A Sberbank mortgage for the purchase of a house is a fairly popular loan product. It is especially in demand among owners of maternal capital who want to use it as a down payment. However, taking out a mortgage on a private house from Sberbank may be more difficult than purchasing an apartment using the same method. The fact is that this transaction has significant features that should be taken into account; we will talk about all its nuances further.

Sberbank mortgage terms for a house

They allow you to purchase not only a ready-made building, but also to build it yourself on a plot of land. The intended use of the loan is quite broad and should be associated with the registration of ownership of a residential building. Thus, the funds received can be used for certain purposes:

- purchase of a finished house with an associated plot of land;

- building a house on your own land;

- construction of a residential building with the simultaneous acquisition of a land plot.

A mortgage for a house with a plot in Sberbank

provides for construction with the involvement of a contractor and on your own. You can also purchase a plot of land with an unfinished object in order to complete it using loan funds.

A Sberbank mortgage manager will help you choose the optimal type of lending, because a lot depends on this. If you use the government assistance you are entitled to, you can save a lot on interest payments.

Mortgages from Sberbank for the purchase of a house are available under the following programs:

- Purchase of real estate under construction. Involves registration of ownership of a residential building on the primary market. The loan amount starts from 300 thousand rubles and cannot exceed 85% of the value under the investment agreement. Debt repayment period is up to 360 months, interest rate starts from 6.5%, down payment from 15% ().

- Mortgage for finished housing. Issued for the purchase of a residential building on the secondary real estate market. The loan amount also starts from 300 thousand rubles and is limited to 85% of the estimated or contractual value of the collateral. The loan repayment period is up to 360 months, the down payment is from 15%, the interest rate starts from 8.5%.

- Mortgage program for the construction of a residential building. The loan amount is from 300 thousand rubles, but not more than 75% of the value of the collateral object or the contract price of the building being built. Loan repayment period up to 360 months, down payment from 25%, interest rate from 9.7%.

- Mortgages for military personnel also allow you to buy a residential home on credit. The amount can reach 2.629 million rubles and depends on the cost of the purchased object. Loan repayment period up to 240 months, fixed rate 8.8%. The first installment is paid from the savings of the NIS participant ().

- Your own turnkey home is a special lending program for residents of the Moscow and Lipetsk regions. Construction is carried out only by Sberbank partners, and the borrower will receive the finished house within 3 months after the mortgage is issued. The procedure for applying for a loan follows a simplified procedure, because the client does not have to provide an estimate or additional collateral. The interest rate starts from 10.9%, amount from 300 thousand rubles, down payment from 15%, repayment time up to 360 months.

At Sberbank, a mortgage for a house requires collateral. But according to some programs, it is not necessary to formalize collateral for the loaned object (that is, the house itself with land), if the loan amount does not exceed 1.5 million rubles. A guarantee from an individual will be sufficient.

When obtaining a mortgage for the construction of a residential building, the debt must be secured for the period of construction of the main collateral. The bank will issue an encumbrance on the land plot, but this amount is often not enough to cover the entire loan amount. This means you will have to attract a guarantor or pledge your own property. After completion of construction, the residential building is registered as a property and pledged to the lender; other security options are canceled.

The terms of a Sberbank mortgage for the purchase of a house require a rate that depends on certain factors. The future borrower will be able to save on the overpayment if he takes into account the peculiarities of its formation. The mortgage percentage for a house in Sberbank may differ depending on the chosen program, but for the main ones the adjustment is as follows:

- +0.4% when depositing less than 20% with your own money;

- +0.5% for non-wage earners;

- +0.8% in the absence of proof of income and employment;

- +1% if the borrower is unwilling to insure himself.

The main difference between a Sberbank mortgage for the purchase of a house and a loan for suburban real estate is that it is given for the purchase of residential real estate. The second program involves the purchase of a non-residential dacha building.

Mortgage conditions for a house with land

Lending rates for such programs are usually slightly higher than for apartments. They start at 8.5% per annum, with the exception of specialized programs for corporate clients, who can be loaned at 7.7% per annum.

Another exception is the government-subsidized rural mortgage program. Within the framework of this program, you can get a loan at 2.7-3% per annum, but provided that the house being purchased is located on land recognized as rural. In most regions, these are defined as lands in the suburbs of large and medium-sized settlements or in small towns with a population of up to 30 thousand people.

“Each bank’s conditions are purely individual,” Reshetnikova clarified. — For most mortgage programs for a house with land, the down payment amount will be 25–50%. But there are also programs where they are ready to consider clients with a down payment of 10%.”

pixabay.com/

Government subsidies

Does Sberbank provide a mortgage for a house with the possibility of attracting funds from housing certificates and subsidies? Since residential real estate is being taken into ownership, borrowers can resort to different options for government assistance. They have the right to apply for a loan on special conditions:

- Use matkapital as a down payment or send these funds to pay off an existing mortgage ().

- Subsidy to lower interest rates. Families who welcomed a second baby between 2021 and 2022 can obtain or refinance a mortgage at 5-6% per annum ().

- Use federal and regional housing certificates to pay part of the cost of a residential building or as a down payment on a mortgage. Conditions are determined by the rules of participation in this program.

Earlier, Sberbank announced its intention to begin issuing rural mortgages. This program allows you to get a loan for the purchase of residential space in a village at 2-3% per annum (). But at the moment the bank has not yet formed an offer.

How do we pay?

Mortgage payment 21,200 rubles per month. We took out a mortgage for 30 years (we specifically took the longest term, since I was on maternity leave, we wanted to insure ourselves). We are gradually doing some minor cosmetic repairs; this year we went to the sea together (we took a mini-vacation for the first time in 4 years).

I want to say that there is life with a mortgage. I would like to close it faster, but for now I have slightly different priorities. If it were just the two of us, we would do the closing, but we have a rather large family in which everyone wants something.

The money for payment is always in cash in the safe. This is a guarantee that they will not be spent accidentally or written off for any services. In addition, there is always money for another payment as a cushion.

Requirements for the borrower

At Sberbank, a mortgage for a house with a plot of land (as well as other housing loan options) is available only to trustworthy clients. The bank carefully checks each applicant, as well as other participants in the mortgage transaction - co-borrowers, guarantors, mortgagors. A good banking history, the presence of a white salary () and the client’s credit load are of great importance. The official requirements look like this:

- Russian citizenship;

- age from 21 to 75 years (and the maximum age limit is taken into account at the time of planned repayment of the mortgage);

- work experience of at least six months at the current job, total - from 12 months.

Please note that the listed requirements apply not only to the main borrower, but also to other participants in the mortgage.

It is easiest for salary clients to get a mortgage for a residential building from Sberbank. At the initial stage of consideration, they will only need a passport; the bank will be able to verify all other data independently. In addition, applications from salary account holders are processed much faster and more loyally. The likelihood of mortgage approval is very high.

Recommended article: What documents are needed to refinance a mortgage

How to get a mortgage on a house from Sberbank if your salary is not enough? The borrower can involve up to three co-borrowers in the mortgage transaction, and not only relatives. Mortgage with friends - nuances, pros and cons - are described in another article. Then their salary will be taken into account when calculating their creditworthiness. This means that the approved loan amount will be higher. In this case, the borrower’s spouse must become a co-borrower on the mortgage (except for cases of drawing up a marriage contract and foreign citizenship). How to take out a mortgage without the participation of a spouse - read in detail in another article.

Package of documents from the borrower

If you decide to take out a mortgage to buy a house from Sberbank, you should pay special attention to the package of documents provided. A passport is enough for paying clients, but the rest will have to order some papers from the accounting department.

So, what will be required at the first stage of mortgage consideration from all its participants:

- passport;

- questionnaire (not required when submitting an application through DomClick, because it is electronic in the service);

- a second document confirming your identity – when applying with a minimum package of documents (this could be a driver’s license, foreign passport, etc.);

- certificates of salary, other financial income () About mortgages based on a bank certificate can be found in another article;

- tax return – for private entrepreneurs ();

- a copy of the work book certified by the employer;

- for state assistance programs: marriage certificates, birth of children, certificate for maternity capital, certificate of maternity capital for a mortgage, other papers confirming the right to state support, etc.

A mortgage on a private house in Sberbank

can be taken out using two documents. But for this, the borrower needs to provide a contribution with his own funds of at least 50% of the cost of the residential building.

Remember that the income certificate and a copy of the work book are valid only for a month after their issuance. All validity periods for mortgage certificates are in another article. The documents must also contain mandatory details. In particular, the most important are the signature of the responsible representative of the organization and the seal. If necessary, the bank has the right to request other papers.

Requirements for the property

A Sberbank mortgage for a private house is riskier than a housing loan for the purchase of an apartment. The fact is that land plots and associated buildings are a less attractive collateral. In case of non-payment of the loan, it will be problematic to sell such real estate. Therefore, the requirements for a house with a Sberbank mortgage are quite serious:

- the object must be located in Russia;

- ownership is formalized in accordance with the established procedure;

- no arrest, lien or other encumbrance has been imposed;

- the property is liquid, that is, it is in good condition and can be sold if necessary (not dilapidated, not in emergency, etc.);

- there should be no illegal redevelopment and reconstruction;

- land acquired for subsequent construction must be located in a village or hamlet and allow subsequent registration of residential real estate (category of individual housing construction, private subsidiary plots on the territory of a populated area);

- the house is a residential building;

- the land plot must be demarcated (that is, have officially established boundaries).

How banks check an apartment for legal purity is described in another article.

Until what year are houses eligible for a Sberbank mortgage?

There is no exact date; the lender looks at the general condition of the building and its liquidity. However, it will definitely not be possible to buy an old house with a Sberbank mortgage , because in case of non-payment, the lender will not be able to sell it to pay off the debt. The percentage of wear and tear on the house should not be more than 50%.

Which houses are suitable for a mortgage at Sberbank should be clarified in advance, even before filling out an application for a loan. After approval, select the real estate option that is more likely to be agreed upon. You can turn to a realtor for help, but it is better to opt for bank partner companies.

It is worth noting that buying a house through a Sberbank mortgage is possible if the land plot is under long-term lease. However, in this case there are significant restrictions on the transaction. The specifics of obtaining such a loan should be clarified with the bank, having previously agreed on the documents with its legal department.

Recommended article: Refinancing a Sberbank mortgage at Rosselkhozbank

Real estate documents

depends on whether the property is being purchased as a finished property or is still under construction. When purchasing a residential building on the secondary market, the list of required papers is much more extensive. Most of them are provided by the seller, but some will have to be ordered by the buyer.

To buy a house through a Sberbank mortgage during the construction phase, you need to provide:

- documents for the land plot (USRN extract, etc.);

- land assessment report;

- estimate for the construction of a residential building;

- agreement with the contractor, if it is involved in the construction process;

- receipts for partial payment, if it has already been made (the bank can count these funds as a contribution with its own funds);

- permission for construction if it will be carried out on your own land.

A package of documents in Sberbank for a mortgage on a house - secondary housing:

- extracts from the register of rights to a residential building and land plot;

- the document on the basis of which ownership rights arose;

- technical passport for the building;

- draft purchase agreement;

- copy of the seller's passport;

- appraisal report (ordered by the borrower);

- certificate of registration;

- consent of the seller’s spouse to conduct the transaction (in accordance with);

- permission from the buyer’s spouse to encumber the property in favor of the bank;

- other documents, if required.

Remember that you are purchasing not only a residential building, but also the land on which it is located. Both real estate objects are pledged to the bank because they are inseparable from each other. If there are other buildings on the land, and the title to them is registered (bathhouse, barn), they will also be encumbered.

It is necessary to pay special attention to. The document is drawn up either according to a bank sample, or in strict accordance with the requirements of the lender. Which points should be contained in the text:

- the subject of the agreement is not only a residential building, but also the associated land plot and other buildings on it;

- Basic data about the property must be written down (exact address, area, cadastral numbers, etc.);

- the total cost of the Sberbank mortgage transaction for a house with land and separately for each property is indicated;

- the rules for monetary settlements are stipulated: part of the amount is transferred with one’s own funds, the second part – through a mortgage;

- The details of the seller’s account, where the bank subsequently transfers the borrowed funds, must be indicated;

- it is necessary to register the personal details of the people currently registered in the house, and when they will be discharged;

- in Sberbank, a mortgage on a finished house requires the registration of a pledge; this should also be reflected in the text.

Separately, it is worth mentioning the assessment of a house for a mortgage in Sberbank. This document is ordered by the seller (buyer) at the stage of checking the property. What exactly will the specialist evaluate? The loaned object and the collateral, if the borrower provides the bank with other property as collateral. In this case, the total value of the land plot and the residential building located on it is assessed.

The cost of appraising a house for a Sberbank mortgage is quite high. The average price is 5-10 thousand rubles and depends on the remoteness of the property being assessed and its characteristics. You can order a home appraisal for a Sberbank mortgage only from an accredited company. You can find a list of them on the credit institution’s website. The bank can accept assessment reports from other companies, but only after a lengthy check, but a positive result is not guaranteed. Real estate valuation for mortgage in Sberbank - list of accredited appraisers, price, terms, procedure in detail in another article.

How to apply

At Sberbank, a mortgage for the purchase of a private home can be obtained in the traditional way by contacting a bank branch. Or submit an application and receive approval (including for a real estate property) remotely through the DomClick portal. This service allows you not only to submit an initial application form for consideration, but also to coordinate a transaction with the bank as remotely as possible. In addition, this way you can get a discount on the interest rate.

The DomClick website requires registration using a mobile phone number, but you can also log in using your existing credentials from Sberbank Online. The second option is preferable, because the bank will be able to identify its client, which means the review will be easier and faster. An online application for a Sberbank mortgage on a house is submitted as follows:

- Log in to the DomClick portal using your login and password from your Sberbank client’s personal account.

- Select the Mortgage section, then Mortgage Calculator.

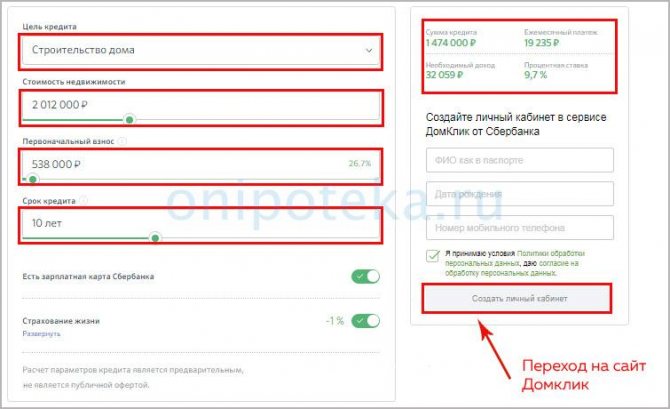

- Specify the purpose of the loan, the value of the property, the size of the down payment, the repayment period and other conditions (whether you are a salary earner, whether you will insure life, etc.).

- Once you have calculated the mortgage for a house at Sberbank using a calculator and found out the basic parameters of the future loan, you can proceed directly to filling out the loan application.

- After this, you need to fill out a form in which you enter your name and passport data, information about your job and marital status.

- After consideration, the bank will give a preliminary response on the application.

- Next, follow the instructions of the service to approve the selected property.

The Sberbank mortgage calculator for buying a house is also available in the description of the lending program. Here you also need to indicate the purpose of the loan, the value of the property, the size of the down payment, the repayment period, the availability of a Sberbank salary card and other details. The calculation result will automatically appear in the field on the right. If the data obtained in Sberbank’s mortgage calculator for purchasing a house suits you, you can immediately submit an application for consideration. To do this, you will have to go to the DomClick portal. How to calculate a Sberbank mortgage using a calculator in 2021 - read more in another article.

Important to know: Reasons for refusal of a mortgage: what should borrowers take into account?

How to find out if a mortgage has been approved by Sberbank via the Internet

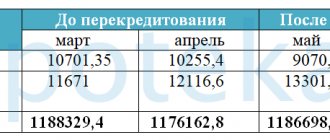

Sberbank mortgage payment schedule

Is it worth applying for Domklik mortgage reviews online?

How to calculate a Sberbank mortgage using a calculator in 2020

Requirements when applying for a mortgage on a plot of land

There is a certain list of conditions that all banks follow. The applicant must meet the following:

- Be over 18 and under retirement age;

- Be a citizen of the Russian Federation;

- Be registered where the pledgor's branch is located;

- Have a good credit history;

- Have a permanent job. Work experience in the last position must be at least 1 year;

- Have a stable income that will allow you to make monthly loan payments.

If a person meets all the points described above, in order to obtain a mortgage for the purchase of a land plot, he needs to collect and present the following list of documents:

- An act confirming the seller’s ownership of the land plot;

- A certificate with state registration of ownership of the claimed plot;

- Cadastral plan of the land, indicating all the necessary items, including number, location, category of the plot, its area and price;

- Title document;

- A certificate from the technical inventory bureau confirming the absence of buildings on the declared site;

- An expert report compiled by an independent appraiser;

- If the land plot is owned by both spouses, the consent of the second spouse to sell must be certified by a notary;

- In the case of co-ownership of a plot by a person who has not yet reached 18 years of age, permission from the guardianship and trusteeship authorities is required.

Transaction procedure

After using Sberbank’s online home mortgage calculator and filling out the application form, the client receives a preliminary decision. He will have to select a property and coordinate it with the bank. When the final answer has already been given by the lender, you can proceed directly to the mortgage transaction.

How to apply for a mortgage on a house at Sberbank:

- The borrower transfers the down payment to the seller using his own funds. If maternity capital is used, this point is skipped - the owner of the house will receive the full amount after registering the transaction in Rosreestr. At the same time, the purchase agreement is signed.

- Then the loan documentation is completed at the bank.

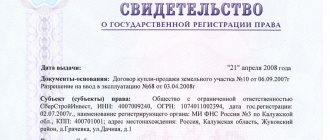

- A package of documents is submitted for registration to Rosreestr. You will need a signed purchase agreement, a loan agreement, a mortgage (if there is an electronic mortgage, then you will not have it on hand), an extract from the register of real estate rights, and a receipt for payment of the state duty. If the client takes out a loan for construction on his own site, there is no need to register the transaction, but a pledge must be issued in favor of the bank (if this is provided for by the terms of the agreement).

- After receiving from Rosreestr documents confirming ownership and the presence of a pledge in favor of the bank (extract from the register of real estate rights, registered purchase agreement), loan funds are issued. As a rule, they are transferred first to the borrower's account, from where they are sent to the seller. How money is transferred during a mortgage to the seller is described in more detail in another article.

Please note that technical documents for the transaction itself are not submitted to the MFC (Rosreestr), but may be required during the process of approving real estate by the bank.

You can submit documents for a transaction not only at the registration authority itself, but also at the MFC, a notary office (if the transaction requires the participation of a notary), and at a bank through an electronic document management system. The pros and cons of electronic transaction registration in Sberbank are described in another article. The last option, how to get a mortgage on a house in Sberbank, is paid. It will cost 7,900 - 10,900 rubles, but the borrower and the seller will not have to go anywhere else. You can also order on-site registration (a specialist comes to the bank office himself), the cost depends on the region, you can find out more by calling 8.

There are also several ways to pay for real estate (down payment and loan funds):

- in cash, in this case the seller draws up a receipt (a sample receipt is in the article - All about the down payment on a mortgage;

- transfer to a current account, leaving the payment order in the borrower’s hands;

- using a safe deposit box - funds are placed in it at the time of signing the loan agreement, the seller takes them after registering ownership of the buyer;

- placement of the amount in a special account, where they are stored until the registration of ownership of the borrower.

The first method is more risky, but it is free. When transferring money from a current account, a commission may arise according to Sberbank tariffs. Using a safe deposit box and a special account is more expensive; the cost is calculated based on the amount and period of placement of money. Also, it is impossible to register a cell if there are more than two sellers.

How to get a mortgage on a plot of land from a bank

Sberbank captured the lion's share of the lending market. The country's largest bank offers programs that cover almost all the needs of the population, including land mortgages. This is one of the reasons for the popularity of Sberbank among the population, which explains the huge number of requests for financial assistance. There are no more requirements for the client here than when applying for other credit products.

You need to convince the bank of your solvency and provide a clean credit history for consideration of the application. These papers will be paid attention first, and the remaining documents are not so significant. If the borrower is a regular customer or receives a salary on a bank plastic card, the interest rate for him will be lowered and the list of supporting documents will be shortened.

You can view the consumer financing programs offered on the website of your chosen lender. An online calculator located on one of the pages will help you simulate the situation. Filling out does not require deep knowledge of economics. The borrower needs to enter the amount he wants to borrow. The remaining actions come down to selecting the conditions established in the program. It's impossible to make a mistake.

The calculator will determine the interest rate, end date and monthly payment. In graphical or tabular form (user's choice) it will show the corresponding repayment schedule. All information can be obtained at the bank office, but much more time is spent on this. If a financial institution has a lot of clients, you will have to wait in line. However, with personal communication it is possible to clarify unclear points.

Rosselkhozbank also gives money for land. The conditions for granting a loan, as well as the procedure for drawing up an agreement, do not differ from other financial offices. Any large bank values each client, therefore it controls the level of their service. Qualified employees of the organization will explain every little detail so that the person who applies has no doubts about the correctness of the choice made.

Costs of buying a house with a mortgage

Sberbank's calculator for a mortgage on a private house does not take into account the costs that the borrower will necessarily encounter during the transaction. Some expenses depend on the characteristics of the loan, but there will always be certain expense items. In particular, you will have to pay:

- State fee for registration of property rights (). When purchasing a house, you must deposit 2,000 rubles, and a plot of land – 350 rubles. Registration of a mortgage agreement for your own property costs 1,000 rubles, in this case the fee is divided equally between all parties to the transaction (the bank and the mortgagors).

- Insurance of collateral property (mandatory in accordance with). The price of home insurance at Sberbank for a mortgage is on average 0.1% -0.2% of the amount of the current debt. Insurance must be taken out every year.

- Financial protection of life and health is not necessary (). But if you decide to purchase it, the cost is calculated individually. On average, you will have to pay 0.5% -1.5% of the loan amount. The insurance is renewed every year, the price depends on the size of the current debt. We analyzed where mortgage insurance is cheaper in another article.

- If necessary, a notary is involved in the transaction. On average, the cost of his work starts from 5,000 rubles and depends on the cadastral price of the property, services provided, etc.

- The assessment report will cost 5-10 thousand rubles.

Home insurance for a Sberbank mortgage

is issued only through accredited insurance companies.

A list of mortgage insurance companies accredited by Sberbank is in another article.

When calculating a Sberbank mortgage on a house, these expenses should be taken into account, because they are paid from the borrower’s own funds. But you can save money on some of them. For example, before insuring a house with a Sberbank mortgage, compare prices from different insurance companies and choose the best ones.

Rate the author

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Date of publication May 6, 2020 May 6, 2020

Expenses

What else you need to pay attention to is the possible costs. In an ideal situation, the buyer pays only for the apartment and insurance. However, the seller may offer to share the costs if such costs are too significant for him. So, for example, a tentative list of expenses would look like this:

- Payment to a real estate agency for finding a seller (or, if the seller asks, for finding a buyer and supporting the transaction): about 2-5% of the cost of the apartment.

Example: If we assume that housing costs 5 million rubles, then the agency’s services will cost 100–250 thousand rubles.

- Payment to the notary for certification of the purchase and sale agreement: about 5-10 thousand rubles.

- Payment to a notary for certifying the consent of the spouse: from 2 thousand rubles.

- Payment to an appraisal company for assessing a home: about 10-15 thousand rubles.

- New extract from the Unified State Register of Real Estate: 350 rubles.

- New registration certificate: from 10 thousand rubles.

- State duty for registering property rights: 2000 rubles for each new owner.