Is it possible to take out a mortgage on non-residential premises for individuals?

Now lenders provide the opportunity for such mortgages not only for legal entities, but also for individuals.

This is due to the development of programs to support small businesses.

Some banks even allow individual entrepreneurs to pledge not only the mortgaged premises, but also any other real estate that they own.

To the garage

Individuals and individual entrepreneurs can take out a mortgage for a garage.

Some banks (for example, Sberbank) issue targeted loans specifically for the purchase or construction of garages. Of course, not all banks offer such a mortgage, but in this case, you can apply for a regular consumer loan.

Note! Garages are not real estate in themselves. They are connected to the land on which they are located. In addition, a garage must, at a minimum, have a foundation to be considered real estate.

Also, according to the law, you can take out a mortgage even for an ordinary parking space. Sberbank already practices issuing such loans.

The terms of this mortgage are:

- The minimum loan amount is 45,000 rubles;

- PV – 15% of the property value;

- Commission for using mortgage funds – 10%;

- The maximum loan term is 30 years.

With land

According to Article 69, Article 103 of the Federal Law, a land plot becomes collateral if a house purchased with a mortgage is located on it.

But there are also cases in which you can take out a mortgage and not pledge a plot of land:

- If it is municipal or federal property;

- If the area of the plot is smaller than that established in the region;

- The property is under the right of permanent use.

You can learn more about mortgages on land in this article.

Commercial real estate

It is more difficult for individuals to buy commercial real estate than for legal entities.

The fact is that legal entities, in principle, issue loans at an increased rate, and if you allow an individual to issue such a mortgage, the bank will lose its money.

Such loans are most often issued:

- For individual entrepreneurs;

- Farm owners;

- Small business owners;

- Heads of companies.

Thus, in this case, the bank will carefully analyze the activities of the company that takes out the mortgage. That is, an individual (for example, the head of an LLC) must provide not only a standard package of documents, but also company papers.

Note! Due to the peculiarities of the legislation of the Russian Federation, issuing loans for the purchase of commercial real estate is accompanied by difficulties for banks. If only because the transfer of non-residential real estate as collateral from an individual is a rather specific process, from the point of view of the law. Therefore, each case should be considered individually.

More often, such loans are accompanied by stricter conditions for the borrower.

Recommended viewing:

Largely:

- The interest rate on a mortgage can be from 11.5% to 20% per annum ;

- Loan amount from 150,000 to 200,000,000 rubles ;

- Down payment on mortgage at least 20%

- Loan term – from 5 to 15 years ;

- The building in which the premises are located must be permanent;

- There should be no encumbrances on ownership.

Commercial real estate mortgage

Commercial real estate is buildings, land plots, premises, the use of which for their intended purpose can generate profit. For example, warehouses, offices, apartments, etc.

Apartments are a relatively new type of real estate on the Russian market, which are premises with a kitchen, which are not subject to the standards in force for residential apartments. Also, you cannot register in the apartments, however, they are increasingly used for living.

You can purchase non-residential real estate with a mortgage. A loan for apartments, warehouses, offices differs from a loan for an apartment or house only in slightly higher interest rates. A mortgage loan for the purchase of non-residential real estate can be obtained by both individuals and owners of small and medium-sized businesses and individual entrepreneurs.

The acquisition of non-residential real estate is now as important as residential real estate. But in this case, you need to be prepared for the fact that obtaining a mortgage loan for the purchase of non-residential premises will be associated with certain nuances and difficulties. Not only individuals, but also business representatives, including entrepreneurs, can apply for such a loan.

Peculiarities

Such programs are launched as a result of government support for small businesses. Both legal entities and individuals have the opportunity to use them. But the design for the latter has a number of difficulties. It is worth considering the following features that individuals will encounter when choosing such a loan:

- Higher rates compared to traditional products;

- The period for which money is issued will be significantly shorter. When purchasing a home, the deadline is 30 years. And when purchasing a non-residential property there will be no more than 10.

- Entry fee - at least 30%;

- Recipients of funds are subject to fairly strict requirements. Stricter than with a classic mortgage;

- When you purchase a building, the land on which it is located usually also becomes part of the security;

- The registered object becomes collateral - in this situation, the financial institution has the right to dispose of this share and plot of land in the event of problems with debt repayment.

Registration of collateral is one of the main difficulties. The specifics of a mortgage loan for the purchase of non-residential premises are such that it will not be possible to instantly transfer the property to a financial institution. It is necessary to organize the transfer of ownership rights. There are 3 ways to implement such a scheme. One of the main scenarios is as follows: the current owner receives an advance payment (it is equal to the first payment), then the ownership rights are transferred to the new owner, and the subject of the transaction itself becomes collateral. After these steps are completed, a loan agreement is concluded and the previous owner receives the remaining amount.

Terms of service

Financial organizations have the right to formulate their own lists of requirements for clients. At least, this is not regulated by law. A person must first contact the organization chosen for cooperation and clarify all questions that have arisen. Conditions for obtaining a loan:

- Availability of Russian citizenship;

- In the case of a company, a good reputation and territorial location are important where the credit institution itself is located;

- The company must be registered in the Russian Federation and be a tax resident.

- The age of an individual is within the range of 21-65 years;

- Area - more than 150 sq.m. and the presence of capital construction status. The location in the region of registration of the bank is also important;

- The subject of the transaction is not burdened with encumbrances.

Remember that utility bills for commercial buildings are usually higher than for residential buildings. Within the framework of such products, you usually cannot use maternity capital or other housing subsidies, as well as receive a property deduction.

Specifics of non-residential premises

If for legal entities the purchase of non-residential premises is a fairly standard and already verified to the smallest detail procedure, then individuals will have to face certain, not always pleasant, nuances:

- The mortgaged property will necessarily become collateral;

- If you buy an apartment, but you cannot register in it;

- The tariff for utilities in non-residential premises is much higher, so an ordinary individual will have difficulty paying for them;

- To repay the loan, you cannot use funds from maternity capital or any other housing subsidies;

- Taxes on such a mortgage are not deductible.

What categories of citizens can be granted a mortgage loan?

The following categories of persons can apply for a mortgage for the purchase of commercial real estate:

- individual entrepreneurs;

- businessmen;

- top managers of companies and organizations.

Only banking institutions can provide them with a mortgage, which is considered an alternative to lending to legal entities. In addition to social status , the bank makes the following requirements for a potential client:

- the client's age must be between 21 and 65 years old;

- the client must have Russian citizenship.

What does the law say?

The entire process of purchasing non-residential commercial premises with a mortgage is regulated by Federal Law 102.

However, even he does not indicate all the intricacies of the process of obtaining such a loan. Everything is considered in general terms. And even then, only regarding the issue of collateral.

102 of the Federal Law regulates only the issue of collateral of such real estate. This means that the requirements for borrowers, forms and lists of documents, as well as other conditions for issuing such loans are completely established by banks. And this may not be beneficial for the borrower.

Features of mortgage lending

Mortgages on non-residential real estate for individuals are quite specific. So only in the conditions of banks you can find many disadvantages and negative aspects for the borrower.

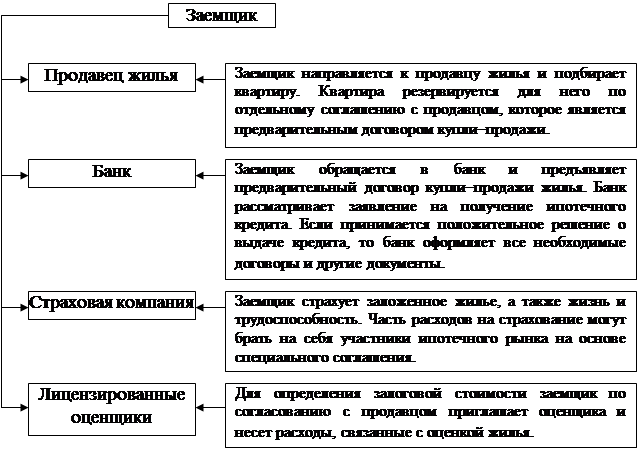

Mortgage lending scheme

Namely:

- Such a loan always provides for increased interest (up to 20% per annum);

- The borrower is given less time to pay off the mortgage. So, if you are buying a home, then in most cases, the maximum loan term is 30 years . In the case of non-residential properties, the mortgage term rarely reaches even 10 years;

- The down payment on the mortgage has been increased. You will have to pay at least 30% of the value of the property;

- The requirements for borrowers are more stringent than in the case of housing loans;

- If you buy a building, then the land plot on which it is located is also registered as collateral ;

- If the mortgaged premises are pledged as part of the common premises, then the lender receives the right to this share and the land plot .

Note! To avoid such conditions, you can take out a regular consumer loan. It is much easier to find a lender for such a loan, and you can purchase any non-residential property:

- Garage or parking space;

- Garden house;

- Outbuilding;

- Apartments.

For individuals

Sberbank offers this category of clients to obtain a mortgage loan on acceptable terms. The maximum loan amount under this program is up to seven million rubles. It is possible to obtain a loan for individuals to purchase real estate for a period of up to 10 years. The average loan rate is 15.5 percent per annum. In this case, no commission is charged to an individual for providing a loan. This category of clients has the opportunity to receive a loan for the purchase of premises for commercial purposes under an accelerated procedure. Moreover, to obtain a mortgage, a citizen does not have to be the owner of an LLC or an individual entrepreneur. Loans are also provided to individuals so that they can acquire their own real estate.

- If an individual takes out a commercial mortgage again, then the bank will offer him special, more favorable lending conditions. For each such client, the institution reviews them individually.

- If the business is related to agriculture, then the down payment amount is from 20 percent of the value of the property. In all other cases, you will have to pay an amount of 25 percent of the price of the purchased commercial property.

Terms of loan

Lenders can set any requirements and conditions, since this is not limited by law.

Therefore, each bank can present its own requirements, and for greater accuracy, it is worth contacting a bank employee directly with this question. Individuals can obtain a mortgage for non-residential premises only under the following conditions:

- An individual is an individual entrepreneur;

- A business owner, one of the founders or a major shareholder;

- Acting top manager in LLC;

- The borrower must be a citizen of the Russian Federation;

- This company must have a good reputation;

- The company must be located in the region where the bank is located;

- The company is registered in the Russian Federation and pays taxes.

- Must be between 21 and 65 years of age;

- The area of the property must be at least 150 square meters;

- The facility is located in the region where the bank is located;

- This is a capital building;

- There are no encumbrances on the property.

Useful video:

Conditions

Express mortgage

Quick loan for the purchase of real estate. The amount that can be obtained using this program reaches 7,000,000 rubles, and the term for which the loan is provided is up to 10 years. The rate is 15.5% per annum. There are no fees charged during registration, a minimum package of documents is required - in “Express Mortgage” everything is focused on the maximum speed of registration, because, as you know, time is money. A mortgage for commercial real estate under this program can be issued not only by LLCs and individual entrepreneurs, but also directly by individuals who are business owners. Another interesting option is that for those who take out a mortgage loan under this program again, special, improved conditions are provided. Moreover, how much they have been improved and by what parameters is considered in each case individually, so you will need to ask the bank’s loan specialist about this.

Business real estate

Large loan for the purchase of real estate. However, within the framework of this program, you can take out relatively small amounts: for example, amounts from 150,000 rubles are available for agricultural producers, and from 500,000 rubles for other borrowers. But the maximum amount reaches 200,000,000 rubles, and in some cities, the list of which you can check on the Sberbank website - up to 600,000,000 rubles, which is very impressive. The rate on this loan is 11.8%, and the maximum term is 10 years. In case of delay, for each day a penalty is charged in the amount of 0.1% of the amount of delay.

This program has several important features:

- with the help of its funds you can pay off debts to other banks;

- the acquisition of real estate under construction is allowed, provided that the developers are accredited;

- You will need to make a down payment - 20% for agricultural producers, and 25% for others, however, when lending secured by a property you already own, a down payment will not be required.

Banks providing loans

Not every bank is ready to provide such a loan. Typically, such an offer can only be found from a major lender.

| Bank | Lending terms |

| Sberbank (Business real estate) | You can take out a loan in the amount of up to 600,000,000 rubles, and repay it no longer than 10 years. The interest rate along with this will be about 14.5%. |

| VTB 24 (Business Mortgage) | The minimum loan amount is 4,000,000 rubles, for a period of up to 10 years. The rate is not higher than 13.5%. |

| Revival (SME Investments) | The maximum loan amount is 150,000,000 rubles, for 10 years of lending. The interest rate is not more than 15.5%. |

| Gazprombank | For each borrower, loan conditions are established individually. |

| Bank of Moscow (Commercial mortgage) | You can borrow no more than 150,000,000 rubles for a period of up to 7 years. The rate will also be calculated on an individual basis. |

Commercial mortgage for business: features

This type of mortgage has been widespread throughout the world for a long time, but in Russia they began to “look” in this direction relatively recently. Such a mortgage implies receiving income from one’s own business activities, and therefore, unlike residential mortgages, it is issued by commercial banks on more stringent conditions. The collateral can be strictly those premises that are already owned by the borrower. You can purchase any non-residential real estate, be it offices, warehouses and other similar areas.

Several features that distinguish a commercial mortgage:

- high interest rate (starts from 12%, Sberbank of Russia offers an even higher rate - from 18%, but with the possibility of early repayment of the loan);

- the repayment period, relative to non-commercial offers, is quite short: maximum - 12 years, minimum - 5 (large Russian banks such as Sberbank and VTB offer mortgages for a maximum period of up to 10 years);

- the down payment is at least 20% of the cost of the purchased property (in some cases, there may be no down payment, subject to the provision of additional collateral).

For the convenience of calculations, bank websites provide calculators for individual calculation of commercial mortgage rates.

The interest rate and monthly payment amount are calculated based on the loan repayment period and the required amount of funds. When the bank considers an applicant’s application, it takes into account such points as length of service and total income of the enterprise/organization.

Registration process

When applying for such a mortgage, the borrower will have to adhere to the following instructions:

- Submitting an application with attached documents;

- Waiting up to two weeks for the bank to review and approve the application;

- The loan amount and other conditions are calculated;

- The borrower selects a property and submits its documents to the bank;

- After approval, a mortgage agreement is concluded;

- Buying a property;

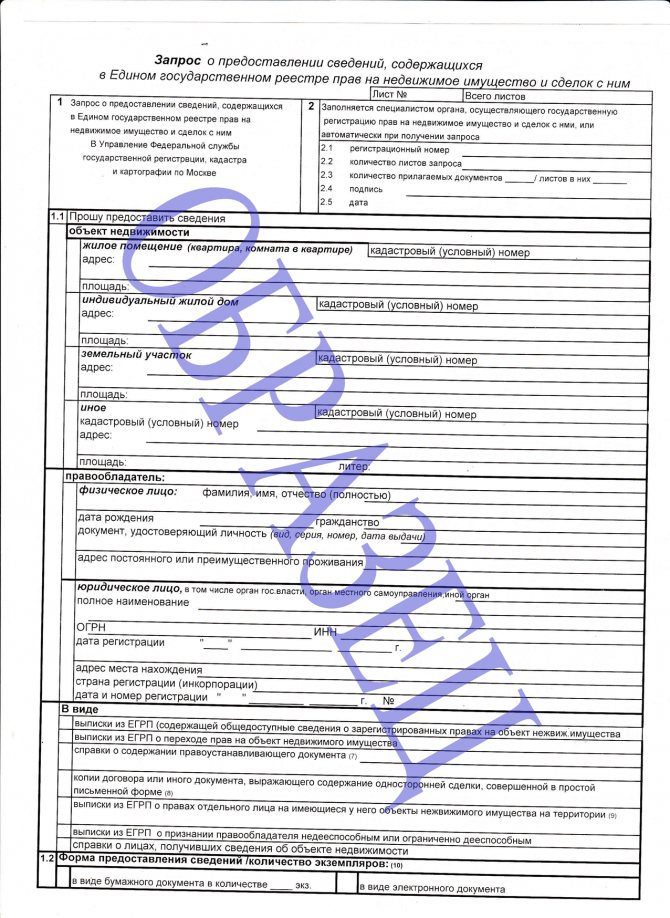

- Registration of the transaction in Rosreestr.

Registration procedure

Required list of documents

When applying for a mortgage, you will have to provide the bank with the following documents:

- A company employee brings the charter;

- Agreement on its creation;

- Extract from the register;

- License to operate;

- A certified sample signature of the manager and an imprint of the company seal;

- An individual entrepreneur must provide a passport;

- Document from registration;

- License;

- Sample of your signature;

- You also need to bring information about the head of the LLC and the financial condition of the company;

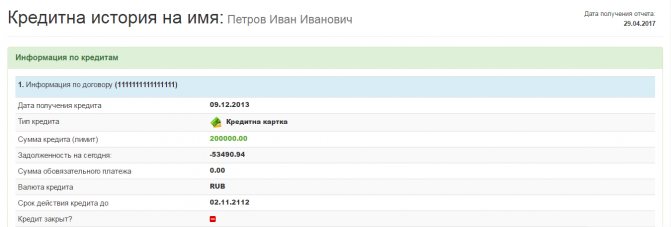

- Information about the company's credit history;

- Copies of business agreements and project.

Photo gallery:

Extract from Rosreestr

License to authorize entrepreneurial business Russian Federation passport

Certificate of registration of individual entrepreneur

Sample of your signature

Help 2 personal income tax

Credit history

Mortgage for the purchase of commercial real estate by an individual - what documents are needed

It will take a long time to collect papers, and there are a lot of them. First of all, you will need personal documents:

- passport;

- certificates of marriage and birth of children;

- SNILS;

- taxpayer number;

- military ID;

- information about income and property owned.

As for the property, you will need its appraisal, purchase and sale agreement, and insurance. The premises must comply with the requirements of the laws of the Russian Federation for non-residential facilities. And, of course, not have any encumbrances (be under arrest, be the subject of a property dispute, be in disrepair, etc.).

Recommended article: Spouse's consent to a real estate transaction

But that's not all. When an individual entrepreneur takes out a mortgage to purchase commercial real estate, he has to collect a full package of papers about his business:

- confirmation of registration (extract from the Register or Certificate);

- certificates from the Federal Tax Service confirming the absence of claims for payment of taxes;

- certificates of movement on accounts;

- license (if the field of activity is licensed);

- all official reports to state fiscal authorities for the last year.

The bank requires all these papers in order to clarify the financial history of the borrower. The lender needs to know about the financial obligations that the loanee has (unpaid mortgage, consumer loans, leasing, and so on). As well as about existing agreements with clients and business partners.

Note! When selling commercial property, an individual entrepreneur will pay an additional tax, since the tax authorities equate the proceeds from the sold premises to income from business activities.

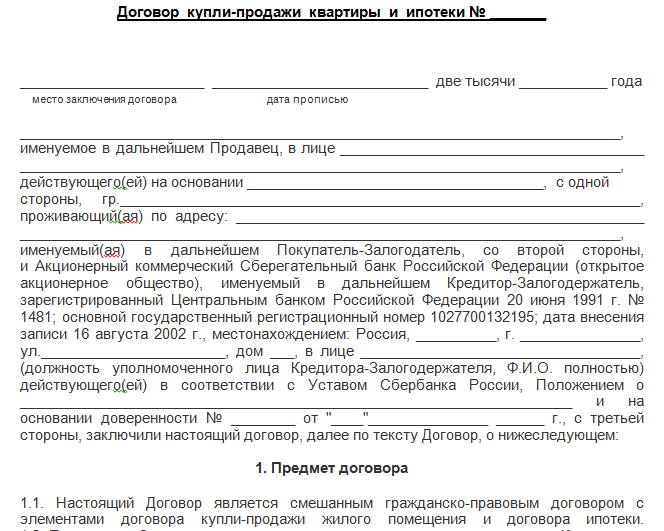

Sample of the concluded agreement

The mortgage agreement is concluded individually. Its clauses may vary depending on the terms of the loan, but basically, such an agreement should have clauses such as information about the borrower and the bank, the terms of the mortgage, the rights and obligations of the parties, as well as a mortgage repayment scheme (the possibility of early repayment is also taken into account).

A full example of a sample mortgage agreement can be found here.

Possible difficulties

It is not easy for individuals to obtain such a mortgage.

Difficulties arise mainly when registering a pledge. The fact is that such real estate is not immediately transferred to the bank. The borrower will have to go through the title transfer process. For this purpose, banks have three main schemes. The seller receives an advance payment in the amount of the first loan payment. After this, the transfer of ownership is formalized and the object is pledged as collateral. And only after this, a mortgage agreement is concluded, and the remaining funds are paid to the seller.

Similar to the previous option, the seller receives an advance payment. But the transfer of rights occurs simultaneously with the execution of the purchase and sale agreement and mortgage. And the transaction is registered only after the transfer of all papers.

The last scheme is the most ornate. First, you need to register a new company, in whose name ownership is transferred. After this, the cost of the property is paid by the bank, and the buyer enters into a purchase and sale agreement with the seller for a new legal entity. The encumbrance will be lifted only after the transfer of the collateral.

Mortgages on non-residential real estate are more difficult for individuals. Such a deal will mean increased interest and a reduced loan term, which is not very profitable for the borrower. However, knowing about all the intricacies of such lending, you can avoid some difficulties and get more favorable mortgage conditions.