IIS is an individual investment account that can be opened by an individual. Its advantage over a regular brokerage account is that a tax deduction can be issued using an IIS.

- Who is eligible for an IIS deduction?

- How to get a tax deduction for IIS?

- What types of IIS deductions exist?

- Which type of deduction should you choose?

- When is it necessary to make a choice regarding the type of deduction to be applied?

Conditions for tax refund

Receiving 13% of the amount deposited into an IIS is subject to a number of requirements and restrictions. Only persons who are personal income tax payers are entitled to this benefit.

Otherwise, the investor is not entitled to any deductions, and the only option left is to open an account for another person who pays income taxes.

Important: The procedure for processing and paying tax deductions is regulated by Article 219.1, paragraph 1, paragraph. 2 of the Tax Code of the Russian Federation.

The state has introduced restrictions on amounts and terms:

- The maximum IIS deposit amount, which is the basis for calculating the return, is 400,000 rubles. As a result, the tax office returns no more than 52,000 rubles. per calendar year.

- The amount payable cannot exceed the amount of income tax actually withheld at the place of employment.

- This year you can get 13% only for the past year or for the past three years. If money was deposited into an IIS in 2021, you can apply for a 13% return in 2021–2022.

- The IIS must be closed no earlier than three years from the opening date.

- Payment of the deduction does not require waiting for the expiration of the three-year period. But if the IIS was closed before the deadline, the 13% received will have to be returned to the state budget. And also pay a penalty - 1/300 of the rate of the Central Bank of the Russian Federation, for each day of unlawful possession of returned tax funds.

You can replenish the IIS deposit at any time: at the beginning, middle or end of the calendar year. The moment of depositing money does not matter; a deduction is due from the entire amount, up to 400,000 rubles.

This means that you can deposit money two weeks before the account is closed and receive a benefit. Such a scheme is not a violation of the conditions, and it is not necessary to participate in trading on the stock exchange.

In this case, replenishment implies the transfer of money in rubles. Currency or other securities are not accepted.

Important: IIS is opened for a period of three years, accordingly, the investor can receive the benefit three times. The total amount that can be returned for the entire period will be 156,000 rubles: 52,000 rubles each. for every year.

Features of using IIS to apply for benefits

Let's take a closer look at several nuances related to using IIS and obtaining a tax deduction:

- A previously opened brokerage account cannot be transferred to an IIS. However, in parallel with the investment one, you can have any number of brokerage ones.

- You cannot withdraw money from an individual IP, even partially. Upon transfer, the account is immediately closed and if 3 years have not passed from the date of opening, the right to the benefit is lost irrevocably.

- Registration of a tax deduction under type “A” does not cancel the obligation to pay tax on profits under an individual investment account. It is calculated at the time of closing. That is, the user does not pay tax for all three years, but can use this money for investment purposes.

- A period of three years is the minimum period for using the account. After this time, it is not necessary to close it and take the money.

- It is permissible to close one IIS, and then open another and receive a deduction for it. There are no legal restrictions here. However, the period during which the first contract must be terminated cannot exceed one calendar month.

- To receive personal income tax there are no restrictions on the number or amount of transactions. The account can be used regularly or once in all three years.

- When dividends and interest income are credited to an IIS account by a broker, this is not considered a deposit, whereas from a bank account an investor is. An individual also has the right to receive a deduction from this money.

If all conditions are met, there will be no problems with refunds. It is recommended to select an account type not immediately, but closer to closing.

This will allow you to make calculations and understand which of the two options is more profitable.

What limitations does the IIS have?

There are several nuances that you should know before opening such an account.

The account must be open for at least 3 years

If you close it earlier, the right to deduction is lost. This means that if you received money under a type “A” deduction, you will have to return it to the budget.

You need to deposit money into the account every year

If you decide to earn a maximum of 156,000 using the “A” deduction, you will have to deposit a minimum of 400,000 rubles into the account.

We'll have to freeze the money

You will not be able to withdraw money from your IIS without closing the account. If the account is closed before three years, you will lose the right to deduction.

You cannot top up your account with more than 1 million rubles

The limit is updated on January 1 of each year.

You should only have one account. If you make several accounts with different brokers, you will still be able to receive only one tax deduction.

Step-by-step video instructions for receiving an IIS deduction

The step-by-step process for processing compensation payments looks like this:

- Open an IIS with any broker.

- To put money into the account.

- For the next calendar year, submit the required package of documents to the Federal Tax Service at your place of residence.

- The tax office reviews the application and documents within three months.

- Within a month, the money is transferred to a bank account.

When an investor issues a tax refund under IIS “A” type, he submits documents to the Federal Tax Service independently.

Type “B” deductions are made through a broker - he is provided with certificates confirming that the benefit has not yet been used.

After which the tax agent, whose role is the broker, does not withhold income tax.

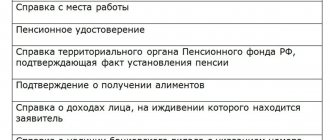

Required documents

The list of documents submitted to the Federal Tax Service to obtain a tax deduction under IIS includes:

- Application for deduction under IIS. It is necessary to indicate the bank details to which you want to transfer money. You can fill out a sample

- 3-NDFL. The IIS deduction is reflected in the declaration; it can be drawn up for a fee, from specialists, or through the “Legal Taxpayer” program - it is available on the tax office website and is available for use free of charge. A blank form for 2021 is possible, but it is important to remember that the Federal Tax Service periodically updates document forms.

- Documentary proof of payment of income tax indicating the amount. This may be a standard 2-NDFL certificate issued at the place of work.

- One of the documents confirming the right to personal income tax compensation: agreement to open an individual investment account; agreement on brokerage services or on trust management, drawn up in the form of a single document (which was signed by both parties); notification/application/notification of accession to a brokerage service or trust management agreement.

- Confirmation of crediting money to the IIS deposit: bank payment order; PKO on depositing funds in cash (issued at the cash desk when replenishing the deposit); if funds are transferred from another account, a transfer order is provided.

Important: It is necessary to submit to the Federal Tax Service not originals, but copies of papers and certificates. Therefore, they should be certified in advance by a notary.

The package of documents for obtaining a tax deduction under the IIS is submitted to the tax specialist in person; you must have a civil passport with you.

It can also be sent by registered or valuable mail with an inventory. First, inspection staff review the papers, then the funds are transferred to the specified details.

Official step-by-step instructions for receiving a deduction can be found on the tax service website at this link.

All the most important things you need to know about the Individual Investment Account (IIA)

The most common type of savings in Russia is a bank deposit. But more and more citizens are paying attention to the securities market, which provides more flexible and profitable opportunities for managing their funds.

The state played an important role in this, making this investment option very attractive. In 2015, the government launched a special type of brokerage account - the Individual Investment Account (IIA).

What is IIS

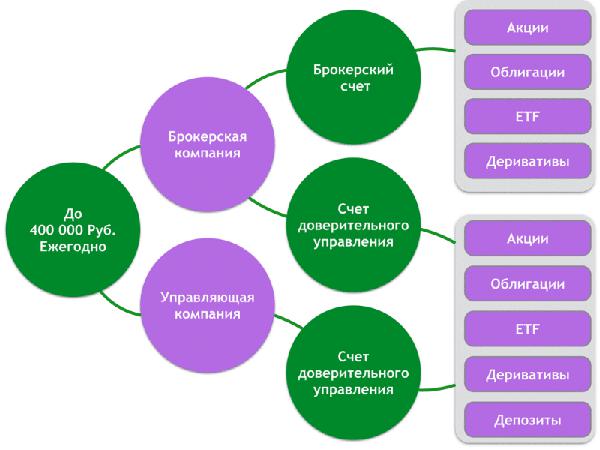

An individual investment account is a simple brokerage account that has a number of preferences.

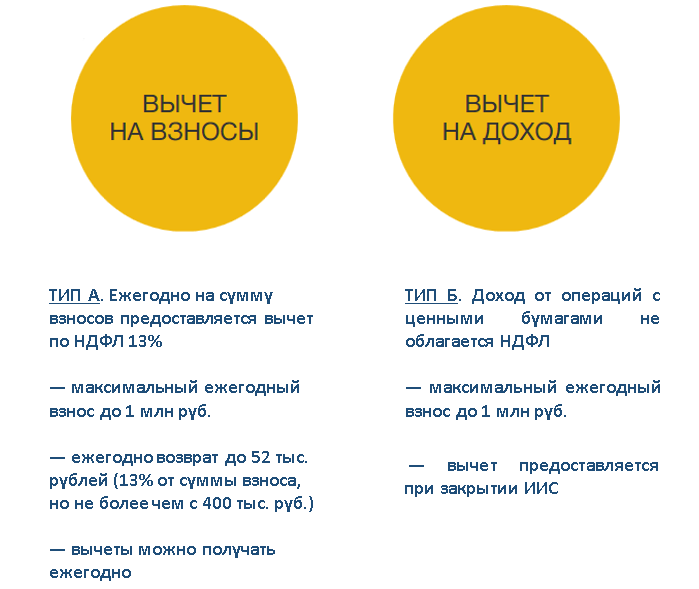

Its main feature is that in addition to income from investments on the stock exchange, any citizen has the right to receive tax benefits from the state. In this case, you can choose from two options: either a deduction in the amount of 13% of the amount contributed annually, or an exemption from paying a tax of 13% on income from trading operations.

To use the IIS, a number of conditions must be met:

— The minimum “account validity period” is 3 years. If you close your account or withdraw funds before this period, you will lose all benefits. The maximum period is not limited. Thus, it is not necessary to close the IIS immediately after 3 years. You can receive benefits from governments for a long time.

— The maximum contribution amount is limited to 1 million rubles. in year. It is on income from transactions within this limit that you have the right not to pay income tax within the IIS of type B. But it is worth considering one nuance: for the deduction of type A, you can receive a 13% return only from an amount of up to 400 thousand rubles. , i.e. no more than 52 thousand rubles. in year. It is not necessary to pay the entire amount at once; you can do it in parts. There are no minimum amount restrictions. Thus, the contribution of funds to the IIS is not required at all, just as its annual replenishment is not necessary.

— You can make transactions with any instruments (including foreign shares and Eurobonds), but this can only be done on Russian exchanges, for example Moscow and St. Petersburg;

— Depositing funds is possible only in rubles . You cannot deposit other currencies or securities into your IIS.

— There can be only one IIS . Unlike brokerage accounts, it is impossible to open several IIS for one individual. At the same time, it is possible to transfer an account from broker to broker.

— Once you select one account type, you cannot subsequently change it to another . If you decide to change the type of deduction, then the IIS will have to be closed. At the same time, you can decide on the option of tax benefits for IIS in any year, for example, before closing the account. But, it is worth considering that if you give preference to the “contribution benefit”, then you will only be able to receive a refund for the last three years. That is, it is still better to make the choice within the first three years from the moment of opening the IIS.

Start investing

Which account type should I choose?

Type A. Annual 13% contribution reduction

By choosing this type of deduction, the investor can count on a personal income tax return from the budget in the amount of up to 13% of the amount deposited in the IIS, but not more than 52 thousand rubles. in year. That is, if you deposited 400 thousand rubles into your account, you can return 52 thousand rubles back. You can place an amount of up to 1 million rubles on an IIS, but still the ceiling for deduction is limited to a contribution of 400 thousand rubles.

To receive a tax deduction, you must contact the tax service with a package of documents and a certificate from a broker, which indicates the amount of funds deposited into the IIS. At the end of tax season, any refund due will be deposited into your bank account. The investor can repeat this operation every year without restrictions - add funds to the IIS and receive 13% back.

Who is it suitable for?

— You have income taxed at a rate of 13%

Type A or contribution relief is essentially a refund of your taxes paid (personal income tax). So if you haven't paid anything for a year, there will be nothing to return. Thus, only the investor who paid personal income tax during the year in which the contribution was made can receive a tax refund. This could be wages, proceeds from the sale of real estate or from renting it out, profits from trading on financial markets (excluding dividends), etc. In addition, the pension received from the non-state pension fund is taken into account.

Important! If the annual income turned out to be less than the amount of the contribution to the IIS in the reporting period, and you paid, for example, personal income tax of 50 thousand rubles, then the refund amount cannot exceed these 50 thousand rubles. In addition, the unused balance of the deduction is not carried forward to subsequent reporting periods. Thus, to receive the maximum deduction from the contributed 400 thousand per year (52 thousand rubles), your official income minus personal income tax must be at least 29 thousand rubles. per month.

— Are you a conservative or novice investor?

If you are not familiar with all the nuances of the stock market and are just taking your first steps, then it is better to choose a contribution deduction. You will create a certain “safety cushion” for yourself due to the guaranteed return of part of the invested funds. In addition, novice investors are advised to start investing in low-risk instruments such as government and corporate bonds of reliable corporations. Such investments will provide a stable income with a minimal level of risk. An additional 13% to investing in bonds makes IIS a significantly more interesting instrument than a bank deposit.

— The funds you are willing to invest in the market are very limited, and you want to receive a government “bonus” annually

Using an IIS does not mean freezing your income for 3 years. Firstly, using the Type A deduction, you can receive up to 52 thousand rubles. annually. In addition to this, by purchasing bonds and dividend securities within the account, you can receive income from them into your bank or brokerage account. Both coupon income on bonds and dividends are received by the broker already cleared of tax (13%). According to the law, crediting these incomes to an account other than an IIS is not grounds for terminating the contract for maintaining an IIS. Simply send your broker an instruction indicating the bank account number or brokerage account where to transfer the funds.

Type B. Income without tax

By choosing this option, the investor does not receive a benefit on the contribution, but all income from operations on an individual investment account is exempt from paying personal income tax at 13% (with the exception of dividends and coupons on bonds). To receive this benefit, you will need to provide the broker with a certificate from the tax authorities stating that he did not use the “contribution benefit” during the entire term of the IIS agreement.

Important point: You can use this option of tax preferences only when closing an individual investment account, that is, at least three years after its opening. At the same time, this option is suitable for people who have not paid personal income tax during the reporting period. Unlike type A, the amount of deduction is not limited, that is, all income is exempt from taxation.

Who is it suitable for?

— You do not have a regular declared income or it is too low

Today, a Russian can count on several types of social tax deductions: for expenses for charity, for education, for treatment and the purchase of medicines, for pensions and insurance. Now you can also get a 13% refund on your IIS contribution. However, such a deduction can only be received by those who pay personal income tax. Thus, if you do not have a regular income or are a pensioner receiving a state pension, your IRA option is Type B.

— You are not a tax resident of the Russian Federation

Even if you are a citizen of Russia, but pay taxes to another state, you cannot count on a Type A deduction, but you can open an IIS and not pay tax on profits from transactions.

— You are an experienced investor and are ready to invest more than 400 thousand per year in the market

You are already familiar with the instruments of the stock market and know how to wisely increase the profitability of your investments without risking losing all your capital. Initially, the limit on annual contributions to IIS was 400 thousand rubles, and from June 2021 the maximum annual contribution increased to 1 million rubles. This primarily concerns the Type B deduction. With the increase in the maximum amount, the potential return on the invested amount has also increased. Unlike a simple brokerage account, tax is not withheld, that is, you can also reinvest the 13% that would annually go “to the treasury” in the market. The amount of deduction here is not limited, that is, all income is exempt from taxation and the higher it is, the greater the benefit from the state.

— You are not in a hurry to withdraw funds from the market

Let's assume that you have long-term goals and do not intend to use the invested funds in the near future. You can use the option of tax preferences under type B only when closing an individual investment account, that is, at least three years after its opening.

Life hack: IIS is opened for a period of 3 years. Start the countdown now, deposit funds later. Even if you don’t have free funds right now, you can open an IIS in advance. The fact is that when opening you do not need to deposit even a ruble; you can top up your account at any time. In addition, you do not incur any financial costs when owning an account. At the same time, the countdown of the minimum period of ownership of an IIS to receive tax benefits (3 years) begins from the moment of concluding an agreement with a broker/bank. Thus, the actual investment period on the stock exchange may be less than 3 years.

How and where to open an IIS

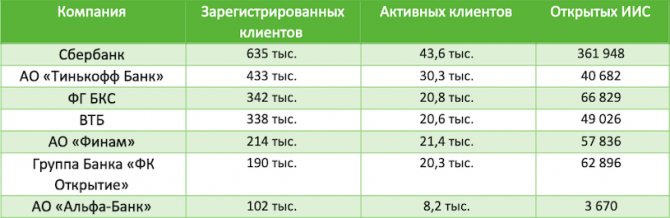

To open an individual investment account, you need to contact a broker and enter into a brokerage service agreement with him. You will need a passport, SNILS or TIN number. A list of brokers providing services for opening IIS is presented on the Moscow Exchange website. We advise you to contact reliable companies. On the Moscow Exchange website you can also familiarize yourself with the leading trading participants by the number of registered investment accounts.

Most leading brokerage companies provide the opportunity to open an account online. To do this, you will need a scan of your passport (the main spread and the page with the registration mark), TIN or SNILS number. Next, fill out the form, and you can sign the agreement via SMS. The account will be opened within one day. If you are already a client of the company, then you won’t have to waste time filling out the data. For example, for a client of the BCS company to do this, simply check the box in the Personal Account in the “Open IIS” column.

How to get your “bonus”?

The procedure for obtaining this type of tax deduction involves submitting a package of documents to the district tax office at your place of residence. This can be done simply by coming to the tax office or sending all documents online.

List of required documents:

- A copy of the brokerage service agreement . You signed such a document when opening an IIS and one copy should be “in hand” or, if you opened an account online, sent to you by email. Even if you do not have such an agreement, you can always contact your broker and he will provide it to you.

- A payment document confirming the crediting of the contribution to the AI S. This can be a payment order (if funds were credited from a bank account) or a cash receipt order (if you deposited cash through a cash register), or an order to credit funds along with a broker’s report on the transaction operations (if funds were transferred from another account opened with a broker). You can easily obtain this document upon request from your broker.

- Certificate 2-NDFL from the employer (or other tax agent) . You can obtain a certificate of the amounts of accrued and withheld taxes for the corresponding year from the accounting department at your place of work.

- Application for tax refund indicating bank details . It is to this account that your tax deduction will be transferred. The application form can be downloaded from your personal account on the Federal Tax Service website in the “taxpayer documents” section.

- Tax return 3-NDFL.

When all the documents are prepared, you submit them to the tax office. This can be done electronically through the website of the Federal Tax Service of Russia; by mail or in person at the tax office. You can submit such a declaration at any time; there is no reference to any specific date. By law, the inspection period can be up to 3 months. Another 1 month is given to transfer funds.

Important point! The tax deduction can be used when submitting a tax return only for the last 3 years and later tax periods. Therefore, if you want to take the deduction for 2021, you must file your return by the end of 2021.

If you close your IIS before the expiration of 3 years from the date of opening, you will have to return the previously received tax deductions, with an additional penalty.

We exempt income from IIS from tax at 13% (type B)

This type of deduction is provided when closing an IIS in the full amount of income received from transactions made on this account. It can be obtained directly from the broker or through the tax office.

1. Obtain income tax exemption directly from the broker

When closing an IIS, you need to provide your broker with documents confirming that you did not use the Type A deduction during the term of the agreement and did not have other IIS accounts. This certificate can be obtained from the tax office at your place of residence by writing a corresponding application in free form. If this fact is confirmed, the broker will not withhold personal income tax after closing the IIS and will pay you all your income from operations on the stock market.

2. Receiving a deduction through the tax office

You need to provide copies of documents confirming your right to a tax deduction (for example, broker reports confirming the fact of transactions on an individual investment account), and also fill out a 3-NDFL tax return.

About strategies for working on IIS

There are different investment options within the IIS, but they can be divided into passive and active.

Passive option

This is the simplest option, which does not require any skills, special knowledge or time spent. You just need to open an IIS and select type A, that is, receive a tax deduction of 13% on the amount of money contributed to the IIS during the tax period.

For example, by depositing 400,000 thousand rubles. per year on an IIS, you are guaranteed to receive 13% of this amount or up to 52 thousand rubles. Every year you can deposit any amount up to 400,000 thousand rubles. and receive your “bonus”. After 3 years, you can close the IIS, or you can continue to deposit amounts and receive deductions.

Life hack: You can deposit money at the very end of the year, and receive a deduction at the beginning of the next. It doesn’t matter what day you opened the account, the tax office must make a deduction for the entire year. For example, if in December 2021 you deposited 400 thousand rubles into an IIS, then in January 2021 you would have the opportunity to submit documents to receive a deduction in the amount of 52 thousand rubles.

Active option

At the same time, we consider the passive option to be the least attractive way to own an individual investment account. You can increase the return on your IRA investments by putting your money to work.

Within the IIS, you can create a portfolio depending on the desired level of profitability, acceptable level of risk, as well as your knowledge and experience.

1. For beginners and conservative investors

Minimum risk level/return slightly higher than the deposit

If you are looking for a more convenient and profitable alternative to a bank deposit, but do not accept risks, and also want your money to be as safe as possible - your option is a federal loan bond (OFZ).

This is a debt security issued by the government and the owner of which it pays a certain interest income, which is called a coupon. By purchasing a bond, the investor lends money not to the bank, as is the case with a deposit, but directly to the state represented by the Ministry of Finance. Therefore, the level of reliability in this case turns out to be higher, given that the insured amount in the bank is limited to only 1.4 million rubles.

OFZs are freely bought and sold on the Moscow Exchange. The price of one security usually fluctuates around 1000 rubles, so you can invest any amount. Lifehack. Coupon income on OFZs is not subject to 13% tax by law. Therefore, it is better to invest in this instrument within the framework of an IIS with a Type A deduction. So, in addition to the coupon, you can also receive a state bonus of up to 52 thousand rubles. in year.

Low level of risk/return higher than the deposit

If you are more tolerant of risk, then you can take a closer look at a portfolio of corporate bonds of reliable companies. You can buy bonds, for example, of Rosneft, MTS, FGC UES and other “blue chips” of the stock market. Such investments will not require constant monitoring and will provide a predictable constant income with a minimal level of risk.

Reasons for refusal to pay personal income tax

If we analyze the responses on the Internet, sometimes income tax payers encounter difficulties in obtaining a tax deduction for IIS.

Legally, a refusal can occur in several cases:

- Violation of the conditions for receiving benefits.

- Incorrect documentation.

- No reason.

If there are suspicions of fraud - when an account is opened and used exclusively for personal income tax refunds - the tax office may refuse.

This is a rather controversial point, because there are no restrictions on the minimum number of transactions. At the same time, it is better to participate in bidding - this will reduce the attention of authorized employees, and will also allow you to make greater profits.

One more point - an individual should have only one IRA. Technically, you can open two of them and claim a deduction for both. However, this is a direct violation of the law and an obvious financial fraud for the purpose of profit.

Also, a lawful refusal goes to everyone who is not a personal income tax payer. This category includes informally employed persons and individual entrepreneurs. The deduction is provided only for income tax, and not for any tax paid to the budget.

Important: Payment of a tax deduction is due both for independent and trust management of an IIS by a broker.

There are several models of individual investment accounts; this does not affect the size or procedure for processing payments.

How to open an IIS

To open an account, you need to contact a Russian broker. It is enough for a company employee to go to the website and ask him about the terms of service, what documents will be needed, whether it is possible to open an IIS online or whether you need to go to the office.

Now most brokers allow you to do this through a smartphone or website - just a passport, TIN and SNILS.

Where to open an IIS

Choose brokers who have a reliable reputation, extensive experience and low commissions. Here are a few companies that are leaders in the field of brokerage services in the Russian Federation. The full rating can be viewed on the Moscow Exchange website.

Compare IIS from different brokers

- Sberbank

- BKS

- Finam

- Tinkoff-Investments

- VTB

- Opening

- Alfa Bank

The best IIS are those where:

- They offer low commissions for transactions.

- They do not charge depository fees or a percentage of contributions.

- They do not charge a minimum monthly fee.

- Interest is charged on the account balance.