Banks approve approximately 70% of mortgage applications. Refusals rarely come. Less common than in 2010. Because the number of clients is approximately constant, but competition between banks is growing. We have to lower the requirements for borrowers and turn a blind eye to minor problems. But there is still a chance of being denied a mortgage. Get into 30% of clients

with problems. It is better to prepare for this in advance and figure out how to convince the bank.

We have looked at the main reasons for failures. And they wrote recommendations on how to protect themselves from them.

Scoring system

First, some technical information.

Banks have scoring systems. Soulless automation checks profiles

borrowers and issues an assessment. The more honest and informative you are about yourself, the higher your chances of scoring a passing grade.

Automatic verification is the first stage. Perhaps the easiest. It all depends on what data you enter in the form and what documents you provide.

Then they evaluate manually. Communicate with you and the employer. They check the information from the questionnaire with the involvement of the bank’s security service. It's worth preparing for this.

We have collected information about what usually causes concerns for banks. Use it and become an ideal borrower.

Main reasons for mortgage refusal

First, the main criteria of banks:

- Age from 21 to 75 years

. - Minimum 1 year

of work experience over . - Work experience at the last place of work is at least 6 months

.

These are usually mandatory requirements.

You need to comply with them, otherwise they won’t give you a mortgage. They won't even consider the application. The exact requirements vary by bank. One needs less age and more work experience. Another allows up to 4 co-borrowers, but requires registration 100 km from the nearest office. Therefore, look at loan offers, consult with employees, and submit an application. Perhaps somewhere you will be approved for a loan.

Below are the main situations when a bank refuses a mortgage and what to do about it.

The apartment is not suitable for the bank

The apartment secures a bank loan until the mortgage is paid in full.

Therefore, he wants to protect himself by taking a good collateral as security. Therefore, it provides loans for the purchase of only liquid real estate. So that in case of problems with the client it is easy to sell it. Real estate usually undergoes banking examination:

- In the city or nearby suburbs.

- Built later than 1965. More precisely, it depends on the material and series of the house.

- A comfortable apartment or private house with a plot.

- Without encumbrances, debts, illegal redevelopment.

- In the region with bank branches.

Sometimes the bank gives approval for real estate with illegal redevelopment (not significant).

An agreement will be concluded with the borrower that all problems will be eliminated and legalized within six months. 100% brake lights

:

- the house is dilapidated;

- recognized as emergency;

- standing in line for demolition.

The client will be denied a mortgage. No options.

How to choose a house to get mortgage approval

- Order an extract from the Unified State Register of Real Estate. Check that the property is clean. Without encumbrances and residents with the right of lifelong residence.

- Go to the website of the city administration

or housing policy department. There you can find out the status of the house: dilapidated, in disrepair or in line for demolition. - Look at court cases

. A search by address and apartment number, if the information was left open, will reveal details about the past of the property. - Choose a new home

. Maximum legal purity. Fresh, reliable building. The developing area of the city is often interesting to the bank. New construction increases the likelihood of mortgage approval.

The client is confused and uncertain in answering questions

Conversations with bank employees are important.

Uncertain, evasive, and confusing answers increase the chance of mortgage denial. You can relax when you apply at the bank. The employee there simply passes on the information and advises you.

Concentrate when a bank representative calls you. You will speak with an analyst. Its task is to prevent bank fraud. Make your mortgage profitable and safe. Therefore, the conversation is like an interrogation

: a lot of questions from different areas, testing the waters and looking for inconsistencies.

Usually the list of questions overlaps with the questionnaire:

- About work

. Where and with whom do you work? What you are doing. How much do you get? What does the company do? How many employees? What color is the office building? - About credit

. What is the amount of the down payment? Why are you renting an apartment? To live or rent. Who will live there? - About you

. The following questions are also possible. The analyst’s task is to identify a person who is unable to pay the mortgage. For example, due to severe illness or problems with alcohol.

There are many questions. They are different. Get ready for this.

How to pass the interrogation of a banking analyst

- Work through the dialogue

. Brainstorm possible questions and answers in your mind in advance. Work them out. Find better wording. - Be confident

. Show that you have nothing to hide. Smooth, confident voice. Specific, clear answers. No stuttering or confusing explanations! - Stick to the questionnaire

. Say what you wrote in the questionnaire. The inconsistencies raise further questions. And they become the reason for refusal of a mortgage.

The client and his employer were not reached

Continuing the point about the survey by a bank analyst.

There will be no problems with answers if they don’t reach you. But the mortgage will not be approved either. Check that the numbers on the form are correct. The bank must contact you and the employer. Submit your application - stay in touch. Be prepared to answer the call at any time.

Miss calls - you won't get a mortgage.

How not to miss a call from the bank

- Check that the numbers are correct. Write them out separately before going to the bank. The main thing is to avoid mistakes.

- Keep your phone handy. After submitting your application, remain in the communication zone. Always.

- Warn your employer. Have him be ready to answer the phone and talk to the bank.

The client has health problems

Continued client problems.

The bank is very interested in the performance of the borrower. It must be operational until the mortgage is paid in full. Health problems are a possible reason for being denied a mortgage. Although it is difficult to find official confirmation of this.

Based on available information, unsuitable clients are identified based on the conclusion of a credit specialist. Suspicions may arise at other stages. For example, when analysts and security service see a photo of the borrower.

There is a high probability of mortgage refusal for:

- pregnant women;

- disabled people;

- came to the bank looking very bad.

A shabby, unpresentable appearance, bags under the eyes and a strange rash on the face - this is suspicious.

What to do if there is a risk of not getting a mortgage due to health

- Look presentable. Better appearance in the photo means higher chances of getting approval.

- Prepare co-borrowers. The bank will relax the requirements for the main borrower if he has a support group.

- Contact a loan broker. He works with several banks and knows their requirements. He will tell you what documents are needed to clear up the financial institution’s doubts.

Overdue on other loans and debts

A bad credit history guarantees that you will be denied a mortgage.

The bank checks how you used and repaid loans in the past. He is interested in:

- Loans taken out

. How much and how often the client took money. Does he have open credit cards? The bank wants to know how the borrower behaves. - Overdue loans

. The longer and longer the delay, the worse. For Sberbank, 31-60 days of one-time non-payment is enough to reject client requests in the future. Even if the remaining loans are closed on time. - Debts for alimony, taxes

, fines and open writs of execution. A client who ignores government payments is unreliable. Debts can be viewed on the website of the Federal Bailiff Service.

Requirements vary by bank.

The larger it is, the more strictly it checks the borrower. Small banks cut off only very malicious defaulters. They look into each case individually and then make a decision. Because they need clients.

How to reduce the chance of refusal if you have debts

- Correct your credit history

. Debts and arrears that arose due to a bank error can be removed. Contact the financial institution where you took out the loan and ask them to provide the correct information to the BKI. - Close debts to the state

. Pay taxes, fees and alimony. Become the most law-abiding citizen. - Take out a small personal loan

. Pay it on time. Show the bank that you have become a reliable borrower. - Contact a small bank

. They are interested in clients and try to understand the situation. If the delay was due to force majeure, for example, loss of work, then a small bank can ignore it. And issue a mortgage!

Problems with documents: forgeries and incorrect data

When you give documents to the bank, double check them.

A mortgage is denied due to errors in paperwork. An error in the passport data in the certificate, an incorrect entry in the work book or employment contract. Every little thing raises the suspicion of the bank.

In most cases, the client will be asked about the error. They will clarify the information and make a decision based on the correct data.

Refusals just because of an incorrect number on the certificate are rare. Usually the bank looks for good reasons. Debts or criminal record.

The situation is worse for clients who sell counterfeits. Purchased 2-NDFL, work book and contract. The bank's security service works well. She finds fakes and refuses the client. Plus marks him as unreliable. So your chances of taking out a loan in the future are reduced.

So forget about document falsification. The chance of getting a mortgage on them is minimal. More often than not they bring problems.

What to do with documents to get your mortgage approved?

- Check documents for errors

. Correct information means fewer problems with the security service. - Submit real documents

. Do you work with a gray or black salary? Find banks that accept certificates using their form. Convince the employer to sign it and answer the bank's call. The financial institution will not accept a certificate without verbal confirmation.

Low salary

Income is one of the main criteria for assessing a borrower.

The bank wants the client to definitely have enough money to service the mortgage and have funds left for everyday expenses. The salary required for approval depends on the region. To put it simply, the more expensive the property, the more salary you need.

For Moscow, the minimum threshold is 60 thousand rubles. Approximately 2 times the average salary in the country.

For Kazan, Samara and other relatively large regions, the minimum threshold is approximately 30 thousand rubles.

For small cities, where apartments cost 300-600 thousand rubles, 10-20 thousand rubles will be enough. But there it is more difficult to find a bank willing to give a mortgage.

More salary means less chance of being denied a mortgage.

How to get a mortgage with a small salary

- Only the white part is small

. Take out a mortgage with a certificate in the form of the bank. There you can enter the real number, not the official one. The main thing is that the salary suits the position and is verbally confirmed by the employer. - The salary is generally low

. Invite co-borrowers. They will become the bank’s guarantee that the loan will be closed.

The higher the salary, the better. Banks love it when clients are guaranteed to be able to repay their mortgage. The main thing to remember is that large expenses cover income in the eyes of a banking analyst

High expenses and financial burden

The bank likes it when the client earns a lot.

But he will refuse a mortgage if the borrower is wasting money. The approximate cost for the regions is as follows:

- for a salary of 30,000 rubles – less than 40-50% of income;

- for a salary of 60,000 rubles - up to 70% of income.

For Moscow, multiply by 2.

The bank takes into account other potential expenses. Family composition and dependents. What if the borrower has elderly parents and will soon have to spend money on their maintenance?

On this point, everything is individual. The bank decides whether it is willing to risk its money.

How to get a mortgage with high costs

- Close old loans

. Pay them off and go get a mortgage. - Involve co-borrowers

. If you can’t get rid of old loans, reduce the risks for the bank with the help of an additional co-borrower. - Contact a loan broker

. He will select offers from banks willing to take risks. Risks will be covered by an increased interest rate.

The client changes jobs frequently

Work mobility is good for a person.

But the bank doesn't like it. Borrowers are often denied mortgages due to regular job changes. The bank likes it if:

- You have worked in one place for a long time. 1-2 years minimum

. The longer the better. - Haven't changed jobs

in the last . Those who have recently joined a new company receive loan refusals. - We gradually climbed the career ladder

. The sudden jump from middle manager to top manager raises many questions. - You work in a stable field

. The bank doesn't like bartenders, security guards, or taxi drivers. These are risky clients with unstable income.

Mortgage approval is often obtained by representatives of stable professions who are loyal to the company.

How to get a mortgage if you recently changed your job to a risky one

- Contact a small bank

. They are interested in clients and treat each one individually. Logically explain to the employee all the nuances of a career. Show that you are a disciplined and reliable worker. - Invite guarantors and co-borrowers

. Give the bank more guarantees that you or someone else will close the loan.

There is nothing else to oppose this filter.

This is approximately how you should look in the eyes of the bank and employer. Ideal employee. Stable position, prestigious field, high salary. Mortgages are willingly given to such people

Small down payment

A mortgage with a small down payment is more of a marketing ploy than a profitable offer.

Banks are interested in clients who are willing to shell out money when buying an apartment. The larger the initial deposit, the higher the lender's guarantees. And a higher chance of getting your mortgage application approved.

Clients who try to reduce the first payment arouse the bank's suspicion. They are usually required to have a white income

. According to the 2-NDFL certificate, with an extract from the salary account and a tax return.

Therefore, it is advisable to have 30-40% of the cost of housing for a down payment. This will reduce the likelihood of your mortgage being rejected. The bank believes that a borrower with a large down payment is inclined to save. He lives within his means. Postpones. Such a client is disciplined and pays on time. What to do to get a mortgage with a small down payment?

- Confirm white income

. Only official certificates. No free form. - Show income stability

. Working in one place for a long time, owning other real estate, investing in shares of large companies. - Invite co-borrowers and guarantors

. As in the previous paragraphs, give the bank more guarantees.

Criminal record

The most clear point. Those with a criminal record are denied a mortgage

. Because for the bank this is a strong stop signal with no statute of limitations.

It's too risky to give money to a criminal. Even if the crime is reposting a meme on a social network.

From the bank's point of view, any violation of the law is bad. Such a client is unreliable. He might break the law again. Then there will be no income from the loan. But there will be problems with the sale of secondary real estate.

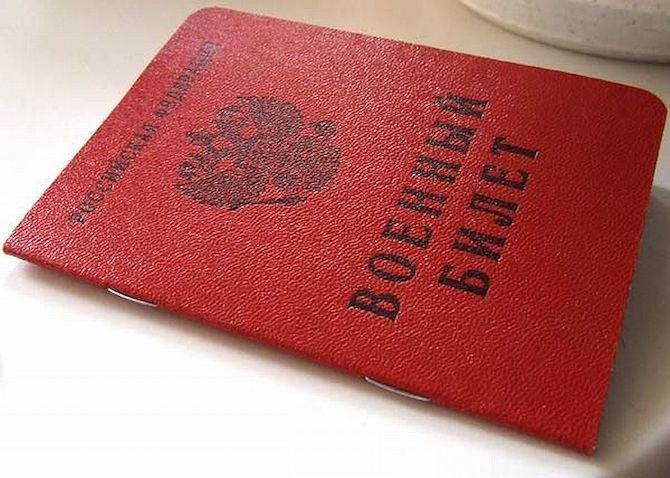

No military ID

A military ID is an additional requirement of the bank for men.

Usually they refuse if the borrower did not serve in the army and there is no deferment in the registration. For the bank, such borrowers are a big risk. Perhaps they are avoiding service. Therefore, at any moment they can be tracked down by the military registration and enlistment office and taken away. As a result, the co-borrower, if there is one, will repay the loan.

Without a military ID, it is more difficult to get a mortgage. The bank needs evidence that the man is not interested in the military registration and enlistment office

For what reasons do banks refuse mortgages?

As a rule, VTB 24, Sberbank and other financial institutions do not tell clients what their decision to issue a loan is based on. Therefore, borrowers are tormented by a logical question: “How can we find out why we are denied a mortgage?”

In fact, the reasons for this decision are quite obvious. And knowing these reasons allows a person not only to save his time, but also to adjust some points to increase the chances of getting a loan.

1. The borrower’s failure to comply with the bank’s basic requirements.

Any credit institution has such requirements. Clients who do not meet them are immediately rejected. And they don’t even consider the other criteria. Therefore, before applying for a loan, find out who exactly the bank wants to see as a borrower. The basic requirements look something like this:

- total work experience over the last 5 years – at least 1 year;

- work experience at the last place of work - at least 6 months;

- suitable age is from 21 to 75 years.

Do you meet the main criteria? Then you can safely apply for a loan. Although even then you cannot be completely sure of a positive answer, since there are many other reasons why financial institutions refuse to issue a loan.

2. Bad credit history.

All credit organizations first study the client’s credit history. The database stores information about the movement of each person's credit funds over the past few years. Therefore, the bank representative immediately sees the presence of debts and arrears or stable loan repayment.

[offerIp]

If you are currently in arrears, the response to your application is more likely to be negative. Also, banks sometimes refuse borrowers who have been in arrears on a loan that has been repaid for a long time. A clean credit history can also raise doubts at a financial institution, because then it is impossible to determine the integrity and solvency of the applicant.

How to get a mortgage if banks refuse because of a clean credit history? You can take out a small consumer loan for a short period of time and then pay it off a little ahead of schedule. The main thing is not to do it too quickly. Otherwise, a banking analyst may regard your actions as a rating increase.

3. There were errors in the documents.

Quite often, credit institutions refuse to issue a loan due to errors in the submitted documents. They are allowed both by inattentive clients and incompetent employees of the organization that issues income certificates.

The most common typos are common. But you shouldn't underestimate them. After all, any errors distort the initial information, which plays an important role in making a decision on issuing a loan.

4. Insufficient financial capabilities.

Can a bank refuse a mortgage due to the borrower’s insufficient solvency? Of course, special attention is paid to this. The longer your work experience and the higher your income, the more trust you have. The lender will need a certificate of form 2-NDFL or a certificate filled out in a bank form and certified by the employer. Try to convince the organization that you have good income, and then difficulties will not arise.

It should be noted that it is much more difficult for an individual entrepreneur who operates under a simplified taxation scheme to confirm the amount of his earnings, and it is quite difficult for a bank to determine his real income. People working informally should also not count too much on getting a loan.

5. Debts in the tax and traffic police departments.

Before contacting a financial institution, be sure to check your debts to the tax and traffic police. Unpaid fines and loans can also let you down.

In most cases, banks refuse to issue mortgages to previously convicted persons. Although they may well make concessions if the conviction was only conditional.

6. Uncertain client behavior.

When making a decision, credit institutions do not limit themselves only to computer data processing; their representatives must talk with applicants. Confusion in answers and uncertain behavior of the client can arouse suspicion among the employee and lead to a negative answer. Therefore, we advise you to always tell the truth, especially when questions relate to your work and salary.

7. Information provided by the borrower cannot be confirmed.

Providing a mortgage loan to a client involves paying a large amount of money. Obviously, it is in the interests of the financial institution to find out about the solvency of the borrower and verify the veracity of the information provided by him. Bank employees carefully check the information received, and if they cannot contact the client’s manager at the specified number, they simply refuse to issue a loan.

That is why it is so important to provide reliable information and warn the accounting department and boss in advance about a possible call. If you provide mobile numbers of your friends and relatives in the questionnaire, you need to warn them too.

8. Falsification of documents.

Modern verification methods make it possible to almost always distinguish a forged document from the original. Therefore, we categorically do not recommend using the services of people offering to issue fictitious documents.

At best, exposed “swindlers” are denied a mortgage, and at worst, they are added to the “black list” (a database of unscrupulous clients). Moreover, falsifying documents is fraught with criminal liability.

9. Poor health of the borrower.

How often do banks refuse a mortgage for this reason? You may be surprised, but the health of the borrower is important to financial institutions. Most often, mortgage loans are denied to clients undergoing long-term hospital treatment and pregnant women. The presence of a disability, as well as obvious signs of a serious illness, are quite common reasons for negative loan responses.

Important!

Listed above are the main criteria by which banks refuse a mortgage. But each organization has its own verification system, with its own requirements. Thus, VTB 24 is less likely to refuse to provide loans to borrowers with lower incomes but longer work experience in one place than to clients with high incomes and numerous marks of places of work in their work books.

In 2021, the stability of the Russian economy has worsened, which is why credit institutions now refuse to issue a mortgage loan in 80% of cases.

10. Low liquidity of the property.

The requirements for the collateral property are often much greater than for the applicant. Why do banks refuse mortgages in this case?

Before issuing a mortgage, bank experts evaluate in detail the property that is being pledged as collateral. They always start from the worst case scenario - the borrower refuses to repay the loan. In such a situation, the financial institution will be forced to sell the mortgaged property in order to cover the principal debt on the loan with the proceeds.

Approximate criteria for assessing the purchased living space:

- legal aspects – there are no illegal redevelopments, debts or other encumbrances;

- location - suburban or urban areas, regions of operation of bank branches;

- landscaping - availability of electricity, sewerage, cold water, bathroom and separate kitchen;

- date of construction - no earlier than 1965;

- type of real estate - a private house with a plot of land or a comfortable apartment.

As a rule, banks refuse to provide mortgages for the purchase of rooms in dormitories and communal apartments. They also do not consider housing located in remote regions, since it is very difficult to sell.

Special situation: the mortgage was first approved, then denied

Separately, there are cases of refusal after mortgage approval. This usually happens when:

- The economic situation has changed. For example, in 2014, the Central Bank increased the key rate. Approved loans became unprofitable for banks. They renegotiated the terms of the loans. Those who stopped approaching were refused before the deal.

- The borrower changed jobs. The bank may reconsider the decision on the application. Especially if the new job has a lower salary.

- New loan. Don't apply for new loans before you get a mortgage. A new loan load may force the bank to withdraw approval.

- Delinquency on old loans. You can't make debts either. Otherwise, the bank will think that you are an unreliable borrower. The refusal may come right before the deal is concluded.

- A criminal case was opened against the borrower. There will be 100% failure. Because tomorrow the borrower could go to jail.

What else could be a reason for refusing to issue a mortgage?

1. The bank employee was unable to reach the client or employer.

Imagine that a client applied to a credit institution for a mortgage, and a few days later went on vacation to another country. The mobile number he indicated in the application form became unavailable. As a result, the bank denies the mortgage because the employee was unable to reach the client by phone.

To avoid getting into a similar situation, be sure to check that all telephone numbers specified in the application form are correct. Moreover, financial institutions ask to provide the employer’s landline number. Always be in touch and warn your boss in advance about a possible call, because a bank employee can call at any time. If you don’t pick up the phone, then don’t be surprised later why you are denied a loan.

You will definitely not miss a call if you do the following:

- warn your management;

- You will always keep your phone with you;

- Please check that the numbers on the form are correct.

2. The employer has a bad reputation.

Example: Anatoly applied to the bank to obtain a mortgage. He has been an employee of a large company for the past 5 years, receives a large salary and is completely satisfied with his work. With contributions to the pension fund, everything is also in order. But after 2 days, a bank employee contacts Anatoly and advises him to change his job. Anatoly is perplexed.

The thing is that financial institutions have access to a database of existing entrepreneurs and companies. The advice of a bank employee in the example above means that Anatoly’s employer is having problems and the company may soon close. Under such circumstances, credit institutions refuse to issue a loan. But if Anatoly finds another, more reliable job, he will probably be given it.

3. High credit load and high expenses.

Let's assume that a girl named Maria rents a house for 15,000 rubles. She calculated that it would be more profitable to pay the same money for a mortgage while living in her own apartment. But, checking Maria’s credit history, a bank analyst discovered 2 existing loans that the girl took out for a dishwasher and a car. Her total monthly loan payment is 20,000 rubles. In addition, Maria has a credit card with a limit of 80,000 rubles, which she has not yet used. As a result, the bank denies the mortgage.

Why was this decision made? Maria’s salary is 50,000 rubles. If she gets a mortgage loan, then another 15,000 rubles will be added to her monthly payments. It turns out that she will only have 15,000 rubles left to live on. This means that Maria is denied a loan because of her debt load.

It is believed that a person who has less than 60% of his salary left after paying off all loans has a large credit burden. If you have a credit card, the bank even adds 10% of the limit to such a client. Moreover, regardless of whether he has ever used this card or not.

If you have a large credit burden and therefore banks refuse a mortgage, do the following:

- Pay off all debts (only after this you need to apply for a mortgage).

- If you can’t do this on your own, attract an uncredited co-borrower with a good credit history and a stable income.

- Use the services of a broker to select a credit institution with flexible financial requirements (usually with a higher interest rate to cover your risks).

4. Small salary.

Employees of financial institutions always check that the monthly mortgage payment does not exceed 40% of the client's earnings. They want to be sure that the borrower has enough finances to make loan payments and maintain their normal functioning.

Thus, an applicant with a salary of 15,000 rubles will never be issued a loan with a monthly payment of 10,000 rubles. Although he can contact some small financial institution or attract a co-borrower. What to do if the employer pays part of the salary “in an envelope”? In such a situation, the applicant must fill out a certificate on a bank form and indicate in it the real amount of his income. It is important that his manager confirms this figure over the phone, and that the salary corresponds to the position held.

Example. Officially, Andrey earns 25,000 rubles. At the same time, he is paid a bonus of 10,000 rubles every month. It turns out that Andrey’s actual salary is 35,000 rubles per month, although according to the 2-NDFL certificate it is only 25,000 rubles. In this case, Andrey should inform the bank employee that his real income is 1.5 times higher than the figure indicated in the certificate.

There is nothing to be afraid of here, since the bank will not complain about the employer to the tax office. It has a completely different goal - to determine the actual solvency of the borrower. If Andrei’s manager confirms this information, then Andrei will receive the desired mortgage.

5. Several refusals in different banks.

Several banks refuse to give Mikhail a mortgage. He does not know that financial institutions transmit information on all decisions to the BKI. Now it will be even more difficult for Mikhail to get a mortgage, since the bank employee will immediately see in his credit history that all banks are refusing him, and will simply not consider his candidacy. Mikhail should have contacted a broker after he was rejected for the first time. Then he would have a much better chance of success.

6. Moratorium refusal.

A moratorium on refusal means that an applicant who has not been approved for a mortgage cannot re-apply within a specified period (usually 1 month). If he does this earlier, the system will immediately refuse to issue a loan.

7. The client often changes jobs.

Another negative factor is frequent changes of employer. This is one of the most common reasons why banks refuse a mortgage.

Confidence in the applicant increases if he works:

- in a stable job. Bartender, security guard, taxi driver, waiter, etc. – these are professions with a high risk of dismissal and unstable earnings;

- at the current position for at least six months;

- 1-2 years in one organization.

If you are denied a loan for this reason, you can contact a small bank. Small financial institutions are interested in each borrower and consider each individual case individually. Another option is to involve a co-borrower. This will convince the bank that if not you, then another person will definitely repay the loan.

8. The borrower has a dubious profession.

Some banks refuse mortgages to clients with a dangerous or dubious profession.

At risk may be:

- government officials who are unable to confirm the full amount of their earnings with a 2-NDFL certificate;

- creative workers;

- firefighters, security guards, bodyguards;

- pawnshop employees;

- individual entrepreneurs;

- gambling club employees;

- sales managers;

- insurance agents and realtors.

Even if the mortgage is approved, workers in hazardous professions are required to insure their life and health. They have a particularly high risk of death and disability. This means that insurance payments for them will be higher.

9. The client previously had a lawsuit with the bank.

Anton applied to a credit institution to obtain a mortgage. A few years ago he was defrauded by a bank, after which Anton sued and won the case. Now another bank refuses to give him a mortgage. It turns out that the trial influenced his decision. Please note that creditors are wary of those who sue them.

10. There is no military ID.

If a man does not have a military ID, there is a risk that he will be called up for service. Who knows, maybe he is evading, and the military registration and enlistment office will find him today or tomorrow. This is why banks refuse mortgages to men between 18 and 27 years old who do not have a military ID.

11. Having a criminal record.

There is an unspoken rule not to give loans to people with previous convictions. And many financial institutions adhere to it. It is believed that a person who has broken the law once may well do it again. And then he will not be able to repay the loan, and the bank will be forced to sell the mortgaged apartment at auction (which is extremely unprofitable).

How to find out why your mortgage was rejected

Your mortgage has been rejected - try to find out the reason.

- Ask a bank employee. They are not required to provide the reason for refusal. But some banks meet customers halfway and tell them why they did not give a loan.

- Compare the costs of loans taken and income. Usually they refuse when expenses exceed 40% of income.

- Check your credit history. Request it from BKI. Refusals come to clients who did not take out loans or were late in payments.

Plus compare yourself to the list of top reasons above. Perhaps you fall under one of them.

Debts with tax and other authorities

Sometimes the reason for refusal of mortgage lending is the presence of any debts to government organizations. It is important to check whether there is any existing debt with the tax office. Even minor fines, as well as unpaid taxes or penalties, can be the main reason for a mortgage refusal. Also, if you have a criminal record, the bank has the right to refuse to issue a loan, but if the criminal record is suspended, some banks may accommodate clients and issue a loan.

Possible solutions

It is important to contact the necessary State organization - the tax service or the traffic police in order to check the presence of any possible debts. If any violations of non-payment are detected, it is important to correct the situation and close all existing debts to the state. Only after the “debt encumbrance” is removed can you contact the bank again. To do this, you can first visit the website of the required government organization to check the availability of existing debt. The fact is that sometimes information about existing fines and debts can be corrected by employees not immediately, but after a certain time.

When is the best time to reapply for a mortgage?

Depends on the bank.

Some banks, after refusing a mortgage, place the client on hold. For some time, all his applications will be rejected. Usually this is no more than 6 months. For loan overdue and other serious situations, the period may increase to 5 years. You can re-apply immediately after the problems have been resolved. Your salary has increased or become completely white, you have money for a down payment, you have found a good co-borrower - go to the bank. He will look at new facts. He will weigh them and give a decision.

Each situation is individual. So try it. Perhaps even a small increase in wages will change the bank’s decision.

Why refinancing may be denied

No one obliges banks to inform borrowers about the reasons why they are denied refinancing, which is what lenders take advantage of. In this regard, understanding each specific reason for refusal can be problematic. But there are some general reasons that affect the outcome of the application.

One of these reasons is that if the borrower has already refinanced his mortgage loan in the recent past, the bank regards such actions as “an attempt to play in its favor.” If the mortgage was obtained less than 6 months ago, then this may be another reason. From an economic point of view, the bank is not interested in this, and if you refinance with the same bank, then especially since the rate will decrease.

There are other reasons, for example, incorrectly executed documents or the presence of illegal redevelopment of housing, which will “pop up” in the process of assessing the property. The same applies if there is no insurance (this is one of the prerequisites for a rate reduction). Also, the bank may refuse the application due to its current policy if, for example, refinancing is not a priority for it.

Delays in repaying loan obligations, poor credit history and non-compliance with the terms of the program (for example, the term/amount of the loan) are reasons for refusal. Sometimes borrowers indicate for refinancing an amount greater than the amount originally borrowed - in this case, there will also be a refusal.

Portrait of an ideal bank client. How to increase your chance of getting a mortgage approved

- Good health.

- Higher education.

- A neat appearance when going to the bank.

- Quick response to calls from the bank.

- Good credit history or lack thereof. It is better if the client has taken out loans before, has repaid everything or is paying consistently.

- Expenses are less than 40% of income.

- Stable, safe job with a decent salary.

- Down payment 30-40% of the property value.

- There are up to 4 co-borrowers.

- Few dependents.

- There are no debts to the state.

- Close relatives do not have a bad credit history.

- No criminal record.

- Military ID or registration with deferment.

- There are other properties owned.

- Good, liquid real estate has been selected. Fresh secondary or new building.

Main reasons

A variety of factors can lead to a bank refusing a mortgage after approval. And sometimes even borrowers with sufficient income and a good credit history face this situation. Among the main factors that help ensure that you are not denied a mortgage after approval are:

- working age – from 21 to 75 years;

- work experience of at least six months;

- total work experience from one year.

Recommended article: Requirements for online mortgage documents

Methods for assessing the creditworthiness of a mortgage borrower

If these conditions are met, you can safely consider a number of lending programs.

Can a mortgage be denied after approval?

Absolutely yes. This may be due to the borrower’s negative credit history, even if it had been improved by the time of the application. To correct it, they usually take out a small loan and repay it on time. But you shouldn't pay off your debt early. The bank may regard such manipulations as a deliberate increase in the rating. This will also contribute to the refusal of a mortgage loan.

The second most common aspect for refusal may be errors made in the documentation. As a rule, they arise due to the inattention of the borrower himself or a bank employee when filling out the questionnaire.

Important! A typo in a document is equivalent to providing false information, which leads to a refusal to issue a mortgage loan.

Requirements for online mortgage documents

Often, borrowers provide the bank with income certificates in free form, indicating a higher salary. But bank employees can call your employer and check your earnings level. People who receive salaries in envelopes are least likely to take out a mortgage.

If Sberbank refused a mortgage after approval, then it is likely that one of the above factors contributed to this. The reason for refusal of mortgage lending may also be:

- uncertain behavior of the applicant, who cannot immediately provide reliable information about the income received or the place of work;

- having a criminal record;

- identification of debts for taxes, housing and communal services, fines;

- unreliability of the employer - the organization is also checked for litigation;

- providing false documentation;

- an attempt to inflate the cost of housing;

- applying for a personal loan for a down payment;

- lack of approved housing if the apartment chosen by the borrower does not meet the requirements of the financial institution;

- presence of outstanding consumer loans;

- change of credit program.

Important! They may also refuse if bank employees fail to verify the information provided by the client, do not get through to the employer, etc.

Important to know: Reasons for refusal of a mortgage: what should borrowers take into account?

Recommended article: Tax deduction when buying a second apartment

Contact all banks, check all options

If you were denied a mortgage - remain optimistic.

There are chances of getting approval from another bank. Use the service on our website where mortgage offers are collected. Remos employees will submit your applications to several banks at once. All you have to do is wait for answers and act according to the situation. There will be refusals - check yourself with the list. Perhaps there is something alarming the banks. Fix any problems, cover any weaknesses, and reapply. Perhaps this time you will look like the ideal borrower.

Remember, many factors influence the bank's decision. Even the economic situation. Therefore, reapply regularly to get a mortgage. Sooner or later you will be approved.