Home » Buying and selling an apartment » Buying an apartment with a mortgage: step-by-step instructions

73

One of the most common ways to get your own home is to purchase an apartment on the secondary market using one of the many mortgage programs. Let's take a closer look at what and how to do to get a loan and become the owner of your apartment.

Do you need a notary when buying an apartment with a mortgage?

Mandatory – no, not necessary. Previously, a notary was needed to certify a purchase and sale agreement. This is not required now. However, it can be useful and even necessary in some cases.

Certification of the purchase and sale agreement

The process of buying an apartment involves drawing up a contract. It is not necessary to notarize it, but it is possible. This, of course, is an additional cost, but at the same time, a certified contract is more powerful than an uncertified one. This is especially true regarding the transaction of buying and selling an apartment on the secondary market. Of all the options available, this is the riskiest. As a result, anything that can at least slightly increase the reliability of the transaction is welcome.

Notary services can be paid by the seller or the buyer, depending on who exactly insists on it. In some cases, the parties agree to share the costs.

Certification of spouse's consent

When considering how the transaction proceeds if the seller or buyer is married, the first thing to note is the need to provide consent from the spouse for the purchase or sale of housing. Without such a document, the transaction may be declared invalid in court, which is not beneficial for both the buyer and the seller.

The notary in this case plays a decisive role. The fact is that such consent must be notarized. Otherwise, the document will not have legal force.

Buying a home with a mortgage on the secondary or primary market

A mortgage loan is issued for the purchase of a specific home. Therefore, before applying for a mortgage, you should decide on the property:

- an apartment in a newly built (under construction) house;

- purchasing housing on the secondary market;

- the money is taken to build your own house/cottage.

Each option has a number of features; lending conditions will differ depending on the object. For example, many banks cooperate with development companies. When buying an apartment from bank partners, you can often find promotions, favorable conditions or low interest rates on the loan.

Do you need the help of a real estate agency or realtor when buying an apartment with a mortgage?

The procedure for buying and selling an apartment at the initial stage involves searching for an apartment seller. You can search for it yourself or contact specialists. The first option is much cheaper, but longer and more complicated. The second, as you might guess, is simpler and faster, but more expensive.

The difference between an agency and a realtor

There is no global difference. A real estate agency is a legal entity that provides certain services for finding buyers/sellers and supporting transactions. Typically, an agency employs several realtors and many other specialists, such as lawyers, managers, call center specialists, and so on. As a result, everyone does their job, which has a positive effect on the final result.

If a realtor works for himself (for example, by registering as an individual entrepreneur), usually his services cost much less than a full-fledged real estate agency. This is its only advantage. Otherwise, one person is simply not able to know everything and competently accompany the transaction acting as a lawyer.

Realtors, like real estate agencies, are very different. Very cool specialists who are capable of supporting the entire transaction at the highest level often go on their own. On the other hand, agencies can be so bad that it is better not to contact them at all. The level of services provided can only be determined in advance based on reviews from other clients.

Rights and obligations

Before signing an agreement with an agency or realtor, you need to check exactly what rights and responsibilities are specified in them. It is also a good idea to check the price for services. The document should not contain any ambiguous phrases or inaccurate data.

Example: If the contract contains a phrase similar to the following: “The client pays for the agency’s services based on the tariff rates posted on such and such a site,” there is a serious chance of very much overpaying. The company can change the rates at any time, both up and down. Of course, you can always try to prove the fact that the rates were implied on the date of signing the contract, but even in one day a lot can change and it is almost impossible to prove this.

If an agency or realtor only offers services to find a seller, it is better to refuse them. The fact is that a person can do the search himself, but only an experienced lawyer can handle transaction support. Ideally, it is worth hiring such a specialist separately, since those who work in agencies often do not have the proper qualifications or experience.

Social program or regular mortgage

All mortgage options can be divided into two main categories: regular and social. There is no point in dwelling on the first one – a classic loan secured by real estate. But the second option usually allows you to get housing much more profitable. Let's take a quick look at the three main types of social mortgages.

Military mortgage

As the name suggests, this product is relevant for Russian military personnel. There is a special program for them, under which a person opens a separate account into which a certain amount is received monthly. Basically, this money can be used to buy a home, although there are other options.

The main feature of such a mortgage is that the serviceman only chooses housing, and the state will pay for it. At least as long as he is in service. As you can easily guess, this is very profitable (the apartment will, in fact, be received for free), but such housing will not be sold until the entire loan is paid off and the service life is 20 years or more. Ideal for people who plan to spend their entire life (or most of it) with military service.

Help for young families

This is another special program under which you can receive a very significant amount for the purchase of an apartment. Of course, the state will not fully repay the debt for a citizen, but even 20-50% of the amount is very significant. Almost any person who really needs their own housing or does not have it in principle can participate in the program.

However, there are many disadvantages. To begin with, the program is only available to persons under the age of 35. Secondly, the state allocates funds from the budget for this program in very limited quantities. As a result, you have to stand in line for many years and it is not a fact that by the age of 35 this line will come. And even if a person turns 35 while on the waiting list, he automatically loses the right to participate in the program.

Maternal capital

This government program is relevant for families with two or more children. The bottom line is that after the birth of the second child, a certificate is issued for 466 thousand rubles (as of 2021). This money can be used both to pay off part of the mortgage loan and to pay the down payment, which is often extremely important.

Separately, it should be noted that many banks offer their clients special preferential lending programs, under which you can get a loan to buy a home on very favorable terms (much better than in a normal situation).

What types of social mortgage programs are there?

The state establishes special mortgage programs for certain social groups. Thus, teachers, Russian Railways employees, military personnel, and young families can take advantage not of standard mortgage programs, but of special offers to improve their living conditions.

The essence of social mortgage programs lies in benefits and subsidies from the state. The most common type of benefit is reduced interest rates. In addition, subsidies can be expressed through the sale of residential premises in the public housing stock at a reduced price.

Young family

Young families use mortgage lending services the most. The main condition for a social mortgage for a young family is that the newlyweds must be under 35 years of age. The state takes special care of the younger generation. Thus, families with children can count on greater financial benefits.

For teachers

Improving the living conditions of young teachers under the age of 35 can be financed by the state. There is only a restriction: a young teacher can take out a mortgage for housing located only in his region of residence. Subsidized mortgage programs for teachers cover about 40% of the cost of living space.

For military personnel

Military mortgages are issued to military personnel with an approximate description of the place of service. Financial assistance from the state is manifested in the direction of funds as periodic loan payments.

Russian Railways employees

Special housing benefits are also provided for railway workers. Persons with at least 3 years of work experience in Russian Railways can participate in the social program for Russian Railways employees. A minimum age limit is also established: only persons over 21 years of age can count on benefits.

Subsidizing mortgages for railway workers is reflected in the payment of monthly interest: a 12% rate is determined, 7.5% of which is paid by the state. In addition, the first contribution for Russian Railways employees is only 10%.

Other categories of citizens

The state has established special government programs for financial support for improving the living conditions of young professionals, large families, and police officers.

In particular, for young professionals there is no down payment on a mortgage, and in the event of the birth of a child in the family, a lump sum payment is due. A young specialist is recognized as a person who finds employment in the first year after graduation.

Unlike other categories of persons, the state is ready to finance the construction of a country house for police officers. Employees of the Ministry of Internal Affairs who have worked in the secondary education system for 10 years or more can count on cash payments.

Spouses with many children have the right to apply to the Federal Agency for Housing Mortgage Lending, which allows them to obtain a mortgage with an annual rate of 6.5%.

Where to start, terms and conditions

The first place to start buying an apartment is to search for a seller and choose a bank that will provide a loan. Everything else, if not secondary, is at least not so important.

Search for a seller

Since an apartment is being purchased, you need to look for the seller, not the buyer, which is somewhat simpler (more offers). To do this, you can use the following options:

- Acquaintances and friends . The easiest and most accessible way is to ask your acquaintances and friends if any of them (or someone they already know) is selling an apartment. Usually such transactions are quite reliable, since they are advised by trusted people and trusted people.

- Specialized sites . For example, Avito and its analogues. There are a lot of proposals here, most of which are quite relevant.

- Local newspaper advertisements . Even though newspapers seem to be becoming a thing of the past, they are still read by a huge number of people. And, as a result, advertisements are placed in them. Their relevance is a little lower, but it’s still worth a try. It should also be noted that many print publications have their own websites on which all the same information is posted, including advertisements for housing sales.

Among other things, you can not just search for advertisements, but also place one yourself: “I’ll buy a three-room apartment in the city center, I’ll consider all options” or something similar. They should also be posted both on websites and in newspapers.

Alternatively, if you don’t have time to search and have the opportunity to spend a certain amount, you can contact real estate agencies or private realtors. They will take care of this issue themselves and can provide additional services, for example, transaction support, which can be very useful.

Bank selection

The logical sequence of actions after finding a seller and conducting preliminary negotiations with him (in particular, you need to make it clear that the purchase is planned using borrowed funds) would be to choose a bank. You need to select it according to the requirements, conditions and loan programs.

Client requirements

To purchase an apartment on the secondary market using a mortgage loan, the client must meet the bank’s requirements. Much depends on the chosen financial institution, but on average, a sample list will look like this:

- Age of the potential borrower on the date of receipt of the loan: 18 years and older. Even if the client is recognized as emancipated (an adult) by a court decision, but is under 18 years of age, he will most likely be denied credit.

- Age of the potential borrower at the date of full repayment of the debt: 60-75 years. Here, too, everything depends on the bank. Usually the limitation is based on retirement age, but not always. It is recommended to clarify this in each individual case. Moreover, some banks offer special, preferential conditions for pensioners with reduced interest rates and so on.

- Total work experience: from 6 months to 3 years. Most often: 1 year.

- Work experience at last place of work: from 1 to 6 months.

There are no special salary requirements, but the bank will definitely take into account the income received to determine the potential loan amount.

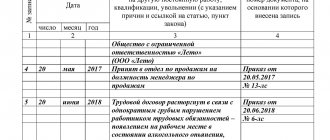

Documents for the bank

Requirements for client documents also vary from bank to bank. Approximate list of required papers:

- Applicant's passport.

- Certificate of income (ideally, in the form of a standard 2-NDFL, but many banks are ready to accept other types of such document).

- A copy of the work record, certified by the manager.

- Documents for the apartment you plan to purchase (they must be requested from the potential seller).

The bank may request other documents, depending on the specific situation of the client.

Mortgage programs

Most banks have at least 2-3 mortgage programs aimed at purchasing an apartment on the secondary market. Before applying for a loan, you need to look through all the available options and choose the most suitable one.

Pitfalls of mortgages on the secondary market - Expert advice

Denis Konarev

1 opinion

2.12k

Who can get a mortgage to buy an apartment on the secondary market. Documents for a mortgage for secondary housing. Advantages and disadvantages of secondary materials. Nuances when concluding a mortgage agreement. Practical advice on choosing an apartment on the secondary market.

Not everyone is ready to purchase an apartment in a new building, since additional funds will be required for repairs. The best option in terms of price and opportunity to live immediately after receiving a loan is to purchase housing on the secondary market.

An additional bonus if the transaction is properly executed can be furniture and appliances left by the previous owners. It is important to take your time and take into account all the nuances.

Below you will learn how to choose an apartment wisely and what you need to know when applying for a mortgage.

The nuances of obtaining a mortgage on the secondary market

Banks are happy to approve mortgage applications for the purchase of real estate on the secondary market. There are several reasons for such loyalty on the part of the credit institution:

- There is no risk of the house not being delivered and long-term construction occurring

. According to statistics, clients deceived by the developer are more likely to be late or stop repaying the loan. The bank finds itself in a difficult position - there is nothing to seize and sell. - No commissioning required

. Construction risks have been taken into account, the house has been delivered, and the title documents are in place. - The client takes out a loan for a long term

, which means the payment amount will be approximately equal to the cost of rented housing and will not greatly burden the personal (family) budget. Clients pay for “theirs” regularly and with pleasure.

After a preliminary decision and selection of an apartment, a full package of documents from the seller will be submitted to the bank for examination. After that, after making sure that there are no fraudulent actions, the collateral will be agreed upon and the loan agreement will be signed.

One of the clients of a large bank, if he has his own funds, when purchasing real estate or a used car, always draws up a loan agreement for an amount equal to 15-20% of the cost.

The bank checks the legal “purity” of the transaction, since not all methods of obtaining information are available to individuals. Within 5 days from the date of issuance of money, it terminates the life insurance contract imposed upon registration.

After 3 months the obligations are repaid. The actual costs incurred for 3 months are an insignificant price to pay for the confidence that there are no risks of loss of real estate and recognition of the transaction as invalid.

Risks

Any transaction carries risks, since the reliability of the information and the true reasons of its participants are unknown.

Pitfalls when buying an apartment on the secondary market:

- Disagreement of one or more owners

. When purchasing an apartment from a married couple, check that it was not purchased during marriage, since each spouse must express consent, even if the marriage is officially dissolved on the date of sale. Minor children registered in the apartment can be discharged after obtaining the consent of the guardianship authorities. Disagreements lead to the recognition of the transaction as invalid. - Do not reduce the official price of the apartment at the request of the seller

, who wants to pay less taxes. However, the new owner will receive a lesser tax refund. If the transaction is invalidated for any reason, only the amount specified in the documents will be refunded. Oral and unformed agreements are not recognized by the court.

Requirements for the borrower

There are no fundamental differences in the requirements for mortgage borrowers.

Banks establish universal criteria under which they are ready to consider applications, and make a decision individually, based on the information provided by the client. Table - Requirements for borrowers

| Criterion | Content |

| Citizenship | RF |

| Age, years | 21, maximum limit as of last payment date 75 |

| Registration | Permanent, at least 6 months |

| Length of work at last place of employment | 3 months, total - a year |

| Minimum income | For Moscow, St. Petersburg, Moscow and Leningrad regions 15,000, regions – 12,000 |

In fact, applications are considered from citizens aged 23-25 years. For younger clients, conditions are set: an increase in the down payment or a guarantee from parents if they are not married.

Similar criteria apply to guarantors and co-borrowers.

Official income must exceed the subsistence level. All sources of income are taken into account, which, when confirmed by documents, are accepted for the calculation of 100% solvency. For example, Ivan P. stated that the salary is 30,000 rubles, and the additional income is 20,000. In fact, the bank will only take into account 40,000 = 30,000 + 20,000 x 0.5.

Documents for consideration of the application:

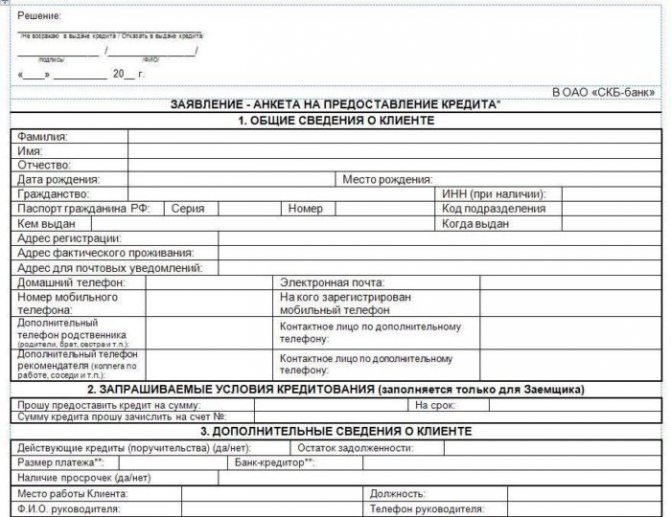

- Questionnaire.

- Passport of a citizen of the Russian Federation.

- SNILS, driver's license or TIN certificate.

- Certificate in form 2-NDFL.

Additionally, you can submit a copy of your work book and information about additional income.

During the audit, some banks ask for access to the Pension Fund’s personal account or an extract from the State Services portal about the amount of deductions.

Young people under 27 years old - military ID.

The bank carries out verification of reliability and assessment of solvency. Makes a preliminary decision and you can begin choosing an object. The decision is valid for no more than 90 days.

Having made a choice, submit for verification:

- Copies of owners' passports.

- Assessment to determine market value.

- Legal documents.

- Cadastral passport.

- Certificate of absence of debt on utility bills and the number of registered persons.

Requirements for the subject of collateral:

- Availability of central communications.

- Separate entrance and dedicated bathroom and kitchen.

- Total area from 18 m2.

- Location within the city or a nearby settlement with a distance of no more than 30-50 km.

- Redecorating.

- The object is not encumbered.

- The house is not included in the community reconstruction program, is not recognized as unsafe and is not subject to demolition.

Conditions for issuing a loan

Sberbank is one of the leaders in mortgage lending, while simultaneously promoting its system for selling collateral through the website https://domclick.ru.

Other financial market participants follow established conditions in order to be competitive. Table - Standard conditions for issuing a loan at Sberbank

| Condition | Content |

| Currency | Russian ruble |

| Minimum amount, rub. | 300 000 |

| Maximum loan amount, % | 85% of the seller's price or the value established by the appraiser. The minimum value is displayed. |

| Term | 30 years |

| Types of collateral | House with land, townhouse, apartment, room in a communal apartment or dormitory, apartment |

| Insurance | Mandatory – subject of collateral |

| Rate per year, % | 10.2-11, according to two documents 11.6 |

Rate increase, %

:

- 0.2 – down payment 15-19%;

- 0.1 – absence of a salary project;

- 0.1 – refusal of life and health insurance.

In some cases, they will add for the lack of a policy for loss of title (if provided), late registration with Rosreestr, etc.

In practice, banks issue no more than 70-75% secured by an object purchased on the secondary market.

The mortgage agreement has a standard form and contains information about the borrower, the collateral, the loan amount, terms and methods of repayment.

When signing a mortgage agreement, please pay attention to the possibility of partial and full early repayment without restrictions on terms and amounts.

Even writing off an additional 2,000 rubles monthly will allow you to save a decent amount per year, including on interest.

It would not be amiss to find a clause on insurance and requirements to conclude additional contracts - so that the bank does not change the rate if there is no need to insure life in a year.

Useful links:

- How to pay off a mortgage with Maternal Capital - All the details

- How and when is it profitable to refinance a mortgage - expert advice

- How to sell an apartment in Mortgage - 4 methods, instructions and documents

- At what interest rates (%) do banks give mortgages (lists) + conditions

- What is a mortgage (essence and types) - is it worth taking and how to get it

Advantages and disadvantages

Advantages of a mortgage for secondary housing

:

- Low rates, since the collateral is registered immediately, on the day the loan is issued.

- No repair costs. If necessary, partial work will not require large sums.

- Assessment of existing social infrastructure - gardens, schools, clinics, shopping centers that have already been built and are operating.

- A large number of offers.

Disadvantages of the purchase

:

- Possible fraud by the seller (selling using forged documents or a power of attorney from a deceased person).

- One of the owners is incompetent, an alcoholic, uses drugs, or is in prison or missing.

- Violations of allocation of shares.

- Down payment 20-30%.

- Presence of third party claims against the object.

- More stringent requirements for potential collateral.

- There is a discrepancy between the data in the market value assessment report and the market price of the apartment, which is why the down payment will need to be increased.

- Restrictions on year of construction.

There are not many statistics, according to the news agency, in a year 70% of loans for the purchase of housing are received on the secondary market and only 30% are received for new buildings.

12 expert and practical tips on how to choose an apartment with a mortgage on the secondary market

Nothing is impossible, just something needs more time, follow a few tips:

- Today it is difficult to find an advertisement for sale from the owner, and all contact numbers are answered or called back later by realtors who want to make money. To save your money, ask your acquaintances, colleagues and friends to chat with your neighbors. Today, many residential complexes have WhatsApp groups and you can directly find the owner with whom you can negotiate a deal. Another option is to walk around the area you like, chat with the grandmothers on the benches or the concierges.

- Realtors understand secondary housing as 2 types of real estate - housing in a new building with pre-finishing from the owner and renovated. If you want to use the services of an intermediary, clearly state what you need. Better yet, write and ask to read it under your signature. From the personal experience of bank client Alena L. Realtors offered apartments from intermediaries without renovation, explaining that “only the developer is primary, everything else is secondary.” Tired of wasting time, a list was compiled indicating what should be in the apartment - from wallpaper to sockets. Options disappeared, and later a suitable apartment was found through a neighbor. The realtor’s goal is to sell “something unnecessary” at any cost.

- When choosing an apartment, first look at the infrastructure of the area. A large number of public transport routes, distance to stops, the presence of hypermarkets and shopping and entertainment centers, as well as most importantly, gardens and schools, affect the value of real estate and the prospects for its growth in the future.

- Find out why the apartment is being sold, find out how many owners there are and look at the documents. Many problems arise when one of the co-owners is not ready to sell. Eviction proceedings are possible in the future.

- If there are redevelopments in the apartment, check their legality. If the changes are not legalized, you can bargain, since during a subsequent assessment for the bank you will need to negotiate with the appraiser so that information about them is not included in the report, not free of charge.

- Look at receipts for payment of utility bills or debt in the personal account of the management company, REP or HOA.

- Inspect the apartment - check the fastening of sockets, the quality of installation of doors and windows, the condition of pipes and plumbing. Sometimes high-quality pre-sale preparation results in a tidy sum for the buyer. Ask friends who are well versed in repairs for help.

- Look at offers for the sale of collateral real estate on bank websites. The price for mortgaged apartments is much lower, since there are restrictions and applications for new owners are approved within 1-3 days.

- Choose housing in the spring and summer, when the market is quiet, demand drops, and sellers are more willing to bargain. In autumn and winter there are more new offers, but prices during this period also increase by several points.

- In the evening or morning, drive by and look at the neighbors in the apartment and entrance, talk to them, find out about the problems of the house and the personality of the potential seller.

- Assess the audibility and condition of the entrances.

- Read reviews on the Internet about the house and the developer.

Question answer

Is it possible to get a tax deduction for an apartment purchased on the secondary real estate market with a mortgage?

It is possible if the borrower is officially employed. The state is ready to return 13% of the mortgage interest paid. The deduction limit is RUB 3 million.

Can a business owner or individual entrepreneur not provide a complete package of business documents for purchasing housing with a mortgage on the secondary real estate market?

Yes maybe. Many banks offer registration using only two documents. This may be a civil passport and license or TIN.

What costs arise when buying an apartment with a mortgage on the secondary real estate market?

Insurance, appraisal, costs for preparing documents for the transaction, state registration fee.

Is it possible to buy an apartment with a mortgage on the secondary real estate market without making a down payment?

Yes it is possible. Many banks offer such lending programs, but only if the borrower is willing to provide a 2-NDFL certificate and confirm other sources of official income.

Conclusion

Your “corner” is status, safety and comfort. To save time and money, consider purchasing a home on the secondary market. Start your search with bank offers, of which everyone has plenty.

Such a step, if the choice is made, will allow you to become an owner within 3-5 days. Despite the pitfalls, such deals have many more advantages.

Remember, everyone makes any choice independently, but no matter what we decide to do, having made it, we will have to live with the result and pay the mortgage later.

( 2 ratings, average: 5.00 ). Please rate us, we tried very hard!

What is the difference between buying an apartment on the secondary and primary markets?

The procedure for purchasing an apartment on the secondary market differs from the primary market in many ways, from the sequence of actions to prices. Both options are convenient and interesting in their own way, but much depends on what exactly is a priority for the potential borrower.

Price

Apartments in a new building are usually more expensive than those on the secondary market. This is not a mandatory rule, but this is exactly what happens most often. Apartments in a new building without renovation (roughly finished) and well-furnished apartments on the secondary market are more or less comparable in price.

If the buyer still plans to do major renovations, purchase the furniture he likes, remodel, and so on, then it is better to choose new buildings. In all other cases, especially when you need a “move in and live” apartment, the best choice is the secondary market.

Home improvement

The second important point is the arrangement of the apartment. Housing in new buildings is usually provided with a rough finish. In some cases, with “repairs from the developer”. The latter is the simplest, cheapest and most primitive option, in which the apartment takes on a more or less residential appearance, but still requires major repairs.

Some developers offer their clients to make high-quality repairs and even furnish the apartment with furniture/appliances of the customer’s choice, but the cost of such housing will be significantly higher than exactly the same on the secondary market.

Reliability of the transaction

But in terms of reliability, the option of buying a home from a developer is significantly better. Simply due to the fact that the apartment has not yet had owners, most of the potential problems with the seller’s relatives, his heirs, minors registered in the apartment, and so on are automatically resolved. There are still certain risks, but they will be significantly less.

Features of calculations

In almost all cases, housing in a new building (on the primary market) is purchased using a non-cash transfer. But when purchasing on the secondary market, the seller may require payments to be made exclusively in cash. This is very inconvenient, especially considering the fact that housing will be purchased on credit and the bank will agree to issue a loan only taking into account the non-cash transfer of funds.

Purchase Features

Before concluding a mortgage loan agreement, you should decide on the property. You can get a mortgage for an apartment in a new building, for a studio, apartment or resale. Banking services allow you to purchase rooms and shares in apartments on credit. Depending on the specific type of apartment, the terms of the contract and the requirements of the bank may change.

In a new building

The most popular and optimal solution for mortgage lending is an apartment in a new building. By purchasing housing in new houses under construction, citizens not only improve their living conditions, but also make a profitable investment. Unlike other types of real estate, when purchasing an apartment in a new building, a banking institution will credit an agreement on shared participation in the construction of residential real estate, and not a purchase and sale agreement.

By drawing up an agreement with the developer on participation in shared construction, it will be possible to significantly reduce the price of the apartment itself. And if the construction of a residential complex is already approaching the final stage, and there is no possibility of concluding an agreement for shared participation in the construction, then the option of an assignment agreement is also suitable.

Cession means the assignment of a claim. That is, the party to the assignment agreement will be the investor who previously entered into a contract with the developer and now cedes the right to claim the debt from the developer of the new building.

How to get the lowest mortgage interest rate for a new building? The answer to this question lies in the many terms of the contract, which can be advantageously changed and agreed upon with the bank.

Thus, the most important factor influencing the amount of interest payments is the amount of the down payment. The more you pay the bank when concluding the agreement, the lower the interest rate will be set in the agreement.

Banking institutions set interest rates depending also on the loan term. Of course, the option of a short-term mortgage is obviously unprofitable for the borrower. However, the longer the contract lasts, the more income the bank loses, taking into account inflation.

When purchasing an apartment in a new building on credit, you should insure against the risk of loss of ownership. This type of insurance is called title insurance. In addition, in the absence of mortgage property insurance, the bank will most likely refuse to conclude a contract. After all, when drawing up an agreement with the borrower, the bank needs a guarantee of the integrity and safety of the collateral, which is the apartment.

Preferential conditions for a mortgage on a new building are provided by banks for regular customers and those who have a salary card. A salary card solves two problems at once. The first is financial benefits and relaxations in the amount and timing of interest payments. And secondly, having a salary card does not require an additional income certificate to be attached to the package of documents.

Important! Typically, banking institutions that issue mortgage loans maintain a register of accredited (approved) developers. By purchasing an apartment from these construction organizations, you can count on significantly favorable bank conditions.

And the time required to complete the contract will be reduced to a minimum. On the official pages of banks you can find out about their accredited partner developers.

An analysis of current conditions shows that on average, for mortgages in new buildings, banks offer contracts with a down payment of 15-25% and annual interest rates of 9% and higher.

Secondary

Unlike new buildings, options on the secondary housing market require additional procedures when applying for a mortgage. Thus, the conclusion of an independent appraiser will be an important document for the bank’s credit commission. The housing appraisal will be carried out at the borrower's expense. There is a possibility of going broke with a secondary mortgage if there is no insurance.

If the purchase and sale agreement is declared invalid, all damage incurred by the bank and financial liability will be borne by the party under the mortgage agreement. However, it is important to remember that claims for invalidation of transactions are subject to a three-year statute of limitations.

Therefore, for the safety of the buyer of an apartment, title insurance is important only in the first 3 years after execution of the contract. After this period, the risk of losing ownership of the property is minimized.

Banks require that an apartment on the secondary housing market be in suitable condition, meet sanitary, technical and fire safety requirements, and not be part of a municipal program of major repairs or reconstruction, or demolition.

The size of mortgage rates on a secondary property depends on the same circumstances as in the case of a new building. There is only one difference - banks do not maintain a register of accredited home sellers on the secondary market.

Studio

An interesting option for improving living conditions is also a studio, which is an apartment without interior partitions. Thanks to the open layout and location in the budget price segment, the studio as a type of residential space is becoming a very popular offer on the housing market.

Depending on the stage of construction, other mortgage programs apply to studios. So, if a borrower is considering the option of a studio in a new building, then a bank employee, when applying for a mortgage, will offer similar conditions that apply to lending for new buildings.

And in the case of purchasing a studio on the secondary market, the borrower will have to prepare a package of documents on a general basis with the involvement of an independent appraiser.

There is one important feature of studio mortgage lending. If there is no permitting documentation for redevelopment, there is a high probability of termination of the mortgage loan agreement due to the recognition of the purchase and sale transaction as invalid.

In such cases, it is recommended to take out title insurance, which will minimize the financial risks of the borrower.

Apartments

When lending for the purchase of apartments, banks impose additional conditions:

- The property must be connected to all communications.

- It is not allowed to locate apartments on underground floors.

- An important requirement is the isolation of living space.

The residential building where the apartments are located must meet the following requirements:- The wear of the structure should be less than 50%.

- It is prohibited to locate apartments in buildings of former camps, sanatoriums, rest homes, military units and guest houses.

Number of floors – minimum 2.

Today banks offer mortgage agreements for apartments with a down payment of 20% or more.

Room and share

Modern banking services make it possible to obtain a mortgage for a share in an apartment or even a room. However, the borrower should know that he will not have to count on the profitability of the trail. The low liquidity of the mortgaged property forces banking institutions to set high interest rates, which can reach up to 20% per annum.

In addition, due to the specifics of the subject of the contract, certain additional requirements for collateral are established. So, a room or share in an apartment must be separate and isolated.

When buying a room or a share in a residential building, it is important to remember that the Civil Code of the Russian Federation established the pre-emptive right to purchase from co-owners when selling a property.

If the borrower purchased a room in violation of this rule, then the remaining co-owners have the right to declare the transaction invalid in court.

When purchasing a separate part of a dwelling, an agreement must be concluded between the co-owners on the procedure for using a room or share in a residential building. Otherwise, the bank may refuse to conclude the agreement.

How does the procedure for buying an apartment with a mortgage work?

Let's take a closer look at the algorithm for buying an apartment with a mortgage based on the step-by-step actions described above. So, the search for a buyer and a bank was mentioned at the beginning of the article. Negotiations are recommended to be carried out immediately in a tripartite format: buyer, seller and bank representative.

Loan processing includes:

- Compiling an application for a loan.

- Awaiting pre-approval.

- Filling out the client questionnaire.

- Providing all necessary documents.

- Waiting for loan approval, taking into account the documents and application form.

- Signing the purchase and sale agreement, loan and collateral (usually simultaneously).

- Payment by the buyer of the down payment.

- Registration of property rights to housing.

- Signing the transfer and acceptance certificate.

A down payment is a mandatory requirement of the bank. You won’t be able to buy an apartment without paying anything for it. On the other hand, the bank does not restrict the buyer in any way and, in fact, he can simply give the money in cash to the seller, asking him for a corresponding receipt. They will be considered confirmation of the fact of payment for the bank.

Registration of ownership usually occurs even before full final payment and signing of the transfer and acceptance certificate. Only when the buyer is convinced that he really is the new owner of the apartment, the bank transfers money to the seller, and the parties sign the transfer and acceptance certificate.

It is often supplemented by a receipt for the full amount of payment for the apartment, but given the fact that the bank sends money by bank transfer and this can be easily tracked, there is no particular need for such a receipt.

Required documents

To purchase an apartment with a mortgage, you must request the following list of documents from the seller:

- Passport of the current owner . This document is needed in order to compare the data of the person who is selling the apartment and its real owner. Some scammers take advantage of the fact that many people do not verify such information and, not being the owners, fictitiously sell housing. In the case of a purchase through a bank, it is almost impossible to do this, since the bank will also check all the papers, but there is still the possibility of an error or inattention.

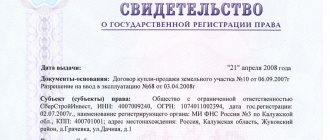

- Extract from the Unified State Register of Real Estate . This document now replaces the certificate of ownership. But in addition to the fact that with the help of an extract you can find out who is the owner of this apartment, it also displays information about whether there are any encumbrances on the apartment or not. If so, the bank most likely will not approve the loan. It is advisable to obtain the extract as “recent” as possible.

- Technical passport . Using this document, the bank and the new owner can determine whether the apartment has illegal redevelopment or not. If so, the bank will not approve the loan. This comes with possible risks. So, for example, if it is necessary to sell housing at auction (if the client cannot repay the debt), an apartment with unauthorized redevelopment cannot be sold.

- Title documents . This “section” includes housing purchase and sale agreements, donation agreements, wills, and so on. Any documents on the basis of which the seller received ownership of the property. Possible risks largely depend on them.

- Extract from the house register . An important document showing who is registered in the apartment. The bank will insist (and it is better for the buyer to join it) that all persons registered in the apartment be discharged before the sale takes place.

- Certificate from the management company . Using this paper, you can understand whether the apartment has debts for utilities or not. Formally, you can sell your home with debts. Moreover, the management company will not be able to demand them from the new owner, and if they try to do this, they can immediately go to court. However, this will still cause some inconvenience, because housing with debts is usually sold at a good discount.

- Permission to sell housing from the guardianship authorities . This document will be needed if a minor is registered in the apartment or is its co-owner. Without permission from the guardianship authorities, it will be impossible to sell such housing. This certificate has an expiration date of approximately 1 month. As a result, it is recommended to receive this document at the very last moment.

- Consent of the seller's spouse to the transaction . This paper is relevant only if the seller is married and the housing is in common joint ownership. Considering the fact that almost any apartment, even a private one, can, under certain conditions, be recognized as the common property of the spouses, the bank usually requires consent, regardless of who, how and for what money it was acquired.

Example: A husband can buy an apartment with money given to him. It will be considered personal property. However, subsequently, if the spouses made repairs to the home, purchased furniture, equipment, and so on, the wife can legally recognize the apartment as common property and not personal property. It's difficult, but possible.

What documents are needed to buy an apartment with a mortgage?

In addition to the above list of documents for the apartment, the buyer will also need additional documents to apply for a loan. This was briefly discussed above. Now let's take a closer look.

- Applicant's passport . Before submitting the application, you need to make sure that everything is in order with your passport - it was replaced with a “fresh” one in a timely manner (for example, upon reaching 25 years old), there are no third-party marks in it, and so on. Any violation and this document is considered invalid. As a result, the loan will not be issued.

- Temporary registration . This document is relevant only if the client does not have permanent residence. Despite the fact that loans are usually not issued under temporary registration, in the case of a mortgage an exception is usually made, but only on the condition that immediately after registration of ownership the client registers in his new home.

- Certificate of income . A mandatory document that is always required by the bank. Shows income level. The bank will prefer the official 2-NDFL certificate, but will consider other options. The main thing is that the document bears the signature of the head of the company where the borrower works, a seal and salary information.

- A copy of the work book . This document is not always required, but is desirable. It indicates that the person currently works absolutely officially, worked before, where he worked, how long he worked, and so on. You can ask for a copy from the accounting department. They cannot refuse.

Expenses

What else you need to pay attention to is the possible costs. In an ideal situation, the buyer pays only for the apartment and insurance. However, the seller may offer to share the costs if such costs are too significant for him. So, for example, a tentative list of expenses would look like this:

- Payment to a real estate agency for finding a seller (or, if the seller asks, for finding a buyer and supporting the transaction): about 2-5% of the cost of the apartment.

Example: If we assume that housing costs 5 million rubles, then the agency’s services will cost 100–250 thousand rubles.

- Payment to the notary for certification of the purchase and sale agreement: about 5-10 thousand rubles.

- Payment to a notary for certifying the consent of the spouse: from 2 thousand rubles.

- Payment to an appraisal company for assessing a home: about 10-15 thousand rubles.

- New extract from the Unified State Register of Real Estate: 350 rubles.

- New registration certificate: from 10 thousand rubles.

- State duty for registering property rights: 2000 rubles for each new owner.

Costs and fees

When purchasing an apartment with mortgage funds, you will need to pay:

- assessment of the selected lending object (from RUB 2,500 per seller);

- insurance of the purchased apartment (this amount can be paid into the mortgage from the buyer);

- rental of a safe deposit box (from the buyer in case of cash payment with the seller, the amount depends on the bank);

- state duty for registering a sales contract (1000 rubles each for seller and buyer);

- percentage for electronic registration (from the buyer or in half with the seller, the amount depends on the bank).

You can handle the procedure for drawing up a purchase and sale agreement with a mortgage yourself, or you can entrust this process to a realtor. But even in this case, all ongoing activities must be kept under control.

About the deposit for an apartment

A mortgage loan is a loan secured by real estate. Most often, the exact housing that is purchased is accepted as collateral, although this is not a mandatory condition.

Apartment valuation

To understand the market value of an apartment, you first need to evaluate it. Banks often require an official report from licensed appraisers. Moreover, they often insist on those that are accredited by this bank. Housing appraisal is a fairly expensive procedure, but it allows you to rightfully demand a specific amount for an apartment.

Most often, the assessment is carried out on the basis of already existing analogues. Simply put, you can roughly estimate the cost yourself, based on other offers of similar apartments in the city or its region.

Example: To simplify it very much, you can imagine 3 apartments similar to the target housing. One of them costs 2 million, the second 2.5, and the third, 1.7 million rubles. The average figure will be the approximate cost of the target apartment: (2.5+1.7+2)/3=2.07 million rubles.

Collateral verification

Before registering collateral, bank specialists must check it. They study the compliance of everything that is said in the documents with the real state of affairs, evaluate access to the apartment and many other parameters. You should prepare for the fact that such checks will be carried out regularly. On average – once a year, but it can be more or less often.

Collateral insurance

A property that is already fully ready for registration as collateral is required to be insured. Moreover, you cannot refuse this insurance - this is a legal requirement. The cost directly depends on the price of the apartment, the insurance period and many different parameters, including even the material of the walls/floors.

Typically, insurance is issued for 1 year and is renewed annually until the loan agreement is closed. However, in some cases, the apartment is immediately insured for the entire term of the loan. Usually in this situation the insurance company gives a good discount.

Encumbrance of collateral

After signing the contracts, an encumbrance is placed on the apartment. In this case, the client does not have to do anything. The bank itself will impose the encumbrance and, moreover, will remove it itself after the debt is repaid.

It must be remembered that the encumbrance will not allow you to sell this home. Also, usually, according to the terms of the agreement, the bank client is limited in certain actions with his home: he cannot register other persons, do redevelopment, and so on without the approval of the bank.

Of course, the financial institution will not constantly monitor all this, but if this fact comes up during the inspection, the bank may demand early repayment of the loan or impose penalties.

Why are banks willing to issue mortgages for secondary housing?

It is believed that secondary housing is cheaper than apartments in new buildings, but this is not entirely true. Both a completely new, “uninhabited” house or apartment and a “Khrushchev” built in the mid-twentieth century are considered secondary.

For realtors and bankers, secondary is any residential premises for which a certificate of ownership has already been issued and registered. So whether an application for a mortgage loan is approved or rejected depends not only on the borrower’s solvency, but also on the quality of the housing that is supposed to be purchased on credit.

At its core (in accordance with Law No. 102-FZ “On Mortgage” dated July 16, 1998), a mortgage agreement is an agreement under which the bank issues money to the borrower on the terms of real estate collateral. So, if the apartment is located in an old, dilapidated or dilapidated building, you can hardly count on a positive solution to the issue of issuing a mortgage loan. Unless other, less problematic and more expensive real estate will be offered as collateral.

By the way, the mortgagor can be not only the borrower himself, but also another person, naturally, with consent to provide his real estate as collateral. It’s another matter if a mortgage is requested for modern housing, which can be easily implemented by the bank if problems arise with the return of funds received from the bank.

How long does it take to buy and sell an apartment with a mortgage?

A home purchase and sale transaction, in ideal conditions, without going to the bank, takes at most 1 day. But this is actually very rare. Most often, discussing the conditions, completing all the necessary papers and other actions take about 3-4 weeks, or even a couple of months. If we also take into account the application to the bank (review of the application, verification of collateral, internal procedures for approving a loan, and so on), then the period can be safely increased by about 1 month.

Thus, the entire procedure for purchasing an apartment with a mortgage will take from 1 to 3 months.

Purchase procedure

When purchasing housing with a mortgage, the following procedure applies.

Conclusion of a loan agreement

The most important step in getting an apartment with a mortgage is choosing a bank and a suitable loan program. When choosing banks, it is worth considering several options, since it is possible to receive a refusal from a credit institution.

In almost all banks, the procedure for purchasing an apartment with a mortgage is the same. The only thing that may differ is the lending programs themselves, which provide benefits for a certain category of persons.

Example of a loan application form

The next step is submitting a loan application. A loan application is submitted along with a package of prepared documents. Having received a response from the credit commission, you can already navigate the price segment of your future housing. It is important to remember that the validity period of the approved loan application is 2 months. After the 60-day period, the application is automatically canceled, so you should hurry to find a suitable apartment.

After identifying the property to be purchased, all that remains is to coordinate further actions with the bank.

Registration of a transaction with the seller and transfer of money

Approval of the property and signing of the loan agreement allows you to register the transaction with the seller and transfer funds to him. The bank can make payment for the purchase and sale agreement, taking into account the preferences of the parties, either through a bank letter of credit or using a regular check. Real estate transactions are subject to notarization.

Insurance and registration of buyer's title

By recording the transaction for the purchase and sale of an apartment in Rosreest, the transfer of ownership is formalized. The buyer needs 3 business days to register ownership.

Title insurance (insurance of the risk of loss of property), as well as life and health insurance of the borrower under a mortgage agreement, is a mandatory requirement of banks.

Thus, they guarantee the fulfillment of obligations under the concluded contract. If the buyer of the apartment does not insure life and health, then banks have the right to unilaterally increase the amount of interest accrued.

Tips on what you need to know when buying an apartment with a mortgage

As you know, buying an apartment, even through a bank loan, is a rather risky procedure. Let's look at the main features and advise on how best to avoid the most popular problems.

Underwater rocks

Pitfalls that are relevant when buying a home with a mortgage:

- Minors are registered . As mentioned above, the bank will insist that all persons registered in the apartment be registered before the loan is issued. An absolutely reasonable request. However, if it is not heard, then a serious problem may arise. It is simply impossible to evict a minor. More precisely, it is possible, but for this he first needs to be provided with housing of similar quality. The new owner, to put it mildly, is not very interested in this. This problem should not be solved, but anticipated: you should independently check the extract from the house register and, if minors are listed there, demand that they be written out.

Discharging adults is also not easy, but it is possible. It is enough to go to court and declare that the residents are living here without the consent of the new owner and are undesirable. However, usually all such persons agree to be discharged voluntarily.

- The apartment was received as a gift . The gift may be taken away. For example, if the donor considers that the apartment is not being used the way he wanted. Let's say the home is valuable to the donor (for example, several generations have grown up in it). Of course, this person will be against the fact that the housing goes to a complete stranger. In such a situation, he can invalidate the gift agreement in court, and the new owner automatically loses the right to the apartment. There is no optimal solution to the problem. Unless you make sure that the donor will not challenge the contract or wait until the statute of limitations expires (1 year from the date of donation).

- The apartment was inherited . In such a situation, other relatives of the deceased may demand their share in the housing. If there is a will, this is not bad, since it immediately indicates all the features of the transfer of ownership. And if not, then the inheritance will be carried out on a general basis and there is a possibility that one of the heirs will not receive everything that is due to him. As a result, the agreement will be challenged in court. Here you can also wait for the statute of limitations to expire or check whether other heirs really have no claims.

- The apartment was received as part of privatization . Such a system may result in a person having the right of lifelong residence being registered in the apartment. It cannot be written out under any circumstances. This point should be clarified using an extract from the house register.

Not all aspects can be checked and anticipated by the client on his own. In many cases, only an experienced lawyer can do this. It is recommended to contact specialists to minimize possible risks.

Who is better to register an apartment for?

What should you do if a family man buys an apartment with a mortgage and wants to make it his personal property? In such a situation, it is necessary to register housing only for yourself, but this will not be enough. According to the law, even if the apartment is registered in the name of one of the spouses, but is acquired during marriage, the other half may demand that such real estate be recognized as joint property.

Moreover, if housing is purchased on credit, then the very fact of payments can be considered as expenses from the family budget. As a result, the apartment will still become joint property. The only option would be to use exclusively donated funds, but this point will also need to be proven.

If we talk about who is better to apply for a loan for an apartment, then the answer is obvious: the one who earns the most and has official employment. If, for example, only the wife is officially employed, but the husband earns more, then you need to apply for a loan for her, and he should be involved as a co-borrower.

In practice, banks almost always require spouses to become co-borrowers with each other.

What documents are issued when purchasing an apartment with a mortgage?

When purchasing an apartment with a mortgage, the buyer is left with:

- Contract of sale.

- A recent extract from the Unified State Register of Real Estate (issued upon registration of ownership).

- The act of acceptance and transfer.

- Loan agreement.

- Pledge agreement.

- Insurance policy for the apartment.

You usually have to obtain a registration certificate yourself. Other documents or copies thereof may also remain. For example, a gift agreement, on the basis of which the previous owner became the owner of the apartment, or, for example, the consent of the seller’s wife. All of them can be used only as a safety net in case of possible problems.

Even when buying an apartment with a mortgage, despite all the bank’s checks, the buyer may have problems with the seller, the housing, the persons registered in it, and so on. At a free consultation, experienced lawyers will tell you what exactly you should pay attention to first. They can also accompany the transaction, minimizing problems.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

2 ratings, average: 4.00 out of 5)

Author of the article

Natalya Fomicheva

Website expert lawyer. 10 years of experience. Inheritance matters. Family disputes. Housing and land law.

Ask a question Author's rating

Articles written

513

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

3

Apartment purchase and sale agreement using a safe deposit box

The procedure for purchasing an apartment is closely related to numerous fraudulent schemes. Get rid of...

33

Contract of sale of an apartment

In the majority of transactions for the alienation of property, a standard agreement is concluded...

6

How to bargain when buying an apartment on the secondary market

You can reduce the price when buying an apartment if you know some of the preparation details...

8

What documents are needed to buy an apartment?

Filling out documents for purchasing an apartment is one of the most responsible...

5

Buying an apartment by assignment of rights

When planning to buy an apartment on the primary market, you may come across advertisements...

29

Agreement on deposit when purchasing an apartment

In case of expropriation of real estate for compensation, the Seller and the Buyer may agree not...

What should you pay attention to when applying for a mortgage?

Applying for a mortgage may involve a number of nuances, which are best known in advance:

- Additional costs will arise during the procedure;

- the housing is not completely yours at the time of mortgage payments, and it can be lost in case of regular delays;

- the possible loss of your apartment will not save you from having to pay the mortgage.

Let's take a closer look at all the possible risks.

Additional expenses

You, as a future borrower, will have to face a list of services that need to be paid. Among them:

- registration fees and charges;

- banking operations with accounts;

- Notary Services;

- issue of a bank card;

- work of appraisers.

So that this or that type of service does not come as a surprise to you, you need to find out in advance what additional costs are involved in applying for a mortgage to the selected bank.

Please note that some banks may insist that their specialist conduct the real estate appraisal. In this case, it will be impossible to challenge the assessment, and there is a possibility that it will be made for a greater benefit for the bank than for you.

Another point that I would also like to emphasize is insurance. Of course, protecting the home purchased with a mortgage is a reasonable step. However, banks often offer other types of insurance services. So, Sberbank will recommend you life insurance for the entire loan repayment period. This is a rather expensive service, and you can refuse it, but the bank will increase the interest rate to reduce its own risks.

Restriction of rights to real estate

Until the loan is fully paid off, the bank sets some restrictions. These conditions may vary from bank to bank. It is only important that they do not go beyond the law.

Any contract will have the following conditions:

- property cannot be resold;

- the bank must be notified about the rental of housing;

- the bank must be notified in advance about any redevelopment;

- Housing cannot be given away as a gift.

Additionally, the following items may be present:

- the need to notify the bank about moving or leaving for a long time;

- the need to report changes in income;

- the ability for the bank to check the condition of the home and the legality of residence of third parties.

Sometimes the bank may include conditions prohibiting early repayment or, for example, the possibility of changing the interest rate unilaterally. Such actions violate civil law and can be challenged in court.

Maintaining collateral

Let's look at the risks associated directly with collateral. Housing can be destroyed or significantly damaged as a result of all sorts of incidents - from a hurricane to a fire. This does not relieve you of responsibility to the bank. In the event of complete destruction of property, an alternative collateral must be provided. If the damage can be repaired, then the repair timeline should be agreed upon with the bank.

There may be heirs who claim the mortgaged apartment. If the court decides that the property remains theirs, you will still be forced to pay off the mortgage debt.