Home/Types of mortgages/Mortgage on maternity leave

The birth of children may lead to a need for improved living conditions. Usually it is the spouse who applies for the mortgage. But his credit history may be damaged, or the couple is divorced, and the woman is left alone with the child. As a result, there is a need to apply for a mortgage on maternity leave. Banks are reluctant to provide such a service. For the company, cooperation with women on maternity leave is associated with additional risk. But banks can accommodate the new mother if they follow a number of rules and prove the company’s reliability.

Do they give you a mortgage on maternity leave?

First of all, you should familiarize yourself with the norms of the current legislation. The rules for issuing a housing loan and the specifics of cooperation with a financial institution are regulated by Federal Law No. 102 of July 16, 1998 “On Mortgage”. It defines the specifics of the transaction, the nuances of property disposal, the terms of cooperation, the closure of obligations and other nuances. However, the legal act does not contain a ban on providing housing loans to women on maternity leave. In fact, it turns out that applying for a mortgage on maternity leave can be done.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

However, in practice, banks are reluctant to cooperate with persons on maternity or child care leave. This is due to the fact that the financial situation of young mothers on maternity leave remains unstable. As long as the child is less than 1.5 years old, the woman will be provided with a benefit in the amount of 40% of the salary. A young mother can care for a child until he reaches 3 years of age. However, after 1.5 years, the amount of the benefit decreases sharply. Therefore, most banks prefer to wait until the potential mortgage borrower continues official work.

Attention

Much depends on the amount of income, the presence of property in the property and other sources of profit. If a woman demonstrates that she will be able to make mortgage payments on maternity leave during the entire period of closure of obligations, the bank is able to make concessions. A decision on each application is made individually.

Ways to get a mortgage while on maternity leave

So, we found out that a maternity leaver still has a small chance of getting a housing loan. How to get a mortgage while on maternity leave:

- Ask at work to draw up a certificate based on the bank’s model so that they do not indicate payments to you as maternity leave. If the accounting department enters the deductions as salary, the bank will be able to accept it for consideration and approve the loan. Is it possible to get a mortgage during maternity leave in this way? Yes, but there is a possibility of being included in the bank's stop list if the trick is discovered.

- Provide documents confirming that you have additional income. This could be a part-time job or a small home business. When calculating solvency, all cash receipts (alimony, pensions, benefits, income from investments, etc.) are taken into account. Take your Social Security eligibility certificates or bank statements and include them with your mortgage application.

- Submit an application to the bank where your salary card is opened. It is much easier for such borrowers to get a loan than for clients on the street, because the lender can easily track all financial receipts to the current account. It is advisable that your maternity benefits cover the cost of living for yourself and the child. A spouse's income can be used as financial support to qualify for a larger mortgage amount.

- Tell your bank that you want to purchase life and health insurance; this is a big plus when considering a mortgage. Most banks practice lowering the rate if there is a policy. Sometimes taking out insurance is even more profitable than paying 1-2% more for the entire loan term. In addition, you do not need to pay the entire amount at once; insurance companies offer to issue the policy in installments. If an insured event occurs, the insurer will cover the mortgage debt for you.

- Increase your down payment. The more money you put down, the higher the likelihood of your mortgage being approved. You can borrow them or ask relatives to take out a consumer loan.

- A mortgage during maternity leave is possible subject to the involvement of co-borrowers. Your spouse will definitely be there, but you can ask other relatives, such as parents, for help. Some banks allow you to attract up to 5 solvent co-borrowers, whose income is enough to repay the desired loan amount. You need to understand that the role of a co-borrower is not limited to signing an agreement with the bank; in case of non-payment, he will have to pay off the debt instead of you.

- Check your credit history. If you have never taken out a bank loan before, you must first apply for 2-3 commodity loans and repay them on time, then you will have a positive credit rating. If you have a good banking history, you are more likely to get a mortgage.

- Get rid of existing debts to other banks, close all credit cards. If you have credit cards that you do not use, the bank will calculate payments on them as if you had used up your entire cash limit. There is no point in keeping them just in case.

You can register the purchased property as your own or divide it between co-borrowers. Lenders allow you to use both options. The spouse automatically becomes a co-owner of the home because it was purchased during marriage.

If all of the above methods do not help, try getting a mortgage for your spouse. The bank will require him to meet all the same conditions: sufficient solvency, good credit history and a “white” salary. You will definitely be his co-borrower, so it is better to collect all possible evidence of additional income.

Recommended article: Alfa-Bank mortgage terms

Options for obtaining a mortgage during maternity leave

A competent approach to the procedure can significantly increase the chances of getting a mortgage approved during maternity leave. To do this you need to use the following methods:

- Attracting co-borrowers and guarantors. This category includes persons who are ready to undertake obligations to the bank if the main recipient of funds violates the terms of the agreement. The difference between guarantors and co-borrowers on a mortgage is that the latter are not only responsible, but can subsequently claim part of the property. If the client refuses to repay the mortgage on maternity leave, the bank will first put forward demands on the borrowers. Their income is taken into account when calculating the maximum available amount. However, the number of co-borrowers is limited. Within the framework of one contract, you can attract no more than 3 persons included in this category. The more co-borrowers and guarantors, the less risk there is for the bank in a mortgage on maternity leave.

- Providing additional collateral. The transfer of property as an encumbrance is necessary so that the bank can compensate for its expenses through the sale of the property if the citizen refuses to fulfill the obligations under the contract on his own. Usually the purchased apartment serves as collateral. If a client wants to increase loyalty to a financial institution, he can take out a mortgage for an additional property. However, only liquid property is considered as collateral for a mortgage loan. These can be apartments, houses and rooms already owned. The company can accept a vehicle or a summer house as collateral for a mortgage on maternity leave.

- Confirmation of the presence of additional sources of income. In practice, a woman on maternity leave can receive money not only from her employer, but also from renting out an apartment, providing any services or performing work. If the activity consistently generates profit, it is worth informing the bank about this. However, the financial institution will only take into account verified sources of income.

- Registration of OGRN. If a woman worked as a teacher before maternity leave, she can continue private practice at home or take up tutoring. In order for the bank to take this source of income into account, it is necessary to obtain permission to conduct such activities. When filling out an application for a mortgage while on maternity leave, you must provide a declaration for the reporting tax period. This will increase your chances of getting a positive decision.

- Providing a large down payment. Banks want to be sure that the borrower has the funds to pay the obligations. Therefore, companies are asked to provide an initial payment. The larger the payment a person makes on his own, the higher the chances of approval of an application for a mortgage loan while on maternity leave. If a woman wants to get a mortgage while on maternity leave, she must pay from 20% to 50% of the cost of the apartment herself.

- Additional ways to increase the likelihood of approval of a mortgage application during maternity leave. Women can take advantage of existing government programs. Thus, it is permissible to issue a family mortgage at 6%. The service is available to persons in whose family a child was born between 2021 and 2022. Additionally, regional programs may be present. When preparing to apply for a mortgage while on maternity leave, you need to collect a full package of documents and certificates. The more information provided to the borrower, the better the company will understand with whom it will be dealing. If the organization sees that the woman will be able to make payments smoothly, the likelihood of a positive decision will increase. It is necessary to monitor the veracity of the information. It is important to answer the credit manager’s questions honestly, and also to ensure that the information in the application form and in the documents do not differ. Otherwise, the company will reject the client’s request without prior consideration.

Is it possible to get a mortgage loan while on maternity leave?

If the husband and wife are not registered

The situation when the mother is not married and is on maternity leave is quite complicated; will they give a mortgage in this case? One of the main criteria for the bank is the overall level of family income. If a woman does not have a husband and she herself is on maternity leave, then according to this parameter she is not a reliable client for the bank.

However, many organizations are loyal to single mothers and are ready to provide them with housing on preferential terms. The best option is to attract a guarantor, or better yet two . Often young mothers involve their relatives in this capacity. The chances will also be increased by the presence of other real estate that can act as collateral. If a young mother is entitled to maternity capital, it can be used as a down payment.

However, in many cases, mortgage banks refuse such applications. An unmarried woman who is temporarily unemployed is not, by the standards of many of them, a reliable borrower. In the absence of guarantors, collateral, or confirmation of official income, the answer will most likely be negative. For what other reasons can banks refuse a mortgage and what to do in such situations, we described here.

Officially married

In a situation where a woman is on maternity leave and has a husband, it is somewhat simpler. In this case , it is recommended that the spouse take out a mortgage for himself . The wife will act as a co-borrower (her income will be taken into account).

If the spouse has outside income, it is recommended to confirm this. For example, she can do some work at home. You can also use funds provided under the Maternity Capital program.

The percentage of approval in this case is determined by the average monthly income of the spouse. If the average income for each family member is at least one subsistence level, the chance of getting a mortgage may be quite high.

In general, it is easier to get a mortgage if it is issued by a husband than by a woman on maternity leave. However, refusal is possible in this case as well. The bank may refuse if the spouse’s income seems insufficient, if he has a bad credit history or does not meet the requirements established by the bank. In some cases, a lending institution may offer a smaller amount than originally stated.

Is it possible to get a mortgage for a husband if his wife is on maternity leave?

If the spouses are in an official relationship, and the recipient of the housing loan is the husband, the wife will necessarily become a co-borrower. Theoretically, the company has no prejudice against families in which one of the spouses is on maternity leave. In practice, this fact can affect the final decision. A family can increase the likelihood of approval of a mortgage application while on maternity leave. First of all, it is worth indicating the husband, who is officially employed, as a financially responsible borrower. However, in this case, the man will be shown more attention. In particular, the banking organization will assess the citizen’s income and credit history. If the salary allows you to smoothly cover your obligations, the company will approve the application.

For your information

If your wife has additional income while on maternity leave, you can indicate information about it in the mortgage application. In this case, the chance of receiving money during maternity leave will increase. An alternative is to use a mortgage on two documents. When providing an offer, the bank only requires a passport and additional identification. It is not necessary to mention the fact that your spouse is on maternity leave. However, the conditions for using such a service will be more severe. The client will have to pay over 40% of the cost of housing on his own. In addition, the offer rate is on average 1% higher than the standard rate.

Is it possible to use maternity capital?

A mortgage during maternity leave using maternity capital is a common practice for banks. It is during this period that parents receive a certificate and want to put it into use as quickly as possible. If you decide to apply with capital as a down payment on a mortgage, you need to find out what documents will be required from you and submit the application for consideration. After this, all that remains is to wait for the bank’s decision.

Will a mother be given a mortgage on maternity leave if she has maternity capital? Depends on the same conditions as with regular lending. A woman on maternity leave will not receive any concessions or benefits. Her application will be considered on a general basis, and perhaps even more strictly, because soon she will stop receiving maternity payments.

There is a high probability of getting a mortgage using capital if, after repaying the debt with a government subsidy, you will only have to return a small amount to the bank. For example, you buy an apartment for 600 thousand rubles. The bank issues you a mortgage for 10 years at 14% per annum in the amount of the full cost of housing, and you contact the Pension Fund with a request to send a certificate for debt repayment. When funds in the amount of 453,026 rubles arrive, your debt will be 146 thousand rubles, the monthly payment will be only 2,200 rubles.

Recommended article: Mortgage AHML (Dom.rf) - conditions and requirements

Mortgage and maternity capital

How to take out a mortgage loan while on maternity leave?

Applying for a mortgage on maternity leave is no different from the classic procedure for obtaining a loan. To use the service, you must:

- Familiarize yourself with the list of bank offers and choose the most suitable one. It is necessary to evaluate not only the interest rate, but also the available limit, the repayment period, the presence of payments for opening an account, and the requirements put forward.

- Contact the organization you like by filling out an application form. You can carry out the procedure during an independent visit to a branch of the organization or via the Internet. All banks have official websites with an online form for applying for a mortgage loan.

- Wait for the decision to be made. It must be remembered that the verdict will be preliminary.

- If the bank has given preliminary approval for a mortgage on maternity leave, you must prepare a package of documents and personally visit the financial institution. Company representatives will re-check the documentation. If the information in the documents does not differ from the information specified in the application, the client will receive final approval. From now on, you can start choosing housing.

- Select a suitable property, contact its owner and inform about your desire to purchase an apartment with a mortgage. If the property owner agrees to this, it is necessary to conclude a preliminary purchase and sale transaction, evaluate the property by inviting a specialist, and also collect papers for the apartment.

- Transfer documents to the premises of a financial institution. The bank will check the housing for compliance with established requirements. Only liquid premises can be purchased with the money of a financial institution.

- Sign the purchase and sale agreement and the loan agreement, as well as provide the down payment on the mortgage on maternity leave. A power of attorney must be issued for him. The paper is required so that the bank can transfer money to the seller.

- Re-register the premises, prepare a mortgage and obtain mortgage insurance.

How to pay a mortgage while on maternity leave

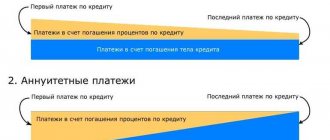

The procedure for paying off a mortgage loan on maternity leave is no different from the standard one. In other words, it must be specified in the contract. Most often the conditions are:

- funds must be deposited into the bank account every month;

- provided that there is a delay, the borrower's funds can be collected by the bank by writing them off from other available bank accounts that are opened with the same credit institution, while the bank is not obliged to notify the debtor of the collection.

To get a mortgage, you can use maternity capital

Important advice: if you find yourself in a situation in which you are about to be unable to pay your mortgage, you can use the following trick: rent out your home, provided that you have a place to live, and with the money you receive from tenants funds pay off the debt in the bank.

Do they give a mortgage on maternity leave?

The issuance of maternity capital is carried out in accordance with the provisions of Federal Law No. 256 of December 29, 2006. The funds can be used to pay off the principal balance of your mortgage or put towards a down payment. If a woman is on maternity leave, she can also take out a mortgage with maternity capital. However, the use of government support does not guarantee a 100% chance of approval of the application. In order for a mortgage to be granted on maternity leave, it is necessary to be able to continue to make stable payments throughout the entire period of closing obligations. To make sure of this, the bank checks the client's solvency and reliability.

Will they give me a mortgage if I'm on maternity leave?

The issuance of loans for the purchase of residential real estate is regulated by the Federal Law “On Mortgage”. The law does not limit the ability to obtain a mortgage loan on maternity leave. But in reality, it is not easy for a woman on maternity leave to get a mortgage. It is necessary to take into account the strict requirements of banks for applicants, established interest rates and the size of the down payment.

Ask credit experts right away about whether they give you a mortgage if you are on maternity leave. After all, if you keep silent about your pregnancy at the stage of drawing up a mortgage agreement, the court may recognize your actions as malicious intent and accuse you of fraud. Deception for the purpose of obtaining personal gain will result in major troubles: the deal will be terminated and sanctions will be imposed on you. You risk being left without a down payment and without housing.

The highest percentage of loan refusals occurs among women on maternity leave. A young mother has the right to take out a mortgage for herself if she goes to work and works for at least six months. But if you approach the matter wisely and thoroughly prepare for buying a home, it is quite possible to get a mortgage loan.

The presence of regular sources of income affects mortgage approval. A woman on maternity leave must prove her creditworthiness to the bank, collect the necessary package of documents, and confirm that the mortgage will be repaid without delay, on time. It is worth enlisting the support of guarantors with high earnings and a positive credit history.

This article is perfectly complemented by the following materials:

How to get a mortgage with a bad credit history, tips for correcting your credit history, a list of banks that approve mortgages with a bad credit history.

Ways to get a mortgage without proof of income, what you need to know and what you will have to sacrifice, useful advice from experts and a list of banks that practice issuing such mortgages - read here.

Conditions for granting a maternity mortgage

- The borrower has a high average monthly income - the bank will approve the loan if you confirm that you regularly receive money, regardless of the source of financing. Although in this case, at the discretion of the financial institution, the size of the mortgage can be significantly reduced.

- Availability of a sufficient amount of funds to support the child after paying off the loan - the family income must be analyzed taking into account the needs of the children.

- Lack of outstanding obligations - if you have open credit cards, you use a personal loan, this will make it difficult to get a mortgage.

- Collateral – a mortgage is provided against property; the higher the appraised value, the more willingly the bank agrees to issue a loan for the purchase of living space.

- Property Insurance – The property you purchase with a mortgage will need to be insured.

- Guarantees of guarantors - it is advisable for a woman on maternity leave to enlist the support of working persons. Sponsors can be husband, parents, relatives, acquaintances.

- If your family falls under the program to support families raising two or more children - if you are eligible for maternity capital, your chances of taking out a mortgage while on maternity leave increase. Indeed, according to the law, the amount of federal financial support is allowed to be used to pay off the down payment or early repayment of the mortgage.

Our handy mortgage calculator will help you calculate your monthly mortgage payment, so you can clearly see how much you'll have to pay each month.

Is it possible to get a mortgage on maternity leave secured by other real estate?

The presence of additional security increases the likelihood of a positive decision on the application. For the bank, this is an additional guarantee, so companies are loyal to borrowers who want to take out a mortgage on maternity leave secured by other real estate. The cost of the premises is taken into account. Typically, the bank is ready to issue no more than 70% of the collateral price. In addition, it is necessary to conduct a real estate appraisal.

Attention

The secured property must have high liquidity. The object that a woman wants to provide as collateral for a mortgage during maternity leave should not be subject to demolition or be considered unsafe. Additionally, the year of construction, its location, transport accessibility, and the availability of communications are taken into account.

Where to get a mortgage while on maternity leave

First, consider mortgage options without mandatory proof of income. There are few such banks, but they can make a positive decision on your application even without income certificates. As a rule, a mortgage with a minimum of documents is issued at a higher interest rate, so first calculate the future payment in a loan calculator.

When choosing a bank, take into account mandatory contributions, for example, collateral insurance and the dependence of the interest rate on various factors. They can seriously affect the final cost of the loan, so it is better to first obtain detailed advice on the terms of the loan from a mortgage manager. Housing loans are issued for a long term; you should not neglect to find out the terms of payment, even if you are not approved for a mortgage anywhere else.

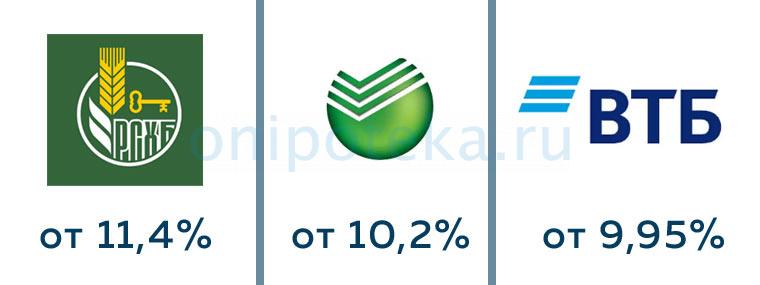

Which large banks have provided a mortgage loan under two documents in 2021:

- Sberbank issues a mortgage from 300 thousand to 15 million rubles using a passport and a second identification document. Interest rate from 10.2%, payment period up to 30 years. You can attract a co-borrower to increase the loan amount. However, the down payment on purchased housing starts from 50%.

- Rosselkhozbank . Interest rate from 11.4% per annum, loan term up to 25 years. You can get up to 8 million rubles here. It is not necessary to confirm your income, as stated in the terms of the program. But the down payment must be at least 40% of the cost of the purchased home.

- VTB also did not stand aside. Here you can get a mortgage without taking into account income from 600 thousand to 30 million rubles. Interest rate from 9.95%, down payment from 30% of the cost of housing. It is not possible to make the first installment of payment for an apartment using maternal capital under this program.

Recommended article: How to refinance a mortgage at Raiffeisenbank

Pay attention not only to banks’ permanent mortgage programs, but also to temporary promotions. For example, during periods of recession, many financial institutions reduce requirements for borrowers and issue mortgages using two documents. Large banks tend to screen loan applications very carefully, but interest rates are low.

Small credit institutions are quite loyal to borrowers and even issue mortgages to clients with a bad credit history, but the interest rate may be 5-10% higher. In terms of the long term, this results in a decent amount of overpayment.

Mortgage for a single mother on maternity leave

If a woman does not have an official spouse, the likelihood of her application being approved is significantly reduced. The fact is that the husband or wife become obligatory co-borrowers. They are held accountable for fulfilling their obligations. Therefore, getting a mortgage for a single mother on maternity leave without a husband is extremely problematic.

You can increase the likelihood of your mortgage application being approved while a single mother is on maternity leave in the following ways:

- by attracting additional co-borrowers and guarantors;

- provide additional security;

- confirm the presence of additional income.

Banks will definitely evaluate the woman’s financial situation. You can expect your application to be approved only if your mortgage payment does not exceed 50% of your total monthly income.

Difficulties in obtaining a mortgage while on maternity leave

The Law “On Mortgages” does not have a clear clause that prohibits or limits mortgage lending to women on maternity leave. They can count on a loan on a general basis if their solvency is confirmed. But whether a woman on maternity leave will be given a mortgage or not depends on the financial organization.

Banks identify a conditional list of unreliable borrowers:

Low income citizens.

Representatives of professions whose income depends on the season or other factors (photographers, artists, guides, travel agency managers, realtors, entrepreneurs, etc.).

Unemployed and unofficially employed people.

Large and single-parent families.

Former bank clients with bad credit history.

People under 25 years of age, as well as citizens over 60 years of age. In the first case, it is believed that young people have not decided on a permanent job; many continue their studies. In the second case, banks are afraid to contact the borrower due to age - there is no guarantee that the person will have time to repay the loan.

The official income level of a woman on maternity leave is small

There are no women on maternity leave on this list. But they belong to the category of people with low incomes - child benefits are significantly lower than the average salary. Based on the official amount of benefits (on average 10,000 rubles), a woman simply cannot afford the monthly payments plus maintenance for herself and the child. Some mothers return to their main job 2-3 months after giving birth full-time while maintaining payments for the baby. But this is the exception rather than the rule.

Getting a mortgage while on maternity leave

Issuing mortgage loans provides financial institutions with enormous income through interest. If a woman, due to her difficult financial situation, is unable to pay her dues on time, the bank will lose significant profits. And according to the law, the bank has no right to deduct a certain amount towards the loan from the benefit. This is the main reason why it is difficult to get a mortgage while on maternity leave.

Tax deduction for mortgage on maternity leave

A tax deduction is a return of part of the funds paid to the state budget. Its provision is commented on by Article 220 of the Tax Code of the Russian Federation. Property deduction when buying a home is 13% for no more than 2 million rubles. So, if housing was purchased for the maximum amount, the tax deduction on the mortgage will be 260,000 rubles. There is a separate deduction for interest. For him, the maximum limit is 3 million rubles. However, refunds are provided only to persons who are officially employed and pay taxes to the state budget.

Attention

While on maternity leave, women do not receive wages. Instead, they receive child care benefits. Cash funds are not subject to taxes. The employer does not make contributions for the employee during this period. Therefore, a woman who is on maternity leave and only on child care benefits can take advantage of the benefit only after returning to the workplace and starting receiving wages.

Is it possible to get a mortgage for a woman on maternity leave?

Now let's approach the issue that interests us from the point of view of not the possibility, but the reality of achieving the goal. So are they really giving credit to women on maternity leave and how often does this happen?

We answer: yes, they do. In addition to the cases listed in the section above, situations may arise in which the applicant applying for a mortgage has any income that:

- are not related to her main place of employment, where she is not currently serving, as she went on maternity leave;

- are permanent.

Unfortunately, a woman does not always have time to solve her housing problem during pregnancy.

Such income may come, for example, through profit from:

- securities of value;

- other assets of various categories;

- own business, etc.

That is why each situation regarding the issuance of a housing loan to a woman on maternity leave will be considered individually. The bank may well make concessions to mothers, however, most likely, it will still demand:

- that a guarantor should take part in the procedure;

- significant price of the collateral property.

However, provided that you are a woman on maternity leave and do not have a large regular income, in almost 98% of 100% of cases you will be denied a mortgage, even if at your place of work:

- you retain your previous position;

- This position is well paid, that is, you have a high level of income.

It's not about how you can potentially pay over time, but what your current financial situation is. Unfortunately, your capabilities are taken into account precisely on the basis of it, therefore, whatever it is, such will be the answer to your request.

Which banks can you turn to for a mortgage while on maternity leave?

Not all financial organizations are ready to cooperate with people on maternity leave. However, it is still possible to find a suitable mortgage offer on the market. Before using the service, you must carefully read the sample terms and conditions for providing funds.

| A bank where you can get a mortgage while on maternity leave | Terms of cooperation |

| VTB | Overpayment from 9.6% per annum, minimum down payment 40%. The company can lend money even to officially unemployed persons. |

| Rosselkhozbank | Interest rate from 9.8% per annum. Down payment 40%. Loan money is issued only for finished housing |

| Sberbank | The overpayment in the organization is 9.5% per annum, the down payment is 50%. If electronic registration is carried out, you can reduce the rate by 0.1%. The company has a Young Family program. |

Attention! The conditions are valid at the time of writing; to clarify the latest information, please contact your consultant.

Mortgage from Sberbank during maternity leave: do they give it and how to get it?

The most popular and strongest credit institution in our country is the well-known Savings Bank or Sberbank. This organization offers various preferential mortgage programs to support young families.

So, one of them is called “Young Family”. It is possible to obtain a mortgage in any subject of the Russian Federation. We consider its conditions in the table below.

Table 1. Conditions for providing a mortgage under the “Young Family” program from Sberbank

| Requirements | Conditions |

| Government subsidies | Young parents are given a subsidy, the amount of which is equal to 30-40% of the price of the residential property they have chosen. |

| Interest | State support is issued along with a loan at 11% per annum. |

| Age limit | Young spouses can get the opportunity to take part in this program if at least one of them is not yet 35 years old at the time of receiving this program. |

| Constant and sufficient income | The income of one of the spouses must be above the minimum, since otherwise you should not expect a positive decision even from Sberbank, known for its loyalty to the population that is not included in the wealthy category. In addition, the income must be constant. |

| Mortgage term | The duration of the mortgage loan in this case for young parents is no more than 30 years, depending on the conditions determined by the borrowers and the bank. |