Features of real estate inheritance

Inheritance of property is regulated by Chapter. 61-65 Civil Code of the Russian Federation. You can inherit real estate by law or by will. In the first case, there is a sequence of heirs:

- First priority: children, parents, spouse of the testator (Article 1142 of the Civil Code of the Russian Federation).

- Second: brothers, sisters (full and half-blood), grandmother, grandfather (Article 1143 of the Civil Code of the Russian Federation).

- Third: aunts, uncles (Article 1144 of the Civil Code of the Russian Federation).

There are also successors in subsequent stages: great-grandmothers, great-grandfathers, children of nephews or cousins (Article 1145 of the Civil Code of the Russian Federation).

The principle of distribution of heirs according to priority is very simple: the property is accepted by the first-order successors, it is distributed between them in equal shares. If there are none, the successors of the second, third or subsequent stages enter into the inheritance.

With a will everything is simpler. A person can indicate anyone in it, not necessarily a relative, and then the property will go to him. But there are people who are entitled to a mandatory share in the inheritance, even if a will is drawn up, and they do not appear in it (Article 1149 of the Civil Code of the Russian Federation). These include disabled or minor children, spouse or parents of the testator. They can receive at least half of the share that would be due to them by law.

This is where the danger lies: citizens who are entitled to a mandatory share can show up at any time.

There are other features of inheritance that need to be taken into account:

- The testator has the right to impose a testamentary refusal on one or more legal successors (Article 1137 of the Civil Code of the Russian Federation). For example, write a will stipulating the right of another person to live in an apartment for life. The heir will become the owner, but he will be obliged to provide living space for the use of another person, and he will have to live with him. In the future, real estate can only be sold under the DCT with the right of lifelong residence, but some sellers are silent about this right.

- The period for entering into inheritance is 6 months from the date of death of the testator, but can be extended if the heir proves that he did not know and could not know about the death of the testator, or there were good reasons for missing the specified period.

- There may be several wills, but the last one has legal force.

Note! Both individuals and legal entities can be called upon to inherit (Article 1116 of the Civil Code of the Russian Federation).

Take the survey and a lawyer will tell you for free how to avoid mistakes in an apartment purchase and sale transaction in your case

Risks of buying an apartment by inheritance less than 3 years old

Based on the above, we can highlight the main risks that await the purchaser of an inherited apartment:

- A few years after the purchase, heirs who have not accepted the rights to housing within 6 months may appear and file a claim to restore the period for entering into inheritance.

- A similar situation threatens to happen to the legal holders of the compulsory share who did not learn about the opening of the inheritance in a timely manner.

- Unscrupulous sellers may try to hide the existence of orders from the deceased owner regarding the legatee who has the right to reside in the apartment.

- There is a possibility that the heir to the apartment will be recognized as unworthy after its sale.

- When registering, the marital share was not allocated from the inheritance.

- The will may be declared invalid.

The occurrence of at least one of the listed circumstances may entail unpleasant consequences for the new owner of the living space, including challenging his ownership of the purchased apartment.

During the first three years after the opening of the inheritance (death of the previous home owner), the risks accompanying the purchase and sale transaction are the highest. This is explained by the existence of statutory deadlines for accepting an inheritance, testamentary refusal, and also a statute of limitations.

The most “dangerous” is the first year after the seller receives the inheritance. The process of succession and registration of housing may extend over this period even for punctual heirs. The main reasons for this: restoration of lost documents, litigation on the division of property, ignorance of the death of the heir due to departure or illness. But even after 12 months, the risks remain relevant, although as they move away from the critical period, the likelihood of their materialization decreases.

How do you enter into inheritance?

The short procedure for entering into inheritance looks like this:

- The testator dies, certificates are issued.

- The heir turns to the notary with an application for entry into the inheritance, a death certificate and documents confirming the relationship (in case of inheritance by law).

- The notary accepts documents and, if necessary, requests additional information.

- After six months, a certificate of inheritance is issued. With it, the assignee goes to Rosreestr and registers ownership of the apartment.

Six months are given just so that all the heirs have time to declare themselves. But this is not always the case, so buying an inherited apartment can be a risky proposition.

Title insurance when purchasing an apartment

Advance agreement for purchasing an apartment

Risks when buying an apartment by inheritance for more than 3 years

Focusing on judicial practice in inheritance cases, experts note a reduction in the described risks in cases of purchasing real estate inherited more than 3 years ago. This is exactly the period of limitation for inheritance cases in accordance with Art. 196 of the Civil Code of the Russian Federation. The beginning of its course is considered to be the moment when the plaintiff learned about the offense or the circumstances preventing entry into the inheritance no longer exist.

The three-year period also includes the ability of the legatee to apply for a material benefit or service provided at the expense of the apartment.

The deadline for filing a claim for the award of inherited housing or challenging the ownership of it is 10 years after the death of the testator or the commission of an unlawful act that is the cause of the claim. And this moment practically equalizes the probability of losing the purchased living space, which was inherited less than 3 years ago or more.

But in any case, purchasing an apartment 1-3 years after its inheritance significantly reduces the likelihood of unpleasant surprises from its potential owners.

Buying an apartment by inheritance: risks for the buyer

What are the risks when buying an apartment by inheritance:

- The seller may not inform about the testamentary refusal, which is entrusted with granting the right of lifelong residence to another person in the apartment. The buyer will buy the property and will be its owner, but this person can show up at any time and live in the living space legally.

- The seller may be recognized as an unworthy heir after the sale of the apartment.

- People who are entitled to an obligatory share will appear.

- Citizens who did not have time to enter into an inheritance may appear and file an application to restore the deadline.

Note: these risks are typical for real estate inherited less than three years before sale. Three years are indicated for a reason: this is the general limitation period, which begins to be calculated not from the moment of death of the testator, but from the moment when the plaintiff learned about his right to inheritance, provided that he had good reasons for missing the deadline, but they disappeared no more 6 months before going to court for restoration. Good reasons mean serious illness, illiteracy, helplessness and other factors related to the personality of the plaintiff. The maximum limitation period is 10 years from the date of death of the testator.

If more than three years have passed

If more than three years have passed since the registration of property rights on the basis of an inheritance certificate, the risks are reduced, but they still exist. It is unlikely that a person will appear who has the right to permanent residence in the apartment, but the sudden appearance of heirs who did not know about the inheritance is quite possible.

If the apartment was received by will

Before purchasing real estate, you need to clarify how it was received - by law or by will. In the latter case, there are also risks for the buyer. There may be other heirs who are entitled to a mandatory share. But here it all depends on how much time has passed since the registration of the seller’s property rights.

There are several other factors:

- A will may be declared invalid if it can be proven that it was drawn up by an incompetent testator or under physical or psychological pressure.

- It is possible for a stranger to live on the basis of a testamentary refusal, which is not always disclosed to buyers.

Lawyer's advice: when buying an inherited apartment or house, it is better to seek comprehensive support from a lawyer or realtor who can check the property for legal purity.

Elena Plokhuta

Lawyer, website author (Civil law, 7 years of experience)

If the apartment was received through hereditary transmission

Inheritance transmission occurs if the successor dies after submitting documents for inheritance. Then the property passes to his heirs by law or will.

The risks here are the same as in other cases. The inheritance can be contested.

Are you tired of reading? We’ll tell you over the phone and answer your questions.

Risks when buying an apartment received by inheritance

Purchasing an apartment is a risky undertaking. There are different situations in the real estate market.

Options for fraud with inherited real estate:

- The will was drawn up under the influence of threats, by an incompetent owner or by a citizen who did not understand the consequences of his actions. The heir takes over. The apartment is resold several times. Proper heirs have the right to challenge the will in court.

- The relatives of the deceased citizen did not know about his death. But subsequently they go to court with a request to restore the deadlines. If the court satisfies such requirements, the previously issued certificate will be invalidated. Consequently, the registration of inheritance occurs again. Property shares are redistributed.

The buyer bears the risk of losing the funds paid as payment for the apartment. An inherited apartment is one of the most problematic objects on the real estate market.

The recipient needs to find out the following information:

- inheritance was by will or by law;

- how many years have passed since the registration of the inheritance?

By will

A special feature of purchasing an inherited apartment received under a will is the ability to study the document. The buyer can read the order and learn about its features.

Important! The seller's desire to hide the document should alert the buyer. If the seller is not planning fraudulent activities, then there is no reason to hide data.

The main difficulties when buying an apartment received under a will:

- The presence of a testamentary refusal or assignment (Article 1137 of the Civil Code of the Russian Federation). A citizen could include a requirement for a dependent or relative to live in the apartment. The law protects the rights of the recipient, therefore, in the event of resale of the apartment, the right to reside is preserved.

- The presence of several heirs. The purchase and sale agreement must be signed personally by each of the owners. However, citizens often issue a notarized power of attorney for one of the sellers. In the will, it is necessary to find out how many heirs the living space is bequeathed to. If the owners do not include one of the potential recipients, then purchasing the property is fraught with trouble.

Perhaps the heirs registered his share legally (by absolute or targeted refusal). However, it is possible that the citizen simply did not know about the existence of the document. In this case, the purchase is fraught with litigation.

- Presence of minor heirs . If the will specifies a minor heir, but he is not one of the owners of the apartment, then it is necessary to request permission from the district guardianship department to refuse to inherit . The presence of a refusal indicates that the amount of property is less than the amount of debts of the deceased. Otherwise, the guardianship department will not give such permission. You need to study the information - perhaps the apartment is under mortgage. Then you also need permission from the bank to sell.

- Actual entry into inheritance . If the property is accepted upon delivery, the seller does not have the necessary documents for the property. Perhaps the heirs did not know about the need to register the property that is in their use. Therefore, you need to check that you have all the necessary documents for the apartment, including a certificate of inheritance rights.

Without a will

Risks when purchasing an apartment inherited by law:

- The list of heirs is not reliably known even to the recipients themselves. The testator could hide information about illegitimate children, children from other marriages, and dependents.

Example. Citizen R. worked for a long time in a position that required business travel. He was away 5 months a year. After his death, his wife and son took over the inheritance. However, a year later a woman showed up. She explained that citizen R. lived with her during business trips. They also have a child together, whom the testator officially recognized. Since she was not given information about his death, she could not submit documents to the notary on behalf of her son in a timely manner. The court restored the deadline for entering into inheritance. The property was distributed among 3 heirs.

- Identification of heirs by right of representation or hereditary transmission . In such a situation, the right to receive the property of the deceased is vested in the heirs of the 2nd or subsequent stage . However, by right of representation, grandchildren can receive a share in the property. This option is fraught with the complete seizure of property from the heir of the 2nd stage .

Example. At the time of the death of citizen A., she did not have an official spouse. And her son and parents died. Therefore, my own sister took over the inheritance. However, after 3 years, his son’s partner showed up. They had a daughter together. Paternity has been officially established. Therefore, the girl had the right to a share in her grandmother’s property. The sister’s certificate of inheritance rights had to be canceled and the rights to the property were transferred to her granddaughter.

It is almost impossible to foresee all the risks in such a situation. The acquisition of such residential premises is advisable only after the expiration of the 10-year statute of limitations.

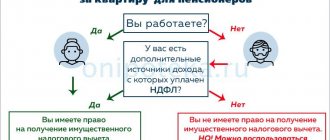

Purchasing an apartment inherited for less than 3 years

A special feature of a transaction with an apartment inherited up to 3 years ago is the need for the seller to pay income tax.

After selling the property, the citizen must:

- file a tax return within the prescribed period;

- pay personal income tax in the amount of 13% of the cost of the object.

Therefore, the seller often insists on an artificial reduction in value in the purchase and sale agreement. He asks to hand over the rest of the funds to him in cash.

Reasons for refusal to reduce the price of an apartment in the contract on the part of the buyer:

- If significant defects in the residential premises are identified, which the seller knew about but hid, it is possible to terminate the transaction in court. However, only the amount under the contract is refundable. If the price is lowered, the buyer loses.

- Hiding information from the Federal Tax Service is fraud. By agreeing to a price reduction, the buyer becomes a participant in actions punishable by law.

Inherited more than 3 years ago

It is believed that purchasing an apartment received as an inheritance less than 3 years ago is a riskier transaction. Since the general statute of limitations has not expired. However, for transactions with inherited property, this period is up to 10 years .

Therefore, in the case of inherited property, you should not rely on the 3-year statute of limitations .

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

Judicial practice shows that the courts take the side of bona fide buyers. Property claims of relatives must be submitted to the heir (Article 42 of the Resolution of the Plenum of the Supreme Court No. 9). The only condition is that the buyer should not be aware of the infringement of the rights of third parties. Otherwise, the purchase and sale agreement may be declared invalid. But even if the buyer does not suffer, he will not be able to avoid judicial red tape (Articles 37–38 of the Resolution of the Plenum of the Supreme Court and the Supreme Arbitration Court of the Russian Federation dated April 29, 2010 No. 10/22).

Purchasing an inherited apartment through a representative

If there are several heirs, then they can issue a notarized power of attorney for one of them for the convenience of registering the trace.

What you need to pay attention to when concluding a contract:

- The power of attorney must be notarized . You can check the authenticity of the power of attorney on the service of the Federal Notary Chamber.

- The list of powers of the trustee must include the right to sign the contract, the right to receive funds (deposit, payment under the contract).

- If there is a power of attorney from a minor owner (aged 14 to 18 years ), an indication of the consent of the legal representative is required.

- If the heir to the share is a minor citizen , then the legal representative does not require a notarized power of attorney to represent his interests. A document confirming his authority is sufficient.

Important! If the issue of acceptance and transfer of proceeds is not spelled out in the document, then you must insist that the heir be present at the conclusion of the purchase and sale agreement.

Example. The heir made a power of attorney for the sale of his apartment. The alienation of the home was explained to the buyers through a representative by the sudden departure of the owner abroad. The parties entered into a preliminary purchase and sale agreement. The buyers gave the representative a deposit. After which the apartment owner revoked the power of attorney. The representative disappeared from sight and stopped answering calls. The owner stated that he was a victim of deception. The main purchase and sale transaction for the apartment did not take place. Buyers did not contact the police. The scammers went unpunished.

Fraudulent schemes

Some of the situations presented below are difficult to call fraud from a legal point of view, but they can add problems to buyers:

- The seller hides the legatee - a person who has the right to live in the inherited apartment on a permanent basis.

- An agreement between an heir and another person entitled to an obligatory share. Taking advantage of the buyer’s ignorance of the laws, they can act like this: the legal successor inherits the apartment and sells it. Next, another heir is announced, who is entitled to the obligatory share, and applies for the restoration of the terms. In their opinion, the buyer must pay compensation for the share, but the law states otherwise: it is compensated by the heir.

- Cancellation of power of attorney. The heir issues a notarized power of attorney for another person, then immediately revokes it. An authorized person sells an apartment on behalf of the principal, who then presents everything as if he is a victim of deception.

The most dangerous thing is a deal with a black realtor. He can force a person to draw up a will on him using criminal methods, and then kill the testator and sell the apartment. If the legal heirs show up and challenge the will along with the transaction, the buyer will be in an extremely unfavorable position and will lose the property.

How to check heirs when buying an apartment?

The problem is that there is no way to check the inherited apartment when purchasing. You can only track the history of the transfer of ownership and refuse the transaction if the property was inherited less than 10 years ago - the safest period after which it will not be possible to challenge the transaction.

Legal advice: to minimize risks, it is advisable to have the DCP certified by a notary. he will check the legality of the transaction, and if there are problems with the documents or other heirs, he will refuse notarization. This is a reason for the buyer to refuse the deal.

Elena Plokhuta

Lawyer, website author (Civil law, 7 years of experience)

When can a purchase or sale not be challenged?

The buyer will not have to return the money for the apartment or pay part of the share to a sudden heir if he proves that he is a bona fide purchaser. This means a purchaser who did not know and could not know about possible heirs or illegal acquisition of real estate by the seller.

In addition, there is paragraph 42 of the Resolution of the Plenum of the RF Armed Forces dated May 29, 2012 No. 9, which often plays a decisive role in legal proceedings:

“If, when accepting an inheritance after the expiration of the established period in compliance with the rules of Article 1155 of the Civil Code of the Russian Federation, the return of the inherited property in kind is impossible due to the absence of the corresponding property from the heir who accepted the inheritance in a timely manner, regardless of the reasons why it was impossible to return it in kind, the heir, who accepted the inheritance after the expiration of the established period has the right only to monetary compensation for his share in the inheritance (when accepting the inheritance after the expiration of the established period with the consent of other heirs - unless otherwise provided by a written agreement between the heirs). In this case, the actual value of the inherited property is assessed at the time of its acquisition, that is, on the day the inheritance is opened (Article 1105 of the Civil Code of the Russian Federation).”

In other words, after the sale of an inherited apartment to a suddenly appearing heir, the seller, not the buyer, will compensate his share.

Risks under a will

Special mention should be made of the troubles that threaten the buyer of an apartment inherited by will.

Some people are confident (mainly due to the assurances of unscrupulous or insufficiently knowledgeable sellers in inheritance matters) that a will provides high guarantees to the purchaser of inherited property. On the one hand, this is true. Some wills narrow the circle of possible successors, distribute the inheritance among designated persons, significantly reducing the time required to register property and eliminating the cause for inheritance disputes.

The act of last will of the previous owner of the property does not always contain clear instructions regarding the heirs and the amount of shares due to them. Sometimes its subject is only the exclusion of certain persons from the circle of legal successors or other orders that are not essential for the buyer. Thus, the presence of a will does not increase the reliability of the transaction, but, as practice shows, on the contrary, it gives additional reason to doubt the purchase of inherited real estate.

Risks of purchasing a bequeathed apartment:

- Contestability of a will. An act of posthumous expression of will of a citizen may be declared invalid* in court at the initiative of any successor from the current line of inheritance by law.

- Availability of additional orders of the testator. The most unpleasant thing for a new owner of a living space is a testamentary refusal. It is expressed in granting a certain person the right to reside in an inherited apartment for a certain period of time or for life. Moreover, this right is not canceled upon alienation of property, that is, the new owner may have an unwanted neighbor in the purchased housing.

- The existence of legal holders of an obligatory share of inheritance. This category of successors cannot be deprived of inherited property even by will - they have the right to claim half of what they could have received by law in any case (unless they are declared unworthy heirs). These may be disabled father, mother, spouse, children and dependents of the testator who, for good reasons, were unable to timely declare their rights to the apartment.

Read more: What length of insurance should be indicated on the sick leave certificate?

* - a will is invalid if the testator at the time of its preparation:

- was deprived of legal capacity;

- was in a state of short-term loss of the sense of reality of what was happening (due to intoxication with chemicals, severe stress, affect);

- was under psychological and/or physical pressure.

Among the risks that are practically impossible for a potential buyer to analyze is the possibility of recognizing the heir as unworthy. Even a successor who was appointed by the testator himself may be deprived of his rights; according to the law, he does not have any advantages over the successor.

The grounds for declaring an heir unworthy may be as follows:

- incriminating him of illegal actions in relation to the testator, his expression of will, as well as other heirs in order to increase the inherited profit;

- failure to fulfill alimony obligations in relation to the now deceased (in cases established by law).

Should I buy an inherited apartment?

You can buy an apartment that was inherited, but after carefully weighing all the pros and cons of the transaction:

This is secondary housing, and it usually costs less than apartments in new buildings

If more than 10 years have passed since the seller accepted the inheritance, the risks for the buyer are reduced to zero

People are wary of buying inherited apartments, and sellers often reduce prices slightly

There is a possibility of challenging the transaction. The apartment and money will most likely not be taken away, but the courts will have to waste time and nerves

If the seller lowers the price too much, this is a reason to be wary: perhaps he wants to get rid of the property as quickly as possible to hide legal flaws

How to protect yourself when buying an inherited apartment?

To minimize risks, it is important for the buyer to follow several rules:

- Carefully study the documents and history of the transfer of ownership. Information can be requested from Rosreestr.

- Indicate only the real cost in the DCP. The seller may ask to indicate a reduced price there in order to reduce the tax amount. But if the deal is challenged, the buyer will receive only what is specified in the contract.

- Buy an apartment if it was inherited at least 7 years ago. The likelihood of heirs appearing remains, but at a low level. If 10 years have passed, they will not be able to challenge the deal.

Note! It is advisable to indicate in the DCT that all financial risks in the event of litigation when other heirs appear are borne by the seller. This is already defined by law, but it is better to reflect such a clause in the contract.

Buying an apartment after inheritance: step-by-step instructions

The purchase and sale of inherited real estate consists of several stages:

- Obtaining a certificate of inheritance and registering the seller's ownership.

- Search for a buyer, discussion of the terms of the transaction.

- Conclusion of the contract, receipt of the deposit.

- Submission of documents for re-registration of ownership in Rosreestr, possibly through the MFC.

- Receipt of the final set of documents. It will be issued after 7 working days if the application was submitted to Rosreestr, and after 9 working days if applied through the MFC.

If the DCT is certified by a notary, he independently submits documents for registration; no fee is charged for this (except for the state fee). The registration period is reduced to three working days.

Contents and sample agreement

The DCT of the inherited apartment must include information about the parties to the transaction and other items:

- The document on the basis of which property rights are registered - a certificate of inheritance.

- Date of registration of the seller's ownership.

- Information about the property: address, area, number of rooms, cadastral number.

- A reference to the fact that the transaction does not violate the rights of third parties, and if they make claims, the seller bears responsibility.

- A guarantee that the property is not encumbered.

- Responsibility, rights and obligations of the parties.

- Cost, payment methods and procedure.

- Date of preparation and signature of the parties to the transaction.

Sample contract

Consultation on document preparation

Documentation

For the transaction, the seller must prepare:

- certificate of inheritance;

- extract from the Unified State Register of Real Estate;

- registration certificate;

- certificate of absence of debts for housing and communal services;

- extract from the house register.

The buyer will only need a passport.

These documents are submitted to Rosreestr along with the DCP in three copies, except for an extract from the house register and a certificate from the housing and communal services.

Expenses

The buyer pays a state fee for re-registration of ownership - 2,000 rubles. If the contract is certified by a notary, and certification is required by law, a state duty is paid for this in the amount of 0.5% of the transaction amount, but not more than 20,000 and not less than 300 rubles.

Note: notarization is required if the property of a child or incapacitated person is sold, or a share in the right of ownership to a stranger who is not the owner of the other share.

If the parties turn to a notary at their own request, instead of a fee, a tariff is paid in accordance with Art. 22.1 “Fundamentals of legislation on notaries”:

| Who is the property being sold to? | Tariff size (RUB) |

| Child, spouse, parent, grandchild for a transaction price of up to 10 million; | 3,000 + 0.2% of the amount |

| From 10 million | 23,000 + 0.1% of the amount over 10 million. |

| To a stranger with a housing price of up to 1 million. | 3 000 + 0,4% |

| From 1 to 10 million | 7,000 + 0.2% of the amount over 1 million. |

| From 10 million | 25,000 + 0.1% of the amount exceeding 10 million. |

How to safely complete a transaction

The rights of the new owner of the living space are protected by the Decree of the Constitutional Court of the Russian Federation dated April 21, 2003. According to its instructions, a person who considers himself the owner of a sold item does not have the right to reclaim it from a bona fide buyer. And paragraph 42 of the Resolution of the Plenum of the Supreme Court of the Russian Federation dated May 29, 2012 No. 9 “On judicial practice in inheritance cases” states that if the inheritance is accepted after 6 months, the successor can only count on monetary compensation from the seller of the apartment.

The main task of the buyer in this case is to ensure the status of a bona fide one, that is:

- Purchase real estate for a fee.

- Be sure that the property was sold if the seller had the authority to do so.

In accordance with the second point, you can protect yourself from an unsuccessful purchase by following the following instructions:

- Ask the owner for title deeds for housing, an extract from the Unified State Register of Real Estate, a house register and a passport.

- Carefully check the documents for authenticity and consistency with each other.

- Study information about the number of residents registered in a given living space and transactions carried out with its participation.

- Review the certificate confirming the absence of debt obligations on the purchased property.

- Find out about the basis on which the seller received ownership of the apartment (if by will, then ask to provide the document).

- Examine the contents of the will for the presence of instructions regarding testamentary refusal.

- Make sure that the purchase and sale agreement contains a reliable and current price for housing.*

Read more: Who is involved in landscaping children's playgrounds?

* - a very important nuance that warns against indicating an undervalued value in the document: in addition to reducing the seller’s expenses, this entails possible financial losses for the buyer if the transaction is terminated.

A transaction through a representative requires careful verification of the power of attorney and the apartment owner’s awareness of it. In addition, you should protect yourself in case the owner decides to revoke the legal force of the power of attorney immediately after payment.

As for the moment of payment, you can adopt several methods of transferring the agreed amount to the seller:

- Immediately after signing the purchase and sale agreement. It is recommended to do this in front of witnesses, requesting a receipt from the seller about the amount of funds received by him (include the passport details of the parties to the transaction and the signatures of witnesses in the receipt).

- By placing it in a bank cell. The buyer places the money for the apartment in a specialized bank safe and orders the release of funds to the seller only if there is a certificate of registration of the apartment in the name of the buyer.

And it is important to understand that even if all precautions are taken, it is impossible to achieve a 100% guarantee of safety when purchasing an inherited living space, but you can increase it to the maximum with the help of an experienced lawyer.

Lawyer's answers to private questions

What is more risky for the buyer: buying an apartment received by the seller by law or by will?

In the first case, legal heirs may appear who missed the deadline for accepting the inheritance. In the second - people who are entitled to a mandatory share, and who also missed the deadline. The risks are approximately the same everywhere.

What are the risks when purchasing an inherited share of ownership?

The buyer risks only if the seller has not provided the pre-emptive right to purchase to the remaining share owners (Article 250 of the Civil Code of the Russian Federation). But then the notary will refuse to certify the DCT, and Rosreestr will not accept the agreement without his signature and seal.

How to prove to the acquirer that he is in good faith?

It all depends on the specific situation. The courts are examining whether the buyer could have found out about the right of third parties to the apartment, whether he knew about it. But in most cases, they are still recognized as bona fide, and compensation is paid by the heirs-sellers.

Do I need my wife's consent to sell real estate that I inherited during marriage?

No. According to Art. 35 of the RF IC, such real estate is considered the personal property of the heir-spouse. Notarial consent is required only for the disposal of a shared apartment.

Can a buyer protect himself from loss of ownership of an apartment inherited by the seller?

Yes, for this it is enough to issue a title insurance contract. Such insurance precisely protects against the risk of loss of property rights, and is usually issued for the statute of limitations for challenging the transaction. But if the risks are minimal, it is not always advisable to buy it.