Many Russian citizens who took out a housing loan have already received a tax deduction for mortgage life insurance. For those who do not yet know about this opportunity, we will tell you about it right now. What kind of deduction is this? To whom and when can it be provided? How much you can save on this - all the details are in this review.

Tax deduction. How it works

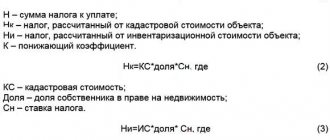

Let's start with the basics. There are taxes that are calculated as a certain percentage of the tax base. Such a base for different taxes can be: the amount of income, sales volume and other indicators.

For ordinary citizens (individuals), the main tax is the well-known personal income tax (). For many years, its size has been 13% of the tax base - the amount of income of an individual (). But the Russian Tax Code (TC) provides for a reduction in tax by the amount of deductions. The tax is calculated as 13% of a person’s income minus allowable deductions. The Tax Code defines standard, social and other deductions.

For example, social deductions are defined, and there is also a tax deduction for mortgage life insurance. This kind of compensation (reimbursement) for the borrower’s expenses is intended to partially alleviate his financial burden and return the tax on life insurance on the mortgage. He has to pay a huge amount of money, starting with the costs of applying for a loan (independent appraisal, realtor fees, mandatory insurance, and others), and then monthly payments for many years.

It is beneficial for the state and the banking institution for the mortgage borrower to insure his life, but this type of insurance is not required in a mortgage (). To encourage the borrower to conclude an insurance contract for voluntary life insurance, since the beginning of 2015, a tax deduction has been established for those who have concluded such an agreement with the insurer.

What does this give to the borrower? He gets back some of his money spent on insurance premiums. In addition, he insures his life, which can provide financial support in case of unfavorable developments.

To whom will part of the insurance costs be returned?

Let’s take a closer look at who and under what conditions the tax authorities will allow you to take advantage of the deduction for mortgage life insurance.

First, about the features of the contract with the insurer:

- the contract is concluded only with an insurance company licensed for this type of service;

- the duration of the contract is from five years;

- Only contributions paid since January 2015 (the moment the right to this reimbursement arises) will be taken into account;

- It is the client’s life that is subject to insurance (reaching a certain age);

- fees are paid only from the client’s personal funds;

- the insurance contract specifies the beneficiary (recipient of insurance compensation upon the occurrence of an insured event). To receive a tax deduction for mortgage life insurance, it is the borrower who must be recorded as the beneficiary (or his immediate relatives, including the previous and subsequent generations).

Introductory information

The income of an individual, subject to personal income tax at a rate of 13 percent (except for dividends), can be reduced by social tax deductions (clause 3 of Article 210 and Article 219 of the Tax Code of the Russian Federation).

Social tax deductions, we recall, are provided for several types of expenses (Article 219 of the Tax Code of the Russian Federation):

- for charitable purposes and donations;

- for education;

- for medical services and medicines;

- to pay additional insurance contributions for a funded pension;

- for non-state pension provision and voluntary pension insurance.

From January 1, 2015, taxpayers have the right to receive a deduction for a new type of expense - voluntary life insurance (clause 4, clause 1, article 219 of the Tax Code of the Russian Federation). Let's look at this deduction in detail.

About the amount of deduction

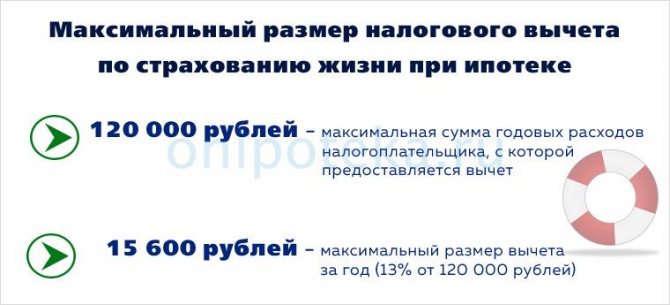

Let's look at some of the restrictions established by the code. Although it is calculated at 13 percent of the insurance premiums actually paid, the entire amount does not always go to the borrower.

First limitation

. There is a maximum amount of contributions paid, from which you can take 13%; according to the law, this is 120 thousand rubles (). If the annual amount of insurance premiums turns out to be more than the established limit, this is indicated in the application, and the amount of the deduction is calculated only from 120,000 rubles. 13% of this limit will be 15,600 rubles.

Second limitation

. The taxpayer can receive this deduction amount only if personal income tax was paid (withheld) in the same amount or higher.

Let's give two examples.

Example one, the year 2021 is the tax period.

The borrower Ivanov entered into an insurance contract for 6 years. For the entire year, he paid 110,000 rubles in insurance premiums. His salary in the same year amounted to 400,000 rubles, from which he paid income tax of 50,000 rubles. Ivanov’s personal income tax refund for mortgage life insurance (deduction) will be 110,000 x 13% = 14,300 rubles.

Ivanov will receive this amount, since the amount of the annual deduction is 14,300 rubles. does not exceed the tax paid for the same period of 50,000 rubles.

Example two.

The borrower Sidorov, under an 8-year contract, paid 200,000 rubles in insurance premiums for the current year. His salary for this year amounted to 755,000 rubles, and income tax of 70,000 rubles was withheld. Tax refund for life insurance with a mortgage of 13% of 200,000 is 26,000 rubles. Taking into account the restrictions on the amount of paid contributions for calculation, 13% will be taken only from 120,000 rubles. Therefore, only 15,600 rubles will be deducted.

Important. The limit of insurance expenses of 120,000 rubles may include not only insurance expenses, but also expenses for medical services, purchase of medicines, education and other types specified in Article 219.

Let's consider two options for receiving a deduction.

Tax deduction for child life and health insurance

Endowment insurance is most often used by parents to save a certain amount, for example, for education, treatment, etc. It is worth noting that the rules for receiving a social deduction are standard, but there are some nuances:

- The Tax Code of the Russian Federation does not stipulate the age of the child

; it turns out that you can insure both a young child and an adult who has reached the age of 18 years. - The insurance policy must be issued for a natural child or an adopted child (guardian). For example, if a man pays contributions for his wife’s child from his first marriage, he will not be able to receive a deduction.

- The insurance premium for a child can be taken into account in the total amount of social deductions (that is, all expenses falling under the deduction cannot exceed 120,000 rubles).

It turns out that a tax deduction on insurance contracts is a good opportunity to save on paying for an insurance policy (in fact, it is a discount of 13%), but few people know about this yet. This is especially important to know for those who pay for insurance purchased with a bank loan.

Method 1. Go to the tax office

We write a statement that we want to return taxes for mortgage life insurance and provide originals and copies of documents. We also fill out a declaration for each year, which will be taken into account when paying.

The application is considered within three months. Next, the calculated deduction amount must be paid within a month.

What to provide to the Federal Tax Service

You will need to present:

- Russian passport of the applicant-taxpayer;

- 3-NDFL declarations for the required years;

- certificates from the accounting department from the place of work in accordance with the form on withholding tax on the applicant’s income for one or more years (or individual entrepreneur’s reporting);

- financial documents about insurance payment, these are usually checks, receipts;

- life insurance contract (and its copy);

- a copy of the insurer's (current) license.

You can come in person or send by registered mail.

It is possible to apply for a deduction online. To do this, you need to register on the State Services website, as well as the identity verification procedure on this website.

Then go to the tax office website in your personal account and send electronic documents from there. In order for them to be signed by the taxpayer and have legal force, an electronic signature will be required.

You can apply for a deduction through NI only at the end of the current year with paid insurance, along with submitting a declaration in form 3-NDFL.

List of documents

A person receiving a deduction through the Tax Service is required to present a list of the following documents:

- Declaration 3-NDFL. To be filled out personally.

- A copy of the insurance contract (policy).

- TIN.

- Certificate of employment (form 2-NDFL) or other documents certifying the fact of tax payment.

- Papers confirming the transfer of insurance premiums (certificates, checks).

- Bank details for transferring deductions.

If a citizen receives compensation through an employer, he will be required to provide proof of payment of contributions and photocopies of insurance documentation.

Method 2. The procedure for filing a deduction at your job

It is possible to return the tax for mortgage life insurance earlier, in the same year when the insurance was paid. This can be done at the place of your official work, through your employer, but you must provide permission from the tax office.

You can confirm your right to receive such a deduction from NI by submitting a written application to the Federal Tax Service with the necessary package of documents.

Within a month, NI will issue a permit (notification) of the right to deduction, which is submitted to the accounting department of the enterprise along with an application for a tax refund (deduction).

What do you need to present to the NI to receive a deduction?

First of all, about what the tax authorities will require. This is the same set of documents as listed above, but you do not need to provide certificates in form 2- and 3-NDFL.

How does a tax refund for life insurance work on a business mortgage? The accounting department of the enterprise, starting from the next month after receiving the application, will not withhold tax from the employee’s salary until the amount of the deduction is fully compensated.

How to issue a return

In January 2015, amendments were made to the Tax Code of the Russian Federation, thanks to which it became possible to receive a tax deduction for long-term voluntary life insurance. Such compensation is part of the income on which you do not have to pay personal income tax. The state either credits the payer with previously withheld funds or does not tax a certain portion of the expenses.

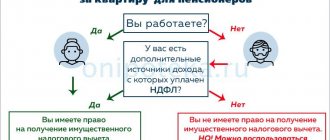

Only citizens of the Russian Federation who have income subject to personal income tax can receive a tax deduction. The possibility of its accrual is regulated by Art. 219 of the Tax Code of the Russian Federation. According to it, a tax deduction for life insurance can be obtained:

- under a pension insurance agreement;

- when signing an agreement on voluntary health insurance;

- when taking out life insurance for a period of five years or more.

In the last two cases, interestingly, the taxpayer must be the policyholder, and the insured may be his relative or child (including adopted child). This same person will receive the funds. When purchasing insurance, it is important to pay attention to whether the company has a license for this type of service. You should also ensure that all essential terms are specified in the contract. According to paragraph 2 of Art. 942 of the Civil Code of the Russian Federation, these are:

- information about the insured person;

- the amount of the insured amount;

- the nature of the insured event and the validity period of the document.

Personal income tax refund for life insurance is charged only for the corresponding clause of the voluntary life insurance agreement. For example, some citizens prefer to enter into a combined insurance document, which insures not only life, but also includes protection against accidents, illnesses, etc.

It is also worth considering the tax deduction for investment life insurance (ILI), not to be confused with the investment tax deduction. In this case, the payer actually credits the company for free, and it insures his life and shares the profit from his investment. Typically, such agreements are long-term in nature, but may involve paying almost the entire amount in 1-2 stages. In this case, you need to remember the limit of 120,000 per year.

There are two ways to get a tax deduction for life insurance:

- Through the tax office.

- It is collected from the employer (clause 2 of article 219 of the Tax Code of the Russian Federation).

Registration of a deduction through the tax center takes place in several stages:

- An application and 3-NDFL for the past year are submitted.

- A 2-NDFL income certificate is obtained from the accounting department at the place of work.

- Documents are submitted to the Federal Tax Service (possibly via the Internet).

- A response from the tax inspectorate should be expected in 3 months, after which another month for the money to be credited to the account.

Through the employer, a personal income tax refund on life insurance can be issued until the end of the year in which the insurance was purchased. However, the employer has the authority to provide a social deduction only if it has undertaken obligations to withhold insurance premiums from wages and subsequently transfer them to the insurance company.

If you contact an employer, the list of documents will be small:

- application for a deduction;

- voluntary life insurance contract.

We suggest you read: How to get a tax deduction after an operation

To apply to the tax office, you need a package of documents, the composition of which may vary depending on the specific case. So, what documents are needed for a tax deduction for life insurance for 5 years:

- original application;

- copies of passport, TIN;

- a certified copy of the insurer's license;

- original 3-NDFL;

- income certificate;

- a copy of the insurance policy;

- if the insurance was purchased for a close relative, then a marriage/birth certificate;

- confirmation of payment for the contract (checks).

To summarize, it is worth recalling once again that the tax deduction for life insurance allows you to return part of the costs for each year in which payments were made. All taxpayers who have issued a life insurance contract for this period can apply for a tax deduction for life insurance for 5 years.

If you want to apply for a tax deduction for investment life insurance, pay attention to the size of annual payments and the ability not to exceed the annual limit of 120,000 rubles - this way you can return the total amount by an order of magnitude more.

Persons who intend to receive tax deductions for life insurance should keep in mind that only information from 2015 is used in deciding this issue.

Important! There was no opportunity to get income tax back for paying insurance premiums until 2015. The date of the agreement did not play a role.

To apply the insurance deduction, continued use of the policy is required. Otherwise, a reverse calculation will be carried out on the part of the person.

According to the law on voluntary health insurance, a personal income tax refund can be obtained if you submit an application within three years from the date of payment for the insurer’s services. If a taxpayer receives expensive treatment, it is worth considering some nuances:

- The insurance deductible amount is returned taking into account actual costs.

- If the medical institution that provided expensive treatment did not have the necessary medications and the patient bought them himself, he has the right to compensation.

- The treatment took place in a licensed institution.

The amount of insurance premiums paid is refunded after verification of the return submitted by the taxpayer. The process may take up to 3 months from the date of presentation of the required documentation.

The following categories of citizens have the right to receive a tax deduction under a life insurance contract:

- Those who paid insurance premiums from their own funds.

- Those who insure themselves, parents, spouse, children.

- Those who have entered into an agreement valid for five years.

Important! The subject of the contract with the insurance company must be life insurance. When a citizen insures himself or family members against accidents, a deduction under this item is not issued.

The Tax Code of the Russian Federation (clause 4 of Article 219) considers the procedure for social tax deductions for life insurance, non-state provision, and voluntary pension insurance.

Important! The maximum amount of paid pension contributions, from which tax refunds will be calculated, is 120,000 rubles.

To receive an insurance deduction for paying pension contributions, the taxpayer must take the following actions:

- At the end of the year in which contributions were paid, file a tax return (form 3-NDFL).

- Contact the accounting department of the organization where the labor activity was carried out to obtain a certificate (form 2-NDFL) about the amount of accrued and withheld tax fees.

- Prepare a copy of the insurance policy (agreement with a non-state fund).

- Make copies of payment documentation that reflects the costs associated with paying insurance premiums.

We invite you to familiarize yourself with: Enforcement case by resolution number

If a citizen paid pension contributions for a relative, documentation (copies) confirming family ties (child’s birth certificate, marriage certificate) will be required. A declaration with copies of documents confirming the right to receive a deduction and recording insurance costs is submitted to the tax office at the place of residence.

If the employer withheld contributions under a non-state pension agreement from the taxpayer’s salary and transferred them to the insurance company, it is allowed to receive a refund before the end of the year. To do this, apply to the employer.

Important! When submitting copies of documents to the Federal Tax Service, confirming the right to deduction, you must have their originals for inspection by a tax inspector.

Many agreements related to life insurance may not qualify for the insurance tax deduction. It is not allowed to issue compensation for life insurance on a mortgage in the usual form of the contract, since the bank is the beneficiary.

Important! When it comes to pension-type insurance, a citizen can count on receiving a refund upon reaching the age of pension.

Persons who meet the following requirements are entitled to insurance deductions:

- Regular payment of taxes on your income.

- Availability of resident status of the Russian Federation.

Residents are citizens who have lived in Russia for more than 6 months.

To get a refund of income tax for life insurance, contact your employer or the tax authority.

At the Tax Service

When filing a tax refund with the Federal Tax Service, you need to prepare a set of the above documents and draw up a corresponding application. When the subject of an agreement with the insurer is the life of a relative, copies of documents certifying the fact of family ties are provided. The collected documentation is sent to the tax authority on any day of the year that follows the year in which the person filed a 3-NDFL declaration and a 2-NDFL certificate.

After submitting the papers, they wait for the deduction to be transferred to the bank details specified in the application. The Federal Tax Service will issue a refund within 4 months from the date of receipt of a package of documents from the taxpayer, if everything is in order with them.

From the place of work

Why may a tax refund be denied?

Tax authorities often refuse to receive a deduction, usually due to some inconsistency with the terms of the refund.

Let's consider the main reasons for the refusal, and whether the situation can be corrected.

Most often, the requirements of Article 219 are not met, for example:

- the duration of the contract is less than 5 years;

- beneficiary – bank;

- the subject of insurance - the life of the borrower or his family - is not clearly stated, the deduction does not apply to insurance against accidents and illnesses;

- the insurer has an invalid license at the moment, and others.

Advice: try to renew the contract, change the insurer.

To receive a deduction when concluding a comprehensive insurance contract for several types of insurance, you must obtain a certificate from the insurance company highlighting the amounts for each type.

How much will be refunded?

Life insurance deductible is paid based on the premium amount. Its amount is determined for the calendar year based on the following factors:

- The tax payer can receive back 13% of the insurance amount, but not more than 15,600 rubles.

- The refund cannot exceed the amount transferred to the state treasury (13% of the official salary).

It is allowed to return a tax deduction for life insurance. If a combined contract has been concluded with an insurance company, which, in addition to the main clause, includes insurance against accidents and illnesses, the refund will be made only in the amount of life insurance premiums on a voluntary basis.

We invite you to familiarize yourself with: Certificate of right to inheritance

Important! If a person has not paid 15,600 rubles in personal income tax to the state treasury, he is not entitled to a full tax refund.

Two reasons for refusal according to timing

The tax deduction for mortgage life insurance begins in January 2015. From here it is immediately clear why they will refuse a deduction for the years before 2015. The contract itself could have been concluded in previous years, but the deduction will be provided only for insurance premiums paid since 2015.

Second point. For social deductions under the same Tax Code, there is a statute of limitations of 3 years. In the current year, a taxpayer can apply for a deduction for the three previous years. A refusal will follow if personal income tax was not withheld during these periods, or a deduction is requested for periods outside the statute of limitations.

Other reasons for refusal to deduct:

- lack of an official place of work, white wages from which income tax is withheld;

- lack of Russian citizenship;

- payment for housing is not with personal or borrowed funds, but is financed with the help of the state, employer, and sponsors.

Popular review: The conditions for receiving a deduction for life insurance on a mortgage are quite acceptable; if you sign the right insurance contract and have an official salary, this is quite possible. And money is never too much, as you know.

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Date of publication November 1, 2019 November 2, 2019