The happy time when taxes had virtually no impact on our budget has passed forever. Nowadays, tax payments are a significant expense item, and it is always important for owners of country houses to understand how much and what they need to pay, what they don’t have to pay for, and how to structure their tax behavior so that there are no unpleasant consequences in the form of huge fines and lawsuits.

In this article we will cover:

— What taxes need to be paid, and which ones are optional — What loopholes are there for summer residents in tax legislation — Will the tax on a house increase if a veranda is added to it? — Do I have to pay taxes on outbuildings?

How to calculate the amount of land tax?

The tax on land plots intended for gardening, individual housing construction or personal subsidiary plots is calculated based on their cadastral value. In some regions there is a difference in the amount of tax on a plot for individual housing construction and a garden plot, in others there is no: local legislative bodies can set different or the same rates for each type of permitted use of land.

Important: The Tax Code establishes a marginal land tax rate of 0.3%.

It cannot be exceeded - in any case, your tax on land cannot be more than 0.3% of its cadastral value.

You can find out the cadastral value of your plot at the Rosreestr branch or on the official website of Rosreestr. There is a special calculator on the tax website for calculating land tax.

AndreichPForumHouse Member

I got 7`188`144 rubles * 0.3%= 21`564.43 rubles for all PDOs.

Dacha: how to calculate property tax?

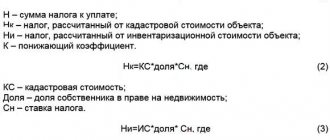

Property tax (residential building) is equal to 0.1 percent of the cadastral value of this house. More precisely, property tax on a dacha is calculated using the formula:

0.1% - (cadastral value of the house - cadastral value of 50 square meters of this house).

That is, the cadastral value of 50 square meters must be subtracted from the cadastral value of the house. 0.1 percent of the balance will be the tax amount. If there are other buildings on the site that are considered real estate, then the tax amount on them will be 0.1% of their cadastral value (the cadastral value of 50 meters will no longer be deducted).

Normative base

Social benefits enjoyed by an individual can reduce the state tax payable after the sale of a land plot or dacha. These include different disability groups, veteran documents, participation in armed conflicts, the presence of disabled dependents, etc. Such preferences can reduce the size of the tax base by up to 10,000 rubles.

Documentation

A citizen can independently calculate the amount of duty that he must pay to the budget of the municipality at the location of the property being sold. To do this, you should use a simple formula, which includes the following indicators:

May 15, 2021 semeiadvo 389

Share this post

- Related Posts

- Rostov region payment for 3 children

- Social assistance in Voronezh for single mothers

- Benefits for large families in the Altai Republic

- List of free medicines for 2021 complete list table

Do I have to pay tax on country houses?

According to (clause 1 of Article 401 of the Tax Code of the Russian Federation), the objects of property tax for individuals are not only residential buildings, but also “other buildings, structures, structures, premises” located on plots (we are talking only about capital buildings). From the point of view of tax legislation, these buildings are equivalent to residential buildings.

At FORUMHOUSE we have already talked about a loophole in tax legislation: until individuals have registered buildings in the Unified State Register of Real Estate, they are not obligated to pay taxes on them.

Only the owner can register a building; the tax department does not have such rights.

There are no penalties for the fact that the building is not registered, and the only thing the tax service can do is recommend registering the building and paying tax for it. But the owner has every legal right to ignore this recommendation and not pay tax on dacha buildings.

If you receive a demand for tax payment or a tax notice regarding unregistered objects, you must appeal it in court. The court will rule in your favor.

A house in the countryside can be an expensive pleasure

Vladimir Putin signed a law according to which property taxes for Russians will be calculated on the basis of cadastral (market) prices. The changes will come into force on January 1, 2015. In the Cherepovets region they have already grown several times. Why?

As legislators explain, the transition from inventory value to cadastral value will not happen immediately, but will be carried out within five years. In the allotted time, each region will independently determine the terms and rates under this law. According to experts, for citizens the annual payment for property can triple, or even more. In Cherepovets, there is high demand for land in the area, but real estate market experts call it deferred. Why?

A person wants to live not in a dusty, smoky city, but in the fresh air, in a village - next to a forest, on the banks of a river or lake. Land in the area is inexpensive, taxes are affordable, and again you do not depend on high city utility bills and taxes. Living in the village and working in the city is the dream of many Cherepovets families. But construction costs and lack of infrastructure are confusing.

Will the new law scare those who already live outside the city or want to buy land and build a house there?

Doubts, it seems to us, are justified, since there are already precedents of dissatisfaction with tax increases in the Cherepovets region. And this was before the law on cadastral value came into force. Let's try to figure it out using the example of the Yugsky settlement, where property tax payments presented to residents of the village of Gorodishche brought people to the point of planning to go to court.

As they explained to us at the district tax office, property tax in the Cherepovets region, as well as in the city, is formed according to the following scheme. First, the inventory value of the property is determined (in simpler terms - BTI assessment). From year to year it is indexed (consider it growing). Calculations are made using special methods that take into account what material the house is built from (wooden, brick), how many floors it has, what land it sits on, etc. The methods are complex, and an uninitiated consumer is unlikely to be able to understand them. The only thing that is clear is that property valuation is the responsibility of the region.

Inventory value is the tax base on the basis of which the tax amount is calculated. Deputies of settlements in the Cherepovets region adjust the amount of tax using tax rates. This is within their authority.

“But deputies have their own restrictions (minimum and maximum tax rates are approved at the federal level and sent down to the regions - author),” explains Ivan Khrenov, head of the Irdomat settlement. — So, the limits for property tax are from 0.1% to 2%, for land — from 0.1% to 0.3. In this case, we are talking about a private residential building and the land plot on which it stands. For entrepreneurs (a person wants to build a store, open a pig farm), only the maximum rate is determined - no more than 1.5%.

This is interesting: Complaint to housing and communal services about cleaning the local area

In the Cherepovets region, property tax rates were significantly adjusted only for residents of the Yugsky settlement. They received the most complaints from them. For other settlements, land tax rates remained virtually unchanged. What happened in Yugsky?

The "rich" pay too

The reason for the sharp jump in payments was the decision of the deputies of the Yugsky settlement to adjust property tax rates. If last year the maximum was 0.4% of the inventory value of the property, then in 2014 it was 1.45%. For many, the tax has increased several times.

— Everything was done somehow on the sly. Payments arrived at the last minute, and the tax itself turned out to be unaffordable for many,” says Andrei Korolev, a resident of the village of Gorodishche. “The administration of the Yugsky settlement explained to us that we were divided into “poor,” “middle,” and “rich,” and this is how the payment turned out. And this despite the fact that the inventory value of the house is increased from year to year. Where is the logic? The house does not get younger over the years, but it does become more expensive. Two years ago, according to the BTI, my house was worth 2 million, now it’s 2.3 million. The tax was 8 thousand rubles, now it’s 30 thousand. An apartment in the city worth 2.3 million is cheaper: the tax on it will be two or three thousand.

Village resident Olga Sergeeva shares the same opinion. She needs to pay 38 thousand rubles in tax for her house on ten acres. Owners of expensive cottages were charged up to 100 thousand rubles a year. It's getting to the point of absurdity. A family was building a house in the village: father, brother, husband. The owner in whose name the house is registered has a salary of 15 thousand rubles, tax - 40 thousand.

Residents of Gorodishche are indignant at why they are charging such taxes: there are no roads (dust, dirt!), no gas, no electricity; no ambulance, no kindergartens; Communication and that only mobile - in general, a darkness.

“The roads to us are two kilometers,” says Andrei Korolev. “We’ve been asking for ten years to repair one kilometer.” They built it, but only poorly, now the contractor is redoing it. We remove the garbage ourselves, improve the territory, and restore order. What and to whom are we forced to pay?

Why are taxes rising?

— In 2014, rates in settlements were adjusted: somewhere downwards, somewhere up. In particular, in the Yugsky settlement. Land and real estate in Gorodishche, in the Chernaya Rechka area, are generally very expensive. Hence the possible increase in property taxes. Yes, we have received many complaints from residents of the Yug settlement. We invite citizens, if they are not satisfied with the amount of tax, to make an independent economically sound assessment of the value of their property. And if it is higher than the market price, go to court,” says Nadezhda Staroverova, deputy. Head of the Cherepovets District Administration for Economics and Finance.

She explained the main principle of formation of settlement budgets. Basically, each of them is replenished by taxes on property, land and money received from the sale of land. These funds are 100% credited to the local budget. But these taxes also need to come from somewhere. The areas in the settlements are large, but the residents were made to cry. This is not a metropolis where you know how to collect the “harvest” of taxes.

For example, in the Yugsky settlement there are 127 settlements: Kostyaevka, Vichelovo, Gorodishche, etc. The population is 4 thousand people. The territories are huge, and the annual budget is 20 million rubles, mere pennies.

“But the territory needs to be developed and maintained: a boiler room, roads, lighting,” says Nadezhda Malkova, the head of the settlement. — Yes, we have adjusted property tax rates. But we haven't changed them since 2006. In addition, I would like to emphasize: only 5% of all real estate in the territory of our municipality are subject to the maximum rate of 1.45%. The budget must be filled one way or another, especially since we have a large tax arrears.

We contacted a number of settlements in the Cherepovets region, and in each of them they said that there was enough land, and new settlers would be welcome here.

For example, a fifth of the entire Cherepovets district is occupied by the Voskresensk settlement. It has 119 settlements, which are located on an area of 426 square meters. kilometers. The people of Europe would be jealous. And we're in trouble. Because it is necessary to build roads, clean them in winter, maintain pipelines and other communications in every village.

- And we have some where only one grandmother lives in winter. Or let’s say the village of Kizboy with 60 houses (50 kilometers from Cherepovets), where one family lives all year round and goes to work in the city. The rest are summer residents,” says Valentina Nikitina, head of the Voskresensky settlement. “We have good lands, again mushrooms and berries, rivers.” For example, the village of Romanovo is located on Lake Romanovskoe, and there are vacant plots there. In the village of Ostrov, land plots of 20 acres (approximate cost of 90 thousand rubles) have been formed: only two kilometers away from the Belozersk road. We are only too happy for the arrival of landowners, including residents of Cherepovets. Why should the lands be empty?

55 hectares - approximately 200 land plots of 15 acres - are divided into the village of Borisovo, Irdomat settlement. In the Malechkinsky settlement, 24 plots have been prepared on 7 hectares. As the head of the settlement, Sergei Anikin, says, the local authorities are vitally interested in their sale, and the sooner this happens, the better. Firstly, before selling the land, you need to spend money to form a site - on geodetic surveys, land surveying, etc. Secondly, the poultry farm in Malechkino has been reducing its volumes since 2011, which means that the treasury has received less taxes from salaries (personal income tax). ). All hope lies in other taxes. Somewhere you have to raise them. Thus, deputies adjusted the land rate. In 2013, 0.1% was used, in 2014 - 0.2%.

So far taxes look manageable. But that's how to say it. Salaries in the outback are low. In the same Yugsky settlement there are not only cottages, but also simple houses in villages. A milkmaid earns 8-9 thousand rubles a month, a machine operator earns 20-30 thousand in the summer season, and no more than 10-12 thousand in winter. So it often turns out that the richest people in the village are pensioners, those over 80, who have larger pensions. But changes are coming in the valuation of property and land.

“We still have to figure it out”

The situation is paradoxical. On the one hand, settlements are vitally interested in the influx of new residents who will develop empty lands. On the other hand, they are vitally interested in replenishing the budget. Will it happen that people will be invited to new lands with promises of fresh air and feasible taxes, and in a year or two the situation will change dramatically? What is the cadastral (market) value of property and how can it affect the development of the village? And does anyone have answers to these questions?

“I think we all still have to figure out the cadastral value of land plots,” Ivan Khrenov, head of the Irdomat settlement, expresses his opinion. — We do not create this cost. As far as I know, this is at the level of the country’s government: a tender for land valuation in the Vologda region was won by some Moscow company. I don’t know what methods were used, but there were some incidents. Two plots of land next to each other, they are like twins. On one of them, a hundred square meters costs 20 thousand rubles, on the next one - 60 thousand.

We contacted our Cadastral Chamber for comments; the head of the structure, Roman Kaminsky, noted to us that they only deal with property accounting, and not valuation. Then we turned to the district BTI.

“The cadastral value is as close as possible to the market value,” explains Natalya Novozhilova, acting head of the Cherepovets branch of the Federal State Unitary Enterprise Rostekhinventarizatsiya - Federal BTI. — Why do paradoxes arise in assessment? I won’t answer this question. Let me just say that cadastral registration of real estate has been carried out in the Vologda region since 2011. Since 2012, technical inventory as such has been abolished. Now there is a technical plan for the object, on its basis the cadastral value is calculated. But it is not our authority to determine it.

Fine. We contact the Department of Property Relations of the Vologda Region. Here's what they told us:

— The state cadastral assessment of lands in settlements of the Vologda region in 2012 was carried out at the expense of the federal budget under state contract No. 85D/2012, concluded between the Federal Service for State Registration, Cadastre and Cartography (hereinafter referred to as Rosreestr), which is the customer of the work, and the Federal State Unitary Enterprise Rostekhinventarizatsiya - Federal BTI", which is the contractor.

This is interesting: Extract from the master plan for the land plot

On December 14, 2012, Rosreestr (Moscow) signed an acceptance certificate for the work performed under the specified government contract. On December 27, 2012, the results of the state cadastral valuation of lands in settlements of the Vologda region were approved by order of the department of property relations of the region No. 206. The text of the order was published in the newspaper “Krasny Sever” on January 18, 2013, accordingly, from this date the results of the state cadastral valuation of lands are applied for calculating rent for the use of land plots; from January 1, 2014 - for tax purposes.

Who is entitled to tax breaks for country houses and dachas?

The full list of beneficiaries is contained in Article 407 of the Tax Code of the Russian Federation, and it is quite extensive. Pensioners, disabled people, heroes of the USSR and the Russian Federation, military personnel, Chernobyl survivors and many others are eligible for benefits.

According to existing tax legislation, it is provided in relation to ONE object of each choice, and the taxpayer himself can determine the object. If he has a house and an apartment, he is entitled to benefits for both the house and the apartment, and if he has two houses, he can choose which one to choose the benefit for.

To receive the benefit, you need to write an application to the tax authority. Without this, the tax service itself will choose your property for which the deduction will be provided. Or even you simply won’t be given a deduction.

LyudochkaForumHouse Consultant

A land tax deduction of 6 acres is provided to pensioners. If the pensioner did not receive this deduction, he probably did not write a statement to the tax office.

Svetlana153 FORUMHOUSE participant

If you want to apply for tax breaks on 6 acres, you need to go to the tax office, unfortunately they don’t do it automatically. This is of a declarative nature.

Normative base

The size of the cadastral value is determined during an independent assessment. It is brought into line with the market value of the property at the time of registration of its ownership. If the documents were prepared before 2014, the value of the site and buildings on it may not correspond to the cadastral value. This is due to the difference in the assessment, which may not have existed at all before this period. Suburban plots were owned by gardening partnerships and were considered common. After the state initiated the dacha amnesty, the owners of “6 acres” began to register their ownership, which gave them the opportunity to carry out various transactions, including purchase and sale.

Calculation formula and tax amounts

The main document for carrying out the procedure for collecting duties and fees into the state treasury is the Tax Code of the Russian Federation. Relations between administrative bodies and individuals (legal entities) in terms of property relations are regulated by the following articles:

Starting this year, you can register in a residential building. Now summer residents can obtain full registration at their place of residence.

To obtain a residence permit, you must contact the passport office. How to proceed to register a garden house as residential:

You might be interested ==> How much does a single mother earn in the Sverdlovsk region

Who pays property tax in SNT?

If SNT is the owner of roads, buildings and other real estate, then it pays taxes for them itself. SNT takes money for taxes from the fees paid by land owners.

If SNT real estate is in shared ownership of the members of the partnership, then they themselves will pay taxes. But there is a loophole here: ALL owners must vote for this, not the majority.

It is illegal to impose SNT property on the owner of a plot without his consent.

Another possible situation is when the general meeting decides to transfer some SNT property (roads, etc.) to the ownership of the region or region where it is located. With this option, SNT members will no longer pay taxes.

Summarizing

As we can see, Russian tax legislation is not the most friendly to summer residents and owners of country houses, but it has quite a lot of loopholes. The extensive list of categories of people entitled to benefits also inspires optimism. In each specific situation, consultants and FORUMHOUSE participants experienced in tax battles are ready to provide advice - you can share it in the Real Estate Taxes section of the forum.

Also on FORUMHOUSE you can find out how to request a recalculation of property taxes and read an article on how to calculate and dispute property taxes.