Unfortunately, when businesses go bankrupt, it is not only big businessmen who suffer, who lose a source of huge income, but also ordinary workers and other employees who lose their jobs. Sometimes wages are not paid for months, but employees continue to come to work, hoping for the best. That is why they are so interested in how wages are paid when an enterprise goes bankrupt. And wages must be paid, even if the employee did not last until the end of the bankruptcy process and quit. Moreover, when a legal entity goes bankrupt, there are almost always arrears of wages to employees.

What happens to employees

So, the company went bankrupt, and there were not only shareholders, but also employees. They will also be hit hard. Not only may they not receive a salary for quite a long time, but they will also lose their jobs as a result, since the enterprise declared bankrupt is liquidated. Moreover, it does not matter whether the employee is a socially protected person. For example, even women on maternity leave can be fired, although a compensation mechanism will be included. In addition, in the event of bankruptcy of an organization, employees may demand:

1. Severance pay in the amount of one average monthly salary in production.

2. Receiving an average monthly salary for two months (for the period of employment). This amount will include severance pay. If an employee registers with the employment center, the number of salaries may increase to three

3. To be sent notice of his upcoming dismissal. This is necessary so that the employee has time to prepare for upcoming financial losses. Typically, notices are required to be given at least two months prior to termination.

But compensation is not everything, because employees worked and have the right to receive wages in the event of bankruptcy of the enterprise. It doesn’t matter when exactly they quit – before or after the start of the procedure, or they didn’t quit at all. True, there is a sequence that, according to the law, must be observed.

At the same time, employees, or rather their representatives, have the right:

- take part in meetings of the arbitration court;

- attend meetings of creditors;

- see the reports of the arbitration manager.

Employees have the right to demand wage arrears, defending their interests. To do this, citizens can apply not only to the labor inspectorate, but also to the prosecutor’s office or court.

Special situations

Any employee of a company being liquidated may leave it before the date specified in the notice of dismissal. Early departure is agreed upon with the manager. Such employees, instead of benefits, receive compensation, which is calculated as the average income for the period between the dates of actual and planned termination of the employment contract.

We suggest you read: Is it possible to return 13 percent on a car loan?

Payments to employees of retirement age must be issued in full, including both benefits.

For employees on maternity or child care leave, general payments must be supplemented by appropriate social benefits (for maternity or child care). If the company’s budget does not have enough funds to issue social supplements, then the employee has the right to apply directly to the Social Insurance Fund. Based on the woman’s application, the FSS will transfer the money within 10 days.

Temporarily disabled employees can also contact the Social Insurance Fund. In case of significant delays in payments, this measure is especially justified, since the internal problems of the organization should not affect the level of mandatory financial wealth of employees during whose working life social payments to the fund were made on time.

Types of debt

There are two main types of debts of a bankrupt company:

- Current. This is the name given to the amount of money that bankrupt companies must pay after bankruptcy is declared. However, the money in question was not paid to the employees. These amounts are not included in the register of claims, but they are in first place in terms of speed of compensation.

- Registry. This category includes debts on wages, benefits, vacation pay, workers' compensation before the company was declared bankrupt. Such debts are included in the register and are listed among the second-priority debts.

First of all, the debtor must pay legal costs, which cannot be avoided if you go through all the circles of hell of the bureaucratic bankruptcy procedure. Only after this will debts be paid to employees, many of whom may have worked for the company for years and built a career in it. You will also have to compensate for damage to health and morale, but only if the company has such obligations to its employees.

Companies are not always interested in transferring debts to employees; therefore, in order to protect their interests, employees can choose a representative who protects their interests. It is best for this to be a professional who has positive experience in such matters.

According to the law, debts of a current nature are initially paid, and only after that the payment of registered debts begins.

Collection of current debts

Since current debts are paid first in the bankruptcy process, let us consider the features of this procedure in more detail. It should be taken into account that the current debt on wages is taken into account separately and is not included in a special register, which includes all claims of creditors. This is a huge advantage for employees whose salary arrears are included in this list. But there is a nuance: current debts also refer to many other expenses that the debtor incurred during the trial. That is why we will consider what debts can be called current:

- legal costs that arose during the consideration of bankruptcy cases;

- payment for work arb. manager;

- payment for the services of those persons who were attracted by the AU to assist in the bankruptcy procedure (notaries, appraisers, etc.).

As a result, the costs turn out to be more than large, because even if employees stand outside the register queue, this does not guarantee that they will get at least something. This happens because debts are covered by income from the sale of the debtor’s property, which is not always enough.

Wage arrears in this situation cannot be returned through the court. The workers' demands have already been accepted, but the problem is the financial well-being of the debtor, which turned out to be so bad that it is impossible to compensate for the debts. But there is also good news. According to statistics, if wage debts are included in the current debt, most likely they will be returned to the person.

But if an employee’s rights are violated, a complaint to an arbitration court is the most objective measure. If the fact is confirmed, then the court will determine the amount of payment.

Collection of registered debts

If wage debts accumulated before the bankruptcy case began, they will be included in the register. It includes all debts, perhaps excluding current ones, which have their own category, which we discussed above. The register contains not only salary debts before bankruptcy, but also the company’s debts to creditors and third parties.

The register is compiled and maintained by a manager appointed by the arbitration court, but there may be cases when this process is handled by a special registrar organization. It is in order to get into this register that you need to contact the manager in time, otherwise you may not be included in the queue or moved too far in the queue. This is fraught with the fact that there will be no money left to compensate the debt.

In order to ensure that the requirement has been included in the register, you can contact the AU. He can issue an extract from the register, and then there will be no unpleasant surprises. But there are several conditions for how you need to send a document:

- the letter must be registered with a list of attachments;

- sent to the address indicated on the FRSB website.

In addition, in addition to information about whether the employee is included in the register, it will be interesting to evaluate other advantages of the document. It contains all the relevant information on the case, so the workers' representative can view the AC reports to stay informed about what is happening and instruct clients.

By the way, if the registry indicates the wrong amount of debt (for example, less than required), this can be challenged. However, in this case you need to seek help from the district court. His decision serves as sufficient evidence and basis for inclusion of changes in the register.

Customer Reviews

Gratitude from Plisetsky V.V. I would like to express my gratitude to Sergei Vyacheslavovich Mavrichev for his sensitive attitude and understanding towards clients. The issue was resolved within one day. I am very grateful to Sergei Vyacheslavovich.

Plisetsky V.V. October 19, 2018

Gratitude from Potapova T.I. I express my gratitude to Denis Yuryevich Stepanov for the work done, high qualifications, as well as for very clear, accessible help in solving my problem (protection of consumer rights). Excellent, very competent lawyer. Thank you very much!

Sincerely, Potapova Tamara Ivanovna, 07/09/2019

Review by Irina D. I thank the Legal Agency of St. Petersburg for the warm, sincere welcome and the detailed, competent, thorough, conscientious legal position of lawyer Andrei Valerievich.

Gratitude from Loseva S.I. I express my deep gratitude to Sergei Vyacheslavovich (lawyer of the firm) for his very clear, accessible help in solving my problem (protecting rights as a consumer). This is the second time I have contacted you to solve my problems. Always everything......and in full.

With gratitude, Svetlana Ivanovna Loseva, 02/15/2019

Gratitude from Marina Kuleshova I express my deep gratitude to Alexander Viktorovich Pavlyuchenko for his competent legal work and professionalism, as well as to his assistant Elena Vladimirovna for the qualified assistance provided. I wish you prosperity and achievement of professional heights.

Sincerely, Marina Kuleshova. 08/15/2018

Gratitude from Antonov Arkady I, Antonov Arkady Shanobich, turned to the Legal Agency of St. Petersburg for help due to the fact that when concluding an agreement for spinal treatment with Medstar, I was actually deceived in the cost of treatment and more. During the process of drawing up a treatment contract with me, no one explained to me that the treatment would be carried out using credit funds; the amount of treatment was constantly changing. My requests to be given longer time to familiarize myself with the procedures and consultations at their price list were refused. That is, there was actually pressure on the client. At home, when I carefully read the entire document, I realized that I had actually been deceived about money and treatment time. On October 30, 2018, I applied for legal assistance from the Legal Agency of St. Petersburg regarding the termination of the contract for treatment at Medstar and the termination of the loan agreement from Alfa-Bank. My case was handled by Denis Yurievich Stepanov, all issues were resolved very quickly and I was informed about all situations. I would like to thank Stepanov D.Yu. and all lawyers who work in this agency.

November 21, 2021

From Pravikovskaya N.B. I express my gratitude to the staff of the legal consultation: Andrei Valerievich and Dmitry Konstantinovich, who helped me resolve the unpleasant situation with the Pyaterochka store.

The issue was resolved in my favor without delay and quickly. They apologized to me and I received monetary compensation, all without lengthy litigation. Once again, thank you very much!

Gratitude I express my deep gratitude to lawyer Konstantin Vasilyevich for his attentive, kind, and, most importantly, very clear and competent explanation of my situation. It's nice to know that the world is not without good people. I wish Konstantin Vasilyevich good health, success in everything, prosperity, good, grateful clients and all the best. Sincerely.

Letter of thanks

Gratitude to Kavalyauskas V.A. from Astafieva A.S. I express my gratitude to the Legal Agency and in particular to lawyer Vasily Anatolyevich Kavaliauskas for the skillfully done work. Vasily Anatolyevich advised and prepared all the documents necessary for court proceedings. As a result of the consideration of the consumer rights case, the result and the high amount exceeded all my expectations. Thank you very much for your qualified work and professionalism.

Sincerely, Astafieva A.S., 03/01/2019

Queue between employees

Since one point in the queue has its own internal order, sometimes receiving a salary during bankruptcy is a rather complicated process with many misunderstandings. Everyone wants to get paid, but the further people stand in line, the less likely they are to receive compensation. And because employees put in the time and effort, they expect fair compensation rather than the possibility of it.

Even creditors who are in the same queue may not receive money at the same time. To avoid confusion, a special calendar is used. The rules here are simple: the sooner the debt appears, the sooner it will be repaid. But management is paid last. This is due to the size of their salary. If the amounts are greater than the stated limits, they go to the end of the queue (executed in the third queue). That is, they may not be compensated at all.

The amount of debt is formed taking into account:

- interest on arrears;

- vacation pay;

- compensation upon dismissal, etc.

The order of payments is as follows:

- First of all, severance pay and salary debts are returned (if the amount does not exceed 30 thousand rubles per employee).

- Next, the remaining debts to employees are compensated.

- Payment for the work of intellectual property owners.

Within queue groups, amounts are divided in equal shares.

Queue to receive wages in case of bankruptcy of an enterprise for individuals

In the event of bankruptcy of a company, salaries are issued in accordance with the priority established by law. In order to avoid confusion in the order, you will need to use a special calendar. So, the earlier the debt was formed, the sooner it will be repaid.

Managers may receive their salaries last. Because their wages have increased the most. If the amount exceeds the limits that were previously declared, it will go into the third priority category. Ultimately, they may not be compensated at all.

Taking into account what factors is the amount of debt formed in bankruptcy:

- Vacation.

- Compensation.

- Interest.

- And so on.

What does the order of payments look like:

- The first stage, which includes wage arrears and severance pay. Salary per employee should not exceed 30,000 rubles.

- Second stage. It includes debt balances.

- The third stage includes payment for the work of those persons who own intellectual property.

Documents for receiving salary

If wages need to be demanded from a company, usually the most effective measure to obtain compensation is to go to court. This is a necessary step if payment of arrears is carried out with violations or the money is not paid at all. But in order to get a positive result on your application, you will need to collect a package of documents confirming the existence of the problem and capable of correcting it. So, the documents in such cases are:

- claim in duplicate;

- a copy of the employment contract;

- a copy of the order for employment;

- a certificate showing the calculation of the salary according to the tariff grid, that is, its average statistical size is highlighted;

- a copy of the payslip for the months when wages were not paid;

- calculation of total debt;

- decision of the labor dispute commission (copy);

- when submitting documents by a representative - a power of attorney.

The list may be expanded depending on the complexity of the case and how long it has been going on. But if you were unable to receive wages for your work, you need to fight for its return. Even if the company goes bankrupt, this is still possible. The law is on your side. And to increase your chances, it is advisable to hire a good lawyer. He will be able not only to help in returning the “bare” debt, but also, if there is a chance, to receive various dividends that will help hold out until the employees find a new source of income.

When there's nothing left to take

“The procedure for collecting wage debts from bankrupt enterprises is complex,” Sergei Solodukhin, deputy head of the department for supervision of compliance with federal legislation of the Novgorod Region Prosecutor’s Office, comments on the situation to a Rossiyskaya Gazeta correspondent. — In many ways, its success or failure depends on the company’s availability of property that can be sold or leased.

For example, in one of the districts of the Novgorod region, an enterprise that owned real estate in demand among tenants went bankrupt.

Most of the employees of the company, which is now in the process of bankruptcy proceedings, were laid off; only a few guards remained on staff. Funds received from renting property allow the bankruptcy trustee to pay for the work of security guards and gradually pay off wage debts with former employees of the bankrupt.

“However, there are other examples when a limited liability company with an authorized capital of ten thousand rubles goes bankrupt, all of whose property is leased or pledged,” continues Sergei Solodukhin. “We, of course, influence the situation, meet with employees, convince them to write statements to the prosecutor’s office to send statements of claim to the court. But if no outside funds are received by the employer, if there is no property, it is very difficult to do anything within the legal framework.

In the Novgorod region, overdue wages amounted to 81.1 million rubles as of March 1, 2021. Of these, 53.6 million were accumulated by one large enterprise, 27.5 million by 24 small companies. Bankruptcies in the Novgorod region account for 85 percent of all salary debts. Therefore, employees of the regional prosecutor's office support the initiative to create untouchable bank accounts, the contents of which will be used to pay money to employees of enterprises.

“Our largest debtor, a plant in the Malovishersky district, produced equipment for a single customer - a carriage building plant from the city of Torzhok,” Sergei Solodukhin shares information. — When the Torzhkovsk enterprise began to have financial problems, the Malovishera plant also began to experience difficulties. Now, according to the bankruptcy trustee, an investor has been found who is ready to purchase the bankrupt’s property and resume production. But the investment, according to the manager, will not cover the entire salary debt, because a large percentage of the property is pledged. If this and other enterprises had in their untouchable accounts amounts equal to two wage funds, many problems would be solved. The main thing is that the bill spells out liability for employers sufficient to encourage them to comply with the new requirement.

Salary amount

Let's talk further about how to receive a salary in a bankrupt enterprise, if during bankruptcy the company changed the salary several times. This fact significantly affects the total amount of the salary paid, and employees may not agree with the presented calculations. However, companies, or rather management and judicial authorities that are involved in the bankruptcy process, act using legal methods.

For example, the court may reduce the amount of the required debt, no matter what kind of debt we are talking about - registered or current. The reason for this change is the fact that the salary increased over the last six months before bankruptcy began. Moreover, this step on the part of the company may be considered an attempt to bring it to a crisis, and then the proceedings will drag on even longer. This does not mean that the money will not be returned at all, it’s just that the difference will be paid only in the third phase, if there is enough money for it.

Let's take a closer look at how debts entered into the register are paid to employees, because there is a certain priority in it. But the unfortunate thing is that there is often not enough money to pay for the remaining debt. At best, only a few injured workers will be refunded; at worst, no one will be compensated.

Deadlines

If the bankrupts do not intend to pay the money at all, or do not pay the entire debt, it is necessary to seek justice. Persons to whom the company owes debt must be included in the register. But this needs to be done while the registry is open, and ideally as early as possible. The register will be closed two months after bankruptcy is officially declared. That is, the information was published and bankruptcy proceedings began.

Although there are cases when more time passes from the beginning of the procedure to bankruptcy proceedings, this should not stop employees from urgently filing documents. Even after this, it is important to make sure that you are included in the register, otherwise you cannot count on compensation later. There is often not enough money even to pay off the first and second stage debts, especially when the company is small and has large debts.

Employees need to be prepared to wait a long time for compensation debt, and the amount of compensation may not change for the better. Debts are compensated after bankruptcy proceedings. This is the last stage of bankruptcy, which is accompanied by several others, which last from several months to a couple of years. Only bankruptcy proceedings can drag on for six months, or even a year. This depends on many factors, such as the size of the company, the composition of its assets, etc.

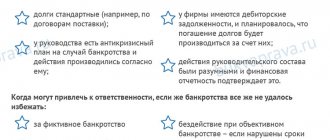

Can the bankruptcy trustee influence the amount of payments?

Yes maybe. We mentioned this right of the bankruptcy trustee when we wrote about the amount of payments. But this procedure is not the decision of the manager alone. This specialist evaluates the company’s total assets, and if he sees that they are not large enough, he submits a special petition to the court under his control. This court grants or denies pending petitions after examining the company's case. In addition, the manager can review the payment of salary in the case of a specific employee. But he cannot satisfy the demands of persons out of turn. This is illegal and is punishable by fines, removal of the manager and other sanctions.