When taking out a mortgage loan, people often pay attention only to such points as the amount of the down payment, the loan term and the interest rate - while such an issue as the repayment method does not come into view. However, the mechanism for calculating payments and accruing/collecting interest, and ultimately the total amount of overpayment on the loan, depends on it.

We are talking about differentiated or annuity schemes; today a number of banks allow borrowers to independently choose one of them. In this article we will take a closer look at the advantages and disadvantages of an annuity.

Annuity payment: what is it?

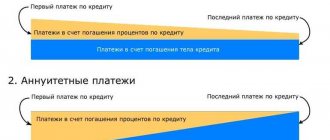

Payment under the annuity scheme is the most common and involves paying off the debt in equal installments over the entire loan term without changing the contribution amount. The payment includes two components - the principal debt and interest accrued by the lender. The specificity of the annuity is that at first almost the entire payment amount goes to pay off interest, and the principal debt decreases minimally. Over time, the ratio changes, and the largest part of the payment goes to repay the principal debt. Banks do this in order to insure themselves - by receiving interest in advance, even if the mortgage is paid off early, their losses will be minimized.

The differentiated scheme involves making large contributions every month, the amount of which is gradually reduced. With this scheme, throughout the entire period of lending, the principal debt is repaid in equal parts, and interest accrues on top of the fixed amount. When the loan is repaid ahead of schedule, the overpayment is also reduced, and the larger the amount and the longer the loan term, the more noticeable the difference will be.

What is an annuity payment

To understand which method of repaying a loan is the most acceptable, you first need to understand what an annuity payment is. Its main difference is the ease of loan repayment. In this case, there is no need to clarify the payment amounts each time; the loan body and interest are repaid in equal installments throughout the duration of the agreement. The monthly payment consists of the amount of repayment of the loan body, that is, repayment of the principal debt, and interest that is accrued for the use of loan funds.

With any payment method, one of the main factors of a loan is a small rate. We have looked at for you how to get a loan for pensioners with a low interest rate.

Of the monthly debt repayment amount, the largest part of the payment is the payment of interest, and the smaller part is the amount of the loan outstanding. In this case, in the first months of debt repayment, the loan body is practically not repaid; the main payments come from interest. Loan payments are not large, so interest on the use of credit funds increases.

Advantages and disadvantages of an annuity

The annuity scheme definitely has its advantages. The first is its simplicity; in everyday life, this scheme is more convenient - a person is always aware of the size of the payment the bank expects from him every month. This makes it possible to plan expenses in advance. Keeping a fixed number in mind is much easier than regularly checking the amount in the payment schedule. If the goal is to reduce the monthly payment amount to a minimum by stretching out the payment period, then an annuity is well suited for this. Do not forget that the longer the loan term, the higher the overpayment of interest.

Another advantage of the annuity scheme is its accessibility; today any bank gives the opportunity to use it for repayment. At the same time, there will be more loyal requirements for annuity borrowers than for those who prefer a differentiated scheme. The monthly payment on the annuity system will always be less than the first payment under the differentiated scheme, this allows you to take out larger amounts. The fact is that for banks, the ratio of the borrower’s income and expenses for servicing the loan is of paramount importance. Thus, annuity makes credit products more accessible.

Early repayment schemes

There are two ways to repay a loan early:

- In the first case, repayment occurs by reducing the loan repayment period. To do this, you must make monthly payments according to the payment schedule, and available funds can be deposited to pay off several monthly payments. This reduces the number of months of payments. For example, instead of 30 months, the loan can be fully repaid in 16 months.

- In the second case, early closure of the loan occurs by reducing the debt. At the same time, the total number of months of making payments does not decrease, but only the amount of payments decreases. This is possible through monthly or one-time deposits of additional funds. Thus, in the future the borrower will contribute, for example, not 4000 rubles, but 3000, 2000, and so on.

Situations arise when it is difficult not only to repay the debt ahead of schedule, but also to pay the obligatory monthly payment. In such cases, the borrower’s reputation deteriorates and in the future it becomes problematic to find where to get a loan with a bad credit history without refusal.

Which is more profitable?

From the point of view of overpayment of interest, an annuity will always lose to differentiated payments. Their main disadvantage is the large amount of down payments. And as the loan amount increases and its term decreases, the difference will become more and more noticeable. Here you need to first look at your income level. If you are able to make large contributions, a differentiated system will be preferable. If at first it is more comfortable to pay less, then it is better to choose an annuity.

Let's do the math with an example. Since each bank offers its own conditions regarding the schedule/payment of contributions, the final figures are indicative, but most often the calculation will be the same. Let's assume that the borrower takes out a mortgage loan in the amount of 3 million rubles, at a rate of 10% per annum for a period of 5 years. If he uses an annuity, then the monthly contribution throughout the entire period will be 63,740 rubles per month. At the same time, he will overpay 824,470 rubles in interest. If he uses a differentiated system, then the limits of the monthly payment amount will gradually change - from 75,000 rubles to 50,412 rubles. The overpayment of interest will amount to 762,500 rubles.

Pros and cons of annuity payment

Annuity payments are, first of all, ease of use and understandable amounts of monthly contributions. But there are also a number of disadvantages.

pros:

- Debt repayment occurs in equal installments throughout the entire loan term.

- A clear payment scheme allows you to effectively plan your budget.

- Financial institutions do not impose special requirements on the borrower when making an annuity payment.

- The interest rate will be lower than with differentiated payment.

Minuses:

- Difficulties may arise if you repay early.

- As a result, the overpayment of interest will be greater than with a differentiated payment.

Early loan repayment

Remembering that they overpay more with an annuity, many borrowers strive to at least partially repay the loan ahead of schedule; all Russian banks allow this. There are options to choose from: you can either reduce the monthly payment or shorten the loan term. Here you need to decide on your priorities in advance: either you need to give less money to the bank, or reduce current expenses. As the repayment period decreases, the total overpayment of interest also decreases, which is logical - the borrower uses the loan for a shorter period, so he must pay less interest.

If the borrower has the task of reducing the monthly payment, then additional funds are immediately freed up. There is another option that experts consider the most optimal. It consists of continuing to pay the initially established amount after the mandatory payment has been reduced. This allows you to shorten the repayment period. Also, if the financial situation worsens, it will be possible to reduce the load and pay only the minimum payment.

This scheme also has a drawback; it consists in a larger overpayment of interest compared to shortening the term. Regardless of the chosen option, annuity borrowers need to understand that the benefit from repaying the loan ahead of schedule always directly depends on how much time is left to pay on the loan. As the end of the term approaches, the benefit of early repayment decreases.

Features of early repayment

If the borrower has the opportunity, the loan can be repaid ahead of schedule. There are two types of debt repayment: full and partial.

Complete

Full repayment of the loan is only possible if the borrower has the entire amount to repay the debt. At the same time, he is obliged to inform the bank of his intention no later than a month before the desired closing date of the loan. The bank calculates the entire remaining amount of the debt, which the borrower must repay ahead of schedule. After making the payment, the loan agreement is closed.

Partial

Partial early repayment of the loan debt implies that the client will make a monthly payment in excess of the required amount.

Additional recommendations

When applying for a mortgage loan, you need to objectively assess your capabilities and calculate your budget for the years ahead. Experts believe that the monthly mortgage payment should not be more than 40% of family income - otherwise there is a risk that you will have to cut back on spending on everyday needs. The payment schedule, as a rule, is formed at the stage of concluding the contract, but preliminary calculations can be made independently using mortgage calculators - they are freely available on the Internet.

Which repayment option should I choose?

If the borrower is interested in reducing the monthly annuity payment, it is better to choose the second option. If the goal is to shorten the loan repayment period (to overpay less), then the first option is suitable.

Repayment options also depend on the type of loan:

- ruble without restrictions on early payment. Both options are suitable, but it is better to consider reducing the monthly payment rather than the terms. After all, the released funds can be included in the next payment or put into circulation;

- ruble with restrictions (but payment is irregular). Needs individual assessment by an expert, as there are variables;

- foreign exchange without restrictions. Reducing the terms will allow you not to overpay for the loan, which is more profitable than with a ruble mortgage. A prerequisite is regular early payments;

- currency with restrictions (the limit amount of early repayment is indicated). Here the first option is definitely more profitable than the second, that is, we reduce the time frame.

By the way, it is better to compare both options using an online mortgage calculator, which can be found freely available on the Internet.

Complete turnkey apartment renovation

- Everything is included The cost of repairs includes everything: work, materials, documents.

- Without your participation After agreeing on the project, we only bother the owners when the repairs are completed.

- The price is known in advance. The cost of repairs is fixed in the contract.

- Fixed repair period Turnkey apartment renovation in 3.5 months. The term is fixed in the contract.

Read more about Done

Conditions for early repayment in Sberbank

The issuance of any loan is accompanied by the signing of a corresponding agreement, which stipulates not only the conditions for obtaining a loan. What the borrower is obliged to do and what he has the right to is necessarily recorded in the loan document. Early repayment of the loan (partial or full) is the right of the loan recipient.

The main nuances of early loan repayment:

- Depending on the chosen lending program, a period is determined during which early repayment of the loan cannot be made. The bank can set different terms, from three months to two years.

- Repaying the loan before the due date does not involve charging a fee. Apart from this, there are no penalties. By the way, until the end of 2011, a commission fee was charged on the amount deposited in case of early repayment of the loan. And only after amendments were made to the Civil Code of the Russian Federation, banks lost this pleasure.

- In the partial repayment aspect, any amount is deposited but the payment is made as per the date specified in the schedule.

That is why it is important for a bank client to know all the clauses of the loan agreement.

Your loan has been approved!