The article describes the key regulatory requirements governing the introduction of summarized recording of working time, and discusses some practical aspects of such accounting.

Article 104 of the Labor Code of the Russian Federation establishes that summarized recording of working time is introduced in those industries where conditions do not allow compliance with the norm of daily or weekly working time, and that the duration of working time for the accounting period (no more than one year) should not exceed the normal number working hours.

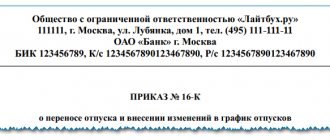

The procedure for introducing summarized working time recording

In accordance with Part 3 of Art.

104 of the Labor Code of the Russian Federation, the procedure for introducing summarized recording of working time is established by the internal labor regulations (hereinafter referred to as the VTR rules). At the same time, the legislator does not establish a special procedure for the organization’s transition to summarized recording of working hours. Based on the normatively established formulations, we can conclude that the VTR rules should only provide for the procedure for introducing summarized recording of working time, and the accounting procedure, determination of the accounting period and other issues can be fixed by local acts of the organization, if the VTR rules provide for and consolidate the corresponding regulations. In particular, it can be established that summarized recording of working time in an organization must be introduced by order (instruction) of the employer, taking into account the opinion of the elected body of the primary trade union organization. Summarized recording of working time can be introduced throughout the organization or for specific employees, in whose employment contracts this procedure for recording work must be established. The document defining the introduction of summarized recording of working time must be presented by the employer to each employee affected by it for review against signature. The VTR rules, which were initially approved by the organization and do not provide for the introduction of summarized recording of working hours, must be amended accordingly. According to Part 1 of Art. 190 of the Labor Code of the Russian Federation, the VTR rules are approved by the employer, taking into account the opinion of the representative body of employees; accordingly, when making changes to the VTR rules, this procedure must be followed. Based on Art. 372 of the Labor Code of the Russian Federation, before making a decision, the employer must send a draft local regulatory act and justification for it to the elected body of the primary trade union organization, representing the interests of all or the majority of employees. In turn, the employee representative, no later than five working days from the date of receipt of the draft VTR rules, sends the employer a reasoned opinion on the draft in writing. If the reasoned opinion of the elected body of the primary trade union organization does not contain agreement with the draft rules or contains proposals for its improvement, the employer may agree with it or is obliged, within three days after receiving the reasoned opinion, to conduct additional consultations with the elected body of the primary trade union organization of workers in order to achieve a mutually acceptable solutions.

If the parties do not reach an agreement, the disagreements that arise are documented in a protocol, after which the employer has the right to adopt a local regulatory act. In turn, the elected body of the primary trade union organization has the right to appeal the text of the rules approved by the employer in the relevant state labor inspectorate or in court.

If there is no primary trade union organization or unites less than half of the workers, at a general meeting (conference), workers can entrust the representation of their interests to a representative (representative body) elected from among the workers (Article 31 of the Labor Code of the Russian Federation).

The procedure for introducing summarized accounting

According to Art. 104 of the Labor Code of the Russian Federation, the procedure for introducing summarized recording of working time is established by the internal labor regulations (hereinafter referred to as PVTR).

The PVTR regulates the working hours, rest periods, incentive and penalty measures applied to employees, as well as other issues of regulating labor relations with a given employer.

Summarized recording of working time at an enterprise can be introduced by order (instruction) of the employer, taking into account the opinion of the elected body of the primary trade union organization (if the enterprise has a trade union).

Summarized working time tracking can be introduced throughout the organization or for specific employees. The condition of summarized accounting must be included in the employment contract.

According to Art. 74 of the Labor Code of the Russian Federation, if the terms of the employment contract determined by the parties, related to changes in organizational or technological working conditions, cannot be preserved, they can be changed at the initiative of the employer, with the exception of changes in the employee’s labor function.

That is, if the PVTR did not initially provide for summarized recording of working time, appropriate changes must be made when applying it.

Keeping records of working hours

In accordance with Part 4 of Art. 91 of the Labor Code of the Russian Federation, the employer is obliged to keep records of the time actually worked by each employee. For these purposes, unified forms No. T-12 and T-13 have been developed [1]. The time sheet is compiled in one copy by an authorized employee and submitted to the accounting department. A completed and signed time sheet is the basis for settlements with employees and the calculation of wages. The shelf life of the working time sheet is five years, and in difficult, harmful and dangerous working conditions - 75 years[2]. If an organization gives employees an advance (for the first half of the month), then the timesheet should be prepared twice a month, separately for the first and second part of the month.

Automation of summarized working time recording

To correctly record the total working time, schedules are drawn up, but this is not always convenient when there are a large number of employees. For personnel working at a computer, time tracking can be automated based on the modern and convenient Bitcop system, which unobtrusively monitors the employee’s activities at the PC, accurately recording the actual duration of working periods and idle periods.

If the specifics of the activities of all employees or part of the team are such that they are faced with a plan to produce a certain useful number of hours over a set period, then Bitcop is ideal as a system that will reliably calculate the actual time worked.

Summarized working time recording

“Budget-funded educational institutions: accounting and taxation,” 2010, N 4

Summarized accounting of working hours

Summarized accounting is a special procedure for distributing and recording working time. The introduction of summarized accounting allows you to adjust the length of time worked within the accounting period (month, quarter or year) if it deviates from the established norm, that is, overtime on some days is compensated by underwork on others. As a rule, in educational institutions such records are introduced not for the institution as a whole, but for individual categories of employees. These include watchmen, drivers, watchmen, operators in boiler rooms, etc. We will tell you in the article how to properly organize and formalize the introduction of such accounting in an institution and how to calculate wages for these employees.

Introduction of summarized working time recording

According to Art. 104 of the Labor Code of the Russian Federation, summarized recording of working time is introduced when, due to working conditions in the organization as a whole or when performing certain types of work, the daily or weekly working hours established for a given category of workers cannot be observed.

When introducing summarized accounting, you must:

1. Establish its procedure by internal labor regulations. Let us remind you that the internal labor regulations are established in the form of a local regulatory act that regulates, in accordance with the Labor Code and other federal laws, the procedure for hiring and dismissing employees, the basic rights, duties and responsibilities of the parties to the employment contract, working hours, rest periods, measures applied to employees incentives and penalties, as well as other issues of regulating labor relations with this employer. Such rules are approved by the employer, taking into account the opinion of the representative body of employees in accordance with Art. 372 of the Labor Code of the Russian Federation and are attached to the collective agreement (Article 190 of the Labor Code of the Russian Federation).

2. Approve the list of employee positions for which summarized recording of working time is introduced.

Minimum wage with summarized recording of working hours

01.10.2018

Question:

Part 3 of Art. 133 of the Labor Code of the Russian Federation establishes that the monthly salary of a person who has fully worked the standard working hours during this period and fulfilled labor standards (labor duties) cannot be lower than the minimum wage.

Thus, if these conditions are not met, the Labor Code of the Russian Federation allows for the possibility of paying wages in an amount that is less than the minimum wage.

How to make payment for labor (in an amount corresponding to the minimum wage when recording working hours summed up, or in proportion to the time worked), if within one month an employee of the institution worked the standard hours established according to the schedule, but did not fulfill the standard hours for this month?

Answer:

Article 104 of the Labor Code of the Russian Federation allows for the introduction in an organization as a whole or when performing certain types of work of a summarized accounting of working time, if the daily or weekly working time established for a given category of workers cannot be observed, so that the working time for the accounting period (month, quarter and other periods) did not exceed the normal number of working hours. In this case, the accounting period of working time cannot exceed one year.

For your information:

when the accounting period is a month and the employee has worked part-time, wages are calculated from the minimum wage in proportion to the time worked.

The normal number of working hours for the accounting period of working time is determined based on the weekly working hours established for this category of workers. For employees working part-time (shift) and (or) part-time week, the normal number of working hours during the accounting period is correspondingly reduced.

The normal number of working hours for the accounting period of working time is distributed over months or weeks based on the shift schedule.

However, if the institution keeps a summary record of working time and a shift schedule is drawn up for the accounting period, then it is for this accounting period that the work rate established for the employee is distributed during the summary recording of working time. At the same time, in different weeks (months) an employee can work a different number of hours so that he fulfills the accounting labor standard for the accounting period when recording working hours together.

The schedule is developed by the manager for the year so that overtime is not allowed due to the fact that in some months work hours are reduced, which is why the standard hours are not met in these months, while in another month the standard may be exceeded.

Thus, if an employee works less than the standard working time in a certain month of the accounting period, which is set at six months (year), then payment is made in the amount corresponding to the minimum wage for the summarized accounting of working time; since the employee worked all the hours that were provided for in his schedule, he should be considered to have fully worked his monthly work quota. This option is suitable for calculating wages if the accounting period in the institution is a quarter or a year.

For your information:

when a time-based wage system (salary, official salary) is introduced in an institution and a summarized accounting of working time is established with an accounting period of more than one month, even if the labor standard is not met in any month within the accounting period, the salary is paid in an amount not less than the minimum wage.

It is necessary to take into account: if during the accounting period there is a failure to comply with the standard working hours due to the fault of the employer, then the employer is obliged to pay for this period (unworked hours) in an amount not lower than the average salary of the employee in accordance with Art. 155 Labor Code of the Russian Federation. For example, if the accounting period is a month and the employee did not fulfill the work standard due to the fact that the employer drew up a shift schedule, then the fault for failure to comply with the standard lies with the employer, so payment is made in an amount not lower than the average salary of the employee, calculated proportionally actual time worked.

Shklovets I. I., expert of the information and reference system “Ayudar Info”

Send to a friend