizations can work so as not to get fined.

But enough about the sad stuff. If you study the topic of the simplified tax system in detail, you will not be afraid of any fines. Watch the video recording of the online seminar and you will also learn about:

- criteria for classifying individuals as small and medium-sized businesses;

- what income and expenses are taken into account under the simplified tax system;

- the concept of “tax base” and its application;

- tax rates;

- tax and reporting periods;

- the procedure for calculating and paying tax;

- preparing a tax return;

- whether remuneration to the MKD council is taxable.

This is interesting: How to legally avoid paying for housing and communal services in 2021

In the handouts for the article you will find regulatory legal acts, letters from relevant departments and sample documents that will help you better understand the topic of the simplified tax system. Ksenia Terletskaya

A homeowners association is a non-profit company, an association of apartment owners in an apartment building for the purpose of general management:

Also, the partnership is created to ensure:

- use and disposal of common property;

- carrying out work to maintain and ensure the safety of this property;

- provision of public services;

- to carry out other activities.

An HOA can switch to a simplified regime at its own discretion. To switch to it from the general regime, you must write an application to the tax authorities. The time within which this needs to be done depends on the tax regime in which the company is currently located. So, for example, if it applies the general taxation system, the deadline for filing an application is December thirty-first, because in this case, the transition is possible only from the beginning of the new year. But these rules only apply to already operating organizations. Newly registered companies must submit such an application within thirty days of registration.

It is worth remembering that not all interested companies can operate on the simplified tax system. Homeowners' associations have the right to switch to a simplified regime, but only if all the conditions for the transition are met. To transfer you need:

- the average number of employees is less than one hundred people;

- the residual value of the organization's assets is no more than one hundred million rubles;

- profit no more than sixty million rubles.

If an HOA has switched to a simplified system, this does not mean that it should not pay other taxes. When using the simplified tax system, there is no need to pay only three taxes:

- company property tax;

- income tax (except for tax paid on dividends);

- VAT, excluding tax payable:

- when importing products into Russia;

- when conducting activities under a partnership agreement;

- due to the fulfillment of the obligations of a tax agent.

The remaining taxes are paid by simplified residents in the same manner as by general regime residents.

Now let's look at how an HOA using the simplified tax system should take into account its income.

The responsibility to pay for home repairs and its maintenance falls on all residents of the house (both HOA members and ordinary residents). Tax accounting of funds received is directly dependent on who paid.

Funds received from HOA participants are membership fees for the internal needs of the partnership. For tax accounting purposes, such contributions are designated revenues. They are not subject to the simplified tax system, therefore, they are not included in the book of expenses and income.

If contributions are accepted from residents of the house who are not members of the HOA, they are included in income subject to taxation, since they do not qualify for benefits.

If donations come from HOA members, they do not need to be included in income. Therefore, they are not subject to taxation. If a third-party organization performs any work for the HOA free of charge, their price is not included in taxable income.

All citizens, as well as organizations, must pay utilities and accommodation on time from the time they began living in the apartment. The financial department considers such payments to be sales revenue. In this regard, there is no need to take it into account when calculating the simplified tax system. According to officials, such revenues should be taxed because they are not earmarked.

There are court decisions on this issue, according to which the tax authorities lost this dispute. The judges explained it this way: the HOA, while receiving payment for utilities, does not itself provide these services. It only acts as an agent for those companies that provide these services. In this case, the HOA does not gain any financial benefit. In this regard, the judge came to the conclusion that such payments should not be subject to simplified taxation.

In some cases, if you choose not to take the above payments into account for tax purposes, you may need to prove your case in court. To do this you need to have the following documents with you:

- charter of the partnership (to confirm the implementation of non-commercial activities);

- cost and revenue estimates;

- invoices confirming payment of utilities;

- accounting documents (to confirm the intended use of money);

- an internal document that regulates the procedure for maintaining separate accounting.

Even though a partnership is a non-profit company, it has the right to carry out business activities and earn money. However, the list of such activities that the partnership has the right to engage in is limited. An HOA can only engage in:

- maintenance and repair of apartments in multi-apartment buildings;

- construction of additional rooms in apartment buildings;

- rental of apartments in multi-apartment buildings.

Income from this activity forms additional income for the partnership. Also, a partnership can engage in entrepreneurial activities if its members include plumbers, mechanics and electricians. The price of services must be defined in an internal document.

Income from such activities must be included in the tax base of the simplified tax system.

Partnerships using the simplified regime can take advantage of the reduction factor, but to do this, one requirement must be met. Profit from property management should be more than 70% of all income. This means exactly those incomes that are taken into account during simplification.

From this we can conclude: a partnership can pay insurance premiums with a reducing coefficient if it is on a simplified basis and receives taxable income from managing an apartment building. For example, an association may count payments from residents for utilities as profits from providing services. If the partnership exists only through targeted payments, it cannot apply a reduction factor and must pay contributions at regular rates.

It is worth noting that when using the income-expenses tax base, insurance contributions can be included in expenses. You do not need to fulfill any special requirements for this. In this regard, they can be written off immediately after payment.

When using the income tax base, the partnership can reduce the tax by 50% of the amount of insurance premiums.

There are situations that require special attention. If the partnership acts as an agent, it does not have to account for utility fees. It must enter into an intermediary agreement with the residents of the house for the provision of services, and then sign an agreement with utility organizations for the receipt of services.

When carrying out statutory activities, as well as entrepreneurial activities, the partnership is required to maintain separate records.

»

Other

Removal of bulky waste: rules and features 2021

Read more

Great article 0

What are the income and expenses of housing and communal services?

The cost estimate of the housing cooperative is determined by the expenses planned for the current year . The main part of this article is formed from:

- carrying out major repairs, the presence of common property;

- repair and maintenance costs;

- funds used to actually carry out repairs in an apartment building.

Experts recommend leaving a reserve balance for expenses not covered by any existing plan . It will be easier to track whether funds are being used for specific purposes if the report contains as much detail as possible.

What about the income side?

HOA funds also consist of several points, according to the text of the Civil Code of the Russian Federation.

- Receipts of a different nature.

- Benefits and revenues on the basis of which apartment buildings are operated, overhauled, and for which certain types of services and other benefits are provided.

- The level of income that economic activity brings. They are then used for the further work of the organization.

- Membership mandatory payments and other types of contributions.

Each type of income and expense has its own designations in the reports . For example, there are such groups:

- income of target budget funds is designated as 400,000;

- type of transfers without additional expenses: 3,000,000;

- division of tax-free income: 2,000,000;

- tax revenue: 1,000,000.

Next come combinations of zeros and ones for specific varieties.

- Profit tax for accounting for individuals from abroad 101010.

- Profit received by organizations and enterprises: 1010101.

- Income tax for organizations and enterprises for a specific article: 1010100.

- Profit and capital gains: 1,010,000.

- Taxable income: 1,000,000.

It is thanks to this classification that all types of income coming to the budget can be taken into account . In housing and communal services the code is 1200, for target budget funds: 3100.

Taxes for housing cooperatives

Litvinenko Alexey Dmitrievich. Taxes for housing cooperatives

Currently, it is impossible to imagine your life without housing. Housing is real estate. The residential real estate market is actively developing in Krasnodar. An actively developing entity in such a market and in relation to the provision of housing services is a housing construction cooperative (HCC).

In paragraph 1 of Art. 110 of the Housing Code of the Russian Federation (LC RF) gives the concept of housing or housing-construction cooperatives, which recognize voluntary associations of citizens or, in certain cases, legal entities on the basis of membership in order to meet the needs of citizens for housing, as well as manage an apartment building.

Housing cooperatives are created on the basis of membership fees to meet the material and other needs of the participants. Housing cooperatives are created for the acquisition, reconstruction and subsequent maintenance of apartment buildings.

A housing cooperative is a legal entity (organization) upon creation of which a TIN, KPP, OGRN are assigned, there is a legal address and a current account can be opened in a bank.

Such cooperatives are non-profit organizations in the form of consumer cooperatives, and they can carry out entrepreneurial activities only to achieve the goal for which they were created.

In accordance with Art. 19 of the Tax Code of the Russian Federation (TC RF) by taxpayers, incl. organizations are recognized that, in accordance with the Tax Code of the Russian Federation, are obliged to pay the relevant taxes and (or) fees. Based on this, a housing construction cooperative is a payer of taxes and fees. Moreover, such a taxpayer has a special status, since it is a non-profit organization.

A housing construction cooperative may apply a general taxation system. Under the general taxation system, the following taxes are usually paid :

- value added tax (VAT);

- corporate income tax;

- excise taxes;

- corporate property tax;

- transport tax;

- land tax, etc.

With regard to the payment of value added tax by housing cooperatives, it should be noted that, in accordance with subparagraphs 29, 30, paragraph 3 of Art. 149 of the Tax Code of the Russian Federation is not subject to taxation (exempt from taxation) the sale of utility services provided, incl. housing construction and housing cooperatives in order to meet the needs of citizens for housing and provided utilities, provided that they are purchased from organizations of the public utility complex, suppliers of electricity, gas, water supply, etc., and the implementation of maintenance works (services) is not subject to taxation and repair of common property in an apartment building performed by the above-mentioned housing cooperatives, subject to the acquisition of these works (services) from organizations and individual entrepreneurs directly performing these works (services).

Thus, since the above-mentioned sale of utilities and other benefits is the main activity of a housing cooperative, such a cooperative is exempt from paying VAT, but is not exempt from the obligation to submit a VAT tax return, even if it is “zero”.

Moreover, such release is a right, not an obligation. An important circumstance in the exemption from VAT is that such an exemption is possible only if the housing cooperative is an intermediary in carrying out repair work; if the repairs are carried out by the forces (employees) of the housing cooperative itself, the tax authority will try to charge additional VAT.

If a housing construction (housing) cooperative carries out a different type of activity (renting property, providing services, etc.) than that specified in subparagraphs 29, 30 of clause 3 of Art. 149 of the Tax Code of the Russian Federation, then the housing cooperative will act as a full-fledged VAT payer.

When applying the general taxation system, corporate income tax is one of the main calculated taxes. Housing cooperatives are also required to calculate and pay corporate income tax.

Tax base, incl. and for a housing construction cooperative is income ,

reduced by the amount of expenses.

However, according to Art. 251 of the Tax Code of the Russian Federation, when determining the tax base, income in the form of property received as part of targeted financing is not taken into account. Targeted financing includes, among other things: budget funds allocated to housing and housing-construction cooperatives managing apartment buildings for shared financing of capital repairs of apartment buildings in accordance with the Federal Law “On the Fund for Assistance for the Reform of Housing and Communal Services” and for capital repairs of common property in apartment buildings in accordance with the Housing Code of the Russian Federation.

Funds from owners of premises in apartment buildings transferred to the accounts of housing cooperatives that carry out and (or) finance activities aimed at carrying out major repairs of common property in apartment buildings are not subject to income tax.

Also, when determining the tax base, targeted revenues received by a non-profit organization (HCB) free of charge from home owners for repairs of common property are not taken into account. To target revenues, incl. include share contributions.

At the same time, taxpayers who are recipients (housing cooperatives) of targeted revenues and targeted financing are required to keep separate records of income (expenses).

According to paragraph 2 of Art. 289 of the Tax Code of the Russian Federation, housing cooperatives have the right to submit a tax return in a simplified form after the expiration of the tax period, in the absence of obligations to pay tax.

Taxpayers of the property tax of organizations are organizations that have property recognized as an object of taxation (clause 1 of Article 373 of the Tax Code of the Russian Federation).

Thus, according to the codified law, if a housing cooperative has property, then the housing construction cooperative is obliged to calculate and pay corporate property tax.

However, on the territory of the Krasnodar Territory there is a law dated November 26, 2003 No. 620-KZ “On the property tax of organizations”, according to which housing cooperatives and housing construction cooperatives are exempt from paying the property tax of organizations (Article 3).

But by virtue of Art. 386 of the Tax Code of the Russian Federation, such organizations are not exempt from submitting a tax return on the property tax of organizations to the tax authority.

If there are vehicles recognized in accordance with Art. 358 of the Tax Code of the Russian Federation, the object of taxation is registered with organizations (housing cooperatives); such an organization is recognized as a taxpayer of transport tax. Thus, non-profit organizations represented by a housing or housing-construction cooperative are obliged to calculate and pay transport tax.

The only relief for housing cooperatives may be that the vehicles used to carry out the activities of housing cooperatives are registered not as trucks, but as self-propelled vehicles, pneumatic and tracked machines and mechanisms, then a lower tax rate is established for the latter.

Taxpayers of land tax are organizations that own land plots recognized as objects of taxation in accordance with Art. 398 of the Tax Code of the Russian Federation on the right of ownership or the right of permanent (perpetual) use.

Thus, if a housing cooperative owns a land plot using the above methods, it is recognized as a payer of land tax. And if the land plots located under the house or adjacent territory belong to the residents, then the residents are recognized as tax payers. In addition, cases are not uncommon when a housing cooperative is the owner of a land plot and, based on this, is a payer of land tax, but claims a tax exemption, since the residents of an apartment building are a preferential category of citizens (pensioners, disabled people, veterans, heroes of Russia and USSR, etc.), in this case the tax authority will refuse to apply the tax benefit and will try to charge additional land tax.

So, the basics of applying the general taxation system for housing cooperatives are reflected above, but such a non-profit organization has the right to apply a special tax regime. Housing cooperatives can apply a special regime only in the form of a simplified taxation system; they are not entitled to apply other special regimes, since either the type of activity (UTII) is not suitable, or the taxpayer status is not suitable (Unified Agricultural Tax, PSN).

The simplified taxation system (STS) can be applied to two taxable objects and using two tax rates:

- income, rate 6%;

- income reduced by expenses, rate 15%.

To apply the simplified tax system, certain criteria are required: submission of a notification about the application of the simplified tax system within a certain period, the absence of branches and representative offices, the share of participation of the founder-organization, the average number, the residual value of fixed assets, etc.

When applying the simplified tax system, the taxpayer is exempt from paying VAT, corporate income tax and property tax.

Taxable and non-taxable income when applying the simplified tax system are mainly defined in articles 249, 250, 251 of the Tax Code of the Russian Federation, which relate to the chapter of corporate income tax, and in part, the expenses under the simplified tax system are similar to the expenses when calculating corporate income tax. Thus, determining the tax base when calculating the amount of tax according to the simplified tax system is partially identical to the corporate income tax.

In addition to the general taxation system and special tax regimes in tax legislation, there is the concept of a single (simplified) tax return.

A single (simplified) tax return is submitted for other taxes by a person (taxpayer), incl. and housing cooperatives that do not carry out transactions that result in the movement of funds through the current account and do not have objects of taxation.

Thus, the taxation of housing cooperatives differs from the taxation of any other organization in that it is a non-profit organization whose purpose is not to make a profit, the main type of activity is not subject to VAT, part of the income received is not subject to corporate income tax and the simplified tax system, a special procedure for submitting tax reports for corporate income tax, in the Krasnodar Territory they are exempt from paying property tax, and payment of land and transport tax depends on the availability of the object of taxation.

So, based on the above, the taxation of housing cooperatives, in principle, is not particularly complicated, but it still has its own subtleties and difficulties. In addition to services on tax matters, our law office also offers other legal services for you, for example, such as: representation in court, consulting and outsourcing, collection of utility bills from debtors, drafting contracts, legalizing redevelopment, transferring premises from residential to non-residential and other activity support.

Prices for the services of lawyers and advocates depend on the tasks.

Call now! Let's help!

+7 (861) 212-54-74, +7 (988) 241-05-75

Filing a claim in court

Statement of claim for debt collection under the contract

Lawyer in civil proceedings

Tags: housing construction cooperative taxation what taxes does a garage cooperative pay taxes in a garage cooperative taxation GSK

What is taxable and what is not?

You should find out what taxes the housing cooperative pays. With a simplified taxation system, there are income that are not subject to taxes :

- funds received by the organization as a commission agent, agent, or other attorneys;

- budgetary capital allocated for equity financing to carry out major repairs;

- owner funds allocated to finance capital repairs;

- contributions from members for the maintenance of the organization itself and the conduct of statutory activities.

As the recipient of targeted revenues, the organization's management must maintain separate records for specific purposes.

You can learn about the risks of housing cooperatives and housing cooperatives on our website. We offer you additional information about:

- leaving the cooperative;

- payment of shares;

- activities;

- registration;

- membership;

- and the general meeting of owners.

What are housing cooperative tariffs and what are they set for?

Tariffs are set on the basis of one document - a list and frequency of work and services related to the maintenance and repair of common property. Housing cooperative tariffs are needed to determine the cost only of work in a given field of activity. Not in any other areas.

Technical and economic information about an apartment building helps to calculate the costs for each specific object.

It’s good if this document is detailed - then the calculation will allow you to get as much information as possible. This way, specialists will have more freedom when calculating tariffs in the future.

But you can only get by with an enlarged calculation if the list and frequency of work are determined only in general terms.

Government recommendations provide practical implementation of each of these options. In addition, the following data is important :

- Tax and fee rates determined by current legislation.

- The cost of fuel and utilities, construction work.

- Payment for housing and communal services based on the tariff schedule.

- Labor costs of workers with the first category.

How is the estimate prepared?

The housing cooperative estimate is the only document that gives the right to demand money from members and third parties . If everything is done correctly, the estimate is in the office safe, with the chairman or manager. Owners must receive this document along with a receipt when the year begins.

Estimate of income and expenses: sample.

There are no universal requirements regarding the content of the document. Receipts and expenses are the two main parts . Expenses can be added regardless of their type. But there are mandatory details that must be included in any estimates. These are the parts with:

- other information;

- contributions to the capital repair fund;

- costs of paying for communication services, utility bills;

- repair estimates for home ownership, maintenance costs;

- information on administration and process management.

Taxes from individuals are part of these costs . In particular, registered property registered in their name. It is better to register expensive types of equipment as general business property. There are other types of taxes, but persons with legal status have no relation to them. Unforeseen expenses should also be included in the estimate , at least to a small extent.

Consequences of accounting theft for HOAs

The volume of theft can be anything, usually it depends on the size of the HOA, the greed of the accountant and his appetite for risk. In judicial practice, amounts range from several thousand to several million rubles.

The consequences of theft also range from years of unnoticed damage to owners to bankruptcy of the HOA. An accountant, in accordance with the above articles of the Criminal Code of the Russian Federation, usually receives a suspended or even real sentence. And the chairman of the HOA in the event of bankruptcy in accordance with civil law (Article 53.1 of the Civil Code of the Russian Federation, Federal Law No. 127-FZ of October 26, 2002) faces subsidiary liability.

This ending came in case No. A43-6766/2019, the decision on which was made by the Arbitration Court of the Nizhny Novgorod Region. The HOA stopped paying the heat supply organization. At the same time, money was collected from apartment owners, but instead of paying the supplier, part of it was transferred to the contractor for roof repairs at an inflated price, and another part was transferred to the accountant’s personal account.

The chairman’s arguments that it was the accountant who facilitated the conclusion of the contract with this contractor, independently transferred the payment to him and transferred the money to his personal account, remained unheeded. The court decided that it was the inaction of the chairman that led to the inability of the HOA to pay for the consumed heat, and brought him to subsidiary liability. Now he has to pay 1.2 million rubles from his own pocket.

Do HOAs need to enter into agreements with owners who are not members?

285905

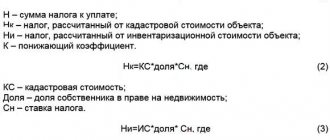

Accounting in housing cooperatives: postings

They might look like this :

| Designation | Meaning |

| Debit 76 Credit 86 | About the member's debt |

| Debit 62 Credit 90 subaccount “Revenue” | Designation for the debt of the owner of the premises who is not a member of the organization |

| Debit 26, credit 70, 69, 71, 01, 10 and so on. | Maintenance costs officially recognized |

| Debit 26 credit 68 | Tax amounts accrued due to the simplified system |

| Debit 26 Credit 60 | Types of expenses associated with the maintenance of common property |

| Debit 99 credit 84 | When the balance is reformed |

| Debit 96 Credit 60 | Expenses for repairs on common property |

And so on.

Each type of finance has its own symbols for displaying in reporting . This type of reporting is consistent with recommendations from government officials for homeowners' associations. But such documents are not recognized as normative.