Home » Division of property » Power of attorney for the purchase of an apartment

4

A power of attorney is used primarily for the sale, rather than the purchase, of an apartment, however, the opposite situations also occur. If the buyer has a trusted person or hires one specifically for such a transaction, this can, in some cases, make the process more reliable and increase the likelihood that the buyer will get exactly what he wants.

When may you need to use a power of attorney to purchase an apartment?

A power of attorney to purchase an apartment may be needed in the following situations:

- The principal is ill and cannot independently purchase an apartment. At the same time, the need for housing is acute. The buyer cannot afford to wait until he recovers.

- The principal is disabled and physically cannot perform this procedure. Usually, in this case, the main negotiations are carried out in person between the buyer and the seller, and the authorized representative collects the documents, inspects the apartment, and so on.

- The principal is not confident in his abilities and is afraid that he might overlook something important. He hires a specialist (lawyer or realtor) who takes care of the home purchase instead.

- The client doesn't have time. He is actively working, on a business trip, and so on. You can find a trusted person among relatives, friends, acquaintances, or hire a specialist. Typically, this situation is relevant if the principal really earns a lot of money and if he stops working even for a short time, there is a possibility that the income will drop sharply.

- The principal is in another city. Most often, the need for a power of attorney arises when the principal is geographically located in another city or even another country. As a result, it is at least inconvenient for him to personally search for an apartment, buy it, and so on. The authorized person performs the main actions (searches for housing, inspects it, prepares documents, checks papers received from the seller, and so on), and the principal signs the contract directly. There may be other options.

There can be a huge number of similar situations. As practice proves, a power of attorney is the only way to purchase an apartment if the buyer himself cannot or does not want to do this personally.

Types of powers of attorney for the purchase of an apartment

There are two main types of powers of attorney: general and general. Both can be used to purchase an apartment, however they are slightly different from each other. When purchasing a home through a trustee, you need to decide in advance what powers to give to such a person.

Ordinary power of attorney

An ordinary power of attorney involves the performance of specific tasks. They are all clearly stated in the power of attorney. Such a document is considered more reliable due to the fact that the trustee is strictly limited to certain limits and does not have the right to act on behalf of the principal in any cases not specified in the power of attorney.

What can a power of attorney allow you to do?

Formally, this list is not limited. However, if we talk about those actions that occur most often, the list of acceptable functions of a trusted person may look like this:

- Finding a suitable apartment . Most often, the principal reserves this point for himself, since only he knows what exactly he needs.

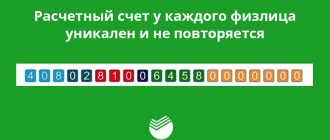

- Collection and verification of documents . The buyer only needs a passport and, sometimes, a bank account statement (to confirm solvency). But the seller is obliged to provide a fairly extensive list of papers. They all need to be checked so as not to fall for scammers or get unnecessary problems.

- Signing the contract and other documents . If the trustee is considered a reliable person, he may be allowed to sign the purchase and sale agreement, inspection report, acceptance certificate, receive a receipt from the seller, and so on.

- Registration of property rights . Most often, this is done personally by the new owner, but this task can also be performed by a trusted person.

- Settlements with the seller . Settlements with the seller are a very important point that the buyer almost always reserves for himself. But this can also be done by a trusted person.

General power of attorney

A general power of attorney differs from an ordinary one only in that it has practically no restrictions. The authorized person under such a document receives the right to deal with the purchase completely independently. Of course, it can report to the principal on the work done, but it still makes decisions itself. Typically, a general power of attorney has only one specific limitation: the document is relevant only for all situations related to the purchase of one specific apartment.

If the power of attorney has no restrictions at all, then the trustee can, on behalf of the principal, use any property, accounts, money, equipment, and so on, belonging to the principal. Such documents are used quite rarely and mainly only in relation to those persons who cannot independently dispose of property for some reason.

Possible buyer risks

But on the part of the buyer making a transaction through an intermediary, there are much more risks. The most common are the following:

- The author of the power of attorney revoked the power of attorney before its expiration. The transaction will be declared invalid, even if the buyer and the trustee themselves did not know about it.

- The principal has died. In this case, only his heir can sell the property, and he still needs to enter into inheritance. In any case, the power of attorney becomes invalid upon the death of the principal.

- The principal was incompetent at the time of writing the power of attorney or did not give an account of his actions while in a state of intoxication. Fraudsters often take advantage of the client’s deranged state by colluding with doctors at specialized clinics. As a result, the power of attorney is actually signed by the sick person. If his relatives prove this fact, the deal will be annulled.

- If the principal was intimidated or misled. After the trial, such a power of attorney will be revoked, and all transactions carried out under its existence will be cancelled.

- The author of the power of attorney may be listed as missing. If his relatives achieve recognition of him as dead through the court, then transactions made on his behalf will be declared void.

This is important to know: Buying an apartment from a legal entity: buyer’s risks

Thus, for the buyer, the most important risk is the likelihood that the apartment purchase and sale agreement will be invalid due to the termination of the power of attorney. As a result, the court will oblige the buyer to return the home to the true owner, and the money will have to be “knocked out” from the scammer’s wallet. But this takes time and is not guaranteed to be successful.

How to issue a power of attorney to purchase an apartment

Drawing up a power of attorney (ordinary or general, in this case it doesn’t matter) is quite simple. Of course, provided that the principal has the opportunity to personally visit the notary.

Procedure

- Discuss with a trusted representative all the features of purchasing an apartment and give clear recommendations regarding certain actions. Alternatively, if the person does not understand anything about this at all, you can allow the trustee to act completely autonomously. This is dangerous, but sometimes only this approach can give the desired result.

- Find a suitable notary who will be ready to draw up and certify the power of attorney in the form that the principal needs.

- Visit a notary in person or order service at home. It must be remembered that the notary's visit is paid separately. Sometimes this is a percentage of the standard payment, but more often the amount for a specialist’s visit is fixed.

- Draw up, sign and have a power of attorney certified by a notary.

- Pay for services.

- Give the document to an authorized person.

Documentation

To issue a power of attorney, a notary will need the following documents:

- Passport of the principal and authorized representative.

- The specific text of the power of attorney, or at least the main provisions.

In some cases, the notary may require additional documents. For example, a certificate from the hospital stating that the principal is an absolutely sane person. This is necessary in order to confirm the fact that the principal is acting in his right mind and perfectly understands the possible consequences.

Expenses

Registration, preparation and certification of a power of attorney are paid services. It should be noted that even if the principal prepares the document himself and gives the ready-made paper to the notary, the final cost will change slightly.

Depending on what exactly is required, how it will be described, what restrictions will apply, and so on, the price of a power of attorney can vary from 2 thousand rubles to 10 thousand rubles. It’s almost never cheaper, but it’s also rare that it’s more than 10 thousand.

Deadlines

If the principal is ready to provide absolutely all the necessary information, then he can receive a ready-made power of attorney in a maximum of 1-2 hours after contacting the notary. Often this procedure takes only a few minutes. A lot depends on what exactly is required.

Example: If a general power of attorney is issued without any restrictions, then the notary will only need to enter the data of the principal and the authorized person in a standard form and print it. This is a matter of a few minutes. But if the principal insists that every possible step of the authorized person be described in detail in the power of attorney, it may take several hours to draw up such a document.

If you are in another city

If the principal is located in a different city from the trustee, then the general principle described above will remain virtually unchanged. The only difference is that the finished document will have to be sent to a trusted person in some way. It can be sent with friends, relatives or, for example, a delivery service.

If the principal is located in another country and, at the same time, powers of attorney are drawn up there in another language, an additional notarized translation of the document will be required. Under such conditions, the price may increase significantly. Specific prices depend on the client's country.

Risks

...for the buyer

When purchasing an apartment from the seller’s authorized representative, the following risky circumstances arise:

- An issued power of attorney can be revoked at any time, and the law does not even require the need to inform the authorized person about this. To cancel a power of attorney, it is enough to contact any notary. The authorized person may not be aware that his power of attorney has been revoked. An agreement concluded under a power of attorney, which has no legal force, will be declared invalid.

- A power of attorney may be revoked due to the death of the principal, which may also not be known to the authorized person in a timely manner. Such a transaction will also be declared invalid and terminated, and the apartment will be returned to the relatives of the deceased seller.

- The power of attorney may be revoked if the fact of insanity or incapacity of the principal at the time of its preparation is proven. In addition, the trustee may also be declared insane or incompetent at the time of concluding the transaction, which will also lead to its cancellation.

- The transaction may be postponed due to the disappearance of the principal until the transfer of funds for the purchase. This issue may drag on for a long time - until the court declares him missing.

This is important to know: From what amount can you return 13 percent from the purchase of an apartment: how are they paid?

These are the most likely risks arising from the provisions of the law. As practice shows, in reality these risks are less likely than concluding a transaction with a trusted person and principal who are fraudsters. Their only goal is to deceive the buyer, which will ultimately lead to the latter being deprived of both money and real estate.

...for the seller

The risk of losing funds that a trusted person will appropriate for himself and disappear with them. It is impossible to guarantee that the trustee will properly fulfill all of his agreements. Therefore, most often a power of attorney is issued to close relatives, friends, and in some cases it can be issued to realtors to conclude a transaction.

It is possible to recover your money only by knowing the location of the trustee and having convincing evidence of where the funds went after they were received from the buyers. In practice, as we understand, this is not so easy to do. Both the buyer and the seller of real estate may find themselves in a deplorable situation.

Therefore, it is not recommended to issue a general power of attorney to the representative for any actions with the property. The safest option would be for the principal to issue a power of attorney for individual actions step by step, as they are completed. So, at any stage of the transaction, the seller can control the progress of its implementation, make adjustments, and even replace the authorized representative or complete the transaction independently.

Who can issue a power of attorney to purchase an apartment?

In some cases, there is not a single notary physically surrounded by the principal and there is no way to get to places where there are notaries within a reasonable time. In such a situation, other persons may act instead of a notary:

- Commander of a military unit (but only on condition that the principal is a military personnel).

- Senior doctor or any other senior leader of a medical institution. This is usually relevant in relation to situations with inheritance, but in rare cases it is also used for drawing up powers of attorney.

- Start a colony or other correctional institution, provided that the principal is a prisoner.

- Captain of a sea vessel.

- Ambassador or consul.

- The senior head of a locality, if there is not a single notary in the area.

Most often, after receiving such a power of attorney, the authorized person needs to visit a notary and have such a document additionally certified.

Rules for issuing a power of attorney for the purchase of an apartment: sample

- commander of a military unit (for military personnel and members of their families);

- head of a medical institution (for military personnel undergoing treatment);

- head of the penitentiary institution (for prisoners);

- captain of the ship (for sailors);

- ambassadors, consuls (for citizens of their country located abroad);

- head of the administration (in the absence of a competent notary in this territory).

Ryazan September 1, 2021 I, Sirina Valentina Ivanovna, born on March 25, 1980 in the city of Ryazan, passport 01 02 123243, registered at the address Ryazan, st. Sovetskaya, 34, apt. 6 I trust my sister Olga Ivanovna Mozheikina, born on August 17, 1983 in the city of Ryazan, passport 01 02 123456, registered at Moscow, st. Krasnodonskaya 90, apt. 65, buy an apartment located at the address: Moscow, st. Energetikov, 5., apt. 35, costing 6,000,000 rubles.

We recommend reading: How to Pay for Water Using a Meter Using Internet Banking

Procedure for purchasing an apartment by power of attorney

Having received the registration and receipt of the power of attorney, the authorized person can begin to perform all the actions specified in such a document. The description below assumes that the fiduciary has no restrictions and can perform any actions on behalf of the principal.

Procedure

- Search for an apartment . The authorized person can independently search for suitable offers on the real estate market or use the services of professionals (real estate agencies). It must be remembered that such services are paid and therefore the trustee will have to transfer additional money. The exception, of course, is situations where such actions were foreseen by the principal in advance.

- Negotiations with the seller . The principal's representative conducts all basic negotiations, voicing the requirements and conditions that he considers necessary or that he has received from the principal.

- Inspection of the apartment . At this stage, the trusted person often takes photos and videos of everything he sees in order to later send the materials to the trustee. Often, during the inspection process, new features regarding housing are revealed. In addition, if the apartment is sold with furniture/appliances, the authorized person can sign the inspection report.

- Verification of documents . The seller provides the buyer's representative with all requested documents. They all need to be checked and studied carefully. For more information about the documents, see below.

- Signing the purchase and sale agreement . When everything has been discussed and the parties know exactly what they want from this transaction, a purchase and sale agreement is drawn up, signed and registered. It is necessary to take into account the fact that this document does not require notarization, but it can be certified if such is the requirement of the buyer, seller or authorized representative.

- Registration of ownership rights to the principal . Once the contract is signed, the title to the new owner is usually registered. In this case, through a representative, the principal-buyer becomes the owner of the apartment.

- Signing the transfer and acceptance certificate and receiving a receipt from the seller . After registering ownership, the parties sign a transfer and acceptance certificate, and the seller also writes a receipt stating that he received the entire amount for the housing in full and has no claims.

Depending on what is said in the power of attorney, some of the actions may be performed personally by the buyer. In addition, almost all sellers, in order to protect themselves, conduct checks on the trustee and the principal. For example, they require at least one personal meeting directly with the buyer to make sure that this person even exists and that he really intends to purchase this property.

Documentation

As mentioned above, a minimum package of documents is required from the buyer and his representative: passports and power of attorney. Some sellers additionally require a bank statement or other document confirming solvency. If for some reason this is not possible, the problem can be solved by the usual payment of an advance or deposit.

A lot more paperwork is required from the seller. Each of them must first be checked for authenticity. This is best handled by an experienced lawyer. Sample list of documents:

- Seller's passport . Necessary for verifying information in most other documents and verifying identity.

- Extract from the Unified State Register of Real Estate . Confirms ownership and shows the presence of encumbrances, if any.

- Registration certificate for the apartment . Shows illegal redevelopment, if any.

- Extract from the house register . Indicates persons who are registered in the apartment.

- Certificate from the housing office or management company . Displays the presence or absence of debts on utility bills.

- Consent of the spouse to sell the apartment. It is only important if the seller is married. A necessary document, without which the transaction may be declared invalid.

- Permission from the guardianship authorities to sell housing. It is only important if the co-owner of the apartment is a minor. Without this permission, the transaction will not be considered valid.

Expenses

The buyer rarely bears the costs when buying an apartment, unless, of course, the seller offers to split them among everyone. This proposal can be accepted, subject to counter-concessions. For example, check out all the residents of the apartment before the transaction is completed or make a good discount on housing.

An approximate list of expenses that the seller and the buyer (his authorized representative) may bear:

- Real estate valuation from specialists: from 2 thousand rubles.

- Real estate agency services for finding a seller and supporting the transaction: from 2% of the cost of the apartment.

- Registration of a new technical passport: from 10 thousand rubles.

- Certification of the purchase and sale agreement: from 5 thousand rubles.

- Obtaining a fresh extract from the Unified State Register of Real Estate: 350 rubles.

- State duty for registration of ownership: 2000 rubles for each new owner.

The cost ratio may not be equal. For example, the seller will pay 70% of all expenses, and the buyer only 30%.

Deadlines

Concluding a transaction with the help of a trusted person can somewhat extend the purchase and sale time frame. On average, approximately 1-2 weeks, which will take to agree on all the conditions between the principal and the trustee. In an ideal situation, when all parties are ready to make concessions, all documents are prepared, and so on, the deal can be closed in just 1-2 days. In practice, the entire procedure takes, on average, about 1-2 months.

Buying an apartment by proxy

In most cases, the procedure for selling and purchasing an apartment is carried out with the direct participation of the buyer and seller. In some cases, under certain circumstances, their interests may be represented by trusted persons who act on the basis of notarized powers of attorney.

What risks may arise in a situation if one of the parties or both acts by proxy? What should you pay attention to when concluding a deal? We will examine these and other questions in this article.

Risks of buying an apartment by proxy

A power of attorney automatically adds possible risks and potential problems for both the buyer and the seller. Let's look at the main ones.

From the seller's side

Possible risks for the seller due to the buyer's use of a proxy:

- Death of the principal . A power of attorney is valid only if the principal is alive at the time of execution of the transaction. Even if, by will, he transfers the rights to all his property to a trustee, the power of attorney still becomes invalid after the death of the trustor. As a result, the trustee must first register ownership of the deceased’s property and only then continue the purchase and sale transaction of the apartment, but in his own name. If, of course, this is still relevant.

- Expired power of attorney . Such a document is also not valid. As a result, any actions of the authorized person will be illegal.

- The principal is not legally capable . If the principal issued a power of attorney without understanding what he was doing, being deceived or under duress, such a document is not valid. As is the transaction made with its help.

- The power of attorney does not specify some actions that the trustee performs . The authorized person has the right to perform only specific actions that are specified in the power of attorney. If it does anything else that goes beyond certain limits, the transaction may be invalidated.

- The power of attorney has lost its force . This means that transactions cannot be concluded with its help.

- The power of attorney was drawn up with errors . Such a document can also be declared invalid with all the ensuing consequences.

Despite the abundance of risks, for the seller the problem will mainly be to take back his home.

From the buyer's side

Potential risks of the buyer-principal:

- Search and inspection of the apartment . The authorized representative may specifically or not specifically choose an apartment that is not suitable for the buyer. Moreover, in order to quickly complete the transaction (for example, if the trustee is promised a percentage of the transaction or a fixed amount), falsify photographs, showing the housing much better than it actually is.

- Payments . The fiduciary may claim that a lot of money was spent on various services when in reality the amount was much less.

- Registration of property rights . The worst thing is if the trustee ends up registering the apartment in his name fraudulently or in any other way, although he buys it with the trustee’s money. It will be quite difficult to prove anything. That is why it is recommended to act without intermediaries at least in the last stages.

Risks for the seller

Can the person who implements the object be deceived? We should not forget that the transaction amount in the contract and the amount actually handed over often do not coincide. An entity that sells real estate on the market generates income that it is obliged to pay (personal income tax). In order to save on payment, the parties agree that one price will be indicated in the document, but a completely different one will be listed.

This is important to know: Buying a share in an apartment with maternity capital from relatives in 2021

The amount corresponding to the agreement between the entities is transferred as payment. In this case there are no violations. It is difficult to prove otherwise.

Advice: Never make concessions or agree to stipulate in the contract an amount different from the actual one. The desire to save on taxes to the budget may have consequences.

Thus, during the transaction of buying and selling an apartment, both parties to the contractual relationship have a chance of falling into the hands of fraudsters. True, the risks of the buyer are several times higher than those of the seller. In order to protect yourself from financial losses and litigation, you need to be sensitive to the issue at the initial stage. You need to assume the worst and check everything you can.

How to secure a transaction

For the trust buyer:

- Choose your confidant carefully . Contact only those people in whose reliability and honesty the buyer is 100% confident.

- Control every action . Any transfers of funds must be made in an accountable manner (for example, with the provision of receipts for payment of services).

- Do the most important things in person . This is especially true when searching for housing, signing an agreement and final payment with registration of ownership.

For the seller:

- It is mandatory to personally meet with the buyer. Usually, even if a person is in another city, he can still come. As a last resort, you can use video calling.

- Check the power of attorney very carefully for errors, compliance with the terms and powers of the authorized person.

- Be sure to check the notary who issued the power of attorney and the power of attorney itself for their relevance.

Power of attorney for realtor

In some cases, a power of attorney is issued to the realtor, within the framework of which he can perform certain actions. It is extremely rare that this is a general power of attorney, because a realtor is a completely stranger who is in no way connected with the buyer (most often) and there is no reason to trust him.

As a result, a power of attorney is drawn up only for some tedious but necessary things. These are exactly what a realtor can do, but no more. As a result, the buyer will still have to deal with the home buying procedure, but he will only perform the key steps, and the realtor will do the rest for him.

Power of attorney for registrars

This is the same power of attorney for a realtor. The bottom line is that real estate agencies have special people who are primarily involved in registering sales and purchase agreements. It is precisely so that the client does not personally go to government agencies and waste time that he signs such a power of attorney and thereby makes his life much easier.

Despite all the convenience, a power of attorney still increases the number of possible problems, and therefore it is necessary to purchase apartments with the help of a trusted person only in individual cases, when a person is guaranteed to be trustworthy or when there are no other options. At a free consultation, experienced lawyers will talk about the main controversial situations and potential risks. If they also accompany the transaction, this will practically eliminate any fraudulent transactions and will also help solve most problems.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

1 ratings, average: 5.00 out of 5)

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

18

Is an apartment purchased before marriage divided during a divorce?

Division of an apartment during a divorce is a standard process associated with the dissolution of...

1

How is maternity capital divided when spouses divorce?

Maternity capital is a state payment due to a woman after the birth of her second...

4

How to sell a car after inheriting

After receiving a certificate of inheritance, the new owner of the car is obliged to...

4

Relinquishment of property during divorce

Former spouses do not always agree to divide their joint property...

Are alimony debts inherited?

Payment of alimony is one of the main sources of income for...

Division of a dacha in case of divorce

During a divorce, it becomes necessary to divide the property that the spouses used in...