Bank guarantee 44-FZ

The concept of a bank guarantee consists of the interaction of 3 parties:

- The beneficiary is the customer in whose favor a contract performance guarantee (CPE) is issued and who receives compensation in the event of failure to fulfill obligations by the supplier.

- Guarantor is a bank that issues a guarantee and reserves the amount specified in the document in its account in order to pay it to the customer if necessary.

- The principal is an applicant for the issue of a guarantee from the bank to confirm his reliability.

Thus, a bank guarantee under 44-FZ is a document confirming the Guarantor’s agreement to pay a certain amount to the Beneficiary in the event of evasion or improper performance of the contract by the Principal.

In addition to providing an application that confirms the viability of the contractor, you need to worry in advance about entering the OIC in case of winning the tender. These are often huge amounts, so many organizations use a bank guarantee as an OIC so as not to withdraw their own assets. It is up to the supplier to decide whether to deposit his own money or issue a BG as interim measures; it is his choice.

General requirements for a bank guarantee

The general requirements for a bank guarantee, which is a type of independent guarantee, are established by paragraph 6 of Chapter 23 of the Civil Code of the Russian Federation. According to paragraph 2 of Art. 368 of the Civil Code of the Russian Federation, a bank guarantee is issued in writing, which allows one to reliably determine its terms and verify the authenticity of its issuance by a certain person in the manner established by law, customs or an agreement between the guarantor and the beneficiary.

In accordance with paragraph 4 of Art. 368 of the Civil Code of the Russian Federation, the bank guarantee must indicate: – date of issue; – principal; – beneficiary; – guarantor; – the main obligation, the fulfillment of which is ensured by a guarantee; – the amount of money to be paid or the procedure for determining it; – warranty period; – circumstances upon the occurrence of which the guarantee amount must be paid.

Federal Law No. 44-FZ dated 05.04.2013 “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” (hereinafter referred to as Law No. 44-FZ) established additional requirements for bank guarantees that are provided to the customer as securing applications for participation in a competition or closed auction, as well as as security for the execution of contracts (hereinafter also referred to as bank guarantees).

Banks authorized to issue bank guarantees

Not all banks have the right to issue financial statements; only certain financial organizations are authorized to do so. They must meet a number of requirements approved in Part 3 of Article 74.1 of the Tax Code of the Russian Federation.

The Ministry of Finance of the Russian Federation is responsible for the List of such organizations. The Ministry of Finance uses the information provided by the Central Bank of the Russian Federation and publishes it in the public domain.

The requirements for banks are described in detail in the legislation: Part 3 of Article 74.1 of the Tax Code of the Russian Federation for guarantees under 185-FZ and Part 1, 1.1 of Art. 45 for guarantees under 44-FZ. These requirements, in addition to standard conditions, for example, the presence of a license and compliance with Central Bank regulations, also contain quantitative ones - the availability of own funds of at least 1 billion rubles. Of course, compliance with all these requirements changes somewhat, and, accordingly, their powers to issue guarantees under 44-FZ also change. To avoid confusion, the Ministry of Finance, together with the Central Bank, maintains an official register of banks.

When a bank appears that meets the above requirements, the Central Bank of the Russian Federation transmits this information to the Ministry of Finance within 5 days from the date of discovery in order to add this bank to the list of organizations issuing financial statements.

The same procedure applies when a bank ceases to comply with the approved provisions and must be removed from the list.

Thus, if necessary, you can check a specific bank for compliance with the requirements established by law. At the same time, you need to know that the security issued by the financial institution continues to be valid and does not require replacement or re-issuance if it is removed from the register.

Bank guarantee period according to 44-FZ

When determining a supplier, the participant has the right to provide a bank guarantee in 3 cases:

- When it is provided as security for an application, its validity period must be at least two months from the closing date for filing applications.

- When signing a contract, it is presented as security for the performance of the contract. In this case, the validity period of the bank guarantee must exceed by at least one month the period of fulfillment of the obligations that are secured by such a bank guarantee, incl. if this period changes within the framework of Art. 95 44-FZ.

- When a bank guarantee provides guarantee obligations, its period must exceed the period for fulfilling such obligations by at least one month. This was indicated by the Ministry of Finance in letter No. 24-03-07/63253 dated 08/19/2019.

Thus, the period for providing a bank guarantee under 44-FZ as security for an application, as security for the performance of a contract and as security for guarantee obligations is different. This must be kept in mind when you contact a bank or other credit institutions to obtain a bank guarantee.

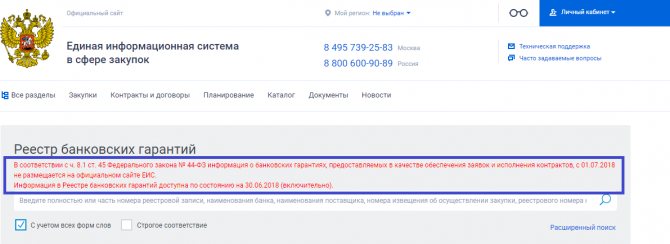

BG register

Until July 1, 2018, the BG register operated in open mode and anyone could familiarize themselves with it on the website of the Unified Information System (UIS). But after July 1, open access to the EIS is closed according to the new rules of PP No. 1005. From now on, information is available only to customers and bank representatives.

The following information is entered into the BG Register (Part 9 of Article 45 of 44-FZ):

- name, TIN and address of the bank that issued the document;

- name, TIN and address of the BG applicant;

- the amount that the guarantor will be obliged to transfer to the beneficiary if the supplier fails to fulfill the terms of the contract (or in case of refusal to conclude the contract);

- validity period of the BG;

- a copy of the guarantee, except for those documents, information about which is included in the closed register of the BG;

- other documents according to the list of Decree of the Government of the Russian Federation dated November 8, 2013 No. 1005.

The institution issuing a guarantee as an OIC, within 1 business day following the day of issue of the BG, is obliged to send information to the register (or closed register) of the BG, based on the rules and procedure for its maintenance. Then, within 1 working day after entering this information into the register, the bank draws up an extract from the register of bank guarantees and transfers it to the applicant.

Register of bank guarantees

The BG provided by the procurement participant as security for an application for participation in a tender or closed auction or as security for the execution of a contract must be included in the register of bank guarantees located in the Unified Information System (UIS).

An exception is made for security deposits provided as security for applications and execution of contracts, if such applications and (or) contracts contain information constituting a state secret. Information about such guarantees is included in a closed register of bank guarantees, which is not posted in the Unified Information System.

When issuing a BG, the bank provides the principal with an extract from the register of bank guarantees.

The bank that issued the bank guarantee, no later than one business day following the date of its issuance, or the day of making changes to the terms of the bank guarantee, includes the necessary information and documents in the register of bank guarantees or, within the specified time frame, sends information for inclusion in the closed register of BG.

The Federal Treasury maintains the register and places it in the unified procurement information system.

The BG register and the closed BG register include the following information and documents:

- name, location of the bank that is the guarantor, TIN or, in accordance with the legislation of a foreign state, an analogue of the TIN;

- name, location of the supplier (contractor, performer) who is the principal, TIN or, in accordance with the legislation of a foreign state, an analogue of the TIN;

- the amount of money specified in the BG and payable by the guarantor in the event of failure by the procurement participant to comply with the requirements of 44-FZ in established cases;

- validity period of the BG;

- a copy of the BG, with the exception of the BG, information about which is subject to inclusion in the closed register of the BG;

- other information and documents, the list of which is established by the Government of the Russian Federation.

Types of BG

The BG is issued both as security for the application and as an OIC. The second case is most common in the field of public procurement.

One of the key conditions for concluding a contract is the irrevocability of the guarantee under 44-FZ . This means that the financial institution that issued the document does not have the right to revoke the guarantee at its discretion and undertakes to fulfill all obligations assumed.

Currently, all bank accounts meet this condition, so banks take a serious approach to checking all financial indicators of the principal. Because if it turns out to be unreliable, then the bank will not be able to avoid paying the “penalty” to the customer.

Irrevocable bank guarantee under 44-FZ 2021

Content

1. BBG: what are the specifics?

2. Forms of bank guarantee

An irrevocable bank guarantee for a government contract is a guarantee that remains valid for the entire duration of the contract and guarantee obligations. This type of guarantee not only proves the integrity of the supplier/contractor, but also provides a guarantee that financial obligations to the customer will be paid in any case, if not by the procurement contractor, then by the bank.

BBG: what are the specifics?

Each bank guarantee is a kind of guarantee from the bank for the integrity of the company’s actions. There are several types of BG:

— execution;

- tender;

- payment;

- advance payment.

Want to win a quote request?

Take advantage of our achievements! We will help you win at least a third of the quotes!

Win Quote

Bank guarantee forms

The first (revocable) form can be changed or completely canceled by order of the bank that issued it, which makes it practically meaningless. The beneficiary is deprived of any leverage in this situation and has no guarantee that the BG provided to him will not turn into a simple piece of paper at any moment.

The second (revocable) form gives the customer absolute protection from an unscrupulous contractor: no matter what happens, the bank will always pay the customer the funds provided. An irrevocable bank guarantee applies not only to the term of the contract, but also to the duration of the guarantee obligations. Another advantage of BBG is a preliminary thorough check of a potential client. No credit company wants to lose their money in vain, so the verification of the supplier will be complete and multifaceted to eliminate any unpleasant surprises.

However, this form of guarantee is beneficial not only for the customer: the bank receives interest for the provision, the supplier does not need to take cash out of circulation and has the opportunity to use these funds to fulfill the contract.

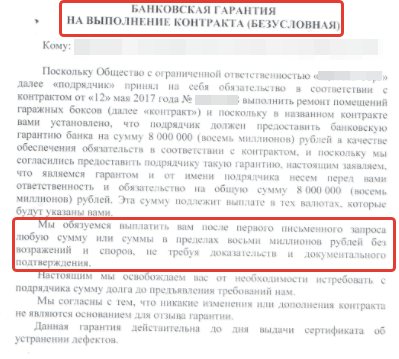

The BBG itself represents the obligation of the bank (guarantor), upon the first request of the customer (beneficiary), to make a payment against the debt of the supplier (principal). The most interesting thing is that the debt does not need to be justified or argued with various documents; the money is received unconditionally, upon request.

Here is an example of such a document:

Back to list

Amount of security for the execution of a government contract

Parts 6 and 7 of Article 96 44-FZ are devoted to this issue.

The amount of the bank guarantee 44-FZ for OIC varies from 5% to 30% of the NMCC specified in the purchase notice.

When the NMCC is more than 50 million rubles, the customer must set the cost of collateral from 10% to 30% of the NMCC. Moreover, if the contract contains an advance payment clause, the security amount must not be lower than the advance payment. If the advance exceeds 30% of the NMCC, then the OIC is set equal to the advance.

The legislation also pays serious attention to anti-dumping measures when a participant offers a price significantly lower than that indicated in the notice.

Article 37 of 44-FZ sets out in detail under what conditions and how OIC is calculated and paid.

Two important points:

- If the NMCC notice contains more than 15 million rubles. and the winner of the auction offered a price for executing the order that is 25% lower than the specified cost, then in accordance with Part 1 of Article 37 of 44-FZ, he is obliged to provide cash security or a bank guarantee in the amount of one and a half times the specified amount in the notice.

- If the NMCC is less than 15 million rubles, then the participant with whom the contract will be concluded has 2 ways to justify its reliability:

- enter the OIC 1.5 times more than specified in the notice;

- submit information proving the good faith of such a participant (Part 3 of Article 37 of 44-FZ) + enter the OIC in the amount specified in the notice.

Both one and a half times OIC and information confirming the good faith of the winner are provided before the conclusion of the contract. If this rule is not followed, the participant will be recognized as having evaded concluding the contract, then a protocol will be drawn up and published in the Unified Information System.

Calculation of a bank guarantee

The amount of bank collateral directly depends on the NMCC. However, each bank has a personal approach to each client. A natural situation is when the size of the OIC depends on the company’s assets and has a certain limit.

The fee for the bank account is also set individually depending on various conditions: the guarantee period, its amount, internal bank regulations, and the financial condition of the company. In some banks, the amount of the BG also depends on the presence of a condition on indisputable write-off, advance payment, and the availability of a standard BG form (it is offered by the customer as part of the procurement documentation).

Let's look at these conditions in more detail.

Requirements that can be presented by the customer to the BG

Having decided on the amount of security, you need to carefully review the documentation for other conditions.

— undisputed write-off: when insuring themselves, some customers include in the documentation a requirement to include in the text of the BG a condition on undisputed write-off. This means that if the supplier does not perform the work under the contract, the customer has the right to make a claim to the bank and receive the OIC amount without unnecessary red tape and litigation.

— advance payment: undoubtedly, an advance payment is a pleasant bonus for the supplier, but on the other hand, this means inclusion in the list of guarantee obligations of responsibility for the return of the advance payment, for which some banks increase the commission.

At the same time, other banks are neutral about the availability of advances under the terms of the guarantee and do not increase their commission. Therefore, it will be important to spend your time and find a bank with suitable conditions.

— BG form : some customers offer their own template (standard layout) of the 44-FZ guarantee as part of the documentation. Most often, the supplier himself decides whether to use it or not. And customers agree with minor amendments from banks.

However, there are customers who insist on their own form. But here another problem arises: all banks issue guarantees in their own form, developed by their lawyers. And there are a number of financial organizations that will not accept a document in the customer’s form.

There are also banks that will not refuse to accept the customer’s BG form, but will do so reluctantly, for a fee.

Therefore, if the customer has proposed his own BG template, we recommend notifying the bank about this in advance, which will allow you to find out whether he will approve or not approve this form. As a result, you will save your energy and time.

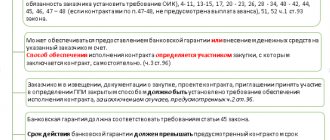

— specific requirements for the text of the BG : many customers do not offer a warranty template, but set a number of requirements that it must satisfy, for example:

- frequent requirement to consider conflict situations under the Civil Code at the customer’s location;

- requirement to disclose the list of obligations covered by the guarantee;

- some customers require BG in paper form, but now this is illegal. An electronic document certified by a qualified digital signature will be sufficient to provide an OIC.

Recommendation: comprehensive requirements for banking support under 44-FZ are specified in Government Decree No. 1005, the draft contract, information card, procurement documentation and its annexes.

Requirements that may be presented by the customer for a guarantee under 44-FZ

Having decided on the size of the guarantee, you need to carefully study the documentation for its other parameters.

— undisputed write-off: some customers, trying to protect themselves, state in the documentation a requirement to include in the text of the BG a condition on undisputed write-off.

In fact, this means that if the principal fails to fulfill his obligations, the customer has the right to make a claim to the guarantor bank and receive the amount secured by the guarantee without disputes or additional proceedings.

— advance payment: here it is important to understand that the presence of an advance payment in the contract, on the one hand, is an absolute advantage for the supplier, and on the other hand, means inclusion in the list of guarantee obligations of responsibility for the return of the advance payment, for which some banks provide for an increase in the commission.

At the same time, many banks today are calm about the availability of advances under guarantee conditions and do not increase their commission. Therefore, it is important to monitor prices on the market, find out and compare the conditions for providing BG by different banks.

— BG form : some customers attach their standard form (layout) of the 44-FZ guarantee to the documentation. In most cases, this form is advisory and not mandatory, and many customers agree to minor amendments by banks.

However, there are often principled government customers who insist on using exclusively the form they developed. It would seem that what problems might be associated with this - use this form and that’s it. But everything is not so simple: all banks issue guarantees in their own form, developed by the legal service. And there are a number of institutions that do not want to agree on the customer’s form.

There are also banks that agree to use the customer’s BG form, but do so reluctantly, for an additional fee.

Therefore, if your customer’s documentation stipulates a certain form of BG, when applying to the bank for a guarantee, you must notify this circumstance in advance so as not to waste time working with a bank that obviously does not approve the layout of the customer’s BG.

— specific requirements for the text of the BG: many customers do not attach their warranty form to the documentation, but prescribe a number of requirements that it must contain, for example:

- there is often a requirement to consider disputes under civil law at the customer’s location;

- requirement to disclose the list of obligations covered by the guarantee;

- some customers require a paper version of the bank guarantee, but this is not legal now. An electronic version signed with a qualified digital signature is sufficient to provide security.

Advice: comprehensive requirements for a bank guarantee under 44-FZ are set out in Government Decree No. 1005, the draft contract, information card, documentation in general and its annexes.

RusTender cooperates with a number of banks included in the list of the Ministry of Finance for the right to issue guarantees 44-FZ and we offer favorable conditions for companies with various financial indicators. You can use the bank guarantee calculator to find out the cost from one of our partners.

Validity period of the bank guarantee

The duration of the BG must be at least 1 month longer than the deadline for fulfilling obligations provided for in the contract (Part 3 of Article 96 of 44-FZ). However, this requirement does not mean strict compliance with it. The auction organizer has the right to indicate in the documentation that the validity period of the guarantee must exceed the period for fulfilling obligations by two or three months.

However, the duration of the contract is not always equal to the period of fulfillment of obligations. Often it includes the customer’s obligation to pay and goes beyond the scope of fulfillment of obligations. Therefore, you need to focus specifically on the deadline for fulfilling obligations.

Validity period of the bank guarantee under 44-FZ

I repeat once again that the BG within the framework of 44-FZ can be provided by the procurement participant as security for the application and as security for the execution of the contract. In this regard, the validity periods of such guarantees should be different.

According to Part 3 of Article 44 of 44-FZ, the validity period of the BG provided as security for the application must be at least two months from the deadline for filing applications.

According to Part 3 of Article 96 of 44-FZ, the validity period of the BG provided as security for the performance of the contract must exceed the validity period of the contract by at least one month .

Normative base

All requirements for a bank guarantee are listed in Article 45 of 44-FZ, and the conditions of OIC are listed in Article 96 of 44-FZ.

In these provisions, the legislation answers almost all questions related to the provision of a BG as an OIC.

An important regulation regulating the requirements for the text of the guarantee is Government Decree No. 1005 of November 8, 2013 “On bank guarantees used for the purposes of the Federal Law “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs.”

Types of bank guarantees

The following types of bank guarantees are used in banking practice:

- tender guarantee;

- payment guarantee;

- payment return guarantee;

- guarantee for VAT refund on application;

- other goals.

As already noted, one of the conditions for participation in a tender for a state or municipal order is to provide the application with a bank guarantee. This is a requirement of Federal Law No. 44-FZ dated 04/05/2013 “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” (hereinafter referred to as Law No. 44-FZ).

Replacement of collateral

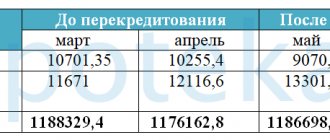

The contract security form can be replaced. This is permitted by current legislation. For example, if the OIC was provided with its own money to the customer’s account, then the contractor subsequently has the right to replace it with a bank guarantee 44-FZ, which will be reduced by the amount of the obligations already actually fulfilled under the contract with the customer.

To do this, a guarantee should be issued, the amount and duration of which should be reduced in proportion to the performance of the contract.

Refusal of a bank guarantee

Not every supplier can receive a bank guarantee. To do this, it must have certain financial indicators, as well as be positive from the point of view of banks. For example, companies that have recently registered or do not have a single executed contract to their credit will most likely not be given a guarantee . In addition, this may be hindered by:

- bad credit history of the organization itself, its manager or owners;

- the presence of litigation;

- existence of enforcement proceedings.

What to do in this case? Experts recommend not wasting time and securing the contract with money . Maybe next time the bank will not refuse the supplier. After all, it is possible that its financial indicators will improve and other negative circumstances will disappear. In addition, at least a couple of completed contracts will significantly increase the supplier’s chances of receiving a bank guarantee.

Procedure and terms for issuing a bank guarantee

44-FZ strictly regulates the deadline for signing the contract by the winning bidder, and therefore the deadline for providing the BG.

If we talk about an auction in electronic form, it lasts 5 days for each party. In this case, the procurement organizer can send a draft contract within 5 days, i.e. both on the 1st and 2nd day after the publication of the protocol for summing up the results of the auction, thereby reducing the period for signing the contract.

That is why interim measures for government orders are usually issued using the express method and the total release time is 2-5 working days:

- Review within 1-2 days from the date of provision of all documentation.

- Issue within 1 day on the day the commission is credited.

- Entering into the register within 1 day after the scan is released.

What documents does the bank usually request?

Absolutely all banks require the applicant to provide accounting and legal documentation: financial statements (or book of income and expenses) for the last year and completed quarters of the current year, constituent papers and an application for issuing a financial statement.

The customer reviews the BG within 3 working days from the date of its receipt and makes an appropriate decision. If the customer does not accept the document, then within these 3 days he is obliged to respond to the winning bidder and explain why he did not accept the guarantee as an interim measure.

Invalid bank guarantees

In practice, there are situations when “gray” and “black” BGs are issued. This option is illegal and dangerous for both the customer and the contractor.

To avoid such a situation, you need to take a serious approach to choosing a financial institution. Below we have given a number of rules that will help you avoid being caught by lawbreakers.

- Which account for transferring the commission is specified in the agreement for the issuance of BG? This account must belong to the institution where the document was issued. If the account account of some other commercial organization is indicated, then most likely, after sending money to this account, you will simply receive a “piece of paper”, and information about the bank account will not be included in the unified register and the guarantee will not be supported by a cash reserve in jar.

- How much documentation is required? If a bank asks for little information and does not ask for financial statements for the previous period, then most likely the institution is running a scam.

- What is the limit set by the bank for the bank account? It would be normal if the maximum guarantee amount approximately corresponds to the company’s average quarterly revenue. If the guarantor approves disproportionately large amounts that do not correspond to the company’s revenue, then think about the legality of the document being issued.

It would be logical to check whether the bank is included in the register list of the Ministry of Finance. However, banks from this list may also turn out to be unreliable, and the BG will lose its validity soon after issuance due to the termination of the license of the credit institution.

Banking support 44-FZ is an important financial lever that allows you not to withdraw a lot of money from circulation to confirm your reliability. It is important for the supplier not to make a mistake in choosing the bank from which he plans to obtain a guarantee to ensure the fulfillment of obligations, where he will be offered the most favorable conditions.

Irrevocable bank guarantee for government contracts

Guarantees can be revocable or irrevocable.

Revocable means that after concluding a contract between the customer and the contractor, the bank has the right to change the terms of the transaction or completely abandon its obligations and terminate the contract. In this case, the beneficiary is left without financial insurance if the principal breaks the deal or performs poor quality work. It turns out that the customer is at great risk.

An irrevocable warranty cannot be revoked. If the bank enters into an agreement with the contractor, then it cannot terminate it or change the terms. If the principal does a poor job and the customer asks for compensation, the bank will be obliged to pay it.

There are also conditional and unconditional guarantees. Conditional - this is when the beneficiary is obliged to provide the bank with evidence of the contractor’s violations, and unconditional - when he may not do this.

Government contracts use only irrevocable guarantees to provide the beneficiary with real protection.

What can you encounter when applying for a bank guarantee?

Let's look at four cases that may occur in practice, as well as how to act in each of them.

- If the customer does not accept the bank guarantee, then there are 2 ways that will help avoid getting caught in the RNP:

- make changes to the BG required by the auction organizer, notify the bank, and reissue the guarantee. But keep in mind that this will take time and require additional financial expenses;

- send the OIC with your own money, and then replace the collateral with a bank guarantee (as described above).

- If you do not have time to complete the BG, then use the protocol of disagreements. You will gain additional time: the customer is given 3 days to correct defects or refuse to change the contract, with an explanation of the reasons for this decision, and you will have another 3 days to sign an updated version of the contract.

In this case, the protocol of disagreements has the function of “postponing” the signing of the document, and therefore introducing an interim measure.

- If the bank refuses to issue a BG, then contact another financial institution. As we said above, each bank approaches the client individually: some look at financial security, while others consider the borrower as a whole. You can also contact agents who will provide professional assistance in choosing a bank.

- The new organization wants to receive a guarantee. Banks work with organizations that have existed for at least 3 months and look at financial criteria.

Therefore, wait until the organization is 3 months old, has experience of participation, and try to register a BG. To gain experience, take part in purchases in which you can provide interim measures with your own money if the bank refuses to issue a guarantee.

Special cases encountered in practice

Some banks require a mandatory guarantee if the amount of the guarantee exceeds the BG limit established by the bank for this. Be prepared for this if you plan to request a large amount as an OIC.

Also in practice, there is a requirement to make a deposit - this means a pledge of funds, partial security, for example, 30% of the amount of the guarantee (the rate is set individually in each bank). The lending institution will offer this option if you do not meet the financial criteria.

It’s rare, but it happens that a bank puts forward a condition to open a current account . This is possible if a BG is required for a very large amount.