In order to use a vehicle in Russia, each car owner purchases a compulsory car insurance policy. Every car driver tries to buy a policy at sales offices that are located near their place of residence or work. But the policyholder cannot always be located at the place of permanent registration, since it is common for a person to move, be it for work, study or other reasons.

Apply for OSA online >>

In this regard, car owners are looking for companies that would sell compulsory motor insurance without registration, because driving without car insurance in Russia in any subject, regardless of the place of permanent residence of the car owner, is punishable by law in the form of a fine. You will find out later in the article whether it is possible to carry out a similar procedure for purchasing a “car title”.

Why is compulsory motor liability insurance important and what is needed to obtain it?

To have the right to drive a car, it is not enough for the owner of the car to have only a driver's license. To complete the process of registering a vehicle when purchasing it from a previous owner or at a car dealership, a motorist needs compulsory motor insurance, which will protect him from possible financial difficulties.

The main objective of car insurance is that it insures the driver in the event of an accident in which he is found guilty and is exempt from paying compensation to third parties (victims).

The current law “On OSAGO” implies ensuring the protection of car owners from the occurrence of such insured events as:

- Compensation for damage caused to the victim’s property (car) through payment of monetary compensation in the amount of up to 400,000 rubles.

- Compensation for harm caused to health (to the injured driver, passengers or pedestrians) by paying compensation in the amount of up to 500,000 rubles.

In all these situations, having an insurance policy will save the car owner from paying the amounts listed above. That is, if the policyholder initiates a car accident, then it will not be him who will compensate for the damage, but his insurance company, with which the contract for the protection of the “car citizen” was signed.

Therefore, MTPL insurance is a means of preventing financial penalties from the law against car owners. In addition, having issued a car insurance policy, a citizen of the Russian Federation has the rights to receive insurance payments from insurance companies, and not from the culprits directly or by filing a claim in court.

Is it possible to apply for compulsory motor liability insurance without registration?

As you already understand, car insurance is an integral part of the legal operation of vehicles on the territory of the Russian Federation. Consequently, car owners have the right to drive a car only if they have a compulsory car insurance policy valid in the country.

But situations in which a driver leaves his place of permanent residence and goes to another region along with his car are not uncommon. In this regard, the question of whether it is possible to make compulsory motor liability insurance without registration remains open, because no one wants to face a fine or more serious monetary penalties.

Situations in which the owner of a vehicle, if he wants to buy a “motor citizen” policy, may not have registration are as follows::

- The owner of the car came from another state and does not have a permanent place of registration (non-resident).

- In this region where the car owner wants to take out a policy, he is located for work or study.

- The car owner purchased the car in another city.

- The owner of the car has changed his place of residence, but has not yet managed to register for a new one.

The driver has the opportunity to issue and sell a policy in any region and not at his permanent residence address. It does not matter whether the policyholder is a citizen of Russia or not. The insurance company does not have the right to refuse to obtain a policy for a driver who has a residence permit in another region.

The refusal to sell “automobile licenses” will apply to those motorists who are not registered anywhere and have not registered with the Federal Migration Service. Often, citizens who are in the capital due to work or relocation are forced to take out an MTPL policy in Moscow without registration. That is, such citizens have permanent registration and simply want to buy car insurance where they work or study.

Is it possible to do OSAGO without registration?

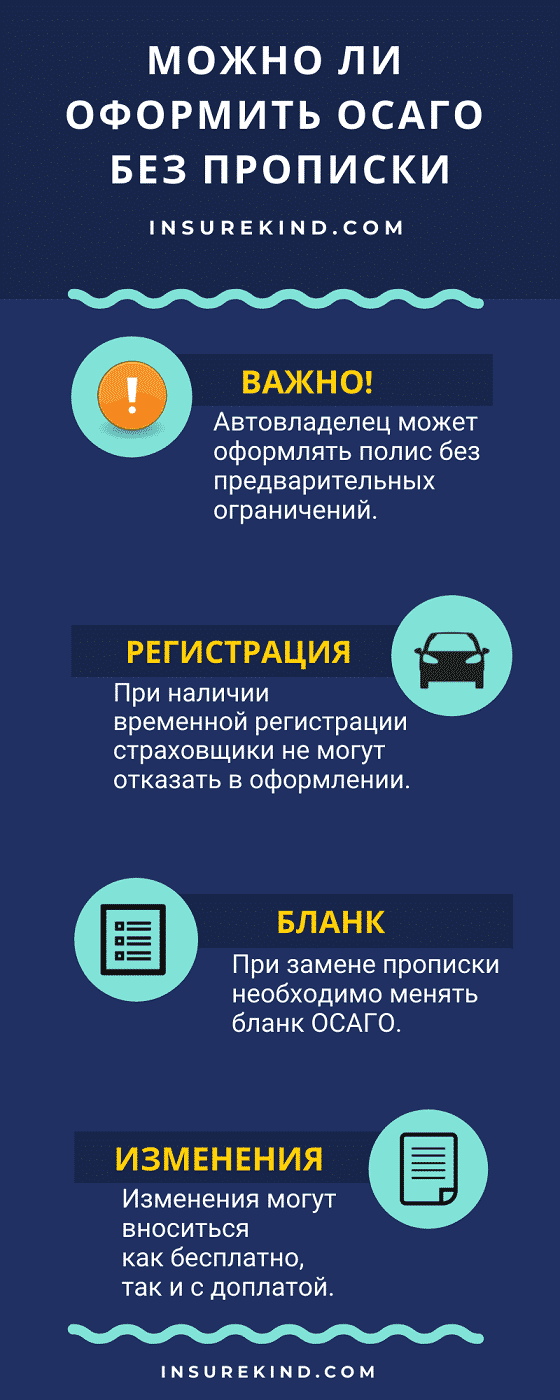

In accordance with the standards prescribed in Federal Law No. 40-FZ, issued on April 25, 2021, a car owner has the right to take out a compulsory motor liability insurance policy in any region without any preliminary restrictions, that is, each citizen can choose the branch of the insurance company in which It is more convenient for him to receive this service, without paying attention to any legal norms and restrictions.

The lack of permanent or temporary registration cannot be considered as a reason for the refusal of representatives of the insurance company to issue a compulsory insurance policy.

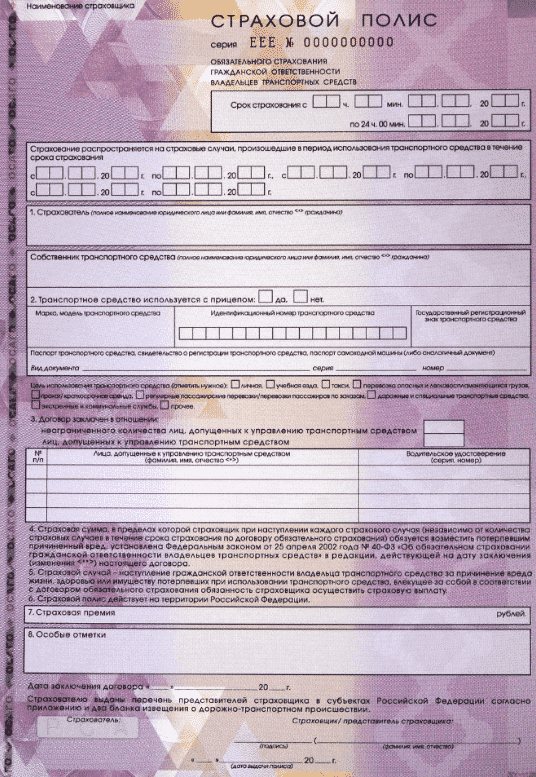

Moreover, in order to issue an insurance policy, a non-resident will need to provide the selected company with the following package of documents:

- military ID or passport;

- registered driver's license;

- passport of your own vehicle;

- diagnostic card;

- a pledge obligation, a loan agreement and other documents confirming the purchase and sale or any other fact on the basis of which a person received ownership of his car.

Despite the fact that today many insurance companies, in the process of issuing an insurance policy, require that they provide them with a vehicle registration certificate, in the absence of one, the car owner has every right to issue the so-called transit compulsory motor liability insurance, the validity of which is no more than 20 days.

At the end of this period, the owner must necessarily carry out the registration procedure for his vehicle, as a result of which he will be provided with permanent registration numbers, along with which he will be able to issue a full-fledged MTPL policy from the insurance company.

Procedure for registration of compulsory motor liability insurance when changing registration

Every motorist should know that even in another region, the rules of compulsory car insurance remain the same, i.e. Every driver is required to have a “motor citizen” if he wants to legally drive a vehicle in the Russian Federation.

According to the law, insurers are required to provide a policy to their clients, even if it does not have temporary registration. This means that if a driver wants to take out an MTPL policy without registration, for example, in Moscow, since he is registered in St. Petersburg, the insurer from the capital has no right to refuse.

That is, having a Moscow registration or some other is already one of the conditions that is necessary when purchasing a car insurance policy. But there are cases in which a car owner, already having a valid auto insurance policy, changes his place of residence.

In such situations, the documents confirming the place of permanent registration will change, and the data that was entered into the policy will become irrelevant (invalid). Consequently, the policyholder is obliged to contact the insurer and report a change of permanent residence address.

At the same time, they will not issue a new “automobile license,” especially if its validity period is still long. The insurer will simply make a note on the current form so that upon renewal, new information about the client will be included in the new policy.

Temporary registration policy

As a rule, motorists, when leaving for other cities for work, always transport their car with them. But as you know, insurance is temporary and its term may expire unexpectedly. For this reason, the owner will have to insure the car where it is currently located.

As mentioned earlier, there should be no refusal to sell a car insurance policy, since insurance companies are required to provide forms to each car owner who applies.

This means that if you do not have a residence permit in Moscow, they will still sell you compulsory motor insurance, the main thing is to have a document capable of confirming your main place of residence (registration). Any motorist has the right to purchase a policy, no matter where he is officially registered. A more simplified option is to purchase a policy online.

Thus, you can buy car insurance remotely and even be in another country. This procedure is possible because when filling out the application, the registration address is indicated in the column.

Purchasing compulsory motor liability insurance in a foreign region

Drivers who are in a region different from their place of residence have the right to take out a car insurance policy without any problems. Agree that due to the lack of registration in a given region, the policyholder should not jeopardize his civil liability.

Therefore, if, while in a foreign region, a motorist remembers that his policy is coming to an end, then he needs to contact any insurance company where he can buy a form. A simpler procedure would be the electronic prolongation of compulsory motor liability insurance without registration at the place of residence, since in this case the driver will be insured with the same insurer and he does not need to visit the company’s office in person.

Can Moscow insurance companies refuse to issue compulsory motor liability insurance for visitors?

For many, it is quite difficult to purchase an MTPL policy without registration in Moscow. Despite the absence of a direct prohibition by the legislator, companies avoid issuing a document if the client is registered in another region. Some explain the refusal by technical reasons, others refer to the need to present the car for inspection. If such difficulties arise, then the first thing you need to do is contact the main office, and if they do not issue a policy after paying for the service, then you should protect your rights. The only legal basis for refusal to provide a policy is the complete absence of registration (for example, a person without permanent residence applied).

The MTPL insurance contract is public, which means that companies are required to conclude it with clients who provide a full package of documents and pay the invoice. But at the same time, they have the right to demand that the car itself be brought for inspection. In case of violation of rights, vehicle owners must apply to the regional branch of the prosecutor's office, FAS, Tsetrobank or RSA.

Every car owner may face a move, and if it is temporary, then it becomes necessary to purchase an MTPL policy in another constituent entity of the Russian Federation. Without this document, it is prohibited to move freely on the country's roads. Nonresidents have every right to receive the same amount of service as local residents, but they are often denied for a variety of reasons. The only legal one is the complete absence of registration; in other cases, you will need to protect your rights by contacting the RSA.

The main problems when buying in a foreign region

But some motorists cannot apply for compulsory motor insurance without registration at their place of residence. In most cases, refusals to issue auto insurance forms due to the lack of temporary registration with the policyholder are illegal, but for the motorist himself, purchasing a policy in another region may not be profitable, for example :

- It is not always the case that the insurer from whom the policy was previously purchased has a branch in the region where the policyholder is currently located.

- After purchasing an “automobile license” in another branch, in the event of an accident you will have to contact this office, and not the one located at your place of registration.

Do not forget that no one will allow you to issue an MTPL policy without registration, since in this case the insurer will not have information about the policyholder and it will be impossible to complete the insurance procedure.

When might it be necessary to take out compulsory motor liability insurance in a foreign region?

Most often, a person has to apply for compulsory motor liability insurance in another region for the following reasons:

- purchasing a car (it can be either a new or used car) from a resident from another territorial unit, which needs to be transported to the region for further use;

- buying a car at a car dealership by pre-order, which is located in another region;

- purchasing a vehicle in order to use it in a region where the car owner is not registered, this may be related to work;

- when they had not yet managed to register after a recent move.

If you decide not to bother and don’t want to purchase MTPL insurance in order to drive a vehicle from someone else’s region to your own, then there is the possibility of earning a fairly large fine. What should you do in cases where you are a guest in a foreign city because you are buying a car?

Is it possible to purchase MTPL insurance not at the place of residence, but where the purchase was made?

Is there a difference in the price for the policy by region?

The reason why it is impossible to issue a policy without permanent or even temporary registration lies in determining its price. Thus, each insurer to whom the policyholder turns is obliged to calculate the insurance premium.

The size of the cost of an insurance policy is influenced by many indicators, including the length of service, the age of the motorist, the technical characteristics of the car and the base rate. But there is another indicator that is related to the place of registration of the owner of the vehicle. This indicator is called the territorial coefficient.

The values of this multiplier are established by law and each region has its own. The more unprofitable the region is for the insurer, the higher the value of the indicator. In megacities, the regional coefficient is high, 1.8-2. In small cities and towns, this figure is lower, since the traffic load, and therefore the frequency of accidents, is lower there.

When calculating the insurance premium, the coefficient taken at the registration address is taken into account. This means that a motorist registered in Khabarovsk, but buying a policy in Moscow, will pay the price calculated for Khabarovsk for the “motor citizen” form.