Legal provisions

The procedure according to which the rights to the property estate of the deceased are registered is reflected in several legislative acts. In particular, this is the Civil Code of the Russian Federation, the fundamental law of the country. In the latter case, Article 35 applies. These acts help decide on what date to carry out assessment activities. The Constitution states that citizens have the right to inherit property. There are two options according to which the thing is transferred. They involve the use of legal acts or the execution of a testamentary disposition. In addition, it is reflected that the legal heir cannot be deprived of the opportunity to receive the things of the deceased.

The Civil Code of the Russian Federation reflects the mechanisms that are used for the purpose of entering the category of powers under consideration. To implement the process in question, you will need to go through several stages. Including, preparing documentation that helps confirm the fact that the citizen has died. After this, they begin to confirm the area where the discovery of the hereditary mass occurs. This can be done using an extract taken from the house register. It reflects the last place where the deceased was registered.

ATTENTION !!! The next step is to contact a notary. This is necessary in order to open an inheritance case. The office employee is provided with documentation confirming that the deceased had the rights of ownership of the property, which he transfers to his successors.

The presence of family ties is also documented or a testamentary act is provided. Then you need to carry out appraisal activities in relation to the property and transfer the compiled document to a notary officer. Only after this is a certificate issued indicating that the person has the right to own property.

It is necessary to make an assessment not only in order to document the price of items included in the property mass, but also to pay a state fee. This obligation is established in the tax law. The cost must be set on the day the citizen died. The amount of the duty depends entirely on how much the inheritance will be valued. Such fees are used to pay the costs incurred by employees of notary offices. They are associated with the formation of evidence indicating the existence of rights of ownership of a thing.

Tips for obtaining a quality real estate appraisal:

- Consult with lawyers first. Legal advice will help you set maximum specific assessment goals

- Take part in promotional offers. All promotions of our company can be found on the website.

- Choose appraisal companies that provide guarantees and stipulate in the contract the possibility of a refund, for example, if the notary refused to accept the appraisal report, arguing for his actions by the low level of the examination performed.

makes an assessment based on standards established in Russia, reflects the real market value of the property and is independent. All assessment reports are drawn up in accordance with Federal Law dated July 29, 1998 135-FZ “On assessment activities in the Russian Federation”.

Types of assessment

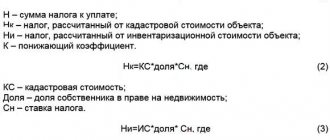

Article 333.25 of the Tax Code of the Russian Federation states that applicants for the property estate have the right to choose the mechanism through which valuation measures are carried out in inheritance cases. For this purpose, the method chosen by the heirs is used. It is worth considering that the one who pays the fee has the opportunity to submit documentation indicating several parameters. It describes the value established during the inventory. The cadastral or market price may also be reflected. In the situation under consideration, it is permissible for the document containing the price to be issued both by an organization acting on behalf of the state and by independent appraisers.

The main point is that when calculating the cost, it is important to do this on the day when the owner of the things died. Otherwise, the activities carried out will not be recognized as legal.

Methods of assessing real estate for accepting inheritance

Successors have the right to choose a document assessing the estate and the method of carrying out the procedure, despite the strict regulations on paying state fees. The person paying the notary fee has the right to determine what document he will provide to the notary (subclause 5, clause 1, article 333.25 of the Tax Code).

The inheritance can be valued at:

- cadastral;

- inventory;

- market;

- nominal.

The notary is not authorized to choose the valuation method independently or demand confirmation of a certain value from the heirs.

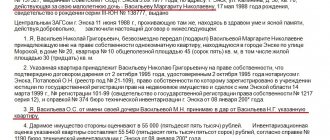

Valuation of inherited property at cadastral value is applied to real estate. It is established during the state cadastral valuation. The cost in this case will be determined according to the relevant entries in the state register. The implementation of such a procedure is regulated by Ch. 3.1 Federal Law “On Valuation Activities”.

The inventory cost is carried out by BTI employees at the last place of residence of the deceased. For several years now, this method of assessment has practically not been used due to experts’ doubts about its objectivity. It is believed that the inventory value turns out to be significantly underestimated.

According to Art. 3 of the Federal Law “On Valuation Activities”, the market value of successive property is the price of this property at which it can be purchased in a free market.

According to experts, this method is the most accurate, since when it is used, the value of the inheritance is assessed not only according to the characteristics of the object, but also based on the situation regarding supply and demand in the market.

If a lawyer receives several documents that indicate different prices, the notary fee will be calculated based on the lower price.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

How is the cadastral value determined?

The value fixed in the cadastre is used to evaluate the value of real estate and land plots. It is considered as the price reflected in the state cadastral registers. The provisions of Law No. 153 of 1998 apply to the procedure for valuing an item at a specified value. This act reflects that the municipal authorities make decisions on conducting the assessment. After this procedure is completed, a tender is concluded. The second party is an independent entity. When the assessment is actually completed and conclusions are drawn, information about the price of a specific object is subject to inclusion in the cadastre.

IMPORTANT !!! Legal successors have the opportunity to obtain information regarding this price by using the official portal of Rosreestr. This resource also helps you place an order for the generation of an extract regarding the prices of a property. To do this, you will need to enter data into the application generated on the portal. Next, find the desired object. To do this, enter the cadastral license plate into the search bar. Then information is given about what its price is. In addition, it contains other characteristics.

After receiving information about the required item online, you will need to upload reporting documentation that reflects the results of the assessment. In addition, you will be able to obtain a document showing the cadastral value in Rosreestr upon direct application. It is necessary to write a statement and submit it to the employees of the specified authority. If the request is completed in accordance with all the rules, then within five working days the citizen will be given a document reflecting the necessary information.

The employee of the notary office is responsible for accepting this paper as an act for calculating the fee. Nowadays, there are quite often situations where the assessment is subject to challenge. If a citizen believes that the calculations made for the cadastral price are not equivalent, then he has the right to visit commercial companies and obtain information regarding the real amount.

Inventory price assessment

This type of value is determined using a conclusion made by an expert appraiser. He works at BTI. To obtain this certificate, you need to visit the specified authority and fill out an application. You need to have with you an act by which the citizen’s identity is verified. It should be taken into account that in 2021 the value in question is practically not used to determine the amount of the state duty. This phenomenon is associated with the fact that when determining the cost, BTI employees take into account few characteristics. For example, the location where the building is located is not taken into account.

In addition, infrastructure and other important aspects are not taken into account. For this reason, the price indicated by BTI employees is much lower than other varieties. Accordingly, this figure is less than the real price of the property. It turns out that the amount of duty paid will be less than it should be. These provisions are spelled out in a letter from the Ministry of Finance dated 2013. It is worth pointing out that such an act is not considered legislative.

This means that if the heir provides a paper that reflects the inventory price, the notary becomes obligated to accept it. On its basis, government fees are calculated.

Conducting a market price assessment

They consider it as the cost according to which it will be possible to purchase a property on the market. In this case, the competition factor is taken into account. This indicator is currently considered quite relevant. This is due to the fact that when calculating it, not only the characteristics of the operational plan are taken into account, but also the purpose inherent in the object and its usefulness. Among other things, it is also important that the created market environment is assessed. In connection with the stated provisions, when calculating the amount of fees, a notary often uses this type of price.

It is also necessary to take into account that the object that is redistributed among heirs is not only real estate or land plots. When a citizen wants to obtain rights to insignificant material values, then the market price option can be used. To draw up an opinion on the market value, a person will need to visit a company of independent appraisers. A mandatory requirement is that they have a license to conduct this type of activity.

IMPORTANT !!! An agreement regarding the provision of services is formed between the customer and the company. It describes the object to be assessed. They also write how much the cost of such services will be. After the agreement is formed, the expert begins to carry out assessment activities.

It includes an inspection of the real estate and the establishment of its characteristics. They must be not only quantitative, but also qualitative. The indicators established on the market are analyzed and the method by which the property is valued is selected.

Then the results obtained are summarized, a conclusion is formed and issued. It is drawn up in the form of a written act. Then the claimant for the property of the deceased submits this paper to the notary.

Valuation of an apartment for inheritance

The procedure for entering into an inheritance is impossible without contacting a notary, who, in order to issue a certificate of inheritance, will need information about the value of the inherited property. Accordingly, it is necessary to conduct an assessment, in this case, of the apartment.

What is an apartment valuation for inheritance?

In the assessment report, an independent appraiser determines the market value of the apartment, on the basis of which the duty that will need to be paid for the inheritance will be calculated.

It should be noted that a feature of such an assessment is that the cost of the apartment must be determined as of the date of death of the testator. Therefore, a copy of the death certificate is added to the standard package of documents. Otherwise, the appraisal process itself is no different from appraising an apartment for any other purpose.

How is the assessment done?

First, you need to provide the appraiser with documents for the apartment: technical and title documentation. This is necessary to determine the parameters of the object, according to which the specialist will subsequently select analogues. Also, copies of these documents must be attached to the report.

Next, the appraiser inspects the apartment. This is required to determine the conformity of the apartment in reality and in documents. The inspection also allows you to better understand the condition of the property, which affects the final cost of the property.

Cost calculation:

Before starting to calculate the market value, the appraiser conducts an analysis of the real estate market, supply and demand for similar apartments in the same area.

Only after collecting all the necessary information, the appraiser calculates the market value of the apartment, taking into account all factors influencing the price: location, area, foundation materials, walls, etc.

What does the client get?

After all the calculations, the appraiser generates a finished report that can be provided to the notary. The assessment report usually consists of 60-70 sheets, bound and numbered according to all standards. The report must be certified by the seal and signature of the appraiser.

The report contains the following sections:

- Information about the Appraiser and the Customer

- Characteristics of the subject of assessment

- Review and analysis of the real estate market

- Rationale for the assessment methodology

- Determination of market value

- Appraiser's documents: Diploma, Certificate of membership in SRO, Extract from the SRO register, Compulsory appraiser liability insurance policy

- Company documents: OGRN, INN/KPP, Insurance policy

- Customer documents: title and technical documentation for the apartment

- Photos of the apartment

How is the duty calculated?

This indicator is influenced by how close the relationship between the applicant for property and the deceased citizen is. In a situation where they are close relatives of each other, an indicator of 0.3 percent of the established value is applied. If the relationship is distant, then this figure is doubled. It is worth pointing out that the legislative acts establish a limitation in relation to the duty.

In particular, close relatives will pay a fee of no more than 100 thousand rubles. Far more than a million.