How to choose a mortgage at Gazprombank, types

The choice of a financial company whose services you can use depends solely on the requirements of the borrower himself . When choosing a bank, people most often pay attention to the interest rate, the possible amount to receive, and which option is more profitable .

Gazrombank offers to take advantage of

mortgage lending , specially designed for a specific category of citizens . Let's consider each option separately.

Documentation for a mortgage during the construction phase

Mortgage lending is used to purchase properties for which ownership has not yet been registered. These include real estate that is not accredited by the bank and is under construction (apartment, townhouse, apartments). At the same time , the package of necessary documents differs depending on the project implementation scheme ( equity participation , housing cooperative , etc. ) .

To purchase real estate in this category, the following list is generally mandatory for all objects:

- preliminary agreement for the purchase/sale of real estate under construction - depends on the lending program;

- permitting documents for the land plot from the authorities;

- permission to carry out construction work and commissioning (a copy of the document can be printed from the official website of the developer);

- certificate confirming land ownership;

- positive expert opinion;

- extract on the land plot from the Unified State Register of Real Estate;

- at the request of the bank - an investment contract, certificates of readiness of the object with information on the number of unsold apartments and the start date of work.

If the borrower purchases an apartment or apartment on a mortgage basis, then an additional project declaration is provided, which is also available on the developer’s website. If there is an encumbrance on the property, you will need to present a guarantee agreement between the creditor bank and the developer.

If the construction of housing, including apartments, is carried out through a housing cooperative, then a construction contract is included in the credit dossier.

Family mortgage

Conditions:

- provided to families that fit the “ young family ” category;

- grace period - interest rate is calculated at 6%;

- at the end of the grace period the interest rate changes - 9.25% ;

- down payment of at least 20% of the total cost of the property;

- maximum up to 500 thousand rubles.;

- lending period - from one year to 30 years ;

- possibility of purchasing housing on the secondary market .

Primary market program

Conditions:

- purchasing housing on the primary market or a house with land ;

- interest rate from 9.2% ;

- from 500 thousand rubles.;

- preferential terms for salary clients;

- down payment from 10%;

- term - from 1 to 30 years .

Mortgage programs from Gazprombank

The bank offers three directions:

- military mortgage;

- “New Residents” program;

- mortgage with state support for families with two children.

In addition, it is possible to refinance the existing mortgage agreement in order to recalculate the interest rate.

At first glance, the choice is small. However, it should be taken into account that the Novosely offer combines several different interesting offers from Gazprombank.

New Residents Program

Participants in this mortgage program have the opportunity to obtain borrowed funds for the purchase of various residential real estate:

- apartments on the secondary market;

- objects in new buildings;

- townhouses;

- apartments;

- houses with land;

- garages;

- parking spaces

Borrowers have the opportunity to obtain a mortgage to purchase a share (or room) in an apartment, provided that the remaining shares are already owned. This is a very advantageous offer for those who share an inheritance or live in a communal apartment.

Loan conditions under the New Residents program require a minimum amount of 100 thousand rubles for a period of at least one year. In this case, the maximum repayment period is 30 years. The maximum amount under this proposal is 60 million rubles for St. Petersburg and Moscow, 45 million for other settlements of the country.

A prerequisite for mortgage lending will be the borrower’s ability to independently make a down payment for a residential property. Its size directly depends on the size of the borrowed amount. The down payment ranges from 10 to 15%.

The period for consideration of a client's application ranges from 1 to 10 days. The countdown begins from the moment a complete package of accompanying documentation and application is submitted to the bank branch.

Family mortgage from Gazprombank

Families in which a second child was born between 01/01/2018 and 12/31/2022 can become participants in the project.

A special condition is the interest rate of 4.5%. You can obtain borrowed funds to purchase housing in the range from 100 thousand to 12 million rubles. A mandatory condition will be to make a down payment for a residential property in the amount of 20% of its total cost.

Important! The period for full repayment of the mortgage ranges from 1 year to 30 years.

Military mortgage from Gazprombank

The list of potential borrowers is limited to military personnel who are included in the register of NIS participants with the appropriate certificate of the established form.

The maximum amount under this program is limited to 2.814 million rubles. The maximum repayment period for mortgage obligations is set at 25 years.

A necessary condition is a down payment of 20% of the total cost of the residential property. The mortgage rate is calculated individually in the amount of 8.8%.

This program allows military personnel to improve their living conditions by obtaining a favorable mortgage.

Refinancing

Conditions:

- from 9.2%;

- from 500 thousand to 45 million rubles.;

- it is possible to spend funds on refinancing under a mortgage lending program with a reduced rate;

- registration is carried out if there is a deposit.

Please note: the possible amount that will be provided to the client is calculated only after the estimated value of the object has been made. The higher the score, the more money is loaned to the borrower.

Mortgage for military personnel

The most preferential product, but only employees can use it.

Conditions:

- minimum rate from 9%;

- the maximum possible amount is 2.5 million rubles. ;

- the main participants may be military personnel who are involved in the savings program for the purchase of real estate in a new home;

- In order for the loan to be approved, it is necessary to register ownership of the borrower .

Please note: in order for the money to be provided, you must decide on a lending program. It is enough to choose the most suitable conditions for yourself and apply with the required documents to the nearest branch.

Documents on the property

According to the terms of mortgage lending, an individual must provide documentation for the property being purchased. The purchase can be made on the secondary and primary markets, so Gazprombank will request different packages of certificates.

On the primary market

When purchasing real estate on the primary market, individuals. the person will have to present the following papers to Gazprombank:

- A copy of the shared construction agreement.

- Certificate of advance payment to the developer.

- An assessment report of a property carried out by an independent expert.

- If the seller is not a partner of a financial institution, then constituent and charter documents are required from him.

- Certificate from local authorities for the allocation of a plot of land for construction.

- Examinations, permits.

On the secondary market

When purchasing real estate on the secondary market, the borrower will have to present:

- Preliminary purchase and sale agreement.

- An agreement that specifies the amount of earnest money given by the buyer to the seller.

- Technical and cadastral passport of an apartment or private house.

- An appraisal report issued by a company included in the list of appraisers approved by Gazprombank.

- Certificate of state registration.

- A document confirming ownership of the property being sold. In this case we are talking about a will, a gift agreement, a purchase and sale agreement.

- An extract from the house register about all registered persons.

- Passport (civilian) and TIN of the owner of the apartment/house.

Requirements for the borrower, documents

Gazprom is one of the few banks that impose strict requirements for the provision of documents for obtaining a loan. To understand if there is a chance of receiving the required amount, you need to familiarize yourself with them:

- citizenship of the Russian Federation with permanent residence;

- age for receiving borrowed funds - men up to 60, women up to 55 ;

- credit history without blemishes;

- work experience at the last place of work for at least 6 months .

When applying, you must have the following documents on hand:

- identity document . It is better if a Russian passport is presented;

- SNILS;

- work book , its photocopy certified with the stamps of the organization in which the applicant currently works;

- certificates in form 2 personal income tax or in the form of the bank. They must contain information about income for the last 6 months .

Please note: all registration takes place according to the regulations.

If you deviate from it, the security service refuses to receive a sum of money. After submitting the entire package of documents, the application is reviewed within 1 to 10 days . After the set time has passed, the potential borrower is informed of the decision made. Despite all the requests, programs and registration rules, the conditions are quite affordable , which allows you to use the services repeatedly.

Attention! Military mortgages are in demand, and according to statistics, they are most often approved.

What papers will the bank require from the seller?

When applying for a loan program, not only Gazprombank will require certificates from applicants. For sellers of real estate who are individuals. persons have developed a list of documentation for mortgages:

- Passport (civilian).

- Birth certificate (if the seller has not reached the age of majority).

- Translation of a (civilian) passport/birth certificate certified by a notary for persons who are not citizens of the Russian Federation.

- Certificate of marriage/divorce.

- Written consent from the spouse to sell the property. If at the time of execution of the transaction the seller is not legally married, then he must write a corresponding statement.

- If persons under the age of majority are registered in the apartment/house, then written consent from the guardianship authorities will be required.

- When selling apartments, you will need to document the seller’s capacity. In this case, you can provide a permit to carry a weapon, a medical certificate, or a driver’s license.

READ Gazprombank Travel Miles cards: accrual conditions, balance check, ways to spend miles

If the seller is a business entity, then Gazprombank will request the following documents from him:

- Charter

- Constituent documents.

- Extract from the Unified State Register of Legal Entities.

- Certificate of registration of a business entity with the Federal Tax Service as a tax payer.

- An order granting an employee the authority to conduct real estate sales transactions on behalf of the company.

- Power of attorney in the name of an authorized person.

- If an organization is selling apartments or a garage, it will be required to provide a letter stating that the transaction is not large in size and does not involve interested parties.

If a business entity sells a real estate property under construction, it must additionally transfer to the financial institution:

- Developer's questionnaire.

- Order on the appointment of an employee to the position of General Director.

- Insurance policy.

- A document recording the interaction between the housing cooperative and the developer.

- An extract received from the JSC register.

If the property under construction is accredited by the bank, then all certificates can be provided in the form of scanned copies (except for extracts from the Unified State Register of Legal Entities). This procedure is regulated by Federal Law No. 214.

Mortgage conditions and interest rate

To provide a sum of money, it is enough to contact the bank with the requested documents, submit an application for provision and wait for the decision of the financial institution.

which program the client will choose. After the security service reviews the certificate confirming income and the availability of property, an interest rate is announced , according to which the service will be carried out in the future.

Purchase of real estate with registered ownership

According to the terms of Gazprombank, the following objects with registered ownership rights can be purchased with a mortgage:

- apartment or townhouse;

- apartments (non-residential premises);

- garage or parking space.

To obtain a mortgage for one of the listed types of real estate, a basic package of documents is provided:

- Preliminary purchase and sale agreement.

- Agreement on advance payment (deposit).

- Floor plan or technical passport of the facility.

- Valuation report (in this case, the appraiser must be on the list of companies approved by the bank).

You will also need documents establishing ownership of the object:

- state registration certificate;

- purchase and sale agreement (privatization, donation);

- certificate from a housing construction cooperative (HBC);

- certificate confirming the right to inheritance.

To obtain a mortgage for a garage, the listed documents will be sufficient. When purchasing an apartment, you will need to present a deed or receipt confirming payment. To purchase an apartment, in addition to everything listed above, you must provide an extract from the house register.

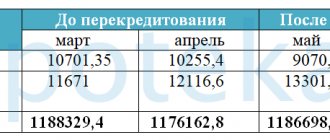

Calculation of monthly payments

Monthly payments are calculated in advance before the client signs the contract. A repayment schedule is provided , which indicates the date of payment, the amount used to repay the principal debt, interest and the total cost .

If you are not a bank client and want to calculate in advance how much you will have to pay each month, you can use a loan calculator. You can use the service by clicking on the link - https://www.gazprombank.ru/personal/take_credit/mortgage/.

How to get a mortgage?

To take out a mortgage from Gazprombank, you must submit an application online and first study the requirements for borrowers and the property.

From the moment the application is accepted until the full package of documentation is approved, no more than 10 days pass. The minimum approval period is 1 day.

Mortgage registration scheme

Algorithm of actions when buying an apartment with a Gazprombank mortgage:

- Read the terms and conditions of the program.

- Fill out an online application on the lender's website.

- Wait for a preliminary decision.

- Choose an apartment or other property. To facilitate the selection of options, Gazprombank clients use the convenient search portal CIAN.

- Order a real estate appraisal from independent experts.

- Submit a complete package of documents for approval of the transaction.

- Conclude a purchase and sale agreement and obtain a mortgage.

How to apply online?

The client’s attentiveness and honesty when filling out the online application provides a high chance of mortgage approval.

To prepare your online application you will need the following information:

- Full name, address, passport details.

- Contact information (email, mobile phone).

- Information about income.

- Information about the employer, work experience, area of activity.

- The parameters of the proposed transaction are the amount and term.

To increase the chances of the bank’s approval, use a loan calculator to select the optimal payment, no higher than 30% of your confirmed income.

Conditions for repayment and early repayment

The possibility of early repayment is available at any bank. AB "Gazrprom" is also no exception . According to the agreement, there is no moratorium on early payment of the amount. Therefore, funds can be deposited at any time convenient for the client.

To perform this action, you need to deposit a sufficient amount of funds into the account and contact a credit officer to write an application. To register yourself, you can follow the link - https://mycredit-ipoteka.ru/wp-content/uploads/2016/03/zayavl_dosrochnoe_gazprombank.pdf.

in writing . If this is a partial deposit, then the schedule is recalculated . If this is a complete closure, an extract is provided , which states that there is no debt to the financial institution.

Is it possible to get a mortgage from Gazprombank using maternity capital?

The opportunity has been realized. It is enough to provide a certificate for maternity capital . The interest rate ranges from 6% to 10.5% .

You can buy housing on the secondary market or in a new house , the main thing is that the bank sees the property being purchased and approves its purchase.

We recommend reading: what is the Starcom pyramid - official website, personal account. TOP 5 debit cards with overdraft credit line - Tinkoff, Sberbank, VTB and other banks. See information here.

How to cancel life insurance after receiving a loan - https://wikiprofit.ru/finances/credits/straxovaniya-zhizni-po-kreditu.html

Interest rate on a mortgage loan at Gazprombank for individuals

If an individual takes out a mortgage at Gazprombank, the person pays attention to the minimum interest rate. In the GPB it is equal to 10.2% for those apartments that are purchased in new buildings (or houses under construction). Since the bank is actively involved in financing a large number of projects, special conditions are also provided for them specifically - the rate starts from 10.2%, and the amount of the start-up fee starts from 0%.

Those wishing to purchase apartments can start from a minimum rate of 10.75%. Almost the same percentage is in the program for the purchase of townhouses. Interestingly, for the purchase of housing from the secondary market, the rates are almost the same.

Documents for obtaining a mortgage

The required documentation package includes an application submitted in the form of a questionnaire. A preliminary application can also be submitted through the official website of Gazprombank.

Mortgages can only be issued to individuals who provide a passport (both original and copy). Additionally, SNILS is required, as you must enter its number in the application form.

Confirmation of employment for the bank is a copy of the work book, certified by the signature and seal of the employer.

And the last mandatory document is needed to confirm income. This can be a 2-personal income tax certificate, or a bank account statement to which wages are transferred. The ideal option for the borrower is if the salary comes to the Gazprombank card, since salary clients do not need to confirm their own income with an additional certificate.

You can apply for a loan only with your passport and at a favorable interest rate by filling out the form at the bottom of the page.

Mortgage for secondary housing

Gazprombank decided not to create a difference between the conditions for providing a mortgage for housing in a new building or in a house built a long time ago. Therefore, the minimum interest rate on a mortgage loan for secondary housing for individuals is similar - from 10.2%. The remaining conditions are listed below:

- down payment percentage – 10% of the total cost of housing;

- loan term – maximum 30 years;

- loan amount – no more than 45 million rubles.

It is important that the mortgage desired by the client corresponds to its intended purpose - purchasing an apartment or a share with ownership rights. An individual cannot spend money issued on a mortgage, for example, on buying a car. For these purposes, you need either a car loan or a non-targeted loan.

You can fill out an application and receive money on your card quickly and only using your passport by filling out the form at the bottom of the page.

Military mortgage

Gazprombank is popular among military personnel due to the presence of a targeted program for them. The established conditions also apply to those apartments that are located in houses built in accordance with road construction agreements under Federal Law-214.

To obtain a mortgage, military personnel require a minimum package of documents. They are required to initially pay a fifth of the entire cost of housing in the form of a down payment. If such an amount is transferred to a bank account, you can count on a rate of 10.6%. The loan term will not exceed 30 years. The amount for a military mortgage is limited - it is equal to 2.25 million rubles.

You can submit an application and receive a preliminary response within 24 hours. To do this, you need to fill out an online application through GPB Home Bank.

Conditions and interest rate on mortgages for Gazprombank employees

Like other related enterprises with Gazprom, this bank also has special mortgage offers for employees. The bank has not announced the exact rates for employees, but it is indicated that the conditions may be preferential. Not only do employees of this banking organization need to submit a simplified package of documentation (they are not required to provide a certificate of income), but also the percentage can be reduced to 10%.

Interest calculation

To understand how much an individual will have to overpay for a mortgage from Gazprombank, consider an example:

- apartment price – 9 million rubles;

- term – 15 years;

- The amount of the entry fee is 2 million rubles.

If a client who applies for such a mortgage is given a loan on preferential terms with a rate of 10.25%, then the monthly payment will be equal to 76 thousand 477 rubles.