Regulatory framework

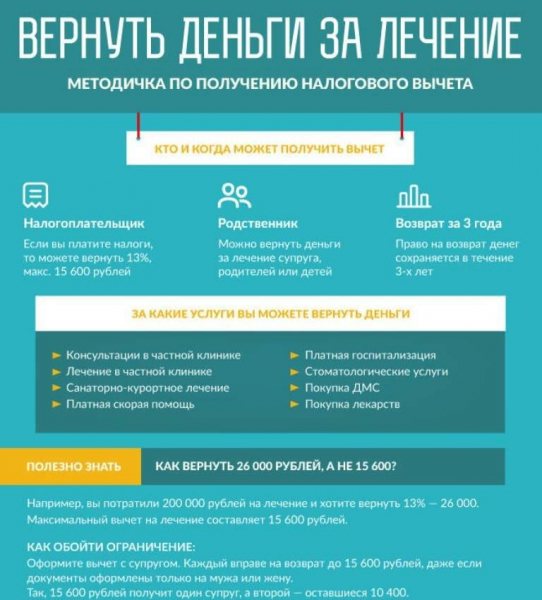

The Government of the Russian Federation has established a list of those medical services and medicines that are subject to this preference. Even unemployed elderly people can get it. The amount of income tax is returned, namely 13% personal income tax .

The following regulations answer the question of whether a pensioner can receive a tax deduction for healing

- Decree of the Government of the Russian Federation No.201 of March 19, 2011;

- Article 219 of the Tax Code of the Russian Federation.

These documents indicate that if a retired citizen does not receive any other funds either from the state or from private enterprises, then he can count on a refund of taxes that were spent on medicine.

Obviously, you can receive it every year without any restrictions. Also, their children have the right to receive a tax deduction for the treatment of parents of pensioners, which is regulated by Art. 219 of the Tax Code of the Russian Federation.

What medical expenses are reimbursed by the state?

Citizens who have retired and have undergone a cycle of treatment ( a process the purpose of which is to alleviate, relieve or eliminate the symptoms and manifestations of a disease or injury, pathological condition or other disability,

), may not return a percentage of personal income tax for all services. There is a special list of approved goods and services, which is enshrined in Government Resolution No.201.

The list of what is subject to tax deduction is as follows:

- funds spent for the operation;

- compensation for emergency medical care;

- health programs of sanatorium resorts;

- health insurance;

- healing in a hospital;

- full course of treatment in hospital.

Also, this benefit for non-working elderly people also applies to a number of medications : antiseptics, vitamins, hormones, painkillers, medications for the nervous system, preventive medications, medications for the circulatory system, etc.

People who continue to work can also count on compensation from the government. In the field of healthcare, payment of sick leaves to working pensioners is carried out by the Social Insurance Fund without attracting funds from the employer. Medical examinations for older people in Moscow in public medical institutions are absolutely free.

Reimbursement for surgery expenses

Employed people and working pensioners can return part of the money.

Basic requirements for receiving compensation

Based on Decree No. 201, in 2021, compensation applies to surgery performed in a city clinic, inpatient department, sanatorium or by emergency personnel. Paragraph 5 pp. 3 p. 1 art. 219 of the Tax Code notes the need for medical organizations to have a license issued by the Russian government.

That is, a deduction is possible only if you contact domestic institutions that provide standard and expensive services. The latter include plastic surgery of the body and face, prosthetics, IVF, organ transplantation, treatment of cancer and diabetes. A citizen can pay for the operation for his wife, parents, children and himself.

Reimbursement period for surgery costs

The money will arrive in your bank account in 2-4 weeks, but only if the tax authorities give a positive response. Documents are verified for about 3 months.

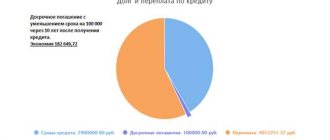

The amount of social tax deduction for the operation

The costs for which a refund is issued are limited to 120 thousand rubles. That is, a maximum of 15.6 thousand rubles can be credited to the taxpayer’s bank account. When receiving expensive services, you can return 13% of all money, but only within the limits of the transferred income tax.

Advice! The right to deduct for expensive medical care is granted based on the tax transaction code.

Documents required for social tax deduction

How can I get government compensation for an expensive paid operation? Collect and submit documents to the Federal Tax Service. Depending on whether a person is employed, disabled or retired, the list of papers differs. However, there are also mandatory documents:

- an agreement on the provision of medical services between a person and an institution;

- act of completion of work;

- certificate 2-NDFL;

- checks and receipts confirming the fact of payment;

- certificate of payment from the medical organization;

- declaration 3-NDFL indicating expenses;

- documents confirming relationship.

Advice! When purchasing medications, provide payment receipts and the original prescription.

Methods for submitting documents to receive a deduction

Options for submitting documentation, their convenience and disadvantages are discussed in the table.

| Feeding method | Benefits | Minuses |

| Federal Tax Service website | Quick login through your personal account | Temporary login and password are obtained only in person at the inspection |

| Through the employer | Can be submitted at any time during the current year | Tax deduction is calculated for the previous year |

| State Services Portal | Quick registration | Providing as much information as possible |

| Personally at the Federal Tax Service | View documents upon transfer, quick information about inaccuracies | Reception only on weekdays |

| Post office | Convenient if the branch is near your home | If there is an error, the papers will reach the recipient in 2-3 months |

Receipt of deduction by husband for wife

Based on Art. 34 of the Family Code, pensions, material benefits, including compensation and non-permanent payments belong to the common property of the spouses. For this reason, the husband has the right to receive a deduction.

Receiving a deduction for the operation together with other social deductions

If there are cumulative situations in one calendar year, the amount of costs cannot exceed 120 thousand rubles.

How many times can a taxpayer take advantage of the social tax deduction?

Russians have the right to receive an annual deduction. The state sets a certain limit, but this rule does not apply to deductions for expensive procedures.

Return deadlines

Verification of documents by the Federal Tax Service takes 3 months. You can receive compensation within a maximum of 4 weeks. Thus, the tax deduction will be credited to your account after 4 months. If there are errors in the documentation, the process is delayed for the same amount of time.

Read more: The period calculated in calendar days includes

Reasons for refusal to receive a tax deduction

Compensation is not provided in the following cases:

- not all documents have been submitted;

- errors in the 3-NDFL declaration;

- income tax was not transferred for the reporting period;

- the funds limit has been reached;

- the documentation was not transferred to the place of registration.

Advice! When submitting papers to the Federal Tax Service, you may be asked for originals; their absence may be one of the reasons for refusal.

In 2021, a tax deduction for treatment or surgery performed is provided only to officially employed persons. Pensioners, labor veterans or disabled people can receive a number of services free of charge. Women on maternity leave and the unemployed are not entitled to a deduction.

We describe typical ways to resolve legal issues, but each case is unique and requires individual legal assistance.

To quickly resolve your problem, we recommend contacting qualified lawyers on our website.

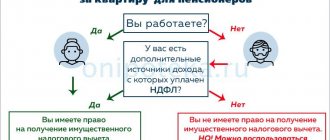

How can a pensioner get a tax deduction?

To get a refund for treatment or medications, you need to start the preference design process. The first step will be collecting the required documents.

Pensioner ( regular cash payments to persons who have reached retirement age, are disabled, have lost a breadwinner, or due to long-term professional activity

) must provide:

- identification document;

- income certificate in form 2-NDFL;

- checks, certificates and other documents that confirm the provision of paid medical services ( the result of at least one action, necessarily carried out during the interaction between the supplier and the consumer, and, as a rule, intangible

); - a license to provide medical care from an organization or indicate its details in the application;

- a contract for the provision and receipt of services or a prescription from a doctor for the purchase of pharmaceuticals;

- tax return in form 3-NDFL.

If children or a spouse receive this preference for a pensioner, then supporting documents will be needed. This could be a marriage certificate, a birth certificate, or a page in a passport where children are registered.

Further, all these documents ( this is information recorded on a tangible medium in the form of text, sound recording or image with details that allow it to be identified

) can be submitted to the tax office or to the functional center

at your place of residence . An application with all additional data is filled out directly on site. After all the required actions have been implemented, a thorough check of the documentation by authorized bodies begins, after which either a positive or negative decision is made. The verification process takes about 90 days .

Return Policy

Refunds of personal income tax for older people on medicines and medical services are made only if several important conditions are met. They are required to be observed by both the pensioner and the medical organization.

Reimbursement of costs is subject to the following requirements:

- the medical organization that treated the patient is licensed to provide assistance;

- services or medicines are included in the list of acceptable ones provided by Government Decree No. 201;

- treatment is carried out directly on the territory of the Russian Federation;

- the pensioner purchased the medicine according to a doctor’s prescription, and not on his own initiative;

- The pensioner must pay for the service or medicine without the help of others, and then confirm the transaction.

If all these aspects are not violated, then a citizen who has retired has every right to receive compensation for healing.

Refund amount

The law strictly establishes the acceptable financial limits for the return of personal income tax for the provision of medical services and the purchase of pharmaceuticals.

If the treatment costs more than the amounts prescribed by law, then this part will not be returned back.

Also in Art. 219 of the Tax Code of the Russian Federation indicates the subsequent cost of treatment, which the state can reimburse for elderly people: 13% of expensive treatment and 13% of the largest amount, which is 120,000, will no longer be reimbursed.

For example, a person wants to receive compensation for a paid operation. If the healing cost 300,000 rubles, then 13% will be counted only from 120,000 rubles, because it is fixed in the law.

Can a personal income tax refund be refused?

There are cases in which tax authorities or multifunctional centers have the right to refuse non-working pensioners to receive foreign currency.

The most common reasons for refusal are the following:

- an incorrectly completed application, with errors and lack of necessary data;

- unreliability of the information provided;

- debt to pay income tax during the period when the subject was still working;

- the treatment was not provided at the expense of the pensioner;

- services or medications are not included in the list of acceptable and authorized by the Government of the Russian Federation;

- lack of a license from a medical organization or a prescription from a doctor.

Having eliminated all errors, a citizen who has retired has the right to re-apply for funds from the state for paid medical services provided.

Important! The papers will again be sent for consideration to higher authorities, and after a decision is made, the funds will be paid within 30 calendar days.

Thus, unemployed elderly people can receive compensation for paid medical care or purchased medications. It amounts to 13% of personal income tax and is due to all citizens who have retired, provided that all criteria are met.

Tax authorities have the right to refuse a pensioner to receive compensation if they consider the submitted documents to be invalid or incorrectly executed. The authorities have 3 calendar months to make a decision, and 30 days to pay.

How to get your money back for ophthalmological treatment

As a person ages, vision problems appear. It is not always possible to correct an illness with glasses or lenses, so a pensioner often needs surgery. Ophthalmological procedures are carried out in public and private medical institutions free of charge (when placed on a waiting list) or for money (at any time).

Read more: When can you get a tax refund on the purchase of an apartment?

By agreeing to paid medical services, an elderly person saves time, but is forced to find funds for surgery. It is legally determined that pensioners are entitled to compensation for paid surgical intervention. Partial or full reimbursement of costs occurs through:

- providing a tax deduction (exemption from income tax or its refund);

- contacting social security authorities with an application for one-time financial assistance.

Working pensioner

A tax deduction for medicines or surgery is only available to pensioners who continue to work or were working in the year when the eye surgery was performed. The maximum period for receiving compensation is 3 years from the date of surgery. For example, a pensioner was officially employed in 2021, and this year he had eye surgery. He will be able to receive the deduction during 2021, 2021 or 2021.

Officially employed pensioners pay personal income tax, the amount of which is 13% of earnings. There is no tax levied on pensions and other social benefits through the Pension Fund or social security. The deduction is due to all working individuals on the following grounds:

- for studying;

- after purchasing a home;

- on mortgage;

- for life insurance;

- for treatment.

For a non-working pensioner

A tax deduction for eye surgery is not provided to pensioners who have completely stopped official work. You can return personal income tax through your son, daughter or working spouse, but grandchildren cannot apply for compensation when paying for the operation of their grandparents.

According to regional legislation, full or partial monetary compensation for eye surgery can be paid to pensioners through social security authorities. To do this, you need to contact the territorial office and fill out a corresponding application. After reviewing the documents provided, a decision will be made. For example, in Moscow financial support is provided on the following grounds:

- Payment for expensive medical services for vital reasons, if they are not provided free of charge.

- Purchasing expensive drugs, medical supplies or materials. Disabled people can use this opportunity if they have not formalized a waiver of social services, and the medications are not included in the List for Medical Use.