Looking for an answer to the question “where is mortgage insurance cheaper?” often faced by people who decide to take out a loan from a bank to buy a home, and mortgage insurance is one of the conditions for obtaining a mortgage.

Is it mandatory or can I refuse this service? It is important to know that the borrower’s reluctance to insure the mortgage may lead to the bank refusing to issue a loan.

Considering that the mortgage insurance procedure entails additional financial costs, each borrower strives to find cheaper and more favorable conditions. For those who are too lazy to read the article and understand the issue, we suggest calling the number right away - Prosto.Insure specialists will tell you where it is better to get mortgage insurance and how to save on it.

First, let's figure out what can be insured with mortgage insurance:

- Real estate object (structure);

- Life and health;

- The right to own property (title).

A brief review and rating from Prosto.Insure will help you make the right choice and find a favorable rate among all insurance companies.

Comprehensive or separate insurance: which is better?

By law, the borrower has the right to insure only the collateral property, but in fact, all insurance companies offer comprehensive insurance.

The client may refuse to insure all positions, but the bank, which does not want to lose its income, may refuse to provide a loan or will approve the application at a standard rate, without a reduction.

If you really want to get a mortgage, it is important to know that comprehensive mortgage insurance is not that expensive - up to 1% of the loan amount and can be reduced to 0.2% -0.5%.

And yet, comprehensive insurance has a number of advantages. You get one policy at a competitive rate that maximally covers your interests related to life insurance, collateral and property rights. The bank, in turn, receives its income and trusts you as a responsible client.

What affects the cost of an insurance policy?

The following will lead to an increase in insurance rates:

- Floor. Insurers sell policies to men at a higher cost than to women.

- The presence of bad habits. If a person smokes or drinks alcohol, he may pay more.

- Age. The cost of insurance increases in proportion to the number of years of the applicant.

- Chosen profession. If there is a high risk of injury, rates will increase.

- Health status. Diseases also negatively affect current tariffs.

- Age of the house. The older the property, the more expensive the insurance.

- Variety. The price of a policy for a house located in a city or in a village will differ significantly.

- Presence of agreements with the insurer. If the bank cooperates with the company, customers may be offered preferential rates.

- History of cooperation. If a citizen has previously interacted with an insurer, bonuses and discounts on mortgage insurance may be provided.

The exact cost will be known at the start of cooperation.

Mortgage insurance: tariffs

When forming the final tariff price, a number of important factors are taken into account:

- Rates of the bank that issued the loan;

- Borrower's age. The tariff increases in proportion to the age of the borrower;

- Borrower's gender. Unlike men, women can obtain insurance at a reduced rate. This is due to the fact that women have a longer life expectancy, which means that the risks that the borrower will not be able to repay the mortgage are reduced;

- Client weight. If a person is overweight, the risk of becoming seriously ill increases. Given this, the insurance company may deny the borrower life insurance. Sometimes a company offers life insurance at a higher rate;

- Professional activity. For risky professions, the tariff is calculated using an additional increasing factor.

To attract customers' interest, insurance companies may often offer personalized discounts or incentives for switching from competitors.

What determines the price of property insurance?

Many factors will affect the final tariff. You don’t need to take them into account yourself - the program will do it for you. But to understand where mortgage insurance is cheaper, take into account the following nuances.

- The organization that issued the loan for the purchase of housing.

Some banks have agreements with insurers, due to which the policy here is cheaper. - A variety of square meters.

The cost of obtaining insurance in the city and the countryside will be different (an apartment will be cheaper). - Age of the house and condition of the property.

It is determined through an assessment procedure. The older the property, the more expensive the policy is. - Age and field of activity of the client.

An increased coefficient awaits representatives of risky professions, as well as older people. - History of cooperation between the borrower and a specific company.

When working together for a long time, insurers offer bonuses and discounts.

Recommended article: How to reduce or increase your mortgage payment

When trying to figure out where mortgage insurance is cheaper, take all these factors into account. But do not forget that a specific tariff is a purely individual indicator. Therefore, you will be told the exact amount only after contacting the organization with a package of papers.

But what you can prepare for in advance is the rise in price of the policy. Knowing which indicators charge higher coefficients, you can eliminate them by achieving a lower price. Although some factors, such as gender or age, cannot be changed.

Sberbank

Here, the amount of insurance for collateral is limited to 15 million rubles. Its cost is 0.25% of the mortgage, with this percentage compounded annually on the balance of the total debt.

The cost of life insurance is 1%. Moreover, if the borrower made this decision voluntarily, then this brings him financial benefit. For example, when applying for a loan at 14.9% per annum, voluntary life and health insurance will help reduce this figure to 13.9%.

Note that only Sberbank does not require comprehensive mortgage insurance. Some borrowers decide to change insurance companies, and here each company also has its own conditions.

At Sberbank, you can receive an insurance premium for the remaining months only if the loan is fully repaid. The full premium is paid only if the client decides to terminate cooperation with the company before the insurance policy comes into force.

RESO

The company cooperates with other banks at the following rates:

Sberbank

- 0.18% – constructive;

- 1% – life and health.

For VTB and other banks, comprehensive insurance, including life and health, costs about 1%, structural insurance about 0.1%, title insurance about 0.25%.

The full bonus can be received if the contract is terminated early within 5 days after its conclusion and before the agreement begins to take effect. The expenses incurred are deducted from the refunded amount, unless there are other conditions in the contract.

Today RESO offers clients an attractive promotion called “Profitable Mortgage”, according to which the client receives a 40% discount during the first year of the mortgage.

VSK Insurance House

This company practices issuing policies with constructive and life insurance clauses. Life insurance will cost you approximately 0.55%. The cost is determined taking into account the factors contained in the health questionnaire.

Structural insurance will cost about 0.43%. If there are several floors in the house or a gasification system, the tariff may increase.

As for the insurance premium, if you want to change the company, it can be returned in full if the borrower voiced his decision before the agreement came into effect, and the period from the moment the contract was concluded and refusal to cooperate does not exceed 5 days.

VTB insurance

The company offers comprehensive insurance:

- collateral property;

- title;

- life and health.

The term of the contract is the same as the repayment period of the mortgage loan. The agreement with third-party banks is concluded for 1 year, after which it is renewed every year.

The average cost of insurance is 1% of the mortgage amount and provides an annual charge of 1% on the remaining loan funds. To change an insurance company, VTB has conditions similar to Sberbank.

For your information, in 2021, due to late submission of documents, the insurance company does not have accreditation, so clients of third-party banks cannot insure life and health here.

If an insurance policy is issued for a period of 1.5-2 years or more, then he can count on a favorable discount.

Approximate rates for mortgage life insurance

How much personal insurance will cost the borrower depends on the established tariffs and the individuality of the individual case. Its size is influenced by age, health level of the borrower and profession . These are very important parameters when determining the contribution percentage.

Approximate rates for life insurance for a mortgage range from 03-1.5% or more of the insured amount.

Personal insurance completely protects the borrower from possible risks associated with incapacity due to illness, accident and other health problems when he cannot pay the mortgage loan to the bank. During the period of illness and rehabilitation, the insurance company takes on the entire financial burden.

Rosgosstrakh

The company offers the following tariffs to its clients:

For Sberbank:

- 0.6% – life and health (for men);

- 0.3% – life and health (for women);

- 0.2% – constructive.

For VTB and other banks these indicators look like this:

0.56% – life insurance (for men);

0.28% – life insurance (for women);

0.17% – structural insurance;

0.15% – title insurance.

The company may, in agreement with the Central Office, offer the client discounts, the amount of which depends on each specific case. The condition for early termination of the contract is full early repayment of the loan. The borrower is paid part of the premium minus 65% of the insurance funds paid.

There are no other reasons for receiving an insurance premium when changing companies.

Ingosstrakh

At Ingosstrakh you can take out both comprehensive insurance and separate insurance for a selected position. They do not have approximate rates, but you can make an approximate calculation of the cost of insurance, taking into account average rates.

In Ingosstrakh it is possible to conclude an insurance contract for the entire term of the mortgage with an annual renewal. Termination of the contract can occur under the same conditions as in other insurance companies. If you switched to Ingosstrakh from another company, then a pleasant bonus awaits you in the form of a discount from 5 to 15%, but its exact size depends on the decision of the management.

If the insured amount does not exceed 3 million rubles, then the decision remains within the competence of the regional branch. For amounts exceeding the above value, the decision will be made by the Central Office in Moscow.

The company has an interesting offer for clients who have entered into a mortgage insurance agreement in the form of a 20% discount if the borrower decides to voluntarily insure utility networks, property, and interior decoration.

What is mortgage insurance

Such an agreement is intended to protect the property interests of the financial organization and the loan recipient in the event of the occurrence of events established by the document. To do this, the borrower makes appropriate payments to the insurance company.

For example, if a debtor ceases to fulfill his financial obligations to the bank due to becoming disabled, this function is performed for him by the organization into whose account the contributions were received.

SOGAZ

Tariffs for mortgage insurance in SOGAZ are considered one of the cheapest.

Structural insurance costs 0.1% if the borrower voluntarily insures furniture, decoration, plumbing or civil liability for a minimum amount of RUB 1,150.

- 0.08% – ownership;

- 0.17% – life and health;

- 1.17% – (insurance) against non-payment of the loan.

If the borrower decides to repay the loan early and, accordingly, cancel the insurance ahead of schedule, he has the right to a partial refund of the insurance premium.

The company will not consider other reasons for refunding the insurance premium.

How to save on mortgage insurance

There are different options for legally reducing the cost of policies issued for home loans.

Refuse additional insurance

By law, borrowers do not have the right to refuse mortgage insurance. All other transactions are concluded on a voluntary basis.

To save money, you need to refuse additional insurance.

If a citizen refuses to take out a policy on his own life, the banking institution, according to current legislation, does not have the right to refuse him a loan, but may raise the interest rate. Therefore, in such a situation, it is recommended to first calculate which option is more profitable.

Do not take out insurance directly from a financial institution

It is beneficial for any lender to have clients take out mortgage policies with them. Such insurance turns out to be 2-3 times more expensive than in third-party organizations.

Make your wife the main borrower

When applying for a family mortgage, it is recommended that the spouse submit the application, and the husband becomes a co-borrower. All insurance companies provide cheaper policies to women.

When applying for a family mortgage, make your wife the primary borrower.

Participate in special promotions

Insurance organizations often offer bonus programs to attract customers. If you constantly monitor offers on the market, you can take out a policy with a discount from 5% to 25%.

Buy housing in a new building

Title insurance is recommended when purchasing housing on the secondary market, because Only the buyer can claim real estate in a new building.

Providing discounts to regular customers

If you have a CASCO or MTPL policy, it is recommended to take out mortgage insurance from the same companies. Most organizations provide discounts to regular customers when they contact them again.

Alpha insurance

The company issues comprehensive mortgage insurance for the same term as the mortgage loan. Along with a decrease in the amount of the repaid loan, there will be an annual decrease in insurance payments.

Early termination of the contract is carried out on conditions similar to those in force at the Insurance House.

The transfer of a borrower from another company to Alfa Insurance gives him the right to draw up an agreement for a period of one year on favorable terms according to a simplified scheme.

The company cooperates with various banks on different programs. Note to clients. Currently the company does not have accreditation allowing it to insure life and (health) clients of Sberbank. Health insurance is available at a rate of 0.18%.

conclusions

Obviously, insurance companies offer a large number of options, conditions and tariffs, from which you can choose the option that suits each borrower. You must understand that insurance is a “safety cushion” that will always work at the right time. For example, having mortgage insurance is protection against the possible appearance of third parties who try to take possession of the property, a house or apartment taken on a mortgage.

In a special mortgage insurance calculator from Prosto.Insure, you can independently familiarize yourself with the current rates for all types of mortgage insurance.

Don’t know which option to choose or where mortgage insurance is cheaper and better? Call us and we will calculate a favorable tariff for you for free!

What will lead to higher prices for life insurance?

There is a whole list of situations when the policy is more expensive. However, they do not allow you to know the exact price. Use the mortgage insurance calculator on the website of the selected company to find out where the mortgage insurance is cheaper. The following are the points due to which insurers increase their coefficients:

- gender – men will have to pay more money for the policy;

- age – the older the applicant, the higher the cost;

- health – chronic diseases contribute to higher tariffs;

- presence of bad habits - for smokers and alcohol drinkers the fee will be higher;

- weight – clients with extra pounds are insured at higher rates;

- profession - there is a high risk of injury, which means that the tariff will also be increased.

The size of the loan will also increase the cost, since the borrower pays a percentage of the loan. By identifying where the cheapest mortgage insurance is, you can lower rates further by eliminating factors that increase your rate. Of course, you will only be able to get rid of some items on the list (excess weight, bad habits, poor health), but this will also help reduce the total amount. There are other ways to reduce the cost of your policy.

Recommended article: Rosselkhozbank mortgage insurance - list of companies, cost, how to refuse and return insurance

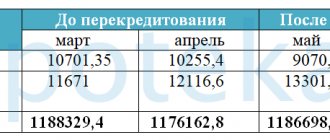

comparison table

| Constructive (real estate) | Life and health | Title | |

| Sberbank | 0,25 | 1 | — |

| RESO | 0,10-0,18 | 1 | 0,25 |

| VSK Insurance House | 0,43 | 0,55 | — |

| VTB insurance | 0,33 | 0,33 | 0,33 |

| Rosgosstrakh | 0,17-0,20 | 0,28-0,60 | 0,15 |

| Alliance | 0,16 | 0,87 | 0,18 |

| Ingosstrakh | from 0.1 | from 0.2 | from 0.2 |

| SOGAZ | 0,08 | 0,17 | — |

| Alpha insurance | 0,15 | 0,18 | 0,15 |

Find out where mortgage insurance is cheaper

Rating of companies by prices

The order of the list is from more favorable tariffs to less affordable ones. It was created on the basis of data provided by insurers.

- The company has the best offer. If you are looking for the cheapest mortgage insurance, you need to contact this organization. Here, for a property policy they will take no more than 0.10% of the loan amount, for life and health they will ask for 0.17%, and the title type is available for 0.08% of the loan.

- Next comes . Structural, health, and title can be insured for 0.10, 0.26, and 0.25% respectively. Also consider reviews where mortgage insurance is cheaper. They are mostly positive. Promotions are regularly held here with discounts of up to 40% when purchasing a policy.

- Ingosstrakh get a comprehensive policy or your own document for each type. Tariffs start at 0.14% of the loan size.

- Alfa Insurance offers different programs for different banks (). You can get a policy for real estate only for 0.15% of the total amount.

- Where is it cheaper to get mortgage insurance if the main borrower is a woman? The best option is . To protect yourself from the consequences of illness or sudden death, the policy is issued for 0.28%, and for property - from 0.17%.

- They offer registration for an amount starting from 0.25%. There is a limit on the cost of housing (15,000,000 rubles). Health insurance will be more expensive – from 1%.

- Next on the list is 0.33% across all types of policies. You will be entered into one comprehensive contract for a year.

- The company offers the highest rates. The minimum you will have to pay is 0.43% for a home policy. Health is insured here for 0.55%.

Recommended article: Life Insurance for Mortgage

When determining where property insurance for a mortgage is cheaper, you should take into account only this indicator (the percentage for the property policy). It was on this basis that the rating was compiled. If you require a comprehensive agreement, the positions on the list will change slightly.

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Publication dateOctober 25, 2019September 30, 2020