Mortgage approval at VTB - current bank offers

VTB offers a wide range of mortgage programs. Their gradation is determined by the type of apartment being purchased, the status of the borrower, and the possibility of implementing state support. Let us outline the main parameters for approving each mortgage:

- New building

. The maximum amount of approval is 60 million rubles, the minimum is 600 thousand rubles. Settlement rate – 9.1% and higher, repayment period – up to 30 years, down payment – 10% or more. - Secondary housing

. The approval conditions are the same as for a new building. It is possible to reduce the percentage to 8.9% when purchasing apartments from 65 sq.m. and payment of the initial amount from 20%. - Refinancing

. Favorable refinancing - the bank repays the existing mortgage at a reduced interest rate (from 8.8%). Approval of up to 30 million rubles is possible, but not more than 80% of the value of the property. - Military mortgage

. Individuals who have been participants in NIS for more than 3 years can count on approval from VTB. The maximum possible financing is 2.435 million rubles, the term is 20 years. Moreover, at the time of repayment of the loan, the borrower should not be older than 45 years. - Non-targeted collateral loan

. Loan for any needs up to 15 million rubles. subject to the provision of a real estate mortgage. Rate – from 11.1%, term – up to 20 years. - State support

. Lending to young families with children at a low rate of 6%. The grace period depends on the number of children. Approval can be obtained by both a husband and wife and a single parent. - Sale of collateral real estate

. Purchase of housing secured or owned by VTB.

On a note. Those who want to get a mortgage approved without unnecessary delays can use the “Victory over formalities” program. Issuance of two documents at 9.6% per annum. The client must provide 40% down payment.

Mortgage with a reduced package of documents

When applying for a loan, the applicant agrees to pay fees that include interest at an inflated rate when compared with standard mortgage programs. The return period is minimal. Having enough money to pay a contribution of 20% (see below for details on how to apply), the applicant undertakes to insure the collateral property and his own life and health. For a refinanced loan, the final terms are negotiated individually. Refinancing with an increase in the repayment period is also possible.

Mortgage program “Victory over formalities”

This is a special offer developed for borrowers who are unable to document their income, as well as for those who are unemployed, receive an unofficial salary, etc. It is enough to have a civil passport and SNILS. If the applicant meets the bank’s requirements, the loan will be approved within 24 hours after submitting the application. All that remains is to sign the agreement, make a down payment and repay the debt on time. This scheme saves time because it does not need to be spent on exhausting documentation collection.

Bank conditions

The abbreviated registration procedure requires acceptance of the following conditions:

- Loan term (years) from 1 to 20.

- The available amount for Moscow residents is from 600,000 to 30 million rubles.

- The maximum for other regions is set at 15 million.

- The down payment to VTB is at least thirty percent.

- The insurance is comprehensive and covers the home and the borrower.

- Those who refuse to take out insurance overpay at a rate of up to 11.7% per annum.

- For those who have issued a comprehensive policy, the interest rate is up to 10.7%.

VTB provides for the possibility of reducing the interest rate under certain conditions, which will be discussed in the corresponding section of the article.

The money is returned according to the annuity scheme. This means payment in equal monthly installments throughout the contract period. Partial or full early repayment is not prohibited at VTB.

Requirements for those wishing to receive a loan under a simplified scheme

The minimum age of the applicant is 25 years. Total work experience – from one year. A guarantor is not required. But this will increase the chances of getting bank approval. A co-borrower is also welcome. This could be a spouse, parents, children, other family members and relatives. Russian citizenship is mandatory, as is registration on the territory of the Russian Federation. Maximum age is 65 years. Before it matures, the loan must be fully repaid. If the borrower is a man under 27 years old, in addition to a passport and SNILS, a military ID will be required.

Who will VTB approve a mortgage: requirements for borrowers

Applications from applicants working in the Russian Federation are accepted for consideration. In this case, registration and citizenship do not play a special role. When negotiating a mortgage, the main focus is on the applicant's income and credit history.

Important! The total work experience is at least 12 months; in the last place, the client must work for at least six months.

To increase the likelihood of approval of the transaction, financial support from co-borrowers is allowed. VTB allows you to call one, two or more guarantors. The following are considered reliable co-borrowers: solvent children, parents, common-law spouses, sisters, brothers and other close relatives.

The procedure for approving a mortgage at VTB 24 is very simple. The stages of processing and approving a home loan at VTB are standard. The decision whether or not to issue a mortgage is made after submitting an application and analyzing the solvency of the borrower and co-borrowers.

How long does mortgage approval last?

Many clients are interested in how long a mortgage approval received from VTB 24 is valid. This information is important for borrowers, since they need to have time to select a suitable property and determine their financial capabilities. In various financial institutions operating in the Russian Federation, this period ranges from 60 to 120 calendar days.

The validity period of a mortgage decision at VTB 24 is 120 days. During this period, the borrower must decide whether he will use borrowed funds from a specific bank to purchase square meters. The decision to issue a loan at VTB is made within 3-4 days, and to refer a credit expert to a consultation, you need to fill out a form on the financial institution’s website.

If the borrower changes his decision regarding raising mortgage funds, or finds more favorable lending conditions in another bank, he can cancel his application.

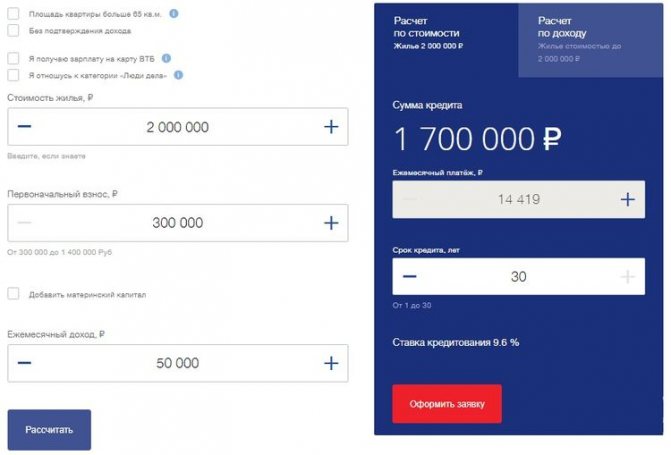

Will VTB approve a mortgage - preliminary calculation

You can find out the likelihood of approval yourself by calculating your mortgage using an online calculator. The result of the calculations will show how realistic it is to get a loan from VTB with your existing income. The service is provided on every page of the website with a mortgage product.

What to do:

- Fill out the form, enter: the market price of housing, the amount of the down payment and income.

- Click "Calculate".

- Evaluate the result.

The program will display on the screen how much you can take, for how long and what the amount of the monthly payment is. The data is quite arbitrary, but it reflects the general situation. For clearer information, you must apply for mortgage pre-approval.

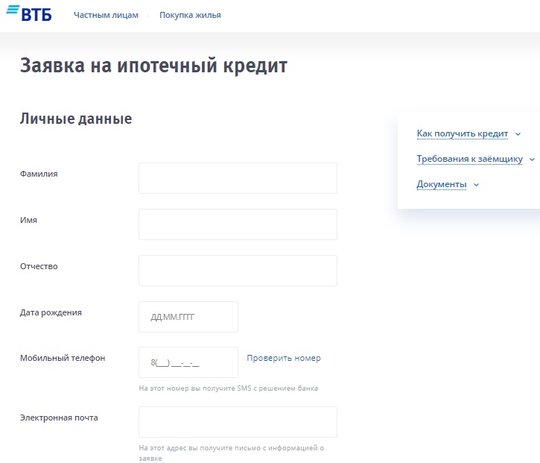

Applying for a mortgage

It is very easy to find out a preliminary decision at VTB. The company has developed a simple online survey form that allows borrowers to quickly assess their chances of approval. You can proceed to filling out the application by clicking on the “Fill out application” button.

The form must display:

- Personal data: full name, year of birth, contacts, E-mail.

- Job information: employer’s tax identification number, income, length of service.

- Mortgage information: condition of the property being purchased, region where the property is located, down payment, housing price, repayment period.

- Passport details.

After filling out the application, click on the “Submit” button and wait for a response.

Applying for a mortgage at VTB 24

Refusal and resubmission of application

If the answer is negative, it is impossible to challenge the refusal of a mortgage at VTB 24, as well as establish the exact reason why the refusal occurred. A repeated application for consideration can be submitted 90 days after receiving a negative response.

Despite the apparent simplicity of the requirements for borrowers, VTB 24 often refuses clients. There are even cases of revocation of an already issued positive conclusion. This is due to the fact that the bank has additional conditions that the borrower and his income must meet in order for his issue to be resolved positively.

These include:

- the presence of income at which the amount remaining at the disposal of the debtor was twice as much as the amount paid on the loan;

- clean credit history;

- absence of material claims from third parties in court;

- the absence of other loans that the borrower did not indicate when filling out the mortgage application;

This is not a complete list of grounds for refusal. The bank is not obliged to inform its client about the reasons why he was not given a mortgage.

Since VTB 24 provides loans for up to thirty years, its main task is to verify as much as possible the borrower and his availability of funds for the entire period of the loan agreement. With such a duration of the mortgage, it is impossible to calculate everything, so quite often there are refusals from the bank. As a tool to reduce its risks, VTB 24 aggressively uses the insurance system. It is offered to clients as a complete package, starting from compulsory insurance of the collateral object and ending with insurance of the borrower:

- life, for the entire period of the contract;

- health;

- job loss;

- loss of earnings

The attractiveness of lending at VTB 24 lies in the fact that the bank takes into account the following income of the borrower:

- at the main place of work;

- at the same time;

The income of the guarantors is also summed up, of which for the purposes of such an assessment there can be no more than four.

VTB 24 approval: how long to wait for a banking decision

After submitting an application, potential borrowers are wondering how long VTB will approve a mortgage. The bank’s actions are standard in most cases:

- within three hours from the moment the application is sent for approval, a bank employee contacts the client and clarifies the missing information;

- the application can be approved within one or two days, then an SMS notification with a preliminary verdict will be sent to your phone; in the same way, VTB can refuse a mortgage;

- then the borrower collects a list of documents and brings them to the branch;

- final approval based on paper evaluation – in 1-5 days.

Under the “Victory over formalities” program, you won’t have to wait long for a decision – the VTB mortgage approval period has been reduced to 24 hours.

On a note. The validity period of the decision is 4 months. At this time, the client must have time to choose a suitable property and apply for money.

VTB 24 programs

You can find out more about the terms of the mortgage on the website. If we talk about the possibility of using two documents, then VTB has one program available - “Victory over formalities”. Characteristic features are:

- Issuance upon presentation of a passport and SNILS.

- Simplified approval and registration scheme.

- Opportunity to purchase finished housing (new buildings, resale).

Additional offers are also available for citizens, such as mortgage refinancing. Anyone can contact VTB with a request to reissue a loan taken from another bank. The result is favorable repayment terms, a loan in rubles, the possibility of early repayment, a lower interest rate, and a changed repayment period.

How to get a mortgage at VTB 24?

In fact, the scheme for obtaining a mortgage differs from the standard one only during the period of collecting documentation, since everything necessary is already there. Therefore, the step-by-step instructions look like this:

- Make a preliminary calculation of the monthly payment using the VTB online calculator.

- Submit an application to the bank. This can be done in person or remotely. Clients use their personal account.

- Wait for approval. A corresponding notification will be sent to the phone number and email specified in the application.

- Provide information about the property you plan to buy with a mortgage. Sign an agreement with the seller.

- For loans with collateral, an additional condition is comprehensive insurance of the property, as well as the life and health of the property.

- After completing an agreement with the bank, make a down payment. The rest of the amount will be transferred by VTB.

- Re-register ownership. Get an extract from Rosreestr. Please note that the property will be encumbered while the debt is repaid.

If you do not pay the required mortgage payments, VTB, based on the agreement, will charge a penalty in the amount of 0.8% of the balance of the debt. If the borrower does not repay the resulting debt, VTB has the right to seize the property for the purpose of selling and repaying the arrears on the mortgage.

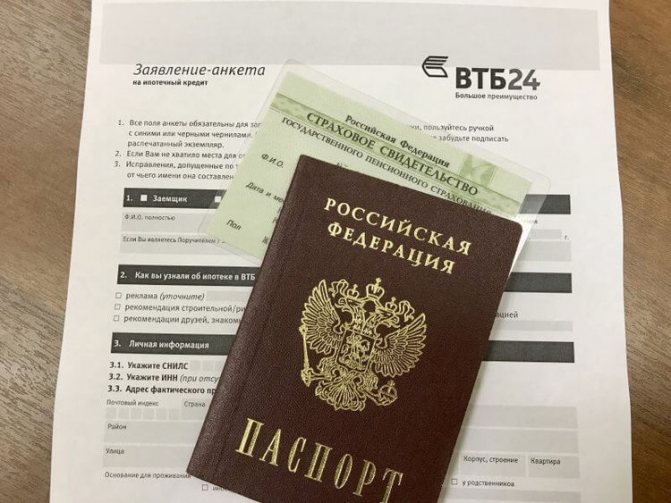

List of required documents

If VTB has pre-approved your mortgage, you can begin collecting the following documents:

- application form;

- passport of a Russian citizen;

- insurance certificate of pension insurance;

- Form 2-NDFL, a certificate in the VTB form or income declaration is acceptable;

- a copy of the work book;

- military ID - for men under 27 years of age.

At VTB, a mortgage is approved in full with the client’s consent to comprehensive risk insurance: loss of ability to work/loss of life, damage to the purchased apartment, restrictions on property rights. Important! Insurance against the risk of loss or damage to collateral real estate is required for the approval of all VTB mortgages.

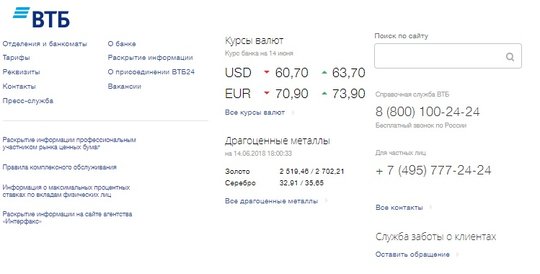

VTB 24 approved a mortgage - how to find out the decision

As a rule, you don’t have to wait long - VTB promptly communicates the decision made. However, if the banker does not notify you of the loan approval or refusal within a week, you should not wait - it is better to act independently. You can find out the solution by calling the help desk - 8-800-100-24-24

. An alternative option is to leave a request to customer support. You can go to the contact form by clicking “Customer Care Service” - the button is located in the lower right corner of the site.

You can clarify information on the approval of a VTB 24 mortgage from the specialist who accepted the documents for consideration.

VTB offers borrowers flexible mortgage terms.

The bank is ready to approve an application based on two documents; cooperation with clients without registration and citizenship of the Russian Federation is acceptable. Mortgage approval at VTB 24 reviews / by NinulyaKiss

Stage 2. Final approval

Here, a personal visit to the bank is mandatory; a specialist will accept your package of documents and check their authenticity and relevance. How long does it take to process a mortgage application at VTB at the stage of studying all the documents?

Recommended article: Sberbank mortgage terms for the secondary housing market

The bank will do a full check and analysis of your data. The final decision takes 3-5 days - this is what the bank promises. But how long does it actually take to get a mortgage approved at VTB? Often the period can be seriously delayed if some problems arise. Let's understand the nuances of the process.

What does the bank check?

The bank checks the borrower in several areas. The bank's credit and legal services and security services participate in the verification. What's important:

- An important point in the VTB mortgage approval status is the state of the applicant’s credit history (CI). If the CI check during scoring was successful, then the bank specialist will additionally check the presence and nature of delinquencies and other parameters of previous loans;

- information about the applicant’s income for the last six months (), as well as the existence of obligations to confirm income and expenses, are very carefully checked;

- the bank can make requests to the Pension Fund, the Migration Service, the Tax Service, the Bailiff Service (data on writs of execution and unpaid fines);

- The bank's security service uses special customer databases to check the borrower's data, the accuracy of income certificates (), information about the employer, the borrower's criminal record, information about the seizure of accounts, and others.

A thorough check may take up to 10 days, and if errors or inaccurate data occur, the period may be significantly delayed. Therefore, there is no clear answer to the question - how long does VTB Bank consider an application for a mortgage?

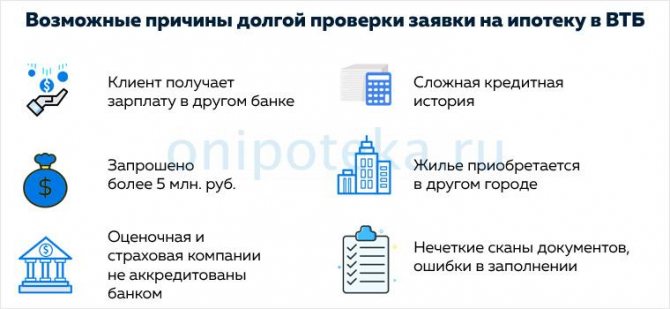

Why is a long review possible?

The bank assures that the decision will be ready in 3-5 working days, but most often this period is longer and can take 3-4 weeks.

Why does VTB take a long time to consider a mortgage application:

- depends on the client's status. It takes literally one or two days for a salary client to be approved, since the bank knows his income and reliability. For other clients, the scope of the review can significantly increase the time required to prepare a solution;

- The approval period may be extended for clients wishing to receive a loan of more than 500,000 rubles. There will be additional checks here;

- the deadline may also be delayed for applicants who use the services of appraisers or insurers not accredited by the bank;

- The type and quality of the documents submitted are important. If there are expired certificates, incorrect data, errors or typos in documents, this can lead not only to an increase in the decision period, but even to a refusal (the validity period of mortgage certificates is in another article);

- the already mentioned credit history of the borrower will also seriously affect the approval period;

- The purchase of real estate in another locality may also affect the approval period.

The difference in approval times also depends on the chosen mortgage program.

The borrower can receive approval within 24 hours if he chooses an exclusive program based on two documents Victory over formalities.

How to find out the status of an application for a VTB mortgage

The standard response option from the bank is an SMS message to the phone number you specified when filling out the application form. If the solution is ready, the client will know about it immediately.

But if within a week you have not received a decision on your application from the bank, it’s time to act and find out the status of your VTB mortgage application yourself. What options exist here:

Recommended article: What documents are needed for a mortgage at Rosselkhozbank

- you can call the bank's phone number 8-800-700-24-10;

- leave a request to customer support. The application form can be found on the website;

- you can call the manager who helped you fill out the form (if you have his phone number);

- Log in to VTB Online Internet banking. You can enter your login and password, go to your personal account and there you can see if the solution has come to the specialists.

The answers to the question - how long does VTB consider an application for a mortgage - are interesting in customer reviews on social networks and forums. Opinions, of course, are different, but many are dissatisfied with the long wait.

Deadlines for re-submitting a mortgage application (if your application is rejected)

If you receive a refusal from VTB on your mortgage application, do not despair. The attempt can be repeated, but when? And how many days does VTB review the mortgage application again? This usually takes about the same time or a little less (if there are fewer checks).

The bank has set a deadline for re-application. After refusal, the client has the right to re-apply for a VTB mortgage after 90 calendar days.

Do I need to reapply?

You may be lucky and the bank will change its credit policy during this period.

Let's give an example . The bank refused you a mortgage because you were in arrears on your previous loan. A little later, the bank changes its credit policy, and a small delay in the previous loan becomes acceptable. And when you resubmit your application after 90 days (even without changing or improving anything), it may be approved, since your slight delay is already acceptable. But this is a happy accident.

How to increase your chances of approval

In general, banks are not obliged to explain the reasons for refusal and usually do not try to do so (). The borrower can only try to understand what exactly led to the refusal.

The following actions are usually recommended to increase the likelihood of mortgage approval at VTB:

- improve your credit history. For example, take out small microloans several times and carefully pay them off;

- attract guarantors, co-borrowers with a high stable income;

- provide documents confirming the client’s additional income;

- increase income (basic salary or additional income).

If you have not found the reasons, you do not understand why you received a refusal, you can turn to the services of credit brokers.

If you are refused again, you can contact another bank, since banks have different credit policies.