Home / Real estate / Purchasing real estate / Buying an apartment

Back

Published: 12/19/2017

Reading time: 7 min

0

591

Making a deposit is quite often practiced by parties when concluding transactions in the real estate market. It is a type of security that guarantees the conclusion of a purchase and sale agreement in the future on the agreed terms.

- What is a deposit and how does it differ from an advance? What is it needed for?

What is a deposit and how does it differ from an advance?

The deposit is paid upon concluding a preliminary purchase and sale agreement. It records the intentions of the parties to sign the main agreement within the stipulated time frame and at the agreed price. The need for a preliminary agreement may arise in the following situations:

- The buyer does not have the entire amount to pay for the apartment at the current moment. He would like to take some time off before he sells another property, settles an inheritance, or gets approved for a mortgage.

- The buyer wants to ensure the legal purity of the transaction by requesting the necessary information on the apartment from Rosreestr.

- The seller needs additional time to collect the necessary documentation (for example, to complete the privatization procedure or re-register an inherited apartment in his name, obtain consent from his wife, etc.); removal of all residents from the apartment, payment of utility debts or settlement of other formalities.

In essence, a preliminary agreement is enough to force the other party through court to sign the main agreement. But the risk of losing your money usually disciplines the seller and buyer very well.

The payment of a deposit is regulated by Art. 380-381. Civil Code.

What is it needed for?

After receiving the deposit, the seller undertakes not to sell the apartment to another buyer, and the price of the property is fixed and cannot be revised by him unilaterally.

In turn, the buyer, when transferring the deposit, also cannot refuse the transaction without serious reasons and prefer another property, otherwise he will lose the deposit. As a result, the apartment seller can be sure that he will receive the full amount for the apartment within a certain time frame.

A deposit should be distinguished from an advance. Although civil law does not have a clear definition of advance payment, the differences between these concepts are as follows:

- The deposit is paid by the buyer before concluding the purchase and sale agreement. The advance payment is paid within the framework of the main contract as a partial payment.

- An advance does not have such strict legal consequences in case of failure to fulfill obligations. It is not subject to a double refund from the seller and can be returned to the buyer upon his request. If the seller changes his mind about concluding the deal, he can simply return the advance payment.

- The advance payment does not serve as a security measure forcing the buyer to purchase this particular property.

Meanwhile, these two concepts have common properties: they are both taken into account as payment for the apartment and represent an amount calculated as a percentage of the full price of the property.

If the seller wants to be sure of concluding a transaction with this particular counterparty, then an agreement with a deposit is beneficial for him. Otherwise, its risks are too great.

How to return the advance if the purchase transaction did not take place?

Thus, the deposit and collateral are conditions that are beneficial, first of all, to the owner of the living space, who is thus insured against possible damage. But just as the tenant has the obligation to provide these finances, the landlord is responsible for the timely return of advance and insurance payments.

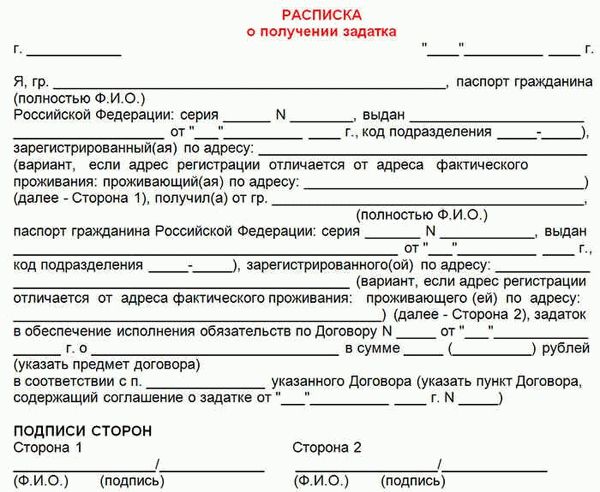

Return to content ○ Advice from a lawyer: ✔ Moved out earlier than stated in the contract, the landlord refuses to give the deposit. The owner will be right if you did not warn him in writing about your intention to vacate the living space in advance, provided that this is reflected in the contract. Return to content ✔ The landlord asks to return the keys, and promises to return the deposit later. In this case, the decision is made by the tenant personally, based on the degree of trust in the owner. If the latter receives the keys to the apartment, he will have no obstacles to its further use. Why do you need to pay a deposit for an apartment? It is not surprising that each of the contracting parties wants to have certain guarantees that the other will not violate its obligations. Thus, paying a deposit for an apartment is a completely normal stage of a purchase and sale transaction, especially in cases where it is processed with the help of a real estate agency. Typically, the transfer of the deposit to the seller occurs when a preliminary agreement is signed, which specifies the agreed amount of the deposit, and the Seller gives the Buyer a receipt of its receipt. On the other hand, no one wants to lose their money, so a potential buyer, before taking any actions, needs to understand how to return the deposit for an apartment and whether it is possible to do this in principle.

- The agreement on the deposit, regardless of the amount of the deposit, must be made in writing.

- In case of doubt as to whether the amount paid towards payments due from the party under the contract is a deposit, in particular due to non-compliance with the rule established by paragraph 2 of this article, this amount is considered to be paid as an advance unless proven otherwise.

This is important to know: Non-residential premises with a window built into the building

Is it possible to hope for the return of the deposit? The answer to this question is given by the following, Article 381 of the Civil Code of the Russian Federation:

- If the obligation is terminated before the start of its performance by agreement of the parties or due to the impossibility of performance (Article 416), the deposit must be returned.

- If the party who gave the deposit is responsible for the failure to fulfill the contract, it remains with the other party.

Deadlines

The time frame within which the parties must conclude the main agreement is determined by them independently. They are indicated in the preliminary agreement. If the prescribed deadlines expire and the agreement is not concluded, then one of the parties must send the other a requirement to sign the agreement.

When the second party evades such a requirement, legal consequences apply to the deposit: it either remains with the seller or is returned in double amount to the buyer.

If specific deadlines for concluding the main agreement are not specified, then the preliminary agreement is considered to be valid for a year.

Certificate of temporary disability of an employee - find out how to get it. Proper payroll calculation is very important. Find out about the important nuances of this process in our professional article.

If you were sent on a business trip over the weekend, then you need our material!

What should be in the contract?

The more conditions are specified, the better. Try to be as specific as possible. It is necessary to indicate, regardless of the type of contract:

- Parties' data. In this case, an agreement must be concluded with the owners of the apartment.

- Detailed information about the property, all owners and registered in the apartment.

- The amount and period for which an advance, deposit or security payment is made. If the transaction is alternative, that is, several apartments are sold and bought at the same time, then prepayments must be made for the same period.

- What should the parties do during this time? For example, the buyer needs to get a mortgage or sell his property, the seller needs to collect all the documents, and so on.

- List of documents that need to be prepared: an extract from the house register, certificates of no debt, permission from the guardianship authorities, consent of the spouse if the apartment was purchased during marriage, etc.

- How the parties notify each other: by regular mail or email.

- How and when will the money be returned?

- When should tenants deregister and physically vacate the apartment?

- Factors that may subsequently affect the buyer's ownership so that he can return the money without loss. They must be identified by legal due diligence.

- Reasons that may interfere with the transaction. For example, refusal of guardianship authorities or problems with legalizing redevelopment in the BTI. Refusal of other participants if the transaction involves the simultaneous purchase and sale of several apartments, etc.

- If you buy an apartment with a mortgage, then be sure to include a clause about the bank’s disapproval of the loan or the real estate itself.

- And finally, the date and place of the transaction are stated - the bank, the notary, who bears the costs of registration, the deposit box, notary expenses and how this is compensated.

This is important to know: Canopies over the entrances of apartment buildings

Olesya decided to buy a one-room apartment on the secondary market with a mortgage. She was approved and given 90 days to find an apartment. An option was quickly found and an advance was made through the realtor. But for some reason the bank did not approve the apartment. The seller himself bought another property and paid a deposit for it. He believed that the deal fell through due to the buyer’s fault and refused to return the “advance payment.”

What was done wrong?

The bank's refusal is considered a circumstance beyond the control of the seller or buyer. Therefore, it is no one’s fault that the deal did not take place. Of course, if all parties had initially discussed this situation and included the corresponding clause in the contracts, then the problem most likely would not have arisen. But even without such a clause, according to the law, the “advance” must be returned. Olesya needs to insist on her own and, if the money is not given, go to court.

Debtor accounting

Accounting for the parties to the transaction will differ. Let us present the features of debtor accounting.

Question: An organization applies the simplified tax system (“income minus expenses”) and acquires real estate using a mortgage loan. According to the loan agreement, this property must be insured. Is it legal to include the costs of insuring collateral as expenses under the simplified tax system? View answer

Accounting

The collateral remains the property of the debtor. That is, it must be recorded on the balance sheet as an asset. The object is included in detailed accounting. It also indicates that the object has received the status of collateral. Guarantees for the fulfillment of obligations must be reflected in the DT of off-balance sheet account 009. The corresponding rule is contained in the Instructions for using the Chart of Accounts established by Order of the Ministry of Finance No. 94n dated October 31, 2000. The value of the collateral property is recorded in account 009 in the amount of the collateral assessment made by the parties to the agreement.

If security is transferred to the lienholder, the change in status must be recorded in the property's inventory records or itemized records. All entries are made on the basis of the transfer and acceptance certificate.

In accounting, the transfer of collateral is not considered an expense of the entity. This is explained by the fact that this transfer does not imply a reduction in financial benefits. The basis is clause 2 of PBU 10/99.

When covering the debt, the collateral must be written off from account 009. Also, entries are made in the accounting for the subaccounts of the accounts. Entries are made that are the opposite of entries when objects are pledged. That is, subaccounts that were previously opened for separate accounting of collateral are closed.

Question: How to reflect in the mortgagor’s accounting the acquisition of pledged property from the mortgagor (a fixed asset (fixed asset) that is not real estate) and the offset of the obligation to pay it and the claim against the mortgagor secured by the collateral? The collateral secures the obligation under the loan agreement: to return the principal amount of the loan, equal to 1,000,000 rubles, and to pay interest accrued during the use of borrowed funds. The amount of interest at the time of offset was RUB 25,013.70. The cost of the pledged asset is determined by the parties to the pledge agreement to be equal to RUB 1,300,000. The foreclosure of the pledged property was carried out out of court. The repurchase of the pledged property was carried out after the auction was declared invalid. This property was purchased at a price of RUB 1,296,000. (including VAT RUB 216,000) and put into operation in the month of purchase. According to the loan agreement, interest is accrued at a rate of 11% per annum and is payable upon repayment of the loan. View answer

Tax accounting

Subclause 1 of clause 1 of Article 146 of the Tax Code of the Russian Federation states that the subject of VAT is the sale of products. This includes the sale of collateral. Article 39 of the Tax Code of the Russian Federation states that sales are considered to be the transfer of rights to property or the provision of services free of charge. When an object is pledged, there is no transfer of ownership rights. This means that no VAT chargeable object is created.

Paragraph 32 of Article 270 of the Tax Code of the Russian Federation states that the cost of the collateral is not included in the cost structure. That is, there is no object for calculating income tax either.

Question: How to reflect in the accounting of the mortgagor organization the sale of the pledged property (an item of fixed assets (fixed assets), which is movable property) to the mortgagee, if the requirement to the mortgagee to pay for the fixed asset is counted against the organization’s obligation to return the amount of a short-term loan and pay interest, which was secured by this collateral? View answer

How to return a deposit for an apartment using a receipt

All-knowing statistics say that almost every fifth real estate transaction involves an advance payment, which is transferred by the potential buyer to the seller of an apartment or private house. At the same time, many subsequently complain that if the sale and purchase fails, serious problems arise with the return of the transferred money. The main motive of the seller is the buyer’s fault that the transaction did not take place. So is there any way to solve this problem and get your funds back? We will look for the answer to this question in this article. The presence of an advance payment, which constitutes some part of the cost of the purchased housing, is stipulated in the preliminary agreement or a special receipt confirming receipt of money by the seller.

VIDEO ON THE TOPIC: Does a receipt have legal force, how to draw up a receipt, sample receipt Ukraine.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call the numbers provided on the website. It's fast and free!