What is a property deduction

New housing requires a considerable amount of money, which you can either earn or take out a mortgage. In the article “Mortgage to buy out a share in an apartment,” we have already talked in detail about this procedure. In both cases, when purchasing an apartment, you will pay with funds from which income tax has already been paid.

According to the state, this injustice must be eliminated, therefore, since January 2001, all home buyers have the opportunity to return 13% of a certain amount spent on the purchased property. Namely, in 2021 from 2,000,000 rubles.

What does it mean? Let's assume that you spent 3,450,000 rubles on the purchase. A tax refund can only be obtained from 2 million - 13% of this amount is 260 thousand. They will be transferred to your bank account.

How is the deduction calculated for an apartment registered as shared ownership?

Since 2014, a law has come into force according to which, when purchasing housing in shared ownership, all share owners have the right to receive an income tax refund, but not more than 260,000 rubles. If the apartment was purchased before December 31, 2013 (inclusive), registered as shared ownership, but you have not yet received a deduction for it, then, regardless of the number of co-owners, a refund of 13% will be made from the cost of the entire apartment.

For clarity, let's look at the following situations:

Example 1. Citizens Ivan and Mikhail Samokhin, who are siblings, decided to get married and buy a two-room apartment. The purchase and sale agreement was concluded in 2015. After registration of shared ownership, each of the brothers received ½ share. The cost of the entire apartment is 6 million, respectively, the price of each share is 3 million. In 2021, the brothers decided to receive the tax deduction due to them by law, and as a result, the state paid both Ivan and Mikhail 260 thousand rubles. If three brothers purchased an apartment in shared ownership, then the third owner would receive 260 thousand.

Example 2. The same situation, but the Samokhins purchased their “kopeck piece” for 6 million rubles not in 2015, but in 2012, and only in 2021 did they submit documents to receive a deduction. In this case, between the two of them, the state is entitled to 260 thousand rubles (13% of 2,000,000), that is, 130,000 each. If there were three brothers, each would receive even less.

Who can take advantage of the deduction

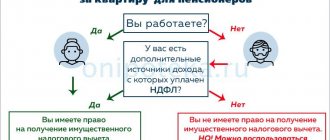

Only the following citizens can apply for a personal income tax refund:

- Income tax payers. Those who do not work, do not pay personal income tax to the treasury, cannot have tax benefits.

- Tax residents of the Russian Federation. Art. 207 of the Tax Code of the Russian Federation covers the circle of persons who can receive a tax deduction. Resident status gives a stay on the territory of the state of 183 days within 12 months . In addition, the recipient of the deduction must be a personal income tax payer in accordance with Part 1 of Art. 224 Tax Code of the Russian Federation. By law, income tax is withheld from non-residents in the amount of 30% of earnings, however, after acquiring the status of a tax resident, the rate is reduced to 13% , and the deduction is applied to the reduced tax.

- Owners of purchased housing. If the shares in the new apartment are registered in the name of third parties, the buyer who made the payment will not be able to apply the deduction to his income. He will have to provide a document confirming the ownership of the housing (extract from the Unified State Register of Real Estate).

This is important to know: Agreement on the procedure for using property of common shared ownership: sample

Tax deduction when purchasing an apartment in shared ownership

If spouses purchase an apartment, one or more purchase and sale agreements are concluded.

The agreement must indicate the buyers, the share of each of them in the common property, but the cost can only be indicated for the entire object - without dividing the expenses of the husband and wife. Then it is considered that the expenses of each of the shareholders are proportional to their shares.

The amount of deduction will be limited to the amount of expenses of each co-shareholder.

If the receipt indicates one payer

A common situation is when one co-owner can document expenses (for example, a husband), paying the entire amount for the apartment, but the other co-owners cannot, although they also took part in the payment. The solution is to issue a power of attorney to the main payer.

According to the tax service (Letter of the Federal Tax Service dated May 17, 2012 No. ED-4-3/8135, Article 26 of the Tax Code of the Russian Federation), the payer can not only personally take part in transactions regulated by the legislation on taxes and fees, but also through his representative To do this, you need to issue a power of attorney.

It should be noted that a “trusted person” cannot be a tax official, a customs official, a representative of the internal affairs department, a judge, a prosecutor or a person engaged in investigative activities (Article 29 of the Tax Code of the Russian Federation).

Tax deduction and movable property, cost of repairs

When indicating the price of real estate in the purchase and sale agreement, you should specify whether the price of furniture, household appliances and other things transferred into ownership along with the apartment is included in it.

Trying to maximize benefits, owners add repair costs to the cost of housing. This is legal only if the sales documents (transfer deed) indicate that the apartment is being sold without renovation. You can compensate personal income tax from the amount spent on finishing the apartment after receiving a certificate of registration of ownership (Letter of the Ministry of the Russian Federation for Taxes and Duties dated December 16, 2004 No. 27-08 / [email protected] ).

Maximum amount of personal income tax “return” for the year

If a citizen has the right to property tax, its maximum amount for the year is equal to the amount of all income tax deductions made, but not more than 260 thousand rubles. (RUR 2 million X 13%). If the amount of annual contributions is not enough, the remainder of the deduction is transferred to the next calendar year.

What is needed in order to receive a property deduction for shared ownership?

The possibility of obtaining a deduction opens up if a number of conditions are met, which may vary depending on the year the property was acquired as shared ownership.

| Question about deduction | Purchase until December 31, 2013 inclusive | Purchase from January 1, 2014 |

| Who is entitled to it? | All residents of the Russian Federation with official employment or individual entrepreneurs working under the general taxation system. | |

| How often can I receive it? | Once in a lifetime, in relation to one object, regardless of its value. | One or more times until the total deduction amount reaches 260 thousand rubles, for example, for 2 apartments worth 1 million each. |

| Which citizens cannot claim a tax refund? | All those who bought a share from close relatives or guardians; Who received housing as a gift from an employer or the state; Those who have not been officially employed for many years and do not pay income tax. | |

| What is the maximum payout amount? | 260,000 rubles. | |

| What is the maximum payment amount for a mortgage? | Doesn't change | 390,000 rubles. |

| On what expenses is 13% returned? | For the purchase of housing; Overpayment on mortgage; For finishing the premises. | |

| On what basis is it possible to receive an income tax refund? | Official salary; Funds received from renting out property; Tax paid to the budget after the sale of housing; Payments under the contract. | |

| What is not grounds for receiving a refund? | Social payments, benefits, labor pensions and dividends. | |

| On what basis are returns carried out? | You can receive payments several times until the total refund amount reaches 13% of the cost of housing. After the first application for a tax deduction, funds that were received on your behalf into the budget of the Russian Federation during the previous calendar year or during the last three years following the year of purchase of real estate will be transferred to your personal bank account. If one payment does not cover the amount of the required deduction, the balance will be paid to you in the next calendar year. | |

| What is the procedure for issuing a tax deduction for shared ownership? | Paid from the entire property (maximum 260,000), regardless of the number of shared owners. | Paid to each share owner in the amount of 13% of the value of the share, but not more than 260,000 rubles. |

| What is the maximum refund amount if housing is purchased through a mortgage lending program? | Doesn't change. | Calculated from an amount of up to 3 million rubles, applicable to the entire object. |

| Where and when to contact? | To the Federal Tax Service at the location of the property, at the beginning of the year following the year of purchase. | To the Federal Tax Service at the place of residence, at the beginning of the year following the year of purchase or (from 2015) to the employer. |

What is shared ownership

According to the provisions of the Civil Code of the Russian Federation, common property is divided into two categories, differing in the essence of ownership:

- Shared – certain shares are allocated in the ownership of property.

- Joint, in which the shares are not established in advance.

When a residential area comes into the possession of several persons and the shares are allocated in advance, shared ownership occurs. You can dispose of a real estate property only with the consent of the remaining owners, regardless of the size of the share. When all the owners live in the same living space, it is impossible to divide it among all in proportion to their shares. The co-owners must resolve this issue among themselves and divide the apartment, determining the procedure for use. If the problem cannot be resolved peacefully, they turn to the judiciary.

The Civil Code of the Russian Federation, in the first part of Chapter 16, covers issues of regulation of common property rights. When we are talking about shares, it is worth focusing on the provisions of a number of articles:

- Article 245 When the shares are not agreed upon in advance, they are considered equal. If money is invested in improving the condition of the living space, the size of the share increases in proportion to the financial investment.

- 246. Any of the owners can sell, donate or bequeath their share.

- 247. Each co-owner has the right to receive his share for use. If this is not actually feasible, compensation can be claimed.

- 248. Income received as a result of the exploitation of shared property is distributed among the owners by agreement. If it is not there, it is proportional to the shares.

Shared property is recognized when each owner is allocated a part of it. The apartment will be equally shared in the following cases:

- This is regulated by current legislation.

- The co-owners made this decision by mutual consent.

- Shares cannot be determined due to the impossibility of establishing the size of the share for each co-owner.

This is important to know: Voluntary abandonment of a land plot in shared ownership

The Family Code of the Russian Federation (Article 39) regulates equal shares in property acquired jointly by spouses, provided that a marriage contract has not been concluded.

When married persons purchase residential space, it is considered joint property. The apartment is registered in the name of both spouses or one of them.

When each spouse contributes money for their part, this will not cause misunderstandings and questions from government authorities and the tax service in the event that citizens apply for a property tax deduction when purchasing an apartment in shared ownership.

Nuances

When determining the amount of the deduction, all expenses spent on acquiring the share are summed up. Situations often arise in which real costs are borne in equal shares by all owners, but the documents indicate that only one paid. In this case, the remaining shared owners can confirm their expenses with handwritten powers of attorney on their behalf to the person making payments to the home seller.

If the property was purchased after December 31, 2013 and its cost is less than 2 million, the deduction limit after the return of 13% of the cost of purchasing the property will not be fully exhausted. This means that the lost portion can be transferred to the next purchase of real estate.

If you are purchasing an apartment with furniture, be sure to check whether there is a mention of the cost of interior items in the purchase and sale agreement. If not, draw up and sign an additional agreement with the seller, which will contain information about the furniture sold and its price. The tax deduction is provided only for housing, so to avoid confusion, furniture and other items included with square meters must be purchased separately.

If the apartment was purchased without finishing or not fully completed, the costs of bringing it into a condition suitable for living, such as facing and plastering walls, laying floors, etc., must be indicated when filing a deduction.

Tax deduction for an apartment purchased with a mortgage

Today, not everyone can afford to purchase a home using personal savings, which is why most citizens apply for mortgage loans. And these are additional expenses. Since 2014, mortgage interest is also included in the list of expenses for which a tax deduction is due.

You may also need to provide the bank with collateral in the form of an existing share of the apartment.

Shared owners-co-borrowers have the opportunity to divide the deduction for mortgage interest equally or in any other proportion, in this case there is no connection to square meters. In addition, every year the proportion can be redistributed; for this, the parties must write a corresponding application.

Tax deduction for the share of a minor

If, in addition to the adult owners, there are minors in the apartment, then the issue is resolved in the following way: according to the tax inspectorate, children do not have the funds to purchase housing, just as they do not have the rights to carry out legal actions with real estate, but, since housing was The parents' savings have been spent, the latter have the right to a refund of 13% of the expenses incurred to purchase the apartment (Resolution of the Constitutional Court of the Russian Federation dated March 13, 2008 No. 5-P).

If one of the parents bought real estate for a child, but this person was not included in the list of co-owners, he has the right to receive a deduction for the child. At the same time, the minor himself retains a similar right to acquire other real estate. You can use it after you reach adulthood. Until 2011, persons who bought housing and registered it for a child were not entitled to a tax deduction.

Features of calculating deductions when purchasing an apartment in shared ownership of spouses

A document confirming the marriage relationship - a certificate issued by the registry office. After this, all property acquired by the husband and wife is their joint property. A different procedure may be reflected in the marriage agreement or purchase and sale agreement.

When purchasing an apartment, spouses have the right to determine each person’s share and receive benefits, the amount of which depends on the time of purchase.

The apartment was purchased by the spouses before 2014.

The tax deduction is equal to 2 million rubles. for both spouses

Distributed in proportion to the size of the husband and wife’s shares in the property

Can only be used once in a lifetime

The apartment was purchased after 01/01/2014.

The deduction amount will be 2 million rubles. for each spouse

Distributed either in proportion to the available shares, or by agreement of the parties

Can be applied when purchasing real estate until the maximum limit of RUB 2 million is exhausted.

In the above example, it is assumed that both spouses work and are entitled to the deduction. But how will the calculation change if the spouse is a housewife and does not pay personal income tax?

In this case, it is necessary to determine the deduction regardless of the size of the shares, because since 2014 this has been possible. The spouse has the right to claim a deduction of 2 million rubles. (the maximum possible), and the wife will be able to take advantage of a deduction in the amount of the remaining amount after she begins paying income tax from her salary.

If the apartment has a mortgage

The rapid growth in the number of apartments purchased with a mortgage has led to changes in legislation. Now, tax deductions “encourage” not only citizens who bought real estate with their own savings, but also citizens who borrow funds.

When applying for a loan from a bank, spouses need to enter into a mortgage agreement. Only with it is it possible to obtain a property NV.

Since the costs when buying a mortgaged apartment consist of the loan body (the cost of the apartment) and interest on it, from 01/01/2014 2 deductions are applied :

- The first one is equal to 2 million rubles. , is applied directly to the price of the home and can be used several times before it is completely spent.

- The second is equal to 3 million rubles. , applies to mortgage interest. Used in relation to various real estate objects.

Such rules have been in force since 2014 . , but before it was different, more profitable for buyers of expensive housing. The deduction for mortgage interest was not limited, the upper limit was unlimited, the amount was 2 million rubles. was deducted once for each of the shareholders, and was distributed in proportion to the share of each of the spouses. This rule is still in effect today. This means that if the apartment was purchased before 01/01/2014 , the spouses can reduce the personal income tax base by 2 million rubles. (one-time) and compensate the income tax spent on interest payments. And if the acquisition is made later, new rules apply.

Example. Terentyeva Galina and her husband Sergei bought an apartment with a mortgage for 8 million rubles . in 2021, and registered it as shared ownership of ½ each. Interest on the loan in the current period amounted to 880 thousand rubles. at a rate of 11% per annum. As owners of shared property, spouses have the right to reduce personal income tax by tax deduction amounts. According to the documents provided to the tax service, Galina and Sergey have the right to a refund in the amount of:

- 2 million rubles X 13% = 260 thousand rubles. (one-time payment from the cost of the apartment);

- 880 thousand rubles X 13% = 114.4 thousand rubles. (repeatedly until the accrued interest amount reaches 3 million rubles).

Galina's salary is 80 thousand rubles. per month. In 12 months she received 960 thousand rubles. and paid personal income tax in the amount of 124.8 thousand rubles. Since the amount of tax she paid is lower than the amount of compensation ( 374.4 thousand rubles ), Galina will be paid the balance next year.

If the spouses bought another apartment before 2014 , and they used a deduction in the amount of 2 million rubles. (or less), they would not be able to reuse it, even if it was not fully used. And it’s quite possible to take advantage of the discount when paying mortgage interest.

This is important to know: The size of the minimum ownership share in apartments

If the share belongs to a minor

Children under 18 years of age have the right to property, but cannot enter into real estate transactions without the presence of a parent or guardian. Families with children voluntarily or involuntarily (using maternity capital funds) allocate a share in the apartment to children, who also have the right to property income. Although children are not entitled to use it themselves, the amount can be taken into account by one of the parents.

The question of the possibility of using the “children’s” property tax deduction has remained controversial for a long time. It was believed that children do not receive income, and therefore are not entitled to tax benefits. The changes were introduced by Resolution of the Constitutional Court of the Russian Federation No. 5-P dated March 13, 2008. According to the document, since the child is in the care of the parents, they, taking care of the welfare of the minor, bear expenses, and therefore can receive a deduction. This rule applies to cases where neither spouse has ownership rights to a share in the apartment.

The child’s parents can independently determine in what proportions they will use the child’s deduction. It is desirable that in the end the larger amount goes to the parent whose income is more significant. Then the refund will happen faster.

A logical question: will a child, upon reaching his 18th birthday , be able to use a property tax deduction when purchasing his own home in the future? The answer is yes, and in full.

Required documents

To return 13% income tax for the purchase of an apartment, you must provide the tax office with:

- declaration (form 3-NDFL);

- applicant's passport;

- certificates of all income during the year (form 2-NDFL);

- application for tax refund with details of the personal account to which the income tax refund will be made;

- a copy of the document confirming the purchase of housing (purchase and sale agreement or contract for participation in shared construction);

- copies of payments confirming the fact of transfer of funds to the seller (checks, receipts);

- a copy of the title document for the share (certificate of state registration or extract from the Unified State Register of Real Estate);

- a copy of the transfer and acceptance certificate (only for shared construction agreements);

- statement on distribution of shares;

- a copy of the marriage certificate.

If the property was purchased with a mortgage, in order to receive a refund on interest, you must additionally provide the following to the Federal Tax Service:

- copy of the loan agreement

- a certificate of the amount of interest withheld for the reporting period.

If one of the owners is a child, attach a copy of his birth certificate to the papers.

Note! All copies of documents submitted to the tax office must be notarized.