1. The right of ownership of the acquirer of a thing under a contract arises from the moment of its transfer, unless otherwise provided by law or the contract.

2. In cases where the alienation of property is subject to state registration, the acquirer’s right of ownership arises from the moment of such registration, unless otherwise provided by law.

Real estate is recognized as belonging to a bona fide purchaser (clause 1 of Article 302) on the right of ownership from the moment of such registration, with the exception of the cases provided for in Article 302 of this Code when the owner has the right to claim such property from a bona fide purchaser.

The emergence of rights to real estate and obligations for its maintenance (Mironova A.R.)

In accordance with the law, rights to real estate are subject to state registration. Is registration of the right of the legal owner of the premises in the apartment building the key to the issue of the moment when the obligation to pay for the premises and utilities arises, as well as the right of shareholders to participate in the general meeting of owners of the premises in the apartment building? To answer this question, let us turn to the regulatory framework and law enforcement practice.

State registration of rights

Moreover, in accordance with Part 1 of Art. 6 of Law N 122-FZ, rights to real estate that arose before the entry into force of this Federal Law are recognized as legally valid in the absence of their state registration introduced by this Law. State registration of such rights is carried out at the request of their owners. The grounds for state registration of rights to real estate in accordance with Art. 17 of Law N 122-FZ are: - acts issued by state authorities or local governments within the framework of their competence; — contracts and other transactions in relation to real estate; — acts (certificates) on the privatization of residential premises; — certificates of the right to inheritance; — judicial acts that have entered into legal force; — acts (certificates) of rights to real estate issued by authorized government bodies; — other acts of transfer of rights to real estate and transactions with it; — other documents that, in accordance with the legislation of the Russian Federation, confirm the existence, emergence, termination, transfer, limitation (encumbrance) of rights.

Emergence of ownership rights to real estate

Article 223 of the Civil Code of the Russian Federation provides that the right of ownership of the acquirer of a thing under a contract arises from the moment of its transfer, unless otherwise determined by law or contract. In cases where the alienation of property is subject to state registration, the acquirer's ownership rights arise from the moment of such registration, unless otherwise provided by law. By virtue of Art. 30 of the Housing Code of the Russian Federation, the owner of a residential premises exercises the rights of ownership, use and disposal of the residential premises belonging to him by right of ownership in accordance with its purpose and limits of use. The owner of the residential premises bears the burden of maintaining the premises. As follows from the above rules, the ownership right to real estate arises from the acquirer only from the moment of registration, and not from the moment of transfer of such property under a deed from the previous owner. Does this mean that the new owner of the premises, who accepted it under the deed and settled in it, has no obligation to bear the burden of maintaining this property?

Who should pay for utilities?

As follows from Art. 153 of the Housing Code of the Russian Federation, citizens and organizations are obliged to pay for residential premises and utilities on time and in full. The obligation to pay for residential premises and utilities arises: - from the tenant of residential premises under a social tenancy agreement from the moment of conclusion of such an agreement; - from the tenant of residential premises under a rental agreement for residential premises of a social housing stock from the moment of conclusion of this agreement; - from the tenant of a residential premises of the state or municipal housing stock from the moment of concluding the relevant lease agreement; - from the tenant of residential premises under a rental agreement for residential premises of the state or municipal housing stock from the moment of conclusion of such an agreement; - from a member of a housing cooperative from the moment the housing cooperative provides residential premises; - the owner of the premises from the moment the ownership of such premises arises; - from the person who accepted from the developer (the person providing the construction of the apartment building) after the issuance of permission to put the house into operation of the premises in this house under the transfer deed or other transfer document, from the moment of such transfer; - from the developer (the person providing the construction of the apartment building) in relation to the premises in this house that have not been transferred to other persons under a transfer deed or other transfer document, from the moment of issuing permission to put the house into operation.

Ownership

Rights of economic management and operational management

The right to participate in the meeting of premises owners in apartment buildings

Thus, the obligation to make utility payments for real estate and the right to participate in a meeting of owners of premises in an apartment building arise from the same moment - the moment of transfer of real estate under the act, despite the fact that this is not expressly provided for in the law.

Having accepted the premises under a deed from the developer, shareholders are required by law to pay rent for the premises and utilities. It is quite logical that they simultaneously receive the right to participate in the general meeting and decide on the choice of how to manage the house even before registering ownership of the premises. It seems fair to extend a similar principle to buyers of apartments under sales contracts: they are also required to pay for housing and communal services from the moment they accept the premises under the act. According to the author, in order to eliminate disagreements and unfounded disputes in this regard, it would be necessary to make changes to the RF LC, in particular indicate in paragraph 5 of part 2 of art. 153 that the obligation to pay for residential premises and utilities arises from the purchaser of the premises under an agreement or other legal basis from the moment of its actual acceptance under an act or other document.

This is important to know: Challenge the privatization of an apartment: statute of limitations

If you do not find the information you need on this page, try using the site search:

Civil legal consequences of changing the terms of the contract on the moment of transfer of ownership

Previously, in publications devoted to the topic of a company’s contractual policy*, we drew the attention of readers to the fact that the current norms of civil, tax and accounting legislation actually form two possible directions of contractual policy.

Note:* Read the articles: - “Contractual policy or sham transactions of companies: the line is blurred”; - “Contractual policy of organizations”

The first is that by changing the type or specific terms of contracts concluded by an organization, we get the opportunity to influence the content of accounting and tax reporting data without affecting the real economic content of the transactions carried out and the risks associated with them.

In the second case, a change in the content of the company’s contracts directly affects the actual content of the operations carried out by the company, adjusting both their economic nature and the risks associated with their presence in the company’s activities. It is this - the second - direction of the company's contractual policy that comes to the fore in modern conditions.

Today we must ask ourselves the question: can we, using the terms of concluded agreements, make the work of our company more efficient and less risky, reduce the tax burden that is unjustified by economic reality, without going beyond the current legislation? Absolutely - yes.

Such opportunities exist, and it is precisely this direction of activity of the company’s management that is the true contractual policy of the company, aimed at legally improving the conditions and results of its activities, and not at actually misleading users of financial statements and regulatory authorities.

One of the effective methods of contractual policy of organizations engaged in trade and/or production activities, and, therefore, selling goods (finished products) under supply contracts, can be the determination of the terms of the contract on the moment of transfer of ownership of the assets being sold.

The subject of the supply agreement is goods - material assets (things), that is, objects of ownership.

According to the general rule of Article 223 of the Civil Code of the Russian Federation, the right of ownership of the acquirer of a thing under a contract arises from the moment of its transfer, unless otherwise provided by law or contract.

Thus, this norm is dispositive. This means that the buyer becomes the owner of the goods at the time of their transfer only on the condition that the parties to the contract have not included in it another condition (different from that defined by the Civil Code of the Russian Federation) regarding the moment of transfer of ownership.

Let us note that, according to Article 224 of the Civil Code of the Russian Federation, the transfer of a thing is the delivery of the thing to the acquirer, as well as the delivery to a carrier for sending to the acquirer or delivery to a communications organization for sending to the acquirer of things in relation to which the seller has not assumed the obligation to deliver them to the buyer.

Consequently, the parties, when concluding a supply agreement, can determine in it that the moment of transfer of ownership of the goods will not be the transfer of values, but some other moment.

This moment can determine the moment of payment for goods, the moment of expiration of a certain period from the date of receipt by the buyer, and so on.

And if such a condition is included in the contract regarding the supplies it formalizes, it will not be the prescription of Article 223 of the Civil Code of the Russian Federation that will apply, but the condition that will be contained in this specific supply contract.

Moreover, such a special condition will not be mandatory for the parties in the future when concluding new contracts or additional agreements to an existing contract.

They will have the right, by mutual agreement, to change it by accepting a general condition on the moment of transfer of ownership (Article 223 of the Civil Code of the Russian Federation), or agree on a new condition for the transfer of ownership, which will differ both from the conditions of the pre-existing agreement and from the general norm Article 223 of the Civil Code of the Russian Federation.

The provision of the supply agreement regarding the moment of transfer of ownership operates independently in relation to the terms of the agreement on the procedure for transferring the goods and its payment, however, it changes the legal consequences of the parties to the transaction fulfilling these conditions.

An integral condition of the supply agreement as a type of purchase and sale agreement is the condition on the procedure for transferring goods from the seller to the buyer. According to Article 456 of the Civil Code of the Russian Federation, the seller is obliged to transfer to the buyer the goods provided for in the contract. Moreover, in accordance with Article 457 of the Civil Code of the Russian Federation, the period for fulfillment by the seller of the obligation to transfer the goods to the buyer is either determined by the supply agreement, or, in accordance with Article 314 of the Civil Code of the Russian Federation, must represent what, according to the norms of the Civil Code, is defined as a “reasonable period”.

Article 458 of the Civil Code of the Russian Federation determines that the obligation to transfer the goods (unless otherwise specifically defined in the contract) is considered fulfilled at the moment of either delivery of the goods to the buyer or the person specified by him (if the contract provides for the buyer’s obligation to deliver the goods), or provision of the goods at the disposal of the buyer (if According to the terms of the contract, the goods must be transferred to the buyer or the person indicated by him at the location of the goods).

The content of these norms of the Civil Code of the Russian Federation shows that the fulfillment of the obligation to transfer the goods is the physical movement of the goods from the seller to the buyer or the physical admission of the buyer to the place where the goods are stored. That is, the transfer of goods to the buyer makes him the owner of the valuables, but nothing more, since the moment of acquiring ownership may or may not coincide with its physical movement.

First of all, the presence or absence of the buyer, who has already become the owner of the goods (that is, as a rule, already having the goods in his warehouse), the right of ownership to it, determines the buyer’s ability to dispose of this property.

According to Article 491 of the Civil Code of the Russian Federation, in cases where the purchase and sale agreement stipulates that the ownership of the goods transferred to the buyer is retained by the seller until payment for the goods or the occurrence of other circumstances, the buyer does not have the right to alienate the goods or dispose of them in any other way before the transfer of ownership rights to him, unless otherwise provided by law or contract or follows from the purpose and properties of the goods.

In the same way, the condition of the supply contract regarding the procedure for payment by the buyer for goods purchased under the contract has independent significance in relation to the condition on the moment of transfer of ownership. According to Article 486 of the Civil Code of the Russian Federation, the buyer is obliged to pay for the goods immediately before or after the seller transfers the goods to him.

At the same time, Article 487 of the Civil Code of the Russian Federation establishes that in cases where the purchase and sale agreement provides for the buyer’s obligation to pay for the goods in full or in part before the seller transfers the goods (advance payment), the buyer must make payment within the period stipulated by the contract or a reasonable time, in accordance with Article 314 of the Civil Code of the Russian Federation, if the period for advance payment for goods is not specifically defined by the contract.

Thus, the combination of the terms of the supply agreement on the procedure for transferring goods by the seller to the buyer, their payment by the buyer (before or after the transfer) and the moment of transfer of ownership of them from the seller to the buyer (at the time of transfer or after payment) creates four possible situations.

Situation 1. The goods have been transferred to the buyer, have not yet been paid for, but ownership has already transferred to the buyer according to the contract at the time of transfer of the goods.

Situation 2. The goods have been transferred to the buyer, have not yet been paid for, and therefore, according to the terms of the contract, ownership of them remains with the seller until payment is made.

Situation 3. The goods are not transferred to the buyer, but are pre-paid by him. At the same time, while actually being with the seller, they continue to remain in his ownership until the moment of transfer, since according to the contract, the moment of transfer of ownership of the goods to the buyer is the moment of their transfer.

We invite you to familiarize yourself with: Sample application for waiver of claims

Situation 4. The goods are not transferred to the buyer, but are pre-paid by him. At the same time, while actually being with the seller, they are the property of the buyer, since according to the contract, the moment of transfer of ownership of the goods to the buyer is the moment of their payment.

The inclusion in the contract of a condition regarding the moment of transfer of ownership of goods at the time of payment by the supplier radically changes the tax treatment of the corresponding transactions under supply contracts.

The Tax Code of the Russian Federation makes the tax qualification of the facts of transfer of goods by the seller to the buyer and payment by the buyer to the seller directly dependent on the procedure for transferring ownership of the goods to the buyer. According to Article 39 of the Tax Code of the Russian Federation, the sale of goods is the transfer of ownership of them from the seller to the buyer.

Thus, according to paragraph 1 of Article 146 of the Tax Code of the Russian Federation and paragraph 1 of Article 248 of the Tax Code of the Russian Federation, until the transfer of ownership of goods, the price of their sale under the contract does not form the base for value added tax (even if the goods have already been shipped to the buyer) and income forming the tax income tax base.

On the other hand, if the seller receives advance payment for goods, the ownership of which passes to the buyer upon payment, regardless of the location of the goods, even if they continue to be stored in the seller’s warehouse (not shipped), the price of their sale forms the tax base for VAT and tax. profit.

Regarding VAT, this is even specifically stipulated by the prescription of paragraph 3 of Article 167 of the Tax Code of the Russian Federation, according to which, “in cases where the goods are not shipped or transported, but the transfer of ownership of this product occurs, such transfer of ownership for the purposes of this chapter is equivalent to its shipment ", that is, to implementation.

Features of the transfer of ownership of real estate

In order to dispose of acquired real estate, it is not enough to formalize a purchase and sale agreement or share management agreement, or to receive property by will or as a gift. According to the law, you can become an owner only after making a record of the transfer of ownership in the Unified State Register of Real Estate. The peculiarity of acquiring real estate is that a certain period of time passes between the signing of the document providing the basis for the transfer of ownership rights and its direct registration with a government agency.

While waiting, the buyer’s interests are protected by law, because there is a risk that the seller will be dishonest and refuse to appear for registration of the transfer of ownership. When concluding a transaction for the alienation of real estate, you need to prepare for any situations and clearly know your rights and obligations at each stage of the transaction.

Choosing the moment of transfer of ownership as a method of minimizing the risk of non-payment of obligations

Determined by the condition on the moment of transfer of ownership, the scope of the buyer’s rights to the goods transferred to him also determines the economic content of his actions in relation to this property, that is, the possibility of extracting economic benefits from it. Only the owner, in accordance with Article 209 of the Civil Code of the Russian Federation, has the rights to own, use and dispose of property.

Consequently, if the delivery agreement includes a condition that ownership of the goods passes to the buyer only after payment, then the buyer, having actually received the goods, that is, becoming their owner, will not have the right to use them in any way until payment to the buyer. them in their activities, that is, sell them, use them in the production of products, etc.

At the same time, he will bear obligations to the owner to ensure the safety of these goods, and, accordingly, the costs of their storage. Under these conditions, it will be completely unprofitable for the buyer to delay payment. And, therefore, such a condition of the supply contract regarding the moment of transfer of ownership of the goods will serve the seller as an additional and very effective guarantor of the timely fulfillment of the buyer’s obligation to pay for the goods.

On the other hand, the condition about the moment of transfer of ownership “on payment” can also be considered as providing additional guarantees for the purchasing organization if the goods are paid for by the buyer in advance (before their transfer). In this situation, regardless of the fact that at the time of payment for the goods they continue to be physically in the warehouse of the selling organization, they become the property of the buyer. The seller becomes only the owner of this property.

As the owner of goods that have become the property of the buyer, the seller is responsible to the buyer for the safety of these valuables and bears the costs of their storage.

The inclusion in the supply agreement of a condition on the transfer of ownership of goods to the buyer at the time of payment, along with a condition on mandatory preliminary (before transfer) payment for goods, makes it necessary for the seller to have the corresponding goods in stock at the time of receipt of payment and, accordingly, be owner of these values.

Let us recall that according to the general rule, defined by paragraph 2 of Article 455 of the Civil Code of the Russian Federation, a purchase and sale agreement can be concluded for the purchase and sale of goods available to the seller at the time of conclusion of the agreement, as well as goods that will be created or acquired by the seller in the future . In the situation we are considering, accordingly, the possibility for the seller not to have in stock the goods already paid for by the buyer is excluded.

We invite you to familiarize yourself with: Contract for the transfer of property into ownership

Consequently, for the buyer, the condition regarding the moment of transfer of ownership of payment upon advance payment for goods is also an additional guarantee of the timely fulfillment by the seller of his obligations to transfer the goods, failure to fulfill which becomes maximally unprofitable for the seller.

Why is state registration needed?

The concepts of “owner” and “owner” are identical at first glance, but this is not so. It will be easier to understand the difference with an example. If a citizen bought an apartment on the basis of a sales contract and fulfilled all obligations, he is the owner. But the buyer will become the owner only after he re-registers the “ownership right”. Then he will be able to:

- sell your property;

- exchange an apartment for another;

- rent out housing;

- pledge real estate when applying for a mortgage or perform other actions related to the disposal of property.

Now you need to decide when the transfer of ownership of real estate occurs. Firstly, you need a basis, that is, the fact of transfer of real estate, confirmed by documents. Such a document may be (Article 14 of Law No. 218-FZ):

- property privatization agreement;

- an agreement on shared participation in construction, if it is planned to receive an apartment from the developer, or an agreement on the assignment of rights of claim;

- contract of sale;

- certificate of inheritance;

- barter agreement;

- gift agreement;

- court decision on division of property;

- mortgage agreement;

- agreement on the division of property between spouses;

- lifelong maintenance agreement with dependents.

All these documents are primary sources for obtaining information about the legality of registration of property rights. And if a civil servant asks for a title document, you must present one of the listed ones. Most often, the basis for the transfer of ownership is a property purchase and sale agreement.

Participants in processes involving the transfer of ownership may be individuals and legal entities, relatives or third parties. The seller has a number of requirements:

- capacity;

- reaching adulthood;

- existence of ownership of real estate.

Their official guardians can act for incapacitated minor citizens with the permission of the guardianship and trusteeship authorities. They will also draw up title documents and participate in the registration of property rights.

The legislative framework

The issue of state registration of property is regulated by the following provisions in Russian legislation:

Regulations on state registration

What is real estate, is state registration required?

The provisions of the law make it possible to determine what belongs to real estate. According to Art. 130, these are things that are closely connected to the earth and cannot be moved. They also include ships and aircraft; objects intended to accommodate vehicles.

At the request of the copyright holder, information about the property is entered into the register, and the owner is issued either a document on the right to the property, or a record of the registration is made on the title document.

The entered information is provided to interested parties, and it is not necessary to contact the same registration authority where the data was entered.

Previously, state registration of real estate was carried out on the basis of Law No. 122-FZ of July 21, 1997, but from January 1, 2020, it finally loses force. Starting from 2021, you must be guided by Law No. 218-FZ.

The document contains basic concepts about real estate accounting. Each object is entered into a special Register and is assigned its own registration number. According to paragraph 5 of Art. 1 of the law, state registration is the only evidence of the owner’s right to property, which can only be challenged in court. The Unified State Register contains information about objects that are firmly connected to the land and cannot be moved without causing disproportionate damage to their purpose. That is, buildings, structures, land plots, construction sites, and parking spaces must be registered.

The Register contains information about rights and termination of rights to property, encumbrances, and transfer of rights to real estate.

The Register combines information about the transfer of rights and cadastral data, that is, when applying, a citizen can receive complete, reliable information reflecting the history of the object: to whom and on what basis it belonged, when it was transferred and other data. Everything will be reflected in the document - an extract from the Unified State Register.

On the protection of buyers' rights until state registration of real estate

According to the article, if the transfer of property is subject to state registration, then the right of ownership arises from the moment the registrar makes the corresponding entry. This means that signing an agreement on the alienation of property, as well as drawing up a transfer and acceptance certificate, does not mean a transfer of ownership. Having prepared the title documents, the buyer becomes the owner who has the right to demand registration of the property.

It states that the transfer of ownership carried out on the basis of a purchase and sale agreement is subject to state registration. This article is of great importance for property, since it directly concerns the protection of rights.

According to clause 3, if the previous owner does not want to re-register, the buyer can go to court to make an entry in Rosreestr forcibly. If the court finds that the actions of the previous owner are unreasonable, the recording will be made despite the seller’s protests. Moreover, the latter must compensate the buyer for the costs caused by the delay in registering the transfer of rights.

The document states the rights of the owner who is not the owner. If a citizen owns property on the basis of a concluded agreement or other document of title, he has the right to protect the object.

According to the resolution, the transfer of ownership must be registered. Before this, the contract, duly executed and signed by the parties (and, if necessary, certified by a notary), is valid. This means that the transferred property is in the possession of the buyer, but only the owner can still dispose of it.

Paragraph 62 of the Resolution also stipulates the buyer’s right to defend his interests in court before registering the transfer of rights. A positive decision on the claim will be made only if the property is transferred from the seller to the buyer. If the property is not transferred, the buyer has the right to file a claim with 2 demands :

- on the transfer of property;

- on forced registration of transfer of ownership.

This is important to know: Re-registration of an apartment share after death

It follows from the provisions of the law that real estate transactions are subject to state registration. To do this, you must have legal documents. The rights of the property purchaser and the seller are protected. If the conditions for the transfer of ownership are not met, the buyer may go to court and demand forced registration of the transfer of rights.

What is the moment of transfer of ownership of real estate

The buyer of real estate is concerned with the question: when can he fully dispose of the real estate? According to Art. 223 of the Civil Code of the Russian Federation, if the alienation of property is subject to state registration, the moment of transfer of ownership coincides with the implementation of registration actions by an authorized person. This fact is evidenced by a mark on the title document containing information: full name of the employee of the Rosreestr branch, date. As a result, the new owner is issued a USRN extract.

When is ownership of an apartment or house transferred?

The period of transfer of ownership is important for calculating taxes and benefits. The moment of acquiring ownership will be important for the tax office.

According to the law, citizens who have owned property for more than 5 years have the right to exemption from personal income tax associated with receiving income from the sale. However, if the property was donated, inherited, received during privatization, acquired under a life annuity agreement, or purchased before 01/01/2016 , the period is reduced to 3 years. The beginning of the calculation of the period is precisely the registration of the transfer of ownership.

The only exception is for property received by inheritance. Citizens who have received a certificate of title to an apartment or house are considered its owners from the moment of the death of the testator. When submitting documents to the tax office, you must attach a copy of the death certificate of the testator, because the certificate of inheritance will be dated on a date that differs from the actual acquisition of ownership by at least six months.

Since property is often purchased on the primary market using DDU, it is necessary to distinguish between the concepts of ownership and rights of claim. If a DDU is concluded, the owner acquires the right to claim the apartment from the developer, but not the property. But as soon as the property is registered in the name of the buyer, the 5-year for subsequent benefits.

If a garage, parking space, or share in a housing cooperative is purchased, ownership rights arise.

Transfer of things and deed of transfer

The first question that the authors address is what is transfer within the meaning of paragraph 1 of Art. 223 Civil Code. In their opinion, in the practice of courts there are two approaches, one of which is to recognize the signing of the relevant act as a transfer, and the second is to recognize the act as one of the evidence of the transfer of actual possession {amp}lt;1{amp}gt;.

The plaintiff, in support of the vindication claim, presented a purchase and sale agreement and a transfer deed, but the defendant did not present any admissible evidence at all justifying the ownership of the disputed property. There is no presumption of legality of actual possession in our law. Therefore, in a dispute over a thing, the defendant had no right to remain silent, taking a passive position when proving.

The adversarial process forces comparison of the evidence presented by the parties. In this dispute, the plaintiff presented evidence, but the defendant did not. This allowed the court not to consider the issue of the actual transfer of property. Therefore, this Resolution does not allow us to assert that the transfer act is considered by the court as a transfer in the sense of paragraph 1 of Art. 223 Civil Code {amp}lt;2{amp}gt;.

A more appropriate reference would be to the Resolution of the Federal Antimonopoly Service of the North Caucasus District dated June 24, 2003 N F08-2166/03. In it, the court called the transfer deed a document of title and indicated that the absence of the deed indicates that the buyer did not become the owner. It is obvious, however, that such an act is not a document of title and such a statement is rarely found in judicial acts. This solution stands apart.

Thus, the authors were unable to prove the existence of two approaches to determining transmission. In all the Resolutions cited by the authors, the courts examined the question of whether actual possession of the thing was transferred. And therefore it is true that the deed of transfer is considered only as one of the evidence in the case.

However, this conclusion requires additional justification. And here a number of other interesting cases can be cited. In particular, the Resolution of the Federal Antimonopoly Service of the North-Western District dated September 18, 2007 in case No. A21-7042/2006, in which the court specifically examined the issue of the need to draw up a transfer deed. One of the participants in the dispute argued that the absence of a signed deed also indicates the absence of a transfer of ownership. The court rejected this approach, pointing out that the presence of the item in the buyer’s possession indicates that the transfer has taken place, regardless of the signing of the deed.

The meaning of the acceptance certificate is formulated very clearly in the Resolution of the Federal Antimonopoly Service of the Central District dated September 27, 2001 in case No. A14-4713-01/188/24. In the dispute, one of the participants argued that the transfer and acceptance certificate is a document of title, and therefore property is transferred only after the buyer signs the act.

The court did not agree with this approach and stated the following. The act is a reflection of real business transactions, in particular the transfer of goods. If the goods were not actually transferred (in this case, they were in the possession of a third party both at the time of purchase and during the dispute), the thing cannot be considered transferred, and ownership rights did not arise.

If the deed is only one piece of evidence of the transfer of real ownership, then the parties may use other evidence in the dispute. In particular, invoices or waybills may also indicate the fact of transfer (see: Resolutions of the FAS of the North Caucasus District dated 04/19/2005 in case No. F08-1559/2005, FAS of the Volga District dated 05/25/2006 in case N A12-25795/ 05С32, FAS Volga-Vyatka District dated 06.12.2005 in case No. A29-1911/2005-2e).

Thus, the decisions listed in the article and above allow us to draw the following conclusion: a deed of transfer is one of the ways to formalize the transfer of a thing; in case of a dispute, other evidence of transfer can be used. If, as evidence of the transfer of possession, one of the participants in the process presented a transfer deed, and the other party did not refute this evidence by others, the court has the right to conclude that possession was transferred.

This is the approach essentially used by the FAS of the North Caucasus District in Resolution No. F08-2166/03 dated June 24, 2003. The court rejected the claim of one of the parties that in the absence of an invoice, the deed of transfer is not sufficient evidence of the transfer of the thing. The idea of the Resolution is simple - if one of the parties presented a deed of transfer, and the other did not present any evidence of the absence of transfer, the thing is considered transferred.

Next, the authors ask themselves: how does this compare with their proposed interpretation of paragraph 1 of Art. 223 of the Civil Code, the possibility of selling a thing with its immediate retention by the seller on a different right (for example, lease), a thing owned by the buyer or owned by a third party? Noting that the law provides for only one of the situations described (clause 2 of Art.

224 of the Civil Code), the authors admit that all three cases occur in life. The courts are inclined to “equate these cases to the transfer of a thing” {amp}lt;7{amp}gt;. And here the authors cited many acts in support of just such an interpretation. They conclude their consideration of the problem with the following conclusion: “This is a kind of deviation from the purity of the design, justified by practical necessity taking into account realities. However, this cannot serve as a basis for refusing to improve legislative norms."{amp}lt;8{amp}gt;.

Such a conclusion can only cause bewilderment.

What “construction” are we talking about? About the system of tradition? However, the need to deviate from the strict requirement of transmission was recognized two thousand years ago. Moreover, this “design” had many modifications related to the historical era, national characteristics and many other factors. So it is hardly appropriate to talk about any “purity” of this system.

Of course, there is no need to refuse possible changes to the law. However, are they necessary in this case? The authors apparently answer in the affirmative. But the practice they cited, rather, suggests the opposite. In fact, why make amendments if in the described cases a transfer of ownership is not required without them? There is no need to change the law if the problem is solved by interpretation.

In addition, most of the links provided by the authors do not convince us that they are right. For example, to illustrate the sale of property with the seller leaving it for rent, the authors refer to the Resolution of the Federal Antimonopoly Service of the Volga-Vyatka District dated January 22, 2007 in case No. A11-18727/2005-K1-14/758/4. This link cannot be considered successful.

Similarly, references to the Resolutions of the FAS of the Far Eastern District dated 05/03/2005 in case No. F03-A51/05-1/920, FAS of the Volga-Vyatka District dated 08/10/2006 in case No. A17-6901/5-2005 and dated 24.08 are unconvincing. 2006 in case No. A11-1043/2005-K1-2/81. In all three cases, the disputes concerned the owner's sale of leased property.

We suggest you read: If an apartment was purchased before marriage, can the wife claim it after a divorce?

The courts recognized the admissibility of such a sale. Indeed, here there is a transfer of ownership of a thing held by a third party. The only catch is that the disputes concerned real estate. Therefore, to transfer ownership, it was not the actual transfer of the thing that was required (clause 1 of Article 223 of the Civil Code), but state registration (clause 2 of Article 223 of the Civil Code).

However, the authors are right about the main thing. The courts recognize the specificity of situations when the possession of a thing is with a third party or the seller must remain the owner after the transfer of ownership. An example of the latter situation (the so-called possessory constitution) is the Resolution of the Federal Antimonopoly Service of the North Caucasus District dated September 20.

2004 in case No. F08-4312/2004. The seller had a debt to the buyer. The parties agreed to repay the debt by transferring the goods (rice). The rice was “transferred” to the seller and was immediately “returned” by the buyer for safekeeping. Although it was clear from the circumstances of the dispute that the seller remained the actual owner of the rice, the court concluded that under such circumstances the ownership had passed to the buyer. Such an approach is unlikely to raise any objections.

The situation is much more controversial when the owner of the thing is a third party. Unfortunately, the authors did not consider this issue in detail. The article only states that judicial practice allows such transactions; several judicial acts are cited as evidence. Meanwhile, the fulfillment of the obligation to transfer a thing held by a third party is distinguished by significant originality. We will try to correct the authors’ omission and analyze the situation.

Procedure and rules for registering the transfer of ownership of an apartment

The algorithm of actions is as follows:

- Collection of documents.

- Contact Rosreestr or submit a request through the electronic portal.

- The registrar checks the documentation and makes a decision to make an entry about the new owner.

- Making an entry in the Unified State Register of Real Estate.

The transfer of rights may be denied for several reasons: lack of title documents, an open dispute about the right to own property, inaccuracies in documentation, or the property being under an encumbrance. To avoid misunderstandings, initiators of applying to a government agency are recommended to systematically check the progress of document preparation on the Rosreestr website.

Attached documents

To register ownership rights in Rosreestr or MFC, you must provide the following documents:

- Identity card (passport). A copy and the original are provided to the government agency.

- Statement. The document form is issued at the place of registration.

- Legal documents. This could be a contract of sale, gift, exchange, privatization, rent, or a certificate of inheritance.

- Cadastral passport. The document contains all the information about the object. If the document has not been drawn up, it is necessary to register the object with the cadastral register.

- Certificate on the number of registered persons (when transferring rights to a house or apartment).

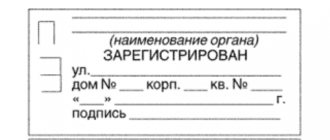

applications for state registration

The list of documents can be expanded:

- if the real estate seller is married, the consent of the spouse will be required for the alienation of property;

- if you have minor children, attracting maternal capital to purchase a home for sale, you will need permission from the Public Organization;

- in case of transfer of the right to a share of the property, written consent of all co-shareholders for the sale and waiver of the pre-emptive right to purchase are provided;

- If a home is sold with a mortgage, permission from the financial institution is issued.

In some cases, the registrar asks to provide an acceptance certificate.

To register land, an application for the allocation of a land plot is submitted, and the received permission is attached to the documents for formalizing the transfer of ownership rights.

Registration period

The duration of registration actions is regulated by Art. 16 of Law No. 218-FZ of July 13, 2015. The applicant will have to wait:

- 7 days if the application is accepted by the registrar, or 9 when submitting an application to the MFC.

- 10 days if documents are submitted for state registration and cadastral registration, or 12 when applying to the MFC.

- 5 days when registering property on the basis of a court decision that has entered into force.

- 5 days when registering a residential mortgage. In this case, the certificate is issued, but with an encumbrance (this is evidenced by the entry in the Unified State Register of Real Estate); the owner can dispose of the property only with the consent of the mortgagee until the loan is fully repaid.

- 3 days if registration is related to the seizure of property.

- 3 days , if the registration concerns a notarized transaction, receipt of an inheritance, allocation of a spouse’s property.