Free legal consultation over the Internet 24 hoursLawyer on housing issues in St. Petersburg. Free legal consultation on labor disputes.

5/5 (3)

About the requirements for drawing up a document

A receipt drawn up by a notary must comply in content and form with the requirements established by law. Only in this case will the document be recognized as legally valid. When drawing up a receipt, the requirements of the law must not be violated.

Attention! The main requirements for compilation are:

- The document is drawn up by a citizen who borrows money. It must be written by hand. A receipt is confirmation that a person has received an item or a sum of money. You must write the text by hand in person. This will help to conduct an examination in the event of a trial;

- At the beginning of the text of the receipt, the passport details of all participants are indicated. They are completely copied from documents;

- If a person is temporarily given a thing for use, it must be described in detail in the text of the receipt, indicating its characteristics. When transferring the car, the engine number, make, year of manufacture and model of the vehicle are written down. When renting out an apartment, an inventory of the things in it is drawn up;

- Further, the text specifies the conditions under which a citizen receives an item for use, and the requirements for making a return. If money is transferred at interest, the text indicates the start date of accrual and the interest rate. The amount is written both in numbers and in letters;

- The date of compilation is indicated at the end of the document. This is a very important point, since legal documents have a statute of limitations. After three years there are no grounds for making demands. During the entire period, persons can go to court in case of conflict situations. The receipt will serve as documentary evidence;

- Both parties to the transaction sign the document and decipher the signatures.

The debt receipt does not need to be certified by a notary. This is done at the request of the citizen.

When drawing up a receipt, the passport of the citizen acting as the borrower must be checked. Any inaccuracy will lead to the deal being challenged in court.

Also, special attention should be paid to the return conditions. It is recommended that the receipt include a clause establishing liability in the event of non-return of the item or money.

The parties may invite witnesses when drawing up a receipt. This situation is not prohibited by civil law. But even the presence of witnesses will not give additional force to the document. Their testimony will be important if the situation goes to trial. Thanks to witnesses, it is possible to confirm under what circumstances and under what conditions the receipt was drawn up.

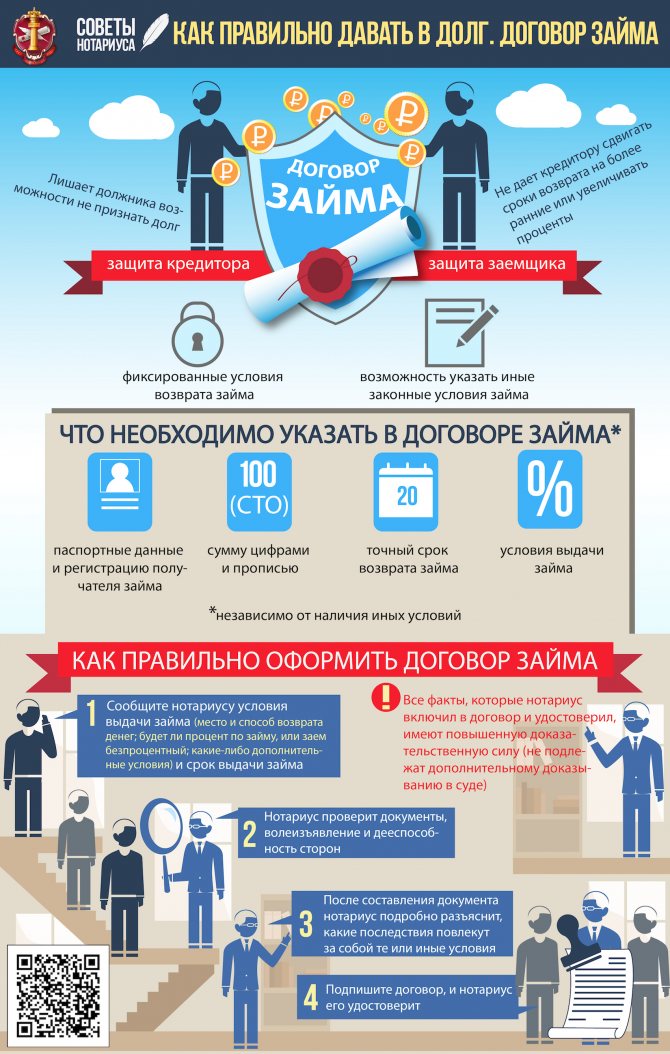

How to lend correctly. Loan agreement.

Financial issues, especially when it comes to loans to friends or relatives, often result in problems. Non-refund of even a small amount is unpleasant. And often even a small loan becomes the subject of controversy. When we are talking about serious funds, the loss of which could affect your financial well-being, the risk of conflicts between the parties increases many times over. Due to misunderstandings by the parties of the conditions under which money is given (borrowed), when the deadline for repayment comes, relations between the parties deteriorate. Sometimes it comes to a complete severance of partnerships, friendships and even family relationships. And this does not, at times, eliminate the problem of refunds or unreasonable demands.

How to protect yourself financially by depriving the debtor of the opportunity not to recognize the debt, and the debtor, in turn, to clearly understand all the conditions for the return of the amount of money and not give the opportunity, for example, to the creditor to move the terms to an earlier date or increase interest?

Undoubtedly, documentary evidence of financial obligations will help with this, with which both you and the borrower will feel calm. The most optimal option for such confirmation, which protects both parties from undesirable consequences of the transaction, is a loan agreement.

One of the main advantages of a loan agreement is that all conditions can be spelled out in detail. The receipt, which is often written in such cases, and which is considered to be the main document when it comes to debt obligations, is actually ineffective. It cannot contain any conditions. The receipt simply reflects the fact of transfer of money and the possible time frame for its return. The loan agreement, in turn, may contain installment terms and other conditions agreed upon by both parties.

The procedure for signing a loan agreement is very simple. You come to the notary, tell them: on what terms you want to give a loan, for how long, choose the place and method of returning the money, determine whether interest will accrue on the loan or whether it will be interest-free, and some additional conditions agreed upon by the parties. All these conditions will be reflected in the contract. The notary will definitely check the documents provided to him, as well as the will and expression of the parties, and make sure that the lender and the borrower are accountable for their actions. After drawing up the document, the notary will explain in detail what consequences certain conditions will entail. And only then the loan agreement will be signed by the parties and certified by a notary.

Why is it better to have a loan agreement certified by a notary? It is important to know that all the facts that the notary included in the contract and certified have increased evidentiary value, that is, they are not subject to additional proof in court. To challenge notarized facts, you must first prove that the notary performed a notarial act in violation of the law. For the court, a notarized loan agreement will be a weighty argument that confirms both the fact that the debtor undertook to repay the money within a certain period of time, and the fact that he received the money exactly on the terms specified in the agreement.

In addition, a notarized loan agreement makes it possible to use the procedure for extrajudicial debt collection using a notary’s writ of execution: https://notariat.ru/sovet/pages/tag/kak-bystro-reshit-problemy-s-vozvratom-dolgov

Any loan agreement, regardless of the presence of other conditions, must indicate: * the name of the recipient (full name, passport data and registration), * the amount in figures and words, * the conditions for issuing money (for example, the amount of interest for the use of funds or the lack of such), * exact deadline for returning the amount.

loans, commodity and commercial loans, loans, bank deposits, bank accounts or other borrowings, regardless of the method of their execution. the recipient of the loan, who assumes the obligation and guarantees the return of the funds received, as well as payment of the loan provided. A consumer loan borrower is an individual who has applied to a lender with the intention of receiving, is receiving or has received a consumer loan (loan). A mortgage loan borrower is an individual, a citizen of the Russian Federation, who has entered into a loan agreement with a bank (credit organization) or a loan agreement with a legal entity (non-credit organization), under the terms of which the funds received in the form of a loan are used to purchase housing. The security for the fulfillment of obligations under such agreements is the pledge of the purchased housing (mortgage). The borrower under a loan agreement is a person who has received a loan and has assumed the obligation to repay it in accordance with the terms of the agreement. Legal entities and individuals who enter into or have entered into an agreement with each other. A party to the agreement may be the state (the Russian Federation, its constituent entities), which act on an equal footing with other participants in civil law relations. Under a loan agreement, one party (the lender) transfers into the ownership of the other party (the borrower) money or other things determined by generic characteristics , and the borrower undertakes to return to the lender the same amount of money (loan amount) or an equal amount of other things received by him of the same kind and quality. a written document, signed by a person, certifying that this person has received money, things or other material assets from another person and undertakes to return them. A correctly executed receipt can serve as one of the proofs of the fact of transfer of valuables, but in many cases is not a sufficient basis for their claim. An official authorized by the state who has the right to perform notarial acts on behalf of the Russian Federation in the interests of Russian citizens and organizations (legal entities). necessary elements when concluding a transaction. The internal desire of a person to complete a transaction in order to create certain legal consequences is called will, and such a desire brought to the attention of other participants is called expression of will. The will and expression of will must coincide to ensure the legality of the transaction. The person who provided the loan and acquires the right to its subsequent return and payment for its provision. an agreement between two or more persons on the establishment, modification or termination of civil rights and obligations. This is a person who, by virtue of an assumed obligation, is obliged to perform a certain action in favor of another person (creditor).

Do I need to have a debt receipt certified by a notary?

The law does not stipulate that a receipt for a debt must be certified by a notary. This becomes mandatory if there are special circumstances approved by law. It is also not prohibited to contact a notary if both parties want it. Most often, the receipt is certified by agreement between the parties to the transaction.

Please note! If the document is drawn up correctly, in compliance with all norms, it will have legal force without notarization. Contacting a notary is an additional opportunity to insure yourself. Such a receipt cannot be challenged in court.

Will they give a loan if the bailiffs have a debt?

Whether the penalty can exceed the amount of the principal debt, read here.

Who is a loan donor, read the link:

How to certify a receipt from a notary: algorithm of actions

The procedure for certification of a promissory note is carried out according to standard rules. Before it is certified, the receipt must be drawn up correctly, in accordance with all legal norms.

The receipt can only be certified by a notary. But at the request of the parties, witnesses can be invited to formalize the transaction. This will become additional insurance. Witnesses will be able to testify in court if problems arise with fulfilling the terms of the contract.

A receipt for the issuance and return of funds is drawn up in two copies. It contains the date and signatures of both parties. By signing, citizens prove that they have no claims against each other.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Not everyone can draw up a promissory note on their own, taking into account all the legal requirements. If difficulties arise, it is better to contact a lawyer for help in drawing up the document.

As soon as the receipt is ready, which complies with all the rules for drafting, the parties sign and the document is taken to the notary. After he reads the text and checks the data, the paper is certified. The notary puts his signature and seal.

Watch the video. Common misconceptions about IOUs:

The debtor does not fulfill his obligations under the receipt: what to do

The parties do not always fulfill the conditions specified in the loan agreement. There are often cases when the party acting as the borrower cannot or does not want to fulfill its obligations and avoids repaying the debt.

In judicial practice, there are situations when the debtor denies that he borrowed money. This is due to the fact that the citizen is not aware of the legal force of the receipt.

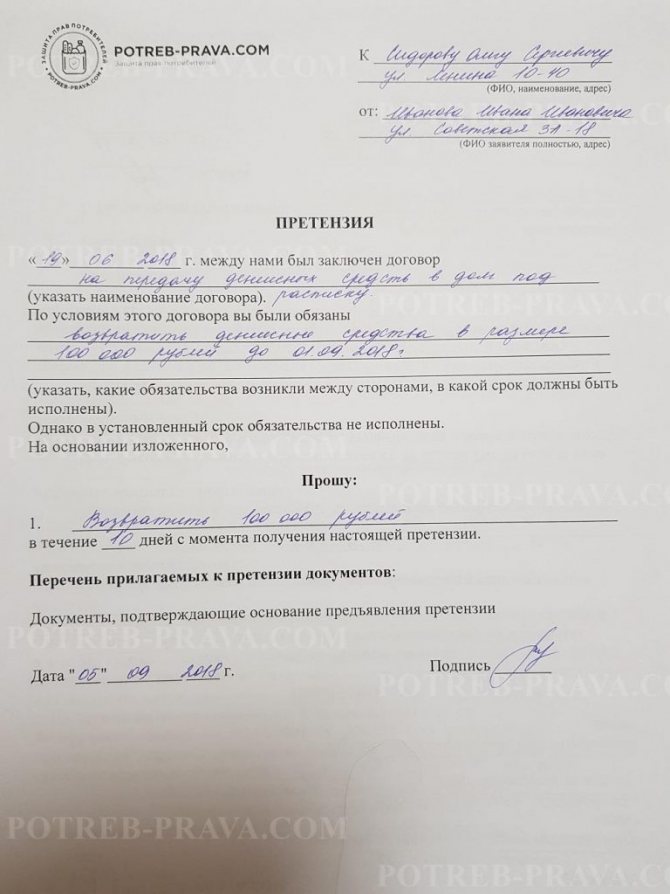

If a party to a transaction is faced with a situation where they refuse to repay the debt, they need to formally demand the repayment. This must be done in writing and sent by registered mail with return receipt requested.

ATTENTION! Look at the completed sample pre-trial claim for debt collection by receipt:

Features of the money donation agreement

This is an agreement on the free transfer of property from one person to another. Since funds are recognized as one of the types of property, they can be transferred free of charge to other persons.

The notary comments:

To transfer a large sum of money through a notary, an agreement is drawn up, which confirms that the transaction is carried out voluntarily, without coercion from one of the parties. A written form of conclusion is required if the amount exceeds 5 thousand rubles. Let us determine the essential terms of the gift agreement:

- Subject of the agreement. This is the amount that the donor transfers free of charge to the donee with his consent.

- Release from obligations to the donor. Donation involves gratuitousness, that is, the donee does not have to fulfill the requirements or transfer property to the donor.

Additional conditions are the period after which the contract comes into force and the transfer of the right to the gift to the heirs.