VTB mortgage lending conditions

VTB Bank is the largest Russian bank, which has a large customer base from different regions of the country. Potential borrowers are attracted by favorable mortgage terms, namely loyal interest rates and long loan terms.

In 2021, mortgages at VTB have become even more affordable. The Bank has introduced a number of changes regarding the issuance of targeted loans. The main one is the reduction of the minimum interest rate, which is now 9.5%. The reformations also affected the loan term; according to them, the borrower can repay the loan for 50 years.

VTB has developed several mortgage programs for its clients. Each borrower can choose the most optimal mortgage option based on their capabilities. You can buy housing as a share, that is, register common ownership, for example, with a close relative.

| Name of the mortgage program | Annual percentage | Down payment amount | Loan amount | Property | Loan terms |

| Buying ready-made housing | 0.131 | 0.15 | From 1.5 million to 90 million rubles | An apartment from the secondary real estate market, a room in a communal apartment (the room must be in good, habitable condition) | Duration up to 30 years |

| Apartment in a new building | 0.131 | 0.15 | From 1.5 million to 90 million rubles | Apartment from the primary real estate market | Duration up to 30 years |

| Mortgaged property | 0.12 | 0.2 | From 1.5 million to 90 million rubles | Resale or new building, which are pledged to the bank | Duration up to 30 years |

| Mortgage for the military | 0.125 | 0.2 | Up to 1.93 million rubles | Housing from both the primary and secondary real estate markets | Duration up to 14 years |

| Victory over formalities | 0.141 | 0.4 | From 1.5 million to 30 million rubles | Housing in a building under construction or finished | Duration up to 20 years |

| Young family | 0.11 | 0.1 | From 500 thousand rubles to 8 million rubles | New building, which is included in the list of the state corporation "Rosstroy" | From 5 to 30 years |

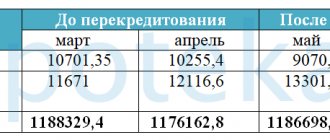

| Refinancing | 0.107 | Not required | From 1.5 million to 90 million rubles | Primary or secondary market real estate, mortgaged from another lender | Duration up to 50 years |

At the same time, today there is an opportunity not to make a down payment. But it is available only to corporate and salary clients, as well as participants in government programs.

Documents for obtaining a VTB mortgage: general package

VTB Bank increases the amount of mortgage loans. Currently, the borrower can receive up to 60 million rubles with repayment within a maximum of 30 years. But at the same time, the lender wants to receive guarantees that the entire amount will be returned on time, including accrued interest.

The peculiarity of a mortgage loan is that the money is issued against real estate purchased or already owned by the borrower. If the latter at a certain stage ceases to fulfill its obligations, the bank has the right to sell the encumbrance. The proceeds are used to pay off debt ().

But this method of solving the problem is quite labor-intensive. It takes months, if not years, to sell a property. It is more profitable for the bank for the borrower to fulfill its contractual obligations and make payments according to the schedule. This means that even at the stage of submitting an application it is necessary to assess the personality of a potential client and check his solvency.

In order for VTB to accept mortgage application documents for consideration at all, the borrower must submit for consideration:

- . Corrections and crossing outs are not allowed. Information must be reliable and complete;

- general passport or other identification document. Copies are made of all sheets, including blank ones;

- SNILS. It is represented only by Russian citizens;

- proof of income. As a standard, the borrower submits . Also accepted for consideration. An entrepreneur at VTB for a mortgage includes declarations for the previous 12 months with the stamp of the tax office in the documents for approving an apartment. Only those who receive it on a VTB card/account do not have to confirm income;

- copy of work record/contact. All sheets are certified with the seal of the employing company and the signature of the responsible person. An alternative is an extract from the work record book.

For men under 27 years of age, the list of documents for obtaining a mortgage at VTB is supplemented by a military ID. Citizens of other countries are required to confirm that they are in Russia legally.

Separately, it is worth touching upon the issue of paying the down payment using maternity capital funds. If the borrower intends to do just that, the list of documents for mortgage approval at VTB is supplemented. included in the general package of documents when submitting an application.

Recommended article: Rosselkhozbank mortgage for the construction of a residential building

Procedure for obtaining a mortgage

To obtain a mortgage, the borrower must go through several successive stages and important steps, each of which is mandatory. Applying for a mortgage at VTB involves collecting various documentation, searching for suitable housing and, finally, concluding an agreement.

First stage: submitting an application

After the borrower has decided on the most optimal mortgage program, he must provide the VTB branch with a complete list of requested documents and write the appropriate application (this could be a passport, income certificate, education diploma). Within 3 days, the bank makes a decision regarding the advisability of providing a loan, assessing the client’s solvency and reliability, after which the loan specialist tells him the answer over the phone.

Stage two: searching for real estate

Once the application is approved, you can proceed to the second stage of applying for a mortgage - searching for housing, and the borrower must do so within two months. The purchased housing must fully comply with the requirements put forward by VTB. In particular, to have good repairs, legalized redevelopment and the necessary utilities. In this way, VTB is trying to protect itself from possible financial risks, because if the borrower turns out to be insolvent, it can quickly sell the property at market value. You can search for suitable real estate either independently or with the involvement of a bank or realtor.

Third stage: real estate valuation

The lender must know the appraised value of the property to apply for a mortgage, since the loan amount should not exceed 85-100% of its value. For this purpose, the borrower must call an independent appraiser, whose services cost money. The lending procedure provides for the preparation of two assessment reports (one is sent to the bank, the second remains with the borrower). The cost of an appraiser’s services directly depends on the type of housing and can vary from 3 to 25 thousand rubles.

Stage four: insurance

VTB imposes a mandatory condition on its clients - insurance. In this case, lending programs will be more loyal, since the financial institution can reduce the interest rate on the loan or cancel the requirement for a down payment. Experts recommend taking out comprehensive insurance, which includes insurance of the purchased property, your own life and health, as well as title insurance. At the same time, at this stage, an insurance tariff is issued - a letter confirming that the insurance company is ready to provide its services, and insurance is carried out after the final decision is made by the bank, but before the mortgage agreement is signed.

Fifth stage: making a final decision

At this stage, the client must take a complete package of documents to the bank. It includes personal papers, documents for the purchased property, as well as an insurance rate. Within 3-7 days, VTB will make its final verdict and determine the size of the loan.

Stage six: conclusion of an agreement

There are two types of mortgage transactions possible at VTB. The most widespread transaction is using a deposit. The client opens an account with VTB, after which he signs a loan agreement and completes a purchase and sale transaction. The bank issues money, which is placed in the cell. After successful registration of the transaction in Rosreestr, the real estate seller receives access to the cell. The second possible option for concluding a transaction is using a letter of credit, that is, transferring funds to the seller’s bank account and blocking them. To unblock funds, you need to obtain documents confirming ownership from Rossestr and take them to the VTB branch.

Stages of purchasing real estate with a VTB mortgage

Stage 1: choosing a mortgage program

First, you need to determine which program you meet all the requirements for. This step will help you save quite a large amount of money on interest.

Recommended article: Mortgage from 1 percent in Sberbank

In addition to interest, the mortgage program depends on:

- Amount of down payment;

- Interest rate amount;

- Minimum income for application approval;

- Requirements for the future borrower.

Step 2: Submitting a Mortgage Application

On the official VTB website, the client should familiarize himself with all the requirements mandatory for obtaining a mortgage.

Filling out the questionnaire will not take much time, but you will have to wait much longer for a response. On average, an application is processed within 7 working days. But if you previously applied for a loan from VTB, following all the rules of the agreement, the bank will send a response in 3-4 days. Sometimes it happens that the bank responds within 1.5 months, but this happens extremely rarely.

The bank does not voice why it refuses applications; to understand the reasons for making such a decision, read the article: “Reasons for refusing a mortgage: what should borrowers take into account?”

Stage 3: property search

Upon receipt of approval for your application, the bank will indicate the amount of money you can count on. An approved loan application is valid for exactly 60 days - the period during which you need to find housing. If the requirement is not met, this application becomes invalid.

Some difficulties may arise if you are focused on secondary real estate. Most sellers are afraid to sell their home with a mortgage and refuse the deal right away. To avoid such a situation, familiarize the owner with the instructions for selling real estate through mortgage lending. Difficulties lie in wait not for the seller, but for the buyer. Since the borrower needs to choose a specific apartment that will meet all the bank’s requirements.

Stage 4: assessing the living space

The most important stage in buying a home is an independent specialist assessment of its market value. Using the data received, VTB will decide whether the property is suitable for a mortgage or not.

Stage 5: decision by the bank

Upon receiving data on the cost of an apartment from an independent expert, the bank decides whether the property is suitable for the mortgage program or not.

Remember! The bank can check the creditworthiness of the borrower and co-borrowers at any stage of document verification before signing the loan agreement. Do not rush to apply for new loans and credit cards until the transaction and settlements have taken place

Stage 6: signing the loan agreement

Before completing the transaction, you should sign a loan agreement. After this, the agreement becomes valid, and the banking organization begins to prepare the n-amount of funds.

Stage 7: conclusion of a notarial transaction

This stage has become mandatory since June 2, 2021 in situations where the property being purchased is in shared ownership or was registered in the name of a citizen under 18 years of age. But if the seller is one adult owner, the transaction is not certified by a notary.

Stage 8: state registration

You're almost at the finish line! At this step, you are required to register the transfer of rights from the seller to the buyer with Rosreestr, so that the owner’s rights apply to the newly purchased apartment. Documents are submitted to the MFC.

Recommended article: How to apply for a loan for maternity capital in a consumer cooperative

— from the Property Buyer:

- Purchase and sale agreement (not signed in advance, only in the presence of a reception specialist) 4 copies. The terms of the purchase and sale agreement with a mortgage and the risks are discussed in detail in another article;

- Loan agreement + copy;

- Mortgage + copy;

- Receipt for payment of state duty 2000 rubles + copy;

- Extract from the assessment report (optional);

- Marriage certificate (required when purchasing as joint property) + copy.

From the seller:

- Title documents (Purchase and sale agreement, Certificate of inheritance, Court decision, Agreement on transfer of apartment into ownership of citizens);

- Legal documents (Certificate of state registration of rights, Extract from the Unified State Register of Real Estate);

- Certificate of registration (if the contract does not contain information about those registered at the time of the transaction);

- Consent of the spouse, Marriage agreement (if the seller purchased the apartment during marriage).

The transaction is completed in no more than 5 - 9 business days.

Upon registration, the borrower will receive two copies (one for VTB) of the purchase and sale agreement and an extract from the Unified State Register of Real Estate.

Stage 9: property insurance

The terms of the VTB mortgage state that the mortgaged property and the life (health) of the borrower must be insured. If the rule is not followed, VTB increases the interest rate.

Mortgage insurance – what is required?

According to the law of the Russian Federation, real estate purchased with collateral must be subject to insurance against damage or damage. In addition, the apartment is insured against fire, possible flood and other unforeseen situations. This is done so that the bank can receive a 100% guarantee of the safety of the home. Such insurance from VTB is quite expensive, but you cannot refuse it, otherwise the bank will refuse a mortgage.

Stage 10: providing the client with money to purchase the property

VTB provides payment to the seller using a letter of credit account or a safe deposit box. But in the case of purchasing living space in a new building, the bank transfers the money to the developer company by bank transfer. In any case, the money will not pass through the hands of the borrower.

You can also familiarize yourself with the general conditions for the provision of a VTB mortgage loan, as well as the terms of the purchase and sale agreement, by downloading the file General conditions for concluding a VTB mortgage transaction.

Risks in mortgage lending

A mortgage is inextricably linked with great risks for a credit institution. Actually, this is why VTB insists on real estate insurance. The main sources of risks are the economic situation in the country, the standard of living of the population, the domestic and foreign policies of the state, the dynamics of rising real estate prices and much more.

All mortgage risks can be divided into three groups:

- credit - the risk of illegal actions, such as the borrower’s evasion from fulfilling its financial obligations. It is almost impossible to avoid it completely. To protect itself as much as possible, VTB requests a large amount of documentation confirming the client’s solvency;

- interest rate - the risk of losses due to the excess of annual rates that are paid to financial organizations on borrowed funds over the rates on loans provided. It is quite difficult to predict the occurrence of interest rate risk;

- liquid - the risk of changes in real estate market conditions, exchange rates, and stock markets. These are factors that the bank cannot control. To reduce risk, banks must develop a resource mobilization plan that identifies sources and costs.

Requirements for borrowers

In order to protect itself from financial losses, VTB Bank puts forward a number of requirements for borrowers. To get a mortgage you must fully comply with them:

- have Russian citizenship and registration in the region where the VTB branch is located;

- have at least a minimum work experience (from one year), and the borrower must have worked at his last place of work for at least 6 months;

- have at least secondary education;

- the age of the borrower can vary from 21 years to 60/65 years for women and men, respectively;

- have a good credit history, that is, at the time of applying for a mortgage, the borrower should not have overdue payments to other financial organizations.

In addition, it is very important that the client is solvent. He must prove his financial solvency with relevant documents, for example, a certificate of income or a bank account statement.

Required documents

To apply for a mortgage at VTB, you must provide a standard package of primary documents. It includes the following papers:

- application for a mortgage loan;

- Russian passport;

- marriage registration certificate;

- children's birth certificate;

- education document;

- another document that confirms the identity of the borrower;

- employment contract;

- employment history;

- certificate from the place of work about the amount of income;

- a certificate indicating the presence of additional sources of income.

As mentioned above, this is a standard set of papers. But you need to be prepared for the fact that the bank may request other documentation. For example, a certificate of ownership of real estate or an extract from the borrower’s account.

After purchasing a mortgaged home, you need to provide a secondary package of documents to the VTB branch. It includes title documents (transfer and acceptance certificate, contract, checks), technical documents, insurance letter, photocopy of the seller’s passport (if we are talking about housing from the secondary market). In this case, the title documentation is subject to mandatory notarization.

Mortgage documents at VTB for registration of a mortgage on real estate on the primary market

A mortgage loan is always secured by real estate purchased or already owned by the borrower or third parties. The latter is possible only with a notarized consent.

The fact of pledge is recorded in a special document - mortgage (). It is compiled in a single copy and submitted for registration to Rosreestr. After this, the borrower cannot perform any legally significant actions with the property without the permission of the lender.

The contents of the mortgage are strictly regulated at the legislative level (). However, the form may vary from bank to bank. At VTB, the following information is included in the mortgage:

- The number of the loan agreement and its most significant points, including the method of debt repayment.

- Information about the borrower and mortgagee.

- The most complete description of the purchased object, indicating all significant parameters.

- Estimated value in the currency of the loan agreement and information about the appraiser.

- Data of the bank branch or mortgage center where the loan agreement was drawn up.

- Information about the government agency that registered the mortgage.

- The date of the mortgage. It is signed by the borrower and a bank representative vested with appropriate authority.

Recommended article: Mortgage conditions of Rosselkhozbank

After the mortgage loan is fully repaid, the bank is obliged to transfer the mortgage to the borrower within 14 days, indicating the exact date on it.

Documents for a mortgage note at VTB:

- general passport and marriage certificate (if available);

- appraiser's report;

- acceptance certificate signed by the buyer and the developer’s representative;

- a copy of the permit to put the facility into operation.

You can submit a mortgage for registration to Rosreestr either in person or through the MFC. All registration actions must be completed within 5 days. In case of purchasing a townhouse or other property with land, the answer will be ready in 14 days ().

Pros and cons of mortgages at VTB

According to statistics, the majority of Russians choose VTB Bank to obtain a mortgage. Among its main advantages it is worth noting the following:

- a large selection of mortgage programs for various categories of citizens;

- low interest rates;

- long loan term;

- prompt decision-making on the application;

- possibility of early repayment of the loan.

Of course, there are also disadvantages. Perhaps the most significant of them is the stringent requirements for potential borrowers, which not everyone can meet. Also, if you refuse to insure your own life and health, the mortgage rate increases by several percent. After registering a mortgage and concluding an agreement, the borrower must pay a commission to the bank of several thousand rubles.

[shortkod477-28-02-2019-11:54:50]

Every person should understand that purchasing a mortgage property is a heavy financial burden. Moreover, difficulties arise already at the stage of its registration. Thus, it is necessary to collect a large number of documents, find real estate that fully meets the bank’s requirements, evaluate it and insure it against risks. This also entails additional expense transactions. But at the end of the journey, a worthy reward awaits you - purchased your own home.