How recalculation is carried out

The possibility of partial or absolute early repayment of a mortgage is provided for by Federal Law No. 284, adopted in 2011. According to him:

- The financial institution claims to pay only those interests that accrued before the date of liquidation of the debt (sometimes to pay only part of these interests).

- Interest payments by the mortgagee must be made only on the actual borrowing of the debt.

- A financial organization does not have the right to demand payment of interest more than was accrued for the use of borrowed funds.

The method of recalculation and the amount of finance required for early repayment of mortgage debt depend on the type of payment used. There are two of them:

- Annuity. The bank adds up the loan amount with interest and splits the total into several equal payments. Let's give an example. Let's say you took out a mortgage for 1 million rubles. at 10% per annum for 5 years. Then over 5 years the overpayment will be 50%, which equates to 0.5 million rubles. You will have to pay both principal and interest. And this is already 1.5 million rubles. 5 years is 60 months. Therefore, every month you will need to deposit an amount equal to the quotient of 1.5 million rubles. by 60. The payment will be 25 thousand rubles. In the first billing periods, the majority of payments will be interest, then they will be equal to payments of the principal debt, and by the end of the mortgage, their share will be the smallest.

- Differentiated. The bank charges interest only on the actual amount of debt each month. Therefore, payments from one period to another change downward. But their value for the first month is slightly higher than with annuity payments. But in recent periods they will be significantly lower. For example, let's take the same data as above. For the first month you will need to pay 1/12 of the annual interest on the debt (that will be 1% of the million) + 1/60 of the debt itself (since there are 60 months in 5 years). After calculation we get the same 25 thousand rubles. But interest next month will be accrued on an amount equal to the difference of 1 million rubles. and 16 thousand 666 rub. Therefore, the payment will be about 24 thousand 860 rubles.

Typically, banks enter into mortgage agreements with annuity payments, since this is the most profitable option for them.

The recalculation itself, regardless of the payment method, can be carried out in two ways:

- By reducing the payment term (example: it was necessary to pay for 5 years, and after partial early repayment - 2 years);

- By reducing the payment (example: you had to pay 25 thousand rubles every month, but you will only have to pay 10 thousand rubles).

Let's consider how the mortgage will be recalculated in both cases, depending on the type of payments made.

Read your mortgage agreement about the early repayment options available to you. Sometimes the bank gives the borrower the right to choose between these options. But this doesn't always happen.

Partial repayment

To determine how to pay your mortgage installments correctly, you need to carefully read the mortgage agreement. Since each bank sets its own conditions for accepting payments throughout the loan term.

For example, VTB 24 mortgage establishes a moratorium on any type of early repayment of a loan during the first 6 months of lending. These measures are aimed at the bank receiving minimum earnings from interest paid.

Other institutions limit borrowers in choosing the type of payments, adjusting the payment schedule, and the amount of the minimum amount of debt at which the mortgage can be repaid ahead of schedule.

Benefit from annuity payments

Many borrowers take out a mortgage on the condition that it is paid using the annuity method. That is, equal payments throughout the entire loan term.

An advanced mortgage calculator will help you understand how best to pay off this type of mortgage. Based on the analysis of calculations, it has been proven that in this case it is profitable to pay off the debt within the first 5 years from the moment of signing the mortgage agreement .

It is in the initial period that the bank receives maximum profit from providing services to the borrower. Indeed, with the annuity type of loans, monthly payments include both payment of the principal of the debt and interest on it. And partial repayment allows you to recalculate the accrued interest, divide it into regular installments and thus shorten the term of the mortgage itself.

After depositing money as a partial closure of the debt, the parties to the transaction enter into an additional agreement defining further lending parameters. The client can either reduce the monthly mortgage payment or shorten the loan repayment period.

For greater reliability, before signing a new agreement, it is recommended to consult with an independent specialist. To take into account all the pros and cons of each scenario.

Before signing a mortgage agreement, it is recommended to familiarize yourself in detail with the bank’s terms and conditions for early repayment of debt.

Reducing the payment term

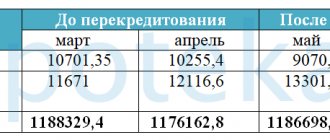

This method is applied equally to both differentiated and annuity methods of mortgage repayment. It consists of reducing the term of the mortgage loan. Let's return to the original data from the example above. If you deposit 250 thousand rubles, then with monthly fees of 25 thousand rubles. The mortgage term will be reduced by 10 payment periods. Therefore, the loan will actually be issued not for 5 years, but for 4 years and 2 months. The amount of monthly payments will remain the same.

Look at the same topic: Refinancing mortgages from other banks through Tinkoff in %%current_year%%

You can refund your mortgage insurance for the unused term of the contract (from the example above - 10 months).

Recalculation for the differentiated method of early repayment of a mortgage loan is carried out in the same way. But due to the fact that the monthly volume of payments decreases, you can pay for a larger number of payment periods with the same amount.

When is it worth seeking a lower mortgage rate through the courts?

It is almost impossible to achieve a reduction in the interest rate under an existing agreement with a bank through the court - the terms of the agreement are not affected by the key rate of the Central Bank of the Russian Federation, the market situation, or the policy of the credit institution. Reducing the rate is the right, not the obligation of the bank, so filing a claim in 99% of cases is doomed to failure, and the client will also have to pay legal costs.

The only case when it is possible to demand a revision of the terms through the court is if the corresponding clause is specified in the contract. For example, the base mortgage rate is 11.7%, but when half of the debt is paid, the bank must reduce this figure to 11.2%. If the client’s request was rejected and the credit institution violates the terms of the agreement, only in this case is it advisable to go to court.

Changing payment amounts

Let's give an example of recalculation of a mortgage after its partial early repayment (annuity), which is made according to the formula: SEV = (NW*PS)/(1-(1+PS)-KPP).

Legend:

- SEV – the amount of the monthly payment after recalculation of interest;

- SZ – loan amount (with the deduction of funds contributed as early repayment);

- PS – mortgage interest rate (monthly, not annual);

- KPP – the number of remaining payment periods.

Let's return to the original data of the example given to illustrate the annuity method of repaying a mortgage. Suppose you contributed 250 thousand rubles for partial early repayment, and the term of the mortgage is another 4 years 10 months. Then you will have to pay monthly: SEV=(750,000*1)/(1-(1+1)-58)=12,711 rub. (rounded).

The loan amount in the calculation is 750,000, not 1,000,000, because we subtracted the deposited amount - 250,000 rubles. And the monthly interest rate at 12% per annum is 1%.

In the case of the differential mortgage repayment method, everything is simpler, since recalculation is made every month as the debt decreases. It will simply be calculated taking into account the deposit of a larger amount of money. Let's give an example. Suppose that 250 thousand rubles were paid 1 payment period after the mortgage was issued. Let's calculate the size of the next payment (3rd in a row):

- Volume of debt after early repayment: 1,000,000 (loan amount) – 16,666 (payment of principal for 1 period) – 250,000 (early repayment) – 8193 (deduction of interest for the second period) = 733,326 rubles. (rounded).

- 1% of the debt: 0.01*733,326 = 7,333 rubles.

- Since it will take another 60-2 months to pay, the debt must be divided into 58 periods. We will receive 12,643 rubles. (rounded).

The amount of the next installment is 7,333 + 12,643 = 19,976 rubles. (rounded value).

How to reduce the mortgage interest when applying for a loan?

The bank has a number of requirements for those wishing to apply for a mortgage loan. All of them are aimed at ensuring the client’s sufficient solvency. The more confident the bank is in your conscientious fulfillment of your obligations, the more loyal the lending conditions can become. In particular, when applying for a mortgage loan, those wishing to pay less should be guided by the following rules:

- Submit the maximum number of documents. The main thing you should be concerned about is having documentary evidence of your income.

- Contact the bank where the client is serviced on an ongoing basis. Having a positive credit history with a bank, an open deposit or deposit may be grounds for lowering the mortgage interest rate.

- Contact the bank issuing the salary card. As a rule, special conditions apply to employees of companies that are partners of the bank.

- Apply under preferential lending programs - check in advance to see if you can get a mortgage at a reduced interest rate with government support.

- Attract solvent guarantors and provide additional collateral - property owned by the bank client.

- Make sure there are no negative points in your credit history. It is also desirable that there are no outstanding debts or open credit cards with an impressive limit - this reduces the credit rating and carries additional risks for the bank.

When applying for a mortgage loan, you should also pay attention to the presence of additional conditions, the fulfillment of which makes the bank’s services much more expensive. These mainly include issuing an insurance policy and paying various commissions.

Mortgage Ready-made housing from Alfa-Bank

Apply now

Which option is most profitable?

If the bank gives you the right to choose between recalculation methods, then you need to choose the one that is most beneficial for you. To understand which recalculation option will allow you to save more money, use a special calculator for calculating monthly installments, which provides the possibility of early (partial or absolute) repayment of the mortgage.

First, recalculate to reduce the payment period, and then to reduce their size. Now compare the remaining debt in the first and second cases. The option where the debt is less will be optimal for you. Use it.

The option of reducing the mortgage term is usually more profitable. This is explained by the fact that by reducing the terms, you also reduce the interest. By reducing the mortgage time by 1 year, you save (based on the example above) 12% per annum, which is RUB 120,000.

Early repayment of a mortgage loan

A real estate loan is a large financial loan, the repayment of which can take a fairly long period of time. During this time, the payer is under constant psychological pressure. Indeed, in the event of unforeseen life situations, the debt will still remain on the shoulders of the borrower and his guarantors, if any.

Sberbank clients are trying to find additional sources of income in order to comply with the mortgage repayment schedule. This could be profit from metal or investment deposits, additional employment, performance of third-party work or provision of services under a rental agreement, etc. An online mortgage repayment calculator will allow you to reduce overpayments for using borrowed funds and prevent violation of the provisions of the loan agreement.

To pay off a mortgage ahead of schedule, the payer does not need to notify bank employees. You just need to fill out the appropriate application and submit it to the credit department of Sberbank. It is important to correctly enter the payment amount and bank details of the account from which the funds will be transferred into the form. Of course, the balance must include an amount of funds that covers the specified amount and the possible amount of the transaction fee.

Using online calculation will allow you to avoid violation of loan terms and reduce the cost of using a loan

Partial early repayment of the loan can be carried out to an arbitrary extent. Interest is accrued only for the actual time of use of loan funds. If such a payment is made at Sberbank, then no commission is charged for making it. If the debt is not fully repaid early, the bank employee reduces the amount of the annuity or the terms of the loan agreement.

To simplify the transfer of funds, Sberbank clients can use the online banking service. In this case, the transfer can be sent remotely and without commission. You just need to log in to your personal account in the system and calculate early repayment using an online calculator. Having repaid the housing loan in full, you will need to obtain a statement from Sberbank confirming the absence of debt to the bank and remove the debt encumbrance from the purchased property.

What you should pay attention to when partially repaying a mortgage loan early

Before making an early repayment, pick up the mortgage agreement and use it to clarify the following points:

- What should be the minimum amount for early repayment? If you have less money, the bank will not consider your desire to pay off your mortgage quickly.

- What is the amount of fine/commission/penalty/penalty provided for early repayment? They may be called differently, but these expenses will definitely exist. Banks explain them by the fact that recalculating a mortgage requires a lot of time and a large number of operations. And the work of bank employees must be paid.

- What you need to do to pay off your mortgage early. Is it difficult from a formal point of view, and does it make sense to pay off the debt in advance?

If you have to pay off your mortgage debt early, do it. This procedure will be more profitable: no fines, penalties or commissions for recalculation will exceed the interest overpaid for using credit finance.

Refund of insurance in case of early repayment of mortgage

Another advantage of quickly closing the debt is the ability to return part of the insurance fee. The size of the benefit obtained from this cannot be calculated in any calculator for early repayment of a mortgage, but it is significant.

To receive money you need:

- close the debt early;

- make sure your insurance is still valid;

- write a statement to the insurance company demanding compensation for the remaining unused amount.

It is important to emphasize that they will not be able to refuse the client, since the beneficiary of insured events is the bank. But, since the debt is paid, such a situation becomes meaningless, and the insurance itself loses its meaning.

You can get more detailed advice at the office of the insurance company or from its official representatives (all modern insurers provide clients with a free contact number where they can contact them with any questions).

Features of partial early loan repayment

Partial or complete liquidation of mortgage debt can be achieved by resorting to one of two types of write-offs:

- On the day of the scheduled contribution. With this method of writing off funds, the amount of debt is reduced by the amount of the payment made.

- On the day between the dates of scheduled mortgage payments. In this case, recalculation will be more complicated. Interest on the debt is accrued daily, but is repaid monthly. Therefore, by the time you decide to deposit a large amount of funds between payments, some of the interest has already accumulated. Therefore, they must be paid from advance deposited funds. Only what is left after paying the interest accrued for these days will be used to pay off the principal debt. This will entail a change in the amount of payment in the next period, since the interest component of the contribution has already been partially paid. It will be less, but from subsequent periods the amount will become slightly larger.

Look at the same topic: Personal account of an NIS participant for military mortgages - how to register in the service?

After the funds are credited to the bank, the mortgage payment schedule will be changed. Therefore, you will no longer need the old one - it will be invalid. The changes that are awaiting the schedule will be associated with either a reduction in the payment period or a reduction in the monthly fee paid. How recalculation is made in each case was described in the corresponding blocks.

The new payment schedule can be obtained in paper form from the bank department. It will also be available for study in your personal account.

Interest rate

The interest rate is a very important parameter when calculating a mortgage. It is measured as a percentage per annum. This parameter shows how much interest is charged on your debt per year. For clarity, let's take a specific interest rate - 12%. This means that another 12% of the debt amount is added to your debt per year, BUT: with mortgage lending, the bank charges you interest not once a year, but daily on the remaining amount of the debt. It is not difficult to calculate how much interest is accrued every day: 12% / 12 months / 30 days = 0.033%.

If you've already used our mortgage calculator and done the math, you've probably noticed that your monthly payment is made up of two parts: principal and interest. Since your debt decreases every month, you accrue less interest. That is why the first part of the payment (principal) increases, and the second (interest) decreases, and the total amount of the payment remains unchanged throughout the entire term.

Different banks offer different interest rates, they depend on various conditions, for example, on the size of the down payment, on the type of housing purchased, etc. Obviously, you need to look for an option with the lowest rate, because even a difference of half a percent will affect the amount of the monthly payment and the total overpayment on the loan:

| Loan amount (RUB) | 2 000 000 | 2 000 000 | 2 000 000 |

| Credit term | 10 years | 10 years | 10 years |

| Interest rate | 12% | 12,5% | 13% |

| Monthly payment (RUB) | 28 694 | 29 275 | 29 862 |

| Overpayment on loan (RUB) | 1 443 303 | 1 513 028 | 1 583 458 |

Table 1. Demonstration of the influence of the interest rate on loan parameters.

Fixed and floating interest rate

A fixed interest rate is a loan rate that is set for the entire loan term. It is specified in the loan agreement and cannot be changed.

A floating interest rate is a loan rate that is not a constant value, but is calculated according to a formula defined in the agreement. The rate consists of two parts: The first component is floating, tied to some market indicator (for example Mosprime3m or the Central Bank refinancing rate) and changes with the frequency specified in the loan agreement (for example, monthly, quarterly or semi-annually). The second component, fixed, is the percentage that the bank takes for itself. This part remains always constant.

Variable interest rate

Sometimes, after paying off your debt early, the mortgage interest rate changes. This can happen at the request of the mortgager if his request is satisfied by the bank or according to the conditions specified in the mortgage agreement. You can find out the annual rate after recalculation from the bank. In advance, you can make the calculation yourself using an online mortgage calculator with advanced functionality.

Early repayment is an alternative option for fulfilling obligations to the bank related to the registration of a mortgage with it. This is a more profitable way for the borrower to eliminate debt, necessitating its recalculation. The sooner the debt is paid off, the lower the interest portion will be.

Mortgage interest rate

This indicator is very important when calculating a mortgage; before going to the bank with documents - read the offers and find the best one for yourself.

The amount of payment, as well as the total amount of overpayment, will depend on what the percentage from the bank will be.

Below are interest rates from popular banks:

| Sberbank | from 7% |

| Tinkoff | from 6% |

| "FC Otkritie" | from 9.30% |

| DeltaCredit | from 8.75% |

| Alfa Bank | from 9.3% |

| VTB | from 6% |

| Gazprombank | from 6% |

| Absolut Bank | from 7% |

| AK Bars | from 9% |

How to calculate the amount of payments

The first step is to enter the data required to calculate payments. In the appropriate columns you need to enter basic information about the loan - the amount of the mortgage, the interest rate, the type of payment - annuity or differentiated.

With an annuity scheme, the size of payments is the same throughout the entire loan period, but their structure changes as the loan is repaid. If at first the payments consist almost entirely of interest calculated on the loan, then over time the share of the borrowed money itself increases. At the last stages, the “body” of the loan is almost 100% of the payments. The second type of payment is differentiated, in which the amount of monthly payments is maximum at the first stage and gradually decreases as the loan is repaid. This occurs by reducing the amount of interest accrued on the remaining debt.

Not all banks offer borrowers a choice. Some financial institutions provide only an annuity payment system, which by definition is more profitable for the bank than a differentiated one.

In addition to the basic options, the calculator is equipped with additional settings that can be used to take into account factors such as commissions, insurance, and the services of third-party specialists. While not directly involved in payment calculations, they nevertheless have a serious impact on the final amount of payments.

After clicking the “Calculate” button, a table with a graph will appear, from which you can find out the amount of monthly payments, divided into principal and interest on the loan, and the loan balance. Calculating a mortgage helps you plan the distribution of income for the coming years and understand whether you are ready to mobilize your financial and personal potential for a long period of life.