Why insure your apartment against flooding and fire?

Surprisingly, but true, it is fire and flood in a rented apartment that owners are most afraid of, but only 20% of them insure the property before renting. And most often, these are owners of premium segment housing. The rest do not want or simply do not know how to obtain insurance for residential property.

For reference

According to DOM.RF , the rental housing market in Russia amounts to 240 million square meters or about 9% of the housing stock of apartment buildings. About 10% of the population live in rented property.

DOM.RF has submitted a bill to the relevant departments for consideration on the creation of a specialized platform for rental housing to account for relations and settlements between tenants and owners.

Home insurance can protect the property owner's property interests. Thanks to an insurance policy, you can compensate for damage caused to property due to the occurrence of insured events: flooding, fire, mechanical damage to property or illegal actions of third parties. According to the law, the homeowner is entitled to compensation for damage caused within the insured amount. Under an insurance contract, compensation payments are borne by the insurance company.

Insurance of residential premises against fire and flooding

You can protect your home, yourself and your loved ones from both disaster and material loss by insuring your apartment or house against fire or flooding. The insured can be either the owner of the property or the tenant, if such an obligation is assigned to him under the rental agreement. Home insurance against fire and flood has become commonplace in recent years. A fire takes away almost everything, and floods in apartments are also not uncommon due to worn-out utility networks. Therefore, apartment owners, in order not to feel in fear, annually insure their homes against fires and floods, since this often becomes the only way to compensate for losses.

How can you protect yourself from wasting money insuring your apartment against fire and flooding? To do this, certain rules must be followed. Having insured an apartment, you should not hope that the damage will be compensated only with one statement of the occurrence of an insured event.

An insurance claim must be justified and always based on evidence. Therefore, in order to pay compensation, it is necessary to prepare a flood (fire) report. This document is drawn up by representatives of housing and communal services in the presence of witnesses, who may be neighbors or acquaintances.

If utility services are to blame for a fire or flood, representatives of the management company will probably try not to reflect this fact in the document. In this case, you should include the relevant information in the document when signing it and contact independent experts. We should also not forget that the culprits of a fire or flooding of an apartment may be its owners. There are many possible reasons: from a broken valve and smoking in bed to a broken washing machine and matches not hidden from children. In such a situation, only a civil liability policy for the apartment owners will help compensate for the damage. When registering, you can specify a material limit within which the insurance company will compensate for the damage you caused.

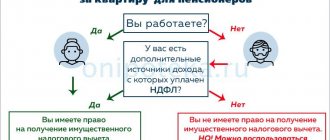

Who should insure property?

You or your neighbors have already spent money on buying a home and good repairs, so it is equally important to take care of preserving your investments and insuring yourself against unforeseen risks. Moreover, sometimes insured events occur due to circumstances beyond your control.

So, if you rent out an apartment and also go away often and for a long time, you should insure it. An additional reason to take out insurance could be fresh renovations from the neighbors below or inattentive neighbors above who have already flooded you a couple of times.

By the way, an apartment can be insured not only by the owner of the property, but also by the tenant himself, but only if he has a lease agreement for this residential premises, which stipulates responsibility for the safety of the real estate and other property.

And keep in mind that before purchasing a policy, it is better to notify the insurance company that the apartment will be rented out. Some companies may refuse to pay the compensation amount if the owner does not live in the apartment (carefully read the contract and insurance conditions). And also the cost of insurance for a rental apartment may be slightly higher.

Rental apartment insurance

Many apartment owners think about the need to insure them before renting them out, but few ultimately resort to the services of insurers. Only those owners who understand how expensive property an apartment is take out an insurance policy, and the elements do not choose a “victim”. How and from what should you insure an apartment when renting? The choice of insurance risks here is more varied than when insuring your own home, since tenants can often be negligent in their rented apartment, not considering it their home.

Unfortunately, an apartment cannot be insured against property damage: no company will insure an apartment against a tenant. To avoid such a risk, you just need to draw up a contract correctly. You can insure your apartment against natural disasters or the impact of third parties (flood, robbery, fire, etc.). A smart approach would be civil liability insurance.

If damage to neighboring apartments is caused by the fault of the tenant, the owner of the property will not suffer serious losses. Of course, it is better to shift responsibility to third parties to the tenant of the apartment by drawing up a rental agreement accordingly, but not every tenant will take on such responsibility without an insurance policy.

Registration of a policy does not take much time, but having issued it, you can be sure that the costs of insurance will be fully recouped. This opportunity should not be neglected, since the elements do not choose a “victim”, and possible damage can cost large financial costs and several years of work. Paying insurance premiums monthly is much easier than dealing with the problem yourself if something goes wrong. And taking out insurance gives the owner confidence in the future. Take care of yourself and your home!

What types of insurance do landlords most often use?

There are two types of insurance: property insurance and third party liability insurance. The difference is that in the first case, you receive compensation, and in the second, insurance compensation is paid to those affected by your actions.

Property insurance

Protects your apartment. You can also include the things that are in it: furniture, appliances, antiques and other valuables. In case of damage, the insurance company guarantees compensation. But at the same time, if a fire started in your apartment, you will need to prove that it was not your fault.

When applying for insurance, you can add to the policy the risks from which you want to protect yourself. Therefore, study all possible options for the occurrence of insured events, both during a fire and during a flood.

Civil liability insurance

Liability insurance is more expensive to insure than personal property. But at the same time, a civil liability insurance policy will free you from the need to compensate for damage to your neighbors caused by your fault. In this case, you will have to restore your property yourself, and compensation for the losses of your neighbors is the responsibility of the insurer.

Advantages of apartment insurance in Soglasiya

Wide coverage

- Design products with the ability to combine insurance objects and risks

- A simplified procedure for issuing a policy is possible (without inspection, photographs and inventory)

- Flexible insurance periods from 1 month to 1 year

Quality settlement

- Minimum documents when settling losses

- Insurance compensation without providing documents from the competent authorities once during the year of the contract, if the amount of damage does not exceed 50% of the annual insurance premium

- Insurance payment for interior decoration without taking into account wear and tear of materials - “new for old”

Comfortable service conditions

- Flexible insurance premium payment schedule

- Informing clients via SMS

- 24-hour contact center 8 900 555-11-55

Special promotions

- Preferential conditions when switching from other insurance companies

- 13th month of CASCO insurance as a gift when signing a policy under the “My Apartment” program

- If you have a CASCO policy, you will receive a 20% discount on apartment insurance

Privileges upon renewal

- When prolonging break-even contracts:

“My Apartment” - discount up to 20%

Features of fire insurance

First, when insuring your apartment against fire, you need to decide what to insure: property or civil liability. It is better to choose both options - this way you can protect yourself as much as possible from the consequences of a fire and receive compensation if the fire occurs through the fault of your neighbors, and also not have to pay them if it is your fault.

Insuring residential premises against fires has important nuances. They must be taken into account when applying for policies. The main aspects are determined by Federal Law No. 69-FZ “On Fire Safety” .

Here are the reasons why your home may be damaged during a fire:

- Actions of firefighters when extinguishing a fire

- The fire itself - that is, the combustion that occurred in your apartment or came from neighbors

- Or, when there was no direct combustion process, but the walls turned black from smoke

When purchasing a policy, make sure that all these cases are listed in the insurance contract. Otherwise, you risk not receiving payment.

For example, the contract will indicate that compensation is due only in case of direct burning. Then you will not receive money for damage from smoke or firefighter actions.

Insurance cost

The cost of apartment insurance is high. Prices start from 1 thousand rubles. The cost is influenced by the area of the room, the material of the structures, the region of residence, and more. The price increases when housing is rented out.

Ways to reduce cost:

- when insuring an apartment against fire, take into account the features of the property - old wiring will increase the risk of fire;

- simultaneously insure real estate and a vehicle - companies provide discounts to such clients;

- renew the old policy rather than issue a new one.

Some companies offer discounts to certain categories of citizens.

Thus, apartment insurance in 2021 remains voluntary. Companies offer a wide selection of policies. They are valid for 1 year with the right of extension. The main thing is to choose an insurance company with a good reputation.

Features of flood insurance

As with fire, there are two types of insurance you can choose from when purchasing a flood policy: liability and property. In addition, insurance must also take into account all possible damage scenarios.

The most common:

- Leakage of pipes, shut-off valves and other communications

- Roof leak

- Human factor (for example, neighbors went to the country and left the tap on)

The main advantage of flood insurance is that payments can be received regardless of whose fault the insured event occurred. Insurance will not only help compensate for damage, but will also free you from litigation.

How much does it cost to insure an apartment?

On average, insurance prices vary from 0.05–0.07% of the value of the property for the year. Typically, the higher the sum insured and the value of the home, the more expensive the policy.

The cost of insurance is also affected by the condition of the apartment, especially the wiring and utility networks. As well as the number of risks specified in the insurance. Therefore, insuring an apartment against fire or fire and flooding is much more profitable than buying “package” insurance that includes explosions, plane crashes and other natural disasters.

Risks

Apartment insurance is a reliable solution that provides a guarantee of compensation for damage caused by the occurrence of insurance risks, such as:

- fire;

- arson;

- explosion;

- bay;

- illegal actions of third parties

(burglary, robbery, robbery); - falling of solid bodies, collision or impact

(on the insured property, for example, from the fall of a tree branch to the fall of airplane debris and meteorites); - natural disaster

(lightning strike, hurricane, earthquake, etc.).

You can spend the insurance payment on the purchase of materials and renovation of the apartment.

By insuring your apartment, you will not have to spend your own money on restoring your home.

An insurance policy can be issued by both the owner and the tenant of an apartment or room in an apartment building.

How to insure an apartment against flooding and fire

Many companies today engage in real estate insurance. Banks insure the property of their clients and, as a rule, sell a ready-made insurance product. There are also specialized insurance companies: Rosgosstrakh, Sogaz, VSK and others, offering a wider range of insurance offers.

Note! There are properties that cannot be insured. For example, you will not be able to obtain insurance for dilapidated and emergency housing.

Before registration, compare the cost of policies and conditions for registration in several places. This will help you choose the most advantageous offer. But also pay attention to the company's reputation. There are scammers on the market who provide services without a license and attract inattentive clients with low insurance costs.

How does the insurance process work?

Having decided on the choice of an insurance company and outlined the optimal conditions for yourself, you should make an accurate list of items for insurance. To reduce the overall cost of insurance, you can include not the entire apartment, but only the most valuable items (expensive clothes, appliances, furniture, plumbing fixtures, antiques, wall decoration, doors and windows). After compiling the list, you can call an insurance agent to conclude a contract. The specialist will easily explain any questions you may have.

Before signing the contract, it is necessary to study all its clauses in detail. Most insurance companies, as a rule, draw up contracts with personal benefit in mind, so various additional conditions and a very complex and confusing procedure for confirming damage are included in the document. Not all clients read the terms of the contract in detail, especially those clauses that are written in small print. Many victims pay attention to some of its points after the occurrence of the insured event. And sometimes it turns out that in order to prove the amount of damage caused, you need to pay experts a significant part of the amount of the insurance payment. Therefore, when studying the terms of the contract, you should be extremely careful, do not hesitate to ask and discuss unclear clauses before signing. If any of the clauses of the contract seem dubious, and the insurance agent assures that the contract is standard, it is better to simply contact another company.

A contract is an agreement between interested parties, written down on paper. This document must take into account the wishes of both parties. The concept of a “standard agreement” exists only in Russia; there is no such thing in any country in the world.

After concluding an agreement and making the first insurance premium, the client is given an insurance policy (a document confirming the conclusion of an agreement with this insurance company). The policy can be obtained immediately after inspecting the apartment or at the company’s office.

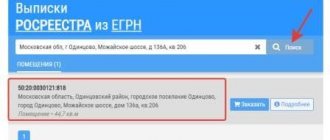

Registration of policies online

The most convenient way to resolve home insurance issues is online. To do this, you need to select a suitable company, study the offer on its website and, if necessary, use a calculator.

Next, you will need to fill out a form on the website. As a rule, they are almost the same:

- Property type

- Risks you want to insure against

- Insurance amount – the maximum amount of insurance coverage upon the occurrence of an insured event depends on it

- Information about you and the insurance object

After which you will be asked to confirm the data (for example, with a code from SMS) and pay for the policy.

The paid policy will be sent to you by email electronically and will have the same validity as a printed one on paper. Along with the policy, insurers usually send detailed instructions on what to do if an insured event occurs. It should also be on the company website.

Important! There is a nuance to executing contracts online - it is impossible to take into account the individual characteristics of the insured property. They will issue you a policy without inspecting the property. Therefore, most insurers offer the client to choose one of the already generated insurance amounts - that is, to use standard conditions. But they don't always fit.

3 814

Documents for registration

The final set of documents depends on the type of insurance and the requirements of a particular company. In all cases, you will need a copy of your passport, title documents and documents confirming the value of the property accepted for insurance. If you take out insurance under basic programs, if an insured event occurs, you will need to confirm the value of the damaged property by providing the appropriate receipts and other payment documents.

ATTENTION !!! Recently, short-term insurance has been gaining popularity. The period ranges from 7 to 60 days. It is usually used during the owner’s absence, for example, on vacation. This option is also suitable for suburban real estate.