Home / Real estate / Land / Taxes / Cost and calculation

Back

Published: 04/27/2017

Reading time: 10 min

0

682

Fulfillment of tax obligations is the responsibility of each entity in respect of which they are established, regardless of its type or category. In particular, various groups of persons owning land plots are obligatory payers of the corresponding land tax. The features of its calculation, as well as the main methods that are used, and specific examples will be discussed further in more detail.

- Basic calculation methods Manual

- Using an online calculator

- Standard settlement terms

Who must pay land tax and what determines its amount?

Not every businessman has to pay land tax.

As soon as a land plot appears as part of his property, the issue of calculating and paying this tax becomes relevant. For example, on January 21, 2020, the company registered ownership of land - from that moment on, it has the obligation to calculate and pay land tax (clause 1 of Article 388 of the Tax Code of the Russian Federation).

If the company decides to register the land under the right of free-term use or has entered into a lease agreement, it does not have the obligation to pay land tax and there is no need to look for an answer to the question of how to calculate the land tax (clause 2 of Article 388 of the Tax Code of the Russian Federation).

IMPORTANT! Land tax is local and is regulated not only by the Tax Code (Chapter 31), but also by land and municipal legislation (in terms of establishing benefits, rates, and payment procedures).

The amount of tax depends on several factors: the regional location and cadastral value of the site, the purpose of its use, the tax rate and the availability of benefits. In relation to this tax, regions are given the opportunity to:

- approve the amount of rates on it, without going beyond the limits established by the Tax Code of the Russian Federation;

- differentiate these rates;

- introduce additional benefits;

- decide on the payment of advance tax;

- set payment deadlines (until 01/01/2021).

From 01/01/2021, local authorities do not determine payment deadlines for land tax. The deadline will be the same throughout the country: March 1 for annual taxes and the last day of the month following the reporting period for advance payments. The new rules are effective from the annual payment for the 2021 tax period.

Starting with the tax for 2021, its declaration has been canceled, and the Federal Tax Service will send messages with the amount of tax calculated according to the data it has. The message will indicate the cadastral number of the plot, the amount of tax, the tax period, as well as the data on the basis of which the tax is calculated: tax base, tax rate, amount of tax benefits, etc. However, this does not mean that legal entities no longer need to calculate the tax themselves. This responsibility will remain with organizations in the future. After all, the payer must know the amount in order to make advance payments during the year (if such are established by local authorities). And the message from the tax office is more of an informational nature. And he will receive it after the deadline for paying advances (see, for example, letter of the Ministry of Finance dated June 19, 2019 No. 03-05-05-02/44672).

Important! Recommendation from ConsultantPlus Compare the amount of tax calculated by the inspectorate with the amount you calculated and paid. If they are equal, then the tax was calculated and paid correctly. If the amounts differ, check:... What to check and what to do in case of an error (yours or the tax authorities), see K+. Trial access to the system can be obtained for free.

ATTENTION! If you do not receive the notification, you are required to independently inform the tax authorities about your taxable property. Read about the nuances in the material “Organizations will have to report transport and land plots to the tax authorities.”

Next, we will consider the procedure for calculating land tax for a legal entity.

Calculation of land tax when changing the cadastral value in case of challenge

In the event of a change in the cadastral value by decision of the commission or court, the land tax can also be recalculated, but already on the date of filing the application to challenge: according to Art. 24.20 FZ-135 “On valuation activities in the Russian Federation” (novation introduced by Federal Law dated July 3, 2016 N 361-FZ), information on the cadastral value established by a decision of a commission or court is applied for the purposes provided for by the legislation of the Russian Federation from January 1 of the calendar year , in which a corresponding application for revision of the cadastral value was submitted (but not earlier than the date of entry into the state real estate cadastre of the cadastral value, which was the subject of the dispute).

Similar data is contained in the Tax Code of the Russian Federation - “information on the cadastral value established by the decision of the specified commission or a court decision is taken into account when determining the tax base starting from the tax period in which the corresponding application for revision of the cadastral value was submitted, but not earlier than the date of entry into the state cadastre real estate of cadastral value, which was the subject of dispute.”

Thus, even if the application to challenge the cadastral value was submitted by the taxpayer in December 2021, and was satisfied in January 2021, the land tax will be recalculated starting from January 1, 2021.

Let us also consider the case when a change in the cadastral value of a plot occurred on the basis of a relevant resolution of local authorities. Let's assume that in the middle of the year (that is, during the tax period) the authorities increased the value of land. Accordingly, the tax base has also increased. What should a taxpayer do - urgently recalculate taxes and advance payments for the entire year? Be prepared for sanctions for underpayment?

However, the Tax Code of the Russian Federation can help here, which states that acts of legislation on taxes and fees, ... establishing new obligations or otherwise worsening the situation of taxpayers or payers of fees, do not have retroactive force. The cadastral value that increased in the middle of the year, of course, significantly worsens the organization’s position, and it can try to prove this in court. The latter take the side of taxpayers (see, for example, the Appeal Ruling of the Supreme Court of the Russian Federation dated 06/08/2017 N 16-APG17-3).

When the qualitative and (or) quantitative characteristics of real estate objects change, entailing a change in their cadastral value, the body performing the functions of state cadastral valuation determines the cadastral value of real estate objects. The corresponding changes are made to the Unified State Register of Real Estate and Real Estate Objects (USRN).

The procedure for calculating and paying land tax on a plot (basic formula)

How is land tax calculated for 2021? At first glance, it’s usually: we multiply the tax base by the rate. In this case, the cadastral value of the land established at the beginning of the corresponding tax year serves as the base (clause 1 of Article 389 of the Tax Code of the Russian Federation).

Important! Hint from ConsultantPlus Where to find the cadastral value of a plot for land tax There are several ways to find out the cadastral value: order an extract from the Unified State Register of Real Estate... You will find two more ways to find out the cadastral value in K+. You can get trial access for free.

If land is bought or sold during the year, the land tax formula will be adjusted taking into account the period of land ownership (the coefficient Kv is calculated as the ratio of full months of land ownership to 12 months). A month in which the ownership right arose before the 15th day or was lost after the 15th day is considered complete (clause 7 of Article 396 of the Tax Code of the Russian Federation).

A different coefficient (Ci) should be applied if the cadastral value changes during the year.

How the tax is calculated in this case, read the article “Calculation of land tax when the cadastral value changes.”

A special procedure for calculating land tax applies if the land is located on the territory of two municipalities at once. Then the cost of the plot is divided between these entities, taking into account the share of area located in each of them (clause 1 of Article 391 of the Tax Code of the Russian Federation). And for each part, its own tax calculation is made using the benefits and rates corresponding to each of the entities.

An example of determining the base for land tax if the site is located in the territories of two municipalities from ConsultantPlus Organizational site with an area of 1,000 square meters. m is located on the territories of two municipalities (MO). Municipality No. 1 accounts for 480 sq. m, for municipality No. 2 - 520 sq. m. m The cadastral value of the plot in the Unified State Register of Real Estate as of January 1 of the year is 2,000,000 rubles. Let's determine the share of the plot for each municipality: For the full example, see K+. This can be done for free.

The company is required not only to calculate land tax based on the cadastral value using all coefficients - it is equally important to report to the tax office on time and pay the tax.

How to calculate and pay tax, read the article “Land tax for the year - how to calculate and when to pay?”

Regional law may require quarterly advance tax payments. Each such payment is calculated as ¼ of the annual tax amount (clause 6 of Article 396 of the Tax Code of the Russian Federation) taking into account the number of months of ownership in the corresponding quarter (clause 7 of Article 396 of the Tax Code of the Russian Federation).

We tell you when to pay advance payments for land tax in the article “Deadlines for paying advance payments for land tax.”

Cadastral value

When calculating land tax, use the cadastral value of each land plot established as of January 1 of the year, which is the tax period (paragraph 1, clause 1, article 391 of the Tax Code of the Russian Federation). If the land plot was formed during the tax period, use the cadastral value established on the date of registration of such a land plot with the state cadastral register (paragraph 2, paragraph 1, article 391 of the Tax Code of the Russian Federation).

To learn whether land tax needs to be calculated if the cadastral value of the land is not determined, see What property is subject to land tax.

Situation: how to find out the cadastral value of land to calculate land tax?

You can find out the cadastral value on the official website of Rosreestr or by submitting a request to the territorial office of this department.

You can submit a written request for information about the cadastral value to the territorial office of Rosreestr in person or by mail. You can also send your request electronically by filling out a form on the Rosreestr website. This follows from the provisions of paragraph 14 of Article 396 of the Tax Code of the Russian Federation, paragraph 1 of Article 14 of Law No. 221-FZ dated July 24, 2007 and paragraph 50 of Order No. 292 of the Ministry of Economic Development of Russia dated May 18, 2012. Information is provided free of charge within five working days from the date of receipt of the request by the Rosreestr department. This is stated in paragraphs 8 and 13 of Article 14 of the Law of July 24, 2007 No. 221-FZ.

In addition, the cadastral value of a land plot can be found on the interactive map on the official website of Rosreestr. This is stated in paragraph 6 of Article 14 of Law No. 221-FZ of July 24, 2007 and Decree of the Government of the Russian Federation of February 7, 2008 No. 52.

Calculation of land tax based on cadastral value using an example

Let's see how to calculate land tax for 2021. For example, a company that registered ownership of a land plot on January 21, 2020, found out its cadastral value at the beginning of the year (980,000 rubles) and the tax rate (1.5%) in force in the relevant area (from the local land regulatory legal act). These legal acts do not provide benefits or increasing coefficients.

Let's calculate land tax in 2021:

980,000 rub. × 1.5% × 11/12 = 13,475 rubles,

Where:

11/12 is a coefficient that takes into account the full months of ownership of the plot (from February to December) from the 12 months of 2021. January is not included in the calculation, since the right to land arose in the second half of the month.

Let's look at an example of how to calculate land tax if local land legislation provides for advance payments. Using the initial data of the previous calculation, we obtain the following:

- The advance payment for the 1st quarter of 2021, taking into account the number of months of ownership, will be 2,450 rubles. (1/4 × 980,000 × 1.5% × 2/3);

- for each of the following reporting periods (for half a year and 9 months of 2021), the payment will be 3,675 rubles. (1/4 × 980,000 × 1.5%);

- at the end of 2021, it will be necessary to pay to the budget an amount equal to the difference between the full tax amount calculated for the year, taking into account the number of months of ownership, and the amount of advance payments accrued for this year (13,475 – 2,450 – 3,675 × 2 = 3,675).

IMPORTANT! The tax is paid in full rubles (observing the rounding rule) - this is established by Art. 52 of the Tax Code of the Russian Federation.

Download a sample payment order for payment of land tax here .

Land tax benefits

When calculating land tax in 2021, you should first take into account the preferences provided by federal legislation. With regard to individuals, complete exemption from it is provided only for the Far Eastern, northern and Siberian indigenous residents who belong to small nations that traditionally manage their economies and maintain a corresponding way of life.

In the same article. 395 lists organizations that do not pay land taxes.

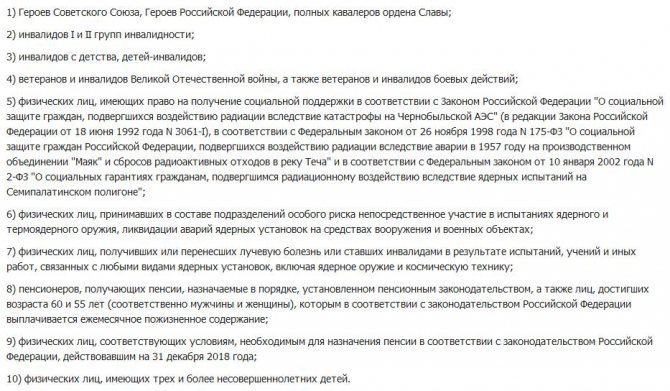

In 2019-2020, innovations introduced into the Tax Code regarding the expansion of benefits for individuals at the federal level began to take effect. According to paragraph 5 of Art. 391 is supposed to reduce the tax base by the cadastral value of six hundred square meters of land for a number of categories of individuals.

The largest category of beneficiaries at the federal level were pensioners.

Let us add to this list those who received preferences on the basis of regulations adopted by the representative bodies of the Moscow Region.

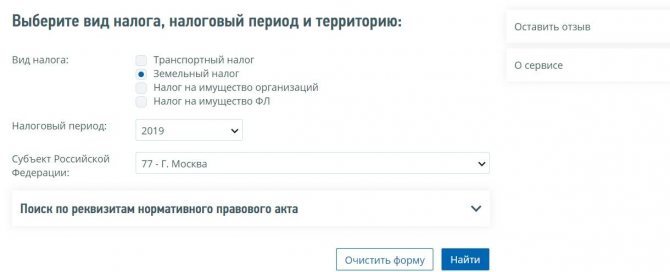

To accurately determine the benefits provided, go to the page of the official website of the Federal Tax Service. Then all you have to do is fill out the form provided and receive a response to your request.

How to calculate land tax taking into account the benefits?

Benefits contained in the Tax Code of the Russian Federation or established by local authorities can exempt a company from paying land tax in whole or in part (Article 395 of the Tax Code of the Russian Federation).

If municipalities have provided a benefit for a company's land plot, the tax is calculated taking into account this benefit.

Let's continue our example of calculating land tax: a company has located a scientific center on its land plot (it occupies 20% of the area and is used for its intended purpose), and local authorities have provided tax exemption for land plots used to house scientific institutions.

The land tax will then be calculated as follows.

- Let's determine the tax base:

(980,000 rub. – 980,000 rub. × 20%) = 784,000 rub.

- Let's determine the amount of tax at a tax rate of 1.5% and coefficient (Kv) = 0.9167 (previously calculated as 11/12):

784,000 rub. × 1.5% × 0.9167 = 10,780 rubles.

Read more about the benefits established by the Tax Code of the Russian Federation in the article “Object of taxation of land tax” .

Calculation features

If a land plot is located on the border of a municipality in such a way that it is simultaneously located on the territory of two or more municipalities, then the tax base is calculated in proportion to the share of the land plot in a given municipality based on its local cadastral value.

For example, if 1/3 of the plot is located on the territory of a municipality with a cadastral value per square meter of 10,000 rubles, and 2/3 is on the territory of a municipality with a cadastral value per square meter of 8,000 rubles, then the cadastral value (CV) of the entire plot will be: CV = (PN)*10000*(1/3) + (PN)*8000*(2/3), where PN is the total area of the land plot in m2.

- Holders of ownership rights to the plot;

- Holders of the right of lifelong inheritable ownership of the plot;

- Holders of the right to perpetual use of this plot.

Calculation of the tax base for land tax based on cadastral value is accepted in most regions of the Russian Federation, and if there is no such value for the land plot (for example, when there is no cadastral passport), land tax is not charged to the individual owner of the plot.

That is, in the absence of a cadastral passport, land tax is not subject to payment, since calculation based on standard value was canceled in 2015 for all regions except the Republic of Crimea and Sevastopol.

On the Crimean peninsula, until 2021, for plots that do not have a cadastral value, the tax base is calculated using the formula NB = (NS)*II, where II is the inflation index established for the Crimean peninsula at 3.8 since 2014.

When calculating the tax on buildings and structures for individuals, the cadastral value for these buildings may also be absent. In this case, the calculation takes place based on the inventory value of taxable buildings and structures.

The inventory value is often much lower than the cadastral value, and therefore not all building owners strive to obtain cadastral passports and pay a large amount of tax, but it will be possible to pay the inventory value only until January 1, 2021.

This cost was determined and fixed as of November 1, 2013 based on the following factors:

- Wear and tear of buildings;

- Cost of building materials;

- Cost of construction work.

Individuals can find out the inventory value for calculating building tax in the following ways:

- Write an application to the BTI;

- View on the Rosreestr website;

- View on the State Services portal;

- Get it at Multifunctional Centers.

When determining the amount of tax in the absence of a cadastral value, the tax base is determined as the product of the inventory value of a residential building or structure by a special deflator coefficient (CD), established annually by the Government of the Russian Federation. In 2021, the value of this coefficient is 1.425.

The tax rate with this method of calculation is differentiated and varies depending on the size of the tax base, calculated based on the inventory value and the value of the deflator coefficient.

For NB amounts up to 300,000 rubles, the rate ranges from 0 to 0.1 percent.

If the NB is more than 300,000, but less than 500,000 rubles, then the rate varies from 0.1 to 0.3 percent, and if the NB value exceeds 500,000 rubles, then the rate can be set in the range from 0.3 to 2 percent .

The specific rates for the tax on buildings and structures for individuals in a particular municipal district are established by the authorities of this district within the specified limits.

If local authorities have not adopted local acts on the value of the tax rate, then its size will be 0.1 percent for a tax rate up to 500,000 rubles and 0.3 percent for a tax rate exceeding 500,000 rubles, in accordance with paragraph 6 of Art. 406 of the Tax Code of the Russian Federation.

pay two taxes

Tax calculations for individuals are carried out by tax service employees, but checking the correctness of the tax authorities’ calculations will help in some cases to detect errors by the Federal Tax Service and reduce the final tax amount.

Is it possible to calculate land tax paid by legal entities online?

How to calculate land tax online? This is a completely natural question with modern automation of settlement processes. Services for calculating tax amounts using an online calculator are offered by many websites.

But you can take advantage of these offers if the tax calculation algorithm is quite simple (for example, there are no benefits, and the site is located on the territory of one municipal district). Otherwise, you will not be able to find a universal calculator.

As practical experience shows, it is better to calculate land tax using a formula you created yourself (automating the process using Excel spreadsheets or other proprietary computer developments).

And for individuals and individual entrepreneurs, a special service is available on the Federal Tax Service website, which will calculate the amount of tax online. See details here .

How to calculate land tax in 2021: calculation formula and examples

Features of the tax

Who pays.

According to the law everyone who owns plots of land must pay for land ownership, registered for permanent use or lifelong inheritable possession. A very limited category of Russians have the right not to pay at all. This includes residents of the Far North - small indigenous peoples living in regions with a harsh climate. There are no other categories of Russians completely exempt from this payment at the federal level, although the law provides for benefits, which we will discuss in detail below.

Tax amount.

Payment for land goes not to the federal, but to local budgets, so how much to pay is dictated by local authorities. Regional leaders cannot increase the rate at their own discretion; it is fixed by law and amounts to:

- 0.3% for lands for social purposes, that is, used for building houses or running personal peasant farms;

- 1.5% for other lands - usually this category includes plots for commercial use.

But you can reduce the rate down to zero. It is also possible to exempt some categories of people from paying altogether. So in most regions, veterans and disabled people, large families, and pensioners do not pay for land. There are no such benefits in federal laws. They may be operating in your area.

To find out exactly, you can contact the tax office in your city or look at the information service of the Federal Tax Service, which provides data on benefits not only for land, but also for other mandatory payments.

Who performs the calculation of land tax?

The tax office calculates the fee for land ownership. The owner does not need to do anything, just wait until the payment arrives, and it will indicate the amount to be paid. The letter must arrive by mail at least one month before the payment deadline. Payment must be made before December 1, which means the notification must be received no later than November 1.

With the advent of electronic services, the Federal Tax Service actively recommends that taxpayers use them. Letters in the mail are often lost, which causes dissatisfaction with people and controversial situations. On the tax office website you can register a personal account and receive notifications there.

Information in your personal account appears earlier than it arrives by mail, and if the tax amount raises questions, you can file a complaint in advance and demand that the tax be recalculated. True, for this it is important to understand how the land tax is calculated and to justify the requirements for recalculation, for example, to provide documents confirming the right to the benefit.

How to calculate land tax

Since 2015, there have been more questions in this area, and all because tax authorities have switched to a new regime for calculating tax amounts. Previously, the standard value of plots was used for this, today - the cadastral value.

The standard price for social land is lower than the cadastral price, since when calculating the standard value, it is taken into account what potential income can be received from conducting any activity on this land. If the plot is intended for building a residential building or running a dacha farm, it is impossible to expect any income from it, therefore the standard value of such land was low.

The cadastral valuation takes into account completely different factors. Here, the area, location, availability of communications, and infrastructure, that is, the cadastral value is close to the market price of the land, which means it cannot be low. The larger the city, the more expensive the land in it; the further into the regions, the cheaper. Therefore, calculating the tax on a land plot of the same area in different cities gives completely different amounts, because the cadastral value of land can differ several times.

The calculation of the cadastral value of land is carried out by expert organizations, in other words - private firms with which local authorities enter into contracts. The data is transferred to Rosreestr, which maintains a database of the cadastral value of plots. To find out how much your plot was valued and what amount to calculate from land tax, you need to go to the Rosreestr website, enter the cadastral number in the form and send a request. The data should appear on the screen within a few seconds.

Benefits when calculating land tax

The transition to a new regime for calculating land tax has significantly increased the amounts in the bills of many Russians. To soften the tax burden for the most vulnerable categories, a federal benefit of 6 acres was introduced. They can use it:

- pensioners - not only by age, but also those who receive a social pension;

- disabled people;

- people of pre-retirement age - women after 55 years and men after 60 years;

- veterans;

- combatants;

- military pensioners;

- large families

For them, when calculating land tax, the rule applies - the amount is not paid for the entire plot, but only for the difference from the area and 6 acres. If the area of the plot is less than six acres, you do not need to pay anything, if it is equal to this figure, the same. But if the plot is 8 acres, you will have to pay tax, but only for 2 acres.

If you bought a plot and have not owned it for a full calendar year, the fee amount should be less, taking into account the time of ownership. If you do not own the entire plot, but only part of it, then the tax will be a multiple of this part, and each owner will receive his own payment.

If there are several plots, you will have to choose which one to pay the full amount for, and which one will have a discount. It is provided upon application, which must be filled out using a form and sent to the tax post office or through your personal account. You can indicate to the tax authorities which area the benefit should apply to, for this you also need to fill out an application. If this is not done, the amount will still be recalculated, but at the discretion of the Federal Tax Service. Typically, the site with the highest tax amount is determined to be preferential.

Formula for calculating a plot of land and examples

The land tax can be calculated using the formula:

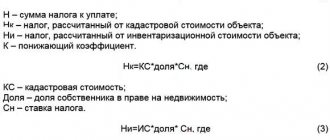

Н = Кс × Рд × Нс / К

The formula uses the following values:

- N - tax payable or the amount that the tax service must present to you;

- Kc is the cadastral price of the plot, you can find it out on the Rosreestr website;

- Rd - the size of your share if the plot has several owners. If one — we take this parameter as one;

- NS - tax rate, the standard is set at 0.3%, in your region it may be the same or lower, you can find out exactly on the Federal Tax Service website;

- K - ownership coefficient, which takes into account the duration of ownership of a plot during a calendar year, with the year of ownership taken as 100.

Let's look at examples of how to calculate land tax.

Ivanov has a plot of 6 acres.

The cadastral value is 2,000,000 rubles. The owner does not have any benefits, the plot has belonged to him for a long time, he is the only owner. As a general rule, the amount will be calculated as follows:

N = 2,000,000 × 0.3 / 100 = 6,000 rubles

Ivanov is a pensioner, and he has a dacha plot of 6 acres.

He doesn’t pay for the land, because the area is equal to the preferential one.

Ivanov is a pensioner, the area of his plot is 8 acres,

and the cadastral value is 3,000,000 rubles. When calculating, you need to subtract the preferential 6 acres from this area in order to clarify the tax base.

3,000,000 / 8 = 375,000 rubles - cadastral value of 1 hundred square meters

375,000 × 2=750,000 rubles - cadastral value of 2 acres, from which the tax will be calculated

N = 750,000 × 0.3 / 100 = 2250 rubles

Ivanov bought a plot of 6 acres in October,

he has no benefits. Cadastral value - 2,000,000 rubles. The amount will be calculated taking into account the ownership period, which is 3 months or 0.25 part of a year. We think like this:

N = 2,000,000 × 0.3 / 100 × 0.25 = 1,500 rubles

You can calculate the amount yourself or use the online calculator on the Federal Tax Service website. Or you can enter your Taxpayer Identification Number (TIN) into the form on the Autonalogs website and within a few seconds find out what tax payments have been accrued to you. You will see not only land tax, but also property and transport taxes, if you are required to pay them, and you will also be able to pay tax fees online without registration.

Calculation of the amount

In accordance with Articles 390, 403, when calculating the amount that the taxpayer must annually contribute to the budget, the cadastral value is taken into account. The latter is determined according to the approved procedure and can be changed, but without recalculating previously paid amounts.

Starting in 2021, the deflation coefficient is no longer used in calculations, which has simplified the calculations somewhat.

And yet, since when determining the final amount it is necessary to take into account all sorts of additional factors, including the possibility of receiving benefits, for calculations it is better to use a convenient calculator posted on the official website of the Federal Tax Service.

During the calculations, the payer will need to indicate the type of object, reporting year, cadastral number, and provide other necessary information, including those giving the right to benefits.

In general, the tax rate on a land plot, determined by part 1, paragraph 1 of Article 394, is 0.3% of the cadastral valuation. In addition, part 2 of the same article allows regional authorities to change general rates, in particular, depending on the method of land use.

In accordance with Part 2, paragraph 1 of Article 406, the tax rate of 0.1% of the cadastre value applies to:

- All residential buildings located on the site and registered in Rosreestr. In this case, 50 m2 is first deducted from the taxable area. After this, the cost is multiplied by the current rate, and then the benefits are subtracted.

- Unfinished objects, if the owner has stated in advance that he plans to build residential premises.

- Garages and other ancillary facilities. The most important requirement for such buildings is the area: it should not exceed 50 m2.

In the vast majority of cases, this rate will apply to a country house. The value can increase to 2% if the total cost of the building exceeds 300 million rubles.

In addition, a subject of the Russian Federation has the opportunity, in accordance with the same article, to set its own rates, depending, for example, on the location of the house.

Read all the latest articles on tax benefits here