Insurance cases subject to payment by the employer

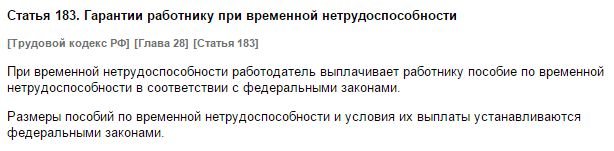

The law provides for guaranteed payments for the period when, for health reasons, a person could not perform work duties (Article 183 of the Labor Code of the Russian Federation).

The employer's obligation to pay for the period of incapacity is stipulated in federal legislation

The following cases are recognized as insurance and therefore obligatory for payment:

- general and occupational diseases;

- temporary disability of women during the prenatal and postpartum period;

- quarantine of the employee himself;

- the need to care for sick preschool children (up to 7 years old) or other incapacitated close relatives;

- prosthetics for medical reasons;

- after-care and rehabilitation in sanatoriums located throughout the country.

In the case when the manager begins to explain that he cannot pay for sick leave, to give arguments that have no legal grounds for refusal, it is necessary to seek a legal solution to the issue on the merits.

For example, there will be direct violations of guaranteed rights if the employer does not pay for sick leave, explaining:

- insufficient work experience after employment;

- domestic origin of the injury;

- part-time work, if the employee has another permanent job;

- the occurrence of an insured event after the termination of employment at the end of contractual terms or dismissal for other reasons.

For information! Sick leave is also payable if a person falls ill within 30 days after dismissal.

They will pay, but not in full

The law regulates the grounds for partial reduction of sick leave payments in certain cases. This is not a refusal, but a justified reduction in the amount of accrued payments, and, unfortunately, all the situations provided for are of a negative nature:

- the patient did not comply with the treatment procedure (taking medications, procedures, adherence to the regimen) prescribed by the doctor without a good reason;

- illness or injury was the result of a person’s inadequate state as a result of taking alcohol or narcotic or toxic substances;

- the patient did not show up at the agreed time to see the doctor or did not undergo the prescribed medical examination.

These cases provide for a reduction in the amount of sick leave pay to the level of the federal or regional minimum wage based on a monthly calculation (sick leave will be calculated not according to real wages, but according to the minimum wage adopted by the state or regional authorities).

Expert opinion

Polyakov Pyotr Borisovich

Lawyer with 6 years of experience. Specialization: civil law. More than 3 years of experience in drafting contracts.

In such dire situations, the patient may receive a smaller amount not for the entire period of illness, but for a certain part of it, allocated depending on the basis. For example:

This is important to know: Are sick leave included in the payroll?

- in case of violation of the treatment regimen, payment is reduced from the date of recording deviations from the doctor’s instructions;

- in case of failure to show up for an appointment or medical examination, the days starting from the date when the patient did not come where it was necessary are subject to reduction;

- alcohol and drugs, as the cause of illness, inexorably reduce pay for the entire period of incapacity.

Deadlines for paying sick leave

In order for days of incapacity to be paid, after recovery, the employee must provide documentary evidence of seeking medical care, drawn up in accordance with the Procedure approved by Order of the Ministry of Health and Social Development No. 624n (as amended on June 10, 2019).

The documents must be submitted to the employer within a maximum of six months from the day when, for medical reasons, you can return to work.

Within 10 days after receiving the certificate of incapacity for work, the issue of payment is resolved.

Direct payment of sick leave benefits is carried out simultaneously with the next payment of wages.

You need to know in which cases sick leave is not paid:

- if the certificate of incapacity for work is submitted later than the established deadlines;

- There were inaccuracies in the preparation of the document or, for example, the seal of the medical institution or the signature of the attending physician were missing.

For information! It happens that sick leave remains unpaid after receiving a salary. For example, if the documents reached the employer a week, a few days before the payment of the advance or salary. It is quite natural that the benefit will be transferred to the next nearest payment.

When sick leave is not paid on time due to a delay in the transfer of wages, the debt must be repaid with a penalty charged for each day of late payment.

They won’t pay sick leave because they didn’t issue a certificate

An employee should not count on payment for time off work if he cannot provide the document on the basis of which this is done, that is, the sick leave certificate itself. The law provides for refusal to issue a certificate for a number of reasons:

This is important to know: Registration of an electronic sick leave certificate in 2021

- the doctor, when contacting him for consultation, did not identify the disease as a result of the patient’s error or deliberate simulation;

- sanatorium treatment without appropriate medical direction;

- missed work due to short-term medical procedures performed one-time, such as vaccination, rinsing, inhalation, etc.;

- routine medical examination of employees, required by the requirements of this organization.

Some categories of health workers cannot issue the sheet, so it is pointless to contact them for sick leave:

- ambulance and emergency physicians;

- doctors at blood transfusion stations;

- emergency room doctors;

- workers of medical and preventive institutions.

NOTE! The law allows you to challenge the non-issuance of a sick leave certificate from a superior manager of the refusing doctor or from the Social Insurance Fund. But you need to be sure that your rights have been violated: a challenge will not always lead to the issuance of the desired certificate.

Legal grounds for refusal to pay sick leave

In Art. 9 Federal Law No. 255, effective as amended and supplemented as amended on December 27, 2019, defines situations in which sick leave is not paid:

- if the employee fell ill during a period when his average earnings were not retained in full or in part (for example, while using the right to free or child care leave for up to three years);

- a child or other relative needed care during annual paid leave;

- a certificate of incapacity for work was issued during the period when, according to labor legislation, the employee was suspended from work (for example, if he did not undergo training and knowledge testing on labor protection and safe work practices);

- the employee was in custody or under administrative arrest during illness;

- time to undergo a forensic medical examination;

- if an injury was sustained or a person fell ill during the downtime of the enterprise (with the exception of cases when the sick leave was opened before the start of the downtime).

In addition, the legislator considers the following to be justified grounds for refusing to accrue benefits for days of incapacity for work:

- intentional infliction of harm to one's health by the insured person (if there is an appropriate court decision);

- temporary loss of ability to work due to the commission of an intentional crime (for example, was wounded, injured while committing a theft or during an attempted robbery).

When does an employer have the right not to pay sick leave?

There are the following situations in which sick leave is not payable:

- The employee's illness occurred during study leave.

- Sick leave was issued during the employee's downtime due to his fault, at the time of removal from duties (for example, due to refusal to undergo a medical examination, failure to obtain a license, etc.).

- A certificate of incapacity for work was issued to an employee who was caring for a sick relative or child during his regular paid leave.

- A fired specialist brought sick leave to care for a child.

- The reason for the hired specialist’s incapacity to work was intentional harm to one’s own health, an attempt to commit suicide, or a crime. The employer's refusal to pay is lawful if the specified facts are confirmed by the court.

The employer has the right not to accept or pay sick leave if it is proven that it is a fake or if errors, inaccuracies, or corrections are found in the document. In the second case, the refusal is temporary: when the specialist brings a version of the paper with corrections, the benefit will be transferred.

Partial payment of disability is provided in situations if:

- the citizen violated the medical regime;

- injury or illness occurred due to the use of alcohol or drugs.

The law provides for restrictions on disability compensation for certain categories of citizens. For example, disabled people are paid for no more than five months of illness per year, and people employed by a company for up to six months are paid for no more than 75 days for the entire period of work.

Sick leave payment amount

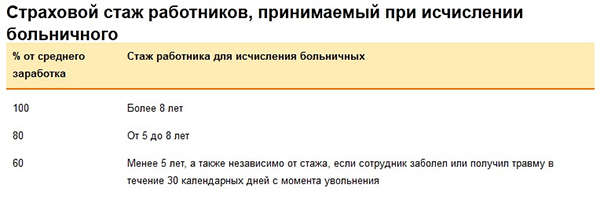

The amount of the benefit paid depends on the amount of insurance coverage at the time of incapacity and average earnings calculated for the two years of work preceding the insured event.

An ill or injured employee, while undergoing treatment, will receive:

- 100% of the average salary, if the insurance period is 8 years or more;

- disability benefits will be reduced to 80% of earnings when the insurance period is 5–8 years;

- 60% of the average salary is due to individuals, starting from the first day of official registration.

Many questions arise about sick leave, if a person does not work, who pays sick leave after dismissal.

The legislator does not emphasize for what exact reasons an employee must be dismissed in order to pay for sick leave if he becomes ill or injured during a month-long period.

There are some nuances to calculating sick pay:

- if the illness occurred while the employee was in an employment relationship with the employer, even when the certificate of incapacity for work is closed after dismissal, the benefit is calculated according to the general rules;

- Having opened sick leave after the official termination of employment, regardless of the number of years of insurance experience, only 60% of the average earnings calculated for the two-year period of work before dismissal are due.

The amount of sick pay depends on the length of insurance coverage

Attention!

If the sick leave was open while the employee was in an employment relationship with the employer, even if the certificate of incapacity for work is closed after dismissal, the benefit is calculated according to the general rules.

When an enterprise has ceased operations by decision of the owner or is declared bankrupt, you have to contact the Social Insurance Fund regarding payment of sick leave after layoffs.

Similarly, if long-term treatment is necessary, the decision on payment for days of incapacity for work is made by the local authority of the Social Insurance Fund.

In such a situation, the former employer pays for the first three days of illness.

In what cases is a certificate of incapacity for work accruing little money?

There are a number of situations when sick leave payment is accrued, but in a smaller amount (in accordance with Part 1 of Article 8 of the Federal Law of December 29, 2006 No. 255 Federal Law).

- If the patient violates the prescribed medical regimen or fails to show up for an appointment at the appointed time in the absence of a valid reason. In this case, the reduction in the amount of sick leave payments will be made from the day the violation was committed.

- If a relationship has been established between the employee’s alcohol, drug or other intoxication and the onset of illness or injury. In this case, the smaller benefit amount will be applied to the entire period of incapacity for work.

Can the amount received under the BL be less than normal earnings?

Many people are interested in the question of why sick leave payments are sometimes less than wages. This is due to the dependence of the amount of this amount on the employee’s insurance experience (according to Article 7 of Federal Law No. 255 of December 29, 2006, as amended on December 27, 2018):

- a person who has an insurance period of 8 years or more is paid sickness benefits in the amount of 100% of his average earnings;

- if the employee’s insurance experience is from 5 to 8 years - 80%;

- when the insurance period is less than 5 years - 60%.

If the illness or injury occurs within 30 calendar days after termination of employment, the benefit amount will also be equal to 60% of earnings.

If a parent or guardian takes sick leave to care for a child and treatment occurs on an outpatient basis, then in the first 10 days of illness, payments will be accrued according to length of service. On subsequent days - in the amount of 50% of earnings.

When undergoing treatment in a hospital, the amount of payments depends only on the accumulated work experience. For a year of sick leave due to a child’s illness, you can receive payment for no more than 60 days (child’s age is up to 7 years) or 45 days (up to 15 years).

Procedure in case of refusal of payments

In the case where a sick leave certificate was promptly provided by a recovered employee, but for the days of illness he did not receive the due benefits, first of all you need to try to find out from the accountant of the accounting department the reasons for his non-payment.

It happens that the essence of the problem concerns only the technical side of the issue, that is, it is necessary to make corrections, for which the certificate of incapacity for work is returned to the concerned employee.

After errors are corrected and the document is received in proper form, benefits are credited within 10 days.

One of the options for solving the problem, when you don’t know what to do, if the employer does not pay for sick leave, citing missed deadlines for submitting documents, despite good reasons, you need to contact the territorial body of the Social Insurance Fund.

Submitting sick leave to the employer

A working person is not immune from illnesses and injuries, but unlike non-working categories, he must comply with a special system when temporarily removed from work. The most important thing is the obligation to document the fact of illness, that the time of absence is justified and was actually used to improve health. In the Russian Federation, special hospital forms have been developed for this purpose, which can be obtained when visiting a doctor at a clinic or hospital.

Initially, the employee informs the employer about the fact of illness or injury by telephone or other means. When the sick leave is closed and permission to work is received, the employee is obliged to provide the employer with a ballot completed in accordance with all the rules. This form allows you to:

- Confirm the reason for absence from work.

- Receive compensation for sick days.

Important

The procedure for accepting and paying for a ballot from a retired employee is established by legislative acts, in particular, Article 183 of the Labor Code of the Russian Federation.

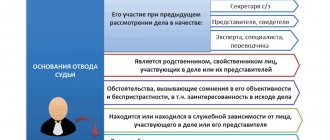

Where to file a complaint against an employer?

You can try to resolve any conflict situation peacefully or seek help in protecting your interests from the competent authorities authorized to make socially significant decisions.

Application addressed to the manager

A verbal request to pay for sick leave is not enough. They write a freely composed statement, observing the basic rules of business correspondence.

Indicate full information about yourself as the applicant to whom the request is addressed to deal with the unfounded refusal to pay sick leave.

The text part outlines the essence of the problem.

The date of application is specified and certified with a personal signature.

In order to ensure that in case of ignoring the request, or refusing to pay for sick leave, there is evidence that the employee tried to resolve the dispute peacefully:

- make a photocopy of the application;

- Having registered a written appeal, they keep one copy for themselves, which should contain the incoming number, the date of receipt and the signature of the responsible person indicating the position who accepted the correspondence;

- if they refuse to register documents, they send an application by registered mail with a list of enclosed documents and notification of delivery of the correspondence to the addressee.

Note. An employer’s unjustified refusal to register and pay sick leave can be appealed by filing an application with the labor dispute commission, if there is one at the place of work.

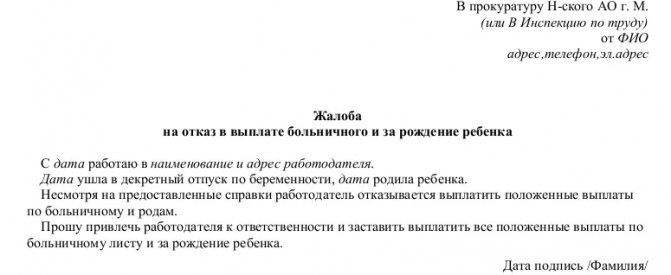

Complaint to state supervisory authorities

The application can be sent to the prosecutor's office or the territorial labor inspectorate.

Sample complaint if the employer does not pay sick leave

An authorized representative of the supervisory authority will conduct an unscheduled inspection in an on-site or documentary form. If these violations are confirmed, the employer is given an order to eliminate them.

The guilty officials will be held accountable in accordance with the procedure established by law.

Filing a claim in court

You can defend your legitimate interests in obtaining sick leave in court.

The deadline for filing a complaint is quite long, amounting to 3 years from the moment the violation of rights became known.

It is not necessary to provide evidence that measures were taken to resolve the conflict peacefully.

It is important to justify the requirements.

When going to court, you need to remember the statute of limitations

When the sheet will not be issued at all

The law provides for several cases when, despite the fact that the employee’s health was damaged and he was provided with medical care, he is not entitled to sick leave. The fact is that the law directly prohibits granting benefits under it in the following situations:

- the disability occurred because the employee committed a crime and suffered as a result;

- the employee intentionally caused harm to his own health.

If the facts of malicious intent are confirmed in court, temporary disability benefits should not be assigned and paid (Part 2 of Article 9 of Federal Law No. 255 of December 29, 2006).

Responsibility of those responsible for non-payment of sick leave

Unreasonable refusal to accept sick leave for accounting and to pay as required by law for days of incapacity for work, violation of the deadlines established for the transfer of funds due, is fraught with liability for the employer:

- Material. Additional costs will have to be incurred by paying a penalty along with the amount of benefits due, calculating compensation for each overdue day of at least 1/150 of the current key rate of the Central Bank.

Important! Financial liability is inevitable at the same time that the manager and other guilty officials may be brought to administrative responsibility or convicted of criminal offenses.

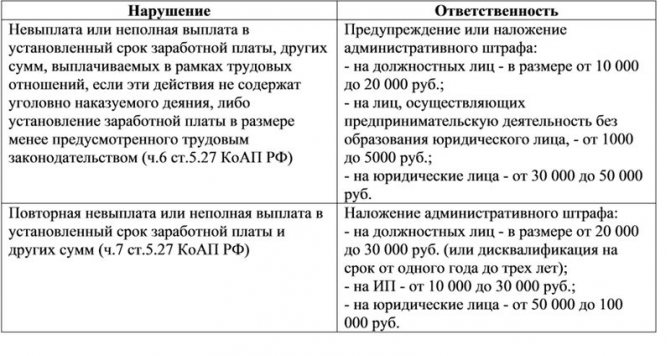

- Administrative. They will issue a warning or impose a fine on officials of 10 thousand rubles each. At the same time, more significant amounts may be recovered from the enterprise as a legal entity. If the employer has previously been punished for similar violations, the amount of the fine increases, and the guilty officials may be disqualified for up to 3 years.

- Criminal. If, taking advantage of his official position, the manager spent money for personal purposes, to obtain his own benefit, in addition to a fine, the amount of which is from 100 thousand rubles, he may face forced labor or imprisonment.

Order a free legal consultation